What is the Enterprise Monitoring Market Size

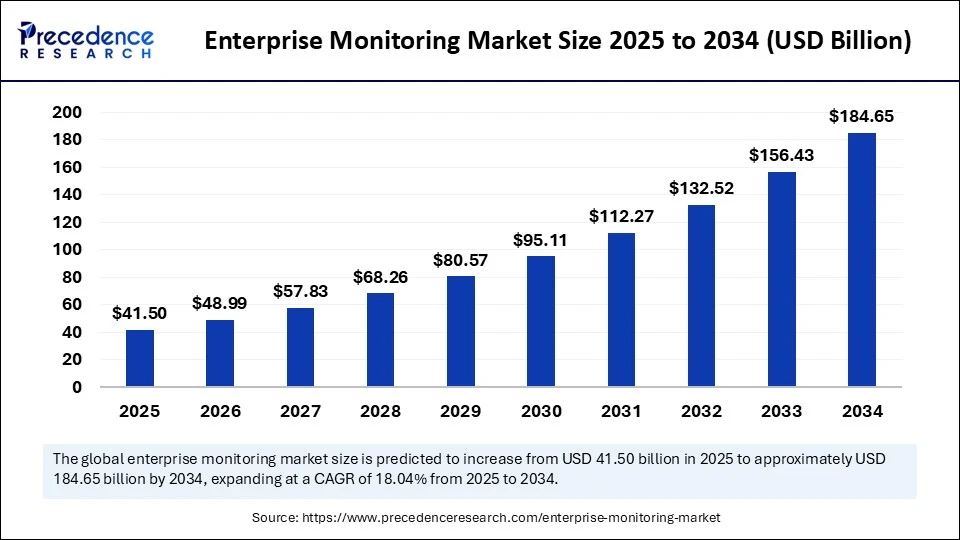

The global enterprise monitoring market size accounted for USD 41.5 billion in 2025 and is predicted to increase from USD 48.99 billion in 2026 to approximately USD 184.65 billion by 2034, expanding at a CAGR of 18.04% from 2025 to 2034. The market growth is attributed to the increasing need for real-time performance visibility and proactive issue resolution across complex, distributed IT environments.

Enterprise Monitoring Market Key Takeaways

- The global enterprise monitoring market was valued at USD 35.16 billion in 2024.

- It is projected to reach USD 184.65 billion by 2034.

- The market is expected to grow at a CAGR of 18.04% from 2025 to 2034.

- North America dominated the global enterprise monitoring market in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By platforms, the application performance segment held the major market share in 2024.

- By platform, the security segment is projected to grow at a CAGR in between 2025 and 2034.

- By digital experience platforms, the synthetics segment contributed the biggest market share in 2024.

- By digital experience platform, the real user experience segment is expanding at a significant CAGR in between 2025 and 2034.

- By vertical, the BFSI segment led the market in 2024.

- By vertical, the healthcare segment is expected to grow at a significant CAGR over the projected period.

Artificial Intelligence The Next Growth Catalyst in Enterprise Monitoring

Artificial intelligence (AI) is disrupting enterprise monitoring technology, delivering real-time visibility, proactive problem resolution and intelligent automation in the complex IT landscape. They no longer use rule-based systems with no learning capabilities as the sole mechanism of monitoring their business. Businesses have instead introduced eclipse-based systems and take advantage of the historical data or modern infrastructure changes enabled by the advancement of AI.

These tools pinpoint the limitations of performance, security, as well as anomalies within a system before they become a critical failure. Furthermore, with the increased sizes and complexities of the digital ecosystems, AI contributes to visibility and upper-level performance that is consistent when in a scattered environment.

Strategic Overview of the Global Enterprise Monitoring Industry

Increasing enterprise monitoring technologies demand due to the need of real-time visibility of the infrastructure is expected to drive the market growth. Such systems offer organizations common views of application, server, network, and cloud-native performance, availability, and security. Enterprise monitoring allows system optimization and incident proactive response using advanced telemetry, synthetic monitoring, and log analysis and AI-powered anomaly detection.

ENISA indicated in its April 2024 edition of Threat Landscape Report that the pillar of continuous monitoring is important to secure the digital infrastructure of both the private and the public environment. Additionally, increased dependence on distributed systems and real-time analytics to drive demand to provide a powerful enterprise monitoring solution seems like it is here to stay.

Market Outlook

- Market Growth Overview: The Enterprise Monitoring market is expected to grow significantly between 2025 and 2034, driven by the expansion of cloud environments, focus on digital experience monitoring, and consolidation of observability and security.

- Sustainability Trends: Sustainability trends involve integration with ESG reporting, sustainable and circular IT management, and data-driven decision-making for sustainability.

- Major Investors: Major investors in the market include Cisco Systems, Inc., Microsoft Corporation, Amazon Web Services, Inc., and Google LLC.

- Startup Economy: The startup economy is focused on observability and cloud-native environments, digital experience monitoring, and addressing the talent gap.

Enterprise Monitoring MarketGrowth Factors

- Rising Complexity of Hybrid IT Environments: Increasing reliance on interconnected on-premise and cloud systems is fuelling demand for unified monitoring architectures that streamline observability.

- Boosting Edge Computing Deployments: The expansion of edge infrastructure is driving the need for decentralized monitoring tools that ensure real-time system diagnostics at remote nodes.

- Growing Emphasis on SLA Compliance: Enterprises are prioritizing service-level agreement adherence, propelling the adoption of monitoring platforms that provide granular performance analytics.

- Expanding Role of AI in IT Operations (AIOps): AI-driven monitoring is accelerating decision-making and root cause analysis, boosting operational efficiency and uptime.

- Driving Integration of Monitoring with ITSM Platforms: Seamless integration with IT service management systems is enhancing incident response workflows and visibility across service lifecycles.

- Surging Regulatory and Audit Demands: Heightened data governance and audit requirements are fuelling investments in monitoring tools that support compliance tracking and reporting.

- Accelerating Adoption of Microservices Architectures: Fragmented service ecosystems are increasing monitoring complexity, driving demand for platforms that support containerized and serverless environments.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 184.65 Billion |

| Market Size in 2025 | USD 41.5 Billion |

| Market Size in 2026 | USD 48.99 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Platform Insight, Digital Experience Platform Insight, Vertical Insight, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is Increasing Reliance on Complex IT Infrastructure Expected to Drive Growth in the Enterprise Monitoring Market?

Increasing reliance on complex IT infrastructure is expected to drive the market. Growing dependence on complicated IT infrastructure lead to the demand of high-tech monitoring solutions. The digital ecosystem in multi-cloud, hybrid, and on-premise settings gives organizations a network of more connected environments that cannot be monitored and managed without supervision. A manual way of monitoring such distributed systems create inefficiencies and latent response to performance problems. To treat this, businesses adopt real-time observability tools that provides a single view of applications, servers, networks. These tools do not just monitor the health of the system, but also give insights to actions that can be taken to prevent the incident as well as the root cause analysis.

A 2024 Gartner report shows that large enterprises have implemented the AI-powered observability into their infrastructure monitoring operations to reduce the mean time to resolution (MTTR) as well as strengthen operational resilience. Furthermore, the goal of providing smooth procedures of use and constant provision of service is what promotes uptake of intelligent self-monitoring technology, thus further fuelling the segment.

(Source: https://www.gartner.com)

Restraint

High Implementation and Integration Costs

High implementation and integration costs restrain the adoption of enterprise monitoring solutions, especially among small and medium-sized enterprises, and are anticipated to limit market expansion. Enterprise monitoring solutions are constrained by high implementation costs and integration costs particularly in smaller and medium sized enterprises.

In the shorter term, in the eyes of many smaller enterprises, the results of investing may seem uncertain, which is why they may be afraid to do it on a large scale. Furthermore, the necessity to maintain it and carry out renovations regularly magnifies the expense further, making the process slow in terms of adoption in the cost-sensitive industries.

Opportunity

Why Is the High Volume of Data Generation from Enterprise Systems Estimated to Create Demand for Scalable Monitoring Platforms?

High volume of data generation from enterprise systems is estimated to create immense opportunities for the players competing in the scalable and intelligent monitoring solutions market. It is estimated that large enterprise systems require scalable and intelligent monitoring as a result of high generation of data. Current companies produce terabytes of data every day based on servers, applications, and devices. Such a volume of data cannot be handled and analyzed using the traditional monitoring methods. Using these platforms, IT teams identify trends and predict capacity requirements and optimize the use of resources, increasing the efficiency in digital infrastructure operations.

- In May 2024, a Gartner Insights report observed that more number of digital-first organizations currently turn to distributed tracing and real-time analytics to ensure observability of complex infrastructure layers. Furthermore, the businesses that have to deal with more than 500 TB of telemetry data monthly are adopting these type of technologies, thus further boosting the market.

(Source: https://www.gartner.com)

Platform Insights

Application performance segment dominated the enterprise monitoring market in 2025, due to the growing demand for real-time visibility of an ever complex enterprise system. APM (Application Performance Management) tools became widespread across organizations to monitor the responsiveness and identify code-level issues. Furthermore, the international banking and e-commerce organizations were quoted to have relied on APM to scale down performance-related outages during peak loads further fuelling the segment growth.

The security segment is projected to grow at the fastest CAGR market in the future years, owing to the increased level of advanced cyber threats against enterprise infrastructure. Organizations also see benefits to adopting security analytics that are incorporated into larger observability platforms to identify unauthorized access, policy violations, and detect anomalous behavior in systems in real-time. The need to protect sensitive information on multi-cloud, hybrid, and distributed environments contributes to create demand for security enterprise monitoring solutions.

In 2024, the National Institute of Standards and Technology (NIST) published a new version of its SP 800-137 Rev. 1 guidance, insisting the importance of having continuous diagnostics and mitigation as part of enterprise-level monitoring systems. In a study conducted by the IEEE Security & Privacy Journal the application of behavior-based anomaly detection tools did better than the traditional SIEM systems detecting zero-day threats in distributed enterprise networks. Furthermore, the growing number of funding are being invested for monitoring-security systems, thus further facilitating the segment.

(Source: https://sprinto.com)

Digital Experiment Platform Insights

Synthetics segment held the largest revenue share in the enterprise monitoring market in 2025, due to the its capacity for proactive identification of problems in software performance before it affects the actual end users. The use of synthetics was also readily embraced by enterprises to replicate and emulate interactions of the user across applications, networks, and geography. This enables an enterprise to stay consistent in its service delivery beyond the peak times. Furthermore, the importance of synthetic monitoring in financial institutions to facilitate the integrity of transactions further boosts the segment.

Real user monitoring segment is projected to grow rapidly during the coming years, owing to the increasing demands of enterprises on user centric insights in distributed application environment. RUM captures real-time user experiences using a variety of browsers on an assortment of devices under a mix of network conditions. They further providing contextually aware views of performance impact on how users use and feel about experiences using applications and services.

Additionally, the large-scale streaming and digital media companies had invested deeply in real user monitoring as a way to minimise churn by tracking real time latency, which further creates demand for these type of technology.

Vertical Insights

BFSI segment dominated the enterprise monitoring market, due to the growing digitalization of core banking systems and the growing productivity of real-time loss of view in financial applications. These banks coupled sophisticated supervision systems to guarantee the effectiveness, security, and conformity of mission-critical frameworks.Sensitivity of the financial information and stringent regulatory controls forced the organizations to implement end-to-end monitoring platforms. This enabled them to provide real-time alerts, detect anomalies and provide audit-ready reports. Most popular banks focused on monitoring based on AIOps to enhance uptime and the speed of root cause determination.The register covered in early 2024 how tier-1 banks were using observability platforms to drive downtime down during high-frequency trading and batch processing tasks. Furthermore, the organizational case study continued focusing on the fact that banks that currently use full-stack observability tools increased the levels of customer satisfaction relying on latency reduction and improved transparency transactions.

(Source: https://pages.awscloud.com)

Healthcare segment is projected to grow at a rapid pace in enterprise monitoring market in the coming years, owing to the drastic growth in investments in digital health infrastructures and increased complexity of IT systems that enable electronic health records (EHR), telemedicine, and connected medical devices. Enterprise monitoring is increasingly being applied by healthcare providers to guarantee that clinical applications be reached and operate properly. That data on patients and other sensitive data is secured, and the health information privacy regulations are addressed, including HIPAA.The 2024 update of the National Institute of Standards and Technology (NIST) to its cybersecurity guidelines on healthcare IT systems recommended a focus on real-time system monitoring as a way to respond to threats to data confidentiality and business continuity.

The 2024 Deloitte Digital Health Outlook reports that the best health networks have adopted cohesive monitoring tools to enhance interoperability and application availability of the clinical software in multi-cloud set-ups. Furthermore, big hospital systems had applied AI-powered observability to track EHR performance during peak patients, thus further boosting the market in this region.

Regional Insights

North America led the enterprise monitoring market, capturing the largest revenue share in 2024, as the maturity of other digital infrastructures, a significant outlay in IT operations, and the initial use of observability solutions based on AI. Large corporations in the United States and Canada implemented complete stack monitoring systems in order to handle intricate IT infrastructure, which includes hybrid cloud, edge computing, and applications based on SaaS.

In 2023 Gartner published report, it reported that more of large organizations in the region had adopted AIOps tools with a view of improving IT incident response and minimizing operational downtime. The existence of these behemoths in the technology industry, including Microsoft, Google, and IBM pushed the pace at which the breakthroughs of telemetry and real-time diagnostics was taking place, further strengthened the domination in this region. Furthermore, the North American organizations were making increased use of security-integrated observability tools to support the emerging threats and regulatory needs, which further boosts the market in this North America.

U.S. Enterprise Monitoring Market Trends

The U.S. enterprise monitoring market is trending towards sophisticated, cloud-native, and hybrid solutions driven by the increasing complexity of IT infrastructure and the need for unified visibility. Strengthening cybersecurity in sectors like healthcare and finance is are significant driver.

(Source: https://www.gartner.com)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the high rate of digitalization in the emerging economies, high growth cloud, and the growing IT service ecosystem in the region. The digital activities are being expanded into the enterprises of the nations, such as China, India, Japan, and South Korea. This leads to the necessity of having sophisticated tools to monitor the system capabilities and guarantee faultless performance of the applied applications.

A McKinsey report of 2024 revealed that Indian businesses boosted their investment in observability tools to foster real-time analytics in logistics, fintech, and healthcare. Some of the big players in the telecom provider industry in Southeast Asia have turned to distributed monitoring frameworks in order to enhance network resilience and minimize latency.

Asia-Pacific emphasized the necessity to undertake real-time integrity monitoring of systems in government-run digital programs of digital public infrastructure in the government. Furthermore, the major APAC businesses are using synthetic monitoring to guarantee a consistent performance on a mobile-first platform, thus further fuelling the market in this region.

China Enterprise Monitoring Market Trends

China's market expansion of multi-cloud and hybrid environments, government initiatives promoting cloud adoption, smart cities, and the digital transformation of traditional industries. Focus on localized solutions and compliance, and growth in niche segments.

(Source: https://www.mckinsey.com)

Europe region is expected to hold a notable revenue share, due to the strict data protection laws, the growth in the use of hybrid cloud systems, and rising needs to obtain real-time oversight of mission-critical systems. Organisations in Germany, France, the UK, and Nordics implemented end-to-end observability solutions to comply with GDPR, lower application latency, and enhance service uninterruptedness. In March 2024, it was reported by ZDNet Europe that financial and Government institutions are adopting full-stack monitoring tools to reduce response times to cyber events and resilience of systems in the event of regulatory stress tests. Furthermore, the Dutch and German manufacturing companies had incorporated the real-time monitoring into their industrial internet of things (IoT) ecosystem, which further propels the market in the European region in the coming years.

Germany Enterprise Monitoring Market Trends

Germany's enterprise monitoring market is driven by strict regulatory requirements, particularly GDPR and BSI C5, and a growing emphasis on data sovereignty and cybersecurity. Technological trends, such as consolidating security and observability platforms, expanding edge computing for Industry 4.0, and addressing talent shortages through managed services.

(Source:https://kpmg.com)

Value Chain Analysis of the Enterprise Monitoring Market

- Technology & Platform Development

This foundational stage focuses on research and development to create the core monitoring technologies, including agents, data collectors, analytics engines, and user interfaces.

Key Players: Cisco Systems, Inc. (Splunk), Dynatrace, Inc., and International Business Machines Corp. - Infrastructure Provision & Cloud Services

The core monitoring solutions require robust and scalable infrastructure for data processing and storage, especially for cloud-native and hybrid environments.

Key Players: Amazon Web Services (AWS), Google Cloud, and Microsoft. - System Integration & Implementation

This stage involves tailoring off-the-shelf monitoring solutions to meet the specific, complex needs of enterprises and integrating them with existing IT ecosystems.

Key Players: Wipro, Accenture, and HCL Technologies - Managed Services & Support

After implementation, ongoing support, maintenance, and data analysis services are often provided as a managed offering to ensure continuous monitoring and compliance.

Key Players: Wipro - End-Use & Feedback

The final stage involves the application of monitoring solutions by end-users across various sectors, including finance, healthcare, e-commerce, and manufacturing.

Enterprise Monitoring Market Companies

- AppDynamics (Cisco) contributes to the enterprise monitoring market with a comprehensive Application Performance Monitoring (APM) platform that provides deep visibility into complex, distributed application environments. Their solutions help enterprises monitor end-to-end performance and user experience, enabling rapid issue resolution and optimisation of business outcomes.

- BMC Software contributes to the market through its suite of AIOps and IT operations management (ITOM) solutions, which provide full visibility across hybrid and multi-cloud environments. Their tools leverage AI to automate performance monitoring, predict issues, and ensure compliance in complex enterprise IT landscapes.

- CA Technologies (Broadcom) contributes by offering a broad portfolio of infrastructure and application performance management solutions designed to provide end-to-end visibility and control. Their software helps manage highly complex systems and optimise application performance across diverse platforms.

- Cisco Systems is a major player due to its extensive networking hardware and software, and its strategic acquisition of companies like AppDynamics and Splunk to offer comprehensive, full-stack observability and security platforms. Their integrated solutions provide unified monitoring across networks, applications, and security.

- Datadog contributes to the market with its SaaS-based monitoring and security platform that provides observability into cloud applications, offering a unified view of metrics, logs, and traces. Their platform enables seamless collaboration between development and operations teams and helps manage dynamic cloud-native environments.

- Dynatrace contributes with an all-in-one, automated, and AI-powered observability platform that provides deep insights into application performance and user experience. Their advanced AIOps capabilities automatically detect anomalies, identify root causes, and provide actionable insights in real time.

- HP Enterprise (Micro Focus) contributes by providing a range of IT operations management (ITOM) solutions, including tools for performance monitoring and analytics. Their software helps manage traditional and modern IT environments to optimize operations and ensure service reliability.

- IBM contributes to the market with its AI-powered AIOps platform that leverages AI and automation for enterprise monitoring across hybrid cloud environments. Their solutions focus on accelerating problem resolution, optimizing IT operations, and enhancing overall resilience.

- LogicMonitor contributes with a cloud-based monitoring platform that provides automated, full-stack observability for enterprises, offering unified monitoring of network, cloud, and on-premises infrastructure. Their technology enables proactive management of IT performance and prevention of costly outages.

- ManageEngine contributes by offering a comprehensive suite of IT management solutions, including tools for network performance, application performance, and log management. Their products provide scalable and affordable monitoring capabilities for businesses of all sizes.

- Microsoft contributes through its Azure cloud platform, offering a range of monitoring and management tools like Azure Monitor and Azure Sentinel for managing hybrid and multi-cloud environments. Their solutions provide a unified view of performance, health, and security across the entire IT landscape.

- Nagios Enterprises contributes to the market with its open-source based monitoring solutions that offer extensive monitoring of IT infrastructure, including applications, services, and operating systems. Their flexible and customizable platforms provide robust monitoring capabilities for various enterprise needs.

- New Relic contributes with a leading observability platform that provides full-stack monitoring, enabling engineers to instrument, analyze, troubleshoot, and optimize their entire software stack. Their solutions focus on providing real-time data and actionable insights to improve software reliability and performance.

- PagerDuty contributes by offering a digital operations management platform that provides real-time incident response and automated issue resolution capabilities. Their platform integrates with various monitoring tools to orchestrate response teams and ensure rapid remediation of critical incidents.

- Riverbed Technology contributes to the market with solutions for network performance management and optimization, offering deep visibility into application and network performance across hybrid environments. Their technology helps improve digital experience and ensure optimal network efficiency.

- SolarWinds contributes with a broad portfolio of IT monitoring and management solutions that provide comprehensive visibility into the performance of applications, networks, and infrastructure. Their tools offer an easy-to-use interface and robust functionality for managing complex IT operations.

- Splunk, now part of Cisco, is a major contributor with its data platform for security and observability, allowing enterprises to monitor, analyze, and act on data from various sources. Their solutions provide deep insights into operations and security, enabling rapid threat detection and response.

- Statseeker contributes with a high-performance network monitoring solution that provides comprehensive visibility and analytics for large-scale enterprise networks.

- Sysdig contributes to the market with its unified cloud security and observability platform built on an open source foundation, offering real-time visibility into containers and Kubernetes environments. Their solutions help manage security and performance in modern cloud-native architectures.

- Zenoss contributes with a hybrid IT monitoring and AIOps platform that provides unified visibility and automated analysis across traditional and cloud-based infrastructures.

Recent Development

- In June 2025, Thales has launched Thales File Activity Monitoring, a powerful addition to the Thales CipherTrust Data Security Platform, designed to boost enterprise visibility and control over unstructured data. This new capability allows organizations to track file activity in real time, detect misuse, and meet regulatory requirements across their data landscape. As the only integrated platform securing both structured and unstructured data, Thales now delivers advanced monitoring and auditing for file types that were once difficult to supervise. “Thales' approach to File Activity Monitoring solves major challenges, such as blind spots in hybrid setups, by offering real-time oversight and intelligent anomaly detection—a true breakthrough for teams dealing with alert fatigue. FAM strikes the right balance between depth and simplicity, supporting SOC improvements without added complexity. With stronger SIEM integration, it enables sharper incident response and keeps teams focused on priorities. We're eager to see FAM evolve and elevate our data protection,” said Leila KUNTAR, Principal Information Security Engineer, Amadeus.

(Source:https://www.businesswire.com)

- In May 2025, Bocada LLC, a recognized leader in IT monitoring and automation, has announced the release of modular add-ons for its flagship platform, Bocada Enterprise. These new extensions offer enterprise IT teams greater adaptability by enabling customized monitoring around high-priority needs. With this expanded framework, Bocada customers can now supplement their Bocada Enterprise licenses with purpose-built modules that extend the platform's baseline monitoring capabilities far beyond backup.

(Source:https://www.bocada.com)

- In May 2025, Seeq, a key player in industrial analytics and AI, has introduced the Seeq Industrial Enterprise Monitoring Suite with the debut of Seeq Vantage, its first enterprise-grade monitoring app. Announced at the company's global industry event, Conneqt, in Miami, the suite delivers an automated, full-spectrum view of operational performance, both historical and current. This expanded visibility enables better decision-making and continuous improvement across complex industrial systems. The solution integrates the power of Seeq's Industrial Analytics and AI Suite with expert-derived context—at a scale designed to deliver meaningful impact across operations.

Latest Announcements by Industry Leaders

- In May 2025,Announcement - Catchpoint, a leading provider of Internet Performance Monitoring, has announced the launch of Mobile RUM, its new native real-user monitoring solution for mobile applications. Built on OpenTelemetry standards, the new feature provides teams with deep visibility into mobile experiences, offering unmatched insights into everything impacting mobile user experience across the Internet Stack—from app code to network performance. This rollout forms part of Catchpoint's broader platform enhancement, which also introduces Benchmarks, an expanded global observability network, BGP private peers, and enhanced AI-driven capabilities. “In today's rapidly evolving digital environment, the demand for dependable native mobile app real-user monitoring (RUM) and global visibility has become increasingly critical. We are proud to meet this demand by launching our latest Mobile RUM capabilities, leveraging OpenTelemetry to elevate the standards of observability, web performance monitoring, and Internet Stack insight,” said Mehdi Daoudi, CEO at Catchpoint. “By equipping our customers with these advanced tools, we help businesses deliver outstanding native mobile experiences, enhance app performance, and maintain a competitive edge in the mobile landscape,” he added.”

(Source: https://www.businesswire.com)

Segments covered in the report

By Platform Insight

- Application Performance

- Security

- Digital Experience

- Infrastructure

By Digital Experience Platform Insight

- Real User Experience

- Web Performance

- Synthetics

By Vertical Insight

- IT & ITES

- BFSI

- Telecom

- Media & Entertainment

- Retail & E-commerce

- Healthcare & Life Science

- Manufacturing

- Government

- Transportation & Logistics

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting