Exosuit Materials Market Size and Forecast 2025 to 2034

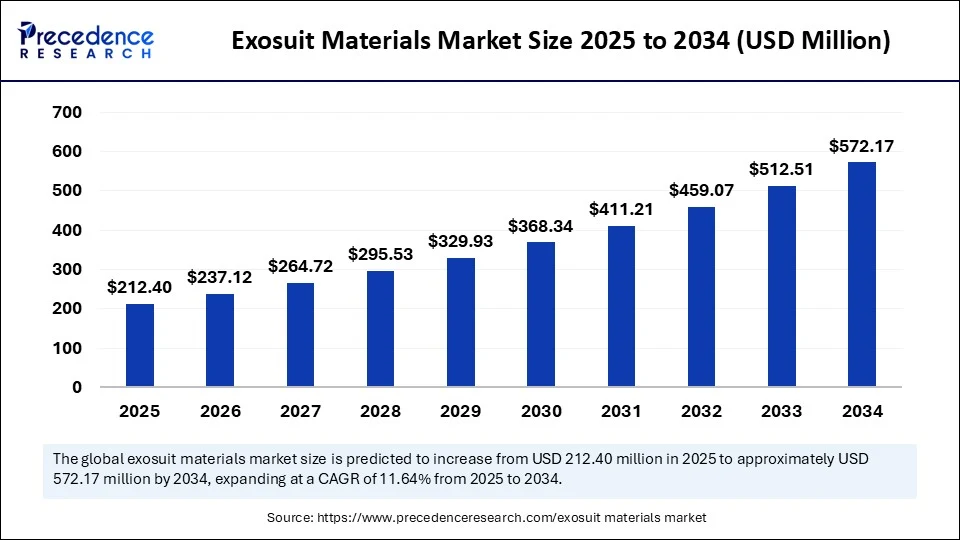

The global exosuit materials market size was estimated at USD 190.25 million in 2024 and is predicted to increase from USD 212.40 million in 2025 to approximately USD 572.17 million by 2034, expanding at a CAGR of 11.64% from 2025 to 2034. The rising demand for exosuits in healthcare, military, and other industries is likely to boost the growth of the market during the forecast period.

Exosuit Materials Market Key Takeaways

- In terms of revenue, the global exosuit materials market was valued at USD 190.25 million in 2024.

- It is projected to reach USD 572.17 million by 2034.

- The market is expected to grow at a CAGR of 11.64% from 2025 to 2034.

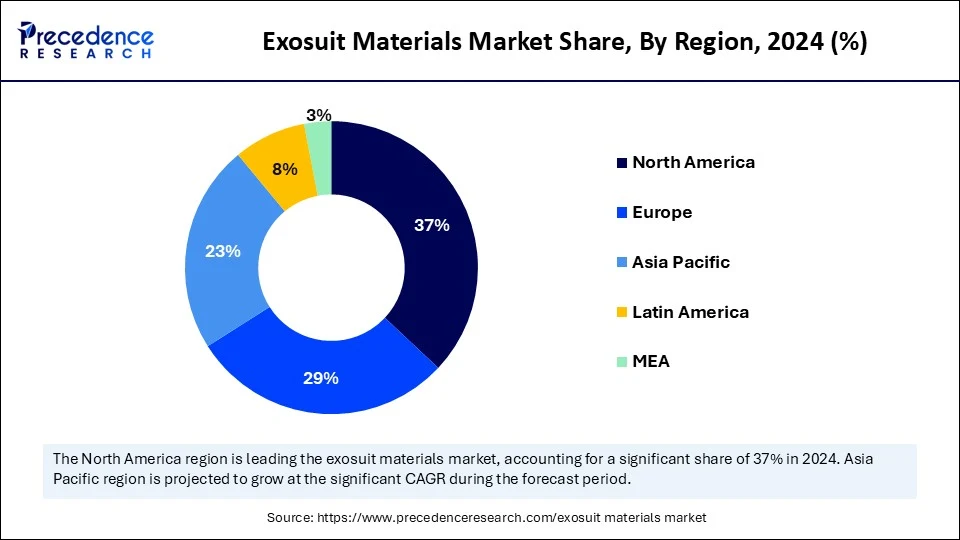

- North America dominated the global market with the largest market share of 37% in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecast years.

- By material type, the soft and flexible materials segment contributed the biggest market share of 45% in 2024.

- By material type, the sensor-integrated materials segment is anticipated to expand at the fastest CAGR over the forecast period.

- By suit type, the soft exosuits segment captured the highest market share of 53% in 2024.

- By suit type, the hybrid designs segment is anticipated to grow at the fastest CAGR over the forecast period.

- By application, the medical and rehabilitation segment held the major market share of 49% in 2024.

- By application, the industrial/occupational segment is anticipated to grow at the fastest CAGR over the forecast period.

- By end-user, the hospitals and rehab centers segment generated highest market share of 43% in 2024.

- By end-user, the manufacturing companies segment is anticipated to grow at the highest CAGR over the forecast period.

What Role Does AI Play in Advanced Exosuit Materials?

Artificial intelligence is revolutionizing the exosuit materials industry by enabling more adaptable, intelligent, and efficient wearable systems. This enhances user comfort, performance, and safety, particularly in rehabilitation and healthcare. AI accelerates material innovation, allowing materials to be pre-designed for specific conditions and optimized for durability, flexibility, and weight. In addition, AI algorithms are used to design and optimize exosuit materials. They can analyze vast datasets to identify the best materials and configurations for specific applications, improving performance and reducing costs.

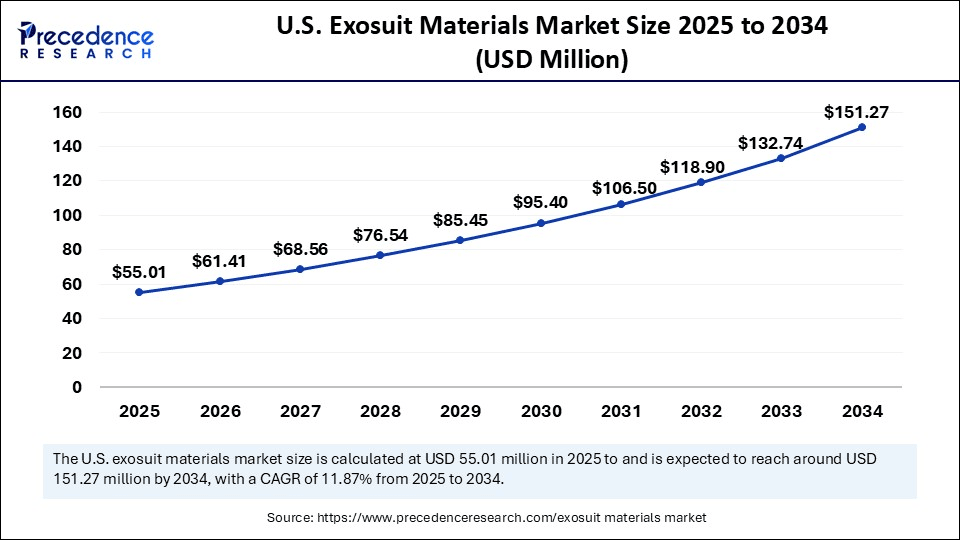

U.S. Exosuit Materials Market Size and Growth 2025 to 2034

The U.S. exosuit materials market size was exhibited at USD 49.27 million in 2024 and is projected to be worth around USD 151.27 million by 2034, growing at a CAGR of 11.87% from 2025 to 2034.

Why Did North America Lead the Exosuit Materials Market in 2024?

North America led the global exosuit materials market with the highest market share of 36–38% in 2024. This is mainly due to the early implementation of advanced technologies, a well-developed healthcare system, and high support from the government. Increased disposable income and an increase in the geriatric population in the region heightened the demand for mobility aids and rehabilitation tools. The U.S. is a major player in the market. There is high demand for advanced materials for exosuits, especially in the field of healthcare and rehabilitation. With the aging of the population, the prevalence of mobility disabilities as a result of strokes, spinal cord trauma, and musculoskeletal diseases is on the rise. The presence of leading medical device manufacturing companies and government initiatives, and funding for healthcare research and development further fuels the growth of the market.

Why is Asia Pacific Witnessing the Fastest Growth in the Exosuit Materials Market?

Asia Pacific is expected to experience the fastest growth during the forecast period. This is due to the increasing need for rehabilitation services, driven by expanding healthcare access and supportive government initiatives in developing economies. Countries like Japan, India, South Korea, and Australia are seeing a surge in demand for assistive technologies, spurred by aging populations, a rise in mobility disorders, and advancements in robotic rehabilitation. Concurrently, there's a growing focus on innovative, lightweight, and responsive exosuit materials, fueled by domestic startups and academic institutions specializing in soft robotics, smart textiles, and wearable technology.

China is a major contributor to market growth. This is due to its strong focus on enhancing human mobility, endurance, and recovery. This effort is supported by government research programs, local manufacturing capabilities, and a large population of elderly and disabled individuals. The combination of national innovation policies, a dynamic tech environment, and growing public-private investment is poised to position China as a global leader in the exosuit materials market.

What are the Key Factors Driving the European Exosuit Materials Market?

The European exosuit materials market is anticipated to experience notable growth in the coming years. This growth is supported by strong regulatory policies, a well-established healthcare system, and increasing investments in both medical and industrial sectors. European countries are at the forefront of implementing wearable robotics in workplace ergonomics, aiming to reduce injuries and improve productivity. Germany, France, and the UK are leading the way in exosuit adoption. Germany is a key player in the market, characterized by a robust regulatory framework and significant investment from major med-tech companies. German manufacturers and research centers are focused on developing soft, lightweight, and sensor-integrated materials, which are enhancing comfort, productivity, and compliance in the healthcare and industrial sectors.

Market Overview

The exosuit materials market refers to the range of advanced materials used in the design and fabrication of wearable robotic systems (exosuits or exoskeletons). These systems augment human strength, endurance, and mobility and are widely used in medical rehabilitation, defense, industrial ergonomics, and elderly support. The materials used in exosuits must be lightweight, durable, flexible (for soft exosuits), or rigid (for powered frames), with high strength-to-weight ratios, biocompatibility, and often embedded sensors or conductive properties.

The exosuit materials market is expanding due to rising demand from the healthcare, rehabilitation, and defense sectors. Wearable assistive technologies are gaining traction in healthcare to aid mobility for those recovering from spinal cord injuries or strokes. The military sector significantly contributes to market growth, requiring robust materials like titanium alloys, ballistic fabrics, and carbon composites to withstand thermal, abrasion, and environmental challenges.

What Factors are Boosting the Growth of the Exosuit Materials Market?

- Increasing Need of Assistive Healthcare Technologies: The rise in age-related ailments, including sarcopenia, incidences of spinal cord-associated injuries, and stroke, is boosting the demand for mobility-assistive devices.

- Demand for Wearable Support Systems: The aging global population is increasingly using wearable support systems to enhance mobility and independence. As the need for non-invasive solutions grows, exosuit materials must be comfortable, skin-safe, and non-restrictive.

- Advances in Technology in Materials Science: Advances in material science are enhancing exosuit efficiency, comfort, and capability.

- Customization and personalization: Advances in 3D printing and other technologies enable the creation of customized exosuits, meeting individual needs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 572.17 Million |

| Market Size in 2025 | USD 212.40 Million |

| Market Size in 2024 | USD 190.25 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Suit Type, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Use of Bio-Based and Recyclable Materials and High Demand for Exosuits from the Healthcare and Military Sectors

Due to growing awareness of climate change and the environmental impact of synthetic fabrics, manufacturers are shifting towards greener alternatives throughout the product life cycle. This leads to the development of plant-based composites, biodegradable polymers, and low-emission production methods, which minimize environmental footprints without compromising performance. This establishes a new industry benchmark and offers expansion opportunities in materials science, especially in designing high-performing, eco-friendly materials focused on wearability, durability, and comfort. Moreover, the rising demand for exosuits in the healthcare and military sectors drives market growth. Exosuits are used for rehabilitation, assisting patients with mobility issues, and enhancing the capabilities of healthcare professionals. They can enhance soldiers' strength, endurance, and protection.

Restraint

High Cost and Limited Availability of Advanced Materials

The high costs and limited availability of innovative materials such as smart textiles, carbon composites, and bio-engineered polymers are significant obstacles to the growth of the exosuit materials market. Although these materials exhibit superior strength, flexibility, and adaptability, their complex manufacturing processes make them expensive. This significantly increases the overall cost of exosuit production, making it economically challenging for mass production. This restricts opportunities for startups and smaller manufacturers and slows the commercialization of advanced exosuit technologies. These difficulties limit the scalability and widespread adoption of high-performance, sustainable materials in the exosuit domain.

Opportunity

Miniaturization and Integration of Sensor-Embedded Materials

Sensor-blended materials offer significant opportunities in miniaturization and integration. Conductive textiles, flexible circuitry, and graphene composites enable real-time functions in material handling, pressure sensing, and feedback control. These advancements allow exosuits to become more intelligent and responsive through semi-autonomous movements. Trends towards reduced size and power consumption of embedded sensors create new opportunities for more compact and user-friendly designs. Research and commercial efforts in small, low-power sensors are driving the development of efficient exosuits.

Material Type Insights

What Made Soft & Flexible Materials the Dominant Segment in the Exosuit Materials Market in 2024?

The soft & flexible materials segment led the market, holding a 44–46% share in 2024. This is mainly due to the increased adoption of flexible exosuits in industrial applications. These exosuits help reduce worker fatigue and injuries in manufacturing, construction, and logistics. Materials like Kevlar, nylon, and thermoplastic polyurethane (TPU) are essential for the exosuit's skeletal framework. Kevlar, a high-strength synthetic material, is ideal for resistance and battle-level exosuits due to its high tensile strain, impact resistance, and abrasion resistance. Nylon, a strong and durable polymer, is used as a base fabric or internal lining. TPU, a stretchy, non-water-absorbing material, is typically used for soft actuators, flexible joints, and outer covers.

The sensor-integrated materials segment is expected to grow at a significant CAGR over the forecast period. This is mainly due to the increasing integration of exosuits with IoT and AI. Graphene-based materials, like graphene oxide (GO) and reduced graphene oxide (rGO), are central to this revolution due to their ultra-high electrical conductivity, flexibility, and mechanical strength. Graphene's biocompatibility and thermal conductivity enhance comfort and wearability during long-term use.

Suit Type Insights

Why Did the Soft Exosuits Segment Dominate the Market in 2024?

The soft exosuits segment dominated the exosuit materials market with 52–54% share in 2024. This is mainly due to the increased need to reduce fatigue and improve comfort for users. Soft exosuits, made from advanced fabrics, shape memory alloys (SMAs), rubbers, and lightweight materials, offer mechanical support without rigid frameworks. Their construction allows for a snug fit, making them suitable for rehabilitation, senior mobility, and light industrial applications. They are also used in stroke rehabilitation and neuromuscular treatment, where soft support and biomechanical positioning are crucial.

The hybrid designs segment is expected to grow at the highest CAGR in the upcoming period. This is mainly due to their increased adoption in various industries. Hybrid designs strike a balance between strength and flexibility by combining both rigid and soft exosuits design. Hybrid exosuits are adapted to mobility and power needs, including industrial lift, military logistics, and high-level physical rehabilitation. The hybrid model will be a significant growth driver across the market, due to the increasing need for multi-purpose, adaptable exosuits. Their growing use in industries is leading to innovative composition material pilotage and smart control interfaces.

Application Insights

How Does the Medical & Rehabilitation Segment Dominate the Market in 2024?

The medical & rehabilitation segment led the exosuit materials market while holding a 48–50% share in 2024. This is mainly due to the increased stroke and spinal cord injuries, which have significantly increased the demand for exosuits in rehabilitation. Exosuits are meant to aid mobility for patients with stroke-related deficits, spinal cord injury, cerebral palsy, multiple sclerosis, and other neuromuscular conditions. Progressive materials, such as shape memory alloys (SMAs), and smart textiles are progressively utilized to deliver responsive support to the user's natural movements. Sensors and AI systems that adjust physiotherapy assistance dynamically are usually added to exosuits in the rehabilitation setting, which enhances treatment results. In addition, adoption is being enhanced by the increase in the number of older adults globally, as well as by the increase in rehabilitative demand in the home.

The industrial/occupational segment is expected to grow at a significant CAGR over the forecast period due to the growing focus on injury prevention. Industrial exosuits are aimed at providing human enhancements through strength amplification, physical unload, and efficiency improvements, especially in heavy applications in manufacturing, construction, and logistics sectors. These exosuits are made using strong, lightweight materials such as carbon fibers, reinforced plastics, and aluminium that would endure tough conditions without causing the wearer fatigue.

End-User Insights

What Made Hospitals & Rehab Centers the Dominant Segment in the Exosuit Materials Market in 2024?

The hospitals & rehab centers segment held a 42–44% share in the exosuit materials market in 2024. This is mainly due to the increased adoption of wearable assistive technologies. Hospitals and rehab centers primarily use exosuits to help patients restore mobility and functions after neurological injury, stroke, spinal cord injury, or orthopedic surgery. These exosuits are made using lightweight materials that are flexible and comfortable to provide prolonged use during physiotherapy sessions. Suits are combined with motion sensors and actuators to deliver customized assistance and help trigger muscle activation and neuroplasticity. The increasing focus on robotic-guided therapeutic sessions and customized therapeutic plans is also contributing to the demand for high-performance materials, as well as satisfying the functional, safety, and hygiene needs of clinical environments.

The manufacturing companies segment is expected to grow at the fastest rate in the upcoming period. This is mainly due to the increased need to improve workforce safety. Manufacturing companies, particularly in industries like construction, warehousing, and logistics, increasingly use exosuits to prevent injuries and ergonomic stress. The growing concern about worker safety is boosting the demand for assistive technologies.

Recent Developments

- In April 2025, Occupational exosuits developer HeroWear raised a Series A round of funding, taking USD 5 million in investment through the Japan-based firm White Road Investments, which will reach out to engage clients at the principal enterprise level, accelerating the integration of engagement levels through Engage. Engage will collaborate with HeroWearing to provide a stipulation on spending governance.(Source: https://www.businesswire.com)

- In January 2024, Mehler Systems launched the ExoM Up-Armoured Exoskeleton. Mawashi Science & Technology has developed the product together with GIGN and Mehler Protection. Designed to keep law enforcement and the military in balance between weight optimization and ballistic protection, this heterogeneous innovation serves as the opposite pole of lightweight and security.(Source:https://mehler-systems.com)

- In March 2023, HeroWear announced the launch of its new exosuit, Apex 2. The company stated that their flagship model, Apex, was iteratively developed over 3 years with user feedback testing. The Apex 2 aims to reduce back muscle stress for workers in warehousing, construction, agriculture, and farming job functions who frequently strengthen their backs and lift shipments, and sales began in summer 2023.(Source: https://exoskeletonreport.com)

Exosuit Materials Market Companies

- DuPont

- Toray Industries

- Hexcel Corporation

- Teijin Limited

- Solvay S.A.

- 3M

- BASF SE

- Arkema

- DSM

- Sabic

- Covestro AG

- Owens Corning

- Parker Hannifin

- Gore Fabrics (Gore-Tex)

- Lubrizol

- Eastman Chemical Company

- E-textiles by Myant Inc.

- StretchSense Ltd.

- Xsens Technologies

- Conductive Composites Co.

Market segment Covered in the Report

By Material Type

- Soft & Flexible Materials

- Textiles (Nylon, Polyester, Kevlar)

- Elastomers (Silicone, TPU, Neoprene)

- Smart Fabrics / E-textiles

- Rigid & Structural Materials

- Carbon Fiber Composites

- High-Strength Aluminum Alloys

- Titanium Alloys

- Engineering Plastics (Polycarbonate, PEEK)

- Sensor-Integrated Materials

- Piezoelectric Materials

- Graphene-based Materials

- Liquid Metal Alloys

- Flexible Printed Circuits (FPCs)

- Energy Storage Materials

- Thin-Film Batteries

- Solid-State Batteries

- Supercapacitor Materials

By Suit Type

- Soft Exosuits

- Fabric-based actuation systems

- Pneumatic / Hydraulic textiles

- Rigid Exoskeletons

- Powered upper/lower body frames

- Passive support structures

- Hybrid Designs

- Mixed soft–rigid architectures

By Application

- Medical & Rehabilitation

- Post-stroke therapy

- Spinal cord injury

- Elderly mobility assistance

- Defense & Military

- Load carriage

- Endurance enhancement

- Injury prevention

- Industrial / Occupational

- Logistics

- Construction

- Assembly lines

- Consumer & Sports

- Mobility aid for the elderly

- Athletic enhancement (early-stage)

By End-User

- Hospitals & Rehabilitation Centers

- Defense Organizations / Military

- Manufacturing Companies

- Construction Firms

- Individuals (Home Care / Personal Use)

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting