What is the Fluorinated Compounds Market Size?

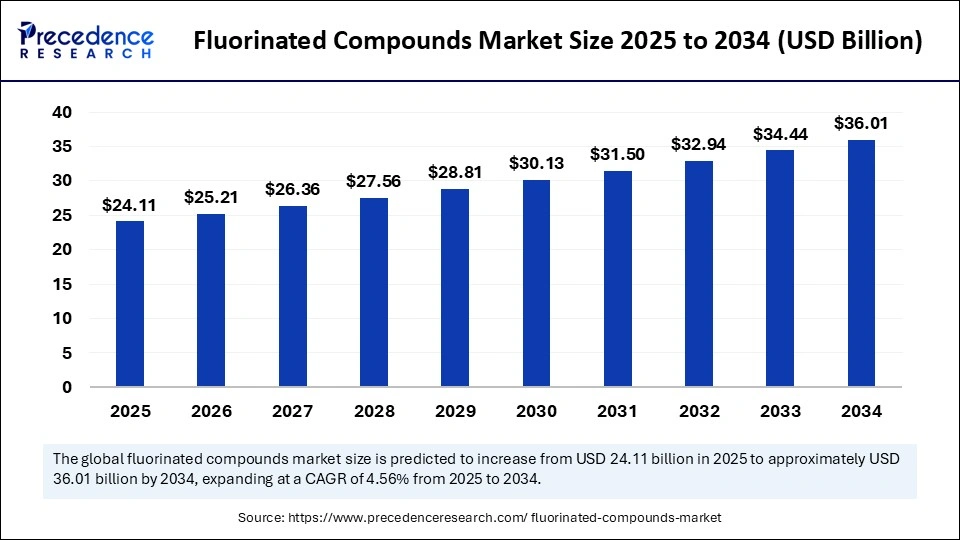

The global fluorinated compounds market size accounted for USD 23.06 billion in 2024 and is predicted to increase from USD 24.11 billion in 2025 to approximately USD 36.01 billion by 2034, expanding at a CAGR of 4.56% from 2025 to 2034. The market is experiencing steady growth, striking a balance between industrial demand and sustainability pressures.

Fluorinated Compounds Market Key Takeaways

- In terms of revenue, the global fluorinated compounds market was valued at USD 23.06 billion in 2024.

- It is projected to reach USD 36.01 billion by 2034.

- The market is expected to grow at a CAGR of 4.56% from 2025 to 2034.

- Asia Pacific dominated the fluorinated compounds market in 2024.

- North America is expected to expand at the fastest CAGR between 2025 and 2034.

- By product type, the fluoropolymers (PTFE) segment held the largest market share in 2024.

- By product type, fluorinated pharmaceuticals & APIs are expected to grow at a remarkable CAGR between 2025 and 2034.

- By manufacturing method type, the electrochemical fluorination segment captured the highest market share in 2024.

- By manufacturing method type, direct fluorination is expected to grow at a remarkable CAGR between 2025 and 2034.

- By Application type, the automotive & transportation segments contributed the highest market share in 2024.

- By Application type, electrical & electronics is expected to grow at a remarkable CAGR between 2025 and 2034.

- By end-user type, the chemicals and materials segment generated the major market share in 2024.

- By end-user type, pharmaceutical & biotech companies are expected to grow at a remarkable CAGR between 2025 and 2034.

Market Overview

The fluorinated compounds market covers a wide range of chemical products containing fluorine, valued for their high chemical stability, low surface energy, hydrophobic and oleophobic properties, and strong carbon–fluorine bonds. These compounds are widely used in refrigerants, fluoropolymers, surfactants, pharmaceuticals, agrochemicals, and specialty industrial applications. Fluorinated compounds offer heat resistance, chemical inertness, dielectric properties, and lubrication advantages, enabling their use across various sectors, including electronics, automotive, aerospace, healthcare, coatings, and energy. Growing demand for high-performance materials, miniaturized electronics, lithium-ion batteries, and fluorine-based pharmaceuticals continues to drive market growth. Regulatory challenges around the environmental impact of fluorinated gases and PFAS are also shaping market shifts toward sustainable alternatives and low-GWP fluorochemicals.

The fluorinated compounds market plays a pivotal role across various industries, including pharmaceuticals, agrochemicals, electronics, and specialty polymers. These compounds are valued for their chemical stability, thermal resistance, and ability to enhance performance in critical applications. Growing demand for advanced materials in semiconductors, electric vehicles, and renewable energy has reinforced the importance of fluorinated compounds. At the same time, the pharmaceutical sector continues to rely heavily on fluorinated intermediates for the development of life-saving drugs. However, regulatory concerns about environmental persistence and toxicity are prompting innovation in sustainable and low-impact alternatives. Overall, the market is experiencing steady growth, striking a balance between industrial demand and sustainability pressures.

How AI Impacted the Fluorinated Compounds Market

Artificial intelligence has significantly influenced the fluorinated compounds market by accelerating R&D and optimizing production. Machine learning algorithms are being applied to predict molecular properties and identify new fluorinated molecules with targeted performance in pharmaceuticals and agrochemicals. AI-driven simulations reduce experimental costs and shorten development cycles for high-value compounds. In manufacturing, AI-enabled process monitoring ensures consistency, minimizes waste, and improves energy efficiency in fluorination reactions. On the demand side, predictive analytics help stakeholders anticipate regulatory shifts and market requirements, enabling faster adaptation. This integration of AI is not only enhancing innovation but also positioning the market toward more sustainable and commercially viable pathways.

Market Key Trends

- Strong demand from pharmaceuticals, electronics, and agrochemicals continues to drive market growth.

- AI is reshaping discovery, formulation, and process optimization for fluorinated compounds.

- Environmental regulations and toxicity concerns remain a significant challenge.

- Asia Pacific leads due to robust chemical and electronics industries.

- North America emerges as the fastest-growing market driven by advanced R&D and regulatory compliance.

- Opportunities lie in green fluorination technologies and next-gen materials for EVs and semiconductors.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 36.01 Billion |

| Market Size in 2025 | USD 24.11 Billion |

| Market Size in 2024 | USD 23.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.56% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Manufacturing Method, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

A major driver of the fluorinated compounds market is the rising demand from the pharmaceutical and electronics industries. Fluorinated molecules are integral to modern drug formulations, where they enhance bioavailability, metabolic stability, and therapeutic efficacy. In electronics, fluorinated polymers and refrigerants play a critical role in semiconductors, displays, and cooling systems. The rapid expansion of electric vehicles and renewable energy infrastructure also requires fluorinated materials in batteries and solar panels. Furthermore, urbanization and agricultural needs are pushing up demand for fluorinated agrochemicals, which improve crop yields and resilience. Together, these applications highlight the versatility and indispensability of fluorinated compounds in advancing modern industries.

Restraint

The fluorinated compounds market faces significant restraints stemming from environmental and health concerns associated with persistent fluorinated chemicals. Compounds like PFAS (per- and polyfluoroalkyl substances) are under intense regulatory scrutiny due to their persistence in ecosystems and potential health risks. Strict regulations in Europe and North America are increasing compliance costs for producers. Disposal challenges and high costs of developing eco-friendly alternatives also act as barriers. Additionally, the availability of safer substitutes in certain applications is gradually pressuring market growth. These restraints underscore the need for the industry to transition toward greener fluorination processes and more sustainable product portfolios.

Opportunity

Despite challenges, the fluorinated compounds market presents vast opportunities in next-generation technologies. Growing investment in electric mobility is creating demand for fluorinated electrolytes and additives in lithium-ion and solid-state batteries. In semiconductors, the need for ultra-pure fluorinated gases and materials is rising with the advancement of smaller and more complex chips. There is also a strong opportunity in the development of sustainable fluorination techniques, including catalytic and bio-based methods, which align with regulatory and consumer pressures for greener chemistry. Furthermore, in healthcare, ongoing innovation in fluorinated drug candidates opens pathways for breakthrough therapies. Companies that successfully balance innovation with environmental responsibility are likely to lead the market forward.

Product Type Insights

Why Did Fluoropolymers Dominate the Global Fluorinated Compounds Market?

Fluoropolymers dominate the global fluorinated compounds market due to their exceptional thermal stability, chemical resistance, and durability across diverse applications. They are widely used in coatings, linings, and membranes, particularly in industries that require high-performance materials under extreme conditions. Automotive, aerospace, and chemical processing rely heavily on fluoropolymers for fuel houses, gaskets, seals, and anti-corrosion systems. Their use in non-stick cookware and construction materials further reinforces their dominance. Additionally, in the renewable energy and semiconductor industries, fluoropolymers are indispensable for insulation, encapsulation, and protective layers. This broad utility has positioned fluoropolymers as the cornerstone of the fluorinated compounds market.

The growing demand for energy-efficient vehicles and advanced electronics continues to sustain the leadership of fluoropolymers. Emerging applications in EV batteries, 5G components, and hydrogen fuel cells are creating additional pull for high-performance fluoropolymer materials. Despite regulatory concerns about persistent fluorochemicals, they often meet stricter standards due to their durability, and potential for greener processing methods are further enhancing their market resilience. With ongoing R&D in sustainable fluoropolymers production, their role as the dominating product type is expected to persist in the long term.

Fluorinated pharmaceuticals and active pharmaceutical ingredients represent the fastest-growing segment of the market, owing to the unique role of fluorine in enhancing drug performance. Incorporating fluorine into drug molecules improves bioavailability, stability, and therapeutic efficacy. The surge in chronic diseases, oncology drugs, and specialty therapies has fueled significant demand for fluorinated APIs globally. Fluorinated intermediates are now essential for the development of next-generation medicines, including antivirals, antibiotics, and cardiovascular treatments.

Biotech companies and pharmaceutical manufacturers are increasingly relying on fluorinated APIs to shorten development cycles and improve success rates in clinical pipelines. With AI-driven molecular design, the discovery of novel fluorinated drugs is accelerating, thereby further propelling the growth of this segment. Regulatory approvals for fluorine-based medicines continue to expand across key global markets. As healthcare investments rise and personalized medicine gains traction, fluorinated pharmaceuticals are expected to outpace other product types in growth.

Manufacturing Method Insights

Why Electrochemical Fluorination Is Dominating the Fluorinated Compounds Market?

Electrochemical fluorination (ECF) continues to dominate the manufacturing methods for fluorinated compounds due to its efficiency in producing a wide variety of stable perfluorinated compounds. The process allows for large-scale production, which is critical for industrial applications where high volumes are needed. ECF is particularly important in manufacturing fluoropolymers, refrigerants, and specialty intermediates. Its scalability and proven reliability make it the go-to process for chemical and material manufacturers worldwide. Furthermore, it enables the production of high-purity compounds, a necessity for sectors like semiconductors and pharmaceuticals.

Although the process is energy-intensive, ongoing improvements in process control and energy efficiency are helping maintain its leadership. Regulatory challenges surrounding PFAS have driven producers to modify and adapt ECF for compliance, ensuring its continued relevance. Global players are investing in upgrading ECF facilities to improve yield, reduce waste, and enhance environmental performance. This balance of scalability and adaptability ensures that electrochemical fluorination will remain the dominating manufacturing method.

Direct fluorination is the fastest-growing method, owing to its ability to streamline production and reduce costs. Unlike multi-step processes, direct fluorination enables the direct substitution of fluorine atoms into organic molecules, creating high-value compounds more efficiently. This approach is gaining traction in the pharmaceutical and agrochemical industries, where the rapid synthesis of new molecules is crucial for maintaining a competitive advantage. Direct fluorination also finds growing applications in specialty materials and advanced electronics.

Advancements in catalytic systems and safer fluorine-handling technologies are accelerating adoption. The method's ability to deliver high-purity compounds with fewer steps aligns with the industry's push for cost reduction and sustainability. While historically considered challenging due to safety concerns, modern containment and automation solutions have made direct fluorination increasingly viable as industries demand faster, more efficient synthesis routes. Direct fluorination is poised to expand rapidly and become a mainstream alternative to conventional methods.

Application Insights

Why are Automotive and Transportation Dominating the Fluorinated Compounds Market?

Automotive and transportation dominate applications of fluorinated compounds due to the sector's reliance on high-performance materials. Fluoropolymers are essential in fuel systems, seals, gaskets, and hoses, ensuring durability under harsh chemical and temperature conditions. Lightweight fluorinated coatings and composites also contribute to improving fuel efficiency and reducing emissions. The rise of electric vehicles further strengthens this application, as fluorinated electrolytes and battery components are critical for performance and safety.

Additionally, aerospace transportation relies on fluorinated compounds for lightweight, durable materials that enhance operational efficiency and safety. With governments and industries pushing for greener mobility solutions, fluorinated materials are central to developing next-generation EVs, hybrid vehicles, and fuel-efficient aircraft. Their chemical resilience and long lifecycle performance position them as irreplaceable in automotive and transportation applications.

The electrical and electronics industry is the fastest-growing application segment in the fluorinated compounds market, driven by the demand for semiconductors, 5G infrastructure, and consumer electronics. Fluorinated gases and etchants are vital in semiconductor manufacturing, enabling precise etching and cleaning of circuits. Fluoropolymers are used as insulators, encapsulants, and coatings to improve device reliability and heat resistance.

The expansion of renewable energy and smart grids is further fueling demand, with fluorinated materials used in solar panels, batteries, and high-voltage cables. As electronics become smaller, faster, and more complex, the need for ultra-pure fluorinated compounds is increasing. This rapid growth is also supported by the global push for digitalization and AI-driven technologies, making electrical and electronics the most dynamic application for fluorinated compounds.

End User Insights

Why Are Chemicals and Materials Dominating the Fluorinated Compounds Market?

Chemical and material manufacturers dominate end-user demand as they rely heavily on fluorinated compounds for the production of polymers, coatings, and intermediates. These companies form the backbone of supply chains serving automotive, electronics, construction, and industrial applications. Large-scale facilities equipped with advanced fluorination technologies ensure a consistent supply and high-quality outputs.

Their central role is reinforced by continuous investments in scaling production capacity and innovating greener processes. By serving as both producers and suppliers, these manufacturers hold strategic importance in the fluorinated compounds ecosystem. Their dominance is unlikely to be challenged, given their infrastructure, expertise, and integration with downstream industries.

Pharmaceutical and biotech companies are the fastest-growing end-users, driven by the increasing importance of fluorinated APIs and drug intermediates. These organizations leverage fluorine's unique properties to develop more effective therapies for oncology, infectious diseases, and chronic conditions. With increasing investments in R&D and AI-driven drug discovery, the pipeline of fluorinated molecules is rapidly expanding.

The biotech sector, in particular, is adopting fluorinated compounds in personalized medicine and advanced therapies. Collaborations between chemical producers and pharmaceutical innovators are accelerating the commercial adoption of new fluorinated drugs. As global healthcare needs rise, pharmaceuticals and biotech companies are set to outpace other end-user segments in growth.

Regional Insights

Why is Asia Pacific Leading the Fluorinated Compounds Market?

Asia Pacific dominates the fluorinated compounds market, fueled by its robust chemical manufacturing ecosystem, large-scale pharmaceutical production, and booming electronics sector. Countries such as China, Japan, South Korea, and India are key hubs for both demand and supply, with advanced infrastructure supporting large-volume production. Rising investments in electric vehicles and renewable energy technologies further drive the consumption of fluorinated materials in the region. Government initiatives promoting industrial expansion and research and development (R&D) are also strengthening the regional foothold. The presence of cost-competitive labor and raw materials gives the Asia Pacific an additional edge.

The region's dominance is also tied to its leadership in semiconductor manufacturing, where fluorinated gases and chemicals play an essential role in etching and cleaning processes. Japan and South Korea, in particular, remain at the forefront of high-purity fluorinated materials for electronics. Simultaneously, China is investing heavily in expanding fluoropolymer production for diverse industrial applications. As pharmaceutical and agrochemical demand continues to rise in India and Southeast Asia, fluorinated compounds are becoming even more embedded in the region's economic fabric.

Sustainability concerns are gradually shaping strategies in the Asia Pacific, with local companies exploring greener processes and compliance with global regulations. While regulatory pressure is less intense compared to Europe, rising awareness and export-driven requirements are prompting industries to adopt responsible practices. This balance between cost competitiveness and evolving environmental priorities ensures the Asia Pacific's continuing dominance in the market.

Why Is North America Growing at the Fastest Rate in the Fluorinated Compounds Market?

North America is emerging as the fastest-growing market for fluorinated compounds, propelled by advanced R&D, stringent regulatory frameworks, and strong demand from high-tech industries. The United States leads the region, with its emphasis on pharmaceutical innovation, semiconductor development, and sustainable chemistry. Rising demand for environmentally safer fluorinated alternatives is fostering research collaborations and technology commercialization. In Canada and Mexico, growing investments in automotive and energy sectors are also supporting adoption. The region benefits from its strong intellectual property ecosystem, which encourages continuous innovation.

North America's rapid growth is further supported by the expansion of its renewable energy and EV infrastructure. Fluorinated materials are critical for high-performance batteries, solar panels, and hydrogen technologies, all of which are gaining policy and financial backing. With strong commitments to carbon neutrality, companies in the region are investing heavily in green fluorination processes and circular economy initiatives. Additionally, partnerships between academia and industry are accelerating breakthroughs in next-gen materials.

Environmental awareness remains a defining factor for the region's growth trajectory. Regulatory scrutiny of PFAS and similar compounds is pushing industries toward safer alternatives, but it also creates opportunities for innovators to fill the gap with sustainable solutions. With its combination of regulatory rigor, innovation culture, and industrial demand, North America is expected to remain the fastest-growing hub for fluorinated compounds.

Fluorinated Compounds Market Companies

- 3M Company

- Arkema S.A.

- Daikin Industries Ltd.

- Solvay S.A.

- Chemours Company

- AGC Inc.

- Honeywell International Inc.

- Dongyue Group

- Gujarat Fluorochemicals Ltd. (InoxGFL Group)

- Halocarbon Products Corporation

- Asahi Glass Co. (AGC Chemicals)

- BASF SE (fluorine intermediates)

- Shanghai 3F New Materials Co., Ltd.

- Pelchem SOC Ltd.

- Sinochem Lantian Co. Ltd.

- Navin Fluorine International Ltd.

- Tokuyama Corporation

- Central Glass Co. Ltd.

- Stella Chemifa Corporation

- Kureha Corporation

Recent Developments

- In September 2025, Dr. Ryi Shin-kun and his research team from the CCS Research Department at the Korea Institute of Energy Research (President Yi, Chang-Keun, hereinafter referred to as KIER) have succeeded in developing a new catalyst capable of stably decomposing greenhouse gases generated in semiconductor and display manufacturing processes, even at low temperatures. Flagship industries of the Republic of Korea, semiconductors and displays, are expected to continue their growth as the importance of AI and virtual reality increases. However, during semiconductor and display production, gases such as carbon tetrafluoride (CF?) and hexafluoroethane (C?F?), which have a greenhouse effect more than 5,000 times greater than carbon dioxide, are emitted, causing negative impacts on the environment.(Source: https://www.eurekalert.org)

Segment Covered in this Report

By Product Type

- Fluoropolymers

- PTFE (Polytetrafluoroethylene)

- PVDF (Polyvinylidene fluoride)

- FEP (Fluorinated ethylene propylene)

- ETFE (Ethylene tetrafluoroethylene)

- Others

- Fluorosurfactants

- Fluorinated Refrigerants (HFCs, HFOs, Blends)

- Fluorinated Specialty Chemicals

- Fluorinated solvents

- Fluorinated monomers & intermediates

- Fluorinated Pharmaceuticals & APIs

- Fluorinated Agrochemicals

- Others

By Manufacturing Method

- Electrochemical fluorination (ECF)

- Direct fluorination

- Polymerization & compounding

- Others

By Application

- Automotive & transportation

- Electrical & electronics (semiconductors, batteries, coatings)

- Aerospace & defense

- Industrial processing & chemicals

- Healthcare & pharmaceuticals

- Agriculture (crop protection)

- Refrigeration & air conditioning

- Energy (fuel cells, solar, batteries)

- Others

By End User

- Chemical & material manufacturers

- Automotive OEMs

- Electronics & semiconductor companies

- Aerospace companies

- Pharmaceutical & biotech companies

- Agrochemical producers

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting