What is the FRP Pipe Market Size?

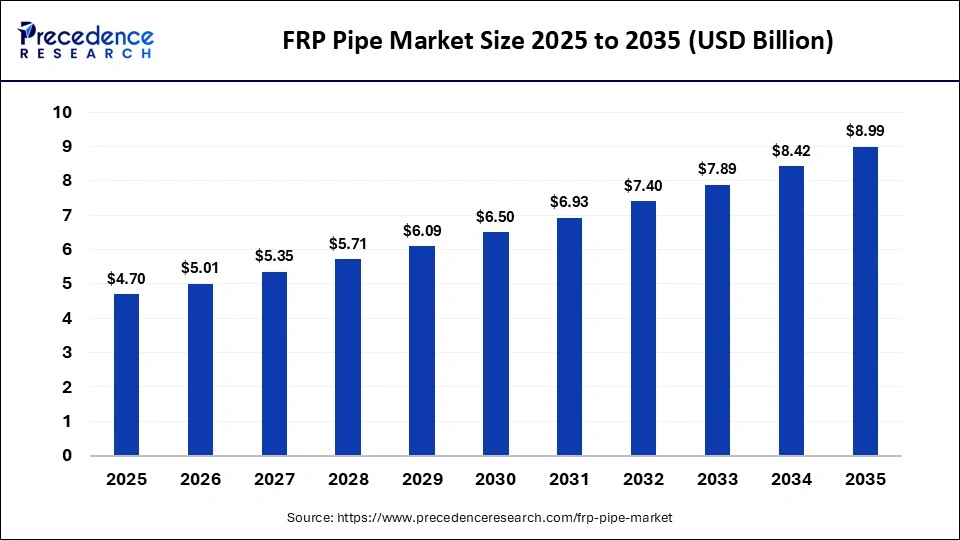

The global FRP pipe market size accounted for USD 4.70 billion in 2025 and is predicted to increase from USD 5.01 billion in 2026 to approximately USD 8.99 billion by 2035, expanding at a CAGR of 6.71% from 2026 to 2035. The FRP pipe market is growing steadily, driven by rising water infrastructure projects, corrosion-resistant demand in chemicals and oil & gas, and increasing adoption in wastewater treatment.

Market Highlights

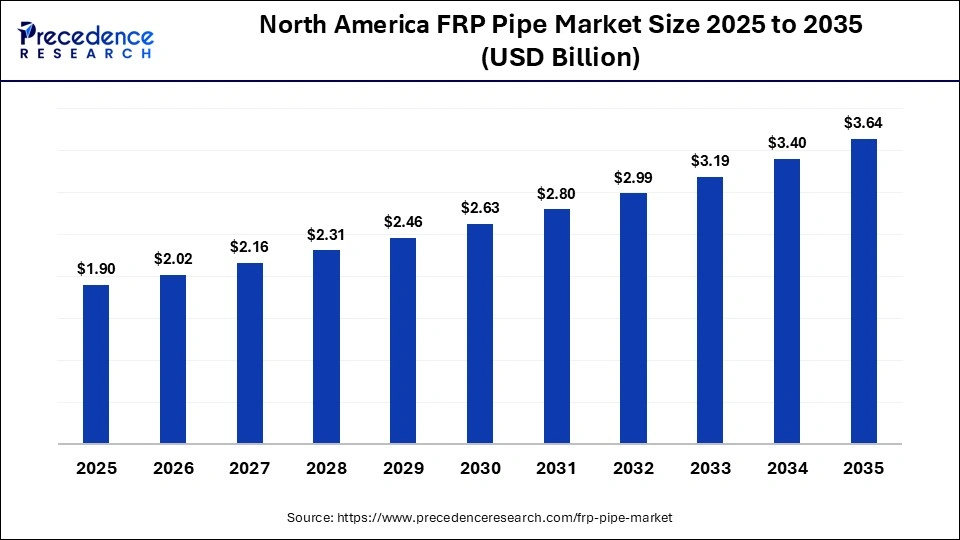

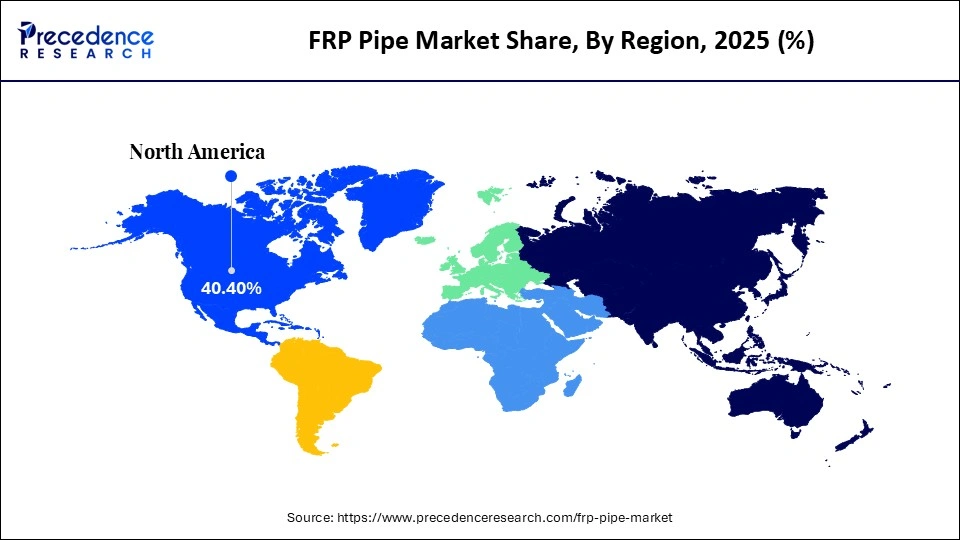

- North America led the FRP pipe market and held a 40.4% of the market share in 2025.

- The Asia Pacific is growing at a CAGR of 6% between 2026 and 2035.

- By material/type, the polyester FRP pipe segment contributed the biggest market share of 2025.

- By material/type, the polyurethane FRP pipe segment is poised to grow at a CAGR of 5.4% from 2026 and 2035.

- By application, the oil & gas segment dominated and held a 42.3% of the market share in 2025.

- By application, the water & wastewater segment is expected to grow at a CAGR of 5.2% from 2026 to 2035.

- By end-user, the industrial segment captured 40.4% of market share in 2025.

- By end-user, the commercial segment is growing at a CAGR of 5.2% between 2026 and 2035.

- By joint/connection type, the bell-and-spigot segment dominated the market in 2025 with 52.4% market share.

- By joint/connection type, the butt-and-strap segment is poised to grow at a CAGR of 5.3% between 2026 and 2035.

What Are the Reasons Behind the Rapid Growth of the FRP Pipe Market?

The FRP pipe industry manufactures piping systems using fiber-reinforced polymer composites, typically combining glass or carbon fibers with thermoset resins such as polyester, vinyl ester, or epoxy. These pipes exhibit high strength-to-weight ratios and inherent resistance to corrosion, abrasion, and chemical attack, making them particularly suitable for environments where conventional metal piping systems are prone to rapid degradation, scaling, or failure. As a result, FRP pipes are widely deployed in corrosive and moisture-intensive settings where long service life and low failure risk are critical.

Growth in the FRP pipe industry is strongly linked to sustained investment in infrastructure and process industries. Expansion of wastewater treatment plants, sewage conveyance networks, and industrial effluent management systems has increased demand for non-corrosive piping capable of handling aggressive media such as chlorides, sulfides, acids, and high-salinity water. Similarly, oil and gas processing facilities, chemical plants, power generation units, and desalination plants increasingly specify FRP piping for cooling water lines, brine handling, chemical transfer, and underground installations where corrosion resistance and reduced maintenance downtime are operational priorities.

Material performance characteristics continue to support broader adoption. FRP pipes are lightweight, which reduces transportation, handling, and installation costs, particularly for large-diameter pipelines and remote project sites. Their low maintenance requirements, resistance to chemical exposure, and ability to tolerate wide temperature fluctuations without loss of structural integrity make them attractive to facility owners seeking to minimize lifecycle costs. Ongoing improvements in resin formulations, filament winding techniques, and quality control during pipe manufacturing are further enhancing pressure ratings, joint reliability, and long-term mechanical performance. These advances are strengthening acceptance of FRP piping across municipal water systems, industrial processing facilities, and infrastructure projects where durability, corrosion resistance, and predictable long-term performance are essential.

Using Smart AI Technology to Change the Way FRP Pipes Are Manufactured & Designed

Artificial Intelligence (AI) is changing how fiberglass reinforced plastic (FRP) pipes are manufactured by embedding data-driven control and decision-making directly into design, production, and quality assurance workflows. In the design phase, AI-enabled simulation tools are used to model fiber orientation, laminate stacking sequences, and resin-fiber interactions under different pressure, temperature, and load conditions. These models allow manufacturers to optimize structural performance parameters such as hoop strength, axial stiffness, and fatigue resistance before physical prototyping begins, reducing design iteration cycles and material waste. During production, machine learning algorithms analyze process variables in filament winding and centrifugal casting operations to maintain optimal fiber tension, winding angles, and resin impregnation consistency, which directly improves mechanical uniformity along the pipe length.

In manufacturing and quality control, AI-powered vision systems and sensor analytics play a critical role in defect detection and process stabilization. High-resolution cameras and non-destructive evaluation sensors, combined with trained machine learning models, identify voids, delamination, dry fiber zones, and resin-rich areas in real time. AI systems correlate these defects with upstream process deviations such as temperature gradients, curing profiles, or fiber feed irregularities, enabling immediate corrective action on the production line. This closed-loop control improves batch-to-batch consistency, enhances pressure rating reliability, and reduces the likelihood of premature field failures in demanding applications such as wastewater conveyance, chemical transport, and oil and gas facilities.

AI-enabled predictive maintenance further strengthens operational efficiency across FRP manufacturing facilities. Sensors embedded in winding machines, curing ovens, and cutting systems continuously generate vibration, thermal, and load data, which AI models use to predict equipment wear and impending failures. This allows maintenance teams to schedule interventions before breakdowns occur, minimizing unplanned downtime, stabilizing throughput, and extending equipment service life. Reduced stoppages and scrap rates translate directly into lower production costs and improved supply chain reliability, particularly for large-diameter or custom-engineered FRP piping systems.

FRP Pipe Market Outlook

- Overview of the Market: New piping materials (FRP) are becoming an increasingly viable option compared to older pipe materials (steel/concrete) because of FRP's corrosion resistance, extended usable life, and lower lifecycle maintenance cost by 30% vs. using traditional materials.

- Impact of Government Infrastructure Developments: Government water, sewer, and pipeline projects are the driving force behind FRP's growing acceptance in new pipe system designs as countries transition to new pipe systems while neglecting the development of new pipe systems for water distribution.

- Sustainability and Environmental Regulations: Environmental laws that govern municipalities, as well as municipal projects funded by the government, are now focused on using a more sustainable type of piping because FRP offers a better solution for future demands for the new piping system due to the lower carbon footprint of FRP pipes and the fact that they can be recycled.

- Government-Funded Projects and National Initiatives: The Indian government's National Water Mission will provide significant new opportunities to increase the amount of water that can be delivered by distribution networks through the increased use of corrosion-resistant, durable pipe systems.

- New Technologies: New advancements in resin systems and embedded monitoring technology are allowing FRP to perform better in all environments where pipelines traditionally have failed.

- Industry Specific Factors: All of the following industries are identifying FRP as a viable alternative to currently used pipe products for lightweight design and corrosion resistance and to extend pipe service life versus current piping alternatives: oil and gas, chemical processing, and desalination.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.70 Billion |

| Market Size in 2026 | USD 5.01 Billion |

| Market Size by 2035 | USD 8.99 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.71% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material/Type, Application, End-User, Joint/Connection Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Material/Type Insights

Why Are FRP Polyester Pipes Leading the Way in FRP Pipe Adoption During 2025?

The polyester FRP pipe segment led the market for FRP pipes during 2025 with a 45.6% share, due to a perfect combination of mechanical strength, corrosion resistance, and affordability. Many industries are switching to using polyester FRP pipes for chemical transportation, along with civic bodies implementing them in municipal water systems. Polyester pipes have also found their way into industrial effluent lines and inside chemical handling facilities because they can handle moderate pressure/temperature conditions with ease. The simple manufacturing process, availability of raw material, and compatibility with large-diameter applications make polyester FRP the go-to material for the largest infrastructure-based projects.

The polyurethane pipe segment is the fastest-growing FRP material segment with a 5.4% CAGR due to increasing demand for greater flexibility, improved abrasion resistance, and higher impact strength applications. As a result, polyurethane pipes are now being used more frequently in mining slurry, transport applications, very aggressive industrial work environments, and vibration resistance applications. Additionally, because of their exceptional structural integrity when subjected to dynamic loading and operating in harsh conditions, polyurethane pipes will continue to be utilized in expanding specialized energy and industrial operations moving forward.

Application Insights

What Makes Oil & Gas the Dominant Application Segment in the FRP Pipe Industry?

The oil & gas segment is the largest customer for FRP pipes because of the large demand emerging from the space for corrosion-resistant lightweight pipes from sources to consumers (downstream) and at sea. FRP pipes are used in produced water systems, chemical injection systems, and fire systems. Because FRP pipes aren't affected by corrosive gas, salt water, and chemicals, they require less maintenance than other types of pipes over the long term. Therefore, they are ideal for long-term use on structures that transport hydrocarbons and their derivatives.

The water & wastewater segment is one of the fastest-growing applications of FRP pipes with a 5.2% expected CAGR in the period between 2026 and 2035, because cities and major civic bodies are increasingly investing in urban supply, sewage treatment, and desalting projects. The long life, smooth internal surfaces, and ability to resist both microbial and chemically corroding agents make FRP pipes more cost-effective for transporting water to, from, and through cities, along with the added benefits of reduced water leakage, lower electricity use, and diminished operational interruptions when upgrading their existing pipelines. The minimal maintenance requirements for these pipes also mean less frequent disruptions to city infrastructure.

End-User Insights

What Made the Industrial Sector the Largest Consumer of FRP Pipes During 2025?

The industrial segment made up the largest end-user in the market for FRP pipes with a 40.4% share in 2025 because of the ever-increasing need for these kinds of pipes in the various industrial sectors, ranging from chemical processing and oil refining to electric power generation and mining. The main advantages of using FRP pipes in these industries are their ability to transport corrosive liquids and gases, their strength to withstand extreme pressures, and their ability to carry large chemical loads without breaking down. FRP pipes are also lightweight and easy to work with in complex plant configurations, and they typically have lower total costs of ownership than metals over the lifetime of the pipe.

The commercial segment is expected to see significant growth in the forecasted period with an expected 5.2% CAGR as demand from the commercial segment of the market is set to expand rapidly, especially with the undertaking of several massive infrastructure projects in emerging economies. These countries are diverting significant resources and funding to the commercial building sectors, as well as major institutional building projects such as data centers and other large institutional buildings. The desire for lower-cost and more environmentally friendly building practices is driving the use of FRP pipe in HVAC system applications, fire protection systems, and utility piping applications where flexibility in design and minimal maintenance costs are primary considerations.

Joint/Connection Type Insights

Why Was Bell-and-Spigot the Most Popular Joint Type During 2025?

The ball-and-spigot segment was the leading joint type in the FRP pipe market during 2025 with a 52.4% share because of its excellent sealing properties, easy-to-install features, and suitability for underground and long-distance pipeline systems. These joints allow for controlled movement and thermal expansion and reduce the risk of leaks. Their dependability during water transmission, sewer line, and industrial pipeline use makes them a popular choice for all municipal water and utility FRP piping installations.

The butt-and-strap segment is set to be the fastest-growing in the market for FRP pipes with a forecasted CAGR of 5.3% because of their ability to accommodate custom on-site fabrication and provide repair flexibility while being manufactured. The unique characteristics associated with butt-and-strap joints make them useful in many industrial and chemical processing plants, where there are irregular pipe diameters in addition to having to route the piping in complex configurations. The ability of the butt-and-strap joint type to produce permanently strong, continuous connections strengthens the structural integrity of that system under the most demanding service conditions.

Regional Insights

How Big is the North America FRP Pipe Market Size?

The North America FRP pipe market size is estimated at USD 1.90 billion in 2025 and is projected to reach approximately USD 5 billion by 2035, with a 2% CAGR from 2026 to 2035.

Why Is North America the Leading Region for the FRP Pipe Market During 2025?

North America is at the top region of the FRP pipe market with a 40.4% share in 2025, driven by formal infrastructure rehabilitation programs, stringent durability requirements, and broad acceptance of corrosion-resistant materials across wastewater, chemical processing, and energy applications. Large-scale replacement of aging metallic pipelines is being executed through municipally funded water and wastewater upgrade programs, where FRP pipes are increasingly specified for gravity sewers, force mains, and industrial effluent lines due to their resistance to corrosion, hydrogen sulfide attack, and abrasive media. Regulatory oversight and performance expectations tied to long asset lifecycles favor materials that minimize leakage risk, maintenance frequency, and unplanned service disruptions.

The region benefits from deep engineering expertise and well-defined performance standards governing FRP pipe design, testing, and installation. Design practices aligned with long-term hydrostatic pressure performance, creep rupture resistance, and joint integrity requirements support confidence in FRP as a permanent replacement solution rather than a niche alternative. In the United States, guidance and acceptance frameworks influenced by organizations such as the American Water Works Association and regulatory compliance expectations under the U.S. Environmental Protection Agency reinforce the use of non-corrosive piping materials in regulated water and wastewater systems. FRP has become a preferred option in projects where ductile iron, steel, or concrete pipelines have demonstrated premature degradation or high lifecycle costs.

What is the Size of the U.S. FRP Pipe Market?

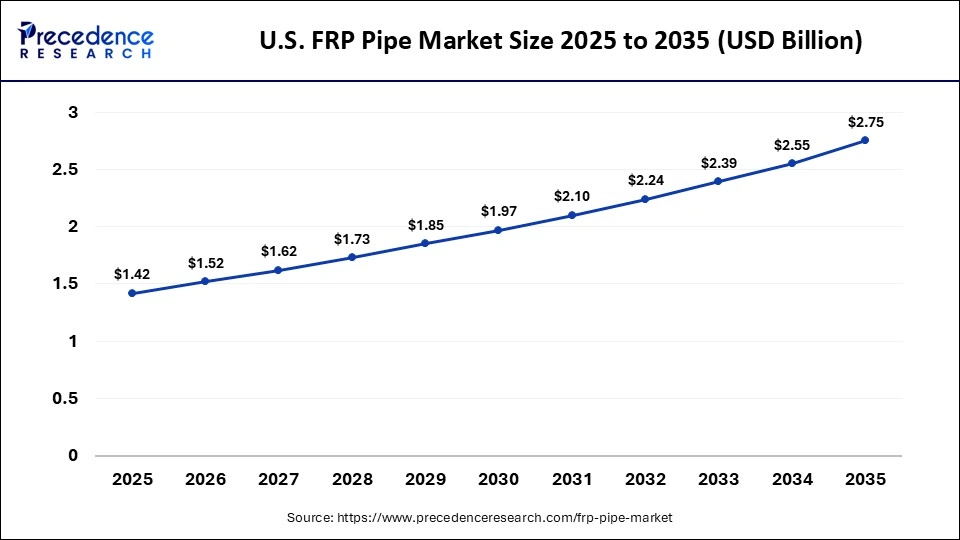

The U.S. FRP pipe market size is calculated at USD 1.42 billion in 2025 and is expected to reach nearly USD 2.75 billion in 2035, accelerating at a strong CAGR of 6.83% between 2026 and 2035.

U.S. FRP Pipe Market Trends

The U.S. has the largest and broadest industrial base and continues to lead large-scale infrastructure retrofitting and was an early adopter of FRP for long-life pipeline construction. Federal and state compliance requirements tied to water quality, asset integrity, and leakage reduction, enforced under frameworks overseen by the U.S. Environmental Protection Agency, have accelerated FRP adoption in regulated water and wastewater networks. In parallel, engineering guidance and material acceptance practices aligned with the American Water Works Association have enabled utilities and consulting engineers to specify FRP with confidence for municipal and industrial systems exposed to corrosive media and demanding service conditions.

Why Is Asia Pacific Set to Experience the Fastest Growth in the FRP Pipe Market During the Forecasted Period Between 2026 and 2035?

The rapid growth of the FRP pipe market in the Asia Pacific region is driven by measurable infrastructure pressures linked to urban population expansion, industrial corridor development, and persistent water management constraints. The region is set to grow at an expected CAGR of 6% during the period between 2026 and 2035, supported by large-scale investments in municipal water supply, wastewater treatment, flood control, and industrial utilities. Rapid urbanization has increased stress on legacy concrete and steel pipelines, particularly in coastal and high-density cities where corrosion, leakage, and maintenance access pose long-term operational risks.

In response, governments across the region are advancing industrial park development and strengthening environmental controls to support sustainable urban and industrial growth. In countries such as China and India, new manufacturing zones, petrochemical complexes, and power generation facilities require piping systems capable of handling aggressive process fluids, high salinity water, and variable temperature conditions. FRP pipe systems are increasingly specified for cooling water lines, chemical transfer, brine discharge, and underground installations due to their lightweight construction, corrosion resistance, and long service life.

Municipal adoption is also accelerating as civic bodies prioritize lifecycle performance and reduced maintenance burden. Water authorities and urban utilities are selecting FRP pipes for gravity sewers, sewage rising mains, and treated water transmission where hydrogen sulfide corrosion, soil aggressiveness, and groundwater intrusion have historically degraded conventional materials. This preference is reinforced by the need to minimize service disruptions in rapidly expanding cities, where pipeline failure has direct public health and economic consequences.

China FRP Pipe Market Trends

China is the largest economy in the Asia Pacific Region and hence, the largest Market in the Asia Pacific Region because of the scale and scope of its Infrastructure Development Initiatives as well as China's focus on Efficient Water Transport and Treatment. Growth in Domestic Manufacturing of FRP Pipe has been significant, with the increasing use of FRP Pipe within Industrial Zones and Municipal Infrastructure Development in China, which is creating continued robust Market Demand for FRP Pipe.

How Is Europe Entering a New Era of the FRP Pipe Market?

Due to robust environmental regulation, systematic refurbishment of aging infrastructure, and a policy-driven shift toward durable and sustainable materials, the European FRP pipe market is experiencing steady and structurally supported growth. Long service life, resistance to aggressive chemicals, and low lifecycle maintenance requirements have made FRP pipes increasingly attractive for chemical processing facilities, waste management systems, district energy networks, and renewable energy installations. These sectors operate under strict environmental compliance obligations, which favor non-metallic piping that reduces leakage risk, corrosion-related failures, and unplanned shutdowns.

At the regulatory level, infrastructure and material selection decisions are strongly influenced by European Union environmental and product safety frameworks enforced by the European Commission. Requirements linked to water quality protection, industrial emissions control, and material traceability encourage the use of corrosion-resistant piping systems in regulated applications. FRP pipes are therefore increasingly specified for wastewater conveyance, industrial effluent lines, and chemical transfer systems where compliance with long-term performance and containment standards is critical.

Investment in coastal protection, flood mitigation, and stormwater management infrastructure is another important demand driver. Across Western and Northern Europe, climate adaptation projects addressing sea-level rise, extreme rainfall, and urban flooding require pipe systems capable of operating reliably in saline, moisture-rich, and chemically aggressive environments. FRP pipes are being adopted in stormwater culverts, pumping stations, and coastal drainage systems where metallic materials are prone to rapid degradation.

Germany FRP Pipe Market Trends

Germany is the leader in Europe for FRP pipe technology, supported by advanced engineering capabilities and rigorously defined performance and certification criteria. National oversight and technical guidance influenced by authorities such as the Federal Institute for Materials Research and Testing reinforce strict validation of mechanical performance, chemical resistance, and long-term durability, enabling FRP pipes to be confidently specified across chemical processing facilities and municipal water and wastewater treatment plants operating under demanding environmental compliance requirements.

Why Is Middle East & Africa Seeing Accelerated Use of FRP Pipes in the Region?

The Middle East and Africa are increasingly adopting FRP pipe systems as a strategic solution for infrastructure development focused on water security, energy production, and industrial expansion. Chronic water scarcity across arid and semi-arid regions has accelerated investment in desalination plants, transmission pipelines, and wastewater reuse systems, where FRP pipes are specified for their resistance to corrosion, scaling, and biofouling under continuous exposure to high-salinity water. In countries such as Saudi Arabia and the United Arab Emirates, national water strategies and desalination programs increasingly rely on non-metallic piping for intake, brine discharge, and internal process networks to ensure long asset life and operational reliability.

Extreme climatic conditions across much of the region further reinforce FRP adoption. High ambient temperatures, aggressive soils, and saline groundwater accelerate degradation of steel and concrete pipelines, particularly in coastal and desert environments. FRP pipes offer stable mechanical performance across wide temperature ranges and strong resistance to chloride-rich conditions, making them suitable for buried pipelines, above-ground industrial networks, and coastal infrastructure exposed to harsh environmental stressors.

South Africa FRP Pipe Market Market Trends

South Africa has the potential to assume a leading role in the Africa and Middle East region as demand for FRP pipes in water treatment, mining, and industrial processing continues to rise. National water infrastructure oversight and rehabilitation initiatives led by the Department of Water and Sanitation are increasing the use of corrosion-resistant piping in wastewater treatment works, bulk water conveyance, and reuse schemes. In parallel, extensive mining and mineral processing activities are driving FRP adoption for slurry transport, acid handling, and tailings water systems where steel pipelines suffer accelerated corrosion. The presence of established engineering firms and a regulatory environment that supports lifecycle-based material selection strengthens South Africa's position as a regional anchor market for FRP pipe deployment.

Value Chain Analysis for FRP Pipe Market

- Raw Material Supply

Suppliers of the raw materials that are needed to manufacture FRP composites include some of the following companies: Glass Fibres, Resins (including Epoxies, Polyesters, Vinyl Esters), and Additives.

Key Players: Owens Corning, PPG Industries, Ashland Global, DSM, Hexion

- Manufacturing & Fabricating

The FRP pipe product is manufactured through various processes including filament winding, curing, and molding. These processes allow the creation of the finished FRP pipe product.

Key Players: Amiblu, Future Pipe Industries, NOV Fiber Glass Systems, HOBAS, Chemical Process Piping

- Quality Testing & Certification

To meet national and international standards, the finished FRP pipe is subject to strength, corrosion, pressure, and compliance testing before being sold.

Key Players: TUV SUD, SGS, Intertek, DNV

- Distribution & Logistics

Distributors and transporters are responsible for the warehousing, logistics, and transportation of the FRP pipes to end users around the world.

Key Players: Kuehne + Nagel, DHL Industrial Projects, DB Schenker

- End Users/Installation

End-use industries use FRP pipes, including oil and gas, industrial infrastructure, and water treatment.

Key Players: Veolia, SUEZ, Saudi Aramco, BASF

- After-Sales & Maintenance

Providers of service perform post-installation maintenance, inspections, and repairs on installed FRP pipes to maximize their service life.

Key Players: Insituform, Aegion, MISTRAS Group

Top Key in Players FRP Pipe Market

- Future Pipe Industries

- National Oilwell Varco (NOV) Inc.

- Amiantit Group

- ZCL Composites Inc.

- Graphite India Limited

- Enduro Composites Inc.

- Ershigs Inc.

- Fibrex Corporation

- HOBAS Pipe USA Inc.

- Sarplast SA

- Hengrun Group Co., Ltd.

- Lianyungang Zhongfu Lianzhong Composites Group Co., Ltd.

- Abu Dhabi Pipe Factory

- FRP Systems

- Industrial Plastic Systems

Recent Developments

- In March 2025, Zhongfu Lianzhong launched a 5-metre diameter fibreglass-reinforced plastic (FRP) pipeline in China, overcoming technical limits and setting a new benchmark for large FRP pipe manufacturing in major engineering projects.(Source: https://www.jeccomposites.com)

- In August 2025, Govt Railway Police (GRP) and East Coast Railway (ECoR) launched formal probes into the Cuttack station roof collapse, questioning officials and contractors while assessing structural safety and future accountability.(Source: https://timesofindia.indiatimes.com)

- In August 2025, ARC Insulation & Insulators Limited announced its IPO launch on August 21, proposing to list on NSE Emerge with a mix of fresh issue and offer-for-sale shares.(Source: https://www.business-standard.com)

- In December 2025, Libya's National Oil Corporation began enhancing pipeline maintenance using composite materials and FRP technologies with Waha Oil Company to boost production, efficiency, and reduce operating costs.(Source: https://libyaupdate.com)

Segments Covered in the Report

By Material/Type

- Polyester FRP Pipe

- Polyurethane FRP Pipe

- Epoxy FRP Pipe

- Others (Vinyl Ester, etc.)

By Application

- Oil & Gas

- Water & Wastewater

- Chemical Processing

- Power Generation

- Others (Industrial, Municipal)

By End-User

- Industrial

- Commercial

- Residential

- Others

By Joint/Connection Type

- Bell-and-Spigot

- Butt-and-Strap

- Socket-and-Spigot

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting