Glycated Albumin Assay Market Size and Forecast 2025 to 2034

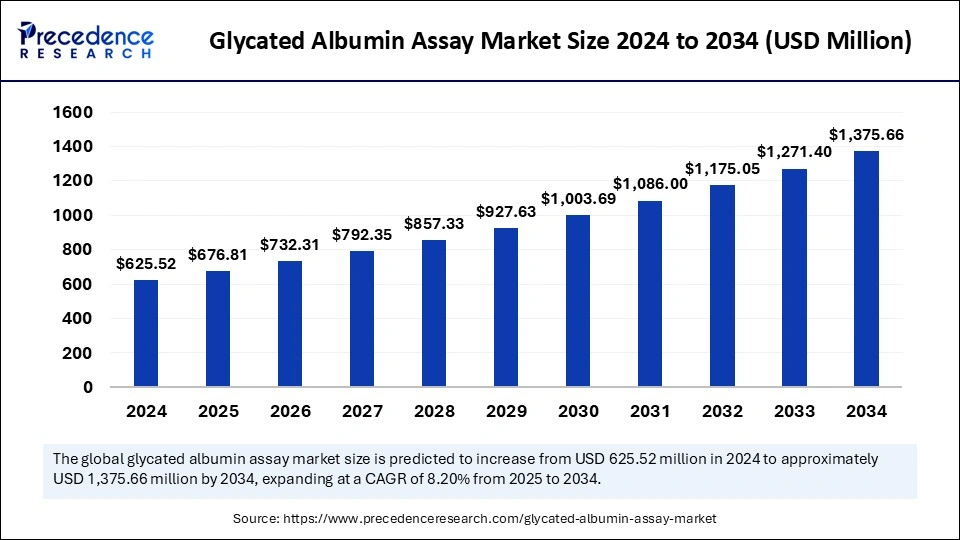

The global glycated albumin assay market size accounted for USD 625.52 million in 2024 and is predicted to increase from USD 676.81 million in 2025 to approximately USD 1,375.66 million by 2034, expanding at a CAGR of 8.20% from 2025 to 2034. The growth of the market is driven by the increasing prevalence of diabetes worldwide, growing demand for clinical diagnostic tests, rising healthcare spending, and increasing research and development activities. Moreover, the increasing need for personalized medicine and rapid technological advancements in diagnostic techniques are expected to boost the growth of the glycated albumin assay market throughout the projected period.

Glycated Albumin Assay Market Key Takeaways

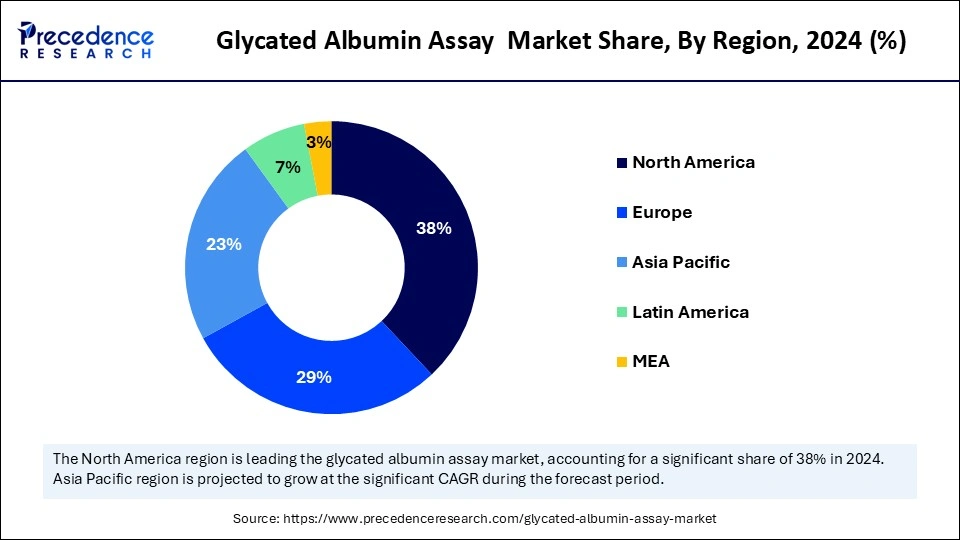

- North America dominated the market with the largest market share of 38% in 2024.

- Asia Pacific is expected to grow at a notable CAGR during the forecast period.

- By application, the type 2 diabetes segment led the market in 2024.

- By application, the prediabetes segment is expected to grow at a significant CAGR in the coming years.

- By end-user, the hospitals & diabetic care centers segment accounted for the largest market share in 2024.

- By end-user, the diagnostic laboratories segment is expected to grow rapidly during the forecast period.

How does artificial intelligence (AI) impact the glycated albumin assay market?

Artificial Intelligence and Machine Learning technologies hold great potential to drive innovation and enhance patient care. In the rapidly evolving healthcare industry, AI emerges as a driving force in the glycated albumin assay market, significantly revolutionizing assay accuracy and efficiency. AI algorithms help improve data analysis and interpretation, leading to quicker and more reliable results. AI algorithms analyze vast patient data, including glycated albumin levels, to identify patterns and improve diagnostic accuracy.

U.S. Glycated Albumin Assay Market Size and Growth 2025 to 2034

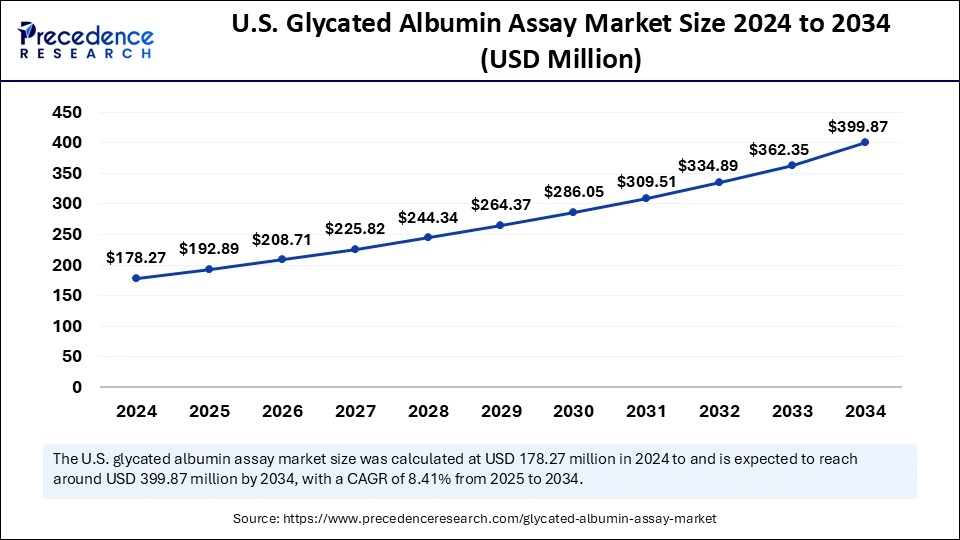

The U.S. glycated albumin assay market size was exhibited at USD 178.27 million in 2024 and is projected to be worth around USD 399.87 million by 2034, growing at a CAGR of 8.41% from 2025 to 2034.

North America held the dominant share of the glycated albumin assay market in 2024. This is mainly due to the presence of sophisticated healthcare facilities, increased incidence of prediabetes and Type 2 diabetes, and the increasing innovations in healthcare technologies. The region is expected to sustain its market dominance throughout the forecast period. The rising awareness regarding early screening, rising private and public investments to enhance the healthcare infrastructure to support diabetes diagnosis, rising R&D activities, and technological advancements in diagnostic tools and techniques support regional market growth.

In addition, there is a high demand for personalized medicine, especially to treat chronic diseases, including diabetes. The rising number of cases of diabetes and the growing geriatric population further contribute to regional market growth.

According to a report published by the Centers for Disease Control and Prevention in 2024, 1 in 3 U.S. adults has prediabetes. The U.S. has about 98 million adults who have prediabetes. There are usually no signs or symptoms of prediabetes, which is why 81% of people don't know they have prediabetes.

According to the report published by the Institute for Health Metrics and Evaluation (IHME) in June 2023, diabetes is mostly prevalent in people aged 65 and above in every country.

Asia Pacific glycated albumin assay market is expected to expand rapidly during the forecast period. This is mainly due to the rising prevalence of diabetes in the region. The growing geriatric population and rising awareness of early detection of diabetes further support regional market growth. Governments of various Asian countries are investing heavily in healthcare and biotechnology research and development (r&d) activities to drive innovations in the field.

The increasing demand for clinical diagnostic tests, technological advancement in diagnostic methods, and supportive government policies influence the market. Moreover, rising government investments to improve healthcare facilities and expanding access to quality healthcare services fuel the growth of the market in the region.

According to a study report published by the Madras Diabetes Research Foundation and the Indian Council of Medical Research in June 2023, about 101.3 million people in India, or 11.4% of the Indian population, have diabetes. It is estimated that 136 million people in India, or 15.3% of the population, are likely to be living with prediabetes.

Market Overview

A glycated albumin assay is the most widely used laboratory test to measure the concentration of glycated albumin in blood serum or plasma. This assay provides critical information into glycemic control, acting as a complementary measure to the extensively utilized HbA1c test. Glycated albumin is a protein found in the blood that has undergone glycation or is chemically altered due to prolonged exposure to glucose. Glycation occurs when a sugar molecule, such as fructose or glucose, binds to a lipid or protein molecule without the regulation of an enzyme. In individuals with diabetes mellitus, high glucose levels can lead to increased glycation of various proteins, including albumin. The glycated albumin assay market is witnessing significant growth due to the rising R&D activities to explore the potential of glycated albumin.

- In November 2024, according to the study report published in the Journal of Applied Laboratory Medicine (JALM), the study investigated glycated albumin as a predictor of adverse neonatal outcomes among pregnant women with diabetes and elevated body mass index.

The study explores the potential of glycated albumin as a risk predictor to establish appropriate glycated albumin cutoffs to guide clinical interventions and improve maternal and neonatal outcomes.

Glycated Albumin Assay Market Growth Factors

- As healthcare systems across the globe continue to seek solutions to enhance their diagnostic capabilities, the glycated albumin assay is expected to experience rapid growth in the coming years.

- The rising elderly population, particularly in developed and developing nations, is anticipated to accelerate the growth of the market in the coming years. The aging population is more susceptible to diabetes.

- The supportive government framework is expected to boost the growth of the market. Several government agencies aim to strengthen the healthcare infrastructure by providing adequate funding, leading to increased demand for effective diagnostic solutions, including glycated albumin assays.

- The increase in R&D activities and the rising investments in advancing healthcare facilities in developing nations create significant growth opportunities in the market.

- The rising demand for point-of-care testing solutions is anticipated to promote the market's growth during the forecast period. Point-of-care testing solutions offer convenience and rapid results.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,375.66 Million |

| Market Size in 2025 | USD 676.81 Million |

| Market Size in 2024 | USD 625.52 Miillion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, End-user, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of Diabetes

With the increasing prevalence of diabetes worldwide, the demand for glycated albumin assay kits is rising, which is a major factor driving the growth of the glycated albumin assay market. For instance, according to the report published by the Institute for Health Metrics and Evaluation in June 2023, more than half a billion people are living with diabetes globally, affecting men, women, and children of all ages in every country, and it is estimated that diabetes cases to rise from 529 million to 1.3 billion in the next 30 years. The latest estimates indicate that the current global prevalence rate is 6.1%, which makes diabetes one of the leading causes of death and disability. At the regional level, the highest rate is 9.3% in North Africa and the Middle East, which is anticipated to increase to 16.8% by 2050. The rate in Latin America and the Caribbean is anticipated to increase to 11.3%.

Glycated albumin assay kits are most widely used in various healthcare settings, including diagnostic laboratories, hospitals, and research institutions. These kits assist in effectively monitoring and managing diabetes mellitus. In diabetic patients, assessing glucose control is crucial. This test plays an integral role when the commonly used HbA1c test fails to reflect glycemic control appropriately. Therefore, the rising incidence of diabetes globally significantly fuels the market's growth.

Restraint

Inadequate Reimbursement

The inadequate reimbursement policies are anticipated to hamper the glycated albumin assay market's growth. Numerous diagnostic firms face major challenges in commercializing their test while getting approval and reimbursement for various diagnostic products. In addition, the high cost of glycated albumin assay creates barriers for some healthcare providers, particularly in middle- and lower-income countries. This, in turn, limits the growth of the market.

Opportunity

Increasing Need for Personalized Medicine

The growing need for personalized medicine is projected to offer lucrative opportunities in the glycated albumin assay market during the forecast period. Personalized medicine and targeted therapies have become increasingly popular. In personalized medicine, glycemic control strategies aid in tailoring diabetes management plans according to the characteristics of individual patients.

Glycated albumin assays assist in effectively managing diabetes, guiding treatment decisions, and minimizing the associated risk of diabetes-related complications. In addition, the development of innovative technologies and methods, such as enzymatic and immunoassay-based approaches, are likely to enhance the accuracy and reliability of glycated albumin assays. Such technological advancements are expected to fuel market expansion in the coming years.

Application Insights

The type 2 diabetes segment dominated the glycated albumin assay market with the largest share in 2024. This is mainly due to the higher prevalence of type 2 diabetes worldwide. Type 2 diabetes requires regular monitoring, in which albumin assays play a crucial role. These assays are essential in assessing long-term blood glucose control to manage the condition.

The prediabetes segment is expected to witness significant growth in the coming years. The segment's growth is majorly attributed to the rising focus on preventing diabetes, improving healthcare infrastructure in developing countries, and a surge in the number of hospitals & diagnostic laboratories. Early detection of prediabetes is important to prevent or postpone the onset of type 1 or 2 diabetes. The rising awareness about early disease detection further contributes to segmental growth.

End-user Insights

The hospitals & diabetic care centers segment held the largest share of the glycated albumin assay market in 2024 owing to the rising focus on early disease diagnosis. Hospitals & diabetic care centers offer advanced solutions for effectively managing diabetes care. The easy availability of glycated albumin assays in these settings bolstered the segment's growth. A glycated albumin kit is a crucial diagnostic test for tracking glycemic control. Hospitals often aim to provide a wide range of advanced diagnostic services for diabetes, in which glycated albumin assays play a crucial role. Additionally, the rise in investments in cutting-edge diagnostic equipment by hospitals and diabetic care centers to offer personalized treatment for better outcomes contributes to segmental growth.

On the other hand, the diagnostic laboratories segment is expected to grow rapidly during the forecast period. This is mainly due to the increasing volume of diagnostic tests conducted in diagnostic labs. These labs often have groundbreaking technologies for conducting tests, attracting a large patient pool. The convenience and cost-effectiveness offered by diagnostics laboratories make them a popular option among patients, bolstering the segment growth in the coming years.

Recent Development

- In February 2025, a study that started with a FARE Grant by the American Association of Hip and Knee Surgeons (AAHKS) received two years ago began looking into glycated albumin, a very standardized test. The study later consisted of a study with 1200 enrolled patients and Dr. Tarabichi predicting 90-day outcomes from these enrolled patients.

Glycated Albumin Assay Market Companies

- Asahi Kasei Pharma Corporation

- Weldon Biotech Inc.

- Abbexa Ltd.

- Biocompare

- EFK Diagnostics

- Elabscience Biotechnology Inc.

- Abbot

- Diazyme Laboratories Inc.

- Abnova Corporation

- Maccura Biotechnology Co.,Ltd.

- LifeSpan BioSciences Inc.

- Geno Technology Inc.

- AMS Biotechnology (Europe) Limited

- Epinex Diagnostics Inc.

- DxGen Corp.

Segments Covered in the Report

By Application

- Type 2 Diabetes

- Type 1 Diabetes

- Prediabetes

By End-user

- Hospitals & Diabetic Care Centers

- Diagnostic Laboratories

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting