What is the GPU as a Service Market Size?

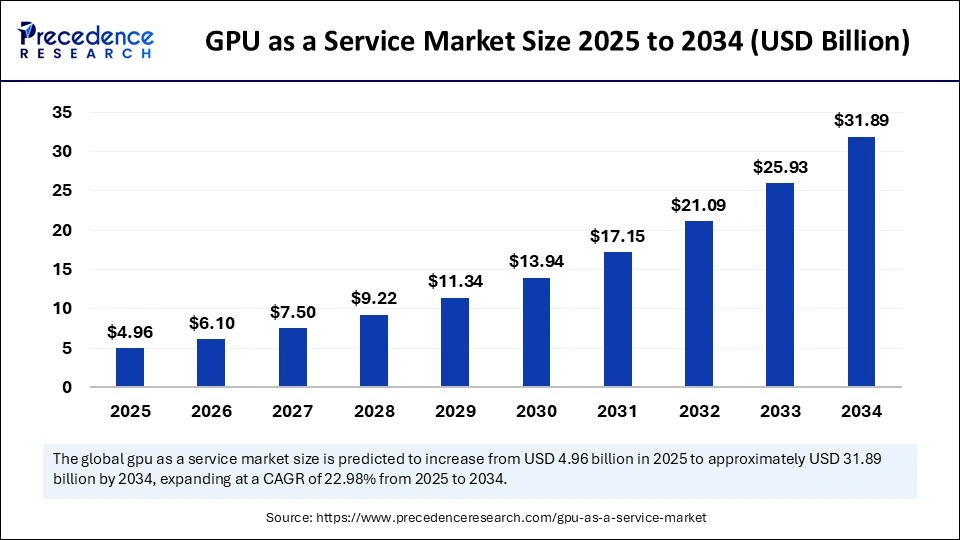

The global GPU as a service market size is valued at USD 4.96 billion in 2025 and is predicted to increase from USD 6.10 billion in 2026 to approximately USD 31.89 billion by 2034, expanding at a CAGR of 22.98% from 2025 to 2034. The market growth is attributed to the increasing demand for high-performance computing solutions across industries such as AI, gaming, and healthcare.

GPU as a Service Market Key Takeaways

- In terms of revenue, the GPU as a service market is valued at $4.96 billion in 2025.

- It is projected to reach $31.89 billion by 2034.

- The market is expected to grow at a CAGR of 22.98% from 2025 to 2034.

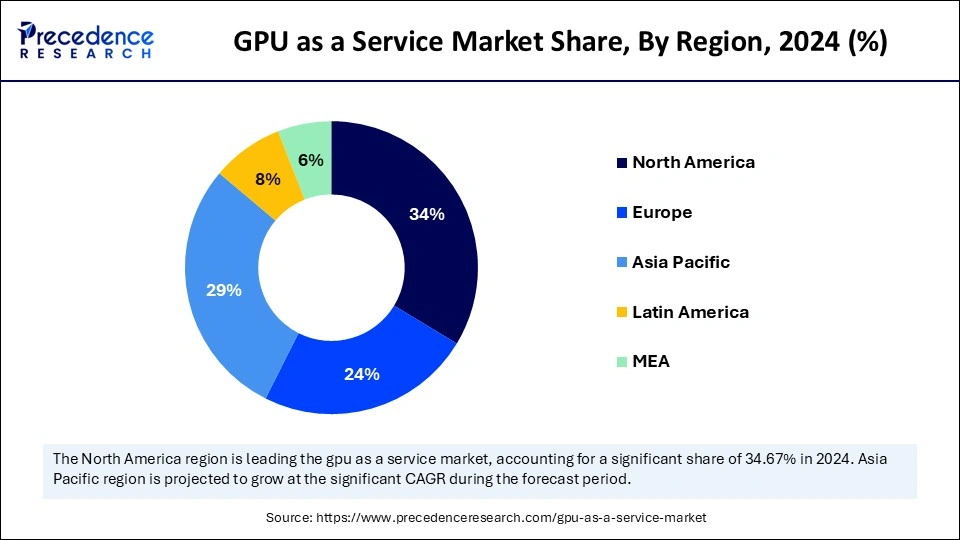

- North America dominated the GPU as a service market by holding more than 34% of market share in 2024.

- Asia Pacific is projected to grow at a fastest CAGR of 25.5% during the forecast period.

- By component, the solutions segment held the major market share of 56% in 2024.

- By component, the services segment is expected to grow at the fastest rate between 2025 and 2034.

- By pricing model, the subscription-based plans segment held the largest share of the market in 2024.

- By pricing model, the pay-per-use segment is projected to expand at the fastest CAGR during the projection period.

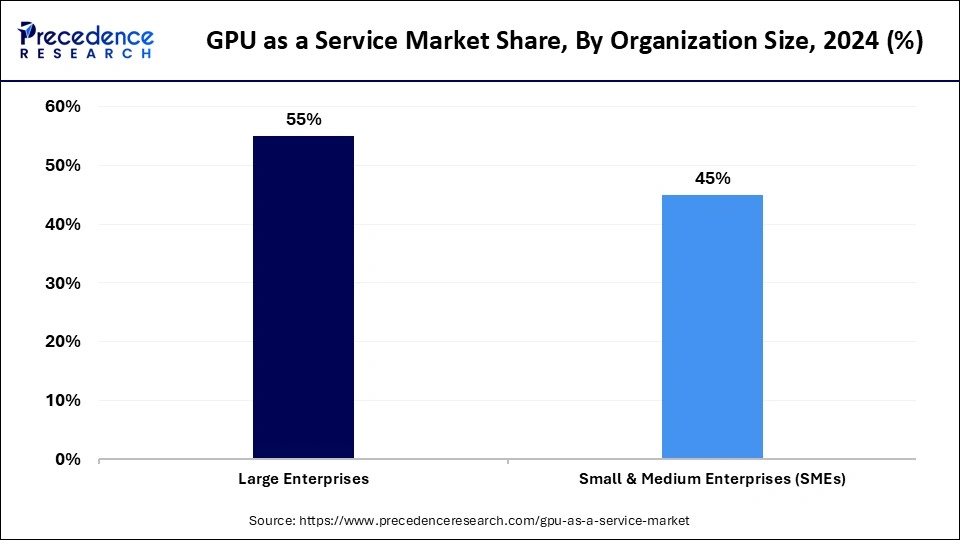

- By organization size, the large enterprises segment led the global market in 2024.

- By organization size, the small & medium enterprises (SMEs) segment is projected to expand rapidly in the coming years.

- By vertical, the gaming segment dominated the market in 2024.

- By vertical, the IT & telecom segment is projected to grow at the fastest rate during the assessment years.

Market Overview

The GPU as a service market is experiencing significant growth due to the rising demand for Artificial Intelligence, big data analytics, and machine learning applications. GPU as a service (GPUaaS) provides the necessary resources for training AI models, as they require high-performance computing (HPC) solutions. The quick adoption of cloud-based GPU solutions occurred due to organizations needing powerful computing infrastructure without having to buy expensive hardware for expansion. In 2024, the National Energy Research Scientific Computing Center (NERSC) predicted that HPC systems with GPU-accelerated services would enhance AI workload processing. Furthermore, the large-scale data processing requirements across healthcare, automotive, and gaming sectors drive the demand for GPU as a service.

GPU as a Service Market Growth Factors

- Rising Adoption of Cloud-Based Solutions: The increasing shift of enterprises to cloud platforms is expected to drive the demand for GPUaaS as companies seek scalable computing power.

- Advancements in AI and Machine Learning: Continuous innovation in AI and ML algorithms, requiring significant computational resources, is likely to accelerate GPUaaS adoption across various sectors.

- Expansion of Gaming Industry: The growing demand for high-quality, real-time graphics in gaming is anticipated to increase the need for GPUaaS solutions, particularly in cloud gaming platforms.

- Increased Investment in Autonomous Vehicles: The development of self-driving cars, which require intensive data processing and AI model training, is expected to boost the demand for GPU-powered services.

- Healthcare Data Analytics: The rise of healthcare data analytics and AI-driven diagnostics boosts the need for GPUaaS to process large-scale medical datasets efficiently.

- Surge in Virtual Reality (VR) and Augmented Reality (AR): The increasing application of Virtual Reality and Augmented Reality in entertainment, education, and industrial sectors is expected to spur demand for GPUaaS for enhanced rendering capabilities.

- Increased Demand for Real-Time Data Processing: The surge in IoT devices and real-time data analytics in sectors such as manufacturing and logistics is anticipated to drive GPUaaS usage for faster decision-making.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 31.89 Billion |

| Market Size in 2025 | USD 4.96 Billion |

| Market Size in 2026 | USD 6.10 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 22.98% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Pricing Model, Organization Size, Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Demand for High-Performance Computing

The increasing demand for high-performance computing across various industries like media & entertainment, financial, gaming, and IT & telecom is expected to drive the growth of the GPU as a service market. These industries heavily implement simulation methods and data analytics that require high processing speed. GPUaaS offers a scalable solution to meet these needs. GPUaaS solutions provide rapid processing along with complex algorithm operations, making them suitable for applications requiring large computing power. The industry-wide movement from classic CPUs toward GPUs accelerates the development of cloud-based GPU systems for greater scalability and operational effectiveness. The U.S. Department of Energy, in its 2024 AI for Science report, emphasized that GPUs have accelerated the computational workflows at its research labs.

Restraints

High Integration Costs and Data Security Concerns

The high costs associated with integrating GPUs in existing infrastructure restrain the growth of the GPU as a service market. AI training, rendering operations, and large-scale simulation require advanced GPUs. The cost of high-end GPUs for intensive applications can be substantial. This limits the adoption among small and medium enterprises. Small and medium enterprises lack enough financial resources to purchase high-performance GPUs. Moreover, storing and processing data on cloud platforms raises data security concerns, preventing widespread deployment of GPUs.

Opportunity

Adoption of Edge Computing

The rising adoption of edge computing is expected to create immense opportunities in the GPU as a service market. The integration of GPUaaS with edge computing enables the processing of data closer to the source. This reduces latency and improves the performance for applications like IoT devices. The healthcare, finance, and retail sectors are investing heavily in AI technologies to streamline and automate their operations. AI technologies require substantial computing power. GPUaaS provides the necessary resources to train and process AI models. Cloud service providers respond to ML framework needs by constructing GPUaaS systems that support TensorFlow with PyTorch. The U.S. Department of Energy distributed USD 68 million as funding for 11 multi-institution AI projects in 2024 to create foundation infrastructure and efficient energy hardware devices. Additionally, advances in AI technologies boost the demand for specialized GPUaaS solutions.

Component Insights

The solutions segment contributed the biggest market share of 56% in 2024. This is mainly due to the increased adoption rate of cloud-based GPUaaS solutions. With the increased adoption of AI technologies, organizations widely implemented GPUaaS solutions for training AI models. These solutions provide computing power for deploying AI technologies. The healthcare, manufacturing, and automotive industries heavily preferred GPUaaS solutions for supporting simulation analysis and autonomous systems' operation. Moreover, these solutions deliver enhanced computational capability, which is crucial for heavy-duty applications.

The services segment is expected to grow at the fastest rate in the upcoming period. The growth of the segment is attributed to the growing demand for assistance and managed services to deploy GPU infrastructure effectively. As organizations heavily invests in GPUaaS solutions, the demand for deployment and managed services increases. Since integrating GPUaaS solutions in existing systems creates complexities, the demand for services to achieve seamless integrations increases.

Pricing Model Insights

The subscription-based plans segment held the largest share of the GPU as a service market in 2024. This is mainly due to the affordability of these plans. Large-scale enterprises often prefer these plans, as they require consistent ongoing GPU capacity. Additionally, subscription-based plans are cost-effective, eliminating the need for substantial investments in GPUs.

The pay-per-use segment is projected to expand at the fastest CAGR during the projection period. A pay-per-use model provides businesses with access to cost-effective and adaptable GPU resources. This eliminates the requirement for substantial investments in hardware. Organizations with inconsistent or uncertain workloads often prefer these plans to achieve better results. These plans enable businesses to adjust resource capacity according to demand fluctuations.

Organization Size Insights

The large enterprises segment dominated the GPU as a service market in 2024 due to their extensive computational needs. Large organizations heavily use GPUaaS solutions and advanced analytics applications to enhance operational effectiveness while fostering innovation. These enterprises often require large computing power due to their extensive operations. This encourages them to invest in GPUaaS solutions.

The small & medium enterprises (SMEs) segment is projected to expand rapidly in the coming years. The growth of the segment can be attributed to the rising adoption of cloud-based solutions among SMEs. Since SMEs often lack financial resources, they prefer cloud-based GPUaaS solutions. These solutions are readily available and do not require spending on physical GPU infrastructure, reducing the financial burden on SMEs. GPUaaS provides SMEs with an economical path to access powerful computational resources through usage-based billing plans. Moreover, the solutions enable organizations of any size, including SMEs, to scale up or down resources according to requirements.

Vertical Insights

The gaming segment led the GPU as a service market with the largest share in 2024. This is mainly due to the increased need for superior graphics, real-time rendering technology, and immersive virtual spaces. Through GPU as a service, gaming developers can create games with high-end graphics. GPUaaS solutions provide better visual capabilities, featuring ray tracing along with 4K resolution to users who would not need to buy expensive gaming equipment. The increased popularity of eSports and live game streaming platforms created the need for GPU resources.

The IT & telecom segment is projected to grow at the fastest rate during the assessment years. The growth of the segment is attributed to the increasing need for network optimization, data analytics, and AI-driven applications, which benefit from high computing power. Telecom companies use GPUaaS solutions to enhance network performance and data processing capabilities. IT and telecom businesses heavily use AI, cloud computing, and edge computing, requiring GPUaaS solutions.

Regional Insights

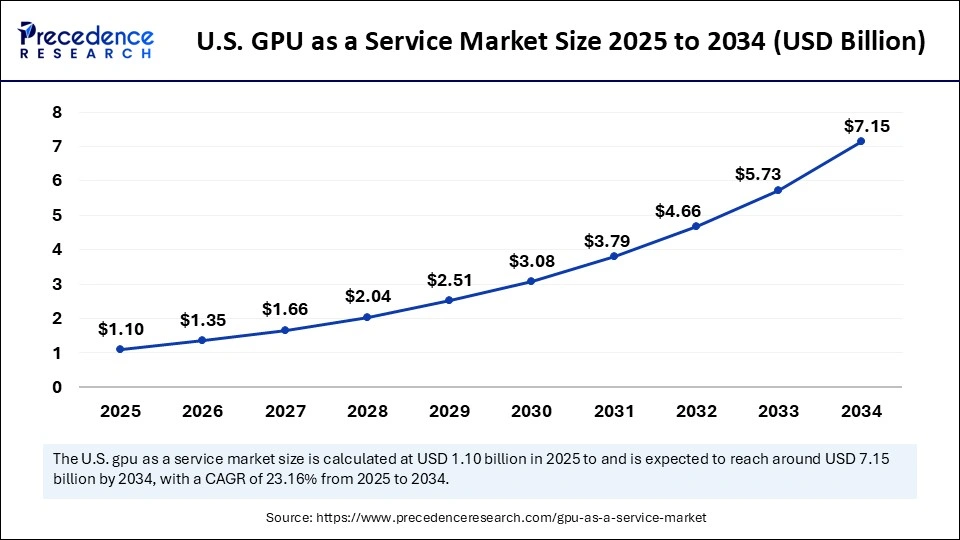

U.S. GPU as a Service Market Size and Growth 2025 to 2034

The U.S. GPU as a service market size is exhibited at USD 1.10 billion in 2025 and is projected to be worth around USD 7.15 billion by 2034, growing at a CAGR of 23.16% from 2025 to 2034.

North America accounted for the largest market share of 34% in 2024. This is mainly due to its robust technological infrastructure, enabling the seamless deployment of GPUaaS solutions. The region is an early adopter of AI and ML technologies, supporting regional market growth. The region is home to some of the prominent tech companies, including NVIDIA, AMD, and Intel, fostering innovations in GPUaaS solutions.

The U.S. held the maximum share of the market in North America. The extensive usage of artificial intelligence and machine learning in the U.S. healthcare and automotive sectors created the need for GPUaaS solutions. The region's leadership was substantially reinforced by Amazon Web Services (AWS) and Microsoft Azure, which provided GPU-accelerated cloud services. Furthermore, the launch of new and advanced AI supercomputers further sustains the long-term growth of the market in the country.

In March 2025, at GTC, NVIDIA unveiled the NVIDIA DGX personal AI supercomputers, powered by the NVIDIA Grace Blackwell platform. The new GX Spark, previously known as Project DIGITS, and the DGX Station, a high-performance desktop supercomputer powered by the NVIDIA Blackwell Ultra platform, enable AI developers, researchers, data scientists, and students to prototype, fine-tune, and inference large models locally. These models can also be deployed on NVIDIA DGX Cloud or any other accelerated cloud or data center infrastructure.

Asia Pacific is expanding at a double-digit CAGR of 25.5% during the forecast period, owing to the rising technological advancements and the rising adoption of AI and data analytics. The rapid digital transformation across the automotive, healthcare, and BFSI sectors is accelerating the utilization of GPUaaS solutions. China, India, and Japan are emerging as major powerhouses in the market. This is mainly due to the rapid expansion of the IT and telecom industries. With the increasing adoption of edge computing, there is a high demand for high-performance computing, contributing to the regional market growth. The rising popularity of mobile gaming further supports market growth.

Europe is considered to be a significantly growing area. The GPU as a service market in Europe is driven by the rising adoption of AI, ML, and cloud computing in industries like automotive, manufacturing, and healthcare. This, in turn, boosts the need for high computing power. There is a strong emphasis on digital transformation. Moreover, the presence of a well-established IT & telecom sector further reinforces the region's position in the market.

GPU As A Service Market Companies

- Qualcomm Technologies, Inc.

- Oracle

- NVIDIA Corporation

- Microsoft

- Intel Corporation

- IBM Corporation

- HCL Technologies Limited

- Fujitsu

- Arm Limited

- Amazon Web Services, Inc.

Latest Announcement by Industry Leader

- In January 2025, SK Telecom launched a new GPU-as-a-Service (GPUaaS) offering in South Korea, marking its entry into the AI-cloud services market. This service, branded "SKT GPUaaS," is hosted in the company's AI Data Center located in Gasan, Seoul. In partnership with GPU cloud company Lambda, SK Telecom aims to secure "stable GPU supplies and expertise" through its investment in Lambda. Initially powered by Nvidia H100 GPUs, the service is expected to incorporate Nvidia H200 GPUs in the first quarter of 2025. The offering will be managed using SK Telecom's AI Cloud Manager, launched in October 2024, which will treat GPU resources as a unified computing system to enhance performance. Kim Myong-gook, head of SK Telecom's GPUaaS business, emphasized that this launch is a pivotal move for SK Telecom, aiming to establish itself as a major player in the AI infrastructure sector. The company's goal is to enhance client competitiveness by using GPUaaS as a platform for AI-driven services.

Recent Developments

- In November 2024, Rackspace Technology, a leading provider of hybrid, multicloud, and AI technology services, announced the expansion of Rackspace Spot with a new geographic location and the introduction of an on-demand GPU-as-a-Service powered by NVIDIA accelerated computing. This expansion comes as the demand for computing power continues to surge. According to IDC, AI data center capacity is "projected to grow at a compound annual growth rate (CAGR) of 40.5% through 2027." Rackspace Spot is poised to meet this demand, offering a premier platform for computation-intensive applications such as artificial intelligence, machine learning, and data analytics, with on-demand, fully managed Kubernetes clusters delivered via a unique open market auction.

- In October 2024, Sify Technologies Limited, India's leading digital ICT solutions provider, launched its CloudInfinit+AI Platform, offering GPU-as-a-Service (GPUaaS). This new platform is a significant addition to Sify's existing portfolio of services. GPUaaS is a cloud-based service that provides users with access to powerful GPUs on a pay-as-you-go basis, supporting compute-intensive tasks such as machine learning, deep learning, model training, inferencing, data analytics, rendering, and scientific simulations, all of which require substantial processing power.

- In September 2024, Lenovo introduced a GPU-as-a-Service (GPUaaS) offering as part of its subscription-based infrastructure model, TruScale. The new offering enables customers to bring AI workloads on-premises, enhancing Lenovo's infrastructure solutions. In addition to GPUaaS, Lenovo incorporated automation, predictive analytics, and generative AI for data protection into its XClarity One management-as-a-service offering, as well as launching a Power and Cooling Services solution.

Segments Covered in the Report

By Component

- Services

- Solution

By Pricing Model

- Subscription-based plans

- Pay-per-use

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Vertical

- Automotive

- BFSI

- Gaming

- Healthcare

- IT & telecom

- Media and Entertainment

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting