India Actuator Market Size and Forecast 2025 to 2034

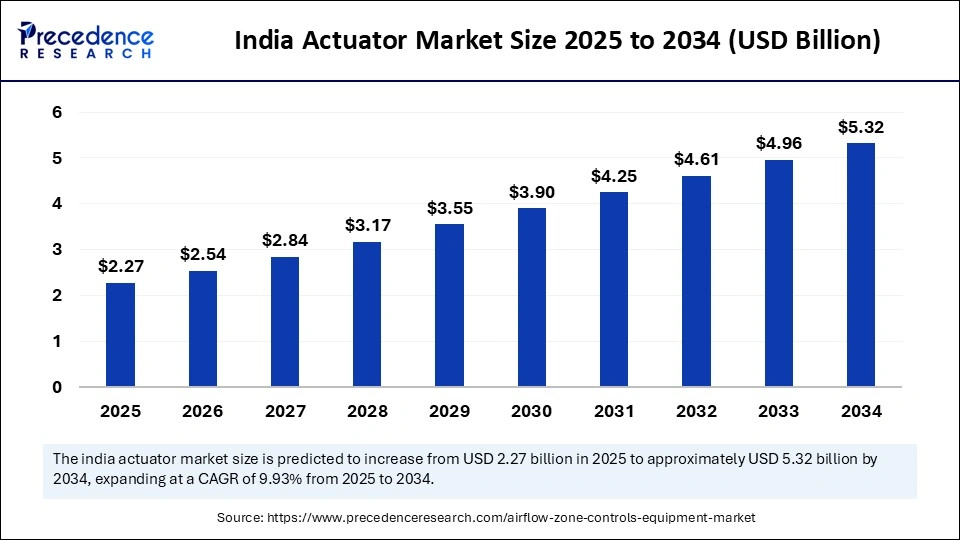

The India actuator market size accounted for USD 2.03 billion in 2024 and is predicted to increase from USD 2.27 billion in 2025 to approximately USD 5.32 billion by 2034, expanding at a CAGR of 9.93% from 2025 to 2034. The market growth is attributed to rising focus on industrial automation and demand for electric vehicles and indigenous defense technologies that rely heavily on actuator-driven precision systems.

India Actuator MarketKey Takeaways

- In terms of revenue, the India actuator market is valued at $ 2.27 billion in 2025.

- It is projected to reach $ 5.32 billion by 2034.

- The market is expected to grow at a CAGR of 9.93% from 2025 to 2034.

- By industry vertical, the automotive segment held a major market share of 23% in 2024.

- By industry vertical, the aerospace segment is expected to grow at the fastest CAGR of 10.23% between 2025 and 2034.

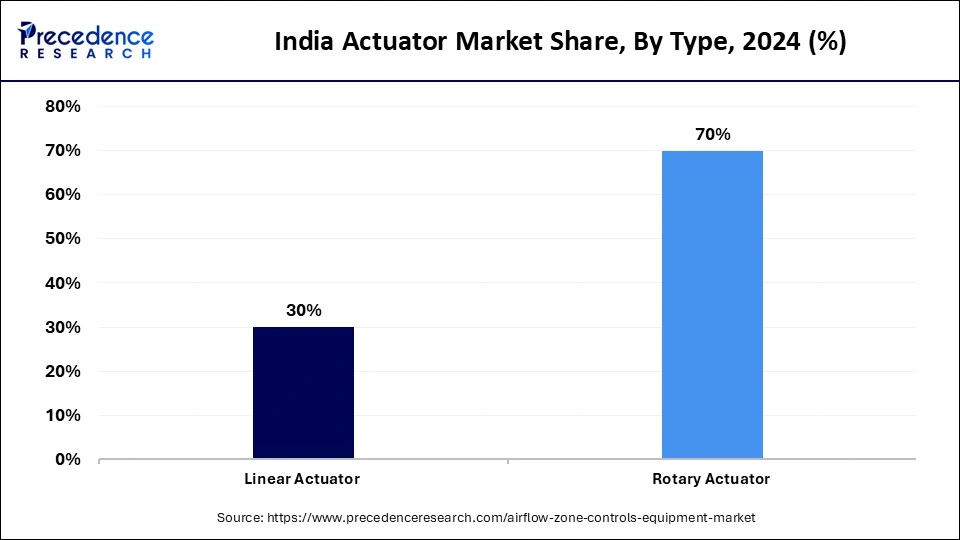

- By type, the rotary actuator segment contributed the biggest market share of 70% in 2024.

- By type, the linear actuator segment is expected to grow at a significant CAGR of 10.40% in the coming years.

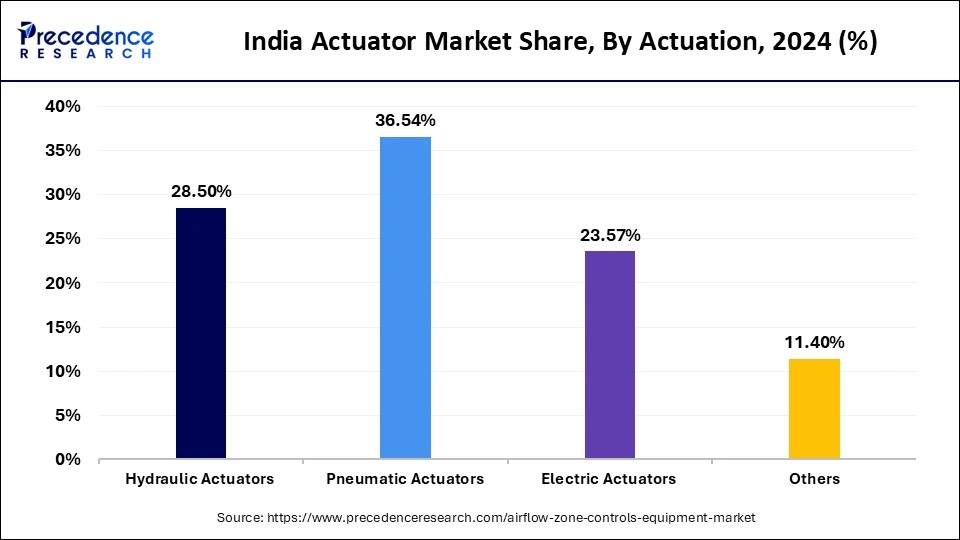

- By actuation, the hydraulic actuators segment captured the major market share of 36.54% in 2024.

- By actuation, the electric actuators segment is expected to grow at the fastest CAGR of 10.10% over the projection period.

Impact of Artificial Intelligence on the India Actuator Market

Manufacturers and system integrators are now integrating artificial intelligence technologies into actuator systems to support real-time monitoring, adaptive control, and predictive maintenance. AI-driven actuators are becoming an important part of creating smart factories where machines can communicate and optimize themselves without human input. Indian automotive companies are leaning toward AI-driven actuators to enhance the precision and responsiveness of electric vehicles. Furthermore, AI-powered actuators can self-monitor, detect anomalies, and learn from operational data, enabling predictive responses and improving overall efficiency.

Market Overview

Increasing automation in various industries, including automotive, manufacturing, aerospace, and energy, is expected to drive the demand for actuators. Actuators, which are mechanical or electromechanical devices, convert energy into motion. They are essential for the precise control of systems in robotics, industrial machinery, vehicle systems, and defense equipment. These devices are central to creating smart, responsive movement in smart factories, electric cars, and sophisticated aerospace platforms. Moreover, the significant investment in smart mobility and infrastructure, along with India's increasing involvement in international supply chains, is expected to further boost actuator integration across various sectors.

India Actuator MarketGrowth Factors

- Rising Demand for Semiconductor Manufacturing Equipment: Growing domestic chip fabrication initiatives are driving actuator integration in wafer handling and precision control systems.

- Boosting Infrastructure for Smart Agriculture: Government-backed agri-tech programs are fuelling the deployment of automated irrigation and seeding systems, which rely on actuators for field-level mechanization.

- Driving Adoption in Railway Modernization Projects: Upgrades in high-speed rail and metro systems are increasing actuator use in door automation, suspension control, and signaling components.

- Expanding Use in Medical Robotics and Surgical Devices: The rising preference for minimally invasive procedures propels actuator demand in robotic arms and motion-control-enabled diagnostic tools.

- Accelerating Defense Export Orders and Offsets: India's growing defense export capabilities are boosting actuator manufacturing tied to offset obligations and international quality compliance.

- Growing Automation in Food and Beverage Processing: Enhanced focus on hygiene, consistency, and throughput is driving the adoption of washdown-grade and stainless steel actuators in food processing lines.

- Rising Adoption in Cleanroom and Pharmaceutical Systems: Strict environmental controls in pharma manufacturing are increasing the need for actuators in sterile packaging, mixing, and precision dosing equipment.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.32 Billion |

| Market Size in 2025 | USD 2.27 Billion |

| Market Size in 2024 | USD 2.03 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.93% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Industry Vertical, Type, and Actuation |

Market Dynamics

Drivers

How is industrial automation driving actuator demand in India?

There is a strong focus on industrial automation, which is boosting the demand for actuators. The growing need to automate manufacturing processes is likely to boost the use of actuators. The automobile, electronics, pharmaceuticals, and textile industries in India are investing in smart factory installations to improve productivity and minimize manual errors. Government initiatives like the Make in India initiative and Production-Linked Incentive (PLI) schemes have led to the rapid adoption of actuators in motion control and precision applications within automated systems.

According to the Ministry of Heavy Industries, more applications were approved under the PLI scheme to manufacture capital goods by mid-2024, indicating a direct increase in automation equipment installation. Additionally, firms in metropolitan cities such as Pune, Chennai, and Bengaluru are embedding smart actuators in assembly lines, increasing the demand for both electric and pneumatic actuators.

Restraint

Inconsistent Power Supply in Emerging Industrial Zones

Inconsistent power supply in emerging industrial zones, especially in Tier II and Tier III cities, is expected to hinder the growth of the India actuator market growth. The lack of consistent power delivery in these areas is likely to limit the large-scale adoption of automated actuator-based systems. Actuators often require a stable power supply to function accurately and efficiently. Inconsistent power supply can reduce the performance, affecting the precision and reliability of actuators.

Manufacturers in such locations also experience frequent electricity supply interruptions, which poses a challenge for electric actuators that require a constant voltage for precision tasks. While bigger cities have superior infrastructure, smaller areas lag in energy stability, which discourages the implementation of high-end automation systems. This power inconsistency introduces operational risks, causing businesses to prefer manual or semi-automatic solutions, further limiting the widespread adoption of actuators.

Opportunity

How is India's growing EV industry boosting the demand for precision actuators?

The rising production of electric vehicles (EVs) creates immense opportunities in the India actuator market. The growing focus on electric vehicle (EV) production is expected to drive demand for precision actuator systems. India's shift toward sustainable transportation through the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) policy has increased demand for electric actuators in battery, braking, and HVAC systems in EVs. Leading automakers and tier-1 suppliers are increasing local manufacturing to meet high-performance requirements, incorporating advanced actuator technologies to enhance vehicle safety, efficiency, and responsiveness. According to the Ministry of Heavy Industries, over 1.8 million electric vehicles received subsidy support by the end of 2024, directly increasing the demand for precision component actuators. Additionally, collaborations between Indian companies and foreign suppliers to localize EV actuator production have increased significantly, further boosting the market.

Industry Vertical Insights

Why did the Automotive Segment Dominate the Market?

The automotive segment dominated the India actuator market with a major share in 2024. This is mostly due to India's robust vehicle manufacturing and the rapid shift toward electric vehicles. Increased production capabilities by major car manufacturers in response to new emission standards, safety regulations, and global export demands further fueled this growth. Consequently, actuators saw increased use in systems like power steering, electronic throttle control, braking, and HVAC modules.

Primary auto centers, such as Pune, Gurugram, and Chennai, have increased automation in production lines, driving the use of actuators in precision assembly. Consumer demand for comfort and safety also drove up the consumption of linear and rotary actuators in both passenger and commercial vehicles. The Automotive Research Association of India (ARAI) updated its electronic safety system certification, requiring more actuator integration in new models. Additionally, MeitY is collaborating to promote the domestic design of sensor-actuator packages for smart vehicles under its Electronics Manufacturing Cluster 2.0 program, bolstering segmental growth.

The aerospace segment is expected to grow at the fastest CAGR in the coming years, driven by India's emphasis on boosting domestic production of aircraft and space technology. Initiatives like Atmanirbhar Bharat and Make in India are promoting the development of indigenous fighter jets, drones, and satellite systems, all of which require high-precision actuators for critical functions. Agencies like HAL and ISRO are investing in advanced actuation systems for flight control surfaces, payload deployment, and robotic mechanisms in satellites.

According to a 2024 review of the defense sector by DPIIT, joint projects between DRDO and private aerospace companies have significantly increased, creating new opportunities for electromechanical actuators in military and commercial aircraft. This segment is expected to be driven by stringent performance specifications, extreme environmental conditions, and increased R&D investment, leading to innovation and adoption of actuators. In 2024, the Ministry of Electronics and IT (MeitY) also introduced design-linked incentives for local startups focused on electromechanical actuators in satellite payload systems and high-altitude UAVs.

Type Insights

What Made Rotary Actuator the Dominant Segment in the India Actuator Market in 2024?

The rotary actuator segment dominated the market with the largest revenue share in 2024, as these actuators are essential in robotic arms, valve applications, and motion control systems that require high torque and precise rotational motion. According to the 2024 automation update from the Ministry of Heavy Industries, manufacturing factories in industries such as automotive and pharmaceuticals have adopted rotary actuators to automate production and reduce downtime. Automotive OEMs use rotary actuators in powertrain and steering systems to enhance mechanical responsiveness.

Industrial clusters like Bhiwadi, Sanand, and Sriperumbudur have maximized the use of rotary actuators in small spaces requiring repeatable motion cycles. Ongoing standardization initiatives by the Bureau of Indian Standards (BIS) have improved rotary actuator design standards, driving the adoption of this technology in critical processes. BIS has also collaborated with major Indian OEMs to update safety requirements for actuator-integrated systems, aligning with IEC 61508 functional safety standards. Additionally, enhanced durability testing procedures for rotary actuators are increasing their use in automotive testing and production environments.

The linear actuator segment is expected to expand at a significant CAGR in the coming years, driven by the increasing electrification of vehicle assembly lines, medical device manufacturing, and smart infrastructure systems. These actuators provide controlled push-pull linear motion and are ideal for electric vehicle battery packs, adjustable seating, and robotic manufacturing cells.

According to the EV Progress Report 2024 by NITI Aayog, next-generation vehicles incorporating linear actuation systems for thermal control and modular design are key in next-generation battery pack design. Automation solution providers in Bengaluru and Noida have implemented smart linear actuators with AI-based feedback for real-time monitoring. The digitization of manufacturing lines through the Industrial Corridors Program of DPIIT is expected to accelerate the adoption of linear actuators in high-speed, sensor-equipped machinery. These trends indicate continued growth in the adoption of smarter, quieter, and energy-efficient linear actuators in discrete and process automation systems across India.

Actuation Insights

How Does the Hydraulic Actuators Segment Dominate the Market in 2024?

The hydraulic actuators segment dominated the India actuator market with a maximum share in 2024, due to their essential role in applications such as construction equipment, metalworking, and military-grade equipment. These actuators support critical functions where high load capacity and consistent force delivery are needed in high-pressure environments. According to the 2024 manufacturing update by the Ministry of Heavy Industries, hydraulic actuation systems have been widely used in heavy vehicle manufacturing zones in Jamshedpur, Pithampur, and Hosur, particularly in excavators, loaders, and defense logistics vehicles.

The Defense Research and Development Organization (DRDO) utilizes hydraulic actuators on armored vehicle systems and artillery platforms, favoring their robust operation. This region's focus on indigenous combat equipment utilizes hydraulic actuation systems due to their durability and ability to withstand various terrains. Furthermore, Bharat Heavy Electricals Limited (BHEL) and Hindustan Aeronautics Limited (HAL) have increased their purchases of hydraulic actuator systems for powerplant equipment and aircraft testing facilities, further boosting the segment's growth.

The electric actuators sub-segment is projected to lead the India actuator market in the coming years, driven by the rising adoption of smart manufacturing, electric mobility, and energy-efficient automation technologies. These actuators offer cleaner operation, easier integration with digital control systems, and require less maintenance compared to hydraulic and pneumatic alternatives. According to the 2024 Digital Manufacturing Outlook by MeitY, several industrial automation zones are planned across Gujarat and Karnataka. These zones have adopted electric actuator solutions to improve energy efficiency and enable real-time control in AI-based systems. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME-II) program has boosted demand for compact electric actuators, used in EV battery packs, braking systems, and climate control.

Major actuator OEMs have established localized manufacturing facilities in Pune and Coimbatore, increasing domestic supply and facilitating technology transfer. The Industry 4.0 Transition Report 2024 by NITI Aayog revealed that a significant portion of new industrial equipment installations feature digitally controlled electric actuators, indicating their potential to dominate future automation in the manufacturing and automotive sectors in India.

India Actuator Market Companies

- Hitachi, Ltd.

- Hella KGaA Hueck & Co

- Firgelli Automations

- Denso Corporation

- Delphi Automotive PLC

- CVEL Automotive Electronics

- CTS Corporation

- Continental AG

- Buehler Motor Inc.

- APC International, Ltd.

Recent Developments

- In September 2023, global automotive supplier Marelli introduced a new line of multipurpose smart actuators designed specifically for electric vehicles at the Battery Show North America in Novi, Michigan. These actuators feature an integrated electronic module capable of autonomous control and seamless connection with vehicle electronics. As modern EVs are projected to require 100+ actuators, Marelli's compact, lightweight solution aims to reduce system complexity and support flexible integration. The devices offer modular mechanical design, onboard diagnostics, and cyber security readiness, allowing for scalable deployment across future vehicle platforms. (Source:https://www.autocarpro.in)

- In February 2025, the Aeronautical Development Agency (ADA) signed a Memorandum of Understanding with Godrej & Boyce Manufacturing Company Limited to co-develop flight control actuators for India's Advanced Medium Combat Aircraft (AMCA) program. Announced during Aero India 2025 in Bengaluru, the collaboration marks a continuation of Godrej's two-decade-long partnership with ADA. The company has played a crucial role in developing flight-critical DDV-based servo actuators and functional elements, reinforcing India's focus on indigenous aerospace capabilities under the Atmanirbhar Bharat initiative.

(Source:https://www.indiatoday.in)

- In September 2024, Keltron, a leading Indian electronics firm, signed an MoU with Norway-based Eltorque to jointly develop electric, hydraulic, and electro-hydraulic actuators for the control and instrumentation sector. The agreement, signed in Thiruvananthapuram, signifies Keltron's renewed commitment to actuator technology, building on its legacy from the 1980s when it supplied pneumatic actuators to power plants and industrial units. The partnership aims to support energy, automation, and infrastructure sectors by delivering modern motion control systems tailored to Indian industry needs.

- In January 2024, Emerson launched the Fisher easy-Drive 200R Electric Actuator, tailored for Fisher butterfly and ball valves used in oil and gas facilities located in cold, remote regions. The actuator is engineered to provide precise and reliable performance in extreme conditions while replacing pneumatic systems that emit greenhouse gases during operation. The 200R addresses key limitations in conventional electric actuators, offering improved uptime, emissions control, and system performance, aligning with the industry's shift toward sustainable and emission-free operations.

(Source: https://www.indianchemicalnews.com)

Segments Covered in the Report

By Industry Vertical

- Automotive

- Door Hardware and Access Control

- Aerospace

- Defense

- Manufacturing

- Robotics

- Others

By Type

- Linear Actuator

- Rotary Actuator

By Actuation

- Pneumatic Actuators

- Hydraulic Actuators

- Electric Actuators

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting