What is the Industrial Burner Market Size?

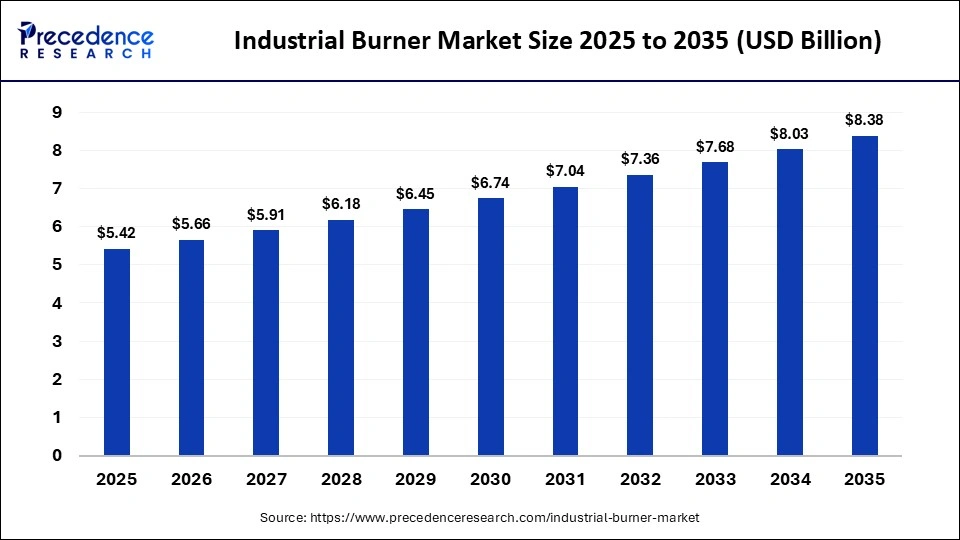

The global industrial burner market size accounted for USD 5.42 billion in 2025 and is predicted to increase from USD 5.66 billion in 2026 to approximately USD 8.38 billion by 2035, expanding at a CAGR of 4.46% from 2026 to 2035. The industrial burner market is experiencing unprecedented growth, driven by rising energy demand from end-user industries.

Market Highlights

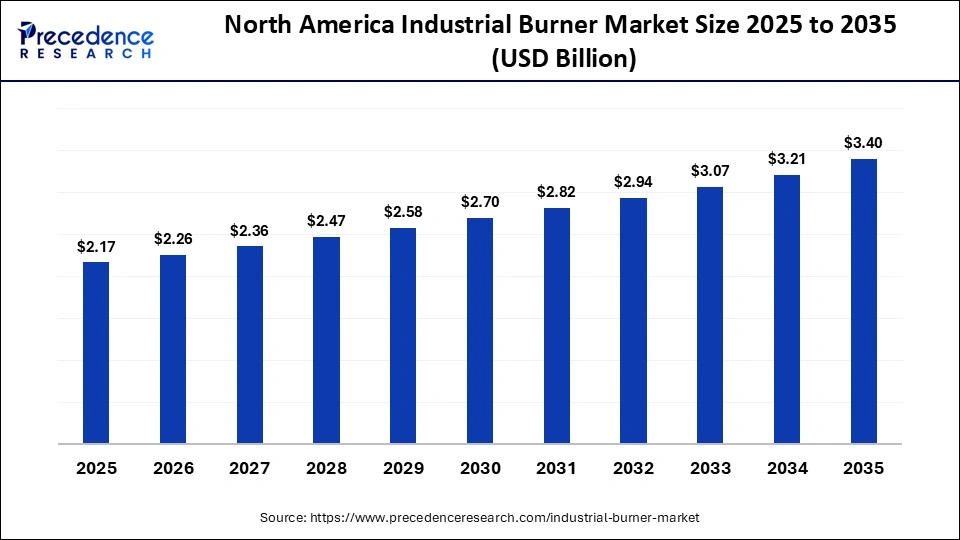

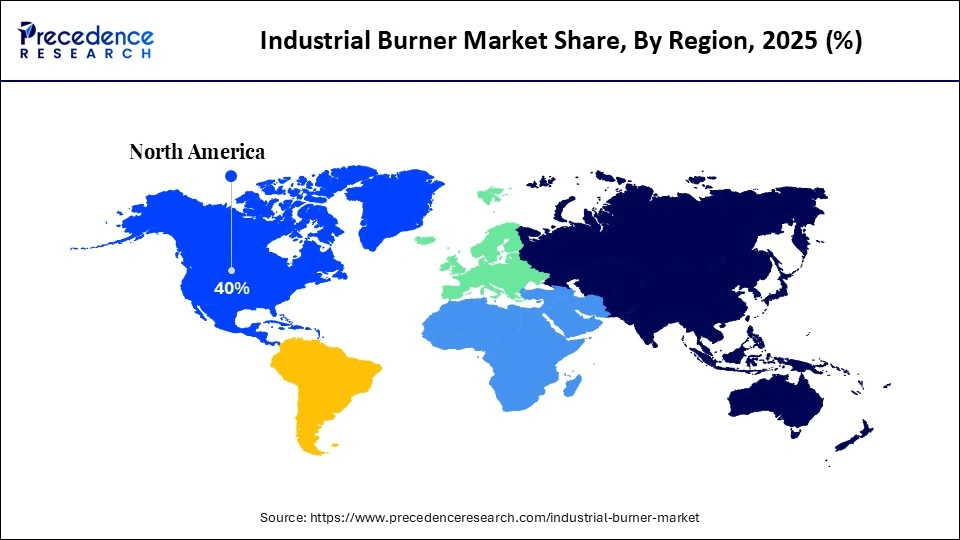

- North America dominated the market, holding the largest market share of 40% in 2025.

- The Europe is expected to grow at a notable CAGR between 2026 and 2035.

- By fuel type, the natural gas segment held the largest market share in 2025.

- By fuel type, the oil segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By burner type, the diffusion burners segment contributed the major market share in 2025.

- By burner type, the dual fuel burners segment is poised to grow at a significant CAGR between 2026 and 2035.

- By industry, the petrochemical segment captured the highest share in 2025.

- By industry, the power generation segment is expected to expand at a remarkable CAGR between 2026 and 2035.

- By capacity, the medium (500-2,000 kW) segment recorded the largest share in 2025.

- By capacity, the low (0-500 kW) segment is set to grow at a notable CAGR between 2026 and 2035.

What is the Industrial Burner?

Industrial burners are critical devices widely used across industries because they provide the controlled heat required for essential thermal processes. They are used extensively in manufacturing, chemical processing, food production, power generation, cement production, and metals processing, where consistent and high-temperature heat output directly influences product quality and process stability.

Industrial burners are engineered combustion systems designed to operate efficiently under continuous and high-load conditions. They can run on multiple fuel types, including natural gas, liquefied petroleum gas, fuel oil, diesel, and dual-fuel configurations that allow operators to switch fuels based on cost, availability, or regulatory requirements. Modern burners deliver high-temperature heat while incorporating advanced automation features such as precise air-to-fuel ratio control, flame supervision, and programmable logic controllers to improve overall energy efficiency and operational reliability.

How Are AI-Driven Innovations Reshaping the Industrial Burner Market?

In an increasingly digital industrial environment, the integration of artificial intelligence is accelerating innovation in the industrial burner market by optimizing combustion efficiency, enhancing operational safety, enabling predictive maintenance, and supporting emissions reduction. AI integration relies on machine learning models and real-time data analytics that continuously evaluate combustion parameters, including flame shape, exhaust composition, temperature gradients, and fuel flow rates. These systems learn from historical and real-time data to autonomously adjust burner settings, maintaining optimal combustion conditions even as fuel quality or load requirements change. This adaptive control improves fuel utilization and reduces excess oxygen levels, which directly lowers energy losses and pollutant formation.

AI-driven monitoring systems also track critical safety indicators, including pressure fluctuations, ignition stability, and abnormal temperature rises, triggering alerts or automated shutdowns when unsafe conditions are detected. By minimizing unplanned downtime, preventing hazardous incidents, and maintaining compliance with emissions standards, AI-enabled industrial burners are becoming central to next-generation industrial heating solutions.

Trade Analysis of Industrial Burner Market

- According to the trade records, the company has 1,277 export-import transactions of industrial burner furnaces, which demonstrates active world trade flows and high demand in a variety of industrial areas.

- It was found that there were 266 buyers and 254 suppliers, and this shows that there is a wide supply network and competition among manufacturers and distributors on a global basis.

- These trade relations indicate possibilities to match credible suppliers and new customers, identify potential markets, and follow the products with future industrial burner prospects in the international trade routes.

Industrial Burner Market Outlook

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to grow at an accelerated pace. The market is driven by rising demand for energy-efficient burners, increasing adoption of low-emission burners, a surge in industrial automation, rapid industrialization in emerging economies, and rising electricity consumption across various end-use industries. This market is also seeing technological advancements in burner efficiency to boost output and reduce carbon emissions.

- Global Expansion: Several leading players in the industrial burner market are expanding their geographic presence through strategic initiatives such as acquisitions, collaborations, and new product launches. Companies are increasingly focusing on broadening their reach to meet global demand. For instance, in February 2024, Honeywell announced the acquisition of the global Compressors Controls Corporation (CCC) to enlarge its footprint in India's energy sector. This includes the anti-surge technology that is majorly used in oil refining, regasification of Liquefied Natural Gas (LNG), and in the steel and coal sectors.

- Sustainability Trends: Sustainability is reshaping the industrial burner market landscape, with a rising demand for renewable energy sources. Several industries are increasingly shifting from fossil fuels to more sustainable energy options. Environmental concerns and the declining cost of renewable energy are mainly driving this transition.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.42 Billion |

| Market Size in 2026 | USD 5.66 Billion |

| Market Size by 2035 | USD 8.38 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.46% |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Fuel Type, Burner Type, Industry, Capacity, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Fuel Type Insights

What Causes the Natural Gas Segment to Dominate the Industrial Burner Market?

Natural Gas: The segment held the largest market share in 2025, supported by rising environmental concerns and increasing cost volatility of oil-based fuels. Natural gas burners are widely adopted because they produce lower levels of sulfur oxides, particulate matter, and carbon dioxide compared with fuel oil, making them better aligned with tightening industrial emissions standards. These burners are commonly used in industrial boilers, furnaces, and large manufacturing facilities where stable heat output and clean combustion are required for continuous operations.

Oil: The segment is expected to grow at a notable CAGR between 2026 and 2035, driven by sustained demand for high-temperature thermal applications that exceed the operating limits of some gas-based systems. Fuel oil remains widely preferred in heavy industries such as petrochemicals, refineries, steel production, and power generation plants, where very high heating capacity and flame intensity are required for process stability. In these environments, oil-fired burners provide reliable heat output even under fluctuating load conditions or in locations with limited access to gas infrastructure.

Burner Type Insights

Which Burner Type Segment Dominated in the Industrial Burner Market?

Diffusion Burners: The segment dominates the industrial burner market, holding a majority share. Diffusion burners are a robust type of industrial burner and are widely used across a variety of industrial applications due to their simple, sturdy design. These burners are commonly utilised in applications where flame stability and robust operation are prioritized over ultra-low emissions.

Dual Fuel Burners: The segment is the fastest-growing in the industrial burner market. Dual-fuel burners are highly valued for ensuring seamless operations and managing expenses. These burners allow industries to switch between different fuel sources, mainly natural gas and oil, based on prices and availability. These burners are widely used across various industries, including power generation plants, chemical processing plants, food and beverage production, metals, and mining.

Capacity Insights

What Causes the Medium (500–2,000 kW) Segment to Dominate the Industrial Burner Market?

Medium (500-2,000 kW): The segment is dominating the industrial burner market. The medium-capacity range is critical in several energy-intensive sectors, such as food & beverages, chemicals & petrochemicals, and manufacturing. Several industries are continuously seeking to enhance energy efficiency, reduce operating costs, and comply with environmental regulations, which has significantly increased the adoption of medium-capacity (500-2,000 kW) burners with modulating controls.

Low (0-500 kW): This segment is the fastest-growing in the industrial burner market. The segment's growth is supported by stringent emissions regulations, rising energy-efficiency demand, and growing demand from small and medium-sized enterprises (SMEs) across various sectors. Low-capacity (0-500 kW) burners are reliable and cost-effective heating devices that require less maintenance.

Industry Insights

What Has Led the Petrochemical Segment to Dominate the Industrial Burner Market?

Petrochemical: The segment is dominating the industrial burner market. The petrochemicals industry is experiencing ongoing investments and expansion in emerging economies, which increases the need for high-power/temperature burners. The sector relies heavily on these industrial burners for energy-intensive operations across processes such as refining and chemical production. Rapid technological advancements are supporting the growth of the petrochemical industry by maximizing output and minimizing carbon emissions.

Power Generation: On the other hand, the power generation segment is a significant and rapidly growing application segment for the industrial burner market. The segment's growth is primarily driven by surging global electricity demand and the growing focus on modernizing power plant infrastructure. Industrial burners are integral components in the power generation industry. These burners generate steam to drive turbines that generate electricity.

Regional Insights

How Big is the North America Industrial Burner Market Size?

The North America industrial burners market size is estimated at USD 2.17 billion in 2025 and is projected to reach approximately USD 3.40 billion by 2035, with a 4.59% CAGR from 2026 to 2035.

What Has Led the North America Region to Dominate the Industrial Burner Market?

North America dominated the industrial burners market, holding the largest market share in 2025. This leadership position is attributed to the rapid adoption of energy-efficient technologies, increasing electricity demand, and stringent environmental regulations. The presence of prominent players such as Honeywell International Inc., Zeeco, Inc., Selas Heat Technology Company, Power Flame Inc., and Bloom Engineering Company Inc. is driving innovation in burner systems. In addition, stringent government emissions policies substantially promote the use of advanced, sustainable combustion technologies in North America.

What is the Size of the U.S. Industrial Burner Market?

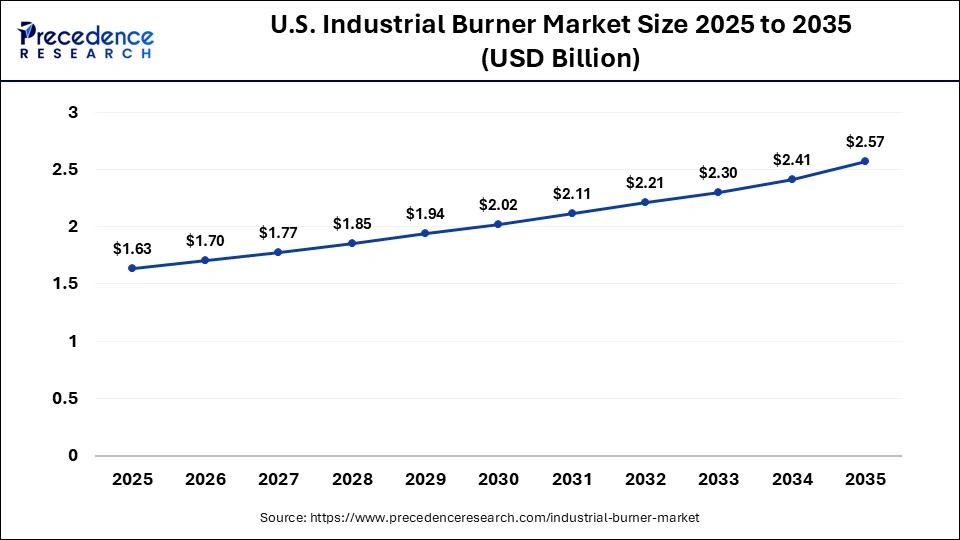

The U.S. industrial burners market size is calculated at USD 1.63 billion in 2025 and is expected to reach nearly USD 2.57 billion in 2035, accelerating at a strong CAGR of 4.66% between 2026 and 2035.

United States Industrial Burner Market Analysis

The United States is transforming the industrial burner market, driven by increasing demand for sustainable energy solutions, a rising shift towards clean energy sources, and a growing focus on energy efficiency across applications in several industries. The United States is a major contributor to the industrial burner market in North America. Several manufacturers in the country are increasingly focusing on developing advanced dual-fuel burners with features like automated switching, modulating options, compatibility, and hinged flanges.

What Causes the European Industrial Burner Market to Grow at the Fastest-Growing CAGR?

The Europe region is the fastest-growing region in the industrial burner market. The region has a robust manufacturing base that focuses on advancing burner technologies. The European region increasingly focuses on sustainable energy solutions and ongoing industrial expansion. The stringent regulatory compliance and environmental standards largely drive the growth. The European Union (EU) is increasingly implementing regulations to promote cleaner energy technologies and reduce emissions.

Germany Industrial Burner Market Analysis

The Germany industrial burner market is experiencing significant growth, driven primarily by strict emission regulations, a strong focus on industrial automation, rapid growth in manufacturing and industrial activities, a rising shift towards renewable energy sources, and surging demand for high-temperature applications across various industries. The country's strict regulatory landscape compels industries to adopt burners that meet these emissions standards, spurring demand for sustainable, advanced industrial burner solutions.

Which Factors Are Responsible for the Growth of the Industrial Burner Market in the Asia Pacific Region?

The Asia Pacific region holds a substantial market share in the industrial burner market. The region's growth is attributed to the expansion of manufacturing and industrial activities, the modernization of power plant infrastructure, and rising investment in renewable energy sources. The rapid industrialization, particularly in countries such as China, South Korea, and India, has significantly increased the installation of new industrial burners. Moreover, growing electricity consumption across industries and increasing adoption of energy-efficiency and low-emission technologies are expected to drive growth in the region during the forecast period.

How Is India Transforming the Industrial Burner Market?

The country is experiencing significant growth. The industrial burner market is growing due to increasing demand for high-power and high-temperature applications across end-user industries such as power generation, chemicals, food & beverages, pulp and paper, metals & mining, automotive, cement, and others. The rising demand for advanced burners with intelligent controls, precise combustion, and reduced fuel consumption is expected to drive growth in the industrial burner market during the forecast period. Additionally, the integration of smart technologies, such as IoT and automation, has improved the operational efficiency and monitoring capabilities of industrial burners.

What Are the Significant Factors Driving the Growth of the Middle East & Africa Region in the Industrial Burner Market?

The industrial burner market is expected to grow at a notable rate in the Middle East & Africa region. The Middle East & Africa region's growth is primarily driven by surging electricity demand, stringent environmental regulations, and rising demand for dual-fuel industrial burners. In addition, industrialization and urbanization have substantially increased the adoption of advanced and low-emission industrial burner technologies. Rapid technological advancements and government support for energy-efficient solutions have driven growing demand for high-efficiency and dual-fuel burners across various end-user industries. Such a combination of factors is expected to drive growth in India's industrial burner market during the forecast period.

South African Industrial Burner Market Analysis

The country is experiencing remarkable growth. The country's growth is driven by rapid industrial expansion across various sectors, increased investment in infrastructure development, and a growing shift towards energy-efficient solutions. The country's increasing electricity demand is likely to fuel investment in new power plants and upgrades, thereby increasing the demand for heavy-duty industrial burners. The strict government rules on greenhouse gases, pushing industries to adopt low-emission burners.

Value Chain Analysis of the Industrial Burner Market

- Raw Material Sourcing: This involves the identification and procurement of metals and materials that are cost-effective and of high quality, guaranteeing production continuity.

Key Players: Baosteel Group, Tata Steel, POSCO, Thyssenkrupp - Component Fabrication and Machining: the transformation of acquired materials into high-precision components needed for dependable industrial burner assembly.

Key Players: Honeywell, Kromschröder, Maxon, Danfoss, Bentone, Wesman Group - Testing and Certification: Checking safety, combustion operation, compliance with emissions, and compliance with industry regulatory standards.

Key Players: TUV SUD, Intertek, UL Solutions, CSA - Installation and Commissioning: On-site installation, calibration, and start-up to achieve optimum operation of the burner.

Key Players: John Zink Hamworthy, Fives, Zeeco, Andritz, Heatgen - Distribution and Sales of Industrial Burners: The distribution and sale of burners to industrial clients by the management of marketing, logistics, and sales channels.

Key Players: Weishaupt, Riello, Oilon, Limpsfield, Baltur, Forbes Marshall

Key players in the Industrial Burner Market

- Fives Group: Provides customized, high-efficiency industrial burners used to refine, process petrochemicals, melt aluminum, and collectively in high-temperature industrial processes.

- Honeywell Thermal Solutions: It offers integrated burners and controls, as well as safety systems, which allow optimization in efficiency and reduction of emissions and remote combustion monitoring.

- Hurst: Provides industrial boiler systems with low-NOx burners that accommodate gas, oil, biomass, and hybrid fuel systems.

- Limpsfield: Produces efficient gas, LPG, and oil burners that focus on very low emissions and high performance of the industrial burning.

Other Major Key Players

- Miura America

- Alfa Laval

- Emerson

- Faber

- Oilon

- Power Flame

- Santin

- Selas Heat Technology

- Thermal Fluid Systems

- Wayne

- Wisconsin Oven

Recent Developments

- In June 2025, Alfa Laval secures an order for the world's first marine boiler system for ammonia emissions incineration. The innovation is aimed at four ammonia dual-fuel vessels, as part of a joint project, to be delivered by 2027-2028. (Source: https://fuelcellsworks.com )

- In February 2024, ExxonMobil and Zeeco, Inc. announced a strategic alliance to market the ZEECO FREE JET Gen 3 next-generation ultra-low NOx, 100% hydrogen-ready burner. The new burner can significantly lower emissions for industrial manufacturers as they explore fuel switching from natural gas to hydrogen, a groundbreaking solution putting industry on the path to net zero. These new burners will be installed at ExxonMobil's Baytown Complex. The new burner technology extends the burner's fuel-firing capabilities to 100% hydrogen.(Source:https://tankterminals.com)

- In January 2025, ClearSign Technologies Corporation, an emerging leader in industrial combustion and sensing technologies, announced that, in collaboration with a major national laboratory, it has been awarded a USD 400,000 grant from the U.S. Department of Energy's ("DOE") Energy Efficiency and Renewable Energy ("EERE") Industrial Efficiency and Decarbonization Office ("IEDO"). The funding will support the development of ClearSign's ultra-low NOx industrial hydrogen burner technology to advance the decarbonization of high-temperature industrial processes.(Source: https://fuelcellsworks.com)

Segments Covered in the Report

By Fuel Type

- Natural Gas

- Oil

- Propane

By Burner Type

- Diffusion Burners

- Premix Burners

- Dual Fuel Burners

By Industry

- Petrochemical

- Power Generation

- Manufacturing

- Food & Beverage

By Capacity

- Low (0-500 kW)

- Medium (500-2,000 kW)

- High (over 2,000 kW)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting