What is Laminated Steel Market Size?

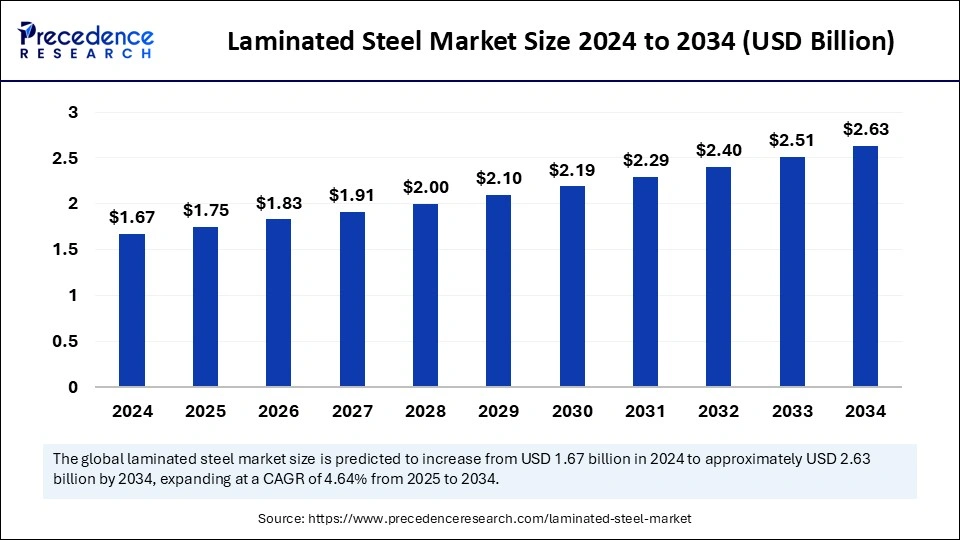

The global laminated steel market size is estimated at USD 1.75 billion in 2025 and is predicted to increase from USD 1.83 billion in 2026 to approximately USD 2.74 billion by 2035, expanding at a CAGR of 4.59% from 2026 to 2035. The laminated steel market is growing rapidly due to the rising demand for high-performance materials and advancements in manufacturing technologies that enhance sustainability.

Market Highlights

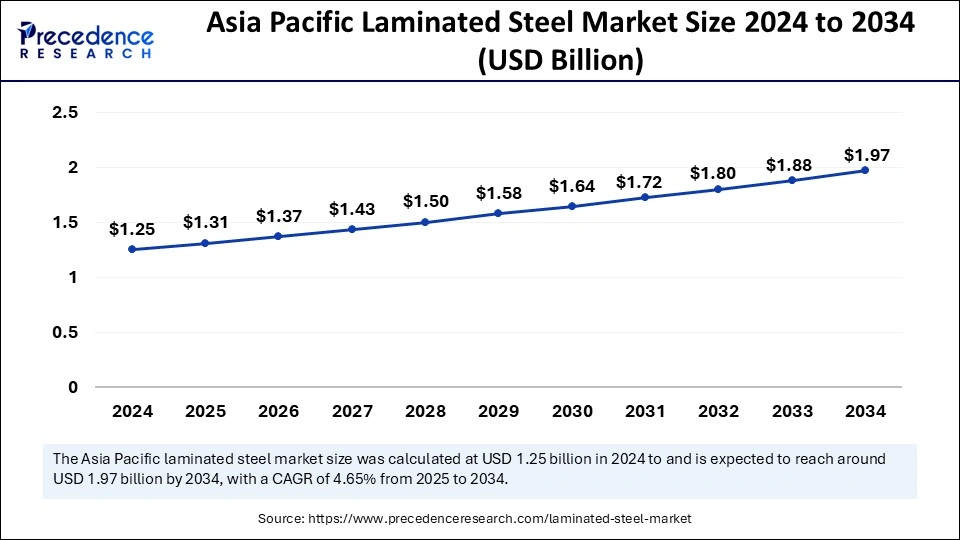

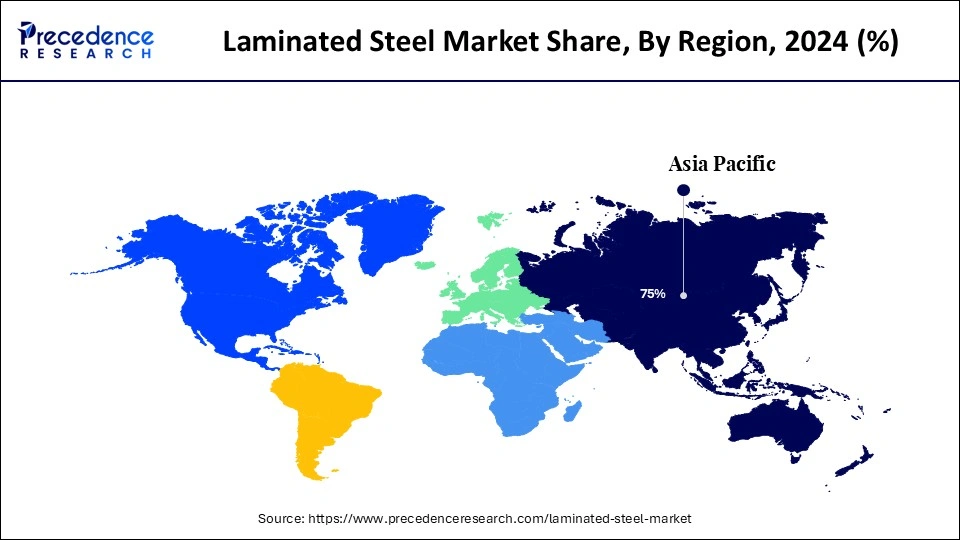

- Asia Pacific dominated the global market with the largest market share of 75% in 2025.

- North America is expected to witness the fastest growth over the studied period.

- Europe is observed to grow at a considerable rate in the upcoming period.

- By product, the carbon steel segment held the biggest market share of 38% in 2025.

- By product, the electrical steel segment is anticipated to grow at the highest CAGR over the projected period.

- By end-user, the automotive segment contributed the highest market share of 40% in 2025.

- By end-user, the electrical and electronics segment is projected to grow rapidly in the coming years.

How is Artificial Intelligence Improving the Laminated Steel Quality?

Integrating Artificial Intelligence in manufacturing improves laminated steel quality by optimizing several processes, enabling defect detection, and allowing precision coatings. Real-time surface analysis by AI-powered vision systems can identify minute flaws that human inspectors might overlook. The application of coatings is optimized by machine learning algorithms, guaranteeing consistent thickness and improved durability. Predictive analytics powered by AI also optimizes pressure and temperature settings, lowering irregularities and enhancing overall product performance. Artificial intelligence is raising the bar for faultless performance of laminated steel by automating quality control and streamlining production procedures.

AI-powered quality control systems are being integrated into the production of laminated steel by companies such as POSCO and Nippon Steel Corporation. Using AI-driven defect detection technology, Nippon Steel can quickly spot anomalies in photos taken by high-speed cameras. By using AI-based predictive maintenance POSCO has decreased downtime and guaranteed uninterrupted production. Furthermore, ArcelorMittal uses AI to streamline coating procedures, guaranteeing reliable adhesion and resistance to corrosion. These developments cut waste and provide industries around the world with premium laminated steel.

Market Overview

The growing demand for laminated steel from the construction and automotive sectors and advancements in steel coating technologies are boosting the growth of the global laminated steel market. Laminated steel is a popular option for manufacturers looking to improve the quality for longevity of their products because of its exceptional strength, resistance to corrosion, and ability to reduce noise. Key market players such as Tata Steel, ArcelorMittal, and Nippon Steel Corporation are investing heavily in cutting-edge technologies to meet the overall growing demand for laminated steel across a range of industries, which further support market expansion. Moreover, the increasing focus on sustainable practices contributes to market growth.

- In March 2025, Thyssenkrupp announced its transition plans to carbon-neutral steel production due to unexpectedly high costs but remains committed to achieving net-zero emissions by 2045 with a planned 3 billion investment. The company is developing new sustainable processes, including hydrogen-based steelmaking to reduce its carbon footprint. This transition aligns with the broader industry trend toward environmentally responsible manufacturing practices.

Laminated Steel Market Growth Factors

- Rising Demand from the Automotive and Construction Industries: Laminated steel's strength, corrosion resistance, and lightweight properties make it ideal for vehicle manufacturing, building structures, and household appliances.

- Advancements in Coating Technologies: Innovations in steel lamination, including eco-friendly coating and improved adhesion techniques, enhance product durability and appeal.

- Increased Focus on Sustainability:Growing environmental concerns are pushing industries to adopt recyclable and energy-efficient materials like laminated steel.

- Growing Industrialization and Urbanization:Rapid infrastructure development and rising consumer demand for high-quality, durable materials contribute to market expansion

- R&D Efforts: Companies are investing in research and development to create advanced laminated steel solutions with enhanced performance and cost-effectiveness.

- Expanding Applications in Packaging: The food and beverage industry is increasingly using laminated steel for cans and containers due to its superior barrier properties.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.75 Billion |

| Market Size in 2026 | USD 1.83 Billion |

| Market Size by 2035 | USD 2.74 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.59% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, End-user, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. |

Market Dynamics

Drivers

Rising Usage in the Automotive Industry

Laminated steel is in high demand due to the growing production of lightweight and fuel-efficient automobiles. Automakers prefer this material because of its exceptional strength, resistance to corrosion, and durability. The growing popularity of electric vehicles boosts the demand for high-performance materials that provide strength and weight reduction without sacrificing safety standards. The laminated steel market is expanding due to rising demand for car aesthetics such as decorative laminated steel components. Manufacturers are investing in laminated steel solutions to improve vehicle acoustics and fuel efficiency.

Advancements in Coating Technologies

Advanced laminated steel products are the outcome of ongoing research and development in steel coating technologies. High-performance coatings are among these innovations, improving durability, scratch resistance, and appearance. In addition, companies are concentrating on creating low-VOC and solvent-free coatings to meet strict environmental standards. The healthcare and food processing industries are using laminated steel as a packaging material, thanks to the development of antibacterial and self-cleaning coatings. To extend the lifespan of laminated steel in harsh environments, smart coatings with improved heat and UV resistance are also being developed.

Restraints

Volatility in Raw Material Prices

Fluctuations in raw material prices hamper the growth of the laminated steel market. Raw materials like steel-reinforced polymers and adhesives are crucial to the laminated steel. Changes in global demand, supply chain interruptions, and geopolitical unrest affect steel prices, which can influence production costs and profit margins. Manufacturers may also be further strained by the growing price of environmentally friendly coatings and adhesives. Unexpected price increases can interfere with production scheduling, making it challenging for businesses to stick to consistent pricing policies. Cost control is made more difficult for manufacturers when they depend on imports of essential raw materials.

Stringent Environmental Regulations

Numerous nations have enacted stringent environmental regulations regarding waste management, emissions, and the use of dangerous chemicals in steel lamination. Operating expenses will rise to comply with these regulations, which require a large investment in sustainable practices. Non-compliance can restrict market growth by resulting in fines, product recalls, and harm to one's reputation. To comply with regulatory requirements, businesses must also invest in sophisticated filtration and waste treatment systems, which raise capital expenditure. Additional uncertainty is created by frequent changes in environmental laws, which force companies to constantly modify their production methods.

Opportunities

Expanding Applications in Electric Vehicles (EVs) and Renewable Energy

The trend toward electric mobility is expected to boost the need for strong and lightweight materials, such as laminated steel, in battery casings, car bodies, and EV infrastructure. Laminated steel is preferred for EVs due to its high strength, durability, and ability to reduce noise. Furthermore, new users for laminated steel are emerging in the fields of renewable energy, including wind turbine components and solar panel frames. As governments and businesses invest heavily in EVs and clean energy, the demand for lightweight and durable materials increases.

Expanding Role in High-end Consumer Electronics

Applications for laminated steel are also expanding in the electronics industry, which creates immense opportunities in the steel laminated market. Consumers' growing preference for high-end home appliances drives the demand for visually appealing, long-lasting, and scratch-resistant laminated steel. Electronics manufacturers now have the chance to create laminated steel products with anti-smudge and fingerprint resistance coatings to meet changing consumer demands as smart appliances become more popular. Additionally, electronics manufacturers are seeking cutting-edge materials for sleek and contemporary product designs, which are expected to propel the market in the near future.

Segment Insights

Product Insights

The carbon steel segment dominated the laminated steel market with the largest share in 2025. This is mainly due to its adaptability, affordability, and durability. Carbon steel continues to be the most popular material. It is essential for structural integrity and long-lasting performance in sectors like heavy machinery, automotive, and construction. Its resistance to high pressure and extremely high temperatures makes it a preferred choice for crucial applications. Carbon steel is an environmentally friendly choice for manufacturers because of its recyclability, which also supports global sustainability initiatives. Governments worldwide are focusing on modernizing infrastructure using strong and sustainable materials like carbon steel, further sustaining the segment's position in the market.

The electrical steel segment is expected to grow at the fastest rate in the market during the forecast period, driven by its growing need to develop energy-efficient technologies. Electrical steel is essential in manufacturing motors, generators, and transformers, all of which are necessary for power grids and electric cars. As renewable energy sources increase, electrical steel is becoming essential for solar power systems and wind turbines. The rapid shift toward cleaner energy sources further boosts the demand for electrical steel because of its capacity to increase efficiency and decrease energy loss. Several nations are implementing policies to boost the adoption of renewable energy and electric transportation, further boosting the need for electrical steel.

End-user Insights

The automotive segment dominated the laminated steel market with the largest share in 2025, as automobile manufacturers have shifted their focus on lightweight materials to improve safety and fuel economy. Laminated steel is used to develop vehicle bodies, panels, chassis, and crash-resistant parts due to its lightweight and durability, improving battery performance and increasing driving range. The rise in popularity of electric vehicles has further raised the demand for laminated steel. As automakers strive for innovation, laminated steel continues to be a crucial component of vehicle design. Governments have implemented stricter emission norms and fuel efficiency regulations, prompting automakers to use advanced materials like laminated steel.

The electrical and electronics segment is expected to grow at the fastest rate in the market during the projection period. Laminated steel is emerging as a key component for sustainable innovation due to the growing demand for energy-efficient transformers, motors, and generators. With the rising production of AI-powered appliances, the Internet of Things (IoT), and smart devices, the demand for high-performance laminated steel is increasing in the electronics industry. Moreover, the rising demand for green energy solutions contributes to segmental growth.

Regional Insights

Asia Pacific Laminated Steel Market Size and Growth 2026 to 2035

The Asia Pacific laminated steel market size is exhibited at USD 1.31 billion in 2025 and is projected to be worth around USD 2.05 billion by 2035, growing at a CAGR of 4.58% from 2026 to 2035.

Asia Pacific registered dominance in the laminated steel market by capturing the largest share in 2025. This is mainly due to strong industrial growth and rapid urbanization. There is a high demand for lightweight and durable materials in sectors like construction, automotive, and electronics. The region's position in the global market has been further reinforced by its emphasis on infrastructure development and government programs that support domestic manufacturing. Additionally, Asia Pacific is now a major player in the production and consumption of laminated steel due to the presence of major steel producers and technological advancements in steel manufacturing methods.

Governments across the region have imposed policies to boost steel production and reduce dependence on imports. For example, China's “Made in China 2025” initiative seeks to improve the nation's manufacturing capacity, particularly the production of steel. To meet the growing demand from both domestic and international markets, leading companies like Baosteel, Nippon Steel, and Tata Steel are increasing their laminated steel production capacities.

What Makes North America the Fastest-Growing Region in the Laminated Steel Market?

North America is expected to witness the fastest growth over the studied period. The regional market growth is attributed to the growing use of electric cars, the rapid shift toward renewable energy, and the strong emphasis on infrastructure development and renovation. The need for laminated steel has increased in sectors like consumer electronics, automotive, manufacturing, and power transmission due to the increased emphasis on sustainability and energy efficiency. High-performance laminated steel solutions designed for next-generation applications are becoming more and more popular in North America as a result of growing investments in cutting-edge materials and technologically advanced manufacturing techniques.

The U.S. leads the North American market, driven by strong automotive production, renovation of aging infrastructure, and increased use of laminated steel in energy-efficient buildings and industrial machinery. Investments in domestic steel manufacturing and reshoring initiatives further enhance market stability.

How is the Opportunistic Rise of Europe in the Laminated Steel Market?

Europe is expected to show notable growth due to its strict environmental regulations, cutting-edge steel processing technologies, and strong emphasis on sustainability. Laminated steel is in high demand in the automotive industry, especially in Germany, France, and the UK, where manufacturers are looking for lightweight and high-strength materials to increase vehicle efficiency. Furthermore, the use of laminated steel is rising in energy storage and power transmission applications because of Europe's dedication to smart grid development and renewable energy.

The European laminated steel market is directly impacted by the EU Fit for 55 Plan and the European Green Deal, which strongly emphasize encouraging energy-efficient manufacturing and lowering carbon emissions. The need for laminated steel is increasing in the region due to the shift toward electric vehicles and environmentally friendly building materials. European steel producers, including ThyssenKrupp, Voestalpine, and SSAB, are investing in research and development to create environmentally friendly laminated steel solutions.

Germany is a major contributor to the European market, supported by its robust automotive industry, advanced engineering capabilities, and emphasis on high-strength laminated steel for precision applications. Continuous R&D investments and adoption of low-emission steel production technologies strengthen the country's market position.

Laminated Steel Regulatory Landscape: Global Regulations

|

Country / Region |

Regulatory Body |

Key Regulations |

Focus Areas |

Notable Notes |

|

North America (USA & Canada) |

United States:EPA (Environmental Protection Agency); OSHA (Occupational Safety and Health Administration); DOT (Department of Transportation) |

Clean Air Act (CAA) VOC & particulate emissions |

Emissions from coating/lamination operations |

Laminated steel (coated steel strip) production involves chemical coatings, adhesives, and surface treatments; VOC, HAP, and particulate limits are central. OSHA/WHMIS requires SDS and hazard communication. |

|

European Union |

European Commission; ECHA (European Chemicals Agency); National environmental & safety bodies |

REACH Regulation (EC 1907/2006) |

Chemical registration & hazard classification |

REACH applies to raw materials (coatings, primers, adhesives); CLP covers labeling. IED/BREFs influence abatement tech for coating/lamination plants. |

|

Asia Pacific |

China MEE (Ministry of Ecology & Environment); SAMR; Japan METI/MOE; India MoEFCC/CPCB; Korea MoE & KAT |

China MEE Order No.12 (chemical registration) |

Chemical safety & registration |

APAC regulations align increasingly with REACH-like frameworks. China enforces emissions for coating processes; India ramps up pollution control in industrial clusters. |

|

Latin America |

Brazil IBAMA/ANP; Argentina Ministry of Environment; Mexico SEMARNAT/PROFEPA |

National air & water quality standards |

Industrial emissions control |

Latin American countries require plant emissions permits; regulations vary, but many reference EU or U.S. norms for VOCs and chemical safety. |

|

Middle East & Africa |

UAE MOCCAE; Saudi SASO; South African DFFE/DMRE |

National environmental protection laws |

Emission compliance |

Local frameworks often refer to international standards (GHS, ISO) for chemical hazard communication and general environmental controls. |

Laminated Steel Market Companies

- Alliance Steel

- ArcelorMittal

- China Ansteel Group Corporation Limited

- JFE Steel Corporation

- LIENCHY LAMINATED METAL CO., LTD.

- Nippon Steel Corporation

- POSCO

- Tata Steel

- ThyssenKrupp AG

- United States Steel Corporation

Recent Developments

- In April 2025, the Merino Group launched Metalam, a premium laminate that combines real metal foil with a kraft paper core to offer both structural strength and decorative flexibility. (Source:https://www.constructionworld.in)

- In September 2025, Hyundai Steel announced the development and commercial production of third-generation automotive steel plates, which aim to provide both high strength and excellent formability.(Source:https://www.businesskorea.co)

- In August 2024, ArcelorMittal Nippon Steel India launched Optigal, a world-class color-coated steel brand with an innovative Zinc-Aluminum-Magnesium metallic coating. The new offering supports the company's efforts to introduce high-quality products to meet the growing demand for superior-quality coated steel.

Segments Covered in the Report

By Product

- Carbon Steel

- Low Alloy Steel

- Electrical Steel

By End-User

- Automotive & Transportation

- Construction & Building

- Electrical & Electronics

- Food & Beverage

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting