What is the Life Science Automation and Robotics Market Size?

The global life science automation and robotics market streamlines research workflows with intelligent automation and AI-driven robotics.The market is driven by rising demand for high-throughput research, precision workflows, and automated systems in drug discovery, diagnostics, and bioprocessing.

Market Highlights

- By region, North America accounted for the largest share of the life science automation and robotics market in 2024.

- By region, the Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By technology type, the laboratory robotics segment held the highest share in 2024.

- By technology type, the AI-driven autonomous systems segment is anticipated to show considerable growth in the market over the forecast period.

- By workflow/application, the drug discovery & high-throughput screening (HTS) segment held a significant share in the life science automation and robotics market during 2024.

- By workflow/application, the bioprocessing & biomanufacturing automation segment is anticipated to show considerable growth in the market over the forecast period.

- By component, the robotic systems segment held a significant share in 2024.

- By component, the software & digital control platforms segment is anticipated to show considerable growth in the market over the forecast period.

- By end user, the pharmaceutical companies segment held a significant share in 2024.

- By end user, the CDMS/CMOS segment is anticipated to show considerable growth in the market over the forecast period.

- By process area, the R&D laboratories segment held the largest share in the life science automation and robotics market 2024.

- By process area, the manufacturing & packaging automation segment is anticipated to show considerable growth in the market over the forecast period.

- By distribution channel, the direct OEM sales segment held a significant share in 2024.

- By distribution channel, the automation integrators segment is anticipated to show considerable growth in the market over the forecast period.

Redefining Remote Care: How AI Is Transforming the Telemedicine Value Chain

The life science automation and robotics market includes automated hardware systems, robotics platforms, software-based lab orchestration systems, and smart instrumentation used in pharmaceutical, biotechnology, medical device manufacturing, academic research centers, CROs, and CDMOs. Applications of end-to-end scientific workflows in drug discovery, high-throughput screening, omics-based research, sample preparation, bioprocessing, cell line development, diagnostics, fill-format, and packaging are supported by solutions. The markets development is indicative of industry-wide trends toward digital, data-intensive research and development (R&D), in which integrated robotics systems are paired with cloud-connected analytics platforms to streamline laboratory workflows.

The drivers of this growth are increasing R&D complexity, expanding biologic pipelines, and the growing need for scalable systems that support multimodal workflows in therapeutics, such as mRNA, cell therapies, and antibody platforms. One of the driving forces of the AIs that allow autonomous optimization of assays, predictive scheduling of experiments, intelligent motion control, QC automation, and real-time detection of anomalies in biomanufacturing lines is AI. As discovery becomes more focused on precise automation of commercial manufacturing steps, the market is still transitioning towards individual robots being linked and towards AI-enhanced laboratory environments.

Key AI Integrations in the Life Science Automation and Robotics Market

The new generation of life sciences is being conducted through AI, which enhances accuracy, accelerates the experimental process, and improves regulatory traceability across drug discovery and biomanufacturing. Applications of machine learning models, which are becoming increasingly popular, include autonomous optimisation of assays, adaptive experimental design, image-based cell analysis, and predictive modelling of molecular interactions. Motion control, AI-based robotic path planning, and automated lab systems make sample handling more efficient, less prone to contamination, and enable real-time calibration of liquid handling systems. Bio-processing platforms utilise AI for anomaly detection, predictive maintenance, quality monitoring, and closed-loop control systems that regulate parameters based on live sensor data.

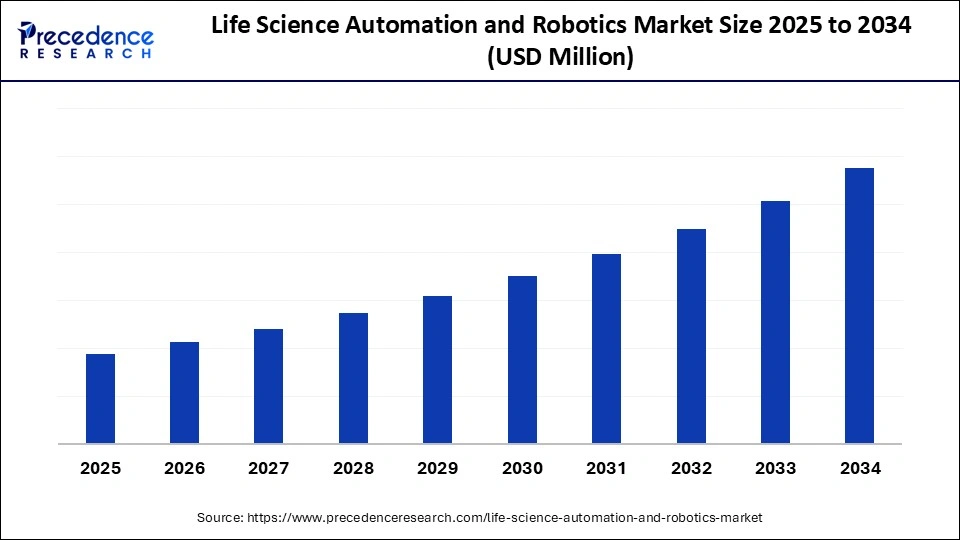

Life Science Automation and Robotics Market Outlook

Growth is due to increasing biologics and cell therapy pipeline, high-throughput research needs, and the need to be reproducible in controlled environments. The rising cost of R&D funding, the shortage of specialised lab labour, and the need to process the labour 24/7 are all accelerating the adoption of automation.

Robots are beginning to experience growth in North America and Europe, and are beginning to grow high-growth centers in APAC, the Middle East, and Latin America due to the increasing healthcare infrastructure and biotech growth efforts supported by the government. Cross-border cooperation in vaccine research, genomics, and biomanufacturing is driving the adoption of automated labs.

Investment has also been observed to be stimulated by major purchases and capital expenditure of large players in the industry, like Thermo Fisher, Danaher, Siemens Healthineers, Roche, and Sartorius, in an effort to extend the automated workflow. Moreover, digital health funds and venture capital firms are experiencing a boom in funding rounds for robotically enabled CDMOs, AI labs, and industrial biomanufacturing automation.

The upcoming new entrants to the ecosystem include Opentrons, Automata, Labforge, and Cytena, which are developing modular, cheaper, and scalable automation. These startups are being invested in by venture capital firms, biotech accelerators, and cloud-AI investors as they strive to democratize lab automation to small and mid-sized research institutions.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology Type, Workflow/Application, Component, End-User, Process Area, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Life Science Automation and Robotics Market Segment Insights

Technology Type Insights

The life science automation and robotics market was dominated by the laboratory robotics segment in 2024, driven by its extensive use in high-throughput research across genomics, drug discovery, proteomics, and clinical diagnostics. Robots are automated to perform tasks such as liquid manipulation, assay setup, microplate transfer, colony picking, and sample preparation, thereby minimizing errors and enhancing consistency. Their supremacy is also aided by the need for faster experimentation, better data traceability, and compliance with regulated environments.

The AI-based autonomous systems market segment will experience a significant CAGR during the forecast period as laboratories shift to self-optimizing, decision-based workflows, replacing predefined automation. These systems are machine learning-based, sensor feedback-based, real-time imaging-based, and algorithmic motion control-based systems capable of adaptively changing experimental conditions automatically. Their expansion is motivated by the increasing demand for closed-loop automation, the acceleration of discovery, and the need for fully unmanned laboratories that can be operated 24/7.

Process and manufacturing robotics are increasingly used at large-scale production sites, and pharmaceutical and biotech firms are abandoning manual batch operations and adopting continuous, automated bioprocessing. These robots are beneficial for sterile fill-finish, packaging, palletizing, inspection, material handling, and machine tending at GMP facilities, improving throughput and reducing the risk of contamination. Compliance is also simplified by robotics, which enables the development of digital audit trails and the regular execution of processes. The demand for commercial-scale bio-production, the labour crunch in specialized manufacturing jobs, and cost pressures compelling businesses towards process automation are the growth drivers.

Workflow/Application Insights

Drug discovery & high-throughput screening contributed the most revenue in 2024 and are expected to dominate throughout the projected period. Robotic liquid handlers, automated plate readers, microfluidic assay screening platforms, and AI-assisted assay design are replacing manual plate readers and hand-designed assays, reducing cycle times to enhance experimental reproducibility in Pharma and biotech companies. Expansion of investment in small-molecule, biologics, and multi-modal therapeutics also increases throughput requirements. Decision-making is improved through the integration of cloud-based data systems, compound libraries, and machine learning models.

The bioprocessing and biomanufacturing automation market is projected to increase significantly as organizations move away from manual processes to digitally connected, fully automated biologic, vaccine, mRNA therapy, and cell and gene therapy manufacturing systems. Automation enhances sterility, operational continuity, batch consistency, and regulatory traceability across both upstream and downstream operations. The GMP facilities use robotic systems to aid in monitoring bioreactors, filling vials, filtration, quality control, and supply chain logistics. The lack of labor in specialized positions is also an incentive to growth, along with the increasing demand for biologics worldwide, and various pressures to lower manufacturing costs through continuous production.

Genomics, proteomics, and cell biology automation are advancing rapidly, with research institutions moving towards robotic platforms to support more complex workflows, including extraction, sequencing preparation, single-cell analysis, CRISPR workflows, protein expression research, and live-cell imaging. In precision medicine, pathogen surveillance, and immunotherapy development, automation will reduce error-prone manual pipetting, improve sample integrity, and increase throughput. Imaging and molecular analytics based on AI aid in interpreting real-time data and mapping phenotypes.

Component Insights

Robotic Systems: The largest market in life science automation and robotics was the robotic systems segment in 2024, and generated the highest percentage of revenue because it is the hub of automation of core laboratory and manufacturing processes. These systems enable high-throughput screening, sample processing, sterile processing, and high-resolution motion control in drug discovery, quality testing, and bioproduction. Moreover, there is an increasing trend among pharmaceutical firms, CROs, and CDMOs to use collaborative robotic arms and modular platforms to resolve labor shortages and attain 24/7 research and production operational efficiency.

It is expected that the software and digital control platforms business will have a high CAGR during the forecast period, as laboratories will be managed by AI, workflows, digital twins, and cloud-based data management. These systems introduce instruments, sensors, and robots into coordinated digital ecosystems and enable them to use real-time analytics, automated records, and regulatory traceability. The software layers also optimize test design, monitor bioprocess performance, and remotely control automated labs. Compliance, data integrity, and multi-site interoperability continue to take a more central stage as significant components of laboratory automation strategies.

Automated systems, such as liquid handlers, cytometry systems, sequencing prep modules, chromatography systems, imaging platforms, and automated PCR systems, are used as scientific workflow tools with specific applications. These tools improve the speed, accuracy, and consistency of an experiment by minimizing sample handling and manual pipetting. They are being adopted due to growing genomic usage, the scalability of protein analysis protocols, and the need to access smaller assays at lower reagent levels. Also, automated instruments are connected to cloud-based software and LIMS systems, enabling a smooth transition in data capture and process validation.

End User Insights

The pharmaceutical companies contributed the most revenue in 2024 and are expected to dominate throughout the projected period. Such organizations have an ample capital base to implement a robotic platform to dispense with precision, handle samples, and enable real-time quality control; the R&D and error-reduction elements in production are accelerated. Increasing attention to personalized medicine and complex biologics also underscores the need for robotic systems that are consistent and scalable. Despite high regulatory standards and rising demand for various drugs worldwide, pharma companies still find it necessary to focus more on automation to enhance compliance, timely market submissions, and operational efficiency.

The CDMOs/CMOs market is expanding rapidly as pharmaceutical and biotech companies are outsourcing manufacturing to lower costs, minimize infrastructure overhead, and expand production rapidly. The CDMOs are also increasingly pursuing demand for robotic bioreactors, automated fill-finish lines, and modular manufacturing systems to cater to a wide range of client pipelines, including biologics, vaccines, and advanced therapies. This enables these organizations to offer competitive service delivery prices and greater efficiency, leading to high adoption of automation technologies to meet capacity expansion requirements and achieve faster time to commercialization.

Contract Research Organizations (CROs) are also experiencing increased automation, including support for global clinical trials, preclinical research, toxicology, and early-stage drug screening. Robotics enables standardized sample handling, automated assays, and digital data acquisition, which benefits CROs by enabling high-quality, quicker turnaround for large volumes of research. As pharmaceutical companies move their R&D offshore to mitigate risk and accelerate innovation, CROs are turning to automated solutions to deliver more reproducible research and regulatory-quality reporting.

Process Area Insights

The R&D laboratories segment led the life science automation and robotics market and accounted for the largest revenue share in 2024, driven by the increasing need for high-throughput experimentation, automated sample preparation, and high-throughput drug discovery. Robotics facilitates accurate liquid handling, assay performance, compound manipulation, and sophisticated cell culture tasks, thereby minimizing variability in manual handling and enhancing the reproducibility of experimental outcomes. With the growth of innovation pipelines, R&D laboratories are the largest users of robotic systems to increase the number of experiments and accelerate scientific discoveries.

The manufacturing and packaging automation segment is set to experience substantial growth as life science firms ramp up production of biologics, vaccines, and tailored therapies on a commercial scale. Robotics enables aseptic production, fill-finish, real-time inspection, and compliant batch traceability, ensuring high product quality and minimizing the risk of contamination. The need to produce in a flexible, modular, and small-batch fashion, particularly in cell and gene therapy production, is increasing, leading to the use of robots that enable quick changeovers and standalone production.

The clinical & diagnostic labs segment is set to see notable growth in the market, as robotics enables automated sorting of samples, nucleic acid extraction, method preparation, and analysis, thereby decreasing turnaround time and enhancing test accuracy. As high-throughput tools such as digital pathology and automated laboratory information systems are increasingly adopted, these labs will reduce manual work and maximize operational efficiency. The momentum towards decentralized testing, point-of-care diagnostics, and rapid clinical decision-making also drives investment in the automated laboratory platform.

Distribution Channel Insights

The largest source of revenue in the life science automation and robotics market in 2024 will be the direct OEM sales channel, which will likely remain the highest-earning channel due to customers strong preference for fully integrated solutions, with vendor support in the form of robots. Life science organizations - especially pharma, biotech, and research institutions are interested in direct association with manufacturers to secure tailored automation arrangements, smooth hardware-software integration, and regulatory-compliant validation administration. Quick OEM delivery, continuous upgrades, and specialized technical services for high-value automation to support mission-critical processes like drug discovery, genomics, and bioprocess automation.

The automation integrators segment will experience high growth as organizations demand more hybrid, multi-vendor automation environments that cannot be achieved with single-OEM systems. System integrators focus on connecting robotics, AI-driven analytics, LIMS platforms, and legacy lab infrastructure to create end-to-end workflows. They are exceptionally well represented in biomanufacturing, QC automation, sample logistics, and lab digital transformation programs. Integrators are also considered important partners for regulatory documentation, validation, training, and cybersecurity; hence, they are important partners for the labs to modernize in phases, rather than replace the full system.

Value-added resellers have an increasing, though lower, presence in the life science automation and robotics market, which mostly serves mid-sized research labs, diagnostic facilities, and regional biotechs seeking affordable, pre-configured solutions. The VARs offer robotic instruments, installation services, workflow configurations, consumables, software packages, and services contracts, which simplify procurement for smaller organizations lacking automation expertise. They are strong in offering localized distribution, quicker delivery, and domain-specific application support.

Life Science Automation and Robotics MarketRegion Insights

North America led the global market with the highest market share in 2024, owing to high levels of pharmaceutical research and development, effective investment in biotech development, and the high volume of biotech research systems in use. The area is enjoying advanced digital infrastructure, early AI applications in drug discovery, and significant investment from giants in biomanufacturing and genomics. The presence of dominant pharma, automation OEMs, and AI-based lab systems can accelerate innovation and regulatory-compliant implementation. Also, the government-funded clinical research initiatives, increasing cell and gene therapy pipelines, and transitioning to autonomous laboratories strengthen market positions in North America.

The U.S. is expected to contribute most of the revenue share in North America, as it has a highly concentrated pool of biotech entrepreneurial activity, international pharmaceutical headquarters, and leading research institutions. High-throughput screening, precision bioprocessing, and digital lab orchestration efforts increase demand for robotic systems, which in turn require greater adoption. The federal programs that promote innovation in biomedicine, effective venture capital, and increased investment in automated GMP manufacturing enhance market growth. The U.S. also leads in AI-powered automation platforms and cell therapy production robotics, which enable rapid scaling of drug development and clinical trials.

Asia Pacific is estimated to achieve the highest CAGR over the forecast period. The growth in the region is driven by the scale-up of pharmaceutical manufacturing, increased government investments in biotechnological research, and the rise in the use of automated bioprocessing systems in countries such as China, Japan, South Korea, and India. The automation is gaining momentum due to increasing biopharma investment and clinical trials, as well as the need to produce localized vaccines and biologics. Innovation is also fostered by the emergence of smart biotech parks, digital labs, and AI-enabled health technologies, which contribute to the regions development as well. Reduced operating expenses drive global outsourcing, which in turn promotes further growth.

China Life Science Automation and Robotics Market Trends

China is swiftly becoming a major growth driver in the life science automation and robotics market due to faster biopharmaceutical production, substantial state investments through programmes such as Made in China 2025, and expanded biologics and vaccine manufacturing capabilities. The country is investing in smart bioreactors, AI-powered lab automation, and robotic clinical diagnostics to build self-sufficiency in drug development. Increasing the capabilities of local manufacturers are robotic handling systems, automated gene sequencing workflows, and production lines meeting GMP standards, which make them less dependent on overseas suppliers. The growth of health-tech startups, robust IP creation, and the rise in the number of clinical trials are all driving the adoption of autonomous and digital lab systems across research and healthcare.

The European life science automation and robotics sector is experiencing sustainable growth owing to the growth of biotechnology hubs, the focus of regulatory bodies on reproducible research, and increased investments in biologics production. Germany, Switzerland, and the UK are among the countries already implementing major pharma centers that embrace automated QC, artificial intelligence-driven drug research, and robotic sample processing to accelerate translational research. Also strengthening the implementation of technology are EU digitalization programs, public-private research collaborations, and increased funding for cell and gene therapy manufacturing. The increasing need for decentralized clinical diagnostics and automated GMP compliance tools, and sustainability driven by ESG, are adding to the consistent market growth in Europe.

UK Life Science Automation and Robotics Market Trends

The UK has world-leading research and rapidly expanding biotech startups, along with high concentrations in AI-enabled drug discovery and synthetic biology, to fortify its market. The adoption of automation across biologics, genomics, clinical diagnostics, and vaccine development is supported by government efforts, including the Life Sciences Vision and investments in high-tech manufacturing hubs. A further leader in automated labs to enable personalized medicine, liquid-handling AI-based genomics pipelines, and artificial intelligence (AI)-driven digital twins to optimize bioprocesses is also the UK. The partnership between universities and CROs with global pharma firms accelerates commercialization, and the UK is a hub of innovation within the wider European life science network.

Life Science Automation and Robotics Market Companies

A global leader in industrial automation and digitalization, offering PLCs, SCADA, and AI-enabled smart manufacturing platforms. Siemens also supports pharmaceutical and biotech production through its digital twin and process control technologies.

Specializes in industrial control systems, robotics integration, and connected manufacturing through its FactoryTalk® suite. Rockwell enables real-time analytics and automated workflows across chemical, food, and life science facilities.

Provides advanced automation, robotics, and electrification technologies used across manufacturing and process industries. ABBs AI-enhanced control solutions support energy efficiency, predictive maintenance, and high-reliability operations.

Offers industrial automation, building controls, and process optimization systems through Honeywell Process Solutions. Honeywell platforms support pharma manufacturing, cleanrooms, and industrial plants with AI-driven quality assurance.

A major provider of process automation, instrumentation, and control systems for energy, chemical, and life science manufacturing. Emersons DeltaV and Ovation platforms incorporate AI for optimization and predictive reliability.

Delivers energy management, industrial automation, and smart factory solutions through its EcoStruxure architecture. Schneider integrates AI, IoT, and cloud analytics to enhance efficiency and sustainability.

Through GE Vernova and legacy industrial portfolios, GE provides grid automation, industrial IoT, and high-performance control systems. Its digital platforms support predictive analytics and large-scale operational optimization.

A leader in process automation, sensor technology, and industrial control systems used in pharmaceuticals, chemicals, and energy. Its AI-based analytics improve yield, safety, and continuous manufacturing.

Offers factory automation systems, robotics, and high-speed motion control solutions. Mitsubishis intelligent controllers and AI-enabled tools support precision production environments.

One of the worlds largest providers of industrial robots and CNC automation systems. FANUC integrates AI for predictive maintenance, robotic path optimization, and smart factory connectivity.

Provides automation systems, machine vision, and robotics for manufacturing and life sciences applications. Omron focuses on AI-enabled sensing and adaptive control technologies.

Recent Developments

- In September 2025, Merck and Siemens renewed a Memorandum of Understanding to develop AI and data-based drug discovery and development. The alliance aims to merge software, systems, consumables, and automotive tools to coordinate the processes of discovery, development, and manufacturing smoothly.(Source: https://www.ddw-online.com)

- In May 2025, GE Healthcare was also approved to produce its new MRI system powered by industrial automation technologies. The systems faster imaging and increased patient comfort represent a significant breakthrough in diagnostic imaging.(Source:https://www.massdevice.com)

- In October 2024, Siemens Healthineers released Atellica Integrated Automation for the Atellica CI Analyst, integrating 25 manual tasks and reducing manual workflow actions by 75 percent. The system improves operational efficiency by automating routine sample handling and reducing turnaround times, enabling the lab to overcome staffing shortages in the global market.(Source: https://respiratory-therapy.com)

Life Science Automation and Robotics MarketSegments Covered in the Report

By Technology Type

- Laboratory Robotics

- Process/Manufacturing Robotics

- AI-Driven Autonomous Systems

- Modular & Collaborative Robots (Cobots)

- Automated Liquid Handling Systems

- Vision-Guided Robotics

- Automated Storage & Retrieval Systems (ASRS)

By Workflow/Application

- Drug Discovery & High-Throughput Screening (HTS)

- Genomics, Proteomics & Cell Biology Automation

- Clinical Diagnostics Automation

- Bioprocessing & Biomanufacturing (Upstream & Downstream)

- Fill-Finish & Packaging Automation

- Quality Control & Inspection Automation

- Sample Preparation & Handling

By Component

- Robotic Systems

- Automated Instruments

- Software & Digital Control Platforms

- Consumables & Accessories

- Integration & Custom Automation Services

By End-User

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Research Organizations (CROs)

- Contract Development & Manufacturing Organizations (CDMOs/CMOs)

- Clinical & Diagnostic Laboratories

- Academic & Research Institutes

- Medical Device Manufacturers

By Process Area

- R&D Laboratories

- Clinical & Diagnostic Labs

- Manufacturing & Packaging

- Quality Control & Regulatory Testing

- Supply Chain & Warehouse Automation

By Distribution Channel

- Direct OEM Sales

- Automation Integrators

- Value-Added Resellers

- Online Industrial Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting