What is the Digital Transformation in Life Sciences Market Size?

The global digital transformation in life sciences market empowers pharma and biotech with next-gen digital solutions for faster, smarter decisions.This market is growing due to the rising need for data-driven workflows that accelerate drug discovery, enhance clinical trial efficiency, and improve regulatory compliance through advanced digital technologies

Market Highlights

- By region, North America dominated, holding the largest market share in 2024.

- By region, Asia Pacific is expected to expand at the fastest CAGR in the digital transformation in life sciences market between 2025 and 2034.

- By technology, the cloud computing segment held the largest market share in 2024.

- By technology, the artificial intelligence & machine learning segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By application, the clinical trials & eclinical solution segment held the largest share in the digital transformation in the life sciences market during 2024.

- By application, the drug discovery (AI/ML-driven) segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By solution type, the software platforms segment held the largest share in the digital transformation in life sciences market during 2024.

- By solution type, the services are set to grow at a remarkable CAGR between 2025 and 2034.2034.

- By end-user, the pharmaceutical companies segment held the largest market share in 2024.

- By end-user, the biotechnology companies segment is expected to expand at the highest CAGR between 2025 and 2034.

- By process area, the R&D digitization segment held the largest market share in 2024.

- By process area, the patient engagement & digital health segment is set to grow at a significant CAGR between 2025 and 2034.

Market Overview

Digital Shifts Accelerate Life Science Innovation

The digital transformation in life sciences market is accelerating as organisations adopt automation, cloud platforms, and artificial intelligence to streamline research, clinical trials, and regulatory workflows. Companies are digitising laboratory operations, integrating electronic data capture systems, and using advanced analytics to manage the growing volume of genomic, imaging, and patient data. This shift is also reinforced by stricter compliance expectations that require real-time documentation, secure data handling, and end-to-end traceability across research pipelines. Overall, digital transformation is becoming essential for improving accuracy, shortening development timelines, and enabling more innovative and efficient scientific outcomes.

Case Study: Roche Unlocks Faster Drug Development with AI-Driven Digital R&D

In 2025, Roche advanced digital transformation in life sciences by launching its AI-enabled Digital R&D Ecosystem, integrating cloud analytics, machine learning, and digital twin modeling into a single workflow. The platform connected preclinical, clinical, and manufacturing data in real time, helping teams predict molecule performance, optimize trial designs, and automate key decisions. This reduced early development timelines by nearly 30% and improved trial efficiency across major therapeutic areas. The initiative positioned Roche as a leader in digital-first biopharma, accelerating precision medicine and setting a new benchmark for AI-driven drug development.

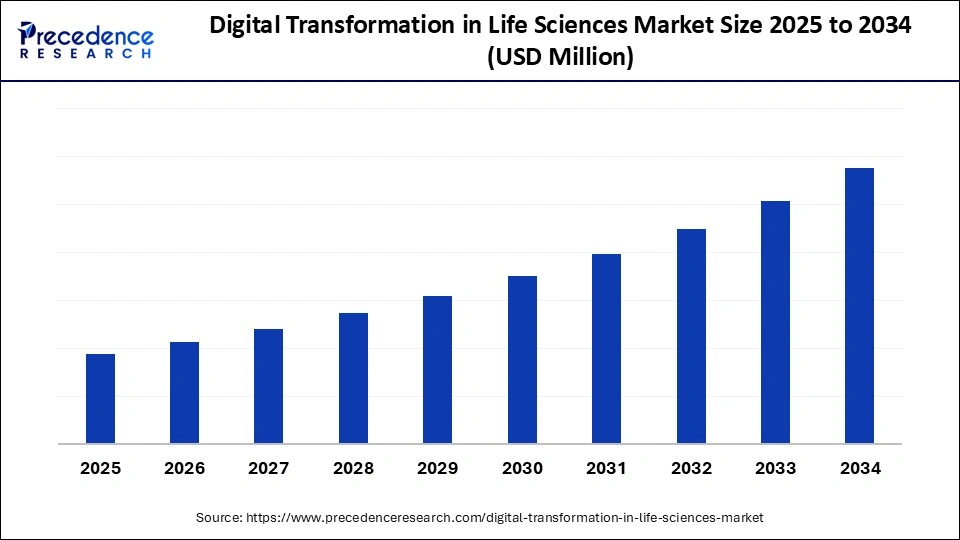

Digital Transformation in Life Sciences Market Outlook

As digital tools simplify R&D clinical trials and manufacturing operations, the life science sector is expanding rapidly. Automation, cloud computing, and artificial intelligence are helping businesses improve accuracy and reduce development time. Workflows are changing, and overall productivity is increasing as a result of the quick adoption of cutting-edge technologies.

Greener digital practices such as paperless labs energy energy-efficient loud systems, and optimized supply chains are being implemented by life science companies. Waste reduction, better resource management, and environmentally conscious operations are all being supported by digital monitoring tools. Digital transformation strategies are increasingly incorporating sustainability as a key component.

Innovations in AI-driven discovery, digital therapeutics lab automation, and health data analytics are creating a thriving startup ecosystem. Due to their ability to address research and patient care bottlenecks, these emerging businesses are attracting significant investor interest. In the life sciences, startups are essential to accelerating the adoption of digital technologies.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Application, Solution Type, End User, Process Area, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Emerging Opportunities in Digital Transformation in Life Sciences Market

| Opportunity Area | Short Informative Insights |

| AI-Driven Drug Discovery | AI accelerates molecule screening, predicts toxicity early, and reduces R&D costs by cutting down lab experiments and trial failures. |

| Decentralized Digital Clinical Trials | Remote monitoring, e-consent, and wearables expand patient reach, lower logistics costs, and deliver real-time trial data. |

| Cloud-Based Unified Research Platforms | Cloud ecosystems break down data silos, improve global collaboration, and simplify regulatory processes by enabling centralized, secure data access. |

| Smart Lab Automation & Robotics | Automated instruments and robotics reduce manual errors, speed up repetitive tasks, and enable near 24/7 laboratory operations. |

| Real-World Evidence (RWE) Analytics | Insights from EHRs and patient data improve treatment outcomes, support regulatory submissions, and strengthen post-market monitoring. |

| Digital Supply Chain Intelligence | IoT tracking and predictive analytics prevent stockouts, reduce cold-chain failures, and boost overall supply reliability. |

Digital Transformation in Life Sciences Market Segmental Insights

Technology Insights

Cloud computing dominates the digital transformation in life sciences market because it enables extensive data integration across R&D, clinical trials, manufacturing, and business operations. It is the go-to foundation for bringing together international teams and enabling the rapid deployment of digital platforms, thanks to its scalability, security frameworks, and compliance-ready infrastructure.

Artificial intelligence & machine learning are the fastest-growing areas of the digital transformation in life sciences market, as companies in the sector increasingly rely on predictive analytics, intelligent automation, and algorithm-driven insights to improve manufacturing outcomes, increase trial efficiency, and accelerate drug discovery. As businesses move toward data-driven and automation-first operating models, its use is growing.

Digital twin technology is becoming increasingly notable because it can create virtual replicas of laboratory equipment and full manufacturing lines, allowing teams to simulate processes before they occur on the production floor. By testing variables in a virtual environment, companies can identify risks early, reduce batch failures, and optimise equipment performance without interrupting operations. Digital twins also support predictive quality by analysing real-time data and signalling when machinery or processes are likely to deviate from required standards. As a result, life sciences companies significantly improve operational reliability, lower maintenance costs, and achieve greater consistency across both research and manufacturing activities.

Application Insights

Clinical trials and eClinical solutions dominate the digital transformation in life sciences market because effective management of international trials now depends on digital tools such as decentralized trial platforms, remote patient monitoring systems, and digital eConsent workflows. These technologies help sponsors manage large, geographically dispersed patient populations while ensuring secure data capture and protocol adherence. They also support higher patient recruitment rates by reducing travel requirements and improving accessibility for diverse participants. As regulatory agencies tighten expectations for data integrity and audit readiness, eClinical platforms play a central role in improving data accuracy, strengthening documentation, and ensuring consistent compliance across global trial sites.

Drug discovery is the fastest-growing segment as organisations increasingly adopt virtual screening, algorithmic target identification, and advanced computational modelling to accelerate early-stage research. These tools allow researchers to test thousands of compounds in silico before entering laboratory validation, thereby reducing experimental time and improving the efficiency of hit-to-lead processes. By prioritising the most promising drug candidates through data-driven insights, companies reduce laboratory costs and achieve faster development timelines. This technology-driven approach also improves prediction accuracy for binding affinity, toxicity, and biological response, supporting more informed scientific decisions.

Real-world evidence is gaining prominence because regulators, payers, and health systems increasingly require real-world data to support value-based approvals and reimbursement decisions. These platforms integrate electronic health records, insurance claims, and patient-generated data to build a comprehensive view of treatment outcomes across diverse populations. They also strengthen long-term post-marketing surveillance by enabling continuous safety monitoring and comparative effectiveness analysis. In addition, real-world evidence systems support genomics and personalised medicine by linking clinical and molecular data, enabling stakeholders to evaluate real-world treatment performance in routine care settings.

Solution Type Insights

The software platform dominates the market for digital transformation in life sciences, enabling unified management of commercial, manufacturing, clinical, and regulatory workflows. They are at the center of digital transformation projects because of their ability to automate processes, integrate data, and ensure compliance throughout the product lifecycle.

Services, including consulting, integration validation, and managed services, are growing fastest segment because implementing AI/ML systems in cloud environments and maintaining GxP-compliant digital ecosystems require expert assistance for life sciences companies. Increased reliance on specialized service providers is being caused by the complex transformation.

Hardware is becoming increasingly prominent as the adoption of IoT-enabled sensors links equipment, processes, and data flows across research and manufacturing environments. Smart laboratory instruments, connected bioprocessing units, and automated handling systems now support digital lab operations by sending continuous performance data to central platforms. These devices enable real-time monitoring of temperature, pressure, contamination risks, and equipment health, which helps teams detect deviations early and maintain consistent product quality. As organisations shift toward fully connected, automated facilities, IoT hardware provides the physical foundation for modern life science operations, enabling every instrument and process to be tracked, measured, and optimised.

End User Insights

Pharmaceutical companies lead digital transformation adoption because they operate large global R&D pipelines, extensive manufacturing networks, and highly regulated clinical and safety workflows that depend on accurate, traceable data. Their investment capacity allows them to deploy advanced digital systems such as enterprise research platforms, global quality management tools, and digital validation frameworks across multiple sites. Pharmaceutical firms also exhibit greater digital maturity because they have long adopted electronic data capture, regulatory information systems, and structured data governance to comply with stringent regional and international regulations. This combination of spending power, complex operational needs, and long-standing digital infrastructure places them at the forefront of the market.

Biotechnology companies are the fastest-growing adopters as emerging biopharma, cell therapy, and gene therapy developers increasingly rely on cloud-native platforms and digitally integrated labs to support rapid experimentation. These organisations are adopting automation tools, connected assays, and AI-driven modelling to accelerate discovery and scale new modalities without building large physical footprints. Their research pipelines often require continuous iteration, which pushes them toward flexible digital systems that support quick configuration, real-time data sharing and collaborative scientific work. As a result, biotechnology companies are driving some of the most rapid shifts toward fully digital, AI-first R&D environments.

Contract research organisations (CROs) are becoming notable digital adopters as sponsors demand faster, more transparent, and audit-ready clinical research services. CROs are investing heavily in decentralized trial tools, digital eSource systems and advanced analytics to streamline patient enrolment, data capture and site management across multiple geographies. These investments allow CROs to deliver higher operational efficiency, reduce cycle times and provide sponsors with real-time oversight. As expectations for digital maturity rise, CROs are evolving into fully enabled clinical execution hubs with integrated technology stacks that support continuous monitoring, automated reporting and regulatory-ready documentation.

Process Area Insights

R&D digitization is driving the adoption of ELNs, LIMS, automation systems and AI-driven tools that streamline experiment workflows and reduce research cycle times. These platforms consolidate experimental data, instrument outputs and analytical results into unified digital records that improve reproducibility and scientific accuracy. Integrated data environments allow researchers to compare historical findings, generate predictive insights and automate routine laboratory tasks, which increases productivity across discovery teams. As competition in early-stage research intensifies, organisations are investing heavily in fully digital discovery ecosystems that support continuous experimentation, real-time collaboration and structured data governance.

Patient engagement and digital health are growing at the fastest rate due to rising use of wearables, mobile health applications, telemedicine platforms and remote monitoring devices. These tools enable decentralised clinical trials by capturing real-time patient data outside traditional trial sites and reducing patient burden. They also support chronic disease management by tracking symptoms, medication adherence and behavioural health patterns. Regulators in major markets are increasingly recognising the reliability of patient-generated data and issuing guidance that encourages their use in clinical evaluations, safety reviews, and evidence submissions.

Manufacturing and supply chain digitization is becoming notable as organisations adopt serialization tools, electronic batch records, IoT-enabled equipment and modern manufacturing execution systems. These technologies help maintain product integrity, reduce human error and strengthen end-to-end traceability from raw materials to finished products. Digital systems also support predictive maintenance and real-time deviation monitoring, which increases manufacturing resilience during periods of supply chain disruption. As global regulatory scrutiny intensifies, biopharmaceutical and life science manufacturers are accelerating modernization to meet documentation, quality and traceability requirements in a consistent and efficient manner.

Digital Transformation in Life Sciences Market Regional Insights

North America leads the digital transformation in life sciences market due to its robust biotechnology ecosystem, advanced cloud adoption, and an established regulatory framework for AI-driven R&D and digital trials. It takes the lead with significant investments in enterprise cloud platforms, decentralized trials, and digital manufacturing. Growing investments in AI-enabled drug discovery and genomic data platforms continue to bolster regional leadership.

The U.S. leads digital transformation in life sciences with strong AI adoption, cloud maturity, and advanced digital clinical trials ecosystems. The fastest modernization in R&D and manufacturing is driven by its biotech hubs and digital hubs, and digital health innovators. Decentralized trials and significant investments in AI-driven drug discovery keep the U.S. ahead globally.

Asia Pacific is the fastest-growing region because biopharma and healthcare ecosystems are rapidly adopting cloud-first clinical platforms, smart manufacturing technologies and fully digital laboratory environments. Countries across the region are investing in modern clinical trial infrastructure, electronic data capture systems and connected quality platforms that support large-scale research programs. Growth is also supported by strong digital health penetration, widespread use of mobile health tools and government incentives that encourage digital adoption in life sciences. Many regional markets benefit from cost-effective R&D structures that enable organisations to build digital discovery centres and high-throughput research facilities at competitive operating costs. As investment in digital labs and computational research accelerates, the Asia Pacific continues to strengthen its position as a major innovation hub for next-generation life science technologies.

India Digital Transformation in Life Sciences Market Trends

India is one of the fastest-growing markets because CDMOs, CROs and pharmaceutical companies are rapidly adopting cloud computing, lab automation and eClinical technologies to modernize research and development. The countrys strong biotech pipeline, combined with expanding incubators and academic–industry collaborations, is accelerating demand for digital platforms that support faster experimentation and secure data exchange. Government programs promoting digital health, electronic records and national data infrastructure are also pushing organisations toward contemporary digital ecosystems.

Adoption of AI for analytics, digital quality assurance and quality control, and smart manufacturing systems is strengthening operational reliability across production and clinical workflows. As more companies invest in connected labs, electronic batch systems and real-time manufacturing intelligence, India is becoming a key contributor to digital transformation in global life sciences.

As governments modernize healthcare and pharmaceutical systems, the Middle East is steadily expanding its digital capabilities across the life sciences sector. Countries in the region are investing in national digital health programs, cloud-based medical record platforms, and unified data networks that strengthen clinical decision-making and population health management. Adoption of AI is rising across hospitals, labs, and research centers, where it supports automated diagnostics, digital pathology, workflow optimization, and predictive patient care. The region is also building advanced laboratory infrastructure, including automated sample processing systems and connected quality platforms, which improve accuracy and operational efficiency. As these initiatives progress, the Middle East is emerging as a growing hub for digitally enabled healthcare and life science innovation.

UAE Digital Transformation in Life Sciences Market

The UAE is rapidly advancing digital transformation in life sciences, supported by large-scale investments in digital pharmaceutical operations, smart hospital infrastructure and AI-led healthcare programs. National strategies encourage the adoption of cloud-based automation, integrated data platforms, and advanced analytics across clinical, research, and manufacturing environments. Hospitals and research centers are deploying AI for diagnostics, patient monitoring, and operational planning, which strengthens healthcare efficiency and treatment accuracy. The country is also promoting partnerships with global biotech firms and expanding its regulatory frameworks to support digital health trials and innovative therapies. Through these coordinated initiatives, the UAE is positioning itself as a leading regional hub for biotechnology, digital health innovation, and next-generation life science capabilities.

Digital Transformation in Life Sciences Market Companies

Actively integrates AI, machine learning, and cloud infrastructure across drug discovery, clinical development, and precision medicine workflows. The company collaborates with major tech firms to accelerate target identification, molecule design, and real-world evidence analytics.

Invests heavily in AI and data science across both pharmaceuticals and crop science, including AI radiology platforms and predictive agricultural modeling. Bayer cloud-enabled R&D ecosystem supports advanced clinical analytics and discovery workflows.

Known for enterprise-scale AI adoption in molecular design, translational research, and clinical trial optimization. BMS leverages cloud environments to accelerate the development of immunology and oncology programs.

Engaged in high-visibility AI partnerships, including collaborations with OpenAI and other tech leaders, to drive next-generation drug discovery. Lilly integrates cloud-based modeling and multimodal data analytics across its R&D operations.

A fully cloud-native biotechnology company whose digital infrastructure was central to its rapid mRNA vaccine development. Moderna uses large-scale AI and cloud platforms for sequence design, prediction models, and automated manufacturing.

Pursues a large-scale data science transformation, integrating AI labs, cloud-native workflows, and enterprise analytics for R&D and commercial operations. Novartis leverages advanced platforms for image analysis, molecule design, and digital clinical trials.

Uses AI and cloud-enabled systems for vaccine development, clinical modeling, and smart biomanufacturing. Pfizers digital infrastructure also supports predictive analytics, supply chain optimization, and large-scale processing of real-world data.

A leader in AI-powered, data-driven healthcare, integrating insights from its pharmaceutical and diagnostics businesses. Roche uses platforms like NAVIFY and cloud-based imaging analytics to enhance disease detection, precision medicine, and clinical decision support.

Recent Developments

- In October 2025, Eli Lilly announced a partnership with Nvidia to build an AI supercomputer to accelerate drug discovery via its TuneLab platform.(Source: https://www.reuters.com)

- In February 2025, EY Parthenon & Microsoft released a life sciences report at BioAsia 2025 that outlines a five-pillar AI adoption framework for pharma companies.(Source: https://www.ey.com)

Digital Transformation in Life Sciences MarketSegments Covered in the Report

By Technology

- Artificial Intelligence & Machine Learning

- Cloud Computing

- Big Data & Advanced Analytics

- Internet of Things (IoT) & Connected Devices

- Digital Twin Technology

- Robotic Process Automation (RPA)

- Blockchain & Traceability System

By Application

- Drug Discovery & Preclinical Research

- Clinical Trials & eClinical Solutions

- Manufacturing & Automation (MES, Robotics)

- Quality Management & Compliance

- Sales, Marketing & Omnichannel Engagement

- Real-World Evidence (RWE) & Data Platforms

- Supply Chain Digitization & Serialization

By Solution Type

- Software Platforms

- Services (Consulting, Integration, Managed Services)

- Hardware (Sensors, IoT Devices, Automation Equipment)

By End-User

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Research Organizations (CROs)

- Contract Development & Manufacturing Organizations (CDMOs/CMOs)

- Medical Device Manufacturers

- Research Institutes & Laboratories

By Process Area

- R&D Digitization

- Clinical Development

- Manufacturing & Supply Chain

- Commercial & Marketing

- Quality & Regulatory

- Patient Engagement & Digital Health

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting