What is the Lithium-ion Battery Recycling Market Size?

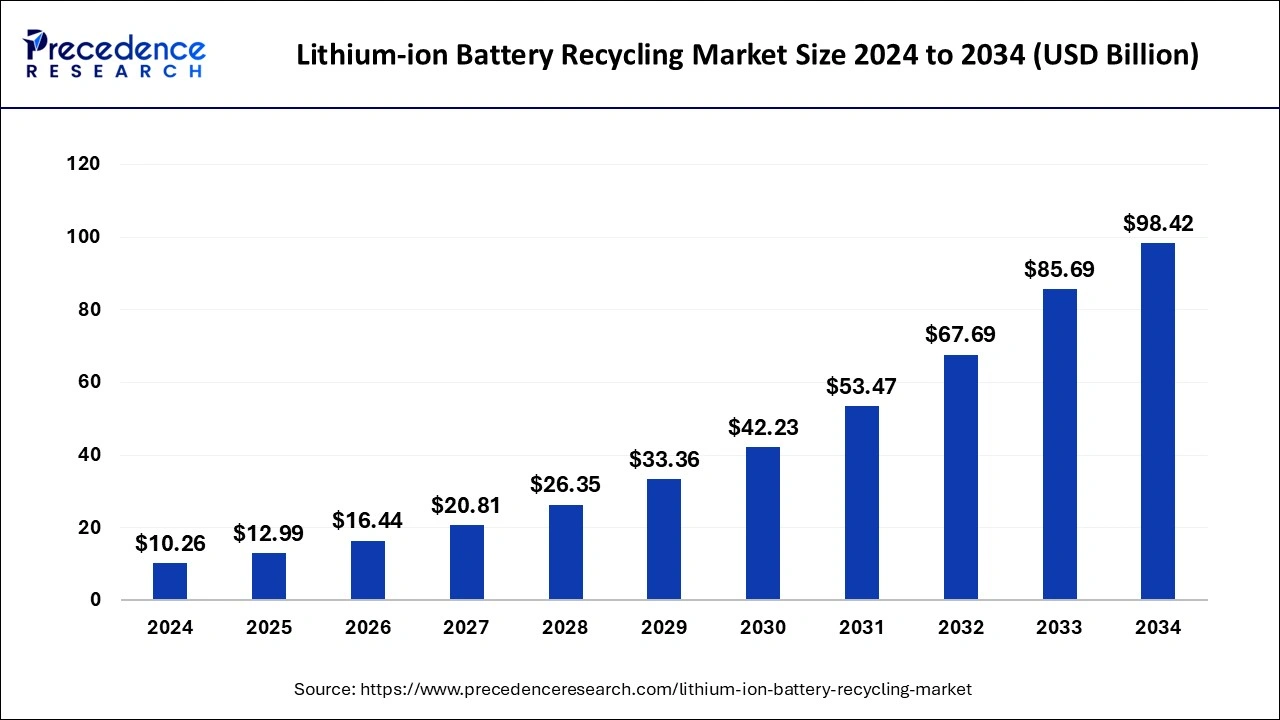

The global lithium-ion battery recycling market size is calculated at USD 12.99 billion in 2025 and is predicted to increase from USD 16.44 billion in 2026 to approximately USD 114.66 billion by 2035, expanding at a CAGR of 24.33% from 2026 to 2035. The lithium-ion battery recycling market is driven by growing demand forelectric vehicles.

Market Highlights

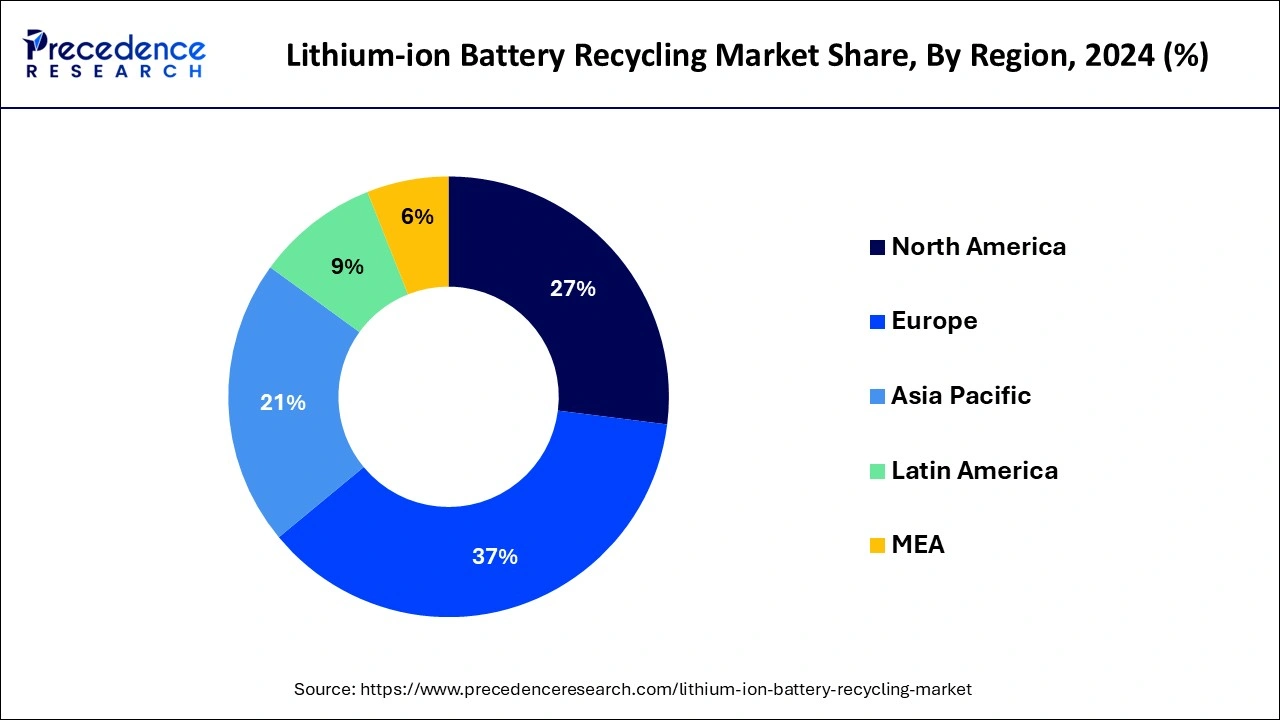

- In 2025, Europe dominated the market with 37% of revenue share in 2025.

- Asia-Pacific region is registering growth at a CAGR of 41% during the forecast period.

- By end user, the non-automotive segment accounted largest revenue share 63% in 2025 and is projected to grow at a CAGR of 39.5%.

- In 2025, the electronics segment generated a revenue share of about 68%.

- The hydrometallurgical process segment has garnered a market share of 65% in 2025.

- The electric vehicle segment is growing at a registered CAGR of 45% over the forecast period.

Global Dynamics and Challenges in Lithium-ion Battery Regeneration Market

Lithium-ion battery regeneration refers to the gathering of lithium-ion batteries from a variety of sources, such as automobiles, consumer goods, industrial equipment, and electronic devices, as well as the extraction of metal using recycling procedures. The world market estimate includes income from sales of such reclaimed elements or components, regardless of whether they are used in additional battery recovery and other uses that necessitate a secondary use. It is said that the majority of elements retrieved are simply used to make batteries.

The worldwide lithium-ion recycling market is anticipated to expand as a result of variables including governmental laws, environmental protection, and increasing understanding. Furthermore, inappropriate lithium-ion battery recycling global growth is anticipated to be hampered during the forecast timeframe by incorrect separating of hazardous lithium batteries, incorrect disassembly, and inappropriate shredding. The availability of coating materials to decrease the likelihood of flame as well as the beautiful appearance of cells are predicted to open up new development potential in the global marketplace.

Integration of AI in the lithium-ion battery recycling industry

Artificial Intelligenceis revolutionizing the game in various industries, including lithium-ion battery recycling. Itsrobotic systems can detect and sort different types of batteries with high clarity.

Its models determine chemical compositions and optimize recovery methods to maximize the extraction of valuable metals such as cobalt, nickel, and lithium. This ensures that it gets the highest possible output from each recycled battery. By enhancing recycling efficiency, AI helps reduce the environmental footprint of battery disposal, contributing to a greener planet.

Market Outlook

- Industry Growth Overview: The lithium-ion battery recycling market is poised for rapid growth from 2026 to 2035, driven by drivers surging as demand for Electric Vehicles (EVs), renewable‑energy storage, and portable electronics drives a growing volume of spent batteries, creating a strong need for recycling and recovery of valuable metals. Strengthening EPR schemes, collection mandates, and recycling targets compel OEMs and importers to finance end-of-life services, catalyzing infrastructure investment and formalizing collection networks, turning recycling from an optional service into a legal and commercial necessity.

- Major Investment: Industrial Recycling Partners provides growth capital to develop giga-scale hydrometallurgical plants and logistics networks, supporting regional feedstock collection and high-yield recovery. Automotive OEM consortium invests jointly in localized recycling facilities and direct-recycling pilots to secure battery-grade materials and decrease supply-chain risks for future cell manufacturing.

- Sustainability Trend: The sustainability trend is driving greater demand for lithium‑ion battery recycling by emphasizing the recovery of critical metals like lithium, cobalt, and nickel, reducing reliance on environmentally damaging mining. At the same time, manufacturers and governments are promoting circular‑economy initiatives, making recycled materials a key part of supply chains and boosting investment in advanced, eco‑friendly recycling technologies.

- Global Expansion: Global expansion of the market is fueled by rising EV production, growing electronic device usage, supportive government policies, and increased investments in recycling infrastructure and advanced recovery technologies across North America, Europe, and the Asia-Pacific regions.

- Startup ecosystem: The startup ecosystem in the lithium-ion battery recycling market is growing as new companies focus on innovative recovery technologies, second-life battery applications, and sustainable material solutions, attracting investments and partnerships to address environmental challenges and support circular economy initiatives.

Key Trends of the Lithium-ion Battery Recycling Market

- The increasing number of closed-loop recycling systems is encouraging market participants to use these models to collect waste batteries and manufacture them into new batteries instead of importing materials from other regions, which reduces dependency on importing materials and increases sustainability.

- The increasing use of AI and blockchain to record and track material in recycling operations to improve material tracking, compliance, and the efficiency of the logistics process within the global supply chain and throughout different geographies.

- The commercialization and trading of "black mass," which is the concentrated form of all the key metals extracted from shredded batteries, has become an acceptable intermediate product for small recycling companies and large recyclers and refineries in Asia & Europe.

- Recycling companies are not only recycling used batteries but are finding other uses for them as energy storage for the grid, where the remaining batteries can still generate power at 50% to 80% of their original capacity.

- The development of EPR regulations requires battery producers to provide a mechanism for the recycling of used batteries and requires the use of a certain percentage of recycled materials in new products.

Lithium-ion Battery Recycling Market Trade Analysis

Black mass and intermediate battery materials are traded around the world by smaller recycling centers to large hydrometallurgical processing plants in South Korea, Belgium, and Germany. These battery intermediates being traded allow countries without significant ore reserves to obtain recycled lithium, cobalt, and nickel to reduce their reliance on traditional mining and help stabilize supply chains in response to increased demand from the growing electric vehicle and electronics industry.

Lithium-ion Battery Recycling Market Growth Factors

- There is a huge requirement for electric automobiles all over the world, together with subsidies offered by governments of different nations for rechargeable batteries. Due to worries about the ecological damage caused by automobiles running on traditional energy sources like gasoline and diesel, there has been a considerable increase in electric vehicle demand.

- Declining price of batteries used in electric vehicles. The resource recovery business is predicted to increase quickly due to the transport industry. Because of its highly efficient, extended lifespan, and low care requirements, lithium-ion batteries are becoming increasingly popular in portable electronics and electric cars, which is projected to benefit the sustainable packaging market.

- New techniques are also created to cut expenses and stop environmental contamination. ECOBAT has developed a mechanism for collecting used batteries. New techniques are also being explored to reduce costs and prevent environmental contamination.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.99 Billion |

| Market Size in 2026 | USD 16.44 billion |

| Market Size by 2035 | USD 114.66 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 24.33% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | End User, Battery Components, Battery Chemistry, Recycling Process, Source and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Interest in Electric Vehicles

The usage of renewable biofuels is becoming more prevalent in the automotive sector. The transport network is heavily dependent on oil as a resource, which is raising worries among economics and the environment alike. The use of electric cars is growing along with ecological sustainability. EDVs are being used more frequently, which is causing an increase in the demand for fuel cells, that are necessary for a constant energy supply. The industry for EVs is anticipated to expand as a result of variables like fuel efficiency, reduced emissions, and customer choice. Due to better battery tech as well as the minimal downtime needs of these fuel cells, the electric vehicle market is rising.

New techniques are being created to cut expenses and stop environmental pollution

By constructing new recycling facilities and collecting sites, businesses are trying to boost their level of competition. New techniques are being forced to cut expenses and stop environmental pollution. To collect the purpose of collecting used batteries, ECOBAT has created its collection mechanism. New techniques are also being explored to cut expenses and stop environmental contamination.

The escalating trend for personal electronics and lithium-ion batteries

The recycling business is predicted to increase quickly thanks to the transportation sector. Because of their highly efficient, extended lifespan, and low care requirements, fuel cells are becoming increasingly popular in portable electronics and electric cars, which is anticipated to have a beneficial effect on the market for goods produced.

Challenges

- Safety concerns about the shipment and storage of the used battery: Dangerous compounds found in used cells include chemicals & toxic substances like lead and zinc. Used cells retain some of their energy, thus increasing the risk of an unintentional release that could harm or harm both individuals and property. Larger lithium-based cells, like those employed in vehicle industries, may be mislabelled as storage batteries by regional battery producers. Due to such problems, state or federal authorities restrict the shipment and storage of expended cells.

- Due to the high expense of lithium recovery out of used lithium-ion batteries, recycle: The Institute for economics And finance (CEE) estimates that just 1-3 percent of lithium gets recovered worldwide from all usage. Furthermore, businesses like Umicore (Belgium), and Toxco (US) among others, are developing technology for the recovery of lithium using lithium-based cells. Furthermore, among the problems identified as industry obstacles include the massive price of recycling, the lack of suitable storage solutions for the collecting of used batteries, and the scarcity of recyclable materials.

Opportunities

Rising acceptance in novel applications, a drop in lithium-ion battery pricing, and recycling at the final moment are all anticipated outcomes of increased production

Modern lithium-ion batteries are made up of several parts that are offered at discounted prices. The costs of these cells are anticipated to significantly fall, according to recent advances and statements made by automakers and manufacturers of lithium-ion batteries. Costs are dropping as a result of innovations including mass production, decreasing unit cost, and the use of technologies to increase storage capacity. The industry for storage of renewable energies is predicted to expand as a result of falling lithium battery prices, and this industry is predicted to favor battery cells above all other rechargeables. The need for recovering used lithium-based batteries is then anticipated to rise as a result.

An increasing number of government recycling programs and R&D projects

There are many uses for lithium-ion batteries, and as additional development and research is done, more advanced qualities are now being created. To meet the increasing need for lithium-ion batteries used in electric mobility, healthcare gadgets, and communication system, businesses are new product manufacturing plants. New opportunities for the growth of the worldwide lithium-ion battery industry are being created by newly constructed factories and expanding research and development activities.

Segment Insights

End Use Insights

The market for recovering lithium-ion batteries is expected to be dominated by the automotive industry. Due to significant advancements in the automotive industry that are directly related to lithium-ion batteries, such as a decrease in the cost of lithium-ion batteries and an increase in the efficiency of electric vehicles, the automotive industry now accounts for the largest segment of the global lithium-ion battery recycling market. These factors increased the demand for battery-powered cars, which boosted the lithium-ion battery recycling business.

Also, regulations and subsidies related to battery recycling by countries such as China and Germany have fuelled the market growth for lithium-ion battery recycling. This stays accredited to the rise in demand for second-life applications of lithium-ion batteries in consumer electronics devices such as laptops, digital cameras, smartphones, and others that do not require longer battery life as compared to electric vehicles and industrial applications.

Battery chemistry Insights

The lithium nickel manganese cobalt oxide (NMC) segment held the largest share of 41.20% in the 2025 global lithium-ion battery recycling market. The NMC oxide is a major cathode material in lithium-ion batteries, which needs expert recycling because of its transitional metals. The development targets on enhancing pyrometallurgical and hydrometallurgical processes for metal purity recovery. Alongside, it is discovering more hybrid methods, direct recycling, and a greener approach.

The lithium iron phosphate (LFP) segment is expected to grow at a CAGR of 9.80% during the forecast period. The LFP batteries are prominent for recycling initiatives due to the rising demand and use of energy storage and EV systems. This further fuels demand for effective and efficient recycling methods that conventionally extract precious metals such as iron and lithium.

Recycling process/technology Insights

The hydrometallurgical process (leaching) segment held the largest share of 38.60% in the 2025 global lithium-ion battery recycling market. The segment, especially the chemical leaching, is crucial in LIB recycling. The chemically based extraction of the cathode metals like Mn, Co, Li, and Ni from mechanically engineered processes' black mass, converting it into a soluble solution, requires development that improves leaching sustainability and efficiency.

The direct recycling/cathode-to-cathode segment is expected to grow at a CAGR of 11.50% during the forecast period. The segment's characterized role is to intervene in hydrometallurgical and energy-intensive pyrometallurgical processes. Further restoring the utilized cathode materials by different non-disruptive methods and via relithiation for reuse purposes. The development thus aims at relithiation techniques and improvement in impurity removal that will boost the segment.

Battery source/application Insights

The automotive batteries segment held the largest share of 61.70% in the 2025 global lithium-ion battery recycling market. The automotive batteries are essential in hybrid, electric, and plug-in electric vehicles (EVs). The rising demand and growth in the EV market have indirectly accelerated growth in this segment, clearly benefiting lithium-ion battery recycling. Following the approach for going greener and cleaner energy sources, the sustainable reach of the EVs has excellently elevated the segment's development and potential.

The energy storage systems (ESS) segment is expected to grow at a CAGR of 10.70% during the forecast period. The ESS is a fundamental source of end-of-life LIBs and their recycling pattern and techniques. At every stage of commercial, residential, and grid scale, the ESS has proven potential. The recycling of ESS controls mining dependency and pollution. Technological advancement and partnership interaction are paving the way for effective development and growth.

End-use/industry Insights

The automotive segment held the largest share of 57.40% in the 2025 global lithium-ion battery recycling market. The automotive industry's growth equals the use of automotive batteries. The segment is leading with its increasing sales of electric vehicles in the global EV market. Most of the key EV companies have integrated the battery recycling option or held it as an approach to promote sustainability worldwide. This strengthens the potential of lithium-ion battery recycling.

The energy and utilities segment is expected to grow at a CAGR of 10.20% during the forecast period. The energy and utilities are playing a pivotal role in investing best in recycling to protect domestic supply chains and reduce material cost and reliance on imports. The government policies and partnerships are forcing development in this segment, focusing on the extension of the LIB recycling potential globally.

Recycling type Insights

The post-consumer (end-of-life batteries) segment held the largest share of 68.90% in the 2025 global lithium-ion battery recycling market. The segment offers a reliable and popular source of essential materials such as cobalt, lithium, and nickel for helping to control environmental impact and accelerate the circular economy. With the expansion, the challenges have a developmental backup and a strong policy support to improve collection rates and explore green chemistry.

The pre-consumer (manufacturing scrap) segment is expected to grow at a CAGR of 9.60% during the forecast period. The segment provides a straight and quality source of crucial materials such as lithium, cobalt, and nickel that reduce carbon presence and dependency on mining. The scrap development is strengthened by excessive battery production, which leads to increased scrap and economically benefits massively, and promotes the direct recycling option.

Material recovered Insights

The cobalt segment held the largest share of 33.80% in the 2025 global lithium-ion battery recycling market. Cobalt is like the first choice in demand material. Though it is expensive, its recovery is crucial for alleviating supply risk. The recycling needs to have double the potential to settle for cobalt's future rising demands. The leveraging of collection rates and speedy technological advancement will fuel improvement, stability, and quality in the cobalt material.

The lithium segment is expected to grow at a CAGR of 11.10% during the forecast period. The lithium plays a crucial role in recycling by standing as a major recoverable element from the invested lithium-ion batteries (LIBs) that elevate growth in the market worldwide for recycling technologies such as hydrometallurgy. The development is driven by the heightening LIB demand from the electronics and electric vehicles market, which is immensely gaining traction in the segment and in LIB recycling.

Regional Insights

Europe Lithium-ion Battery Recycling Market Size and Growth 2026 to 2035

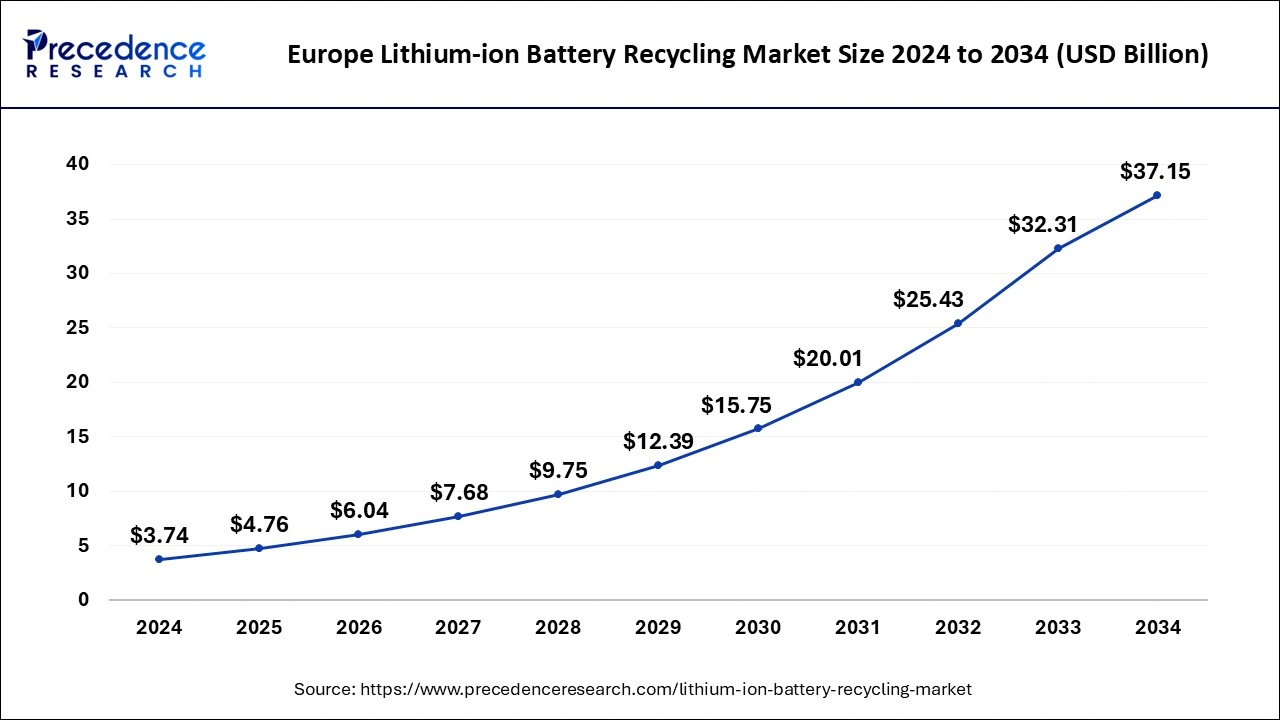

The Europe lithium-ion battery recycling market size is estimated at USD 4.76 billion in 2025 and is predicted to be worth around USD 43.35 billion by 2035, at a CAGR of 24.72% from 2026 to 2035.

What Made Europe the Dominant Region in the Market?

Europe registered dominance in the lithium ion battery recycling market by capturing the largest share in 2025. The region's dominance is attributed to a combination of strict sustainability regulations, ambitions for EV adoption, and policies ensuring responsible end-of-life battery management. The region emphasizes high-purity recovery, traceability, and the use of recycled materials in local cell manufacturing to reduce dependence on imports. Significant investments in safe collection networks, standardized disassembly, and scalable hydrometallurgical plants, often supported by public–private partnerships, ensure environmentally compliant and commercially viable recycling operations.

Germany is a major contributor to the market due to a strong regulatory push, booming demand from the electric vehicle (EV) sector, and advanced recycling infrastructure. The country benefits from stringent environmental laws and circular-economy policies that require battery collection and recycling. As EV adoption rises and older batteries reach the end of life, large volumes of spent lithium-ion batteries flow into well-equipped recycling facilities that efficiently recover valuable metals, making recycling both environmentally and economically favorable.

What Makes North America the Fastest-Growing Region in the Market?

North America is the fastest growing in the lithium-ion battery recycling market during the forecast period.

Major key players are formulating significant plans concerning the treatment of battery systems that have been established. Governments of North America offer tax credits, financial incentives, or subsidies to businesses engaged in responsible recycling activities. These incentives encourage compliance with regulations and boost the market's growth by making it economically attractive for companies to invest in recycling infrastructure and technologies.

Factors Fueling the Expansion of the North American Lithium-Ion Battery Recycling Market

The North American market is growing due to the rapid adoption of electric vehicles, the expansion of renewable energy storage, and strict environmental regulations promoting safe disposal. Rising demand for recovered lithium, cobalt, and other valuable metals, combined with advancements in recycling technologies and increasing investments by manufacturers and governments, is driving market growth across the region.

Key Trends Driving the U.S. Lithium-Ion Battery Recycling Market?

The U.S. market is expanding due to the growing electric vehicle fleet, increased use of consumer electronics, and government regulations encouraging sustainable battery disposal. Rising demand for recovered lithium, cobalt, and nickel, coupled with advancements in recycling technologies and investments in domestic recycling facilities, is boosting capacity and efficiency, driving significant growth in the U.S. market.

What Potentiates the Asia Pacific Lithium-ion Battery Recycling Market?

Asia Pacific has the largest installed base of lithium-ion batteries, from consumer electronics to electric vehicles, making the region a key source of feedstock for recycling. Domestic processing capacity is increasing to keep value-added recovery local, while governments and OEMs are increasingly focusing on closed-loop strategies to secure strategic minerals. Moreover, rising raw‑material scarcity (especially lithium, nickel, and cobalt) and high material costs make recycling an economically attractive way to recover critical battery metals, reducing the region's reliance on mining and imports

Market Dynamics and Growth Factors in the Asia-Pacific Lithium-Ion Battery Recycling Market

The Asia-Pacific market is expanding as industrial and commercial sectors seek cost-effective sources of lithium, cobalt, and nickel from spent batteries. Increased battery manufacturing, supportive policies for circular economy practices, and rising partnerships between recycling firms and battery producers are accelerating growth. Additionally, technological innovations in safe disassembly, material recovery, and scalable recycling processes are strengthening the market across China, Japan, South Korea, and emerging economies in the region.

China's large EV fleet and electronics manufacturing base generate consistent volumes of spent batteries, enabling economies of scale for recycling facilities. Strong local policies and industrial coordination promote domestic processing to recover critical metals and reduce import reliance. Advanced recycling technologies, including hydrometallurgical and direct recycling methods, combined with integration into upstream cathode manufacturing, create a compelling closed-loop value chain within the country.

Why China's Lithium-Ion Battery Recycling Market is Expanding?

The China market is increasing due to the country's rapid growth in electric vehicle production and large-scale battery manufacturing. Supportive government policies, stringent environmental regulations, and incentives for circular economy practices are encouraging proper recycling. Additionally, rising demand for recovered lithium, cobalt, and other critical metals, combined with investments in advanced recycling technologies and industrial-scale facilities, is driving market expansion in China.

How is the Opportunistic Rise of the Middle East & Africa in the Market?

The Middle East & Africa (MEA) is experiencing an opportunistic rise in the market. The MEA region is witnessing a surge in battery usage, driven by the growing adoption of electric vehicles, expanding consumer‑electronics demand, and rising deployment of energy storage, which is producing higher volumes of end‑of‑life lithium‑ion batteries and thus expanding feedstock for recycling. Many African countries offer opportunities for collection and informal refurbishment networks. Gulf states are shifting toward circular processing to diversify their economies and ensure a stable supply of battery materials for future energy projects. In many African countries, formalizing collection efforts, enhancing safety standards, and creating incentives for return-to-market schemes are initial priorities.

What Factors Influence the Market in Latin America?

Latin America's growing electrification of transport and expansion of energy storage are generating vast feedstock pools that support regional recycling hubs. The region's mineral resources and refining expertise enable the recovery of valuable materials, potentially reducing raw material exports and supporting future local cell or component manufacturing. Overcoming challenges such as fragmented collection systems, long transport distances, and capital-intensive recovery facilities requires targeted investments in logistics, pilot recycling plants, and public awareness initiatives to build practical circular supply chains.

Growth Drivers of the UK Lithium-Ion Battery Recycling Market

The UK lithium-ion battery recycling market is growing due to increasing adoption of electric vehicles, rising use of consumer electronics, and stringent government regulations on battery disposal. Growing environmental awareness and incentives for sustainable practices are driving proper recycling initiatives. Additionally, advancements in battery recovery technologies and increasing demand for reclaimed lithium and other metals are further boosting the market's expansion in the UK.

Value Chain Analysis

Resource Extraction

- Resource extraction in lithium-ion battery recycling begins with the collection and disassembly of spent batteries.

- Batteries are mechanically separated into a “black mass” rich in valuable metals such as lithium, cobalt, and nickel.

- The black mass undergoes hydrometallurgy (acid leaching) or pyrometallurgy (smelting) to recover and refine individual metals for reuse.

Key Players: Li-Cycle, Umicore, Redwood Materials, American Battery Technology Company (ABTC), TES Group.

Energy Storage Systems

- Energy storage systems (ESS) play a key role in circular lithium-ion battery recycling, using recovered materials to develop new storage solutions like grid stabilization and backup power.

- Viable batteries are repurposed directly, while non-functional ones undergo pyrometallurgical or hydrometallurgical processes to recover valuable metals such as lithium, nickel, and cobalt.

- This approach enhances sustainability and reduces raw material dependency.

Key Players: Tesla, LG Energy Solution, Panasonic, CATL, Fluence Energy.

Grid Maintenance and Monitoring

- Grid maintenance and monitoring at lithium-ion battery recycling facilities focus on managing high energy demands and reducing safety risks from volatile materials.

- Smart grid technologies and advanced monitoring systems are essential for safe, efficient, and reliable operations.

- Effective energy management ensures continuous recycling processes while minimizing hazards and operational downtime.

Key Players: Siemens, Schneider Electric, ABB, General Electric (GE), Eaton.

Top Vendors and their Offerings

- Ecobat: Ecobat specializes in recycling lithium-ion and other batteries, offering collection, safe dismantling, and recovery of valuable metals like lithium, cobalt, and nickel for reuse in new batteries and industrial applications.

- TES: TES provides comprehensive lithium-ion battery recycling services, including collection, disassembly, and advanced hydrometallurgical and pyrometallurgical recovery processes, supplying reclaimed metals for battery manufacturing and sustainable industrial solutions.

- Umicore: Umicore delivers sustainable lithium-ion battery recycling, focusing on safe material recovery and refining processes to reclaim cobalt, nickel, and lithium for use in new batteries and other high-performance applications.

- AkkuSer: AkkuSer offers lithium-ion battery recycling and second-life solutions, including safe disassembly, metal recovery, and repurposing usable batteries for energy storage systems, reducing environmental impact and supporting the circular economy.

- Fortum: Fortum provides advanced lithium-ion battery recycling, emphasizing safe collection, mechanical separation, and chemical recovery of valuable metals like lithium, cobalt, and nickel, supplying materials for new battery production and industrial use.

Lithium-ion Battery Recycling Market Companies

- AkkuSer (Finland): Known for its lithium-ion battery recycling capabilities and processes.

- Accurec-Recycling GmbH (Germany): A specialized battery and accumulator recycling company that focuses on developing and optimizing recycling technologies for various types of batteries, including lithium-ion batteries.

- American Manganese Inc. (AMI) (Canada): Involved in the recycling of lithium-ion batteries and other related materials.

- American Zinc Recycling Corp (AZR) (U.S.): A major recycler of zinc and zinc-bearing materials.

- Batrec Industrie AG (Switzerland): Specializes in the recycling of various battery types, including those containing hazardous materials like mercury.

- Battery Recycling Made Easy (BRME) (US): A participant in the lithium-ion battery recycling market, also listed as a prominent player in the industry.

Other Key Players

- Contemporary Amperex Technology Co. Ltd (CATL) (China),

- DOWA ECO-SYSTEM Co., Ltd. (Japan)

- Duesenfeld GmbH (Germany)

- Envirostream Australia Pty Ltd (Australia)

- Euro Dieuze Industrie (E.D.I.) (France)

- GEM Co., Ltd (China)

- Glencore International AG (Switzerland)

- Lithion Recycling Inc. (Canada)

- Metal Conversion Technologies (MCT) (US)

- Neometals Ltd (Australia)

- OnTo Technology LLC (US)

- Raw Materials Company Inc. (RMC) (Canada)

- Redux GmbH (Germany)

- Redwood Materials, Inc. (US)

- Retriev Technologies Inc. (Canada)

- San Lan Technologies Co., Ltd (China)

- SITRASA (Mexico)

- SMC Recycling (US)

- SNAM (France)

- Sumitomo Metal Mining Co., Ltd. (Japan)

- Tata Chemicals Limited (India)

- uRecycle Group Oy (Finland)

Recent Developments

- In October 2025, Redwood Materials raised $350M led by Eclipse Ventures with Nvidia's NVentures participating. The investment is aimed at scaling material recovery and energy storage operations tied to recycled battery materials amid increased domestic and industrial demand.(Source- https://www.linkedin.com)

- In December 2024,Re-New-Able Technologies and Redivivus partnered to establish the state's first scalable lithium-ion battery recycling facility. This collaboration represents a critical step in addressing the growing challenges of lithium-ion battery waste, especially as electric vehicle adoption and renewable energy storage solutions expand.

- In April 2024, Green Li-ion declared the launch of its first commercial-scale installation to produce sustainable, battery-grade materials, the first of its kind in North America. The plant, located within an existing recycling facility, will make valuable battery-grade cathode and anode materials from concentrated components of spent batteries using Green Li-ion's patented multi-cathode-producing Green-hydro rejuvenation technology.

Segments Covered in the Report

By Battery Chemistry

- Lithium Iron Phosphate (LFP)

- Lithium Cobalt Oxide (LCO)

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- Lithium Manganese Oxide (LMO)

- Others (e.g., lithium-titanate)

By Recycling Process / Technology

- Pyrometallurgical Process (Smelting)

- Hydrometallurgical Process (Leaching)

- Mechanical/Physical Recycling

- Direct Recycling / Cathode-to-Cathode

- Hybrid Recycling Technologies

By Battery Source / Application

- Automotive Batteries

- Electric Vehicles (EVs)

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Consumer Electronics

- Smartphones

- Laptops/Tablets

- Power Tools

- Wearables

- Industrial Batteries

- UPS (Uninterrupted Power Supply)

- Forklifts

- Telecom Towers

- Energy Storage Systems (ESS)

- Grid-scale

- Residential

- Commercial

- Others

By End-Use/Industry

- Automotive

- Consumer Electronics

- Energy & Utilities

- Industrial/Manufacturing

- Telecommunications

- Others (e.g., defense, aerospace)

By Recycling Type

- Pre-consumer (Manufacturing Scrap)

- Post-consumer (End-of-life Batteries)

By Material Recovered

- Lithium

- Cobalt

- Nickel

- Manganese

- Aluminum

- Copper

- Graphite

- Plastics and Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting