What is the Low-Carbon Footprint Coatings Market Size?

The global low-carbon footprint coatings market focuses on eco-friendly coating solutions designed to reduce carbon emissions, support sustainability, and meet rising environmental regulations across industries. The market is poised for robust growth, driven by sustainability mandates, stringent environmental regulations, and rising demand for eco-friendly, high-performance surface solutions across industrial and architectural applications.

Market Highlights

- Asia Pacific dominated the low-carbon footprint coatings market in 2024.

- Europe is expected to grow at the fastest CAGR between 2025 and 2034.

- By type / product / formulation, the waterborne coatings segment held the largest market share in 2024.

- By type / product / formulation, the powder coatings segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By application / end-use industry, the architectural / building & construction segment held the largest share of the market in 2024.

- By application / end-use industry, the industrial coatings segment is growing at a strong CAGR between 2025 and 2034.

- By resin / chemical type, the acrylic resins segment dominated the market with the largest share in 2024.

- By resin / chemical type, the polyurethane / bio-based resins segment is posed to grow at the highest CAGR between 2025 and 2034.

Decarbonizing the Built Environment: Charting the Path to Net Zero

Low-Carbon Footprint Coatings are a class of surface coatings designed to minimize environmental impact by reducing greenhouse gas emissions throughout their lifecycle, manufacturing, application, and end-of-life disposal. They aim to deliver the same or enhanced performance as traditional coatings (protection, durability, aesthetics) but with a significantly lower carbon footprint. The low-carbon footprint coatings market is a segment of the coatings industry focused on developing and commercializing environmentally friendly products with reduced climate impact. Growth in this market is driven by government regulations, rising consumer demand for sustainability, and corporate environmental objectives. These factors are fueling innovation in areas such as waterborne, powder, and bio-based coatings, as well as energy-efficient solutions like reflective and insulating paints.

Technology Shifts Enabling Sustainable Manufacturing

The low-carbon coatings market is undergoing a significant technological shift driven by artificial intelligence. Companies like Arkema, AkzoNobel, and Omya are utilizing AI-driven lab automation to develop decorative paints with up to 50% reduced carbon emissions, meeting consumer demand for eco-friendly products . Additionally, AkzoNobel's collaboration with coatingAI has led to the creation of "Flightpath," an AI-based software that optimizespowder coating application processes, reducing defects, overspray, and energy consumption. These advancements not only lower the environmental impact but also improve cost-effectiveness and performance in the coatings industry.

Five Sustainability Trends Shaping the Low-Carbon Footprint Coatings Market

- Shift Toward Bio-based and Waterborne Formulations: Waterborne coatings use water as their primary solvent instead of organic solvents, significantly reducing VOC emissions. This is crucial for meeting air quality regulations and improving indoor air quality. Strict environmental standards, along with greater awareness of climate change among users and companies, are key factors driving this transition.

- Focus on Energy-Efficient and Multifunctional Coatings: Widespread use of reflective coatings on urban buildings and infrastructure can lower city temperatures. This, in turn, reduces the energy needed for cooling and improves overall environmental quality, supporting decarbonization efforts.

- Use of Sustainable and Recycled Raw Materials: Innovations in sustainable materials have led to coatings that perform as well as or better than their traditional counterparts. For example, bio-based polyurethanes provide superior durability and wear resistance, and highly durable coatings extend the lifespan of objects, reducing the need for new materials and often requiring reapplication.

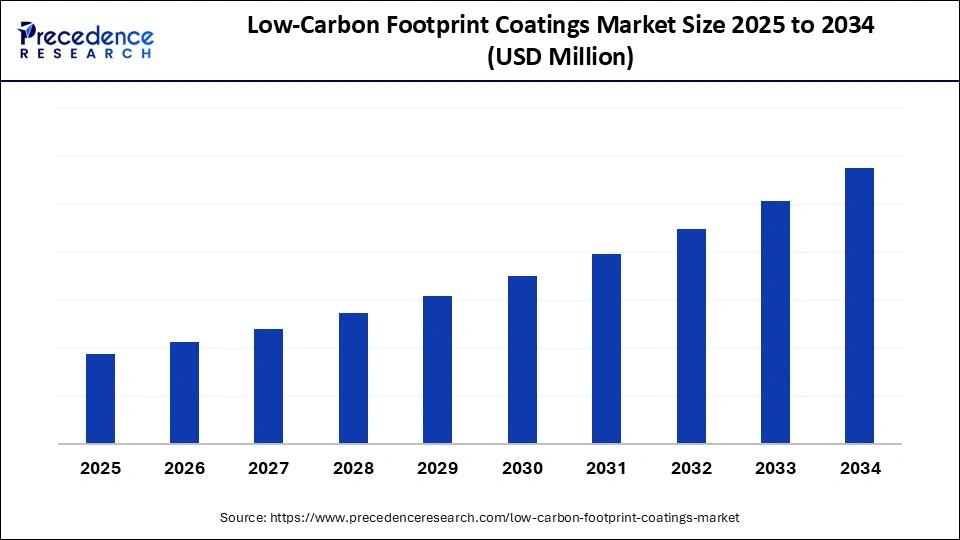

Low-Carbon Footprint Coatings Market Outlook

The low-carbon footprint coatings market is experiencing significant growth, driven by increasing consumer preference for eco-friendly and sustainable products, including low-VOC paints for both residential and industrial applications. Corporations are also actively pursuing sustainability and ESG objectives, which is boosting demand for green coatings across supply chains and end products. Key industries, primarily construction and automotive, are major growth drivers, as both sectors increasingly adopt environmentally friendly coatings to comply with global sustainability standards and enhance market appeal.

The growing sustainability trend drives demand for low-carbon footprint coatings as consumers and industries increasingly prioritize eco-friendly, low-emission products to reduce environmental impact. Additionally, regulatory pressure and corporate ESG goals encourage adoption of green coatings, creating opportunities for innovation and market expansion.

Major investors in the market include leading multinational corporations such as AkzoNobel, PPG Industries, The Sherwin-Williams Company, BASF SE, and Nippon Paint Holdings. These companies are actively supporting the market by investing in research and development to create sustainable, low-emission coating solutions. For instance, AkzoNobel has introduced powder coatings that reduce energy use by 20% and are committed to increasing revenue from sustainable solutions to over 50% by 2030.

Growing demand from eco-conscious consumers and industries is propelling the market growth. Consumers are more aware of the negative impacts of traditional coatings, such as air pollution and health hazards from VOCs, and are actively seeking greener alternatives for both industrial and residential use. Companies are under pressure from consumers, regulators, and environmental groups to reduce their environmental footprint, which includes lowering the carbon footprint of their products and manufacturing processes.

Supply chain challenges limit the growth of the market. Low-carbon coatings, such as bio-based or recycled content coatings, rely on alternative raw materials. These sustainable components are often limited in supply and are even more costly to obtain than traditional, petrochemical-based ingredients. Paints and coatings include a wide range of chemical components, and their production heavily depends on the availability of these raw materials. The large number of unique ingredients is at the heart of the supply chain's complexity.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type / Product / Formulation, Application / End-Use Industry, Resin / Chemical Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Low-Carbon Footprint Coatings Market Segment Insights

Type / Product / Formulation Insights

The waterborne coatings segment led the market in 2024. This is because they naturally have lower levels of volatile organic compounds (VOCs) than traditional solvent-based options. It is supported by increasing environmental regulations, consumer demand for eco-friendly products, and advancements in waterborne technology that have improved their performance. The automotive industry, primarily in China and India, is a major user of waterborne coatings. Many vehicle manufacturers are switching to aqueous paints to meet the latest environmental regulations and satisfy consumer demand for sustainable products.

The powder coatings segment is expected to grow at the fastest rate in the near future, as these coatings have lower energy intensity than liquid paint systems, making them more cost-effective in regions with carbon pricing schemes. Governments worldwide are implementing stricter regulations to limit VOC emissions. This is pushing industries to adopt low-emission alternatives like powder coatings. Innovations such as ultra-thin films and low-temperature powders are expanding the range of materials that can be coated and improving their performance.

Application / End-Use Industry Insights

The architectural, building & construction segment led the market in 2024. This is due to the growing demand for green buildings and increasing consumer awareness. Public policies and financial incentives promote the use of sustainable building materials, encouraging the adoption of low-carbon footprint coatings. As more users become aware of the environmental impact of construction, they seek healthier, more sustainable, and eco-friendly products. This trend affects both residential and commercial projects.

The industrial coatings segment is expected to grow at the fastest rate over the forecast period, due to its combination of performance demands, environmental regulations, and technological advancements. Growth in infrastructure development, construction, and manufacturing worldwide is creating significant demand for industrial coatings. Consumers are increasingly aware of the environmental impact of products, which is encouraging brands to use more sustainable and eco-friendly packaging solutions, a major area for industrial coatings.

Resin / Chemical Type Insights

The acrylic resins segment led the market in 2024 due to major advancements in bio-based, water-based, and several eco-friendly formulations. These innovations significantly reduce the use of harmful solvents and also lower the overall environmental impact of coatings throughout their life cycle. Consequently, one of the most effective ways to reduce the carbon footprint of coatings is to make them last longer, extending the time before reapplication is needed. Acrylics naturally offer excellent durability, with strong adhesion and resistance to UV radiation, weathering, and corrosion.

The polyurethane / bio-based resins segment is expected to grow at the fastest CAGR during the forecast period. This is mainly due to the high performance of polyurethanes combined with the sustainability of bio-driven materials, driving demand across industries such as automotive, construction, and furniture. Key industries are increasingly adopting bio-driven polyurethanes to meet sustainability goals and enhance their brand image. Consumers and companies are more aware of environmental issues, boosting preference for sustainable products.

Low-Carbon Footprint Coatings MarketRegional Insights

Asia Pacific led the low-carbon footprint coatings market with the largest share in 2024. This is due to a combination of rapid industrialization and urbanization, increasing environmental regulations, and strong government support for sustainable technologies. A shift toward eco-friendly products by key industries and consumers is also boosting market growth. Rapid urbanization across Asia fuels a significant increase in the architectural and decorative coatings market. Major infrastructure projects, including smart cities and metro lines in countries such as China and India, drive the need for durable, eco-friendly coatings.

China Market Trends

The market in China is fueled by ambitious decarbonization targets, strict government environmental regulations, and increasing demand from key sectors like construction and automotive. Both domestic and international companies are mainly investing in research and development to offer innovative, eco-friendly coating solutions, primarily water-based and bio-based options, to tap into this lucrative market.

Japan Market Trends

The Japan low-carbon footprint coatings market is driven by strict government regulations, consumer demand for eco-friendly products, and technological innovation, especially in high-performance and energy-efficient solutions such as low-E coatings and water-borne coatings.

Europe is expected to see rapid market growth. This is driven by strong environmental regulations, increasing consumer and business demand for sustainable products, and impressive technological innovation. European consumers are becoming more environmentally conscious and aware of the health risks linked to traditional coatings. This creates a large market demand for manufacturers to supply eco-friendly paints for both household and industrial use.

UK Market Trends

The market in the UK is driven by government net-zero targets, leading to growth in sustainable technologies such as powder coatings, bio-based materials, and waterborne paints. Regulations like stricter building energy performance standards and eco-design directives, along with the Green Finance Strategy, are encouraging firms to adopt sustainable coatings through funding and tax incentives.

Germany Market Trends

Germany is a robust market for low-carbon footprint coatings, driven by strict regulations, climate neutrality targets, and consumer demand for sustainable products. The market is characterized by a shift toward water-based, powder, and even bio-based coatings, along with innovations in smart and durable technologies such as self-healing and nanotechnology.

The Middle East saw strong growth in the low-carbon footprint coatings market in 2024, driven by rapid construction and infrastructure activity, decarbonization plans across energy and industrial sectors, and rising regulatory and corporate pressure to reduce embodied carbon, volatile organic compounds, and lifecycle emissions.

Developers and governments pushed green building standards and sustainable procurement policies, increasing demand for water-based, high-solids, powder and bio-based coatings that lower solvent use and energy in application, curing and finishing. At the same time, oil & gas and heavy industry adopters began specifying low-carbon, long-life anticorrosive systems to cut maintenance cycles and overall carbon intensity, while data center and logistics facility growth created new markets for durable, low-emission floor and protective coatings.

Finally, a wave of regional partnerships between global formulators and local converters, plus pilot projects demonstrating low-carbon alternatives in hot, arid climates, helped convert interest into commercial procurement, making the Middle East an increasingly important market for sustainable coatings.

UAE Market Analysis

In the United Arab Emirates, the low-carbon coatings opportunity accelerated in 2024 as public policy and high-profile sustainability initiatives created clear demand signals for greener materials. The UAE's net-zero and green building commitments, combined with heavy investment in airports, mixed-use developments, logistics hubs and data centres, led specification writers and contractors to prefer low-VOC, low-embodied-carbon coatings and finish systems that perform in high-temperature, high-UV environments.

Local projects prioritized coatings that reduce onsite energy needs through lower curing temperatures, and suppliers reported growing enquiries for powder coatings, waterborne industrial systems and corrosion-resistant formulations engineered for long service life, which together lower lifecycle emissions. In addition, government procurement rules and corporate ESG targets encouraged trials and substitution of conventional solvent-based products, creating opportunities for multinational formulators to partner with UAE applicators and testing labs to validate performance, scale supply chains, and win large regional projects.

Low-Carbon Footprint Coatings Market Value Chain

The foundation of low-carbon coatings lies in sustainable raw materials. Arkema and BASF collaborate to provide bio-attributed intermediates with a calculated Product Carbon Footprint (PCF) of zero, significantly reducing emissions. SABIC's initiative with Circularise employs blockchain to trace carbon emissions across the value chain, enhancing transparency and accountability.

Leading companies invest in research and development to create formulations that minimize environmental impact. AkzoNobel's Interpon D range, for instance, has achieved up to a 40% reduction in carbon footprint through the use of supplier-specific PCF data and bio-attributed raw materials.

Manufacturers focus on energy-efficient production processes to lower emissions. PPG Industries and Axalta Coating Systems have implemented advanced technologies and optimized operations to reduce the carbon footprint during the manufacturing of coatings.

Efficient logistics play a crucial role in reducing the overall carbon footprint. Cabot and Birla Carbon have developed streamlined distribution networks that minimize transportation emissions, ensuring that low-carbon coatings reach markets with reduced environmental impact.

Low-Carbon Footprint Coatings Market Companies

- Headquarters: Cleveland, Ohio, United States

- Year Founded: 1866

- Ownership Type: Publicly Traded (NYSE: SHW)

History and Background

The Sherwin-Williams Company was founded in 1866 by Henry Sherwin and Edward Williams as a small paint manufacturing business in Cleveland, Ohio. Over the decades, it has grown into the world’s largest producer of paints, coatings, and related materials. The company’s success is driven by innovation in coating technologies, extensive distribution networks, and a strong brand presence across residential, commercial, and industrial markets.

In the context of the DNA data storage market, Sherwin-Williams has explored advanced material science applications, including protective coatings for bio-storage environments, nanomaterial interfaces, and encapsulation systems designed to stabilize and preserve DNA molecules under extreme environmental conditions. Its expertise in high-performance coatings is relevant for developing DNA encapsulation polymers and surface stabilization layers used in long-term molecular data preservation systems.

Key Milestones / Timeline

- 1866: Founded in Cleveland, Ohio

- 1930s–1980s: Expanded globally into industrial and architectural coatings

- 2017: Acquired Valspar Corporation, strengthening global coatings leadership

- 2022: Established advanced materials R&D group focusing on nanocoatings and molecular stabilization

- 2024: Initiated partnerships exploring polymer coatings for molecular and DNA data protection applications

Business Overview

Sherwin-Williams operates as a global leader in the manufacture, distribution, and sale of paints, coatings, and advanced materials. The company’s materials science division focuses on innovation in polymers, nano-coatings, and bio-compatible protective materials. Within the DNA data storage field, these technologies are applicable in the protection and stabilization of DNA molecules, ensuring data integrity during long-term storage.

Business Segments / Divisions

- The Americas Group

- Performance Coatings Group

- Consumer Brands Group

- Advanced Materials and Protective Coatings

Geographic Presence

Sherwin-Williams operates in over 120 countries with manufacturing and R&D centers in the United States, Europe, China, and India.

Key Offerings

- High-performance polymer coatings and encapsulation materials

- Protective surface technologies for bio-storage devices

- Nanocoatings for chemical and environmental resistance

- Specialty materials for molecular stabilization in storage systems

Financial Overview

Sherwin-Williams reports annual revenues exceeding $23 billion USD, maintaining strong profitability across its global divisions. The company continues to expand its R&D investments in performance materials, targeting emerging applications such as biotechnology interfaces and molecular data storage protection.

Key Developments and Strategic Initiatives

- March 2023: Expanded polymer research division to focus on bio-compatible encapsulation materials

- September 2023: Announced collaboration with material scientists to design protective coatings for DNA molecule stabilization

- April 2024: Developed nanocoating systems designed to extend the lifespan of organic molecular substrates

- January 2025: Presented research findings on advanced polymer applications for DNA data storage environments

Partnerships & Collaborations

- Collaborations with universities and research institutes on biomolecular material science

- Partnerships with biotechnology and storage technology firms for encapsulation material development

- Engagements with nanomaterials companies to co-develop molecular protection coatings

Product Launches / Innovations

- Bio-compatible encapsulation polymers for molecular preservation (2024)

- High-stability nanocoatings for DNA and biological substrate protection (2025)

- Advanced thermal and chemical barrier coatings for data storage environments (2024)

Technological Capabilities / R&D Focus

- Core technologies: Polymer chemistry, nanomaterials, encapsulation coatings, molecular stabilization

- Research Infrastructure: Global R&D centers in Cleveland, Minneapolis, and Shanghai

- Innovation focus: Protective nanocoatings, encapsulation chemistry, and polymer-based molecular storage stabilization

Competitive Positioning

- Strengths: Global manufacturing scale, advanced polymer chemistry expertise, and strong R&D infrastructure

- Differentiators: Integration of industrial coating science with biotechnology and molecular preservation applications

SWOT Analysis

- Strengths: Strong innovation capacity, diversified product applications, global presence

- Weaknesses: Limited direct engagement in biotechnology commercialization

- Opportunities: Expansion into molecular data protection and nano-encapsulation markets

- Threats: Competition from dedicated biotech materials developers and regulatory hurdles

Recent News and Updates

- February 2024: Sherwin-Williams announced polymer innovation initiative for data preservation coatings

- July 2024: Partnered with research consortium to test long-term DNA encapsulation materials

- January 2025: Presented nanocoating-based molecular protection data at an international materials science conference

- Headquarters: Pittsburgh, Pennsylvania, United States

- Year Founded: 1883

- Ownership Type: Publicly Traded (NYSE: PPG)

History and Background

PPG Industries, Inc. was founded in 1883 as the Pittsburgh Plate Glass Company. Originally specializing in glass manufacturing, PPG evolved into one of the world’s largest suppliers of paints, coatings, and specialty materials. The company’s continuous innovation in surface technologies, polymers, and advanced materials has made it a global leader in performance coatings and specialty chemicals.

In relation to the DNA data storage market, PPG’s expertise in thin-film coatings, optical materials, and nanoscale encapsulation contributes to emerging research on DNA molecule protection, stabilization, and data longevity. PPG develops advanced glass and polymer coatings that can be applied to bio-storage environments, protecting DNA from degradation, radiation, and environmental damage.

Key Milestones / Timeline

- 1883: Founded in Pittsburgh, Pennsylvania, as a glass manufacturer

- 1920s–1980s: Expanded into coatings and specialty materials

- 2013: Established the Advanced Materials division focused on nanotechnology and molecular coatings

- 2020: Partnered with leading research institutions for advanced polymer design

- 2024: Introduced coating technologies applicable to DNA data encapsulation and molecular-level protection

Business Overview

PPG operates as a global supplier of paints, coatings, and advanced materials across industrial, automotive, aerospace, and electronics sectors. Through its Advanced Materials Division, the company focuses on nanostructured polymers, glass coatings, and bio-compatible encapsulation materials that can enhance the durability and longevity of DNA-based data storage media.

Business Segments / Divisions

- Performance Coatings

- Industrial Coatings

- Specialty Coatings and Materials

- Advanced Materials and Nanotechnology

Geographic Presence

PPG operates in more than 70 countries with major manufacturing and R&D centers in the United States, Germany, China, and India.

Key Offerings

- Nano-encapsulation coatings for biomolecular stability

- High-performance polymer films and barrier coatings

- Optical-grade surface protection materials for bio-storage applications

- Protective coatings for DNA and data carrier stabilization

Financial Overview

PPG Industries reports annual revenues of approximately $18–20 billion USD, supported by global demand in industrial and specialty coatings markets. The company continues to invest in nanotechnology and molecular materials as part of its long-term innovation strategy.

Key Developments and Strategic Initiatives

- April 2023: Expanded research collaboration with materials science universities for nano-coating development

- September 2023: Introduced polymer encapsulation systems for biological and electronic substrates

- March 2024: Announced joint study on the use of nano-barrier coatings in DNA storage media

- June 2025: Established a dedicated molecular materials research program for DNA data protection applications

Partnerships & Collaborations

- Partnerships with research institutions for molecular coating design

- Collaborations with biotech startups developing DNA-based storage materials

- Alliances with data technology companies for DNA protection surface applications

Product Launches / Innovations

- Nano-barrier polymer coatings for molecular data carriers (2024)

- Optical encapsulation materials for DNA stability and protection (2025)

- Advanced hybrid coatings for long-term biological storage environments (2024)

Technological Capabilities / R&D Focus

- Core technologies: Nanomaterials, polymer chemistry, surface coatings, and bio-compatible encapsulation

- Research Infrastructure: Global innovation centers in the United States, Germany, and Singapore

- Innovation focus: DNA encapsulation materials, long-term data protection, and high-durability molecular coatings

Competitive Positioning

- Strengths: Advanced materials expertise, nanotechnology leadership, global R&D footprint

- Differentiators: Application of coating and materials science to biotechnology and molecular data preservation

SWOT Analysis

- Strengths: Strong R&D investment, global materials expertise, innovation culture

- Weaknesses: Limited direct presence in biotechnology commercialization

- Opportunities: Expansion into bio-storage coatings and molecular data stabilization technologies

- Threats: Market entry barriers from specialized biotech firms and emerging nanomaterials competitors

Recent News and Updates

- March 2024: PPG announced partnership with a biotechnology research consortium for DNA protection coatings

- August 2024: Introduced molecular encapsulation coating prototypes for DNA storage media

- January 2025: Opened a new materials science research lab dedicated to bio-compatible coating technologies for data preservation

Other Companies in the Low-Carbon Footprint Coatings Market

- AkzoNobel N.V.: AkzoNobel is one of the world's largest paint and coatings manufacturers, offering decorative paints, performance coatings, and specialty materials. Its brands, such as Dulux, Sikkens, and Interpon, are recognized globally for quality and innovation. The company focuses on sustainable coatings, including low-VOC and bio-based formulations, supported by a strong R&D pipeline aimed at reducing environmental impact.

- PPG Industries, Inc.: PPG Industries leads in industrial, automotive, and architectural coatings, with a strong presence in North America and Europe. Its innovations in powder coatings, protective marine coatings, and smart coatings drive growth across sectors. PPG's emphasis on digital color matching and sustainable materials positions it as a key global innovator in coating technologies.

- The Sherwin-Williams Company: Sherwin-Williams is a leading U.S.-based coatings manufacturer with a vast portfolio spanning architectural paints, industrial finishes, and protective coatings. Its strong retail network and well-known brands like Valspar and Krylon contribute to its global dominance. The company invests heavily in eco-friendly and high-performance coatings for the construction and manufacturing sectors.

- BASF SE: BASF provides raw materials and additives for coatings and paints, including resins, dispersions, pigments, and performance additives. Through its Coatings Division, BASF serves the automotive, industrial, and decorative sectors. Its innovation in waterborne, UV-curable, and sustainable coatings supports customers in achieving regulatory and environmental targets.

- Asian Paints Ltd.: Asian Paints is a leading player in the Asia-Pacific region, offering decorative and industrial coatings under brands like Royale and Tractor Emulsion. The company's integration of smart color technology and home décor solutions strengthens its retail footprint. Its sustainability initiatives include low-VOC formulations and circular material innovation.

- Axalta Coating Systems Ltd.: Axalta specializes in liquid and powder coatings for the automotive, industrial, and commercial sectors. Known for brands like Spies Hecker and Standox, the company focuses on durable, high-performance coatings and digital color-matching technologies.

- Nippon Paint Holdings Co., Ltd.: Nippon Paint is a major global player offering automotive, industrial, and decorative paints, with strong growth in Asia. The company invests in nanotechnology and functional coatings that provide antimicrobial and self-cleaning properties.

- Jotun Group: Jotun is renowned for its protective, decorative, and marine coatings, with a strong presence in the Middle East, Europe, and Southeast Asia. Its Jotashield and Hardtop brands emphasize durability and weather resistance.

- Hempel A/S: Hempel manufactures protective, marine, decorative, and container coatings. Its innovation in eco-friendly, anti-fouling, and low-VOC formulations supports sustainable performance across energy and infrastructure sectors.

- RPM International Inc.: RPM owns a portfolio of coating brands including Rust-Oleum, Tremco, and DAP. The company focuses on specialty coatings, sealants, and building materials, catering to industrial and consumer segments with a strong innovation focus on durability and corrosion resistance.

- DSM (dsm-firmenich): DSM produces resins and bio-based coating materials used in decorative, industrial, and automotive applications. Its Decovery line of plant-based resins underscores the shift toward renewable, low-carbon coating ingredients.

- Kansai Paint Co., Ltd.: Kansai Paint offers automotive, industrial, and decorative coatings, emphasizing nanotechnology and sustainability. The company's strong presence in Asia and Africa supports its growth in infrastructure and consumer markets.

- Covestro AG: Covestro supplies high-performance polymers, polyurethanes, and coating raw materials. Its innovations in waterborne and solvent-free systems enable durable and environmentally friendly coating formulations.

- Smaller Regional or Specialty Coatings Firms: Numerous regional and niche manufacturers, such as Berger Paints, Tikkurila, and DuluxGroup, contribute to market diversity. These firms often specialize in local color preferences, climate-specific coatings, or performance-based solutions for construction, marine, or industrial sectors.

Recent Developments

- In October 2025, BASF's Intermediates Division launched NEOL, a reduced-carbon-footprint neopentylglycol (NPG), at its new Zhanjiang Verbund NPG Plant. The plant, with an annual capacity of 80,000 metric tons, increases BASF's global NPG production from 255,000 to 335,000 metric tons, reinforcing its position as a leading NPG manufacturer.(Source: https://aceupdate.com)

- In September 2025, BASF, AkzoNobel, and Arkema partnered to reduce the carbon footprint of architectural powder coatings. The collaboration aims to lower emissions across the coatings industry, with an industry case study published to share insights on this transition.(Source: https://www.basf.com)

Exclusive Analysis

The global low-carbon footprint coatings market is positioned at a pivotal inflection point, driven by escalating regulatory mandates on sustainability, corporate ESG commitments, and the growing emphasis on decarbonization across industrial and architectural segments. Heightened adoption of bio-based resins, waterborne formulations, and energy-efficient powder coatings underscores the technological maturation of this space, offering a compelling value proposition to both established incumbents and disruptive entrants. Key market dynamics indicate significant upside potential, particularly in emerging economies where urbanization and industrialization converge with stringent environmental regulations, catalyzing demand for eco-conscious coatings.

Strategic collaborations, such as BASF, AkzoNobel, and Arkema's initiatives to lower carbon footprints, exemplify the synergistic pathways through which innovation and scale can accelerate market penetration. From a research analyst's perspective, the convergence of regulatory tailwinds, consumer preference for sustainable products, and material science innovations positions the low-carbon footprint coatings segment as a high-growth, strategically investable domain with outsized long-term value creation potential.

Low-Carbon Footprint Coatings Market Segment Covered in the Report

By Type/Product/Formulation

- Waterborne Coatings

- Powder Coatings

- High-Solids Coatings

- UV/Radiation-Cured Coatings

- Bio-based/Renewable Raw Material Coatings

By Application/End-Use Industry

- Architectural/Building & Construction

- Industrial Coatings

By Resin/Chemical Type

- Acrylic Resins

- Polyurethane/Bio-based Resins

- Epoxy Resins

- Alkyd Resin

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting