Low Endotoxin Gelatin Market Size and Forecast 2025 to 2034

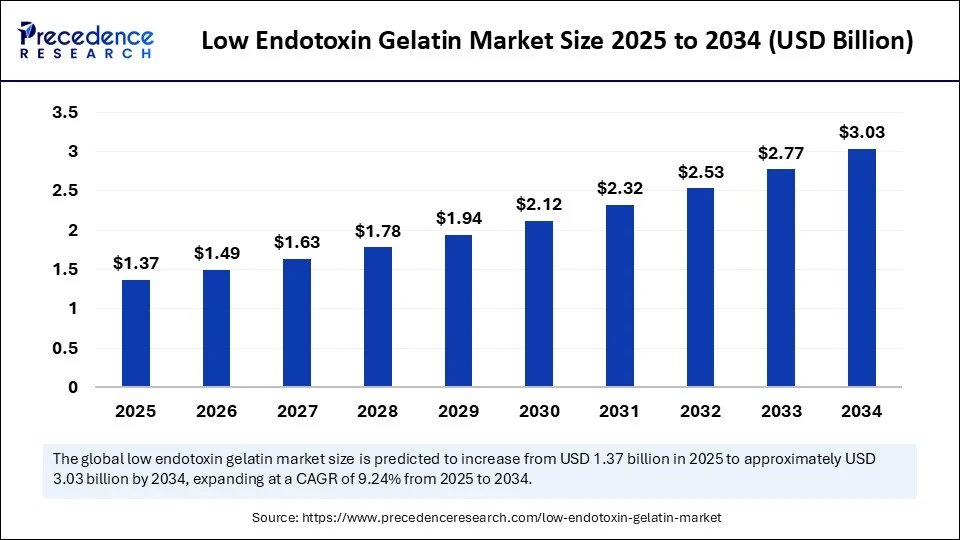

The global low endotoxin gelatin market size accounted for USD 1.25 billion in 2024 and is predicted to increase from USD 1.37 billion in 2025 to approximately USD 3.03 billion by 2034, expanding at a CAGR of 9.24% from 2025 to 2034.The growth of the market is attributed to the increasing demand for high-purity biomaterials in pharmaceutical and biomedical applications.

Low Endotoxin Gelatin Market Key Takeaways

- The global low endotoxin gelatin market was valued at USD 1.25 billion in 2024.

- It is projected to reach USD 3.03 billion by 2034.

- The market is expected to grow at a CAGR of 9.24% from 2025 to 2034.

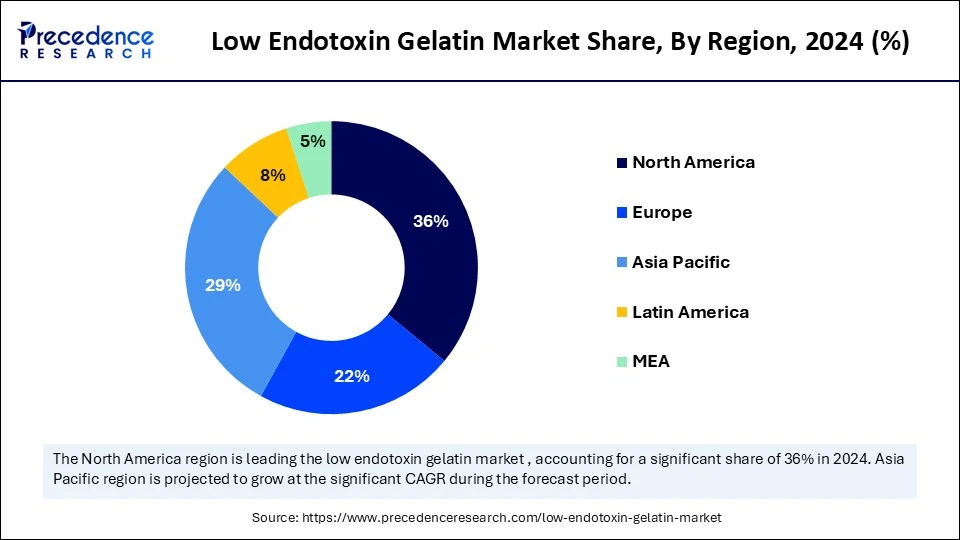

- North America dominated the low endotoxin gelatin market with the largest share of 36% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- By type, the type A segment held the biggest market share in 2024.

- By type, type B is expected to grow at the fastest CAGR during the forecast period.

- By application, the pharmaceutical segment led the market in 2024.

- By application, the food & beverages segment is expected to grow at the fastest CAGR in the coming years.

How is Artificial Intelligence Enhancing Quality Control in the Gelatin Manufacturing Process?

Artificial intelligence (AI) improves quality control in the gelatin production process through automation, predictive analytics, and real-time monitoring. Manufacturers can reduce waste and guarantee batch uniformity by immediately detecting impurities or inconsistencies during production using AI-powered sensors and computer vision. By predicting endotoxin risks and optimizing critical parameters like temperature, pH, and hydrolysis time, machine learning models help produce consistently high-quality products. AI is especially useful for pharmaceutical-grade and low-endotoxin gelatin applications because it simplifies regulatory standard compliance by automating documentation and enhancing traceability throughout the supply chain.

U.S. Low Endotoxin Gelatin Market Size and Growth 2025 to 2034

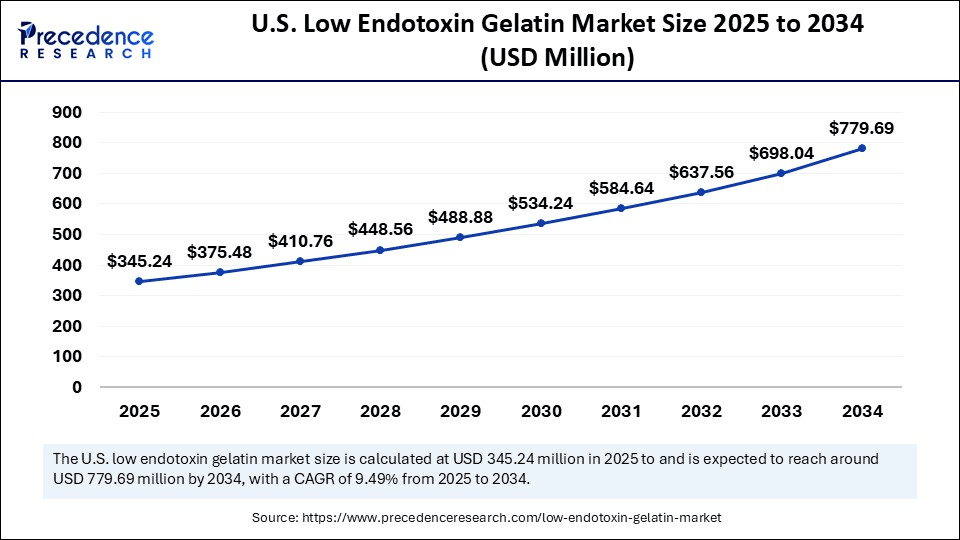

The U.S. low endotoxin gelatin market size was exhibited at USD 315.00 million in 2024 and is projected to be worth around USD 779.69 million by 2034, growing at a CAGR of 9.49% from 2025 to 2034.

What Made North America the Dominant Region in the Low Endotoxin Gelatin Market?

North America dominated the low endotoxin gelatin market by capturing the largest share in 2024. This is mainly due to its strong manufacturing capabilities, stringent regulatory environment, and sophisticated pharmaceutical ecosystem. The region is a leader in the production of injectable medications, biologics, and regenerative therapies, all of which depend on ultra-pure gelatin. A steady supply of premium gelatin for use in food and medicine is guaranteed by well-established supplier networks. Furthermore, there has been increased investment in drug delivery systems and next-generation therapies, creating opportunities for low-endotoxin gelatin. The demand for medical-grade gelatin in the pharmaceutical and nutraceutical industries is also driven by a strong emphasis on safe and clean-label ingredients. Stringent regulations regarding the safety, quality, and efficacy of pharmaceutical and food products also influence the market.

Asia Pacific is expected to grow at the fastest CAGR in the coming years due to the rapid expansion of pharmaceutical and nutraceutical sectors, alongside increasing awareness regarding ingredient purity and product safety. Pharmaceutical and food manufacturers are being encouraged to transition to low-endotoxin gelatin due to a strong push for clean-label food and health products. Additionally, the need for medical-grade gelatin in tissue regeneration, drug delivery systems, and biologics is growing in the region. Increased production capacity and higher healthcare spending also contribute to market expansion. The demand for high-quality, contaminant-free ingredients is rising in the pharmaceutical industry as more people become concerned about their health and well-being, driving the growth of the market.

Europe is considered to be a significantly growing area. The growth of the low endotoxin gelatin market in the region is driven by its strong legacy in pharmaceutical innovation, stringent safety regulations, and growing focus on sustainable sourcing. The region emphasizes high-purity ingredients for medical and nutraceutical applications, backed by quality control frameworks such as GMP and ISO standards as well as a supply chain that is properly regulated. The use of low endotoxin gelatin is being driven by the growing need for biomedical materials in advance for wound care implants and drug delivery systems. The drive for pharmaceutical-grade gelatin also fits in nicely with Europe's move toward traceable and ethical animal-derived ingredients. The role of ongoing research and development in bioengineering and regenerative medicine in influencing future applications is further enhanced.

Market Overview

The low endotoxin gelatin market is witnessing steady growth, driven by increased use in biotechnology, pharmaceutical, and medical industries where high purity and biocompatibility are essential. Because of its low levels of endotoxins, which lower the possibility of unfavorable immune reactions, this gelatin is widely used in tissue engineering drug delivery systems, vaccine stabilizers, and wound care. The market is expanding due to growing investments in regenerative medicine and increased regulatory focus on product safety in clinical applications. Furthermore, the rising use of low-endotoxin gelatin in a range of medical applications supports market growth. Advancements in extraction and purification technologies are improving the consistency and quality of low-endotoxin gelatin.

Why is the Demand for Low-Endotoxin Gelatin Increasing Across Healthcare and Biopharma Industries?

The growing preference for low-endotoxin gelatin stems from its crucial role in ensuring the safety and efficacy of sensitive biomedical applications. This kind of gelatin provides a dependable option for injectable medications, cell culture, and tissue scaffolding as pharmaceutical companies and research institutions prioritize products with extremely low contamination risks. It is essential for creating vaccines, biologics, and cutting-edge treatments because of its capacity to adhere to stringent regulatory requirements and lower inflammatory reactions. There is a strong emphasis on patient safety and adherence to international health standards, which is driving the market's growth.

Low Endotoxin Gelatin MarketGrowth Factors

- Rising Biopharma Demand: Used in drug delivery, vaccines, and regenerative therapies, low endotoxin gelatin is preferred for its purity and safety.

- Strict Regulatory Requirements: Tight FDA and EMA guidelines are pushing companies to adopt low-endotoxin materials to ensure compliance.

- Advances in Purification: Improved production technologies are enabling consistent use. High-quality low endotoxin gelatin for sensitive uses.

- Tissue Engineering Growth: Increasing applications in skin grafts and scaffolds boost demand due to gelatin's biocompatibility and low immune risk.

- Higher R&D investments: Growing life sciences research drives demand for safe, endotoxin-free materials like this specialized gelatin.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.03 Billion |

| Market Size in 2025 | USD 1.37 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Focus on Patient Safety and Regulatory Compliance

There is growing pressure on the pharmaceutical and healthcare sectors to adhere to stringent international regulatory standards governing the level of endotoxins in medical products. Manufacturers of drugs can comply with FDA, EMA, and other international standards by using low endotoxin gelatin, which lowers the possibility of unfavorable immune reactions. Parenteral medications and implanted medical devices are two highly regulated applications where it is a preferred ingredient due to its capacity to support safe clinical outcomes. The use of this type of gelatin in delicate therapeutic formulations is becoming more popular as patient safety continues to be a primary concern.

Advancements in Regenerative Medicine and Tissue Engineering

Advancements in regenerative medicine and tissue engineering significantly drive the growth of the low endotoxin gelatin market. Low endotoxin gelatin is becoming an essential biomaterial as interest in 3D bioprinting, wound healing, and tissue scaffolding increases. It is perfect for regenerative treatments because it promotes cell adhesion proliferation and differentiation without inducing inflammation. The creation of bioink skin substitutes and scaffolds for organ regeneration all make extensive use of it. The need for sterile and useful biomaterials such as low endotoxin gelatin is rising rapidly as clinical research and trials in regenerative medicine pick up speed.

Restraints

Limited Raw Materials Availability

To produce low-endotoxin gelatin, raw materials must be obtained from sterile, tightly regulated environments. Typically, these materials are collagen derived from pigs or cows. It can be challenging and result in uneven supply to maintain such high standards across the supply chain. Any disturbances in the health of livestock or the supply chain may impact the supply of premium collagen. This not only restricts output but also raises prices because of the shortage of raw materials. Furthermore, the addressable market may be smaller due to ethical and religious concerns about gelatin derived from animals.

Regulatory Barriers

Regulatory challenges hamper the growth of the low endotoxin gelatin market. Approval for use in pharmaceutical and biomedical applications involves rigorous testing, documentation, and validation processes. This can be both time-consuming and costly, especially for startups or smaller players lacking regulatory experience. Delays in obtaining approvals can hinder product launches and limit early-stage revenue. In some countries, the lack of harmonized standards further complicates compliance. These challenges discourage new entrants and can reduce innovation and competition in the market.

Opportunities

Growing Use in Regenerative Medicine

The increasing application of low-endotoxin gelatin in regenerative medicine offers significant opportunities for the market. For wound healing cell therapy and tissue engineering, it acts as a safe, biodegradable scaffold material. It is a favored option for creating biomaterials for skin grafts, cartilage repair, and organ regeneration because of its capacity to promote cell adhesion growth and proliferation. The market for pyrogen-free and biocompatible gelatin is predicted to grow steadily as investments in regenerative technologies pick up speed. Additionally, research institutes and biotech companies are collaborating to advance the development of injectable hydrogels and 3D scaffolds based on gelatin. Its medical significance is growing as non-toxic, naturally resorbing biomaterials are sought after.

Expansion of Clean-label Nutraceuticals

The clean label movement in the nutraceutical industry is creating new opportunities for low endotoxin gelatin in the functional food and dietary supplement space. Customers want collagen-based drinks, candies, and capsules to contain ingredients that are clear, secure, and efficient. Premium health brands as also served by low endotoxin gelatin because they provide high purity and traceability. In markets that are closely watched like North America and Europe, its use can also help with regulatory compliance. Pharmaceutical-grade excipients are now being highlighted in the marketing of nutraceutical companies as a way to position themselves. Furthermore, the demand for safer multipurpose ingredients is being generated by the convergence of food, beauty, and health sectors, which are further opening the door for medical-grade gelatin.

Type Insights

Why Did the Type A (Acid Process Gelatin) Segment Dominate the Low Endotoxin Gelatin Market?

The type A (acid process gelatin) segment dominated the market with the largest share in 2024. This is mainly due to its high purity, fast production via acid processing, and superior functional performance. It is perfect for pharmaceutical uses such as vaccines, hemostatic agents, and gel-based drug delivery because of its low microbial content. Furthermore, it has good solubility and is recognized by regulatory frameworks like EP and USP. One of its main benefits in parenteral formulations is that it is compatible with human biology, which guarantees a decreased immunogenic response. In developed nations with infrastructure for processing pork, Type A is also simpler to source, guaranteeing steady availability and stable prices.

The type B (alkaline process gelatin) segment is expected to grow at the fastest rate during the forecast period due to the rising global demand for bovine-sourced, ethically processed, and culturally accepted gelatin, especially in halal, kosher, and vegetarian-sensitive markets. It is made by alkaline treatment, which has a longer degradation period and increases gel strength, making it perfect for 3D-printed medical scaffolds and sustained drug release systems. Advancements in biomedical applications such as wound dressing and cell encapsulation further fuel its expansion. Significant investments are being made in Type B manufacturing by several nations in order to satisfy rising export and domestic demand. Furthermore, its applicability to high-performance regenerative therapies makes it a very desirable candidate for further development.

Application Insights

Why Did the Pharmaceutical Segment Dominate the Low Endotoxin Gelatin Market in 2024?

The pharmaceutical segment dominated the market with a major revenue share in 2024, as low endotoxin gelatin is vital in meeting global health and safety standards for injectables, implantables, and medical devices. It lowers the risk of pyrogenic reactions, guarantees product sterility, and works with a variety of APIs and biology. Low endotoxin gelatin is frequently utilized as a scaffold stabilizer or carrier due to the rising demand for monoclonal antibodies vaccines and personalized medicine. It blends perfectly with human tissue because it is non-toxic and bioresorbable. Pharmaceutical use is the strongest market since top pharmaceutical companies give low endotoxin materials top priority to comply with FDA and EMA regulations.

The food & beverages segment is expected to grow at the fastest rate in the upcoming period due to the rising consumer demand for ultra-clean, safe, and functional ingredients. Low-endotoxin gelatin is extensively utilized in clean-label candies, collagen supplements, protein-enriched drinks, and cosmetic edibles. Brands have been compelled to use medical-grade ingredients in food formulations due to post-COVID emphasis on immunity and gut health. Companies are switching to low-endotoxin ingredients for safer and higher-quality products because international regulatory bodies tighten contaminant standards in food processing. Pharmaceutical-grade gelatin is also in high demand due to the merging of nutraceutical and food categories.

Low Endotoxin Gelatin Market Companies

- Rousselot

- Gelita AG

- Nitta Gelatin NA Inc

- Tessenderlo Group

- Weishardt

- Torbas Gelatine BV

- Ewald Gelatine GmbH

- Norland Products Inc

- Lapi Gelatin Spa

- Junca Gelatines S.L.

Recent Developments

- On 29 January 2025, GELITA announced the launch of its Endotoxin Controlled Excipients portfolio, featuring MEDELLAPRO and VACCIPRO gelatin and collagen peptide products tailored for bioscience applications.

(Source: https://pharmaceuticalmanufacturer.media) - On 2 May 2024, Nitta gelatin India ltd. announced a Rs 60 crore expansion project of its collagen peptide facility in Kakkanad, Kerala. This expansion will nearly double production capacity from 600 MT to 1,150 MT annually, improving supply for pharmaceutical grade and low endotoxin applications.

(Source: https://www.thehindubusinessline.com)

Segments Covered in the Report

By Type

- Type A (Acid Process Gelatin)

- Type B (Alkaline Process Gelatin)

By Application

- Pharmaceutical

- Biotechnology

- Food & Beverages

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting