What is Ni-based Superalloys Market Size?

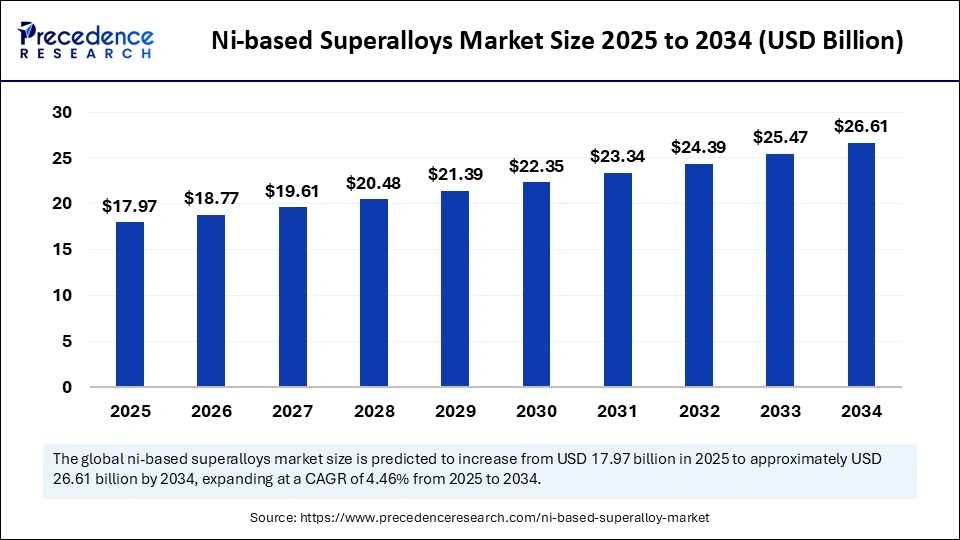

The global Ni-based superalloys market size is calculated at USD 17.97 billion in 2025 and is predicted to increase from USD 18.77 billion in 2026 to approximately USD 26.61 billion by 2034, expanding at a CAGR of 4.46% from 2025 to 2034. The increased demand for Ni-based superalloys in aerospace and energy industry is driving the global market.

Market Highlights

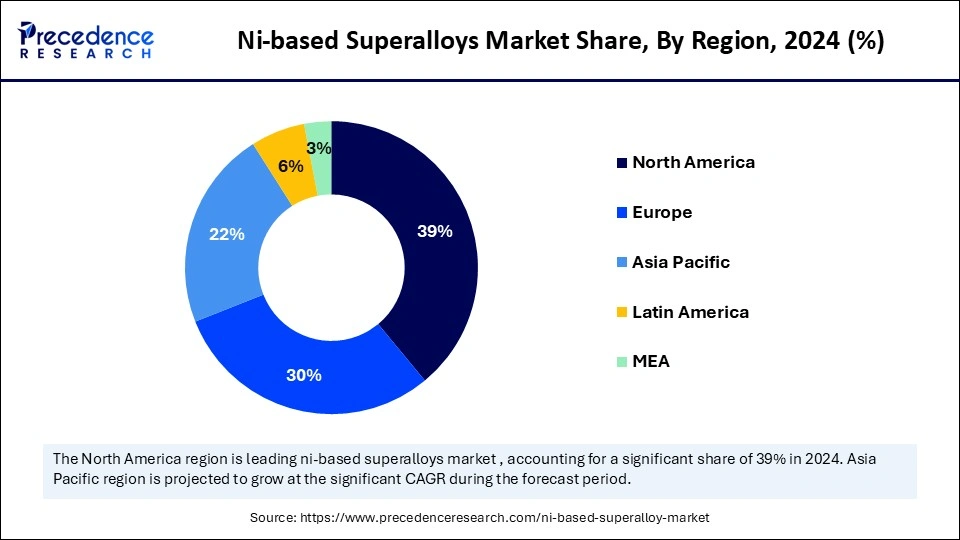

- North America accounted for the largest market share of 39% in 2024.

- Asia Pacific is projected to grow at a significant CAGR from 2025 to 2034.

- By application, the aerospace segment led the market while holding the largest share in 2024.

- By application, the industrial gas turbines segment is projected to grow at a CAGR from 2025 to 2034.

- By alloy type, the gamma prime alloys segment led the market while holding the largest share in 2024.

- By alloy type, the single crystal alloys segment is expected to grow at a CAGR between 2025 and 2034.

- By form, the bars and rods segment led the market while holding the largest share in 2024.

- By form, the powders segment is expected to grow at a CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 17.97 Billion

- Market Size in 2026: USD 18.77 Billion

- Forecasted Market Size by 2034: USD 26.61 Billion

- CAGR (2025-2034): 4.46%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Key Technological Shift in Ni-based Superalloys Market?

The growing adoption of additive manufacturing and 3D printing is achieving a key technological shift in the Ni-based superalloys industry. The market is witnessing significant technological growth, with the integration of AI for optimization of processes and a growing emphasis on recycling and sustainability. The additive manufacturing is enabling the transformation of complex part production, manufacturing efficiency, AI to enhance material development, and sustainability initiatives to advance recycling methods and circular economic principles. 3D printing reduces material waste and enables the reduction of environmental impacts.

In August 2025, researchers at IMDEA Materials Institute developed a streamlined and industrially scalable methodology for designing and controlling microstructure in nickel-based superalloys. These superalloys are manufactured by laser power bed fusion (LPBF) to enhance practical pathways for microstructure control in 3D-printed Ni-based superalloys. (Source: https://phys.org)

What is Ni-based Superalloys?

The Ni-based superalloys market is expanding due to high demand from the aerospace and power generation industries for materials that can withstand extreme temperatures. The demand for Nickel-based superalloys has increased in industries like aerospace, energy, and manufacturing. Ni-based superalloys are crucial in manufacturing components, including engine parts, exhauster system, and turbine blades in aircraft. The adoption of AM technologies is fueling demand for specialized Ni-based superalloy powders.

The demand for energy-efficient power generation has increased across the globe, driving the requirement for durable superalloys in nuclear reactors and gas turbines. Nickel-based superalloys are essential for high-performance materials to withstand extreme temperatures, mechanical stress, and corrosion. The advancements in additive manufacturing (AM) and precision casting techniques are enabling advanced Ni-based superalloys for these industries.

The GRX-810 powder developments in 2022 from NASA an oxide dispersion strengthened (ODS) alloys, particularly for using them in extreme temperatures. The GRX-810 powder is a Ni-Co-Cr-based alloy were created for applications like aerospace, including liquid rocket engine injectors, hot-section components, and preburners trubines. (Source: https://www.metal-am.com)

Ni-based Superalloys Market Outlook

- Industry Growth Overview: The increased industrial activities and robust investments in aerospace and power generation are expected to fuel industry expansion in regions like Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa, between 2025 and 2034. Development of novel alloys with enhanced high-temperature strength, mechanical performance, and corrosion resistance, enabling global reach to the Ni-based superalloys.

- Global Expansion:The Ni-based superalloys industry is growing rapidly in North America and the Asia Pacific due to the strong existence of a robust defense & aerospace industry and focus on fuel efficiency. The rapid industrialization and government initiatives for the aerospace and manufacturing sectors are solidifying the global expansion of the Ni-based superalloys industry.

- Startup Ecosystem: Numerous innovative companies are emerging, addressing the rising demand for high-performance materials, including ABD, Nanomaterials Companies, and Alloyed. These startups are focusing on technological advancements, like additive manufacturing (AM), cutting-edge materials, and sustainability production methods.VoxelMatters held the webinar on October 23rd, 2025, with collaboration of HP AM Solutional, Tecnalia, and Continuum Powders, to unveiled ways of breaking barriers with low-carbon M247 for binder jet production. This nickel-based superalloy is designed for binder jet 3D printing on HP's Meta Jet Platform.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.97 Billion |

| Market Size in 2026 | USD 18.77 Billion |

| Market Size by 2034 | USD 26.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.46% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application,Alloy Type,Form, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

Application Insights

Which Application Segment Dominated the Ni-based Superalloys Market in 2024?

In 2024, the aerospace segment dominated the market due to increased demand for Ni-based superalloys in the aerospace industry. The increased air travel and growth in defense expenditures are fueling this demand. Additionally, focus on the development of fuel-efficient and lightweight aircraft all fuels the demand for Ni-based superalloys materials in the aerospace industry. The Ni-based superalloys provide high-performance materials to withstand extreme temperatures and corrosive environments. Ni-based superalloys are crucial in jet engines, turbine components, and other aircraft parts.

The industrial gas turbines segment is expected to grow fastest over the forecast period, driven by increased demand for high-performance materials. Industrial gas turbines provide high-temperature strength and corrosion resistance, with high volume, research, and innovations. Industrial gas turbines require Ni-based superalloys due to their ability to withstand extreme temperatures, mechanical stress, and corrosion. The ability of industrial gas turbines to enhance efficiency and longevity. The demand for high reliability and durability is making Ni-based superalloys necessary for gas turbine components to reduce downtime and maintain costs.

Alloy Type Insights

How Gamma Prime Alloys Segment Dominated the Ni-based Superalloys Market?

The gamma prime alloys segment dominated the market in 2024, due to its high-performance strength and creep resistance. Gamma prime alloys are highly weldable and machinable, enabling higher wear rates and poor surface finishes. The superior mechanical strength, widespread adoption in critical aerospace & energy components, and thermal stability fuel its adoption. Gamma prime alloys are suitable for turbine blades, jet engines, and other high-performance applications. Research and development efforts with a strong focus on optimization of gamma precipitate size and distribution.

The single crystal alloys is the second-largest segment, leading the market, due to its superior mechanical strength, thermal stability, and widespread adoption in aerospace and energy components. The single crystal alloys offer high-performance applications like power generation and aerospace by reducing grain boundaries. This alloy type is ideal for higher operating temperatures and great efficiency in turbine blades and other critical components. The single crystal alloys are essential in turbine components, jet engines, and other high-performance applications.

Form Insights

Which Form Dominates the Ni-based Superalloys Market?

In 2024, the bars and rods segment dominated the market, due to its increased adoption in industries like power generation, oil & gas, chemical & petrochemical processing, and aerospace & defense. This industry has seen a large need for high-performance components. The bars and rods are highly resistant to corrosion, offer high strength, and are able to withstand extreme temperatures. Aerospace is a major industry that fuels the adoption of bars and rods for products like gear components, struts, shafts, and engine parts. The bars and rods are highly durable, making them essential for gas turbines and nuclear reactors.

The powders segment is projected to grow fastest over the forecast period, driven by its widespread utilization in the production of complex and high-performance parts. The industrial parts with difficulty in manufacturing need specialized Ni-based superalloys powders. Expanding industries like aerospace, defense, and energy are driving the adoption of Ni-based superalloys, especially AM techniques like Powder Bed Fusion (PBF) for creating compact and near-net-shape components. The demand for high-quality and specialized Ni-based superalloys powder has increased due to the increased use of alternative manufacturing (AM).

Regional Insights

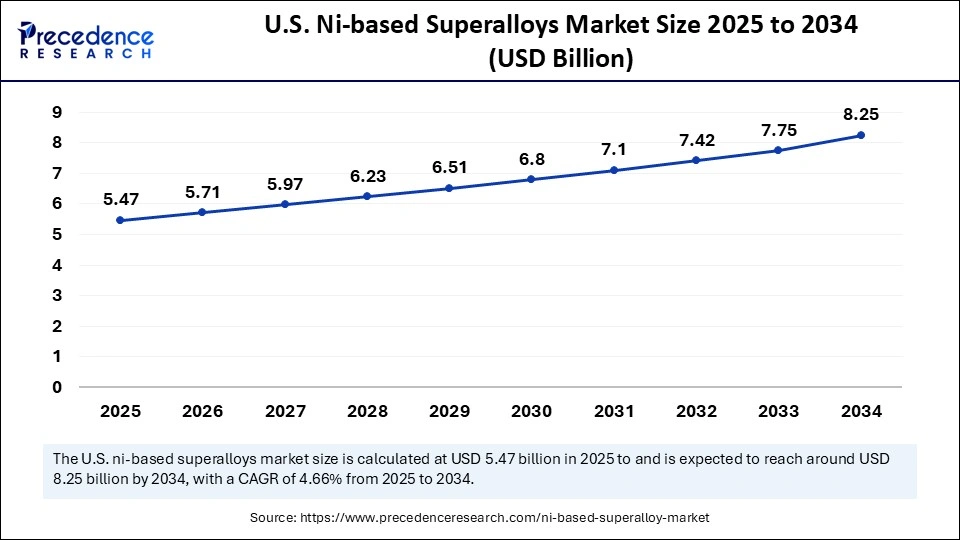

U.S. Ni-based Superalloys Market Size and Growth 2025 to 2034

The U.S. Ni-based superalloys market size exhibited at USD 5.47 billion in 2025 and is projected to be worth around USD 8.25 billion by 2034, growing at a CAGR of 4.66% from 2025 to 2034.

North America Ni-based Superalloys Market

North America dominates the global market, due to regions robust aerospace and defense sector with consistent investment and novel applications. North America has implemented several regional manufacturing policies reviewing the manufacturing and adoption of nickel-based superalloys with strong demand from key industries like aerospace, manufacturing, and automotive. This market is further fostering growth with geopolitical developments like sanctions and tariffs, driving the need of regional companies to focus on strengthening the regional and domestic supply chain. In August 2025, novel tariffs on nickel imports from several countries, including Indonesia, were announced. With a strong presence of aerospace, defense industries, and power generation, the Ni-based superalloys industry is maturely and sustainable in North America.

U.S. Market Trends

The U.S. is a major player in the regional market, driven by the country's robust aerospace, defense, energy, and automotive industries. Factors including advancements in aerospace, sustained demands, manufacturing innovations like 3D printing, and the strong presence of space exploration sectors, are facilitating this growth. NASA testing for space propulsion and the presence of key players like Boeing, Lockheed Martin, and General Electric are fueling demand for high-performance superalloys in turbine blades, structural components, and jet engines. In September 2025, the U.S. government announced revealed up to $331 million in investments for novel transmission lines, to boost demands in the power generation sectors.

Asia Pacific Ni-based Superalloys Market

Asia Pacific is the fastest growing region in the global market, contributing in growth due to the region's robust infrastructure development and rising demand for high-performance materials, like Ni-based superalloys in industries like stainless steel production, renewable energy, and electric vehicles. Asia is experiencing significant growth in focus on product innovations and sustainability. Significant developments, like the introduction of novel materials, a great emphasis on sustainable production methods, and high-temperature alloys. Government initiatives and investments for local manufacturing industries and startup companies are feuling innovations and development of high-performance materials, including Ni-based superalloys.

Rapid Industrial Growth: Feuling China's Market

China is a major player in the regional market, contributing in growth due to countries rapid industrial developments and government investments. China is a major largest consumer of Ni-based superalloys for industries like automotives, aerospace, defense, energy, power consumption, and the manufacturing sector. The existence of key companies like Fushun Special Steel and HENAN BEBON IRON&STEEL is enabling notable innovations in global manufacturers. China's initiatives in cost-effective production and processing of superalloys are solidifying countries position in the global market

Ni-based Superalloys Market - Value Chain Analysis

Feedstock Procurement

High-purity nickel and numerous another critical alloying elements are major sourcing for feedstock procurement for nickel-based superalloys. Desired properties of the final alloy are crucial for the specific materials and procurement methods.

Key Players: Aperam, Eramet Group, Haynes International, Inc., and Nippon Yakin Kogya Co., Ltd.

Distribution to Industrial Users

Distribution of Ni-based superalloys to industrial users evolves the manufacturing supply chain, from the raw material producers to specialty alloy manufacturers for various industrial end-users.

Key Players: ATI (Allegheny Technologies Incorporated), Special Metals Corporation, Precision Castparts Corp. (PCC), and Haynes International, Inc.

Regulatory Compliance and Safety Monitoring

Regulatory compliance and safety monitoring for Ni-based superalloys evolves a multi-faceted approach for addressing material performance, human health risk, and environmental protection associated with manufacturing and utilization.

Key Players: ATI Metals, Special Metals Corporation, Carpenter Technology Corporation, and Haynes International.

Top Companies in Ni-based Superalloys Market & Their Offering

- Allegheny Technologies Inc. – Has expanded its Ni-based superalloy power production to meet with increasing additive manufacturing industry and expand development & marketing of novel powder compositions, for optimization of various AM processes, including Laser Power Bed Fusion (L-PBF) and directed Energy Deposition (DED).

- Haynes International Inc. – offering nickel-based alloys similar to its previous success of HAYNES 233 and HAYNES 282, with a strong focus on alloys with improved creep resistance and higher operating temperatures for expanding the industrial and gas turbines capabilities.

- Sandvik AB– specializes in AM powders, positioning its Osprey brand as the primary provider of nickel superalloy powders for AM by expanding capabilities.

- Precision Castparts Corp. (PCC) – Increasing its investments in Ni-based superalloys casting by the development of large, more complex, and precise superalloy castings. Focusing on the production of next-generation, close-tolerance superalloy forgings for high-tech engines and structural aerospace components.

- Aperam S.A. – Acquired Universal Stainless and Alloy products, Aperam to integrate and expand its production capabilities and market presence.

- VDM Metals GmbH – Offering customized material solutions for identifying and developing alloys with specific properties, particularly for applications in electronics, aerospace, and medical engineering.

- Carpenter Technology Corp. – Providing widespread properties of nickel superalloy powders and offering end-to-end solutions, including design consultation to finished 3D-printed parts.

Other Key Players

- Nippon Yakin Kogyo Co., Limited

- Precision Castparts Corporation

- Sandvik AB

- Eramet group

- Mishra Dhatu Nigam Limited

- Special Metals Corporation

- ATI

- Aubert & Duval

Recent Developments

- In February 2025, the three novel aerospace materials, including high-temperature nickel alloy billets, Alloy S152 forged bars, and Superni 41 plates, were launched by MIDHANI. These materials are essential for cutting-edge jet engines, aircraft, and other space technologies. (Source: https://www.thehindu.com)

- In November 2024, EOS added two nickel-based superalloy powders for its Laser Beam Powder Bed Fusion (PBF-LB) additive manufacturing machines. These two powders, EOS NickelAlloy IN738 and EOS NickelAlloy K500, have been commercially available for the EOS M 290 family of machines since December 2024; also, EOS M 400-4 will be available in the first half of 2025. (Source: https://www.metal-powder.tech)

Segment Covered in the Report

By Application

- Aerospace

- Industrial Gas Turbines

- Marine

- Automotive

- Others

By Alloy Type

- Gamma Prime Alloys

- Single Crystal Alloys

- Polycrystalline Alloys

By Form

- Bars and Rods

- Sheets and Plates

- Powders

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content