PEGylation Proteins Technology Market Size and Forecast 2025 to 2034

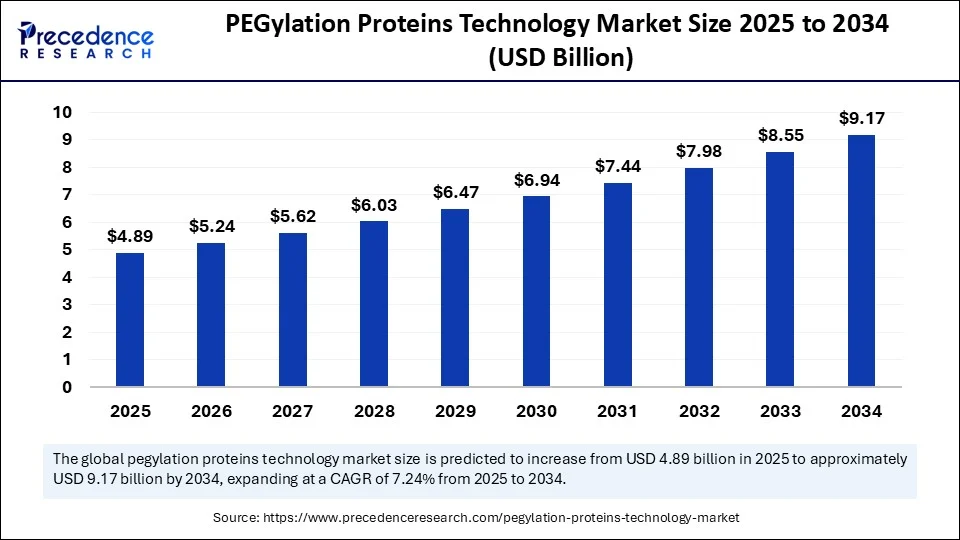

The global PEGylation proteins technology market size accounted for USD 4.56 billion in 2024 and is predicted to increase from USD 4.89 billion in 2025 to approximately USD 9.17 billion by 2034, expanding at a CAGR of 7.24% from 2025 to 2034. The market growth is attributed to rising demand for long-acting biologics that enhance patient adherence and reduce treatment burden through PEGylation-enabled drug delivery.

PEGylation Proteins Technology Market Key Takeaways

- In terms of revenue, the global PEGylation proteins technology market was valued at USD 4.56 billion in 2024.

- It is projected to reach USD 9.17 billion by 2034.

- The market is expected to grow at a CAGR of 7.24% from 2025 to 2034.

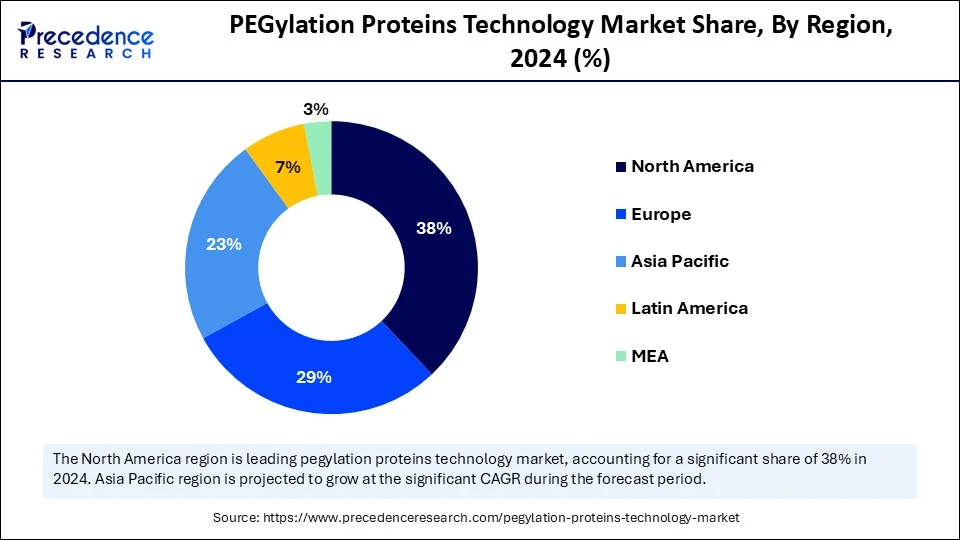

- North America dominated the global PEGylation proteins technology market with the largest share of 38% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By type of protein, the monoclonal antibodies segment held the major market share of 35% in 2024.

- By type of protein, the enzymes segment is projected to grow at a CAGR between 2025 and 2034.

- By PEGylation technology, the linear PEGylation segment contributed the biggest market share of 40% in 2024.

- By PEGylation technology, the cloud security segment is expanding at a significant CAGR between 2025 and 2034.

- By therapeutic application, the oncology segment captured the highest market share of 30% in 2024.

- By therapeutic application, the autoimmune disorders segment is expected to grow at a significant CAGR over the projected period.

- By end-user, pharmaceutical companies generated the major market share of 45% in 2024.

- By end-user, the CROs segment is expected to grow at a notable CAGR from 2025 to 2034.

Impact of Artificial Intelligence on the PEGylation Proteins Technology Market

Artificial intelligence (AI) is fast transforming the PEGylation proteins technology market and improving innovation and accuracy in the research, development, and commercialization. Using AI-driven platforms, scientists are able to determine the best PEGylation sites on protein molecules, predict their molecular stability. Furthermore, the AI produces more intelligent stratification, which helps PEGylated therapeutics achieve quicker approval and greater safety, and conclusive results.

U.S. PEGylation Proteins Technology Market Size and Growth 2025 to 2034

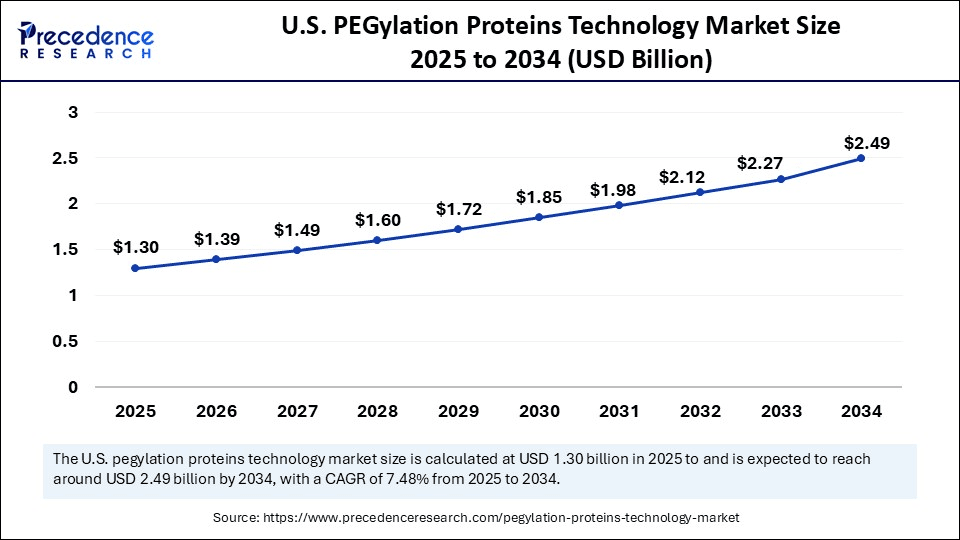

The U.S. PEGylation proteins technology market size was exhibited at USD 1.21 billion in 2024 and is projected to be worth around USD 2.49 billion by 2034, growing at a CAGR of 7.48% from 2025 to 2034.

Why Does North America Continue to Dominate the PEGylation Proteins Technology Market Landscape?

North America led the PEGylation proteins technology market, capturing the largest revenue share in 2024, accounting for 38% market share, due to a deep bench of innovators and manufacturers, including therapeutic protein developers, PEG reagent suppliers, and CDMOs, across the entire end-to-end value chain, from discovery through scale-up. The FDA CMC guidance on complex biologics and conjugates establishes expectations that reduce dossier preparation and lifecycle management complexities over PEG-modified products.

Oncology and autoimmune indications have dense networks of clinical-trial resources, which facilitate the enrolment of patients. That provides the data expected to hasten supplemental filings and label extensions. Long-acting formulations that mitigate infusion burden are also important to payers and integrated delivery networks. In 2024, the FDA confirmed that more than 90 PEGylated biologics and conjugates were either under active review or late-stage development in oncology and haematology, which highlights the good regulatory base present in this technology. Furthermore, the Technology transfer & co-development alliances between major pharmaceutical companies and specialists in specific biotech firms maintain strategic alliances, further fuelling the PEGylation proteins technology market in this region.(Source: https://www.fda.gov)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the expansion of biopharmaceutical centers in China, India, South Korea, and Singapore. These nations are investing in conjugation chemistry, stepped-flow or continuous processes, and analytical platforms suited to PEGylated proteins.

Modernization of regulations, including PMDA in Japan and NMPA in China, facilitates a faster pathway for high-value biologics. This factor is expected to reduce time to market for regional sponsors. The WHO 2024 report also reveals that in Asia that more than 20 million new cancer cases are reported, which promotes an aggressive use of biologics that need PEGylation to extend half-life. Moreover, the availability of PEG reagents and linker libraries is broadened through university-industry consortia and licensing agreements, thus further facilitating the market in the coming years.(Source: https://www.emro.who.int)

Market Overview

PEGylation proteins technology refers to the process of covalently attaching polyethylene glycol (PEG) polymers to therapeutic proteins, peptides, or small molecules to enhance their pharmacokinetic properties. The PEGylation process improves solubility, stability, and half-life, while reducing immunogenicity and proteolytic degradation. This technology has applications across biopharmaceuticals, including cancer therapy, enzyme replacement therapy, and chronic disease management, and plays a critical role in improving drug efficacy and patient compliance.

Increasing chronic and oncology indications continue to promote the use of PEGylated biologics, and authoritative data in 2024 reinforces this trend. Innovation cycle Regulators bolstered the innovation cycle in 2024, FDA approved 50 new drugs, citing a record 18 biosimilars, further enhancing biologics access and lifecycle management of long-acting products. CDC Developers are prioritizing the PEGylation transition to site-specific as a means of maintaining full activity to reach homogenous conjugates in favor of more precise dosing across oncology and autoimmune pipelines. Furthermore, the increasing payer attention to decreased infusion burden and clinic time also benefits long-acting injectables based on PEGylation chemistry, enhancing a demand-side driver at the end of 2024.

(Source: https://bdmai.org)

PEGylation Proteins Technology Market Growth Factors

- Rising Demand for Advanced Biologics: Growing reliance on biologics and biosimilars is fuelling the adoption of PEGylation for enhanced stability and therapeutic efficacy.

- Boosting Clinical Trial Activity in Oncology: Expanding oncology pipelines and trial enrollments are propelling the development of PEGylated protein-based therapies.

- Driving Preference for Long-Acting Formulations: Patient-centric treatment models are driving demand for PEGylation-enabled drugs that reduce dosing frequency.

- Growing Investment in Conjugation Chemistry R&D: Increased funding in site-specific PEGylation techniques is boosting innovation and product pipelines.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 9.17 Billion |

| Market Size in 2025 | USD 4.89 Billion |

| Market Size in 2024 | USD 4.56 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Protein, PEGylation Technology, Therapeutic Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Will the Growing Demand For Advanced Drug Delivery Systems Accelerate PEGylation Adoption?

Growing demand for advanced drug delivery systems is anticipated to accelerate the market growth in the coming years. Controlled release and increased drug solubility to achieve more precise therapy are a focus in the pharmaceutical field. PEGylation technology improves the stability of proteins, immunological silencing, and increases circulation time. In 2024, the FDA Center for Drug Evaluation and Research (CDER) approved 50 new medicines, with 74% approved in the first review cycle, and achieved FDA performance goals in 94% of cases, demonstrating growing openness to new delivery methods.

Clinical investigators note that by year-end 2024, the FDA received 38 PEGylated drug products across different disease indications, which points to increasing confidence in PEGylation strategies. Biopharma developers also refined their drug-delivery portfolio with FDA registration of new PEG conjugation reagents, such as HZ-PEG-HZ in 2025, signifying their readiness to engage next-generation formulations. Furthermore, the growing trend positions PEGylation as a critical technology in addressing the expanding global disease burden, especially in regions with aging populations and limited healthcare access.

(Source: https://www.fda.gov)

(Source: https://aiche.onlinelibrary.wiley.com)

(Source: https://www.biochempeg.com)

Restraint

Competition from Alternative Drug Delivery Technologies Anticipated to Limit Growth Potential

Widespread adoption because of competition from alternative technologies is anticipated to limit the growth of the PEGylation proteins technology market. New methods like lipid nanoparticle, albumin fusion, glycosylation optimization, and conjugation to bio-degradable polymers. They provide long half-life effects without the same concerns arising in PEGylation. Bio companies are putting these platforms to the test as a way to differentiate pipelines and avoid PEG regulatory attention. Additionally, the hamper market growth due to high manufacturing complexity is anticipated to limit expansion.

Opportunity

Surging Investment in Biologics Research Is Driving Innovation in PEGylation Technologies

Surging investment in biologics research is projected to strengthen market growth and further create immense opportunities for the players competing in the PEGylation proteins technology market. PEGylation strategies are developed through synergism across academia, biotech startups, and multinational companies to enhance the PEGylation methodologies and clinical translation. Strong research momentum and commercial interest. Patent filings on PEYlated molecules are at a steady increase, and are displaying strong research potential and commercial activity trend. The use of the altered therapies in more therapeutic areas will be accelerated in pipeline development. (Source: https://www.mdpi.com)

FDA-approved 16 biologics in 2024, 32% of the total drugs approved, and a higher percentage than in the previous years, reflecting an increasingly shrinking focus on protein-based therapeutics taking advantage of PEGylation methods, MDPI. Scientists obtain NIH grants to investigate PEGylation innovation, such as in October 2024, a 2-year NIH grant was used to develop zwitterionic PEG (ZPEG) to promote prolongation of circulation and reduce immunogenicity at Drexel University. Moreover, the spurring regulatory approvals for PEGylated drugs are likely to support market expansion.(Source: https://drexel.edu)

Type of Protein Insights

Why Does the Monoclonal Antibodies Segment Hold the Backbone of the PEGylation Proteins Technology Market?

The monoclonal antibodies segment dominated the PEGylation proteins technology market in 2024, accounting for an estimated 35%, due to their increasing clinical use in oncology, autoimmune diseases, and the therapy of rare diseases. PEGylation improves the pharmacokinetic properties of monoclonal antibodies, which increases serum half-life and decreases clearance rates and the efficacy of treatment.

Multiple biologics based on monoclonal antibodies were approved in 2024 by global regulators, including the EMA and FDA, and many of them used PEGylation to enhance dose schedules. In 2024, the U.S. FDA greenlit more than 15 monoclonal antibody therapeutic programs, which shows a rise in the innovation of biologics in the sphere of cancer and immunology. Furthermore, drug majors such as Roche, Amgen, and Novartis have focused on the PEGylated monoclonal antibody pipeline to meet the increasing demand for targeted biologics.

The enzymes segment is expected to grow at the fastest rate in the coming years, owing to the powerful research and clinical interest. Enzyme PEGylation increases stability at physiologic pH, sustains resistance to proteolytic degradation, and increases the life span of a treatment. This gives them appeal in the treatment of enzyme-deficiency conditions, oncology, and metabolic illnesses. Additionally, the increasing number of enzyme-based PEGylated drugs to be used as reliable and/or extendable therapies, making enzymes a key market growth mechanism in this market.

PEGylation Technology Insights

How Is Linear PEGylation Maintaining Its Dominance in Shaping the PEGylation Proteins Technology Market?

Liner PEGylation segment held the largest revenue share in the PEGylation proteins technology market in 2024, accounting for 40%, as it requires less chemistry, is less costly to produce, and has displayed compatibility with various therapeutic proteins. PEGylation Linear PEGylation PEGylation enhances the circulation half-life and decreases immunogenicity in biologic agents, and is appealing to monoclonal antibodies, cytokines, and enzymes of interest.

Amgen, Roche, and Pfizer are pharmaceutical innovators that all made significant investments in linear PEGylation-based formulations to improve therapeutic profiles and to extend product life-cycles. Annually beginning in 2024, the Center for Drug Evaluation and Research (CDER) of the U.S. FDA has reported that 10 or more new PEGylated biologics were in clinical trials under IND applications, many of which would use linear PEG structures to make them efficient to manufacture. Furthermore, these are the attributes that made linear PEGylation the most popular technology segment, which is widely applied to most biopharmaceutical pipelines.

(Source: https://www.fda.gov)

Site-specific PEGylation segment is expected to grow at the fastest CAGR in the coming years, as there is increasing interest in precision-driven alterations. Such an approach allows site-specific PEGylation of predetermined locations of a protein to provide enhanced uniformity, stability, and activity and reduce the associated structural change. Additionally, the rising need for specific therapies and very stable biologics is expected to compel site-specific PEGylation toward a greater growth driver over the forecast period.

Therapeutic Application Insights

Why Is Oncology Anticipated to Anchor the PEGylation Proteins Technology Market Growth Trajectory?

The oncology segment dominated the PEGylation proteins technology market in 2024, with a market share of about 30%, due to the prevalence of cancer globally. The need to utilize a well-functioning biologics scaffold made oncology the most prominent usage area of PEGylated proteins. Pegfilgrastim, peginterferon alfa-2b, and PEG-asparaginase are used as PEGylated drugs to increase half-life and reduce the lack for daily dosing and patient compliance in long-lasting chemotherapy regimens.

Cancer is the second-leading cause of death in the world, according to the World Health Organization 2024 report, with an alarming number of nearly 10 million deaths every year. This further highlights the importance of developing more pharmacokinetically clean and tolerable therapies. Furthermore, the increasing investments in combination therapies, specifically immuno-oncology, are projected to further increase the dependence on PEGylated oncology biologics, entrenching the dominance of oncology in this segment.(Source: https://www.who.int)

The autoimmune disorders segment is expected to grow at the fastest rate in the coming years. PEGylated proteins have several important advantages in treating chronic inflammatory diseases through the increased binding to immunogenicity, extension of drug stability, and reduced dosing frequency.

PEGylated TNF inhibitors, including certolizumab-pegol and PEG-interferon beta, are common not only in rheumatoid arthritis, Crohn's disease, and multiple sclerosis. They are also likely to gain popularity as the market is demanding longer-acting drugs. Additionally, the site-specific PEGylation strategies are advancing efficacy in autoimmune therapeutics with enzyme retaining activity but with low toxicity in the system, thus further boosting the segment in the coming years.

End-User Insights

How Are Pharmaceutical Companies Driving Leadership in the PEGylation Proteins Technology Market?

The Pharmaceutical Companies segment held the largest revenue share in the PEGylation proteins technology market in 2024, accounting for a 45% share, due to its widespread use of PEGylated proteins in both large-scale drug development and commercialization initiatives, which made it dominant. International companies included PEGylation in therapeutic pipelines to increase drug half-life, decrease the dosing requirements, and improve the competitiveness of products.

IFPMA 2024 report estimates that more than 65% of approved biologics that have been submitted to lifecycle management initiatives include PEGylation to perpetuate clinical relevance and expand market exclusivity. Those products have advanced into priority review or accelerated approval, which signifies regulatory faith in PEGylation-induced drug safety and efficacy. Furthermore, the PEGylation was reported to represent almost one-third of all protein modifications owing to its increasing potential to augment biologics based on data reported in the European Medicines Agency.(Source: https://aiche.onlinelibrary.wiley.com)

The CROs segment is expected to grow at the fastest CAGR in the coming years, owing to the increasing trend of outsourcing in preclinical and clinical studies. The CROs are improving their service capability through the adoption of advanced conjugation platforms and site-specific PEGylation technology. Moreover, outsourcing PEGylation projects helps to speed up the time frame of drug discovery and increases the flexibility in manufacturing biologics.

PEGylation Proteins Technology Market Companies

- Acrux Limited

- Alder Biopharmaceuticals

- Biocon Limited

- BioMarin Pharmaceutical Inc.

- Boehringer Ingelheim International GmbH

- Catalent, Inc.

- CordenPharma International

- Cytograft Tissue Engineering, Inc

- Lonza Group AG

- Merck KGaA (MilliporeSigma)

- Nektar Therapeutics

- Novo Nordisk A/S

- PegBio Co., Ltd.

- Polymun Scientific Immunbiologische Forschung GmbH

- ProBioGen AG

- Samsung Biologics Co., Ltd.

- Sartorius AG

- Shire (Takeda)

- Thermo Fisher Scientific, Inc.

- WuXi AppTec Co., Ltd.

Recent Developments in the PEGylation Proteins Technology Market

- In May 2025, BASF Industrial Formulators has strengthened its reactive polyethylene glycol (PEG) portfolio in Europe with the launch of Pluriol A 2400 I, an isoprenol-PEG (iPEG) tailored for polycarboxylate ethers (PCE) in the construction sector. The new product enables the development of third-generation superplasticizers, offering enhanced flow performance and long-term durability. According to Jordi Tormo, Vice President of Business Management Industrial Formulators, BASF is now the only European supplier of iPEG, ensuring reliable supply through a backward-integrated manufacturing process. He added that local sourcing of Pluriol A 2400 I not only strengthens raw material independence but also contributes to reducing COâ‚‚ emissions across the value chain.

(Source: https://www.basf.com) - In May 2025, Bayer announced that the U.S. Food and Drug Administration (FDA) had approved Jivi, a recombinant DNA-derived extended half-life factor VIII concentrate, for use in pediatric patients aged 7 years and above with hemophilia A (congenital Factor VIII deficiency). The decision is based on findings from the Alfa-PROTECT and PROTECT Kids clinical trials, which confirmed the safety and efficacy of Jivi in children between 7 and 12 years of age with severe hemophilia A. Bayer emphasized that this milestone highlights its commitment to advancing treatment options for the global hemophilia community by providing innovative therapies that reduce treatment burden.(Source: https://www.bayer.com)

- In July 2024, Huateng Pharma, a leading global supplier of PEG derivatives and a contract development and manufacturing organization (CDMO) for APIs and intermediates, introduced its latest breakthrough product: Y-Shape PEG NHS, a branched 2ARM Succinimidyl Carboxymethyl Ester designed for efficient amine PEGylation. The novel derivative reacts rapidly with lysine amino groups on proteins and biologics, significantly enhancing water solubility, biocompatibility, and therapeutic performance of modified molecules. Easily soluble in aqueous buffers, the Y-Shape PEG NHS ester simplifies the PEGylation process for proteins and other biologics, reinforcing its role as a critical enabler in advanced protein drug development.(Source: https://www.clinicalresearchnewsonline.com)

Segments Covered in the Report

By Type of Protein

- Monoclonal Antibodies (mAbs)

- Enzymes

- Cytokines & Growth Factors

- Peptides

- Other Therapeutic Proteins

By PEGylation Technology

- Linear PEGylation

- Branched PEGylation

- Site-Specific PEGylation

- Random PEGylation

- Other Methods

By Therapeutic Application

- Oncology

- Infectious Diseases

- Cardiovascular Disorders

- Autoimmune Disorders

- Diabetes

- Other Therapeutic Areas

By End-User

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Research Organizations (CROs)

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting