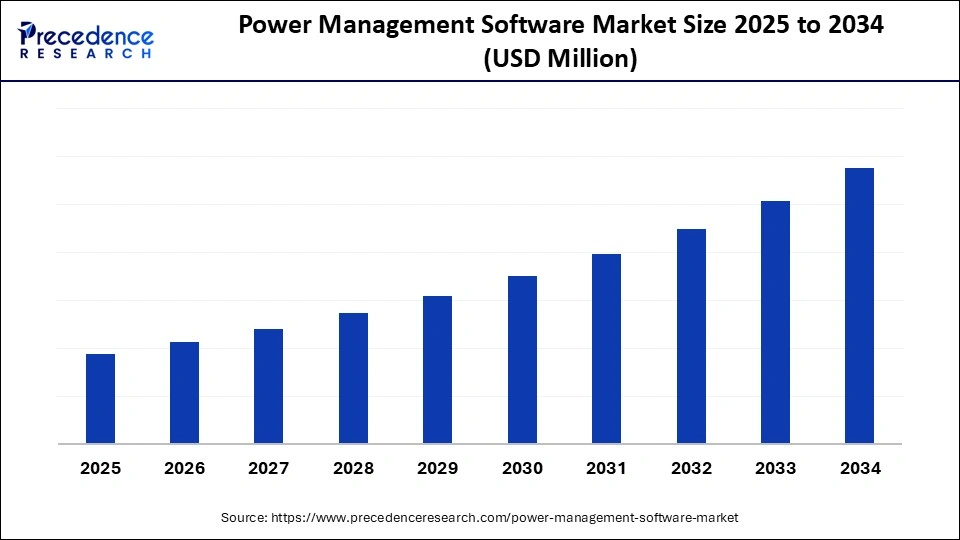

What is the Power Management Software Market Size?

The global power management software market is driven by growing adoption of smart energy monitoring and optimization systems across industries.The growth of the power management software market is driven by rising energy efficiency demands, smart grid adoption, and the integration of renewable energy systems.

Power Management Software Market Key Takeaways

- North America dominated the global power management software market with the largest share of 42.5% in 2024.

- Asia Pacific is expected to expand at a 6.5% CAGR throughout the forecast period.

- By component, the software segment led the market while holding a 52.5% share in 2024.

- By component, the services segment is expected to grow at a 6.8% CAGR in the coming years.

- By deployment mode, the on-premises / private cloud segment captured a 67.5% revenue share in 2024.

- By deployment mode, the cloud/SaaS segment is expected to expand at a 6.7% CAGR throughout the forecast period.

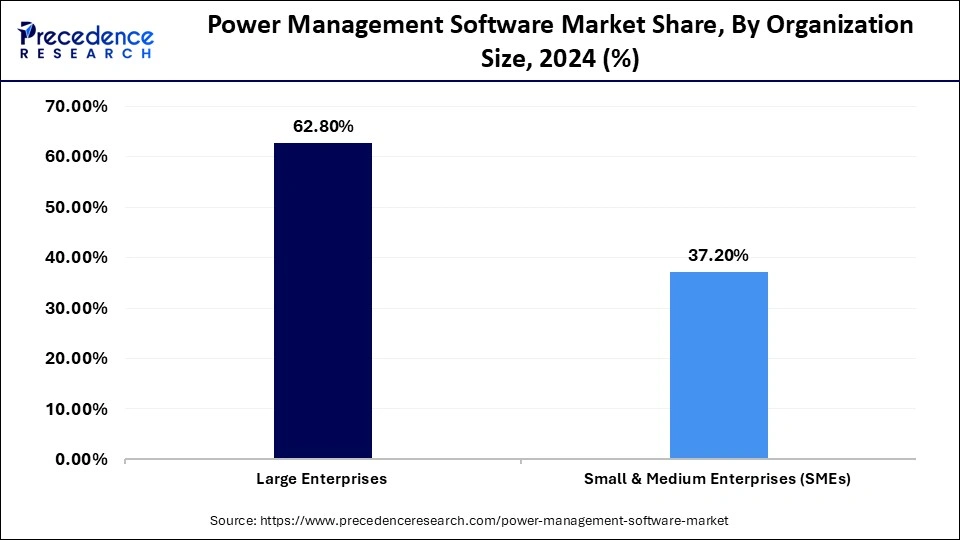

- By organization size, the large enterprises segment led the market while holding a 62.8% share in 2024.

- By organization size, the small & medium enterprises (SMEs) segment is expected to grow at a 6.4% CAGR between 2025 and 2034.

- By application, the data centers segment held a 35.8% share of the market in 2024.

- By application, the industrial & manufacturing segment is expected to grow at a 6.7% CAGR in the coming years.

- By end-user, the IT & telecommunications segment led the market while holding a 35.8% share in 2024.

- By end-user, the manufacturing & industrial segment is expected to expand at a 7.0% CAGR over the forecast period.

What is Power Management Software?

Power management software comprises software solutions that monitor, control, analyze, and optimize the generation, distribution, consumption, and quality of electrical power across assets, facilities, and grids. Examples include energy management systems (EMS/BEMS/IEMS), data-center power & DCIM software, demand response and load-shedding controls, distribution management / grid-edge orchestration, power analytics, and software that interfaces with power electronics and power management hardware. These solutions enable improved energy efficiency, reduced costs, real-time visibility, and automated control across industrial, commercial, utility, and data-center environments.

Power management software is critical for facilitating effective energy use, automated operations, and intelligent control across various industries, including utilities, manufacturing, data centers, and business infrastructure. These software systems combine real-time monitoring, predictive analytics, and automated controls to control power consumption, energy waste, and ensure grid stability. It covers the spectrum of applications, including energy management systems (EMS), building energy management systems (BEMS), data center infrastructure management (DCIM), and industrial energy optimization applications, all of which guarantee efficient and cost-effective operations.

The power management software market is experiencing robust growth due to rising energy prices, increased use of IoT and AI tools, and sustainable tendencies worldwide. The growth in renewable energy production and electric mobility has also generated the need to have intelligent energy orchestration and demand-response functionality. Moreover, industries are moving to cloud-based power management systems, which are scalable, offer remote accessibility, and feature advanced analytics that enable maintenance prediction and performance optimization.

Key Technological Shifts in the Power Management Software Market Driven By AI

The application of AI-driven tools in power management is grounded in real-time data from sensors, meters, and connected devices to forecast energy demand, detect anomalies, and optimize the automated distribution of power. In data centers and industrial environments, AI algorithms enhance load balancing, identify inefficient equipment, and enable predictive maintenance, thereby reducing operational costs and minimizing system outages.

Furthermore, the integration of AI with cloud computing and edge analytics enables scalable, flexible power management across complex infrastructures. As the use of renewable energy sources rises, AI-powered energy orchestration supports grid stability and facilitates dynamic energy pricing models. Overall, AI is transforming power management software from reactive monitoring tools into proactive, autonomous systems that drive sustainability, reliability, and operational intelligence across global energy networks.

Power Management Software Market Outlook

- Market Growth Overview: The power management software market is expanding rapidly due to the rising emphasis on energy efficiency, the adoption of smart grid technologies, and the growing automation of industrial processes. To simplify energy consumption and reduce operational costs globally, organizations are increasingly adopting AI, IoT, and cloud-based systems.

- Global Expansion: The market is witnessing strong growth across North America, Europe, and the Asia-Pacific, driven by supportive government initiatives, the integration of renewable energy sources, and the ongoing digitization of key industrial sectors. Emerging markets are also increasing their investments in intelligent energy infrastructure, offering software vendors significant opportunities for international expansion.

- Key Investors: Major investors include venture capital firms, energy companies, and global technology leaders such as Siemens, Schneider Electric, and Microsoft. These players are actively investing in AI-driven energy optimization platforms, cloud-based analytics, and smart grid software to enhance both sustainability and operational efficiency.

- Startup Ecosystem: Startups are focusing on areas like AI-powered energy analytics, predictive maintenance, and IoT-based monitoring systems. Innovations in renewable energy management, microgrid control, and enterprise-level energy solutions are being supported by accelerators and incubators, fostering a dynamic startup ecosystem that complements established players and accelerates technological advancement.

What Factors are Fueling the Growth of the Power Management Software Market?

- Increasing Energy Efficiency Demand: The escalating energy costs and increased requirements for efficiency are driving organizations to adopt power management software that monitors and manages the power usage, reduces wastage, and enhances the sustainability levels in industrial, commercial, and data center facilities.

- Demand for Renewable Energy Sources :The increasing trend of shifting towards renewable energy, such as solar and wind energy, highlights the need for intelligent software that balances fluctuating energy sources, maintains grid stability, and optimizes available distributed energy resources through predictive and automated control systems.

- Adoption of Digitalization and IoT: The growth of IoTs, sensors, and AI-driven analytics can enhance the transparency, dependability, and reactiveness of power systems, thereby accelerating the adoption of advanced power management platforms.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Mode, Organization Size, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Energy Efficiency and Smart Infrastructure

Industries, utilities, and data centers are being forced to reduce energy consumption, operational costs, and carbon emissions. Power management software allows organizations to trace, regulate, and optimize real-time energy consumption, thereby meeting state requirements and corporate ESG objectives. The tendency to use IoT, AI, and automation technologies will enhance analytics and energy forecasts, making these systems inseparable in integrating smart infrastructure and renewable energy. The proliferation of electric vehicles (EVs) and distributed energy resources (DERs) is also creating new possibilities of dynamic load management and grid-edge intelligence. As nations invest in smart grids and digital transformation programs, the demand for intelligent, connected, and adaptive power management platforms is continuously growing, leading to market expansion.

Restraint

High Implementation Costs and Integration Complexity

The power management software market has strong growth potential, but there are challenges associated with the high costs of deployment and the complexity of system integration. The utilization of advanced power management systems will require significant investments in equipment, software, and qualified technical personnel. These expenses can make small and medium-sized businesses a big discouragement. Additionally, implementing power management software with existing infrastructure and various energy systems may require specific customization, which can prolong the deployment process and increase maintenance costs. The issue of interoperability and cybersecurity is also a hindrance to adoption, particularly in sensitive operations industries.

Opportunity

Rising Demand for Intelligent Energy Optimization

The power management software market offers opportunities as the need for energy efficiency, cost saving, and sustainable operation in the industries and utilities is increasing. Organizations are experiencing increasing pressure to optimize energy consumption, as the cost of electricity rises, environmental policies become stricter, and as a means to ensure corporate sustainability. The movement is creating a successful software solutions market to provide real-time monitoring and predictive analytics, and automated control within industrial plants, commercial buildings, data centers, and utility grids. Market potential is further increased due to the shift to renewable energy sources and distributed power resources. To balance variable generation, control peak loads in the market, and maintain grid stability, intelligent energy orchestration is necessary. The technological advancements, enabling policies, and sustainability-driven approaches make the market a high-potential industry for both existing and new players worldwide.

Segment Insights

Component Insights

Why Did the Software Segment Lead the Market in 2024?

The software segment led the power management software market while holding a 52.5% share in 2024. This is primarily due to the growing adoption of smart energy monitoring, automation, and advanced analytics across industries, commercial enterprises, and utilities. Organizations increasingly leverage these software platforms to gain real-time visibility into energy consumption, detect inefficiencies, and implement predictive maintenance strategies.

The integration of AI, IoT, and cloud computing further enhances these capabilities, enabling remote decision-making and dynamic optimization of energy use. The shift toward renewable energy sources and the proliferation of multi-site, distributed power systems have also heightened the importance of software solutions that can manage complex grids and distributed energy resources (DERs).

The services segment is expected to expand at a CAGR of 6.8% during the projection period, driven by rising demand for implementation, integration, and maintenance of advanced energy systems. There is a notable surge in demand for professional services such as system configuration, data analytics consulting, and energy audits, as organizations adopt more sophisticated power management frameworks. Managed services are also gaining traction, as enterprises outsource their energy monitoring and optimization needs to specialized providers to enhance performance and reduce operational costs.

Moreover, integrating modern cloud-based platforms with legacy infrastructure presents technical challenges that necessitate professional support. The rise of smart grids, electric mobility, and renewable energy integration is creating continuous service opportunities in customization, real-time monitoring, and adaptive energy optimization.

Deployment Mode Insights

What Made On-Premises / Private Cloud the Dominant Segment in the Market?

The on-premises / private cloud segment dominated the power management software market with a 67.5% share in 2024, driven by organizations' preference for secure, customized, and highly controlled energy management environments. Critical infrastructure sectors such as power grids, manufacturing plants, and data centers prioritize data sovereignty, low-latency processing, and system reliability, requirements better fulfilled through on-premises or private cloud deployments. These configurations ensure compliance with stringent cybersecurity standards and regulatory mandates while addressing specific operational needs. Additionally, industries with legacy systems find easier integration with private clouds or hybrid models, as opposed to full cloud migration.

The cloud / SaaS segment is expected to expand at a 6.7% CAGR over the forecast period, fueled by the benefits of remote access, real-time monitoring, and centralized control across distributed facilities. The subscription-based model lowers upfront costs, making cloud solutions attractive for small and medium-sized enterprises seeking digital transformation without heavy infrastructure investment. Furthermore, cloud-based services leverage AI, IoT, and big data analytics to enhance forecasting accuracy, automation, and predictive maintenance. Cloud deployments also allow seamless upgrades, integration of smart devices, and improved communication across multiple locations, thus driving broader adoption.

Organization Size Insights

Why Did the Large Enterprises Segment Hold the Largest Market Share in 2024?

The large enterprises segment held about 62.8% share of the power management software market in 2024. Large corporations, including manufacturing plants, utilities, and data centers, demand sophisticated energy management systems capable of supporting complex, multi-location operations and handling vast volumes of data. To optimize performance, minimize downtime, and meet sustainability goals, these organizations are heavily investing in digital transformation initiatives that incorporate AI, IoT-enabled power management, and analytics-driven solutions.

Additionally, stringent environmental and regulatory compliance requirements drive the adoption of integrated software systems for real-time environmental monitoring, preventive maintenance, and carbon emissions tracking. Their financial capacity also enables them to implement tailored on-premises or hybrid solutions that ensure data security and seamless integration with legacy systems.

The small and medium enterprises (SMEs) segment is expected to grow at a 6.4% CAGR in the upcoming period, driven by increasing awareness of energy efficiency and cost-saving benefits. SMEs are gradually adopting power management software to streamline operations, reduce energy costs, and advance sustainability efforts without requiring substantial capital expenditure. The availability of affordable, cloud-based, subscription models has lowered entry barriers, making these solutions accessible to smaller organizations.

Moreover, government incentives and evolving energy optimization mandates are encouraging SMEs to upgrade their power infrastructure. With the growing use of IoT devices, SMEs are also implementing data analytics and remote monitoring tools to gain real-time energy insights and improve operational efficiency.

Application Insights

What Made Data Centers the Dominant Segment in the Power Management Software Market?

The data centers segment dominated the market while holding a 35.8% share in 2024, driven by the increasing demand for energy efficiency and reliable power infrastructure to support digitalization and cloud computing. As the largest consumers of electricity, data centers require optimized energy management to control costs and achieve sustainability goals. Power management software enables data centers to monitor power consumption efficiency, optimize cooling requirements, predict energy needs, and prevent downtime through intelligent automation and advanced analytics.

The integration of AI and IoT enhances visibility over distributed assets, ensuring continuous operation and effective energy distribution. With the global shift towards hyperscale and edge data centers, coupled with mounting ESG and carbon reduction mandates, operators are increasingly adopting advanced energy management solutions.

The industrial & manufacturing segment is expected to grow at a 6.7% CAGR in the coming years, propelled by a focus on energy efficiency, cost reduction, and sustainability. Power management software is becoming standard practice in these sectors for monitoring equipment performance, managing peak loads, and minimizing energy wastage in production facilities. Integration with automation systems, IoT sensors, and predictive analytics facilitates real-time decision-making and preventive maintenance, thereby reducing operational downtime.

Manufacturers leverage these tools to optimize energy consumption, maximize asset utilization, and comply with environmental regulations. Driven by commitments to carbon neutrality and production efficiency, the industrial and manufacturing sector is poised for sustained growth in the global power management software market.

End-User Insights

Why Did the IT & Telecommunications Segment Lead the Market in 2024?

The IT & telecommunications segment led the power management software market while holding a 35.8% share in 2024, driven by the rapid expansion of online infrastructure, data centers, and 5G networks globally. Power management software enables IT and telecom operators to monitor energy consumption across network facilities, optimize load distribution, and prevent outages through real-time analytics and automated controls. The increasing deployment of AI, edge computing, and cloud-based services has escalated energy demands, making intelligent power optimization critical for operational resilience and cost reduction.

Additionally, the sector's growing commitment to sustainability and carbon neutrality aligns with the adoption of power management solutions aimed at minimizing emissions and enhancing efficiency. Given the surging data traffic and connectivity requirements worldwide, the IT and telecommunications industry remains a major end-user of advanced power management technologies.

The manufacturing & industrial segment is expected to grow at a 7.0% CAGR over the projected period, fueled by rising interest in operational efficiency, sustainability, and Industry 4.0 initiatives. Power management software assists manufacturers in monitoring real-time energy usage, reducing waste, and optimizing power distribution across production lines. The integration of IoT, automation, and predictive analytics improves energy visibility, enabling early fault detection and performance optimization. As industries transition to smart factories, digital power management systems are increasingly embedded within manufacturing ecosystems to maximize asset utilization and ensure uninterrupted operations. Moreover, escalating energy costs and stricter government sustainability mandates are compelling manufacturers to adopt intelligent energy management solutions to reduce carbon emissions and comply with regulations.

Regional Insights

What Made North America the Dominant Region in the Global Power Management Software Market?

North America dominated the global power management software market, commanding a leading share of 42.5% in 2024, driven by its advanced energy infrastructure, rapid adoption of digital technologies, and robust regulatory frameworks. Rising energy costs and an increasing focus on sustainability have compelled enterprises and utilities to implement intelligent power management solutions for real-time monitoring, energy optimization, and predictive maintenance. The region's leadership is further reinforced by significant investments in smart grid development, renewable energy integration, and digital transformation initiatives across commercial and industrial sectors. Continuous technological advancements, coupled with favorable policy support, are expected to stimulate market growth and innovation throughout the forecast period.

The U.S. plays a pivotal role in this dominance, supported by federal and state-level policies that incentivize energy efficiency, demand-response programs, and renewable energy mandates. Leading technology vendors and startups are rapidly developing cloud-based, AI-driven, and edge-optimized solutions tailored for large enterprises, utilities, and data centers. Additionally, the country's strong emphasis on ESG compliance, alongside growing attention to carbon footprint reduction and energy cost management, is accelerating adoption across IT, telecommunications, manufacturing, and commercial industries.

Why is Asia Pacific Considered the Fastest-Growing Region in the Power Management Software Market?

Asia Pacific is expected to expand at the fastest CAGR of 6.5% throughout the forecast period, driven by rapid industrialization, urbanization, and increasing energy demand. Key economies such as China, India, Japan, and South Korea are heavily investing in smart infrastructure, renewable energy integration, and industrial automation, thereby fueling strong demand for advanced power management solutions. The expanding network of data centers, manufacturing plants, and commercial complexes in the region requires efficient energy monitoring, predictive maintenance, and automated load control to optimize operational costs and improve sustainability. Government initiatives focused on enhancing energy efficiency, reducing carbon emissions, and promoting digitalization further bolster market.

China stands out as a major growth engine within the region, supported by ambitious renewable energy targets, large-scale smart grid projects, and the rapid expansion of data centers and industrial facilities. Government policies encouraging green energy adoption, energy storage solutions, and industrial IoT deployment are driving both local and international vendors to accelerate power management software implementation. Moreover, the integration of AI and cloud technologies in China's energy systems enhances real-time monitoring and predictive analytics capabilities, contributing to greater operational efficiency and grid stability.

Country-Level Investments & Funding Trends for the Power Management Software Market

- U.S.: The U.S. is a major investor in smart grid infrastructure, renewable energy adoption, and data center energy efficiency. Leading industry players such as Schneider Electric, Siemens, Eaton, and ABB have received significant funding to develop AI- and cloud-based power management solutions aimed at reducing operational costs, improving energy utilization, and supporting long-term sustainability goals.

- Germany: Companies like Siemens, Schneider Electric, Bosch, and ABB are actively financed to advance smart grid integration, industrial automation, and energy optimization software. These efforts are driven by Germany's strong focus on industrial efficiency and strict environmental compliance standards, making it a leader in sustainable energy management practices.

- China: China's rapid urbanization, development of smart cities, and expansion of renewable energy infrastructure have led to increased investments in power management technologies. Key vendors such as Huawei, State Grid Corporation, Schneider Electric, and Siemens are leveraging government support to deploy AI-driven monitoring systems, predictive maintenance tools, and grid-edge technologies to boost energy efficiency and sustainability across sectors.

- Japan: Japan continues to invest heavily in industrial automation, data center efficiency, and overall energy conservation. Leading companies such as Toshiba, Hitachi, Mitsubishi Electric, and Yokogawa are supported in delivering AI-based analytics platforms, intelligent load control, and predictive maintenance solutions to help organizations reduce energy consumption and comply with national energy regulations.

Power Management Software Market Value Chain Analysis

- Research & Development (R&D) and Technology Innovation: This stage involves the conceptualization and development of core technologies that power management software relies on, such as AI algorithms, IoT integration, edge computing, and advanced data analytics. R&D also includes innovation around user interfaces, interoperability with hardware systems, and cybersecurity frameworks, all of which ensure the software remains scalable, accurate, and secure.

- Software Design & Architecture: At this stage, companies architect software platforms that meet the energy efficiency needs of different end-user segments such as industrial, commercial, and utility-scale environments. This includes building modular platforms capable of integrating with existing energy systems, developing customizable dashboards, enabling load forecasting, and supporting real-time data acquisition and analytics.

- Deployment & Customization: This phase covers the deployment of the software solution within customer environments, often involving customization based on industry-specific needs or infrastructure complexity. At this stage, service providers often offer energy audits, system sizing, interface development, and KPI configurations to align the solution with business objectives like ESG compliance, cost reduction, or resilience.

- Maintenance, Support & Upgrades: Post-deployment support is critical to ensure uninterrupted performance and cybersecurity. This includes regular updates, patch management, cloud backups, performance optimization, and on-call technical support. With rapid innovation in energy tech, providers also need to offer upgrade paths, such as enabling integration with renewable sources, EV chargers, or AI co-pilots, to future-proof client systems and maintain long-term relationships.

Major Players in the Power Management Software Market & Their Offerings

Tier I: Market Leaders

These companies dominate the market through broad portfolios, global operations, deep domain expertise, and integrated hardware + software + services offerings.

| Company | Key Offerings / Strengths in PMS Market |

| Schneider Electric | Strong global footprint, integrated energy management & automation solutions, and software platforms for power monitoring, grid control, and building energy optimization. |

| Siemens | Combines industrial automation, smart grid technologies, and software analytics capabilities to deliver scalable energy management systems. |

| General Electric (GE Digital) | Offers software for grid applications, industrial energy use analytics, and integration with large infrastructure operations. |

| ABB | Provides power management solutions tied to electrification, grid control, and industrial automation systems. |

| Honeywell | Leverages its experience in process control, building systems, and energy efficiency software in industrial and infrastructure settings. |

Tier II: Established Players

These firms are significant players with strong presence in particular segments or regions, often adding complementary modules or niches to their core offerings.

| Company | Key Offerings / Strengths in PMS Market |

| Eaton | Power distribution and energy management modules for industrial and commercial infrastructure. |

| Emerson Electric | Solutions for process industries, combining software for power analytics with control systems. |

| Rockwell Automation | Industrial automation platform that integrates energy management capabilities for factories. |

| Mitsubishi Electric | Energy management software for buildings, industry, and infrastructure, particularly in Asia. |

| Johnson Controls | Specializes in building systems, HVAC control, and energy optimization software for commercial real estate. |

Tier III: Emerging & Niche Players

These are smaller, specialized or regional firms, often innovating in specific modules (e.g. analytics, optimization, demand response) or emerging markets.

| Company | Key Offerings / Strengths in PMS Market |

| ETAP | Power systems analysis software, focused on power networks modeling and energy optimization. |

| Fuji Electric | Energy management & control systems with strong presence in parts of Asia. |

| Larsen & Toubro (L&T) | Engineering + digital solutions in emerging markets with local deployments of energy software. |

| Yokogawa Electric | Instrumentation + process control + energy analytics in industrial sectors. |

| Innovative start-ups / regional vendors | Focused on cloud-native, AI powered or IoT-driven energy management tools in smaller geographies or niche verticals. |

Recent Developments

- In February 2025, Eaton announced innovative smart power management solutions, highlighting their energy efficiency and intelligent power management. The company specializes in power management technologies for the industrial and commercial sectors, focusing on sustainable and customer-centric solutions.(Source: https://equipmenttimes.in)

- In July 2024, Siemens collaborated with Microsoft to connect its Simatic Energy Management System to the Azure IoT, enabling real-time monitoring, analysis, and optimization of energy use. This cooperation aims to develop more efficient energy management capacities of industries and utility companies.(Source: https://digitalisationworld.com)

- In June 2023, Nordic Semiconductor developed the nPM1300tm Power Management IC, featuring efficient buck converters, LDOs, and built-in battery charging. The solution minimizes the Bill-of-Materials by combining several components into a single, small chip to serve battery-operated gadgets.(Source: https://www.nordicsemi.com)

Exclusive Analysis

The power management software market is undergoing a paradigm shift, catalyzed by a confluence of macroeconomic sustainability mandates, digital industrial transformation, and grid decentralization. As organizations recalibrate their operational models to align with ESG frameworks and decarbonization imperatives, PMS solutions have emerged as pivotal enablers of intelligent, autonomous energy orchestration across multi-asset infrastructures.

The market is experiencing secular tailwinds driven by the proliferation of AI-embedded systems, edge computing, and IoT-integrated microgrid ecosystems, especially within hyperscale data centers, energy-intensive manufacturing, and distributed renewable portfolios. Increasing regulatory scrutiny over carbon disclosure and energy benchmarking is accelerating the adoption of cloud-native and hybrid PMS platforms that offer real-time analytics, load optimization, predictive diagnostics, and cyber-secure demand response capabilities.

While legacy systems still constrain full-scale modernization, this challenge is simultaneously fostering a robust opportunity for software vendors to offer modular, interoperable solutions with minimal disruption to existing architecture. Moreover, emerging markets in Asia Pacific, MENA, and Latin America are demonstrating rapid digital infrastructure growth, representing a greenfield opportunity for PMS providers to establish footprint via public-private partnerships and utility decarbonization initiatives.

The long-term trajectory of the market is defined by the convergence of power intelligence with smart grids, EV integration, and AI-governed energy trading systems. In this context, vendors who can deliver scalable, API-friendly platforms that transcend mere monitoring and offer prescriptive and autonomous energy management are poised to capitalize on the growing demand for digital energy resilience, cost optimization, and sustainable growth.

Segments Covered in the Report

By Component

- Software

- Hardware

- Services

By Deployment Mode

- On-Premises / Private Cloud

- Cloud / SaaS

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Application

- Data Centers

- Industrial & Manufacturing

- Commercial & Building Automation

- Utilities & Distribution Grid

- Residential

- Microgrids & Renewable Integration

By End-User

- IT & Telecommunications

- Manufacturing & Industrial

- Commercial Real Estate / Buildings

- Utilities & Grid Operators

- Healthcare, BFSI, Retail, Transportation

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting