6G-Enabled Industrial Microservices Market Revenue and Forecast by 2033

6G-Enabled Industrial Microservices Market Revenue and Trends 2025 to 2033

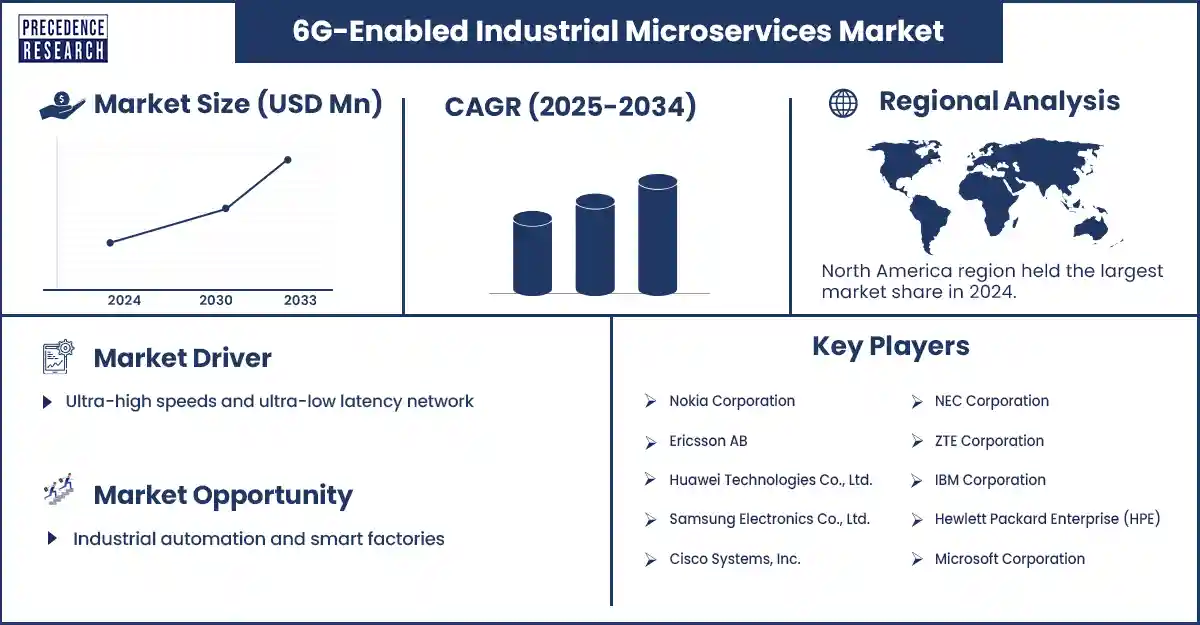

The global 6G-enabled industrial microservices market growth is fueled by demand for ultra-low latency, edge computing, and Artificial Intelligence-driven industrial automation. The 6G-enabled industrial microservices market involves the integration of 6G wireless communication technology with microservices architecture in industrial environments, particularly within the Industrial Internet of Everything (IIoE) framework. This integration provides ultra-high-speed, ultra-reliable, and low-latency connections, along with native AI and advanced sensing capabilities.

Key Drivers Enabling the Growth of the 6G-Enabled Industrial Microservices Market

The market is largely driven by the exceptional performance of 6G technology, enabling advanced industrial applications such as autonomous robotics and telemedicine. Enhanced cybersecurity features, including quantum-resistant encryption and AI-driven threat detection, appeal to sectors that require high data protection, such as finance and defense. The seamless integration of AI, Machine Learning, and the IoT further enhances efficiency and decision-making for smarter industrial applications. Additionally, 6G's advanced sensing and high-precision positioning technologies facilitate new uses, including robotic navigation and environmental monitoring. Government funding and supportive regulatory frameworks also play a vital role in accelerating technological adoption.

Segment Insights

- By component, the platforms and frameworks segment is the market leader, as the advanced capabilities of 6G are best realized through robust software frameworks and platforms essential for creating, deploying, and managing complex microservices.

- By deployment model, the cloud-based segment led the market since cloud platforms offer the necessary scalability, flexibility, security, and cost-effectiveness that align with 6G's advanced network requirements and microservices architecture.

- By enterprise size, large enterprises held the largest market share due to their significant financial resources, ability to invest in advanced digital transformation, and the complexity of implementing 6G and microservices that require large-scale infrastructure.

- By application, the smart manufacturing and automation segment dominated the market, as 6G's ultra-low latency and massive data capacity directly enable advanced industrial applications.

- By end-use industry, the manufacturing and automotive sectors are the market leaders because 6G's ultra-low latency and high bandwidth are essential for enabling real-time data processing, smart robotics, and digital twins.

Regional Insights

North America currently dominates the 6G-enabled industrial microservices market, attributed to the strong presence of leading technology companies, robust cloud infrastructure, and high adoption of digital transformation initiatives. The region has a mature and advanced cloud infrastructure, which is crucial for deploying microservices architectures, especially for 6G-enabled industrial applications.

Asia-Pacific region is the fastest-growing area for 6G-enabled industrial microservices, driven by a strong emphasis on 6G development and significant investments in research and development by leading countries such as China, South Korea, and Japan. Supportive government policies are in place to facilitate the transition from 5G to 6G and promote the adoption of related technologies, including IoT and smart city applications.

6G-Enabled Industrial Microservices Market Coverage

| Report Attribute | Key Statistics |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

6G-Enabled Industrial Microservices Market Key players

- Nokia Corporation

- Ericsson AB

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Cisco Systems, Inc.

- NEC Corporation

- ZTE Corporation

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Microsoft Corporation

- Amazon Web Services (AWS)

- Google Cloud (Alphabet Inc.)

- Siemens AG

- General Electric (GE Digital)

- Schneider Electric SE

- Rockwell Automation, Inc.

- Intel Corporation

- Qualcomm Technologies, Inc.

- Fujitsu Ltd.

- Capgemini SE

Recent Developments

- In July 2024, China launched the world's first 6G field test network that integrates communication and intelligence, demonstrating that 6G transmission capabilities can be achieved using 4G and 5G technologies. This development allows for deeper integration of communication with artificial intelligence and validates the feasibility of 4G and 5G connections supporting 6G transmission capabilities.(Source: https://www.chinadaily.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6809

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344