What is the 6G-Enabled Industrial Microservices Market Size?

The global 6G-enabled industrial microservices market is driven by convergence of edge computing, AI, and advanced connectivity. This ecosystem allows industries to deploy agile, scalable microservices architectures. The convergence of Industry 4.0, the introduction of edge computing, the growing demand for ultra-high speeds and low latency in 6G networks, and the expansion of smart factories are expected to drive the growth of the global 6G-enabled industrial microservices market over the forecast period. Several key players in the market are widely adopting effective strategies to expand their market presence and gain a competitive edge. Additionally, the market is expanding in emerging regions, particularly North America, fuelled by the supportive government framework and advanced industrial IT infrastructures.

6G-Enabled Industrial Microservices Market Key Takeaways

- North America dominated the 6G-enabled industrial microservices market with the largest market share of 35% in 2024.

- Asia Pacific is expected to expand at a rapid pace during the forecast period.

- By component, the platforms & frameworks segment captured the biggest market share of 50% in 2024.

- By component, the services segment is anticipated to experience the fastest growth during the forecast period.

- By deployment model, the cloud-based segment contributed the highest market share of 55% in 2024.

- By deployment model, the hybrid / edge-cloud integration segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By enterprise size, the large enterprise segment held the biggest market share of 65% in 2024.

- By enterprise size, the SMEs segment is expanding at a significant CAGR from 2025 to 2034.

- By application, the smart manufacturing & industrial automation segment generated the major market share of 40% in 2024.

- By application, the digital twin & simulation segment is experiencing rapid growth during the forecast period.

Market overview

The 6G-Enabled industrial microservices market refers to the ecosystem of microservice-based software architectures integrated with next-generation 6G connectivity for industrial applications. Microservices break down large, monolithic applications into modular, independent services that can be deployed, updated, and scaled individually. With 6G networks expected to deliver ultra-low latency (<1 ms), terabit-level speeds, AI-native networking, and enhanced security, industrial microservices can support real-time automation, distributed intelligence, autonomous systems, and digital twin applications.

How is Artificial Intelligence (AI) impacting the growth of the 6G-enabled industrial microservices market?

In today's rapidly evolving digital landscape, AI-powered 6G-enabled industrial microservices emerge as a transformative force, holding great potential to impact the market's growth. The utilization of Artificial Intelligence (AI) is increasingly focused on enabling advanced and data-driven automation within industrial environments. The vast amount of data generated by Industrial Internet of Things (IIoT) devices can be easily processed and analyzed in real-time by Artificial Intelligence (AI), offering valuable insights for operational optimization and predictive maintenance. An AI-enabled network helps predict and prevent failures, and dynamically allocates resources to meet ongoing industrial needs. AI-powered advanced security measures, including AI-driven threat detection, end-to-end protection, and quantum-resistant encryption in 6G networks, provide robust protection against evolving cyber threats by safeguarding sensitive data and critical infrastructure in industries such as healthcare and finance.

6G-Enabled Industrial Microservices Market Growth Factors

- The rising demand for highly reliable, adaptive, and scalable industrial IT infrastructure is anticipated to accelerate the growth of the 6G-enabled industrial microservices market during the forecast period.

- The rising penetration rate of Industrial Internet of Things (IIoT) gadgets is anticipated to promote the growth of the global market in the upcoming years.

- The rising awareness regarding the key benefits offered by 6G over its predecessors is expected to contribute to the overall growth of the market in the coming years.

- The convergence of Industry 4.0 and the growing importance of edge computing are anticipated to fuel the expansion of the 6G-enabled industrial microservices market in the coming years. The deployment of 6G is anticipated to support Industry 4.0 initiatives by providing enhanced capabilities for edge computing.

- The supportive government initiatives and surge in funding for 6G research and development, particularly in developed and developing countries, are likely to drive innovation and increase adoption across various sectors.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

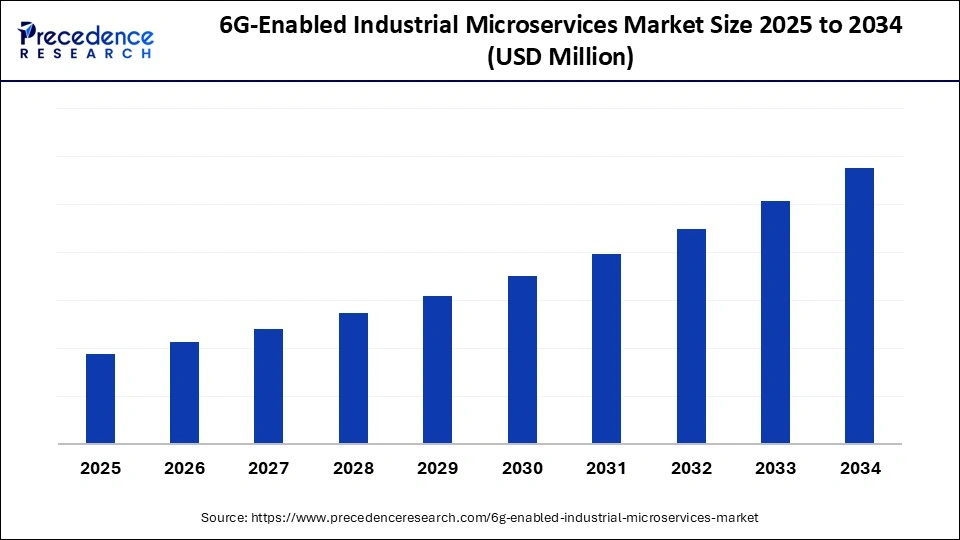

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Model, Enterprise Size, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Ultra-high speeds and ultra-low latency network

The growing demand for ultra-high speeds and ultra-low latency networks is expected to drive the growth of the 6G-enabled industrial microservices market during the forecast period. The capacity of 6G networks for unprecedented data speeds and ultra-low latency (<1 µs) allows real-time data processing, control, and decision-making for highly complex industrial automation and advanced applications such as extended reality (XR) and holographic communication, autonomous systems, advanced robotics, and others. 6G's ability to support an unparalleled number of devices per square kilometer, which leads to a more interconnected industrial ecosystem, enabling hyper-connectivity across extensive networks of machines, sensors, and workers. Therefore, as 5G networks approach capacity limits, this has led to an increasing demand for 6G-enabled services to support sophisticated industrial applications with their enhanced capabilities.

Restraint

High infrastructure costs

The cost associated with 6G networks is anticipated to hamper the market's growth. The 6G network requires highly expensive infrastructure investment to broaden coverage and operate. The research and deployment of the 6G infrastructure increases the need for high upfront financial investments, which can slow down its adoption, particularly in lower and middle-income countries. Such factors are likely to limit the expansion of the global 6G-enabled industrial microservices market.

Opportunity

Industrial automation and smart factories

The industrial automation and smart factories are projected to offer lucrative opportunities to the 6G-enabled industrial microservices market during the forecast period. In the world of industrial IoT, where connected devices play a crucial role increases the need for 6 G-enabled services increases for enhanced communication reliability. 6G is the next step in providing ultra-fast and more reliable connectivity, assisting in powering everything from predictive maintenance to efficient resource management. 6G-enabled services are indispensable in the future of industrial automation and improving industrial operations, especially in smart factories and IoT systems. 6G technology ensures smoother operations and less downtime in the industrial sectors. 6G-enabled microservices significantly accelerate the digital transformation in smart factories, which allows for unprecedented levels of enhancing productivity, automation, and efficiency. 6G provides the ultra-low latency for quick data collection from IoT devices and machinery, allowing for real-time analysis and providing instant adjustments to any manufacturing processes. Its ability to support a network of interconnected robots, sensors, and machines often leads to more complex and efficient automation.

Component Insights

What Made the Platforms & Frameworks Segment Lead the 6G-Enabled Industrial Microservices Market in 2024?

The platforms & frameworks segment was dominant, with the biggest share of the global 6G-enabled industrial microservices market in 2024. The segment includes service mesh, orchestration, and APIs. Platforms are specifically designed frameworks for effectively managing and orchestrating resources across the cloud-to-edge continuum. Several developers are increasingly utilizing high-performance frameworks adapted for the new 6G environment. The 6G architecture heavily relies on cloud-native and service-based models, which substantially increases the adoption of industrial microservices. Service mesh technologies are crucial for managing the complex network communications between industrial microservices to ensure reliability, security, and observability.

On the other hand, the services segment is also experiencing the fastest growth. The segment includes consulting, integration, maintenance, and managed services. Specialized services are required to build, implement, and maintain 6G-enabled industrial microservices in the market. Providers are increasingly focusing on managing the underlying 6G network infrastructure to ensure ultra-low latency and bandwidth required by industrial microservices. Services also include orchestration and management of containerized microservices using various platforms to simplify deployment and scaling.

Enterprise Size Insights

What Causes the Large Enterprise Segment to Dominate the 6G-Enabled Industrial Microservices Market?

The large enterprise segment held a dominant presence in the market in 2024. Large enterprises have the significant resources to invest in and adopt 6G-enabled microservices, which leads to smooth, seamless integration of devices and systems across the entire industrial value chain, increasing the use of holographic technologies, and more detailed digital representations of physical assets and processes. Large enterprises can process and act on massive amounts of data in real-time, driving AI-driven automation and predictive maintenance. On the other hand, the SMEs segment is expected to grow at a notable rate. 6G network connectivity allows SMEs to integrate an unprecedented number of IoT devices without harming system performance. The emergence of 6G technology, with its nearly-zero latency, ultra-fast data speeds, and integration with AI/ML, represents an opportunity for small and medium enterprises (SMEs) to increasingly adopt and leverage industrial microservices. SMEs can leverage AI-based analytics to obtain actionable real-time insights from vast datasets, allowing for optimized logistics, manufacturing, and marketing operations.

Deployment Model Insights

How Did the Cloud-Based Segment Dominate the 6G-Enabled Industrial Microservices Market in 2024?

The cloud-based segment dominated the market in 2024, driven by the increasing importance of cloud-native architecture. Cloud-native architecture deploys applications that are built and optimized for the cloud. These play a pivotal role in managing the complexity and scalability of the various industrial applications. The cloud-based microservices offer a wide range of industrial applications, such as Smart manufacturing and Industry 5.0, intelligent industrial automation, and optimizing complex logistical operations with greater efficiency. On the other hand, the hybrid / edge-cloud integration segment is expected to register the fastest growth. The hybrid/edge-cloud integration is an emerging paradigm that offers an innovative and promising pathway for a new era of industrial automation and efficiency. The integration of a hybrid edge-cloud architecture is gaining immense popularity in industrial settings by leveraging the full potential of a 6G-enabled network. This integration is leading owing to its ability to combine on-premise industrial control with the scalability of central cloud computing for complex tasks. The hybrid edge-cloud model also allows for real-time control of industrial processes with a significant increase in automation, improving efficiency, and reducing errors.

Application Insights

How Smart Manufacturing & Industrial Automation Segment Dominated the 6G-Enabled Industrial Microservices Market in 2024?

The smart manufacturing & industrial automation segment dominated the market in 2024. A 6G-enabled network is the backbone of industrial automation, which ensures real-time data transmission with minimal delay. 6G with ultra-reliable, low-latency communication enables an effective human-robot interface and allows manufacturers to solve complex problems with ease. 6G allows for precise, real-time control of machinery and autonomous systems in factories and logistics. The adoption of 6G in smart manufacturing & industrial automation aims to create intelligent, integrated, and self-optimizing manufacturing environments. 6G robust connectivity is essential for delivering the high-volume data needed for smart decision-making and reducing operational downtime. On the other hand, the digital twin & simulation segment is witnessing the fastest growth, owing to the demand for real-time data and advanced analytics and increasing focus on improving decision-making. The ultra-fast and low-latency 6G networks are likely to support the creation of real-time digital simulations of factories and production lines, providing an innovative tool for effective monitoring, predictive maintenance, and optimization.

Regional insights

How did North America lead the 6G-enabled industrial microservices market in 2024?

North America held the dominant share of the 6G-enabled industrial microservices market in 2024. The growth of the region is attributed to the presence of a robust tech-driven ecosystem, widespread adoption of Industry 4.0 principles, increasing use of industrial automation, rising R&D investments, rising demand for reliable connectivity, and strong government-industry partnerships. The region is increasingly focusing on leveraging 6G's ultra-high speeds and low latency for advanced industrial automation, smart manufacturing, the creation of sophisticated digital twins, and AI/ML-driven applications. The regional market is also experiencing growing demand for connected devices (IoT) in various sectors, along with the shift towards Industry 4.0, which spurs the demand for 6G networks capable of handling massive amounts of data and assisting in asset tracking and inventory management. The United States is a major contributor to the expansion of the 6G-enabled industrial microservices market. The country's leading telecom operators are making significant investments in 6G technologies, such as AI-based network management and terahertz communications. Supportive federal and state-level policies are anticipated to accelerate 6G rollouts by offering attractive financial incentives and streamlining permitting processes. Such factors are expected to propel the growth of the advanced antenna systems market in the North American region.

What made Asia Pacific the fastest-growing region in the 6G-enabled industrial microservices market in 2024?

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. The region's fastest growth is attributed to the increasing presence of key market players, rapid pace of urbanization, rising use of industrial automation, rising integration of AI and edge computing, a surge in investment for research activities, a supportive government framework, and the increasing need for ultra-high speeds and low-latency networks across various industries. The integration of Artificial Intelligence and Machine Learning (AI/ML), rising adoption of IoT devices, and the increasing significance of edge computing drive demand for 6G's robust connectivity, real-time processing, and massive data handling capabilities. The rising demand from smart factories in the emerging nations is expected to accelerate the market's expansion during the forecast period. 6G network assists smart factories to experience significant improvements in operational productivity, efficiency, and flexibility, reducing costs and enhancing agility. The rapid digital transformation across various industries such as manufacturing, energy & utilities, automotive & transportation, healthcare & life sciences, aerospace & defense, and others, coupled with the digital revolution of the telecommunications sector, is bolstering the region's expansion in the coming years.

- In December 2024, A breakthrough in antenna technology that could revolutionize the future of wireless communications, particularly for the upcoming 6th generation (6G) networks, was announced by a research team led by Professor Chan Chi-hou, Chair Professor of the Department of Electrical Engineering at City University of Hong Kong (CityUHK). The team developed a novel metasurface antenna capable of simultaneously generating and controlling multiple frequency components through software. This major advancement promises to enhance the efficiency and capabilities of wireless communication systems.(Source: https://techxplore.com)

- In March 2025, Korean researchers succeeded in developing a core wired network technology that enables remote conferences, collaborations, and surgeries in a 6G environment. This technology will open up a hyper-immersive metaverse world in the future 6G world. Electronics and Telecommunications Research Institute (ETRI) has developed the key solutions required for hyper-immersive, high-precision services. The research team announced that they developed a network stack technology tailored to the end-to-end network performance and successfully validated the technology by demonstrating a remote conference without delay.(Source: https://www.eurekalert.org)

6G-Enabled Industrial Microservices Market Companies

- Nokia Corporation

- Ericsson AB

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Cisco Systems, Inc.

- NEC Corporation

- ZTE Corporation

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Microsoft Corporation

- Amazon Web Services (AWS)

- Google Cloud (Alphabet Inc.)

- Siemens AG

- General Electric (GE Digital)

- Schneider Electric SE

- Rockwell Automation, Inc.

- Intel Corporation

- Qualcomm Technologies, Inc.

- Fujitsu Ltd.

- Capgemini SE

Industry Leader Announcements

- In March 2025, NTT Corporation (NTT) and NTT DOCOMO, Inc. (DOCOMO) announced the successful demonstration of the In-network Service Acceleration Platform (ISAP), a foundational component of the Inclusive Core mobile network architecture being built by NTT and DOCOMO to meet the evolving data processing needs of the 6G era. Using the ISAP and Inclusive Core architecture, researchers minimized the delay and fluctuation in data exchange between the terminal and server while improving AI analysis from a 57% “correct answer rate” (with conventional architecture) to a 90% rate.(Source: https://www.businesswire.com)

Recent Developments

- In March 2025, NVIDIA unveiled partnerships with industry leaders T-Mobile, MITRE, Cisco, ODC, a portfolio company of Cerberus Capital Management, and Booz Allen Hamilton on the research and development of AI-native wireless network hardware, software, and architecture for 6G. Next-generation wireless networks must be fundamentally integrated with AI to seamlessly connect hundreds of billions of phones, sensors, cameras, robots, and autonomous vehicles.

(Source: https://nvidianews.nvidia.com) - In March 2025, Korean researchers succeeded in developing a core wired network technology that enables remote conferences, collaborations, and surgeries in a 6G environment. This technology will open up a hyper-immersive metaverse world in the future 6G world. Electronics and Telecommunications Research Institute (ETRI) has developed the key solutions required for hyper-immersive, high-precision services.(Source: https://www.eurekalert.org)

Segments Covered in the Report

By Component

- Platforms & Framework

- Services

- Hardware Infrastructure

By Deployment Model

- On-Premise

- Cloud-Based

- Hybrid / Edge-Cloud Integration

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Application

- Smart Manufacturing & Industrial Automation

- Predictive Maintenance

- Supply Chain & Logistics Optimization

- Robotics & Autonomous Systems

- Industrial IoT & Edge Intelligence

- Digital Twin & Simulation

- Cybersecurity & Risk Management

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting