What is the Smart Pills Market Size?

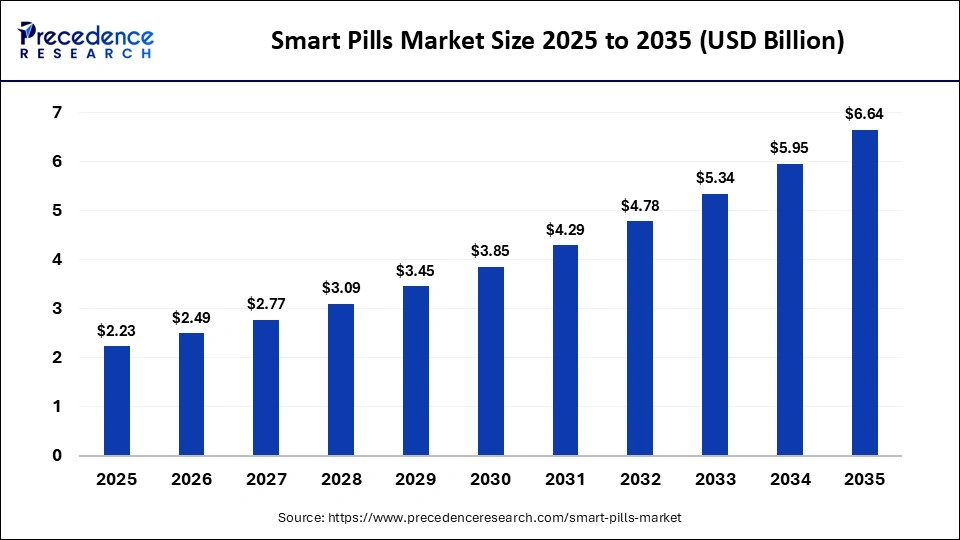

The global smart pills market size was calculated at USD 2.23 billion in 2025 and is predicted to increase from USD 2.49 billion in 2026 to approximately USD 6.64 billion by 2035, expanding at a CAGR of 11.52% from 2026 to 2035. The market is witnessing substantial growth driven by the increasing demand for real-time patient monitoring, the rising prevalence of chronic diseases, and growing consumer awareness of digital health solutions. Demand is surging from applications in drug delivery monitoring, diagnostic imaging, and internal health tracking, further supported by breakthroughs in ingestible sensors and wireless communication technologies.

Market Highlights

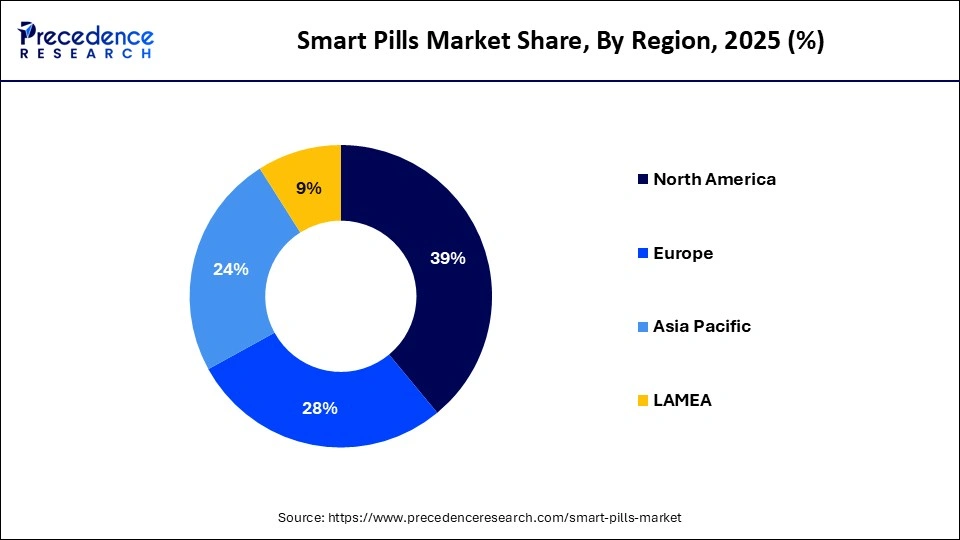

- North America dominated the market with the largest market share of 39% in 2025.

- The Asia Pacific is expected to grow at a remarkable CAGR of 12.84% between 2026 and 2035.

- By application, the capsule endoscopy segment captured the highest market share of 55% in 2025.

- By application, the drug delivery segment is poised to grow at a healthy CAGR of 11.36% between 2026 and 2035.

- By disease identification, the celiac disease segment generated the largest market share in 2025.

- By disease identification, the small bowel tumor segment is expanding at the fastest CAGR between 2026 and 2035.

- By target area, the small intestine segment contributed the highest market share in 2025.

- By target area, the stomach segment is growing at a strong CAGR between 2026 and 2035.

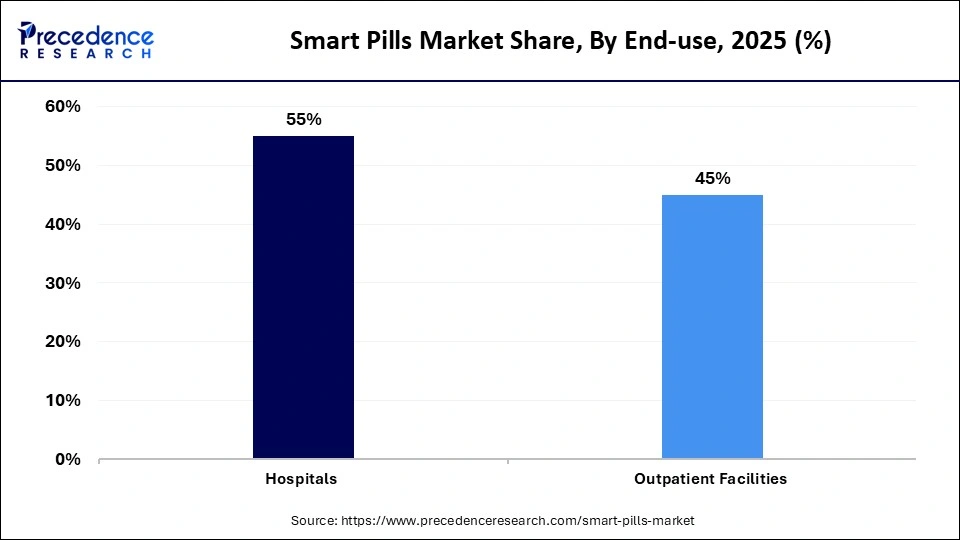

- By end-use, the hospital segment held a major market share of 55% in 2025.

- By end-use, the outpatient facilities segment is expected to expand at a notable CAGR from 2026 to 2035.

What are the Smart Pills?

Smart pills are ingestible, miniaturized medical devices embedded with sensors, cameras, microprocessors, and wireless transmitters that travel through the gastrointestinal tract to collect physiological and visual data. These devices measure parameters such as pH, temperature, pressure, and imaging data, transmitting information in real time to external receivers for clinical analysis. Smart pills are increasingly used to support non-invasive diagnosis, disease monitoring, and targeted drug delivery, reducing reliance on conventional endoscopy and other invasive procedures while improving patient comfort and diagnostic precision, particularly in gastrointestinal disorders.

Market growth is being driven by advances in sensor miniaturization, wireless communication, and data analytics, alongside rising demand for personalized and patient-centric healthcare solutions. Smart pills are gaining traction in remote monitoring, chronic disease management, and targeted therapies, aligning with broader shifts toward digital health and precision medicine. While high device costs, regulatory complexity, and data privacy concerns remain constraints, continued innovation and clinical validation are accelerating adoption, especially in GI diagnostics, where early detection, continuous monitoring, and minimally invasive care are increasingly prioritized over traditional diagnostic approaches.

How did AI influence the Smart Pills Market?

Artificial intelligence is transforming the smart pills market by enabling advanced analysis of complex, high-volume physiological data to support personalized diagnosis and treatment. AI algorithms process continuous sensor inputs such as pH, temperature, pressure, and motility data generated as smart pills move through the gastrointestinal tract. By interpreting these datasets in real time, AI systems can identify abnormal patterns linked to inflammation, bleeding, infections, or functional GI disorders, providing clinicians with deeper, faster insights than traditional episodic testing methods.

Beyond diagnostics, AI is playing a growing role in risk prediction, therapy optimization, and product development. Machine learning models assess individual patient profiles to predict disease progression and support early intervention strategies, while also monitoring medication adherence through ingestible sensor data. In parallel, AI-driven modeling is accelerating smart pill and drug development by optimizing molecular structures, predicting compound performance, and reducing trial-and-error in formulation design. These capabilities are shortening development timelines and improving clinical outcomes, reinforcing AI's role as a core enabler of precision medicine and next-generation gastrointestinal care.

Smart Pills Market Outlook

- Industry Growth Overview: The smart pills market is poised for explosive growth from 2026 to 2035. This growth is primarily driven by the increasing global burden of chronic diseases, including diabetes and GI issues, as well as a shift towards personalized, remote patient monitoring, with tech and pharma giants investing heavily in tiny biosensors for real-time health data.

- Integration of Smart Pill Technology with AI and ML: This trend allows the analysis of the vast amounts of data collected by smart pills, helping physicians identify conditions more accurately and quickly. Along with tailoring medication dosages and treatment plans, it enhances efficacy, minimizes side effects, and overall improves patient compliance, particularly for chronic conditions.

- Global Expansion: The worldwide market is expanding rapidly due to huge potential in North America, Asia-Pacific, and Europe due to increasing chronic disease rates, increasing healthcare access, and tech adoption. Latin America and the Middle East & Africa are also emerging regions in the global market.

- Major Investors: Many companies like Medtronic, Olympus, and Philips are investing in sensor tech and integration. Additionally, Google and Samsung are exploring ingestible tech along with developing novel sensors and AI analytics for digital therapeutics.

- Startup Ecosystem: Startups like CapsoVision, Medibio, and those incubated by major firms like J&J's JLABs are developing disruptive ingestible biosensors, focusing on drug delivery monitoring, gut health analysis, and early disease detection.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.23 Billion |

| Market Size in 2026 | USD 2.49 Billion |

| Market Size by 2035 | USD 6.64 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.52% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, Disease Identification, Target Area, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Application Insights

What made the Capsule Endoscopy Segment Dominant in the Smart Pills Market in 2025?

The capsule endoscopy segment dominated the market in 2025. This is mainly due to offering a painless, non-invasive way to visualize the entire GI tract, especially the hard-to-reach small intestine, replacing uncomfortable traditional scopes for diagnosing issues like Crohn's, bleeding, and tumors. Improved camera resolution, longer battery life, wireless data, and AI-assisted analysis enhance reliability and diagnostic accuracy. The increasing prevalence of gastrointestinal disorders and a shift toward simpler, more effective diagnostic methods fuel its adoption.

The drug delivery segment is expected to have the fastest growth during the forecast period. This is due to increasing chronic diseases, demand for personalized medicine, patient preference for self-administration and home care, and technological advances. This further enables targeted, precise, real-time medication release, boosting adherence and outcomes beyond just diagnostics. This shift moves smart pills from purely diagnostic to therapeutic, leveraging miniaturized sensors, AI, and wireless tech to enable real-time data transmission, feedback, and personalized dosing.

Disease Identification Insights

How did the Celiac Disease Segment Lead the Smart Pills Market in 2025?

The celiac disease segment led the market in 2025. This is because of its high prevalence, the demand for non-invasive diagnostics like capsule endoscopies for small bowel visualization, increased patient and physician awareness, and technological advances. This further enables gluten-sensing capsules and precise monitoring, making smart pills a superior, less uncomfortable alternative to traditional biopsies, with earlier detection, better management of gut health, and personalized treatment response tracking for this chronic autoimmune condition, improving personalized care.

The small bowel tumor segment is expected to have the fastest growth in the market. This is mainly because of the small intestine's challenging anatomy for traditional diagnostics, increasing prevalence of related diseases, increasing demand for non-invasive tools, and crucial demand for early, precise detection of rare tumors. Smart pills offer a comfortable, non-invasive alternative to traditional procedures, aligning with growing patient preference for less burdensome diagnostics. Increased research funding and supportive government policies boost innovation and adoption.

Target Area Insights

Why did the Small Intestine Segment Lead the Smart Pills Market in 2025?

The small intestine segment led the market in 2025. This is mainly due to the organ's complex and difficult-to-access anatomy, which makes traditional endoscopic diagnosis challenging. Smart pills, particularly those used for capsule endoscopy, offer a non-invasive, patient-friendly, and effective solution for visualizing and diagnosing a wide range of small intestinal disorders. As a key site for nutrient absorption, it is an ideal target area for future smart pill applications in targeted drug delivery, ensuring medications reach the optimal site of action and improving therapeutic effectiveness.

The stomach segment is expected to have the fastest growth in the global market. This growth is mainly driven by increasing gastric cancers, gastritis, and the demand for better drug delivery for diabetes and neurological conditions, utilizing smart pills for targeted treatment and non-invasive diagnostics. Conditions like gastritis and IBD benefit from smart pills for precise diagnosis and localized treatment, with sophisticated systems for delivering drugs to the stomach that overcome biological barriers for better systemic disease management.

End-use Insights

What made the Hospital Segment Dominate the Smart Pills Market in 2025?

The hospital segment dominated the market in 2025. This is mainly because hospitals are central to advanced patient care, using these ingestible sensors for non-invasive diagnostics, improving medication adherence, streamlining workflows, and enabling better monitoring of chronic diseases. Hospitals heavily use smart pills for capsule endoscopy to visualize the GI tract, diagnosing Crohn's, celiac disease, and cancers non-invasively, reducing the need for traditional scopes and facilitating easier adoption and integration of smart pill technologies.

The outpatient facilities segment is expected to have the fastest growth in the market. This is mainly because patients and doctors prefer its less invasive nature, improving comfort for diagnosing GI issues like Crohn's and bleeding. They offer detailed internal imaging, real-time data, and AI integration for early detection, enhancing accuracy in outpatient diagnostics. Shifting complex diagnostic procedures from costly inpatient hospitals to efficient outpatient centers reduces healthcare burden, benefiting both providers and patients.

Regional Insights

How Big is the North America Smart Pills Market Size?

The North America smart pills market size is estimated at USD 869.70 million in 2025 and is projected to reach approximately USD 2,622.80 million by 2035, with a 11.67% CAGR from 2026 to 2035.

How did North America Dominate the Smart Pills Market in 2025?

North America dominated the smart pills market in 2025, driven by its advanced healthcare infrastructure, high prevalence of chronic gastrointestinal diseases, favorable regulatory environment, and rapid adoption of innovative medical technologies. The region hosts key market players such as Medtronic and CapsoVision, whose continued investment in research and development is advancing sensor performance, AI-enabled analytics, and device miniaturization. Strong collaboration between industry, academic medical centers, and research hospitals further supports clinical validation and early adoption of smart pill technologies.

Regulatory clarity also plays a critical role in sustaining regional leadership. The U.S. Food and Drug Administration provides a well-defined, though rigorous, approval pathway for novel medical devices, offering predictability for manufacturers while ensuring safety and efficacy. This structured framework accelerates commercialization timelines and builds clinician confidence, encouraging wider adoption of smart pills for gastrointestinal diagnostics, remote monitoring, and patient-centric care across the United States and the broader North American market.

What is the Size of the U.S. Smart Pills Market?

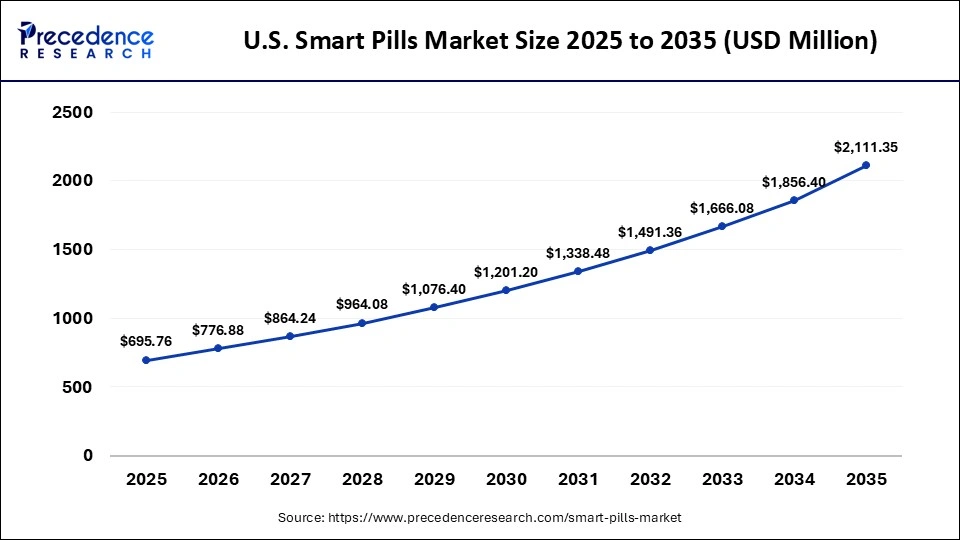

The U.S. smart pills market size is calculated at USD 695.76 million in 2025 and is expected to reach nearly USD 2,111.35 million in 2035, accelerating at a strong CAGR of 11.74% between 2026 and 2035.

The U.S. Smart Pills Market Trends

The U.S. is a significant player in the market, driven by a high rate of adoption of innovative medical technologies and a large, discerning consumer base that is willing to embrace new health solutions. In addition to hosting major industry players like Medtronic and CapsoVision, the U.S. benefits from substantial investment in R&D. The U.S. FDA plays a crucial role by offering relatively swift approvals for new devices and technologies, facilitating faster market adoption.

How Will Asia Pacific contribute to the Smart Pills Market in 2025?

The Asia Pacific region is expected to experience the fastest growth during the forecast period, driven by rising demand for minimally invasive diagnostic solutions, a large and aging population, and increasing prevalence of chronic diseases. Countries such as Japan and China, which have some of the world's most rapidly aging populations, are seeing higher incidence of gastrointestinal and age-related conditions, directly increasing the clinical need for smart pill technologies that enable non-invasive, patient-friendly diagnostics and monitoring.

Growth is further supported by rapid industrialization, rising healthcare expenditure, and modernization of healthcare infrastructure across China, India, and South Korea. Government-backed digital health initiatives and favorable policies promoting advanced medical technologies are accelerating the adoption of smart pills in hospitals and diagnostic centers. Expanding access to specialized care, combined with increasing clinician acceptance of AI-enabled and remote monitoring solutions, is reinforcing Asia Pacific's position as the fastest-growing regional market for smart pill technologies.

India Smart Pills Market Trends

India is projected to be one of the fastest-growing markets in the Asia Pacific region. This growth is largely due to a strong push for affordable and accessible healthcare solutions tailored to its large population, making smart pills particularly relevant for gastrointestinal diagnosis. India's robust contract manufacturing sector, complemented by FDA-certified plants, positions it as a key location for cost-effective production of high-tech medical devices for both domestic and international markets.

Emergence of Europe in the Smart Pills Market in 2025?

Europe is experiencing notable growth in the smart pills market, supported by an aging population, high prevalence of gastrointestinal disorders and chronic diseases, and well-established healthcare infrastructure. Demand for minimally invasive diagnostics is increasing as healthcare systems prioritize patient comfort, early detection, and efficient disease monitoring. Supportive government initiatives and structured regulatory frameworks across the region are creating favorable conditions for the adoption of advanced ingestible diagnostic technologies.

Countries such as Germany, the United Kingdom, and France benefit from strong public healthcare systems and sustained investment in medical R&D. European governments are actively promoting healthcare digitalization programs and allocating funding for innovative diagnostic tools, which helps streamline evaluation and approval of new medical devices. These efforts are accelerating clinical integration of smart pill technologies across hospitals and specialized diagnostic centers throughout the region.

Germany Smart Pills Market Trends

Germany holds a significant position in the European market, primarily due to its strong healthcare system and a clear regulatory pathway for digital health solutions. The pioneering Digital Healthcare Act (DiGA) facilitates the prescription and automatic reimbursement of approved digital health applications, providing a clear and scalable market entry point for manufacturers with a focus on secure data transmission and interoperability within the broader digital health infrastructure.

How will Latin America surge in the Smart Pills Market in 2025?

Latin America is experiencing significant growth in the smart pills market, supported by demographic shifts, rising healthcare investment, and accelerating adoption of digital health technologies. Expanding middle-aged and elderly populations, combined with increasing prevalence of gastrointestinal and chronic conditions, are driving demand for minimally invasive and patient-friendly diagnostic solutions across the region.

Countries such as Brazil and Mexico are implementing regulatory reforms to streamline approval pathways for pharmaceutical and medical device products, improving time-to-market for innovative technologies. This transition toward connected healthcare ecosystems is creating favorable conditions for smart pill adoption, particularly in capsule endoscopy and medication monitoring applications, where non-invasive diagnostics and improved patient compliance are increasingly prioritized by healthcare providers.

Brazil Smart Pills Market Trends

Brazil is a key contributor in Latin America, emphasizing digital health and leveraging its large government-run public healthcare system. Initiatives like the Popular Pharmacy Program aim to expand access to medicines and healthcare. An aging population is expected to drive demand for solutions addressing chronic and age-related conditions, including innovative diagnostic tools like smart pills for remote patient monitoring.

How will the Middle East and Africa Emerge in the Smart Pills Market in 2025?

The Middle East and Africa represent a key region in the global smart pills market, driven by a high prevalence of chronic and gastrointestinal diseases, rising healthcare expenditure, and increasing demand for non-invasive diagnostics and patient-centric care. Growing awareness of early disease detection and the need to reduce reliance on invasive procedures are encouraging healthcare providers to adopt advanced ingestible diagnostic technologies across public and private healthcare systems.

Proactive government initiatives aimed at modernizing healthcare infrastructure and strengthening local technology ecosystems are further enhancing market opportunities. Governments across the region, particularly within the Gulf Cooperation Council, are investing heavily in healthcare as part of broader economic diversification strategies. These investments are supporting deployment of advanced medical technologies, expansion of specialized diagnostic centers, and adoption of digital health solutions, creating a favorable environment for smart pill integration across hospitals and research institutions.

Saudi Arabia Smart Pills Market Trends

Saudi Arabia is part of the Middle East and Africa region, an emerging market for smart health technologies. The market is driven by an increased focus on healthcare infrastructure development and high R&D investment within the GCC countries. As healthcare access and infrastructure improve, opportunities for smart pills in diagnostics and monitoring are expected to rise.

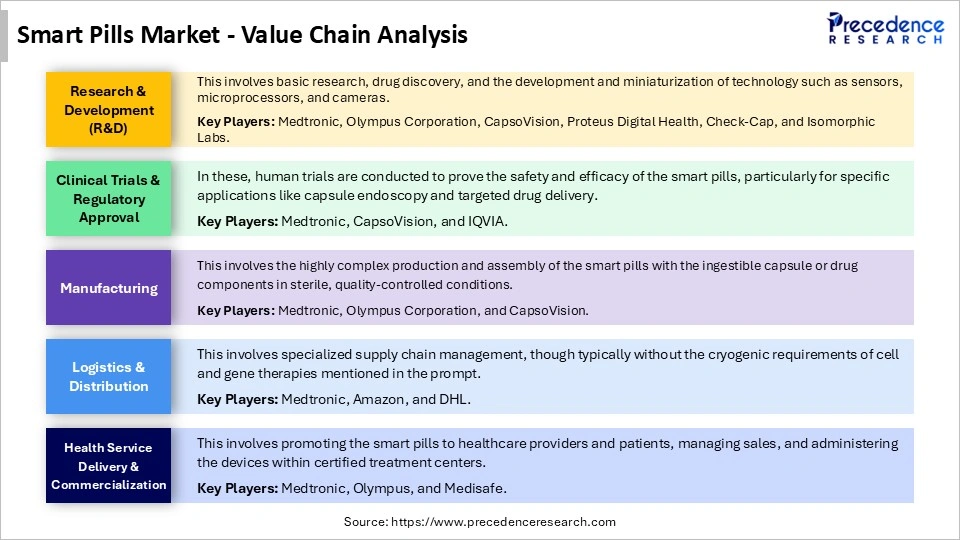

Smart Pills Market Value Chain Analysis

Who are the major players in the global smart pills market?

The major players in the smart pills market include Medtronic, Olympus Corporation, Otsuka Holdings, Pentax Medical, CapsoVision, etectRx, Check-Cap Ltd, Intromedic, and BodyCap.

Recent Developments

- In December 2025, TempraMed Technologies Ltd. launched VIVI Cap Smart, an advanced version of its original VIVI Cap device. The new product enhances TempraMed's offerings by combining digital health features with passive temperature protection for insulin and GLP-1 pens. This technology ensures medications remain effective by preventing temperature fluctuations without user intervention, enabling better communication with healthcare providers.(Source: https://finance.yahoo.com)

- In January 2025, CapsoVision received FDA clearance for its CapsoCam Plus for pediatric patients aged two and older. This noninvasive diagnostic tool improves comfort and accuracy in capsule endoscopy, reducing the stress associated with traditional procedures. CapsoCam is a child-friendly solution that enhances the experience for patients and healthcare providers, remarked Johnny Wang, President and CEO of CapsoVision.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Application

- Capsule Endoscopy

- Drug Delivery

- Vital Sign Monitoring

By Disease Identification

- Occult GI Bleeding

- Crohn's Disease

- Small Bowel Tumors

- Celiac Disease

- Inherited Polyposis Syndromes

- Neurological Disorders

- Other Disease Indications

By Target Area

- Esophagus

- Small Intestine

- Large Intestine

- Stomach

By End-use

- Hospitals

- Outpatient Facilities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting