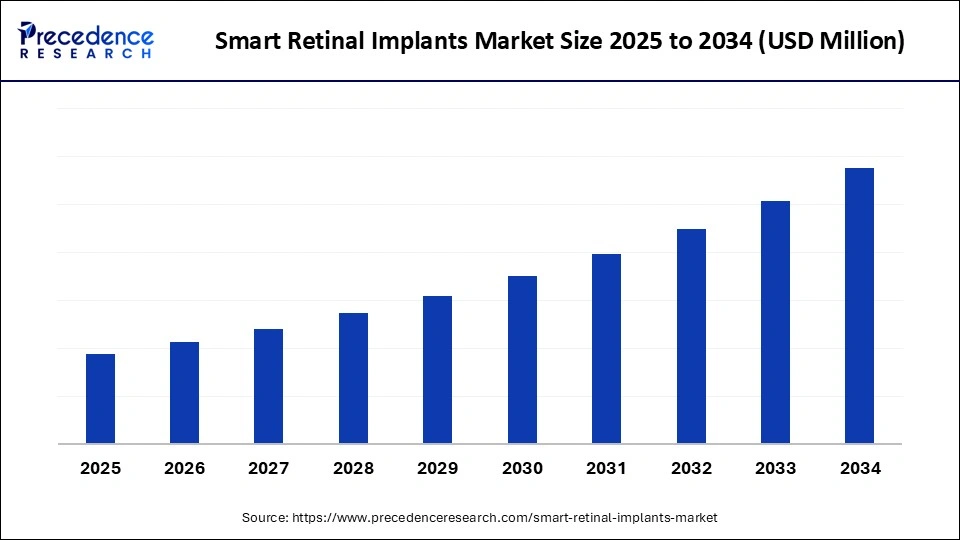

Smart Retinal Implants Market Size and Forecast 2025 to 2034

The smart retinal implants market continues to grow with supportive regulatory pathways and collaborations between tech developers, clinicians, and patient groups. It's reshaping the future of vision restoration. The market for smart retinal implants is growing due to the rising prevalence of vision impairments, technological advancements in retinal prosthetics, and increasing demand for solutions that restore vision in patients with retinal degenerative diseases.

Smart Retinal Implants Market Key Takeaways

- North America dominated the smart retinal implants market with the largest market share of 65% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By implant type, the subretinal implants segment held the biggest market share of 40% in 2024.

- By implant type, the optogenetic-based implants segment is expected to grow at the fastest CAGR during the forecast period.

- By technology, the microelectrode arrays segment captured the highest market share of 45% in 2024.

- By technology, the AI-integrated implants segment is projected to grow at the fastest CAGR during the forecast period.

- By material, the biocompatible metals & polymers segment contributed the maximum market share of 55% in 2024.

- By material, the nanomaterials segment is the fastest-growing during the forecast period.

- By end user, the hospitals & specialty clinics segment generated the major market share of 60% in 2024.

- By end user, the ambulatory surgical centers segment is emerging as the fastest-growing during the forecast period.

Market Overview

The smart retinal implants market is experiencing significant growth, driven by the rapid development of implantable technology and the increasing prevalence of retinal conditions, such as age-related macular degeneration and retinitis pigmentosa. The quality of life for patients suffering from degenerative vision loss is being improved by the growing use of biocompatible, minimally invasive retinal prosthetics. Furthermore, the market is expanding due to the world's aging population and rising awareness of cutting-edge treatment options. The creation and marketing of novel retinal implant solutions are being further accelerated by encouraging government programs to provide more financing for ophthalmic research and growing investments from medical device companies. Hospitals and specialty eye care facilities are increasingly important end users, which helps explain why these implants are becoming so popular.

- In October 2024, Science Corporation announced preliminary clinical trial results for its PRIMA implant, a fully wireless retinal prosthetic designed to restore vision in patients with degenerative retinal diseases.(Source: https://finance.yahoo.com)

- In July 2024, Genentech reintroduced Susvimo, an ocular implant providing an alternative to frequent injections for treating wet AMD patients.(Source: https://www.gene.com)

How is AI transforming the development and optimization of the smart retinal implants market?

Artificial Intelligence revolutionizes the development and optimization of devices in the smart retinal implants market by enabling more precise, adaptive, and personalized vision restoration solutions. Real-time processing of visual data is made possible by AI algorithms, which enable retinal implants to dynamically modify stimulation patterns in response to changes in their surroundings. This flexibility improves the standard of vision restoration for patients suffering from retinal degenerative disorders. AI-driven models also help create implants that more closely mimic natural vision by simulating visual perceptions. AI also helps to optimize stimulation parameters and electrode configurations, which raises the efficacy and efficiency of retinal prosthetics. Retinal implants are becoming increasingly advanced through the integration of AI, enabling patients to enjoy greater autonomy and enhanced visual experiences.

- In September 2024, Neuralink received FDA breakthrough device designation for its blindsight brain computer interface, aiming to restore vision by stimulating the visual cortex directly.(Source: https://neuralink.com)

Smart Retinal Implants Market Growth Factors

- Rising prevalence of retinal diseases: Increasing cases of age-related macular degeneration (AMD), retinitis pigmentosa, and other degenerative retinal disorders drive demand for vision-restoring implants.

- Technological advancements: Innovations in microelectronics, bio-compatible materials, and wireless implantable devices enhance implant performance and patient outcomes.

- Growing geriatric population: Aging populations globally are more prone to vision loss, creating a larger target market for retinal implant solutions.

- Supportive government initiatives and funding: Governments and healthcare organizations are promoting research and reimbursement schemes for advanced vision restoration technologies.

- Increasing awareness and acceptance: Patients and healthcare providers are becoming more aware of smart retinal implant options, boosting adoption rates.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Implant Type, Technology, Material, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of Retinal Diseases

Age-related macular degeneration, retinitis pigmentosa, and diabetic retinopathy are among the retinal conditions that are causing a significant increase in the number of patients who are eligible for retinal implants, leading to growth in the smart retinal implants market. Since more than 500 million people globally are at risk of developing diabetic retinopathy, there is a growing need for efficient vision restoration methods.

- In July 2024, Genentech reintroduced Susvimo, an acular implant providing an alternative to frequent injections for treating wet AMD patients.(Source: https://www.gene.com)

Supportive Government Initiatives and Funding

Ophthalmic research and development are receiving more funding and favorable regulatory pathways from governments across the globe. Patients in need of advanced treatment now have easier access to them thanks to these initiatives that are speeding up the clinical trials and approval procedures for treatments in the smart retinal implants market.

Restraints

Complex Surgical Procedures

Highly skilled ophthalmic surgeons and advanced surgical equipment are needed for the implantation of retinal prosthetics. Some hospitals and clinics are discouraged from providing these treatments due to the complexity of the procedures and the potential for complications. Procedures are made more difficult by recovery times and the need for precise electrode placement. Inadequate training programs for surgeons further hamper the quick expansion of implant procedures into new markets.

Regulatory Challenges

They are categorized as medical devices, and retinal implants need to obtain strict regulatory approvals before being introduced to the smart retinal implants market. Protracted approval processes and anti-specific compliance requirements may hamper market expansion and commercialization. Regional variations in regulatory frameworks also present extra challenges for multinational corporations attempting to introduce new devices at the same time. Documentation from clinical trials and frequent post-approval monitoring requirements increase the complexity and expense.

Opportunities

Lowering Cost & Expanding Accessibility

Retinal implants are currently very costly, which prevents many patients in developed markets from using them. Costs can be reduced by businesses using 3D printing, scalable production techniques, and simplified external hardware. Devices that are reasonably priced would enable penetration in underdeveloped areas where retinal disorders are common but cutting-edge treatments are still unavailable. Cost-sharing models may also benefit from collaborations with public health systems and non-profit organizations.

Improving Visual Resolution & Functional Outcomes

Patients are unable to read, recognize faces, or carry out daily tasks efficiently because many of the implants currently on the smart retinal implants market only offer basic light perception. To provide richer visual experiences, opportunities exist in the development of improved optics, sophisticated stimulation algorithms, and higher electrode densities. Additionally, improvements in motion detection and contrast sensitivity will increase users' freedom and mobility. Businesses will have a significant competitive edge if they can provide a meaningful functional vision.

Implant Type Insights

Why Did Subretinal Implants Dominate the Smart Retinal Implants Market in 2024?

Subretinal implants led the smart retinal implants market because they directly stimulate the remaining photoreceptors in the retina after being surgically positioned beneath it. They can provide higher resolution and more natural-looking vision than other implant types because of their positioning. Numerous trials have confirmed their clinical efficacy, and in 2024, their dominance was further solidified by their robustness, stability, and ability to integrate with the eye's natural processing. Their growing number of regulatory approvals has made them the industry standard for sophisticated retinal prosthetics.

Optogenetic-based implants are experiencing rapid growth because they offer a solution that is less reliant on hardware, combining genetic engineering with light-sensitive proteins. For patients with severe degeneration, this technique opens up new therapeutic avenues, lowers the risk associated with electrode arrays, and simplifies surgery. These implants are now the market segment that is growing the fastest due to increased funding for gene therapy and optogenetics research. Long-term adoption is appealing due to its potential for non-invasive upgrades.

Technology Insights

How Did Microelectrode Arrays Secure Their Dominance in the Smart Retinal Implants Market in 2024?

Microelectrode arrays have dominated since they provide precise stimulation of retinal neurons and are still the most well-established technology for retinal prosthetics. Manufacturers and clinicians chose them because of their demonstrated safety record, clinical dependability, and versatility across implant designs. Their leadership position was also influenced by decades of R&D and regulatory familiarity. Their extensive commercial availability further cemented their dominance.

AI-integrated implants are the fastest-growing because they can improve image processing, modify patterns of stimulation, and tailor treatment to the unique neural response of each patient. These implants are very appealing for future adoption because they use real-time learning to maximize vision outcomes. Both tech companies and healthcare providers are showing a great deal of interest in the convergence of AI and medical implants. It is anticipated that AI algorithms will revolutionize retinal restoration in the future as they advance.

Material Insights

What Made Biocompatible Metals and Polymers the Preferred Material Choice for the Smart Retinal Implants Market in 2024?

The biocompatible metals & polymers dominated because they provide toughness, corrosion resistance, and low tissue rejection, which guarantees implants' long-term stability, leading to growth in the smart retinal implants market. There are fewer regulatory obstacles because widely used materials like titanium, platinum, and medical-grade polymers are already well established in other implantable medical devices. Their standing as demonstrated cost-effectiveness and safety solidified the top materials. They can be easily produced on a large scale, which makes them very scalable to meet demand worldwide.

Nanomaterials are the fastest-growing segment because they offer next-generation implants, better conductivity, flexibility, and the ability to be smaller. Higher-resolution stimulation is made possible by these cutting-edge materials, which also enhance the electrode-tissue interface and reduce power needs. Rapid adoption of nanotechnology in retinal prosthetics is being driven by an increase in research on the technology and its translation into medical applications. Innovation is reaching new heights thanks to its ability to integrate with bioelectronics.

End User Insights

In 2024, Why Were Hospitals and Specialty Clinics the Primary End Users in the Smart Retinal Implants Market?

Hospitals & specialty clinics dominate as they have the advanced infrastructure, surgical skills, and rehabilitation programs needed for complicated retinal implant procedures. They also serve as the main locations for clinical trials and post-operative care, which further solidifies their crucial position in the market. Patients typically prefer these settings due to their safety and comprehensive care. Additionally, their solid partnerships with academic institutions guarantee ongoing improvements in implant techniques.

Ambulatory surgical centers are expanding rapidly as they offer minimally invasive and reasonably priced procedures. Their expansion is being fueled by the growing need for outpatient care as well as the trend in healthcare systems toward cost reduction. Both patients and providers are increasingly drawn to them due to their ease of use and accessibility. The use of outpatient surgeries is also being accelerated by expanding insurance coverage.

Regional Insights

What Market Dynamics Enabled North America to Dominate the Global Smart Retinal Implants Market in 2024?

North America dominated the smart retinal implants market due to its strong presence of top implant developers, sophisticated healthcare infrastructure, and high awareness of retinal degenerative diseases. Adoption was accelerated by supportive reimbursement guidelines and active involvement in clinical trials. Strong R&D funding and enabling regulatory frameworks strengthened its position as the industry leader. Its position is being further strengthened by collaborations between tech firms and healthcare organizations.

Asia Pacific is the fastest-growing region, driven by the increasing number of people with diabetes, the increasing prevalence of retinal diseases, and the advancement of healthcare infrastructure. Medical tourism is expanding access to cutting-edge surgeries, while governments are making significant investments in vision restoration technologies. The need for reasonably priced solutions also makes the area a prime location for potential future market growth. Programs for screening and raising awareness are assisting in expanding the patient base.

Smart Retinal Implants Market Companies

- Second Sight Medical Products, Inc.

- Retina Implant AG

- Pixium Vision SA

- Bionic Vision Technologies

- Nano Retina, Inc.

- Intelligent Implants GmbH

- iBionics

- Optobionics Corporation

- VisionCare Ophthalmic Technologies

- Ocumetics Technology Corporation

- Nidek Co., Ltd.

- Boston Scientific Corporation

- Medtronic plc

- Alcon (Novartis)

- Johnson & Johnson Vision Care, Inc.

- Zeiss Group

- Ophthorobotics AG

- Gensight Biologics

- LambdaVision, Inc.

- Neurotech Pharmaceuticals, Inc.

Recent Developments

- In August 2025, the National Eye Institute & collaborators' study confirms the long-term benefit of the ENCELTO implant (over 24 months), slowing photoreceptor loss in MacTel patients.(Source: https://www.nei.nih.gov)

- In September 2025, XPANCEO & INTRA-KER unveiled an intracorneal implant prototype to restore vision in corneal blindness, projecting images to the retina, bypassing the cornea; initial proof of concept demonstrates stable performance in simulated conditions and donor eye tests. (Source: https://www.optica.org)

Segments Covered in the Report

By Implant Type

- Epiretinal Implants

- Subretinal Implants

- Suprachoroidal Implants

- Optogenetic-Based Retinal Prosthesis

- Others (Hybrid/Next-Gen Smart Implants)

By Technology

- Microelectrode Arrays

- Photodiode Arrays

- AI-Integrated Image Processing Implants

- Wireless Power Transmission Implants

- Nanotechnology-Enabled Retinal Implants

By Material

- Biocompatible Metals (Platinum, Titanium)

- Polymers (Polyimide, Silicone)

- Ceramics

- Nanomaterials (Graphene, Carbon Nanotubes)

- Hybrid Materials

By End User

- Hospitals & Specialty Clinics

- Ophthalmology Research Institutes

- Ambulatory Surgical Centers (ASCs)

- Academic & Research Laboratories

- Homecare/Remote Monitoring Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting