What is the Sustainable Laboratory Plasticware Market Size?

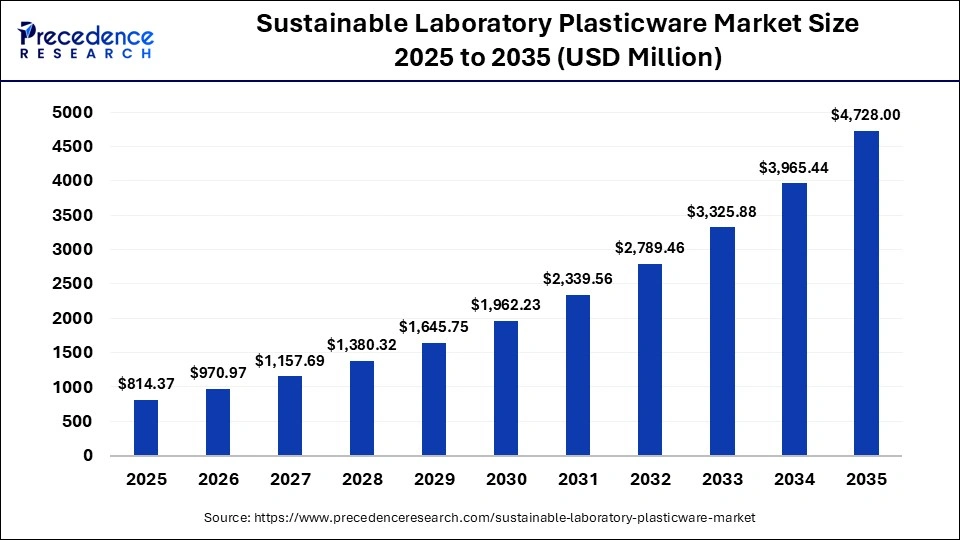

The global sustainable laboratory plasticware market size was calculated at USD814.37 million in 2025 and is predicted to increase from USD970.97 million in 2026 to approximately USD 4,728.00 million by 2035, expanding at a CAGR of 19.23% from 2026 to 2035. This market is growing due to increasing demand for friendly and recyclable lab products.

Market Highlights

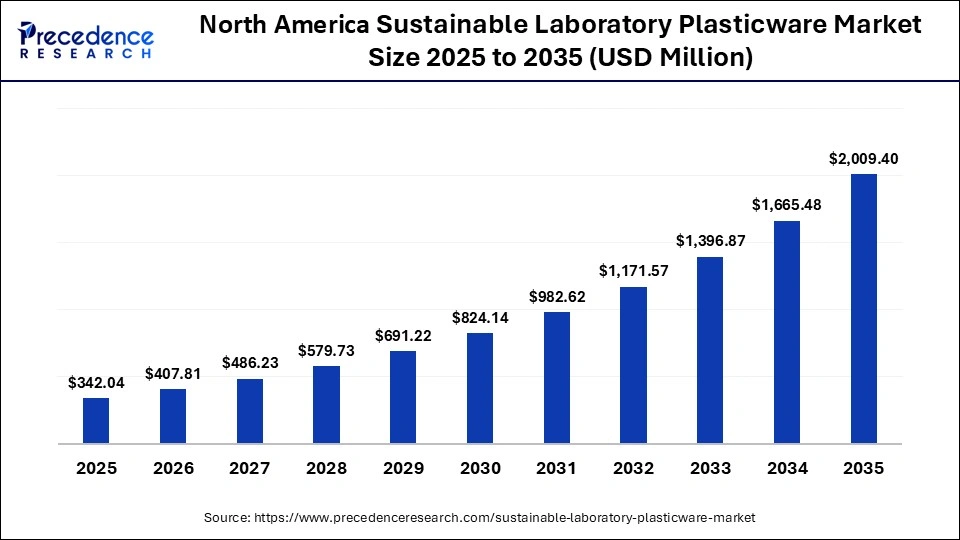

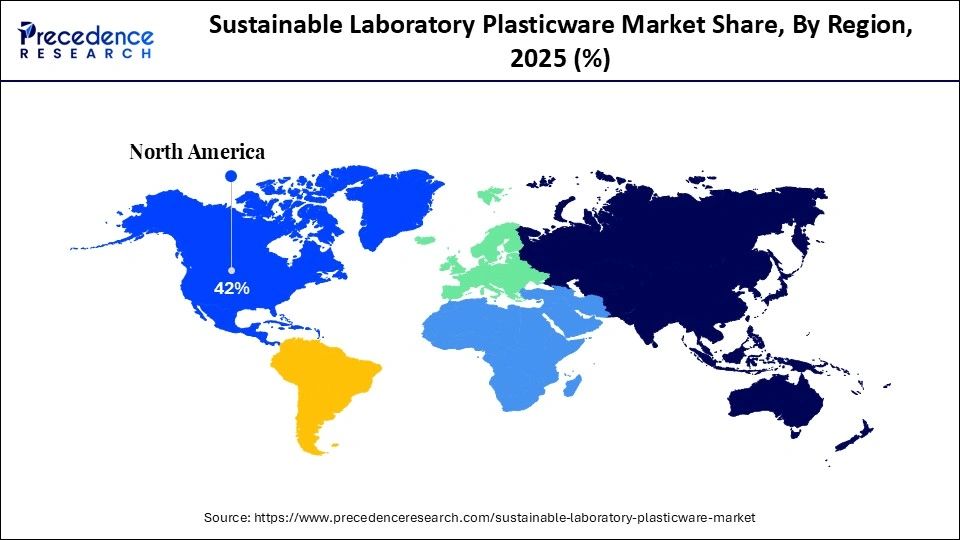

- North America dominated the sustainable laboratory plasticware market with 42% of the market share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 26% between 2026 and 2035.

- By product type, the reusable, sustainable plasticware segment generated the biggest market share of 48% in 2025.

- By product type, the recycled plasticware segment is expanding at the fastest CAGR of 21% between 2026 and 2035.

- By material type, the recycled plastic segment contributed to the highest market share of 41% in 2025.

- By material type, the cellulose acetate segment is growing at a strong CAGR of 19% between 2026 and 2035.

- By end user, the pharmaceutical & biotechnology companies segment held a major market share of 36% in 2025.

- By end user, the industrial & environmental testing labs segment is expected to expand at a notable CAGR of 22% from 2026 to 2035.

- By distribution channel, the direct sales to the institutional labs segment captured the highest market share of 57% in 2025.

- By distribution channel, the e-commerce & online segment is poised to grow at a healthy CAGR of 43% between 2026 and 2035.

Why Is the Sustainability Laboratory Plasticware Market Gaining Momentum?

The sustainability laboratory plasticware market is gaining momentum as laboratories actively reduce environmental impact from single-use consumables. Growing adoption of recyclable, bio-based, and reusable plasticware is being driven by institutional sustainability targets and green lab certification programs. Regulatory pressure to reduce plastic waste and improve traceability of laboratory consumables is accelerating procurement shifts toward sustainable alternatives. Academic and pharmaceutical laboratories are prioritizing lifecycle assessments, favoring products with lower carbon footprints and reduced virgin plastic content. Advances in material science are enabling durable plasticware that maintains sterility, chemical resistance, and precision while supporting reuse or recycling. In parallel, large research organizations are standardizing sustainable purchasing policies, creating long-term demand visibility for eco-friendly laboratory plasticware suppliers.

Market Trends

- Growing adoption of recyclable, biodegradable, and reusable laboratory plasticware

- Rising preference for bio-based and low-carbon plastic materials

- Increased focus on reducing single-use plastic waste in laboratories

- Manufacturers investing in eco-design, lightweighting, and sustainable packaging

- Increasing partnerships between labware manufacturers and sustainability-focused research institutions

- Rising demand for certified sustainable products to meet regulatory and compliance standards

Opportunities

- Expansion of sustainable plasticware adoption in pharmaceutical, biotech, and clinical laboratories

- Growing demand for customized and application-specific eco-friendly lab consumables

- Increasing government and institutional funding for green laboratory initiatives

- Rising opportunities for manufacturers offering recyclable, refillable, and circular-economy–based labware solutions

Where Will Future Demand for Sustainable Laboratory Plasticware Come From?

| Demand Area | Future Demand Trend |

| Pharmaceutical & Biotech Labs | High demand due to a strong focus on sustainable R&D operations |

| Academic & Research Institutes | Rising demand driven by green lab certifications and funding support |

| Clinical & Diagnostic Labs | Moderate to high growth as labs reduce single-use plastic waste |

| Recyclable Plasticware | Strong demand due to the circular economy and waste reduction goals |

| Bio-based & Low-carbon Plastics | Fastest-growing demand segment supported by innovation |

| Reusable & Refillable Labware | Increasing demand to cut long-term operational and disposal costs |

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 814.37 Million |

| Market Size in 2026 | USD970.97 Million |

| Market Size by 2035 | USD4,728.00 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 19.23% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Material Type, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental insights

Product Type Insights

What Makes the Reusable, Sustainable Plasticware Segment Dominate the Sustainable Laboratory Plasticware Market?

The reusable sustainable plasticware segment dominates the market with around 48% market share, as laboratories place a greater emphasis on waste reduction and long-term cost effectiveness. Pharmaceutical academic and research laboratories looking to meet sustainability targets while maintaining operational reliability find these products very appealing because they support repeated use without sacrificing performance.

The recycled plasticware segment is the fastest-growing segment, expanding at nearly 21% market share, motivated by laboratories to increase adoption of circular economy practices. Labs are being encouraged to switch to recycled alternatives for routine applications due to the growing availability of high-quality recycled polymers and the growing regulatory pressure to reduce the use of virgin plastic.

Material Type Insights

Why Did the Recycled Plastic Segment Dominate the Sustainable Laboratory Plasticware Market?

Recycled plastic led the market by material type, accounting for about 41% market share, because it is widely applicable across lab consumables and has a smaller environmental impact. Their dominance in large-scale laboratory operations is further reinforced by their cost advantages over bio-based materials and compatibility with current manufacturing processes.

Cellulose acetate is witnessing the fastest growth with a 19% market share, backed by its capacity to decompose naturally and growing recognition as a sustainable substitute for traditional plastics. It is attractive for specific laboratory applications centered on sustainability because of its clarity, chemical resistance, and renewable origin. Rising adoption is also supported by institutional green lab programs that prioritize bio-based consumables. Improved manufacturing techniques are enhancing performance consistency, making cellulose acetate suitable for routine laboratory workflows without compromising accuracy.

End User Insights

What Made Pharmaceutical & Biotechnology Companies Dominate the Sustainable Laboratory Plasticware Market?

Pharmaceutical & biotechnology companies segment dominates the market with nearly 36% market share, since these businesses are pioneers in sustainable laboratory practices. Consistent demand from this segment is driven by corporate sustainability commitments, strong regulatory scrutiny, and high laboratory consumable consumption. Adoption is further supported by internal ESG reporting requirements and supplier sustainability audits. Large-scale R&D and quality control operations amplify the impact of switching to recyclable and bio-based plasticware.

Industrial & environmental testing labs represent the fastest-growing end user segment, growing with a 22% market share, fueled by increased environmental monitoring efforts and more stringent compliance standards. Sustainable plasticware is being used by these labs more frequently to comply with environmental regulations and cut down on waste operations. Growth is reinforced by expansion of water, soil, and air testing programs across public and private sectors. Cost savings from reduced waste disposal and improved recyclability are accelerating adoption in high-throughput testing facilities.

Distribution Channel Insights

Why Did Direct Sales to the Institutional Labs Segment Dominate the Sustainable Laboratory Plasticware Market?

Direct sales to institutional labs dominate the market with 57% market share, as big labs favor bulk purchases, long-term supplier relationships, and specialized sustainable product solutions. For high-volume users, this channel guarantees reliable supply quality control and more affordable prices.

The e-commerce & online marketplace segment is the fastest-growing distribution channel, expanding at 43% market share, driven by ease of use, increased product visibility, and simple comparison of sustainable products. For easy access to environmentally friendly lab supplies, small and mid-sized labs depend more on internet resources.

Regional Insights

How Big is the North America Sustainable Laboratory Plasticware Market Size?

The North America sustainable laboratory plasticware market size is estimated at USD 342.04 million in 2025 and is projected to reach approximately USD 2,009.40 million by 2035, with a 19.37% CAGR from 2026 to 2035.

What Made the North America Region Dominate the Sustainable Laboratory Plasticware Market?

North America leads the sustainable laboratory plasticware market with about a 42% market share, supported by robust regulatory frameworks and early adoption of green lab initiatives. Strong enforcement of environmental and waste reduction standards by bodies such as the Environmental Protection Agency has accelerated the shift toward recyclable and bio-based laboratory consumables. The region hosts a high concentration of pharmaceutical, biotechnology, and life sciences companies with formal ESG and sustainability mandates. Large academic research institutions and national laboratories are actively transitioning away from single-use plastics to meet carbon reduction goals. Procurement policies increasingly favor suppliers offering lifecycle transparency and recyclable materials. High awareness of sustainable laboratory practices, combined with strong purchasing power, continues to reinforce North America's leadership in this market.

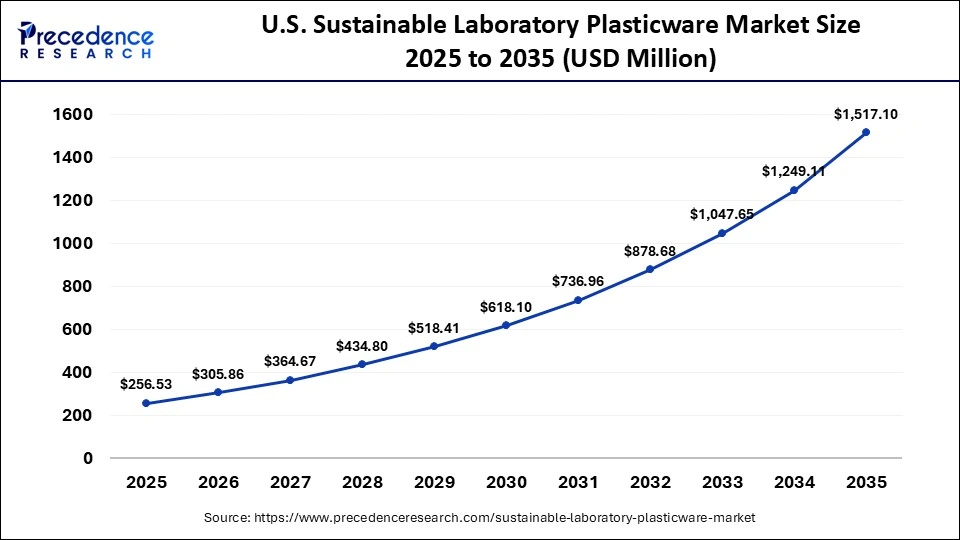

What is the Size of the U.S. Sustainable Laboratory Plasticware Market?

The U.S. sustainable laboratory plasticware market size is calculated at USD 256.53 million in 2025 and is expected to reach nearly USD 1,517.10 million in 2035, accelerating at a strong CAGR of 19.45% between 2026 and 2035.

U.S. Sustainable Laboratory Plasticware Market Trends

The United States sustainable laboratory plasticware market is driven by robust regulatory enforcement, widespread adoption of green lab certification programs, and strong sustainability commitments from biotechnology and pharmaceutical companies. Reusable and recycled laboratory consumables are gaining traction across academic, government, and commercial laboratories due to increased life sciences research funding and mounting pressure to reduce single-use plastics. Federal research agencies and large universities are embedding sustainability criteria into procurement decisions. Corporate ESG reporting requirements are accelerating measurable reductions in laboratory plastic waste. Advances in recyclable polymers are improving performance parity with conventional plasticware. Together, these factors are normalizing sustainable plasticware as a standard choice in U.S. laboratory operations.

Why is Asia Pacific the Fastest-growing in the Sustainable Laboratory Plasticware Market?

Asia Pacific is the fastest-growing region, expanding at approximately 26%, driven by rapid growth in pharmaceutical manufacturing, expanding academic and contract research infrastructure, and rising environmental awareness. Governments across the region are actively promoting sustainable manufacturing practices and waste reduction policies within healthcare and research sectors. Large-scale investment in life sciences parks and biotech clusters is increasing consumption of laboratory consumables, accelerating the shift toward recyclable and bio-based plasticware. Cost-competitive local manufacturing is making sustainable alternatives more accessible to a broader range of laboratories. Increasing participation in global clinical trials is also pushing laboratories to align with international sustainability standards. Together, regulatory support, scale-driven affordability, and rising ESG expectations are positioning Asia Pacific as the fastest-growing market for sustainable laboratory plasticware.

India Sustainable Laboratory Plasticware Market Trends

India market is expanding steadily due to the quick expansion of academic research institutes, contract research firms, and pharmaceutical manufacturing. Laboratories are adopting recycled and reusable plasticware as viable substitutes for traditional lab consumables due to cost concerns, government initiatives promoting sustainability, and growing environmental consciousness.

Why is Latin America seeing gradual growth in the market for sustainable laboratory plasticware?

Latin America is witnessing gradual growth in sustainable laboratory plasticware adoption, supported by tightening environmental regulations and steady expansion of healthcare and laboratory infrastructure. Public health laboratories and diagnostic centers are increasingly prioritizing eco-friendly consumables as governments invest in disease surveillance, environmental testing, and water quality monitoring. Growing awareness of plastic waste management is encouraging laboratories to adopt recyclable and reusable plasticware to reduce disposal costs and regulatory risk. Academic and research institutions are beginning to align procurement practices with sustainability objectives set by funding agencies. Limited budgets are driving preference for cost-effective sustainable alternatives rather than premium solutions. Together, incremental regulatory pressure, infrastructure development, and rising environmental awareness are enabling measured but consistent market growth across Latin America.

Brazil Sustainable Laboratory Plasticware Market Trends

Brazil leads the Latin American market driven by expanding sustainability regulations environmental testing initiatives, and robust pharmaceutical production. The demand for recycled and reusable lab plasticware is rising as a result of increased government emphasis on recycling and waste reduction, as well as increased funding for biotech research.

Why Is MEA Set to See Notable Growth in the Sustainable Laboratory Plasticware Market?

The Middle East and Africa region is set to see notable growth as governments increase investment in healthcare modernization, clinical diagnostics, and environmental monitoring infrastructure. Laboratories in countries such as the United Arab Emirates and Saudi Arabia are gradually adopting sustainable laboratory plasticware in line with national waste reduction and sustainability strategies. Rising participation in international clinical trials is encouraging compliance with global environmental and laboratory standards. Urban research hubs and reference laboratories are prioritizing recyclable and reusable consumables to reduce long-term operational costs. Growth of public health surveillance and environmental testing programs is increasing routine laboratory throughput, amplifying plasticware demand. Together, infrastructure investment, regulatory alignment, and sustainability awareness are supporting steady adoption of sustainable laboratory plasticware across the MEA region.

UAE Sustainable Laboratory Plasticware Market Trends

The UAE stands out within the MEA because of its cutting-edge medical facilities and emphasis on sustainability and innovation. The demand for sustainable and superior laboratory plasticware is being driven by government led green initiatives for the growth of research facilities and the widespread use of high-end laboratory technologies.

Who are the Major Players in the Global Sustainable Laboratory Plasticware Market?

The major players in the sustainable laboratory plasticware market include Merck KGaA, Thermo Fisher Scientific, Corning Incorporated, Eppendorf AG, Globe Scientific Inc., DWK Life Sciences, Greiner Bio-One International, Sartorius AG, VWR International, Beckman Coulter, Nalgene (Thermo Scientific), CELLTREAT Scientific, Thomas Scientific, Labcon North America, Axygen (Corning), BrandTech Scientific, Plastocraft, Sustainable Laboratory Products (SLP), Biohit Oyj, and Porvair Sciences.

Recent Developments

- In February 2025, Project Mumbai partnered with RACE 2025 (Recycling and Compounding Expo) to champion sustainability and knowledge-sharing in plastics recycling and compounding, with events and collaborations to drive eco innovation.(Source: www.polymerupdate.com)

- In October 2025, Evonik showcased its latest sustainable polymer innovations including mass balanced and circular materials designed to reduce environmental footprint and promote lifecycle sustainability at the K 2025 plastics fair in Düsseldorf.(Source: www.evonik.com)

Segments Covered in the Report

By Product Type

- Reusable Sustainable Plasticware

- Single-Use Recyclable Plasticware

- Biodegradable Plasticware

- Compostable Laboratory Plasticware

- Recycled Plasticware

By Material Type

- Recycled Plastics

- Bio-Based Polymers

- Biodegradable Polymers

- PLA (Polylactic Acid)

- Cellulose Acetate

- Others (PHA, PBS)

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Government Research Labs

- Clinical & Diagnostic Laboratories

- CROs & CMOs

- Industrial & Environmental Testing Labs

By Distribution Channel

- Direct Sales to Institutional Labs

- E-Commerce & Online Marketplace

- Laboratory Distributors & Resellers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting