What is the Temperature Monitoring Systems Market Size in 2026?

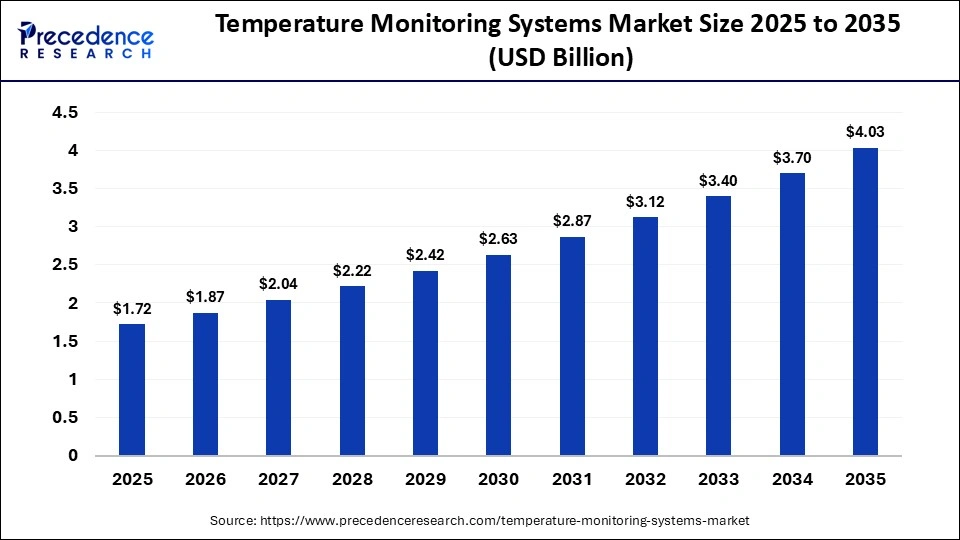

The global temperature monitoring systems market size accounted for USD 1.72 billion in 2025 and is predicted to increase from USD 1.87 billion in 2026 to approximately USD 4.03 billion by 2035, expanding at a CAGR of 8.90% from 2026 to 2035. The growth of the market is driven by the rising use of high-quality temperature monitoring devices from the industrial sector, along with technological advancements in sensor technology.

Key Takeaways

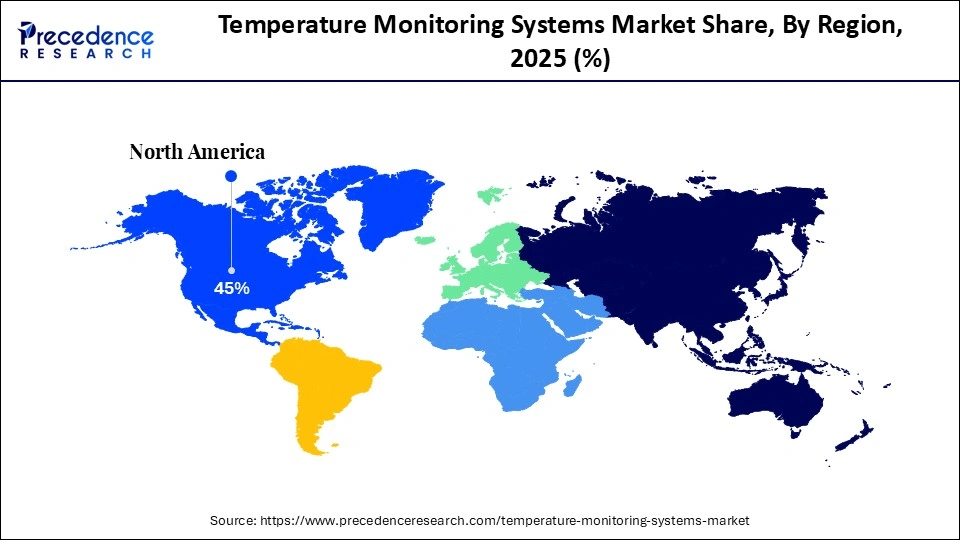

- North America led the market with the largest market share of 45% in 2025.

- Asia Pacific is expected to expand at the highest CAGR during the forecast period.

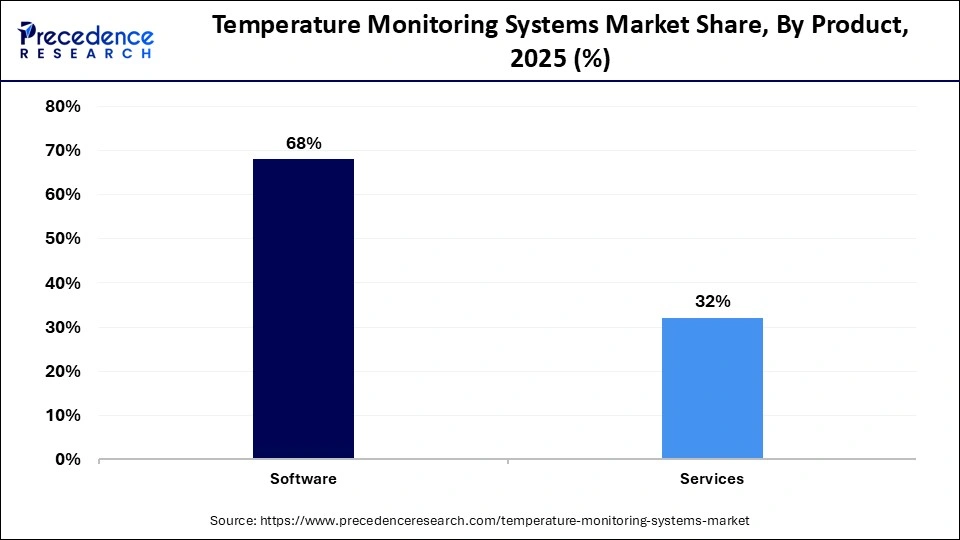

- By product, the digital temperature monitoring devices segment held the major share of 71% in 2025.

- By product, the analog temperature monitoring devices segment is expected to expand at a significant CAGR during the forecast period.

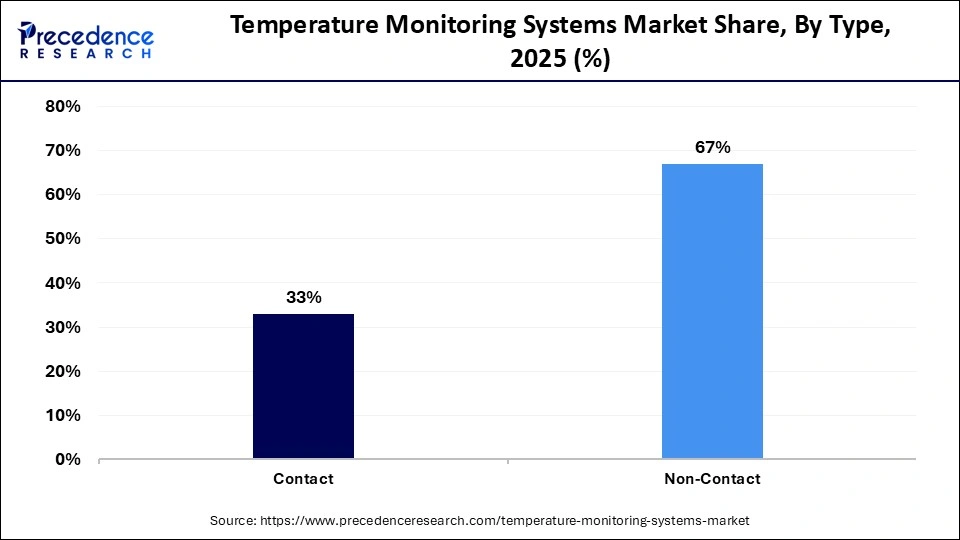

- By type, the non-contact segment contributed the highest share of 67% in 2025.

- By type, the contact-based segment is expected to grow at the fastest CAGR between 2026 and 2035.

- By end-user, the healthcare facilities segment accounted for the biggest market share of 65% in 2025.

- By end-user, the home care settings segment is expected to grow with a significant CAGR during the forecast period.

Market Overview

The temperature monitoring systems market deals with the manufacturing and distribution of high-quality temperature monitoring devices. Temperature monitoring systems are advanced solutions that use IoT, sensors, and data loggers to track and record the temperature of environments, equipment, or products in the industrial sector. This market is growing due to increasing demand for safety, quality, and regulatory compliance across industries such as food & beverages, pharmaceuticals, healthcare, and logistics. Rising awareness of product spoilage prevention, the expansion of cold chain logistics, and stricter government regulations for temperature-sensitive goods are driving adoption.

How is AI Impacting the Temperature Monitoring Systems Market?

AI is significantly transforming the market for temperature monitoring systems by enabling predictive analytics, automated alerts, and intelligent decision-making. Instead of simply recording temperature data, AI-powered systems analyze patterns in real time to predict potential deviations, equipment failures, or cold chain disruptions before they occur. This helps reduce product spoilage, minimize downtime, and ensure regulatory compliance in industries such as pharmaceuticals, food & beverages, and healthcare. Nowadays, market players are integrating AI into temperature monitoring systems to enable real-time anomaly detection, enhance energy efficiency, and deliver improved data analysis.

- In June 2025, Metafoodx launched an AI-based temperature monitoring system. These monitoring systems are designed to enhance food safety.

Major Market Trends

- Product Launches: Market players are continuously engaged in launching a wide range of products to cater to end-user needs. For instance, in October 2025, Metis Engineering launched an isolated thermocouple module. This module is designed to enhance the capabilities of industrial temperature monitoring.

- Collaborations: Various maritime companies are collaborating with tech providers to develop high-quality temperature sensors. For instance, in April 2025, eMarine collaborated with ABB. This collaboration aims at developing an innovative temperature sensor for the maritime sector.

- Rise in the Number of Public Hospitals: The increase in the number of public hospitals in several nations has increased the demand for temperature monitoring systems. According to the American Hospital Association, there are around 6100 hospitals in the U.S. in 2025-26.

- Advanced Sensor Technologies: Use of high-precision, low-power sensors with better accuracy, miniaturization, and environmental resilience is increasing.

- AI and Data Analytics Integration: AI-driven analytics are being applied to predict deviations, optimize thresholds, and automate alerts for proactive responses.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.72 Billion |

| Market Size in 2026 | USD 1.87 Billion |

| Market Size by 2035 | USD 4.03 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.90% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Insights

Why Did the Digital Temperature Monitoring Devices Segment Dominate the Market?

The digital temperature monitoring devices segment dominated the temperature monitoring systems market with the largest share in 2025. This is due to the increased adoption of advanced digital temperature monitoring solutions from various industries, including food and beverage, cold chain logistics, and pharmaceuticals. Additionally, the surging deployment of digital temperature monitoring solutions in the data centers, as well as the rapid investment by the market players for developing digital thermometers, is positively contributing to the segment. Moreover, several advantages of digital temperature monitoring systems, such as real-time monitoring, enhanced accuracy, superior operational efficiency, and cost savings, have boosted their adoption.

The analog temperature monitoring devices segment is expected to grow at a significant CAGR during the forecast period. This is due to the surging application of analog temperature monitoring solutions for real-time tracking of thermal conditions. The growing use of analog temperature monitoring systems in numerous sectors, including food and beverage, HVAC, pharmaceuticals, and oil & gas, is playing a prominent role in shaping segmental development. Moreover, numerous benefits of analog temperature monitoring devices, including low power consumption, high reliability, and real-time data delivery, are expected to drive their adoption.

Type Insights

What Made Non-Contact the Leading Segment in the Temperature Monitoring Systems Market?

The non-contact segment led the market while holding a major share in 2025. This is due to the increased use of non-contact thermometers in the food and beverage sector to check food quality. These thermometers find numerous applications in medical screening and diagnosing problems in various automotive parts, such as motors and engines, thus driving their adoption. Moreover, several benefits of non-contact thermometers, such as rapid reading, superior convenience, versatility, and enhanced hygiene protection, have driven their adoption.

- In November 2025, Withings announced that the FDA had approved BeamO. BeamO is an advanced contactless thermometer designed for enhancing accurate home health monitoring.

The contact-based segment is expected to expand at a significant CAGR between 2026 and 2035. The growth of the segment is driven by the growing application of contact-based thermometers for monitoring temperature in the residential sector. Additionally, the surging use of rectal thermometers in monitoring the health conditions of infants, along with their wider adoption in the industrial sector, is positively contributing to the segmental development. Moreover, numerous advantages of the contact-based thermometers, including high accuracy & precision, fast response times, cost-effectiveness, and superior versatility, are expected to propel the growth of this segment.

- In December 2025, Smart Meter launched iDigiTemp. iDigiTemp is a handheld thermometer that operates through cellular networks and is adopted globally by patients and healthcare providers.

End-User Insights

Why Did the Healthcare Facilities Segment Dominate the Market?

The healthcare facilities segment dominated the temperature monitoring systems market in 2025. This is mainly due to the critical need to maintain precise temperature conditions for vaccines, blood samples, biologics, and other temperature-sensitive medical products. Hospitals, laboratories, and pharmacies require continuous monitoring systems to ensure patient safety, prevent product loss, and comply with stringent regulatory standards. Additionally, the expansion of cold chain requirements for vaccines and specialty drugs has further strengthened adoption across healthcare facilities. Moreover, partnerships among healthcare companies and market players aimed at integrating advanced temperature monitoring solutions in the blood banks have driven the growth of this segment.

The home care settings segment is expected to expand at a significant CAGR during the forecast period. This is mainly due to the growing use of traditional thermometers in homecare settings for monitoring chronic fevers among patients. Also, the increasing focus of market players on developing IoT-enabled smart thermostats to monitor room temperature for ensuring a consistent environment in homes is playing a prominent role in shaping the segmental landscape. Moreover, the surging application of wireless temperature sensors and Bluetooth data loggers to identify heating and cooling issues in the residential sector is expected to accelerate the growth of this segment.

- In January 2026, LI-COR launched HOBO. HOBO is a Bluetooth-enabled data logger used for measuring temperature in modern homes.

Regional Insights

North America Temperature Monitoring Systems Market Size and Growth 2026 to 2035

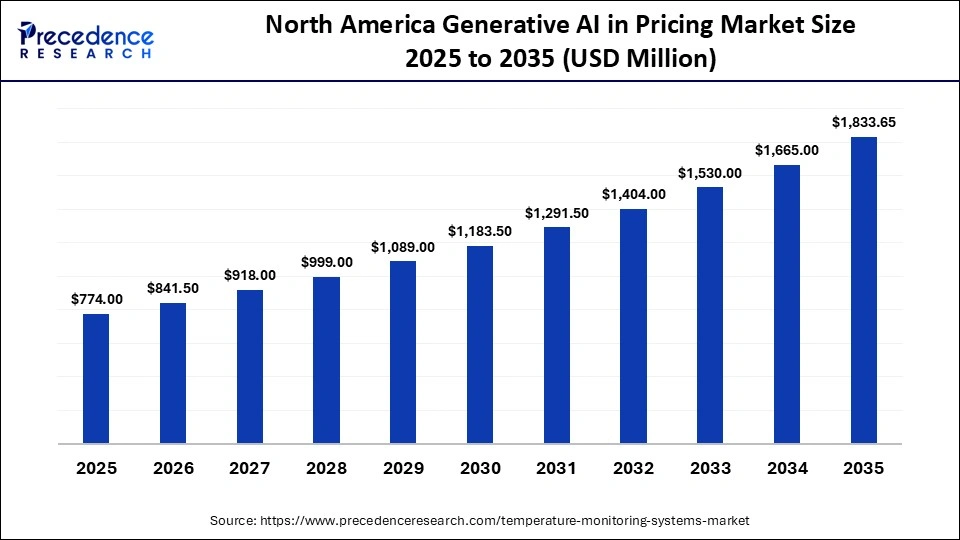

The North America temperature monitoring systems market size is estimated at USD 774.00 million in 2025 and is projected to reach approximately USD 1,833.65 million by 2035, with a 9.01% CAGR from 2026 to 2035.

Why Did North America Dominate the Temperature Monitoring Systems Market?

North America dominated the temperature monitoring systems market by capturing the largest share in 2025. The dominance of the region in the market is attributed to the increasing demand for analog temperature monitoring devices from the industrial sector in the U.S., Canada, and Mexico. The region has high adoption of cold chain logistics for vaccines, biologics, and perishable foods, driving demand for reliable and compliant monitoring solutions. Early adoption of IoT-enabled systems, strong technological capabilities, and significant investments in smart supply chain management have further reinforced North America's market leadership. Moreover, product launches and collaborations among various market players, such as 3M, Masimo, and Exergen Corporation, have driven the growth of the market in this region.

- In December 2024, Exergen Corporation launched Temporal Scanner TAT-2000C. Temporal Scanner TAT-2000C is a high-quality thermometer designed for consumers across the U.S. and Canada.

U.S. Temperature Monitoring Systems Market Size and Growth 2026 to 2035

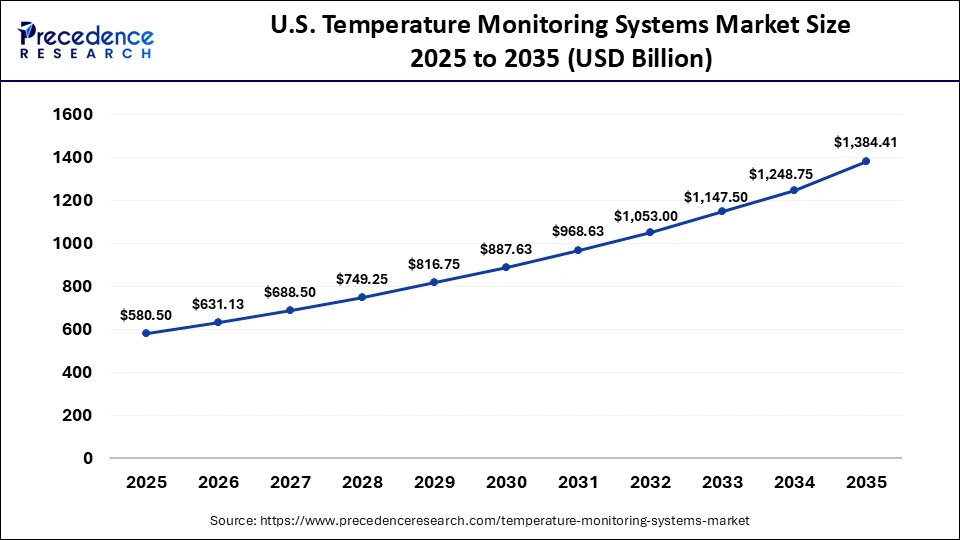

The U.S. temperature monitoring systems market size is calculated at USD 580.50 million in 2025 and is expected to reach nearly USD 1,384.41 million in 2035, accelerating at a strong CAGR of 9.08% between 2026 and 2035.

U.S. Temperature Monitoring Systems Market Trends

The U.S. leads the North American temperature monitoring systems market. This is mainly due to the growing demand for digital monitoring devices from the pharmaceutical sector, along with the rise in the number of healthcare facilities. Moreover, the rapid investment by the market players in advancing research and development of monitoring devices is positively contributing to the industry.

How is the Opportunistic Rise of Asia Pacific in the Market?

Asia Pacific is expected to expand at the highest CAGR during the forecast period. This is primarily due to rapid industrialization, expanding healthcare infrastructure, and growing cold chain logistics networks in various nations, including China, South Korea, India, and Japan. Increasing pharmaceutical production, vaccine distribution programs, and rising food exports are driving demand for reliable temperature monitoring solutions. Additionally, government initiatives to strengthen healthcare systems, improve food safety standards, and promote digital transformation are accelerating the adoption of IoT-enabled and real-time monitoring technologies across the region.

China Temperature Monitoring Systems Market Analysis

China is a major contributor to the temperature monitoring systems market within Asia Pacific. This is due to the rapid adoption of cloud-based monitoring solutions in the industrial sector, coupled with advancements in sensor technology. Additionally, the rise in the number of biotech startups, coupled with the opening of new pharma units, is positively contributing to this market.

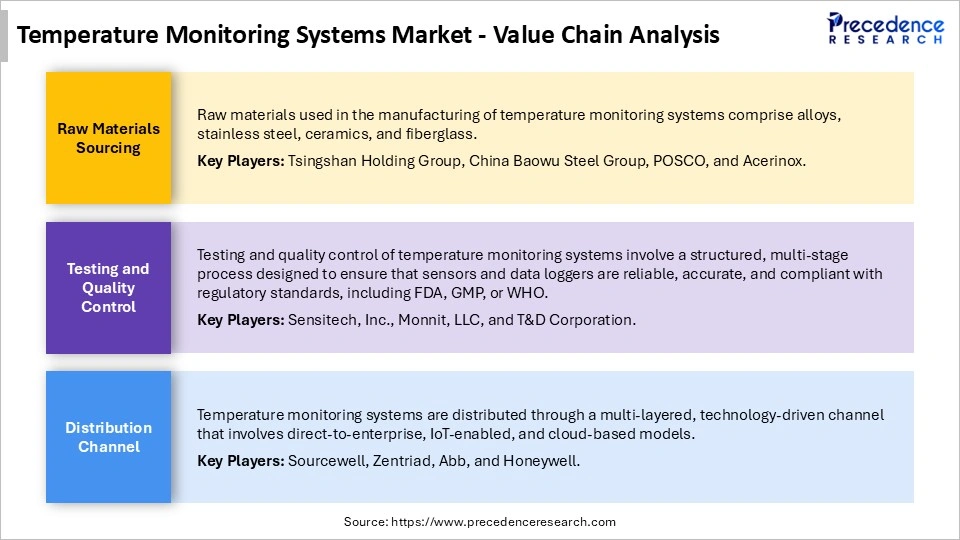

Temperature Monitoring Systems Market Value Chain Analysis

Temperature Monitoring Systems Market Companies

- Koninklijke Philips N.V. (Netherlands)

- Toshiba Inc. (Japan)

- 3M (U.S.)

- Exergen Corporation (U.S.)

- Masimo (U.S.)

- Omron Healthcare (Japan)

- Geratherm (Germany)

- Braun Healthcare (Germany)

- A&D Company Ltd. (Japan)

Recent Developments

- In December 2025, Vistab International AB launched Frashtag, a color-changing smart label that tracks the time and temperature of perishable foods, ensuring safety and quality. It provides a cost-effective, easy-to-integrate solution for food safety and quality management systems.(Source: https://foodindustryexecutive.com)

- In June 2025, Sensirion launched the SHT40-AD1P-R2 and SHT41-AD1P-R2 digital humidity and temperature sensors, offering high accuracy and reliability for demanding environments. Featuring a removable protective cover, they ensure durability during handling and deployment and are now available through Sensirion's global distribution network.(Source: https://sensirion.com)

- In January 2025, Lonestar Tracking launched a new temperature-controlled solution. This solution is designed to ensure product safety and improve cold chain management.(Source: https://www.freshplaza.com)

Segments Covered in the Report

By Product

- Digital Temperature Monitoring Devices

- Analog Temperature Monitoring Devices

By Type

- Contact

- Non-Contact

By End-User

- Healthcare Facilities

- Home Care Settings

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting