Triazine Type UV Absorber Market Size and Forecast 2025 to 2034

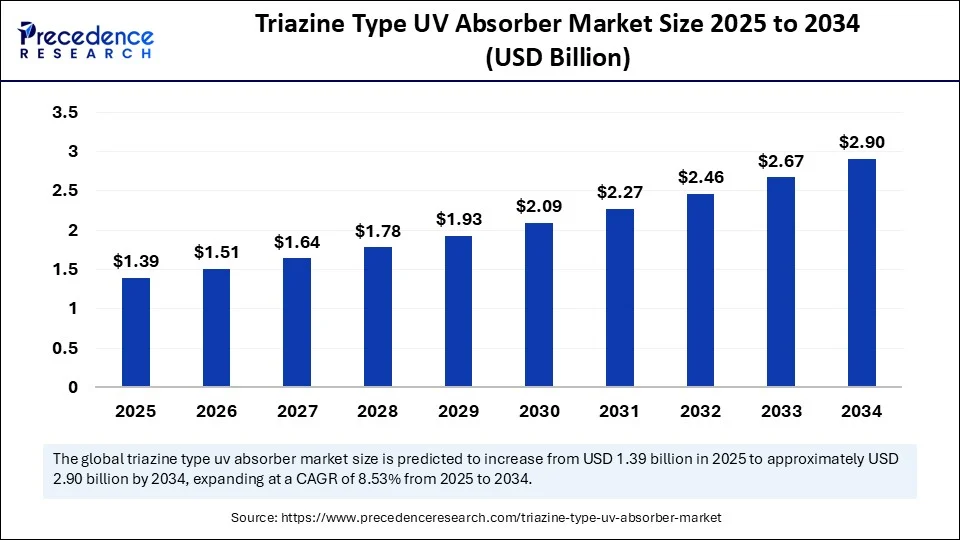

The global triazine type UV absorber market size accounted for USD 1.28 billion in 2024 and is predicted to increase from USD 1.39 billion in 2025 to approximately USD 2.90 billion by 2034, expanding at a CAGR of 8.53% from 2025 to 2034.The increased demand for triazine type UV absorbers in various industries like packaging, automotive, construction, agriculture, and personal care is driving the growth of the market.

Triazine Type UV Absorber MarketKey Takeaways

- In terms of revenue, the global triazine type UV absorber market was valued at USD 1.28 billion in 2024.

- It is projected to reach USD 2.90 billion by 2034.

- The market is expected to grow at a CAGR of 8.53% from 2025 to 2034.

- Asia Pacific dominated the triazine type UV absorber market with the largest share in 2024.

- North America is expected to grow at the highest CAGR from 2025 to 2034.

- By product/grade type, the monomeric triazine UV absorbers segment contributed the largest market share in 2024.

- By product/grade type, the polymeric triazine UV absorbers segment is expected to grow at a notable CAGR between 2025 and 2034.

- By function, the UV absorption segment contributed the largest market share in 2024.

- By function, the dual function (UV + thermal stabilization) segment is expected to grow at the highest CAGR between 2025 and 2034.

- By formulation, the powder segment led the market while holding the largest share in 2024.

- By formulation, the liquid/dispersion segment will grow at a significant CAGR between 2025 and 2034.

- By end-use industry, the plastics & polymers (PE, PP, PET, PVC, etc.) segment led the market while holding the largest share in 2024.

- By end-use industry, the automotive coatings & paints segment will grow at the fastest CAGR between 2025 and 2034.

- By application type, the masterbatch segment contributed the largest market share in 2024.

- By application type, the surface coatings segment is expected to grow at a notable rate between 2025 and 2034.

- By distribution channel, the direct sales (B2B) segment contributed the largest market share in 2024.

- By distribution channel, the online platforms/e-commerce segment is expected to grow at the highest CAGR between 2025 and 2034.

How is AI Impacting the Triazine Type UV Absorber Market?

Artificial Intelligenceis transforming the market due to its key role in material science advancements, synthesis optimization, and predictive modeling. Machine learning algorithms analyze a vast amount of chemical structure data to help with new material discovery. AI stimulation and prediction of the performance of novel triazine-type UV absorbers aid in designing more effective molecular structures. AI algorithms provide synthesis optimization to reduce production cost and environmental impacts. The predictive modeling of AI models can help to enhance the performance of triazine UV absorbers in various applications, including textiles, coatings, and plastics.

Market Overview

Triazine-type UV absorbers are high-performance chemical compounds primarily used to protect materials, especially plastics, coatings, and polymers are from ultraviolet (UV) radiation degradation. These absorbers are part of the broader class of UV stabilizers and offer excellent thermal stability, low volatility, and long-lasting protection, particularly suited for demanding applications such as automotive coatings, high-end plastics, and construction materials. The market for triazine-based UV absorbers is driven by increasing demand in industries like automotive, packaging, building & construction, and electronics, especially where materials are exposed to prolonged UV radiation. Government and strict environmental regulations are enforcing policies to reduce environmental impact and adopt eco-friendly UV absorbers, boosting the use of sustainable alternatives like triazine-type UV absorbers.

What are the Major Factors Driving the Growth of the Triazine Type UV Absorber Market?

- Awareness of UV Radiation Damage: The awareness of UV radiation damage has increased, driving industrial focus toward product durability and longevity, driving adoption of UV absorbers for material protection from radiation.

- Industrial Demand: The demand for triazine-type UV absorbers has increased in industries like automotive, construction, agriculture, personal care, and packaging to protect materials, preserve quality, and extend lifespan.

- Rapid Industrialization: rapid growth of industries like the automotive and construction sectors, driving the adoption of triazine-type UV absorbers.

- Sustainable Demands: consumers being aware of sustainability, driving demand for sustainable and eco-friendly products, making companies' efforts and developments of new UV absorbers to reduce environmental impacts.

- Technological Advancements: technological advancements in formulation and manufacturing process of UV absorbers, enhancing effectiveness and increasing accessibility.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.90 Billion |

| Market Size in 2025 | USD 1.39 Billion |

| Market Size in 2024 | USD 1.28 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.53% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Grade / Type, Function, Application Type,End-use Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Regulatory Focus on Material Durability and Safety

Strict environmental regulations are being enforced for the use of UV absorbers in various industrial applications to reduce material degradation caused by UV radiation. These regulations are empowering manufacturers to invest in research and development to create high-performance UV absorbers that meet requirements. Regulatory agencies are encouraging industries to adopt high-performance UV absorbers like triazine for their high photostability and broad-spectrum protection, driven by growing emphasis on environmental safety and product lifespan. The regulatory trend is highly performing industries like automotive, construction, and packaging, where material degradation is a major concern, leading to economic losses and safety concerns.

Restraint

Environmental and Health Concerns

Triazine-type UV absorbers can cause a potential health risk. The production and disposal of these absorbers can lead to adverse environmental impacts. This can lead to regulatory restrictions and reduce demand. The development of advanced triazine-based UV absorbers requires high R&D investments, which can be a barrier for budget-conscious manufacturers. The growing trend for the development of more sustainable and eco-friendly UV absorbers is driving the need for further R&D investments to create new products and meet regulatory requirements.

Opportunity

Integration of Smart Materials and Nanotechnology

The integration of smart materials improves the efficiency of UV protection and product differentiation. Nanomaterials play a crucial role in enhancing the effectiveness and stability of triazine UV absorbers. Integration of smart materials and nanotechnology is improving the performance and durability of UV absorbers for various applications, including in industries like construction, automotive, and packaging. Nanotechnology enables the development of polymer-bound UV absorbers and nano-structured UV absorbers to improve UV protection with minimum concentrations. Manufacturers are rapidly leveraging smart materials and nanotechnology to develop unique and high-performance UV absorbers, including triazine.

Product/Grade Type Insights

What Made Monomeric Triazine UV Absorbers the Dominant Segment in the Market in 2024?

The monomeric triazine UV absorbers segment dominated the triazine type UV absorber market in 2024. The dominance of monomeric triazine UV absorbers stems from their unique properties and versatility. These absorbers play a vital role in protecting various materials from UV radiation damage. Industrial applications, such as plastics, coatings, and personal care, are the major adopters of the monomeric triazine UV absorbers. The monomeric triazine UV absorbers are crucial in enhancing the durability of materials and sustainability practices.

The polymeric triazine UV absorbers segment is expected to grow at the fastest rate in the upcoming period due to the increased adoption of these absorbers in various industrial applications, including coating, plastics, and cosmetics. Polymeric triazine UV absorbers are highly effective in UV protection. Strict regulations regarding product safety and growing awareness about UV-related skin issues and damage are driving the adoption of polymeric triazine UV absorbers.

Function Insights

Which Function Segment Leads the Triazine Type UV Absorber Market in 2024?

The UV absorption segment led the market while holding the largest share in 2024 due to its superior ability to protect polymers and coatings from ultraviolet degradation, which is critical across various industries. Triazine-type UV absorbers have significant UV absorption capabilities to help prevent material degradation, which is mostly caused by UV radiation. The adoption of absorbers with UV absorption capabilities is high in industries like automotive, plastics, construction, and coatings. UV absorbers are crucial in absorbing UVA and UVB radiation.

The dual function (UV + thermal stabilization) segment is expected to expand at the fastest CAGR over the forecast period due to its multifunctional protection capabilities, making it highly desirable in demanding industrial applications. The excellent properties of UV absorbers drive the adoption of dual-function absorbers for protecting against UV radiation and high temperatures. Dual-function UV absorbers are versatile and effective in various applications, helping to protect materials from UV radiation and temperature. The UV and thermal stabilization of triazine-type UV absorbers is crucial in a harsh environment.

Formulation Insights

Why Did Powder Formulation Dominate the Triazine Type UV Absorber Market in 2024?

The powder segment dominated the market in 2024 due to its stability and versatility in various applications. The power formulation of triazine-type UV absorbers is highly used in industries like automotive and construction due to their excellent absorption capabilities and thermal stability. The powder triazine-type UV absorbers make it easier to incorporate into different formulations, are highly stable, and versatile for various applications.

The liquid/dispersion segment is expected to expand at the highest CAGR in the upcoming period due to its superior ease of application, compatibility, and performance advantages across diverse end-use industries. Liquid/dispersion formulation of triazine-type UV absorbers is crucial in applications that need excellent dispersion. Liquid/dispersion formulations of triazine-type UV absorbers exhibit a homogeneous size, enhancing their ability to promote better dispersion in thermoplastic polymers. Coating and adhesive applications are major adopters of this formulation.

End-Use Industry Insights

Which End-Use Industry Dominate the Triazine Type UV Absorber Market in 2024?

The plastics & polymers (PE, PP, PET, PVC, etc.) segment dominated the market in 2024 due to increased use of UV-sensitive plastics & polymers materials in various applications. The increased use of plastics & polymers in construction materials, automotive parts, and packaging solutions drives demand for triazine-type UV absorbers to protect products from UV radiation. Many polymers, such as polypropylene, polyethylene, and polycarbonate, degrade under UV exposure, leading to discoloration, cracking, and loss of strength. Triazine UV absorbers are highly effective in preventing these effects, making them essential in polymer stabilization.

The automotive coatings & paints segment is likely to grow at a significant rate during the projection period due to the increased need for long-lasting UV protection in automotive surfaces, where durability and resistance to environmental damage are essential performance criteria. UV absorbers prevent automotive coatings & paints from UV-induced degradation and preserve aesthetic appeal. The use of high-gloss finishing, interior comfort features, and metallic coatings & paintings in vehicles is further driving demand for advanced triazine-type UV absorbers.

Application Type Insights

How Does the Masterbatch Segment Dominate the Triazine Type UV Absorber Market?

The masterbatch segment led the market in 2024 due to efficient dispersion properties and the user-friendly nature of the masterbatch. The increased utilization of masterbatch in the plastic and coating industries is driving the need for efficient UV absorbers like triazine. The masterbatch is a mixed additive of UV absorbers in carrier resin, which helps to enhance dispersion, handling, and reduce dust.

The surface coatings segment is expected to grow at the highest CAGR over the forecast period due to the heightened use of UV absorbers in preventing surface coatings from UV radiation and high temperatures. The demand for durable and aesthetically appealing coatings has increased in various applications, such as construction, automotives, and industrial applications. Triazine-type UV absorbers offer superior absorption, thermal stability, and resistance to extraction, making them ideal solutions for surface coating.

Distribution Channel Insights

How Does the Direct Sales (B2B) Segment Lead the Triazine Type UV Absorber Market in 2024?

The direct sales (B2B) segment led the market in 2024 due to the increased demand for tailored services and strong control over supply chains. Direct B2B sales allow manufacturers to collaborate closely with end-users to tailor triazine UV absorber formulations to specific material or performance needs. This flexibility is crucial in high-precision applications. Manufacturers are securing long-term agreements with key end-users, which drives segmental growth.

The online platforms/e-commerce segment is expected to expand at the fastest growth rate over the forecast period due to the urgent need for triazine-type UV absorbers in various industries like plastics, paints & coatings, and textiles. Chemical manufacturers are embracing digital platforms to expand their reach, driving online sales of these absorbers. The expanding use of e-commerce platforms in various industries is fostering the segment's growth. Additionally, the growing consumer preference for convenience and accessibility is further contributing to this growth.

Regional Insights

What Made Asia Pacific the Dominant Region in the Triazine Type UV Absorber Market?

Asia Pacific dominated the global triazine type UV absorber market with the largest share in 2024 due to its strong manufacturing base, expanding industrialization, and increasing demand across various sectors such as automotive, plastics, and construction. Asian consumers are becoming aware of the importance of UV protection of products and materials. Expanding industries and economic growth in emerging countries like China, Japan, India, and South Korea are driving the adoption of UV absorbers in applications like construction, agriculture, automotive, and consumer goods. The growing demand for durable and aesthetically pleasing products is further driving innovations in UV absorbers.

China is leading the market in the region due to its vast automotive and construction industries. The robust manufacturing base and increasing investments in infrastructure developments are fostering the need for advanced UV absorbers. Additionally, the Chinese government's initiatives, like “Make in China 2025”, are driving innovation and development of cutting-edge triazine-type UV absorbers.

North American Triazine Type UV Absorber Market Trends

North America is the fastest-growing region in the global market due to its stringent environmental regulations, expanding industries, innovations in high-performance formulations, and advanced polymer and coating industries. The increased awareness about the importance of UV protection, advancements in UV absorber technologies, and the growing shift toward eco-friendly products are fostering this growth. Additionally, the strong existence of key market players and their large investments in the R&D sector are bringing significant innovations to the emerging market.

The U.S. is a major player in the regional market, contributing to growth due to its strong manufacturing base, increasing R&D investments, and strict environmental regulations. The demand for UV-stable material has increased in various industries, regulatory changes are promoting the use of eco-friendly alternatives, and a strong emphasis on advancements in formulations is fostering innovations and developments of advanced triazine-type UV absorbers in the U.S.

European Triazine Type UV Absorber Market Trends

Europe is expected to grow at a notable rate in the upcoming period due to the increased adoption of UV protection technologies and materials in various industries and a strong push toward sustainability. The increasing awareness about the harmful effects of UV radiation and the focus on eco-friendly alternatives are fostering this growth. European governments have implemented several strict regulations promoting the use of sustainable and eco-friendly products, driving the adoption of triazine-type UV absorbers in various industries. Germany is a major player in the regional market, contributing to the growth due to its robust industrial base. There is a rising demand for UV absorbers in high-performance applications, supporting market growth.

Triazine Type UV Absorber Market Companies

- BASF SE

- SABO S.p.A.

- Ciba Specialty Chemicals (now part of BASF)

- Solvay

- Evonik Industries AG

- Songwon Industrial Co., Ltd.

- Addivant (now part of SI Group)

- Clariant AG

- 3V Sigma S.p.A.

- Suqian Unitechem Co., Ltd.

- MPI Chemie BV

- Mayzo Inc.

- Lycus Ltd.

- Hangzhou Shinyang Samwoo Fine Chemical Co.

- Beijing Tiangang Auxiliary Co., Ltd.

- Rianlon Corporation

- Everlight Chemical Industrial Corp.

- Valtris Specialty Chemicals

- Foster Corporation

- DSM Engineering Materials (for triazine-based stabilizers in engineering plastics)

Recent Developments

- In June 2025, the Dutch distributor of specialty chemicals and ingredients for food, personal care, and pharmaceutical markets, Caldic, extends its collaboration with Sarex Overseas, a Mumbai-based manufacturer of chemicals, API intermediates, and triazine-based UV absorbers. The Caldic has been announced as the exclusive distributor for triazine-based UV absorbers of Sarex Overseas in Europe.(Source: https://www.chemicalweekly.com)

- In January 2024, Solvay unveiled its sustainable triazine UV absorber formulation, which is used in bio-based materials, at the 2024 American Cleaning Institute (ACI) Annual Meeting & Industry Convention, held under the theme “Advancing Cleaning Innovation.” (Source: https://www.indianchemicalnews.com)

Segment Covered in the Report

By Product Grade / Type

- Monomeric Triazine UV Absorbers

- Polymeric Triazine UV Absorbers

- High-Purity Grades (for electronics/optics)

- General Industrial Grades

By Function

- UV Absorption

- Light Stabilization (Synergistic with HALS)

- Dual Function (UV + Thermal Stabilization)

By Formulation

- Powder

- Granules

- Liquid/Dispersion

By End-use Industry

- Plastics & Polymers (PE, PP, PET, PVC, etc.)

- Automotive Coatings & Paints

- Construction Materials (PVC siding, insulation)

- Adhesives & Sealants

- Cosmetics & Personal Care Products

- Agricultural Films & Nets

- Electronics & Optical Films

- Packaging (especially food-grade packaging)

By Application Type

- Masterbatch

- Surface Coatings

- Bulk Polymer Compounding

- Solvent-based Systems

- Water-based Systems

By Distribution Channel

- Direct Sales (B2B)

- Distributors & Dealers

- Online Platforms / E-commerce

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting