UAV Satellite Communication Market Size and Forecast 2025 to 2034

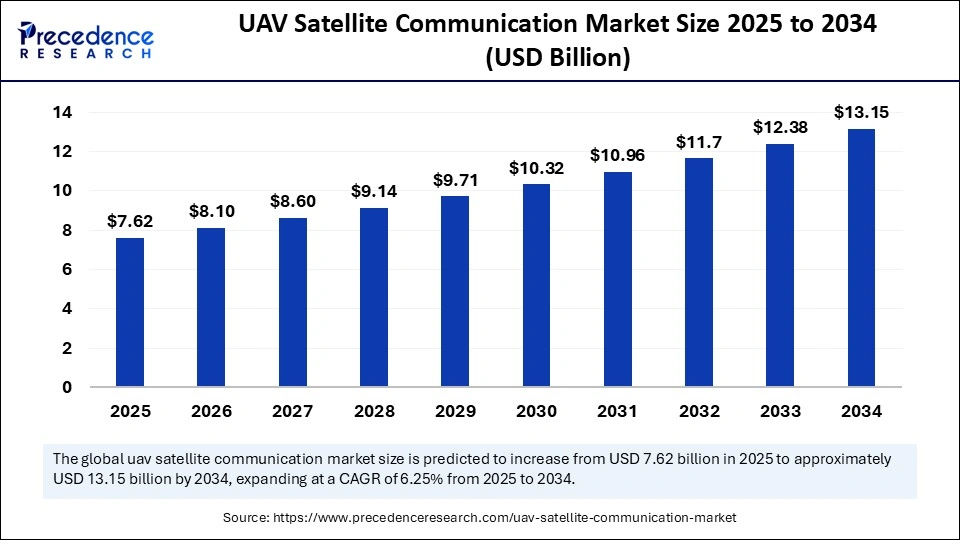

The global UAV satellite communication market size was calculated at USD 7.17 billion in 2024 and is predicted to increase from USD 7.62 billion in 2025 to approximately USD 13.15 billion by 2034, expanding at a CAGR of 6.25% from 2025 to 2034. The increased demand for more reliable, long-distance, and beyond-visual-line-of-sight (BVLOS) communication is driving the global market. Additionally, the market is experiencing significant growth with increased UAV integration in various sectors.

UAV Satellite Communication Market Key Takeaways

- In terms of revenue, the global UAV satellite communication market was valued at USD 7.17 billion in 2024.

- It is projected to reach USD 13.15 billion by 2034.

- The market is expected to grow at a CAGR of 6.25% from 2025 to 2034.

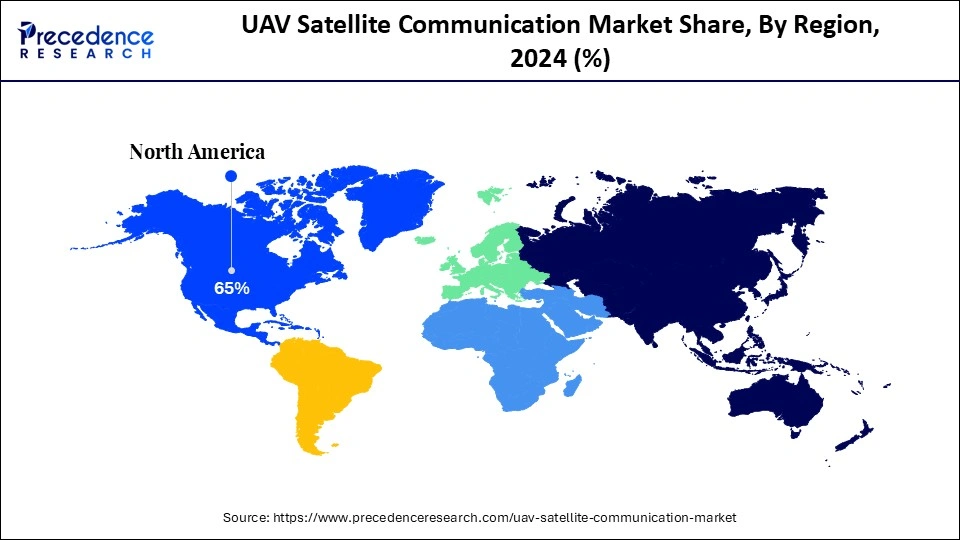

- North America dominated the global UAV satellite communication market with largest market share of 65% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By component, the satcom terminals (airborne) segment contributed the biggest market share of 55% in 2024.

- By component, the software-defined radios & communication systems segment is expected to grow at a notable CAGR between 2025 and 2034.

- By frequency band, the Ku-band segment captured the highest market share of 50% in 2024.

- By frequency band, the multi-band solutions segment will grow at a CAGR between 2025 and 2034.

- By platform, the medium-altitude long endurance (MALE) UAVs segment contributed the maximum market share of 60% in 2024.

- By platform, the small tactical UAVs segment will grow at a CAGR between 2025 and 2034.

- By end-user, the defense & security agencies segment generated the major market share of 70% in 2024.

- By end-user, the commercial operators (logistics, energy, telecom) segment will grow at a CAGR between 2025 and 2034.

Market Overview

The UAV satellite communication market refers to the specialized communication technologies and solutions that enable beyond visual line-of-sight (BVLOS) operations for unmanned aerial vehicles by leveraging satellite networks. SATCOM allows UAVs to maintain real-time data transfer, video streaming, command & control (C2), navigation, and surveillance capabilities even in remote or oceanic regions where terrestrial connectivity (4G/5G, radio links) is unavailable. This market is driven by the increasing adoption of UAVs for defense & intelligence, disaster management, remote sensing, precision agriculture, border monitoring, and logistics delivery. Growth is also fueled by advancements in low-earth orbit (LEO) satellite constellations, miniaturized SATCOM terminals, and integration of UAVs into civil airspace.

The rapid growth in commercial and defense applications is the key factor fueling demand for advanced UAV satellite communication solutions, especially for beyond visual line-of-sight (VLOS) operations. The UAV satellite communication systems are experiencing significant adoption growth in urban air mobility. Moreover, the regulatory streamlining and novel business models are offering a boost in the integration of these solutions.

Major Innovations and Investments for UAV and Satellite Communication Solutions

- In September 2025, $13 million was invested by Kraken Robotics for global orders of synthetic aperture sonar & subsea batteries. This system will equip uncrewed underwater vehicles across the U.S., Turkey, and Norway to enhance their UUV capabilities. (Source: https://www.unmannedsystemstechnology.com)

- To strengthen Netherlands-Finland cooperation, advance autonomous drone technologies, and support NATO joint expeditionary force priorities, DeltaQuad and the Dutch Coalition partnered for defense and security in September 2025. This three-year collaboration is expected to improve cooperation between the Netherlands and Finland in defense and aerospace. (Source: https://www.unmannedsystemstechnology.com)

- In August 2025, a Rs 30,000 cr deal for procuring 87 MALE drones and fostering indigenous UAV manufacturing was declared by the Defense Acquisition Council. This contract is set to split between a 64:36 two-lowest-bidders ratio, to establish two distinct production lines. These initiatives are expected to improve electronic warfare capabilities, reconnaissance, and precision strike abilities. (Source: https://economictimes.indiatimes.com)

What Role is AI Playing in UAV Satellite Communication Solutions?

Artificial intelligence is playing a significant role in optimization, monitoring, and advancing designs in UAV satellite communication solutions. AI-driven UAV satellite communication solutions are able to predict demand and allocation of resources like power, bandwidth, and coverage with more efficiency and enhanced network performance. AI monitors and optimizes network performance, which helps to enhance its capabilities in real-time and detect anomalies.

AI can adjust parameters for optimal performance according to requirements and commands. AI integration in satellite payloads for significant applications helps to enhance their performance and efficiency. Major players are focusing on the development of AI-driven UAV technologies to improve efficiency and smooth satellite communication.

- On September 8, 2025, a leading provider of unmanned aerial systems (UAS), TEKEVER, participated in a high-level technology showcase of its AI-driven AR3 and AR5 drones ahead of DSEI 2025. This launch has highlighted companies' cutting-edge autonomous capabilities, UK border support, and defense partnerships. This event was designed to cover government officials from Five Eyes nations, including Canada, Australia, New Zealand, the UK, and the U.S.(Source:https://www.unmannedsystemstechnology.com)

What are the Key Trends of the UAV Satellite Communication Market?

- Rising Military Spending: The increased military budget enables the adoption of advanced technologies, driving the equipping with a satellite communication system for real-time surveillance and reconnaissance.

- Expanding Commercial and Civil Aviation: The growth of commercial and civil aviation is boosting demand for UAV satellite communication systems.

- Government Initiatives: The government worldwide is focusing on investing heavily in cutting-edge technologies such as UAVs and satellite technology for enhancing military capabilities.

- Technological Investments: The government and prominent players are investing heavily in the technology sector for the development of high-performance SATCOM systems.

- Miniaturization Innovations: The emphasis on innovations in miniaturization enables the development of compact, high-performance, and lightweight satellite components for small and more versatile drones, which are gaining traction in the global market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.15 Billion |

| Market Size in 2025 | USD 7.62 Billion |

| Market Size in 2024 | USD 7.17 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.25% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Frequency Band, Platform, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expanding Satellite Networks

The satellite network expansion has boosted demand for reliable and high-bandwidth connectivity across various applications, driving the adoption of UAV satellite communication solutions. The rapid growth in the number of LEO satellites and HTS is contributing to this expansion, which provides faster data transmission, low-latency, and high potential for multi-Gigabit links for UAVs. Particularly, the expansion of LEO constellations has boosted the need for UAV satellite communications solutions for real-time and more secure data transmission in remote and extreme environments. The ongoing innovations in the development of hybrid communication systems for integrating satellite with 5G/terrestrial networks are further solidifying market expansion.

Restraint

High Initial Investment

High upfront investments in satellite communication infrastructure are a major restraint for the global market. UAV satellite communication needs specialized technologies and continuous maintenance, making them costly, particularly for small and medium-sized organizations. The small companies face spectacular barriers to the adoption of these technologies. The high initial investments required in these technologies limit their accessibility across the global market.

Opportunity

Technological Advancements

Technological advancements such as advancements in miniaturized satellite antennas, integration with 5G networks, development of hybrid communication systems, multiband & multifunction antennas and communication systems, high-throughput satellites (HTS), and increased use of low-earth orbits (LEO) satellites are holding spectacular growth opportunities for the market. Key manufacturers are emphasizing the development of advanced UAV satellite communication solutions with high-speed, low-latency, and reliable communications. These solutions are rapidly being integrated with LEO satellites, miniaturized components, and integrated satellite-cellular networks like 5G networks and IoT. Technological innovations are enabling the facilitation of beyond visual line-of-sight (BVLOS) operations across diverse applications.

Component Insights

Which Component Segment Leads the UAV Satellite Communication Market in 2024?

The SATCOM terminals (airborne) segment led the market in 2024, due to increased demand for reliable connectivity in military and commercial applications. Military and commercial sectors have increased demand for more reliable, high-speed, and long-range communication, driving the adoption of airborne SATCOM terminals. These terminals are highly evolved as a result of the proliferation of commercial and military UAVs, providing real-time data transmission and high operational efficiency. Technological advancements like ultra-compact terminals and increased use of satellites for beyond-visual-line-of-sight (BVLOS) operations are further increasing the adoption of airborne SATCOM terminals.

The software-defined radios & communication systems segment is the second-largest segment, leading the market due to increased need for high-performance and precision communication technologies in various sectors. The software-defined radios & communication systems enable high-data-rate communication over long distances. These components are crucial in operating NLOS environments for avoiding signal congestion. Key industries like commercial, emergency services, and military are the major adopters of these components, driven by their ability to enable small UAVs and robotics platforms to adapt to dynamic conditions in real-time.

Frequency Band Insights

What Made Ku-band Segment Dominate the UAV Satellite Communication Market in 2024?

The Ku-band segment dominated the market in 2024, due to its balance of high data rates, manageable cost, and reliable coverage. The Ku-band is affordable compared to other frequency bands, making it supportive of critical real-time data transmission for navigation and control over drones. The Ku-band frequency is the most widely adopted for drone controls in long-range surveillance and military applications. This band offers higher bandwidth, high stability, and is cost-effective for both military and commercial UAVs.

The multi-band solutions segment is expected to grow fastest over the forecast period, driven by its high reliability and flexibility. These frequency bands offer strong connectivity for various applications and environments. The multi-band Solutions are mainly used for dynamic switching between frequencies for various tasks, ensuring beyond-visual-line-of-sight (BVLOS) communications, and offer redundancy. The ability of multi-band Solutions to provide high bandwidth for real-time data transmission makes it suitable for diverse operations.

Platform Insights

Which Platform Dominates the UAV Satellite Communication Market?

In 2024, the medium-altitude long-endurance (MALE) UAVs segment dominated the market due to its enhanced operational reach. The medium-altitude long-endurance (MALE) UAVs are long-endurance and high-attitude platforms enabling persistent, real-time, long-distance command and control required for military and civil operations. This platform operates at high altitudes of 10,000-30,000 feet and extends a duration of 24-48 hours, enabling prolonged, high-level surveillance and persistent presence over large geographical areas. The platforms enable the offering of a critical edge in border security, ISR, surveillance, and logistics, particularly in critical and remote areas.

The small tactical UAVs segment is expected to lead the market over the forecast period, driven by their large use in military & defense, surveillance, and reconnaissance operations. The high demand for reliable and long-range communications in these applications is driving the adoption of small tactical UAVs. This platform provides real-time intelligence, particularly in hostile environments, beyond-visual-line-of-sight (BVLOS) applications. The increasing defense spending and technological advancements are fostering the segment's growth.

End-User Insights

Which End-user Dominated the UAV Satellite Communication Market in 2024?

The defense & security agencies segment dominated the market in 2024, due to the increased need for secure and reliable communication solutions in mission-critical operations. The defense & security agencies have boosted the need for more secure and long-distance communication in remote or hostile environments. This end-user conducts various applications like surveillance, reconnaissance, and tactical operations. UAVs with integration of satellite-based connectivity enable improved operational capabilities via offering real-time and beyond-visual-line-of-sight (BVLOS) command and control. These technologies are bringing critical advances in national security and border security operations.

The commercial operators (logistics, energy, telecom) segment is the fastest-growing segment in the market, driven by increased adoption of UAV technologies in commercial operations. The increased use of hybrid satellite-terrestrial networks and the creation of integrated platforms for connectivity management and data analytics are fostering this growth. The commercial operators have increased adoption of advanced antenna and modem technologies for beyond-line-of-sight (BVLOS) operations. Logistics companies have increased UAV satellite communications solutions for fleet management and drone deliveries; similarly, energy and telecom companies are using these systems for asset monitoring and improving global connectivity, respectively.

U.S. UAV Satellite Communication Market Size and Growth 2025 to 2034

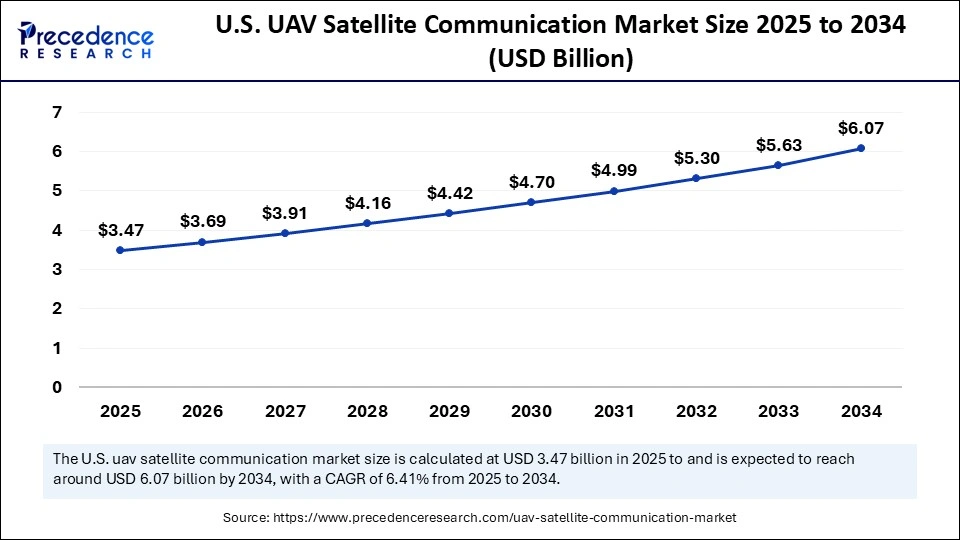

The U.S. UAV satellite communication market size was evaluated at USD 3.26 billion in 2024 and is projected to be worth around USD 6.07 billion by 2034, growing at a CAGR of 6.41% from 2025 to 2034.

North America UAV Satellite Communication Market

North America dominates the global market, driven by the region's cutting-edge technological infrastructure and high adoption rate of UAVs. North America has experienced significant growth in investments in the defense and aerospace sector, enabling the adoption of advanced technologies. Regulatory support for novel technological innovations is contributing to this growth. Additionally, ongoing collaborations between government agencies and private companies are further aiding in the expansions.

Robust Military and Defense Sector: To Lead the U.S. Market

The U.S. is a major player in the regional market, contributing to growth due to the advanced defense and aerospace sector and a strong focus on technological advancements. The increased defense and military spending have boosted demand for secure and beyond-line-of-sight (BVLOS) technologies in the country. The growing trend for the adoption of next-generation LEO satellite constellations like Starlink is fostering this growth. Additionally, ongoing innovations in low-latency connectivity, advancements in compact and lightweight antenna technologies are setting the market to grow further.

- From September 2 to 4, 2025, the Caesars Forum was held in Las Vegas, reflecting the geospatial industry from the commercial UAV Expo 2025. This event serves as a reminder of how fat the industry has become and which areas are required to receive attention and care in workflows and applications. (Source:https://www.geoweeknews.com)

Asia Pacific UAV Satellite Communication Market

Asia Pacific is the fastest-growing region in the global market, growth driven by the region's increasing defense spending in surveillance and secure beyond-line-of-sight (BVLOS) communication. The rapid expansion of agriculture, logistics, and disaster management applications is further driving demand for advanced UAV satellite communications solutions. Additionally, the government investments and initiatives for technological advancements and the defense & aerospace industry are fueling innovations and adoptions of these solutions across Asia.

China's Market Trends

China is a major player in the regional market, contributing to growth due to the country's advanced defense and aerospace industry and government initiatives. China has set a strong focus on the national defense sector. The increased adoption of UAV technology in different sectors and strategic collaboration of the government with companies and other countries are leveraging strong growth in the development, adoption, and export of UAV satellite communications solutions in China.

Emerging Indian Market

India is a significant player in the regional market, driven by countries' expanding aerospace & defense industry, agricultural use, and government support. The market is experiencing spectacular growth with increased demand for high-speed connectivity, government support, and broad industry adoption. Major sectors like defense, disaster management, and IoT are the key adopters for these technologies.

- In January 2025, the Indian Space Research Organisation (ISRO) launched the NVS-02 navigation satellite to strengthen India's navigation with the Indian constellation (NavIC) system. This satellite uses the GSLV-F15 rocket from Sriharikota, designed to offer accurate positioning and timing services for India and surrounding areas. (Source: https://www.thehindu.com)

Value Chain Analysis

- Testing and Certification

Testing and certification of UAV satellite communications solutions evaluate their performance, safety, and reliability for ensuring compliance with regulations like aviation and telecommunication.

Key Players: SGS and UL Solutions, RTX, L3Harris Technologies, and Thales.

- Installation and Commissioning

The solution installation and commissioning involve hardware integration, system configuration, and extensive testing.

Key Players: SKYTRAC, Indra Sistemas, Honeywell Aerospace, and Inmarsat.

- Maintenance and After-Sales Service

The UAV satellite communication solutions require maintenance services including remote monitoring, over-the-air software updates, and scheduled maintenance. The after-sales services include technical support, training & certification, and upgrades & optimization.

Key Players: Northrop Grumman, RTX, L3Harris Technologies, Inc., and Israel Aerospace Industries.

UAV Satellite Communication Market Companies

- Cobham Satcom

- Gilat Satellite Networks

- Inmarsat Global Limited

- Viasat Inc.

- Iridium Communications Inc.

- Hughes Network Systems LLC

- Intelsat S.A.

- SES S.A.

- Thuraya Telecommunications Company

- Eutelsat Communications

- L3Harris Technologies, Inc.

- Honeywell Aerospace

- General Atomics Aeronautical Systems, Inc.

- Northrop Grumman Corporation

- Boeing (Insitu)

- Lockheed Martin Corporation

- Blue Sky Network

- UAV Satcom Ltd.

- SkyPerfect JSAT Corporation

- Orbit Communication Systems

Recent Developments

- On September 8, 2025, the ARK DIST SR and ARK DIST MR, two compact USA-built distant sensor modules, were unveiled by ARK Electronics. These modules are designed for precision & high-performance short-range and mid-range rangefinding in demanding UAV operations. (Source:https://www.unmannedsystemstechnology.com)

- In September 2025, the next-generation SPARTAN UAV was introduced by Ascent AeroSystems at Commercial UAV Expo 2025 in Las Vegas. This SPARTAN is a next-generation with a proven NX30 coaxial UAV platform. This technology is designed for defense, industrial, agricultural operators, and public safety with new standards of performance, reliability, and versatility. (Source: https://www.satnow.com)

Segment Covered in the Report

By Component

- SATCOM Terminals (Airborne)

- SATCOM Antennas (Parabolic, Flat-Panel, Electronically Steered)

- Transponders & Modems

- Ground Control Stations (SATCOM-enabled)

- Onboard Data Processing Units

- Software-Defined Radios & Communication Systems

By Frequency Band

- L-Band

- S-Band

- C-Band

- Ku-Band

- Ka-Band

- X-Band

- Multi-Band Solutions

By Platform

- Fixed-Wing UAVs

- Rotary-Wing UAVs

- Hybrid/VTOL UAVs

- High-Altitude Long Endurance (HALE) UAVs

- Medium-Altitude Long Endurance (MALE) UAVs

- Small Tactical UAVs

By End User

- Defense & Security Agencies

- Commercial Operators (Logistics, Energy, Telecom)

- Government Agencies (Disaster Relief, Border Control)

- Research & Academic Institutions

- Civil Aviation Authorities & Air Traffic Management

By Region

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

Get a Sample

Get a Sample

Table Of Content

Table Of Content