US Hydrogen Generation Market Size and Growth 2024 to 2033

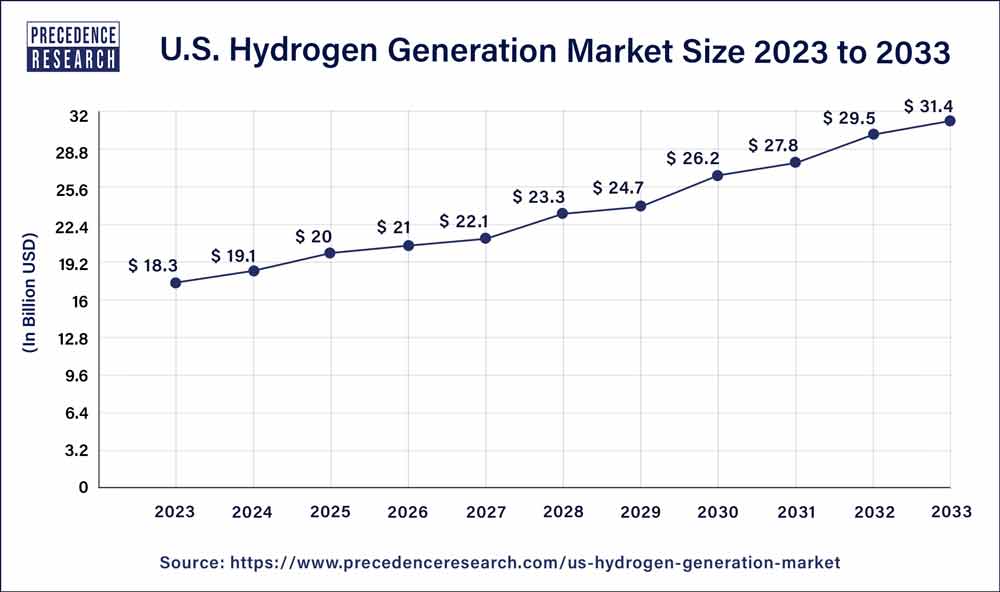

The UShydrogen generation market size is anticipated to reach around USD 31.4 billion by 2033, increasing from USD 18.3 billion in 2023 and poised to grow at a CAGR of 5.7% from 2024 to 2033. The U.S. hydrogen generation market is driven by a rise in the market for clean hydrogen.

Key Takeaways

- In terms of revenue, the global U.S. hydrogen generation market was valued at USD 19.1 billion in 2024.

- It is projected to reach USD 31.4 billion by 2033.

- The market is expected to grow at a CAGR of 5.7% from 2024 to 2033.

- By type, the green hydrogen segment dominated the market in 2023.

- By system type, the merchant segment dominated the market in 2023.

- By system type, the captive segment is observed to witness the fastest rate of expansion during the forecast period.

- By source, the natural gas segment is dominated the market in 2023.

- By technology, the steam methane reforming segment dominated the U.S. hydrogen generation market.

- By application, the ammonia production segment dominated the market in 2023.

U.S. Hydrogen Generation Market Overview

The U.S. hydrogen generation market revolves around the processes associated with hydrogen as an essential component in many industrial processes, such as the creation of chemicals, the production of ammonia, and the refining of petroleum. The demand for sustainable hydrogen production methods is fueled by the rising use of hydrogen in hydrogenation reactions as companies work to reduce carbon emissions. It provides a versatile and dispatchable power-generating option for gas turbines and fuel cells to produce low- or zero-emission electricity. Technologies based on hydrogen-based power generation are anticipated to be essential components of the energy mix as the United States moves toward greener energy sources.

Efficiency, affordability, and scalability improvements are being made in electrolysis, especially in alkaline and proton exchange membrane (PEM) electrolysis. The capital and operating expenses of producing hydrogen are reduced by electrolyzer design and material science advances, making electrolysis more competitive with traditional techniques. Government initiatives and subsidies are significant factors propelling the market for hydrogen generation's expansion. Hydrogen-related projects are observed to receive financing, tax credits, and regulatory support in the United States through several federal and state-level initiatives that speed up research, development, and implementation.

Growth Factors

- Emissions in the steel, ammonia, and refining industries can be decreased by using hydrogen.

- The U.S. hydrogen generation market is driven by strict laws and industry-wide emission reduction goals to use clean fuels like hydrogen.

- The potential of hydrogen to store surplus renewable energy and offer grid flexibility is becoming more and more popular.

- Demand for clean hydrogen is driven by the growing interest in heavy-duty hydrogen trucks and fuel cell electric vehicles (FCEVs).

- Tax advantages, grants, and loan guarantees encourage the production and use of hydrogen.

- Collaborations across governmental, commercial, and academic institutions can quicken the pace of discovery and application.

- Technological developments in electrolysis and renewable energy are reducing the cost of hydrogen production.

- Efficiency is being increased by creating high-performance electrolyzers and better manufacturing techniques, promoting the growth of the U.S. hydrogen generation market.

- Investments in hydrogen pipelines, refueling stations, and storage facilities are essential for the industry to flourish.

- Putting carbon pricing schemes in place can encourage clean hydrogen usage even more.

Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 31.4 Billion |

| Market Size in 2024 | USD 19.1 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 5.7% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, System Type, Source, Technology, and Application |

U.S. Hydrogen Generation Market Dynamics

Driver

Increasing investments and public-private partnerships

The investments support the advancement of cutting-edge technology research, the expansion of production capabilities, and the development of hydrogen infrastructure. Through public-private partnerships, government resources and private-sector innovation are combined to expedite the development of hydrogen generation and make it more affordable, accessible, and efficient. This partnership encourages the growth of hydrogen applications in several industries, including industrial processes, energy storage, and transportation.

Restraint

Limited policy support

Policies are essential to encourage investment, shape the regulatory landscape, and promote innovation. However, the development of hydrogen generation is hampered by the requirement for comprehensive and uniform policies. Businesses can fund hydrogen infrastructure development and technologies with the right regulations. Furthermore, the lack of regulations or long-term incentives to promote the use of hydrogen may discourage interested parties from investing in R&D and deployment.

Opportunity

Leveraging renewable resources

Sustainable and ecologically friendly hydrogen production is possible with the help of renewable energy sources, including solar, wind, and hydroelectric power. This aligns with international initiatives to mitigate climate change and cut greenhouse gas emissions. Utilizing renewable energy sources for hydrogen creation can lead to cheaper production costs than conventional fossil fuel based approaches as their cost keeps declining. As a result, hydrogen may become more widely accepted and competitive in the energy market.

Leveraging renewable resources in the hydrogen generation sector is further supported by government efforts and incentives such as tax credits, subsidies, and renewable portfolio requirements that promote renewable energy and decarbonization. These laws establish a supportive legal framework for funding and advancing hydrogen projects utilizing renewable energy sources.

Type Insights

The green hydrogen segment dominated the U.S. hydrogen generation market in 2023. Cleaner energy sources are becoming more popular as awareness of climate change and the need to cut carbon emissions grows. Green hydrogen is an environmentally friendly substitute for conventional hydrogen production techniques that rely on fossil fuels. It is created through electrolysis using renewable energy sources like the sun and wind.

Green hydrogen generation has also become more economical and efficient due to developments in renewable energy technology, which has fueled its broad acceptance. The green hydrogen industry has grown even faster thanks to government incentives, assistance, and regulatory support for renewable energy and hydrogen efforts.

System Type Insights

The merchant segment dominated the U.S. hydrogen generation market in 2023. Cost-effective hydrogen production is made possible by merchant hydrogen generation plants' large-scale, highly efficient nature. Technological advances and constant innovation in hydrogen production techniques have made merchant providers even more competitive. These facilities are dedicated to hydrogen production only, allowing them to optimize technology and procedures for optimal output and efficiency.

The captive segment is the fastest growing in the U.S. hydrogen generation market during the forecast period. These businesses may meet their specialized needs for hydrogen with a dedicated and dependable source thanks to captive generation, which is frequently more efficient and economical than sourcing hydrogen from outside sources.

Furthermore, captive hydrogen generation is now more widely available and commercially feasible thanks to technological developments, particularly in electrolysis and steam methane reforming. This has enabled businesses to employ clean energy sources like solar and wind to manufacture hydrogen locally, helping them meet sustainability targets and cut greenhouse gas emissions.

Source Insights

The natural gas segment dominated the U.S. hydrogen generation market in 2023. The industry's most popular technique for producing hydrogen is steam methane reforming (SMR), which uses natural gas as a feedstock because of its abundant supply and affordable price. High-temperature reactions between natural gas and steam are used in SMR to create hydrogen. Furthermore, natural gas is preferable for producing hydrogen due to its established infrastructure and processing skills, particularly for industrial uses like ammonia manufacturing and refining.

Technology Insights

The steam methane reforming segment dominated the U.S. hydrogen generation market in 2023. Due to its effectiveness and broad use in the industrial sector, SMR is a well-known technique that uses a high-temperature steam reaction to create hydrogen from natural gas as a feedstock. This process is the go-to approach for hydrogen production in the US because it is scalable, affordable, and yields high-purity hydrogen suited for a wide range of industrial uses.

The coal gasification segment is the fastest growing in the U.S. hydrogen generation market during the forecast period. Coal gasification involves converting coal into synthesis gas primarily composed of hydrogen and carbon monoxide. This process allows for efficient hydrogen extraction from coal, making it a viable source for hydrogen production. Further, technological advancements have made coal gasification more cost-effective and environmentally friendly, driving its adoption in the hydrogen generation industry.

Application Insights

The ammonia production segment dominated the U.S. hydrogen generation market in 2023.Large-scale activities are frequently used in ammonia production plants, and huge volumes of hydrogen can be produced as a byproduct. This scale makes it possible to generate hydrogen economically and efficiently. Numerous facilities that produce ammonia already have infrastructure for developing and distributing hydrogen, which gives them a market advantage. The integration of hydrogen generation into ammonia production processes is becoming more and more possible due to technological advancements. Since hydrogen may be sold or used in various industrial operations, producing hydrogen as a byproduct of ammonia manufacturing is generally more financially advantageous.

The power generation segment is the fastest growing in the U.S. hydrogen generation market during the forecast period. Shifting toward greener energy sources is becoming increasingly important in the fight against climate change and greenhouse gas emissions. Because it only releases water vapor when burned, hydrogen is regarded as a pure energy source. Recent developments in electrolysis technology, which uses electricity to split water into hydrogen and oxygen, have improved the efficiency and economics of hydrogen generation. Hydrogen also improves grid stability since it can be stored and used as a dependable backup power source for sporadic renewable energy sources like solar and wind. Finally, government programs and rewards are designed to advance hydrogen as a sustainable energy option.

U.S. Hydrogen Generation Market Companies

- Air Products and Chemicals, Inc.

- Weldstar, Inc.

- Praxair, Inc.

Recent Developments

- In October 2022, an international producer of industrial gases based in Niagara Falls, New York, recently increased the investment in a building project there from $17 million to $90 million. Linde declared earlier this year that it would build 4501 Royal Ave. as its first PEM (Proton Exchange Membrane) plant in North America. That remains the objective, but the corporation will invest more to develop a 35-megawatt electrolyzer facility to produce more green hydrogen.

Segments Covered in the Report

By Type

- Blue Hydrogen

- Gray Hydrogen

- Green Hydrogen

By System Type

- Merchant

- Captive

By Source

- Natural Gas

- Coal

- Biomass

- Water

By Technology

- Coal Gasification

- Steam Methane Reforming

- Partial Oxidation (POX)

- Electrolysis

- Others

By Application

- Methanol Production

- Ammonia Production

- Petroleum Refinery

- Transportation

- Power Generation

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting