Veterinary API Market Size and Forecast 2025 to 2034

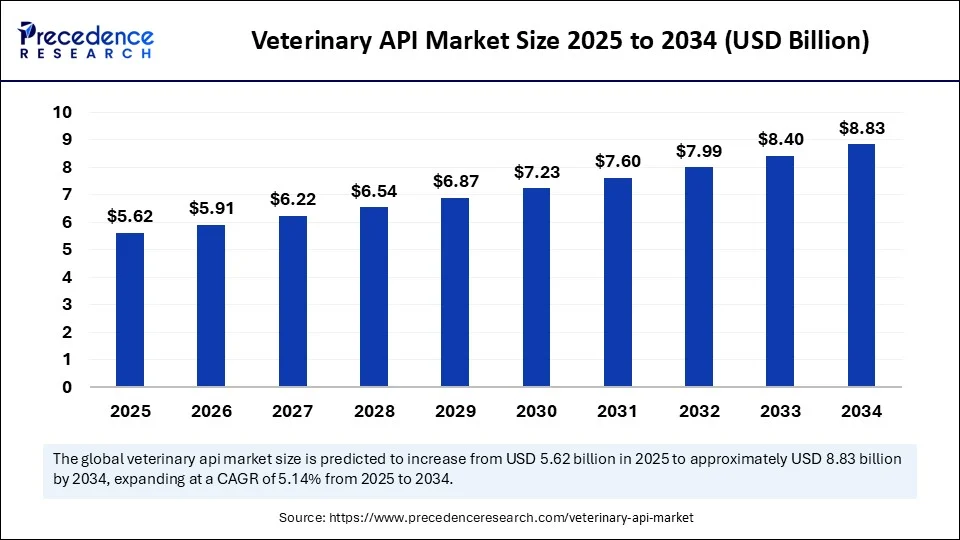

The global veterinary API market size accounted for USD 5.35 billion in 2024 and is predicted to increase from USD 5.62 billion in 2025 to approximately USD 8.83 billion by 2034, expanding at a CAGR of 5.14% from 2025 to 2034.The veterinary API market is witnessing steady growth, driven by the rising focus on animal health, zoonotic disease control, and livestock productivity. With the increasing demand for high-quality animal-derived food products, veterinary pharmaceuticals have become essential in both companion and production animal healthcare.

Veterinary API MarketKey Takeaways

- The global veterinary API market was valued at USD 5.35 billion in 2024.

- It is projected to reach USD 8.83 billion by 2034.

- The market is expected to grow at a CAGR of 5.14% from 2025 to 2034.

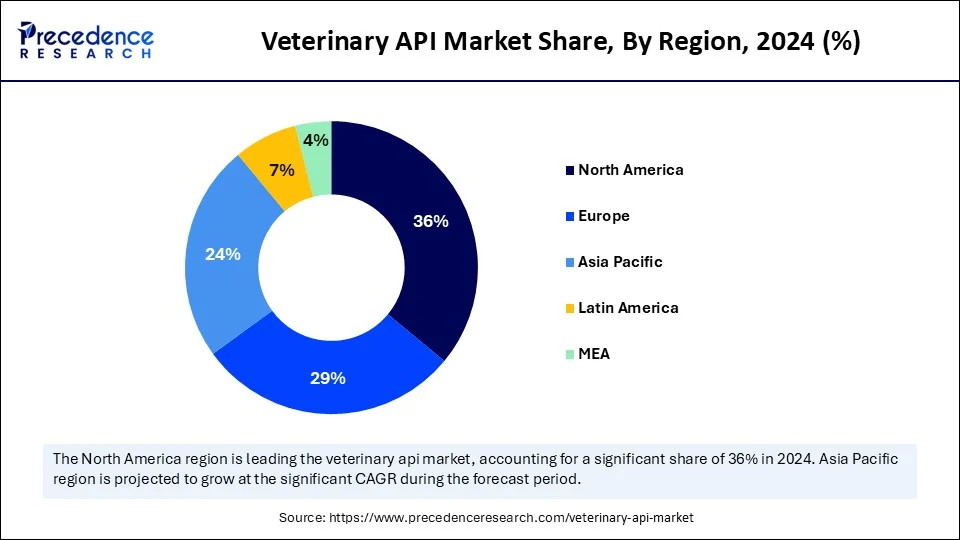

- North America dominated the veterinary API market with the largest market share of 36% in 2024.

- Asia-Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By service type, the in-house manufacturing segment held the biggest market share in 2024.

- By service type, the contract outsourcing segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By synthesis type, the chemical-based API segment led the market in 2024.

- By synthesis type, the biological API segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By animal type, the production animals segment contributed the highest market share in 2024.

- By animal type, the companion animals segment is expected to grow at the fastest CAGR in the upcoming period.

- By therapeutic, the anti-infectives segment generated the major market share in 2024.

How is AI Revolutionizing the Veterinary API Market?

Artificial Intelligence (AI) is reshaping the veterinary API market by accelerating drug discovery, improving disease prediction, and enabling precision dosing in animals. AI-driven platforms are being used to analyze animal genomics, monitor health parameters via sensors, and tailor medications for specific breeds or conditions. These innovations not only reduce R&D costs but also enhance the efficacy and safety of veterinary drugs. Furthermore, AI models are being applied to forecast outbreaks, streamline supply chains, and even detect antimicrobial resistance, thereby supporting more efficient and sustainable veterinary care.

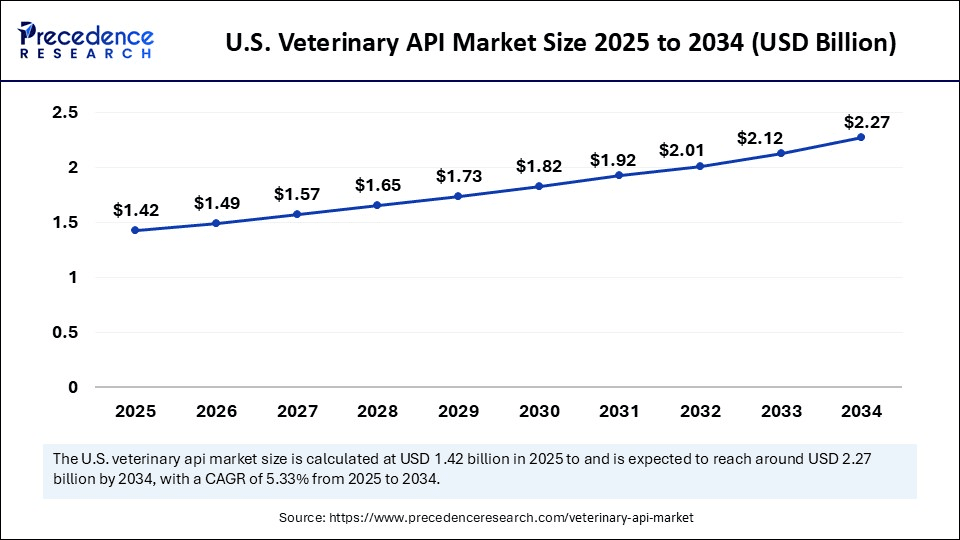

U.S. Veterinary API Market Size and Growth 2025 to 2034

The U.S. veterinary API market size was exhibited at USD 1.35 billion in 2024 and is projected to be worth around USD 2.27 billion by 2034, growing at a CAGR of 5.33% from 2025 to 2034.

What Factors Contribute to North America's Dominance in the Veterinary API Market?

North America registered dominance in the market by holding the largest revenue share in 2024. This regional supremacy is underpinned by a well-established animal healthcare infrastructure, significant investments in veterinary disease research and development, and a high level of pet ownership. The presence of major pharmaceutical and animal health companies, such as Zoetis, Elanco, and Merck Animal Health, enables robust R&D pipelines and the continuous development of specialty APIs targeting a wide range of conditions, from parasitic infections to chronic inflammatory diseases in companion animals. Moreover, the FDA's strict regulatory framework ensures product quality and efficacy, influencing the growth of the market in the region.

The North American livestock industry is another critical contributor, where precision farming and disease management systems are rapidly being adopted to meet food safety standards and export regulations. The growing concern over zoonotic diseases, antimicrobial stewardship, and traceability is pushing for more advanced and compliant APIs, especially in injectable and long-acting formulations. The region also leads in integrating AI, IoT, and tele-veterinary services, which support customized drug protocols and promote consistent use of APIs, such as long-acting antiparasitic, novel antibiotics, immunomodulators, and biologics.

The U.S. is a major player in the North American veterinary API market due to the increasing pet ownership, especially among millennials and Gen X. There is a high demand for preventive, wellness-focused models, increasing the use of APIs in therapies for obesity, arthritis, and cardiac health. Simultaneously, increasing livestock farming and the push for antibiotic stewardship in animal protein production are prompting demand for specialty APIs and non-antibiotic solutions. With strong regulatory oversight from agencies like the FDA-CVM, the country is expected to maintain its position in veterinary drug development.

Asia-Pacific: The Next Frontier in Veterinary Healthcare

Asia Pacific is expected to grow at the fastest CAGR in the upcoming period, propelled by the increasing livestock population, high demand for animal protein, and government-backed disease eradication programs. Countries like India, China, Vietnam, and Indonesia are investing heavily in modernizing their veterinary infrastructure, particularly in rural and semi-urban areas where livestock farming is a key livelihood. The expansion of commercial poultry and aquaculture, coupled with rising incidences of zoonotic and endemic diseases, is creating an urgent need for APIs that are cost-effective, scalable, and tailored to regional needs.

Additionally, the increasing ownership of companion animals, especially in urban areas, is fueling the demand for APIs related to dermatology, pain management, and metabolic care. Domestic pharmaceutical manufacturers are increasingly focusing on API self-reliance to reduce dependency on imports, aligning with broader policies such as Make in India or similar national initiatives. The growing awareness of zoonoses and antimicrobial resistance is reshaping public health policies and encouraging API localization and GMP (Good Manufacturing Practice) compliance. There is a high demand for specialty APIs for anti-inflammatory drugs, dewormers, dermatology, and nutraceuticals. Government programs spreading awareness regarding animal welfare further support regional market growth.

Market Overview

The veterinary API market is expanding due to rising concerns over zoonotic diseases, regulatory frameworks for animal welfare, and increased pet ownership across urban populations. APIs are highly sought after by veterinary drug manufacturers, contract manufacturers, and government health agencies. They are widely used in the development of antibiotics, antiparasitic, NSAIDs, and vaccines. Emerging countries, especially in Asia-Pacific and Latin America, are witnessing heightened investment in livestock healthcare and aquaculture medicine, further fueling the demand for efficient APIs.

Stringent regulations regarding animal food safety and pharmaceuticals are influencing API manufacturing processes. The market is emerging as a critical pillar of the global animal healthcare ecosystem, driven by the growing prevalence of zoonotic diseases, the rising demand for high-quality animal-derived food products, and the increasing pet population. As the world becomes more conscious of food safety, animal welfare, and antimicrobial resistance, the veterinary pharmaceutical sector is under pressure to deliver effective, targeted, and compliant drug formulations, all of which begin with high-quality APIs.

Major Key Trends in the Market

- Rising demand for routine vaccinations, parasite control, and diagnostics is driving the use of targeted APIs.

- Increasing pet adoption, especially among millennials, is raising the demand for pet-specific antibiotics, anti-inflammatory APIs, and dermatological treatments.

Shift toward customized APIs, especially for emerging biologic therapies like monoclonal antibodies and recombinant vaccines, boosts the growth of the market. - String emphasis on antimicrobial stewardship, tighter controls, and guidelines on antibiotic use in animals are encouraging API innovation with lower resistance profiles.

- Veterinary drug manufacturing companies are increasingly adopting eco-friendly synthesis processes and solvent-reduction techniques in response to environmental compliance pressures, supporting market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.83 Billion |

| Market Size in 2025 | USD 5.62 Billion |

| Market Size in 2024 | USD 5.35 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.14% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Synthesis Type, Animal Type, Therapeutic, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Animal-derived Products

A key factor driving the growth of the veterinary API market is the escalating demand for animal-derived food products such as meat and milk, particularly in emerging economies. This surge is putting immense pressure on livestock producers to maintain the health and productivity of animals, thereby increasing reliance on veterinary drugs and preventive care. APIs used in antibiotics, anthelmintics, and vaccines are crucial for treating infections and preventing outbreaks that can cripple food supply chains. Additionally, rising awareness among farmers regarding livestock welfare and biosecurity measures is encouraging routine veterinary interventions, further boosting the demand for high-quality APIs.

Restraint

Antibiotic Resistance

One of the most pressing restraints in the veterinary API market is the growing global concern over antimicrobial resistance (AMR). Excessive and unregulated use of antibiotics in livestock leads to cross-resistance in humans, drawing the attention of regulatory authorities. In response, stringent compliance frameworks are being introduced, including bans on certain antibiotic classes for non-therapeutic use. This regulatory pressure not only increases the cost and complexity of R&D and production but also slows the market entry of new entrants. Additionally, maintaining traceability and quality control standards across API supply chains, especially in low-cost manufacturing regions, remains asignificant challenge.

Opportunity

Rising Demand for Specialized APIs

A remarkable opportunity lies in the rising demand for specialty APIs for companion animals and exotic species. As urbanization continues, more people are adopting pets and seeking premium veterinary care. This includes demand for APIs in pain management, dermatology, oncology, and nutrition-enhancing supplements. Moreover, as governments and NGOs invest in zoonotic disease surveillance and pandemic preparedness, the need for fast-acting, scalable veterinary treatments will rise, creating space for innovative API development, especially in the fields of biologics, gene therapy, and recombinant vaccines. Untapped markets in Africa, Southeast Asia, and Latin America also offer lucrative opportunities for market players.

Service Type Insights

Why Did the In-House Manufacturing Segment Dominate the Market in 2024?

The in-house manufacturing segment dominated the veterinary API market with the largest share in 2024. This is mainly due to its tight control over quality, compliance, and intellectual property. Large veterinary pharmaceutical companies prefer to produce APIs internally to maintain consistency in formulation, ensure regulatory adherence, and reduce dependence on third-party suppliers. This is especially crucial in markets like North America and Europe, where stringent FDA and EMA guidelines are enforced. Additionally, in-house teams enable faster innovation cycles, R&D integration, and the ability to respond quickly to outbreaks or market-specific requirements. The control it offers over scalability, cost optimization, and proprietary technologies makes it a preferred choice for companies with established infrastructure.

On the other hand, the contract outsourcing segment is expected to grow at the fastest CAGR in the upcoming period, as small and mid-sized veterinary drug manufacturers are seeking to minimize capital expenditure and time-to-market. By leveraging specialized contract manufacturers, companies can focus on core competencies like drug development and branding while outsourcing complex synthesis and bulk production. Moreover, contract manufacturers now offer regulatory-compliant, GMP-certified services and advanced capabilities like biologics and high-potency APIs, making outsourcing an efficient, scalable, and strategic approach in a competitive market.

Synthesis Type Insights

How Does the Chemical-based API Segment Dominate the Veterinary API Market in 2024?

The chemical-based API segment dominated the market with a major revenue share in 2024 due to its scalability, affordability, and broad therapeutic applications. Chemical-based APIs form the backbone of many conventional veterinary treatments, ranging from antibiotics and antifungals to NSAIDs and antiparasitic. With increasing demand in emerging economies for accessible animal treatments, chemically synthesized APIs remain a cost-effective choice. Advancements in green chemistry, solvent-reduction processes, and high-purity synthesis techniques are also revitalizing interest in chemical APIs. Moreover, chemical APIs allow for mass production and ease of formulation, making them essential for treating widespread infections and in developing fixed-dose combination drugs.

The biological API segment is expected to grow at a remarkable CAGR due to the growing demand for precision treatments, vaccine formulations, and immune-enhancing therapies for both companion and livestock animals. Biological APIs include recombinant proteins, monoclonal antibodies, and live attenuated vaccine components that offer targeted, longer-lasting effects with fewer side effects. The trend toward preventive veterinary care and the increasing impact of zoonotic threats are fueling biologic API development. Moreover, biologicals are often viewed as sustainable alternatives to chemical drugs, with rising support from global regulatory agencies encouraging their adoption.

Animal Type Insights

What Made Production Animals the Dominant Segment in the Market?

The production animals segment dominated the veterinary API market in 2024 owing to the massive global demand for livestock-derived food products, including meat, milk, and eggs. Countries across Asia-Pacific, Latin America, and Europe rely heavily on animal husbandry for both domestic consumption and exports. To maintain herd health and productivity, APIs are widely used in antibiotics, anti-infectives, parasiticides, and growth promoters for cattle, poultry, pigs, and sheep. The globalization of animal farming, especially in developing nations, has led to a high demand for routine preventive and therapeutic treatments, boosting API demand. Moreover, government regulations on food safety and animal traceability, especially in Europe and North America, are encouraging the controlled use of high-quality APIs for disease management and outbreak prevention in production animals.

The companion animals segment is expected to grow at the fastest rate in the upcoming period, driven by a global rise in pet ownership, humanization of pets, and increased veterinary care expenditure. Dogs, cats, and even exotic pets are increasingly seen as family members, and their health is becoming a priority for households worldwide. This trend is particularly noticeable in urban areas of North America, Europe, and growing economies like China, India, and Brazil.

API use has increased in drug formulations for chronic conditions, such as arthritis, cancer, obesity, anxiety, and diabetes in pets. Additionally, the rising production of vaccines, anti-infectives, dermatological drugs, and nutraceuticals for pets is driving the demand for specialty APIs. The rise of pet insurance, premium pet food brands, and specialized veterinary clinics has further accelerated the uptake of APIs, supported by R&D in pet-specific drugs and customized dosage formulations.

Therapeutic Insights

Why Did the Anti-Infectives Segment Dominate the Market in 2024?

The anti-infectives segment dominated the veterinary API market with the biggest revenue share in 2024 due to the widespread prevalence of bacterial and fungal infections in both livestock and companion animals. In commercial farming, maintaining herd immunity and productivity is critical, and infections can lead to economic losses and food supply disruption. Hence, broad-spectrum antibiotics and antifungals are used extensively. In pets, common issues like wound infections, dental problems, and respiratory conditions require regular anti-infective treatment. Despite growing concern over antimicrobial resistance, the need for controlled, effective anti-infectives remains strong, especially when integrated into responsible use programs and regulatory compliance frameworks.

On the other hand, the antiparasitic segment is expected to grow at a remarkable rate during the forecast period due to the rising incidence of parasitic infections across livestock, poultry, aquaculture, and pet populations. These include internal parasites like worms and external infestations such as fleas, mites, and ticks. The spread of vector-borne diseases like theileriosis, babesiosis, and tick fever in tropical and sub-tropical zones has heightened the need for effective and long-lasting anthelmintics and ectoparasiticides. Pet owners are increasingly opting for preventive antiparasitic treatments, especially in urban environments. As climate change and global trade increase exposure to parasites, the demand for fast-acting, residue-free, and breed-safe antiparasitic APIs is expected to rise in the coming years.

Veterinary API Market Companies

- Merck Animal Health

- Boehringer Ingelheim Animal Health

- Elanco Animal Health, Bayer Animal Health

- Alivira Animal Health Ltd.

- Chempro Pharma Pvt. Ltd.

- Elanco

- Excel Industries Ltd.

- MENADIONA

- Ofichem Group

- Qilu Animal Health Products Co., Ltd.

- Siflon Drugs

- SUANFARMA

- Vetpharma

- Zoetis

Recent Development

- In October 2023, Stallen expanded its capabilities by commencing operations at a new veterinary API facility in Vatva, Ahmedabad. Stallen aims to introduce a slew of APIs from this facility to reduce the dependency of products being imported from China in the animal health sector.

(Source: https://www.srpublication.com)

Segments Covered in the Report

By Service Type

- In-House Manufacturing

- Contract Outsourcing

- Contract Development

- Preclinical Development

- Clinical Development

- Contract Manufacturing

By Synthesis Type

- Chemical-based API

- Biological API

- HPAPI

By Animal Type

- Production Animals

- Companion Animals

By Therapeutic

- Antiparasitics

- Anti-infectives

- NSAIDs

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting