What is the Virtual Commissioning Market Size?

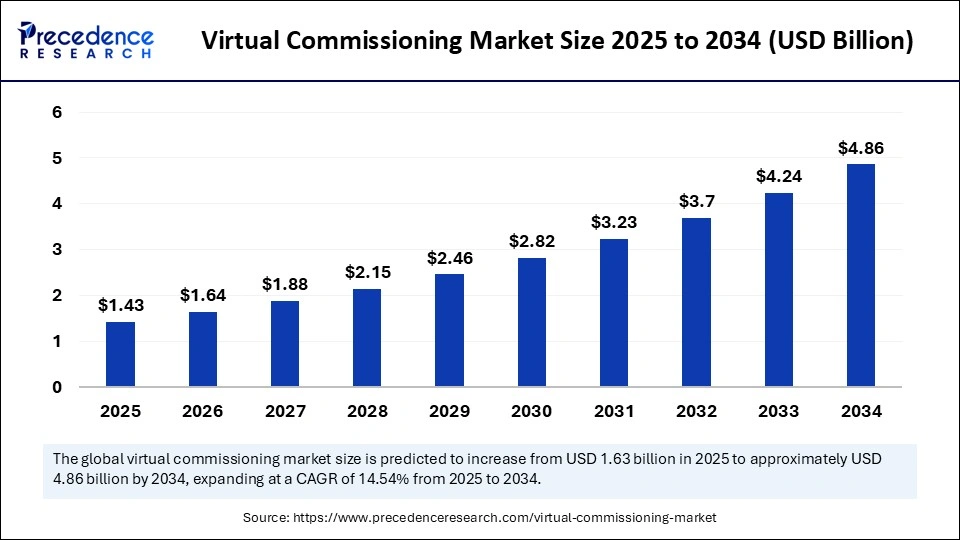

The global virtual commissioning market size was calculated at USD 1.25 billion in 2024 and is predicted to increase from USD 1.43 billion in 2025 to approximately USD 4.86 billion by 2034, expanding at a CAGR of 14.54% from 2025 to 2034. The virtual commissioning market has experienced significant growth in recent years, reflecting the increasing reliance on digital platforms for freelance and gig-based work. As of 2024, the virtual commissioning market has seen remarkable expansion in recent years, driven by the rise of digital platforms that facilitate freelance and gig work. This trend highlights a broader shift towards remote and flexible work arrangements, which continue to shape the modern workforce. As of 2024, this growth underscores the increasing reliance on technology to connect employers and workers worldwide.

Virtual Commissioning Market Key Takeaways

- In terms of revenue, the global virtual commissioning market was valued at USD 1.25 billion in 2024.

- It is projected to reach USD 4.86 billion by 2034.

- The market is expected to grow at a CAGR of 14.54% from 2025 to 2034.

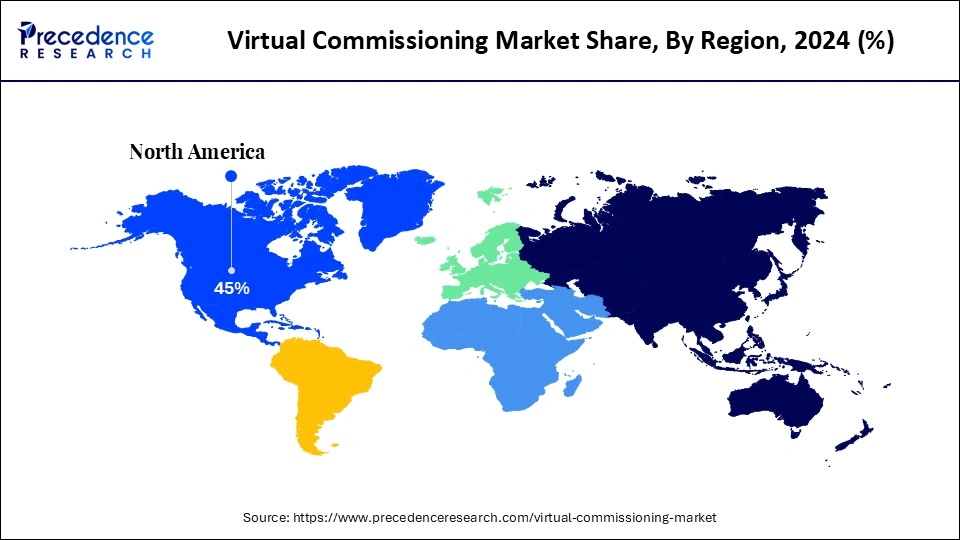

- North America dominated the virtual commissioning market with the largest market share of 45% in 2024.

- By region, Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By type/technology, the plant & processing simulation segment captured the biggest market share of 63% share in 2024.

- By type/technology, the robotics and automation simulation segment is predicted to witness significant growth over the forecast period.

- By application/end-use industry, the automotive & transportation segment held the highest market share in 2024,

- By application/end-use industry, energy & utilities & process engineering is expected to grow at a remarkable CAGR between 2025 and 2034,

- By deployment/service model type, the on-premise segment contributed the maximum market share of 40% in 2024,

- By deployment/service model type, cloud is expected to grow at a remarkable CAGR between 2025 and 2034.

- By organization type, the large segment generated the major market share in 2024,

- By organization type, the SME's are expected to grow at a remarkable CAGR between 2025 and 2034.

Market Overview

The virtual commissioning market represents a transformative shift in how industrial automation systems are designed, tested, and deployed. By creating digital twins of machines and production lines, engineers can stimulate operations before physical implementation. This approach minimizes costly downtime, reduces errors, and accelerates time-to-market. Industries such as automotive, aerospace, and manufacturing are increasingly embracing this practice. As smart factories and the Industry 4.0 concept gain traction, virtual commissioning is becoming a critical enabler of efficiency. Its role is no longer operational but central to modern industrial competitiveness.

The market is expanding steadily as enterprises look to cut commissioning costs and optimize performance. Adoption is particularly strong among sectors that operate with high complexity and require precision engineering. From robotic systems to large-scale assembly lines, virtual commissioning offers scalability across multiple use cases. Vendors are integrating their platforms with advanced simulation and control tools, increasing adoption. Growing emphasis on predictive maintenance and real-time monitoring also supports market growth. The overall landscape reflects a market that is both evolving and consolidating at the same time.

How AI impacted the Virtual Commissioning Market?

Artificial intelligence has significantly reshaped the virtual commissioning landscape. AI-powered models allow more accurate simulation of unpredictable scenarios, reducing human error. Machine learning algorithms enhance predictive analysis, enabling systems to self-adjust during commissioning. AI also bridges the gap between virtual models and real-world execution by improving calibration and synchronization. With AI, commissioning becomes faster, smarter, and less resource-intensive. This integration is pushing the market toward autonomous and adaptive commissioning environments.

Market Key Trends

- One major trend is the convergence of virtual commissioning with digital twin technologies. Another is the integration of VR/AR interfaces to provide immersive simulation environments.

- Cloud-based deployment is also on the rise, offering scalability and collaboration across geographies. Sustainability initiatives are driving manufacturers to adopt commissioning strategies that reduce waste and energy use.

- Interoperability across platforms and systems is emerging as a key requirement. Collectively, these trends point to a more connected, intelligent, and sustainable future for the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.86 Billion |

| Market Size in 2025 | USD 1.43 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application / End-Use Industry, Deployment / Service Model, Organization Size / End-User Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Cost reduction remains the most powerful driver behind adoption in the virtual commissioning market. Manufacturers are under constant pressure to accelerate product launches without compromising quality. The growing complexity of production systems makes traditional commissioning inefficient and risky. The rise of smart manufacturing initiatives is creating demand for advanced simulation tools. Workforce shortages in engineering roles further amplify the need for digital automation. These factors collectively ensure steady momentum for the virtual commissioning market.(Source: https://www.prnewswire.com)

Restraints

Despite its potential, the market faces several challenges. High upfront costs for software, hardware, and training continue to be barriers for smaller enterprises. Integration with legacy systems is often complex and resource-intensive. There is also a learning curve for engineers unfamiliar with simulation platforms. Concerns around cybersecurity in connected environments add another layer of resistance. These restraints, while significant, are gradually being addressed through modular solutions and cloud adoption.

Opportunities

The future offers vast growth potential. The increasing use of digital twins in predictive maintenance creates new opportunities. Expanding adoption in small and medium-sized enterprises can unlock untapped markets. Integration with AI and machine learning opens avenues for autonomous commissioning. Emerging economies investing in smart manufacturing represent another frontier. These opportunities suggest that the virtual commissioning market is still in its early growth phase.

Type / Technology Insights

Why Plant and Process Simulation is Dominating the Virtual Commissioning Market?

Plant and process simulation holds the dominant position in the virtual commissioning market, primarily because it forms the foundation of most industrial automation projects. Manufacturers rely on these simulations to model entire production facilities, optimize layouts, and test end-to-end workflows before implementation. This dominance is reinforced by its ability to reduce downtime, improve system reliability, and cut overall commissioning costs. Moreover, industries such as automotive, energy, and heavy manufacturing heavily depend on plant and process simulation to validate large-scale, complex operations. The trust in its proven track record and wide applicability ensures its continued leadership in the market.

Robotics and automation simulation is emerging as the fastest-growing segment, fueled by the rapid adoption of industrial robots and advanced automation technologies. As factories worldwide embrace robotics for tasks ranging from assembly to logistics, the need to virtually test, program, and optimize robotic systems before deployment has skyrocketed. These simulations allow engineers to validate robotic paths, ensure safety, and integrate collaborative robots into production lines without halting operations. This trend is being accelerated by the demand for flexible, adaptive manufacturing in high-mix, low-volume industries.

Application Insights

Why Are Automotive and Transportation Dominating the Virtual Commissioning Market?

The automotive and transportation sector dominates the virtual commissioning market due to its reliance on highly automated production systems. Car manufacturers utilize digital twins and simulation models to validate assembly lines before their physical setup. The rise of EV manufacturing and autonomous vehicle testing further boosts adoption. High production complexity demands error-free commissioning, making virtual models indispensable. This sector also faces immense pressure to reduce time-to-market, which virtual commissioning directly supports. As a result, automotive remains the anchor application driving widespread adoption.

Beyond manufacturing, automotive suppliers also benefit from virtual commissioning in robotics and mechatronics integration. Tier-1 and Tier-2 suppliers utilize the technology to optimize system design before client delivery. Transportation infrastructure projects, such as rail systems, also leverage simulation for safety and reliability. The financial impact of downtime in this sector amplifies the importance of pre-validation. Partnerships between automotive OEMs and software vendors are common to accelerate innovation. This deep integration ensures that automotive retains its leadership position in the market.

The energy and utilities sector is emerging as the fastest-growing application for virtual commissioning. Power plants, renewable energy systems, and grid management projects require reliable and efficient operations. Virtual commissioning allows these systems to be tested digitally, reducing risks of outages. Process engineering industries, such as oil, gas, and chemicals, also benefit from early-stage validation of control systems. With the rise of renewable energy, the complexity of hybrid power systems makes commissioning more demanding. This drives rapid adoption of virtual commissioning in the sector.

Moreover, sustainability goals are pushing utilities to adopt more advanced technologies. Simulation enables optimization of energy efficiency and safety protocols. Process industries that face high regulatory scrutiny also utilize digital tools for compliance validation. Cloud-enabled commissioning helps global energy players manage distributed assets efficiently. Collaborative projects between technology providers and energy firms are accelerating adoption. Together, these factors ensure that energy and process industries remain the fastest-expanding end-user base.

Deployment Model Insights

Why On-Premise Is Dominating the Virtual Commissioning Market?

On-premise deployment currently dominates the virtual commissioning market landscape due to its control and security advantages. Large industrial firms prefer in-house deployment to safeguard sensitive design data. On-premise systems also offer higher customization capabilities, aligning with specific plant requirements. The absence of dependency on external connectivity ensures reliability in critical environments. Many legacy systems still integrate better with on-premise platforms than cloud-based alternatives. This preference continues to cement on-premise as the dominant mode of deployment.

Furthermore, industries with long-standing automation setups invest heavily in maintaining local infrastructure. The predictability of performance without network disruptions is a key advantage. Organizations with extensive IT departments find it easier to manage on-premise solutions internally. In high-value sectors like aerospace, local hosting addresses regulatory requirements on data security. On-premise also enables tighter integration with proprietary control systems. These advantages explain why, despite the cloud surge, on-premises remains the current leader.

Cloud-based deployment is the fastest-growing model due to its scalability and cost-effectiveness. SMEs and startups, in particular, benefit from avoiding high upfront infrastructure costs. Cloud platforms allow distributed teams to collaborate on commissioning projects in real time. Remote monitoring and simulation are enabled seamlessly via cloud solutions. As industries transition to global operations, cloud commissioning provides unmatched flexibility. The subscription-based pricing model also makes adoption easier for smaller enterprises.

Additionally, cloud systems integrate effortlessly with AI, ML, and IoT technologies. They support rapid updates and innovation cycles, ensuring firms remain technologically competitive. Vendors are increasingly offering hybrid cloud solutions to ease the transition. Cloud deployment also aligns with sustainability goals by reducing hardware overhead. With 5G and high-speed internet, reliability concerns are being addressed. This makes cloud the clear growth driver for the future of virtual commissioning.

Organization Size Insights

Why Large Enterprise is Dominating the Virtual Commissioning Market?

Large enterprises are the primary drivers of virtual commissioning adoption, largely due to their financial strength and complex operational requirements. Multinationals in automotive, aerospace, and heavy manufacturing rely on advanced simulations. They seek to reduce downtime costs, which can run into millions for large plants. Their investment in Industry 4.0 technologies naturally extends into commissioning solutions. Dedicated R&D departments accelerate the adoption and integration of digital tools. These factors collectively position large enterprises as the primary market drivers.

In addition, large companies often collaborate with leading technology providers to co-develop customized platforms. They can afford high-end on-premise infrastructure and specialized workforce training. Their global supply chains also require robust validation across multiple facilities. Large enterprises tend to prioritize efficiency and quality, both of which commissioning delivers. Government and regulatory compliance further push adoption in sensitive industries. This ensures their continued dominance in the virtual commissioning market.

Small and medium-sized enterprises represent the fastest-growing adopters of virtual commissioning. Cloud-based solutions and subscription models are lowering barriers to entry. SMEs seek affordable ways to compete with larger firms through digital innovation. Virtual commissioning helps them test systems without heavy investment in prototypes. As more SMEs move toward automation, simulation offers a cost-effective pathway. This democratization of access is driving rapid adoption among smaller businesses.

Moreover, SMEs value the speed virtual commissioning brings to product launches. It allows them to remain agile in competitive markets. Partnerships with software vendors often provide bundled training and support. As governments encourage SME digitalization, subsidies and incentives further boost adoption. The flexibility of cloud platforms aligns perfectly with SME resource constraints. Consequently, SMEs are expected to drive future growth in this market.

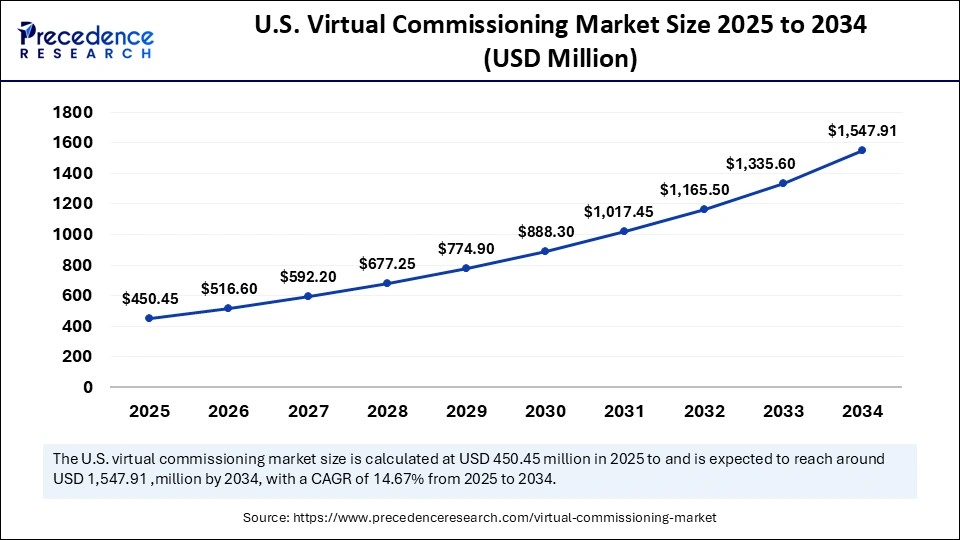

U.S. Virtual Commissioning Market Size and Growth 2025 to 2034

The U.S. virtual commissioning market size was exhibited at USD 393.75 million in 2024 and is projected to be worth around USD 1,547.91 million by 2034, growing at a CAGR of 14.67% from 2025 to 2034.

Why Is North America Dominating the Virtual Commissioning Market?

North America continues to dominate the virtual commissioning market due to its strong industrial automation base. Leading automotive and aerospace manufacturers in the region are early adopters of simulation technologies. The presence of major technology providers further supports ecosystem development. Investments in smart factories and Industry 4.0 initiatives are driving demand for advanced commissioning. The region's skilled workforce accelerates adoption despite higher costs. Overall, North America remains the benchmark for innovation and market leadership.

In addition, government incentives and digital transformation programs further fuel regional adoption. Enterprises increasingly collaborate with simulation software vendors to co-develop tailored solutions. The high maturity of cloud infrastructure supports large-scale deployment of commissioning platforms. Strong partnerships between OEMs and technology providers enhance innovation. The culture of early adoption ensures that North America maintains a first-mover advantage. Its dominance is reinforced by continuous reinvestment in automation and R&D.

Why Is Asia Pacific Gaining Traction in the Virtual Commissioning Market?

Asia Pacific is emerging as the fastest-growing region in this market. Asia Pacific benefits from rapid industrialization, particularly in China, India, and Southeast Asia. The demand for cost-effective automation drives interest in virtual commissioning. Meanwhile, leads in sustainability-driven adoption, especially in China's advanced manufacturing sector. Both regions see strong government support for digital manufacturing initiatives. As a result, growth in this market outpaces that of other global markets.

Additionally, Asia Pacific's growing SME base is increasingly experimenting with cloud-based solutions. Industry 5.0 agenda, focusing on human-centric and sustainable technologies, aligns with virtual commissioning. Strategic collaborations between academia and industry accelerate technological development. The rising focus on electric vehicles and green technologies further boosts adoption. In both regions, cultural emphasis on innovation and competitiveness is evident. Together, Asia Pacific and Europe represent the engines of future market expansion.

Virtual Commissioning market- Value Chain Analysis

- Raw Material Sourcing

Virtual Commissioning does not directly involve raw material sourcing; rather, it focuses on stimulating and validating automation control systems such as PLCs and robots through a digital twin of the production line or machine. Its primary role is to optimize and accelerate the commissioning of physical manufacturing equipment, ensuring systems work as intended before deployment. Material sourcing, on the other hand, takes place beforehand, as it is essential to secure the physical components needed for building and operating the equipment that virtual commissioning later tests and refines.

- Component Manufacturing

The virtual commissioning market does not directly involve raw material sourcing; rather, it focuses on simulating and validating automation control systems such as PLCs and robots through a digital twin of a production line or machine. Its primary role is to optimize and accelerate the commissioning of physical manufacturing equipment, ensuring systems work as intended before deployment. Material sourcing, on the other hand, takes place beforehand, as it is essential to secure the physical components needed for building and operating the equipment that virtual commissioning later tests and refines.

- Testing and Certification

Virtual commissioning leverages a digital twin or virtual model of industrial plants and equipment to test and validate automation control systems before actual assembly. By doing so, it enables early detection of design flaws, accelerates development timelines, and minimizes potential risks. Through this virtual environment, engineers can simulate real-world operations, verify control logic, and fine-tune system performance. The result is a smoother, more efficient, and cost-effective commissioning process once the physical system is deployed.

Virtual Commissioning Market Companies

- Siemens

- Rockwell Automation

- ABB

- Dassault Systèmes

- Visual Components (and Delfoi)

- Maplesoft

- CENIT

- MathWorks

- Beckhoff Automation

- HEITEC AG

- ISG Industrielle Steuerungstechnik

- Robotmaster (Hypertherm)

- ArtiMinds

- OCTOPUZ

- machineering GmbH & Co. KG

- Xcelgo

- RoboDK

- Drag and Bot

- KEB

Recent Developments

- In September 2025, Admiral Dinesh Kumar Tripathi, Chief of the Naval Staff, underscored that future challenges can only be met through the partnerships built today, stressing that the ability to collect, analyze, and share information in real time will be central to strengthening both deterrence and defence. He made these remarks at the commissioning ceremony of INS Aravali, the Indian Navy's newest naval base, held in Gurugram on Friday. On the occasion, the CNS was accorded a Guard of Honour by 50 personnel. Captain Sachin Kumar Singh, the unit's first Commanding Officer, led the ceremony by reciting a Sanskrit invocation and reading out the commissioning warrant.(Source: https://www.thestatesman.com)

- In September 2025, with passenger numbers surging, sustainability requirements intensifying, and operations becoming increasingly complex, airports can no longer rely on outdated tools to meet future demands. Dassault Systèmes is helping airport operators transform the way they manage infrastructure, streamline operations, and elevate the passenger journey through its Airport Experience solution, driven by the power of the 3DEXPERIENCE platform.(Source: https://aviationweek.com)

- In August 2025, Muon Space unveiled its MuSat XL platform, a powerful 500-kg-class satellite designed to support the next generation of low Earth orbit (LEO) missions. The company also announced Hubble Network as the platform's first customer, marking a significant milestone for the new high-performance system.(Source: https://www.muonspace.com)

Segments Covered in the Report

By Application / End-Use Industry

- Automotive & Transportation

- Aerospace & Defense

- Machine Manufacturing & Industrial Equipment

- Energy & Utilities

- Packaging Industry

- Process Engineering (chemicals, pharma, food & beverage)

- Others (consumer electronics, medical devices, etc.)

By Deployment / Service Model

- On-Premises Simulation Tools / Licensed Software

- Cloud / SaaS-based Virtual Commissioning Platforms

- Hybrid Deployments

- Consulting, Integration & Services

By Organization Size / End-User Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises / OEMs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting