3D Electronics / Additive Electronics Market Size and Forecast 2025 to 2034

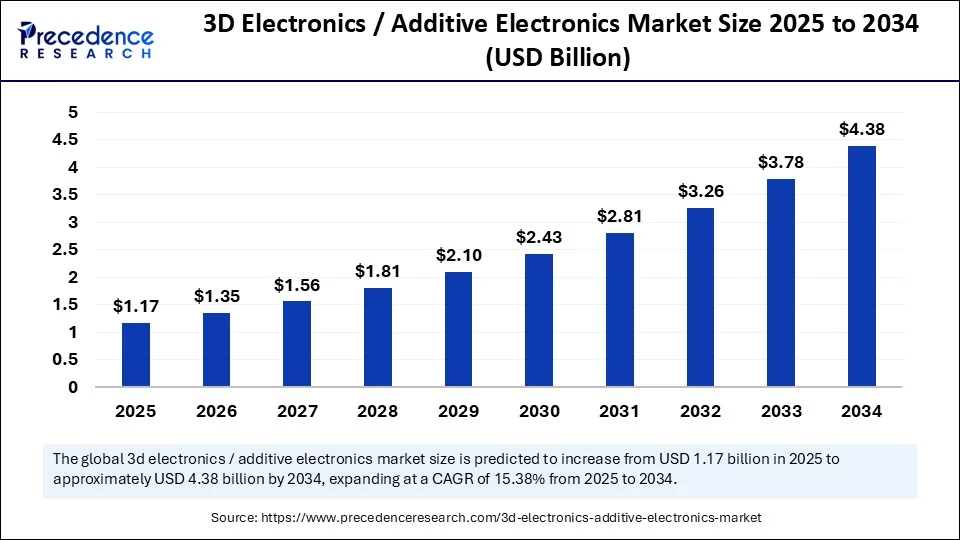

The global 3D electronics / additive electronics market size was estimated at USD 1.01 billion in 2024 and is predicted to increase from USD 1.17 billion in 2025 to approximately USD 4.38 billion by 2034, expanding at a CAGR of 15.83% from 2025 to 2034. The 3D electronics / additive electronics market is driven by the demand for miniaturized, high-performance, and customized electronic solutions across diverse industries.

3D Electronics / Additive Electronics Market Key Takeaways

- In terms of revenue, the global 3D electronics / additive electronics market was valued at USD 1.01 billion in 2024.

- It is projected to reach USD 4.38 billion by 2034.

- The market is expected to grow at a CAGR of 15.83% from 2025 to 2034.

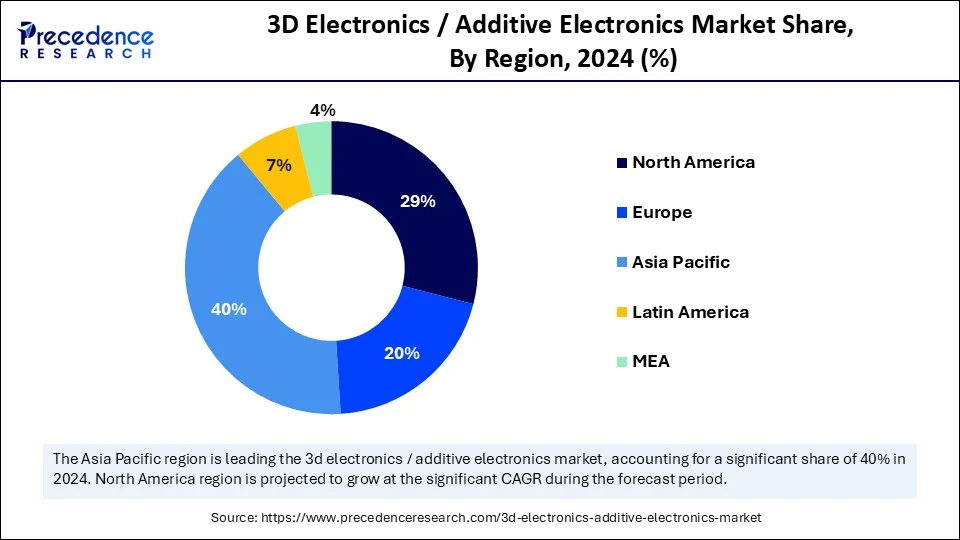

- Asia Pacific dominated the global 3D electronics / additive electronics market with the largest market share of 40% in 2024.

- North America is anticipated to witness the fastest growth during the forecasted years.

- By technology, the screen-printing segment has captured the biggest market share of 29% in 2024.

- By technology, the aerosol jet printing segment is anticipated to show considerable growth over the forecast period.

- By material, the conductive inks segment contributed the highest market share of a 36% share in 2024.

- By material, the conductive filaments segment is anticipated to show considerable growth over the forecast period.

- By component, the printed circuits segment generated the major market share of 33% of the market in 2024.

- By component, the sensors segment is anticipated to grow at the fastest CAGR over the forecast period.

- By application, the consumer electronics segment held the largest market share of 31% in 2024.

- By application, the healthcare and medical devices segment is expected to grow at the highest CAGR over the forecast period.

- By end-user, the OEMs segment accounted for significate market share of 42% in 2024.

- By end-user, the medical device companies segment is anticipated to show considerable growth over the forecast period.

How Is AI Integration Transforming the 3D Electronics / Additive Electronics Market?

Integrating Artificial Intelligence into the 3D printing process of electronics is transforming the design, creation, and optimization of electronic components. Technologies that enable highly complex printing processes to be automated, the ability to analyze large datasets, and improve the precision of design and predictive material behaviors are made possible with AI-driven algorithms. Manufacturers can maximize print paths, minimize material wastage, and, in real-time, identify defects to enhance efficient production and product quality by using machine learning.

- In AI, the technology can also enable the personalization of device functionality into applications such as 3D printing wearable devices and the Internet of Things by incorporating smart and intelligent sensing and data processing. With the evolving capabilities of AI, 3D electronics will enable smarter, more efficient, and highly customized manufacturing solutions.

Asia Pacific 3D Electronics / Additive Electronics Market Size and Growth 2025 to 2034

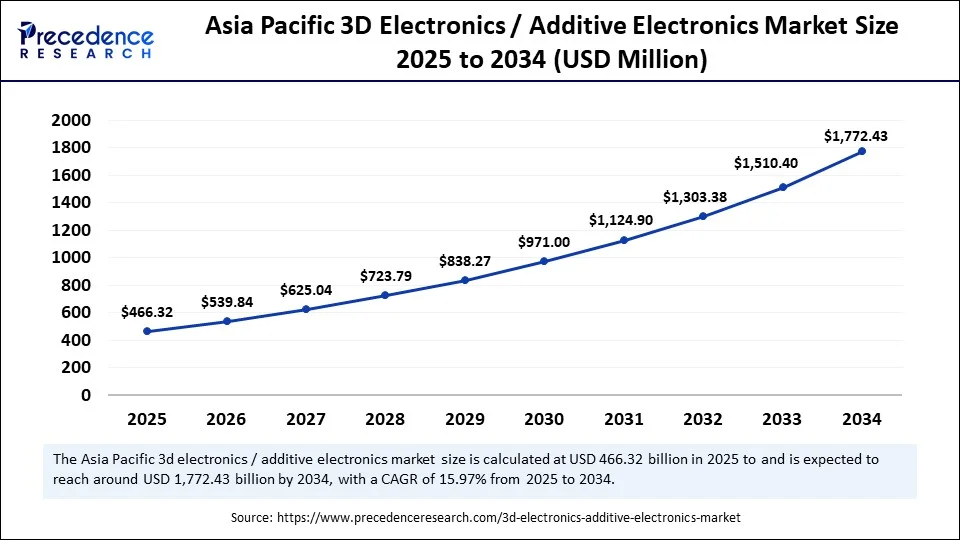

The Asia Pacific 3D electronics / additive electronics market size is exhibited at USD 466.31 million in 2024 and is projected to be worth around USD 1,772.43 million by 2034, growing at a CAGR of 15.97% from 2025 to 2034.

What Made Asia Pacific the Dominant Region in the Global 3D Electronics / Additive Electronics Market in 2024?

Asia Pacific led the market in 2024, holding the largest market share at 40%. This dominance is fueled by the region's strong manufacturing base, rapid industrialization, and substantial investment in new technologies. The region benefits from low production costs, a skilled labor force, and supportive government initiatives promoting smart manufacturing and Industry 4.0. Industries like consumer electronics, automotive, telecommunications, and healthcare are increasingly adopting 3D-printed electronics to produce smaller, lighter, and more efficient products.

China is a major contributor to the market. Being the world's largest electronics manufacturing hub, China is heavily investing in digital and additive manufacturing to boost its global market competitiveness. This market growth is also propelled by a robust supply chain, government policies like Made in China 2025, and rising domestic consumption of high-tech products. Furthermore, China's focus on innovation, supported by extensive R&D infrastructure and public-private partnerships, is accelerating advancements in 3D-printed circuitry and flexible electronic devices.

Why is North America Experiencing the Fastest Growth in the 3D Electronics / Additive Electronics Market?

North America is expected to grow at the fastest CAGR during the forecast period, driven by well-established manufacturing industries and the increasing adoption of advanced electronics across various sectors. The region also benefits from significant investment in research and development, government support for innovation, and advanced technological infrastructure. There is a high demand for high-performance electronic and medical devices, creating the need for additive electronics.

The U.S. leads the North American 3D electronics sector, with prominent manufacturers increasingly investing in additive manufacturing to develop customized electronic components, particularly for aerospace and military applications. With favorable government policies and ongoing technological innovations, the U.S. is at the forefront of developing next-generation electronics.

What are the Key Factors Driving the Growth of the European 3D Electronics / Additive Electronics Market?

Europe is expected to grow at a notable rate in the upcoming period. Advancements in printed electronics, additive manufacturing, and flexible circuits are fueling market growth. There is a high demand for high-performance sensors in the consumer electronics, automotive, aerospace, and healthcare industries. Europe's strong R&D networks and government investment in digitalization and Industry 4.0 are fostering the development of lighter, more efficient, and customizable 3D electronic components. The rising demand for wearable electronics and smart packaging solutions is creating opportunities in the market. Germany is a major player in the market. The automotive and aerospace industries in Germany are leveraging 3D-printed electronics to design lighter, more functional products and enhance design flexibility, supporting regional market growth.

Market Overview

The 3D electronics / additive electronics market refers to the advanced manufacturing segment focused on embedding electronic functionality directly into 3D surfaces and structural components through additive processes. It enables miniaturization, design flexibility, and integration of electronic circuits into non-traditional form factors such as curved, flexible, or complex 3D substrates. This market is driven by the convergence of electronics with automotive, healthcare, aerospace, and IoT-based smart devices, offering performance, space-saving, and cost advantages.

The 3D electronics / additive electronics market is booming due to the enhancement of additive manufacturing technologies, higher attraction of small-sized and high-performance electronic devices, and the high-scale adoption of additive electronics into major industrial segments that include consumer electronics, automotive, aerospace, and healthcare. The possibility of producing personalized lightweight and miniaturized devices follows the expanding popular movement toward smart wearable devices, the integration of IoT, and customized medical equipment.

What Factors Are Fueling the Rapid Expansion of the 3D Electronics / Additive Electronics Market?

- Technological Advancements: Continued advances in 3D printing methods and materials enable the creation of more complex, miniaturized electronic components that perform better, offering greater design possibilities and applications on the market.

- Rapid Prototyping and Customization: High customization and speed of prototyping, 3D printed electronics accelerate time and cost efficiency during the development process, providing fit-for-purpose solutions in various industries.

- The Rise of Wearables and IoT: The growth of wearable device and IoT technology markets requires embedded electronics and flexible parts that are perfectly compatible with 3D printing and additive electronics.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.38 Billion |

| Market Size in 2025 | USD 1.17 Billion |

| Market Size in 2024 | USD 1.01 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.83% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Material Type, Component Type, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Relevance of 3D-Printed Electronics

The relevance of 3D printed electronics is significantly changing the electronics manufacturing landscape, as it enables the incorporation of electronic features. The use of 3D printing in the electronics industry involves the creation of conductive, simple features being molded directly onto plastic, such as antennas. With the ever-increasing demands of the market for consumer products to be smaller, thinner, and more powerful, manufacturers are struggling with the production of traditional PCBs, and many tend to outsource their design to third parties. The 3D printing of electronics comes to the rescue here by enabling in-house prototyping, which leads to speedier development and manufacturing while also saving a substantial amount of money and mitigating intellectual property risks associated with outsourcing.

Restraint

High Initial Investment Costs

The high costs of 3D-printed electronics are a major factor inhibiting the large-scale adoption of the technology. Establishing advanced additive manufacturing systems for electronics production incurs significant capital expenses, including specialized equipment, materials, software, and skilled labor. These initial high charges pose a significant barrier to small and mid-sized manufacturers and startups, which require funds. To counter this limitation, strategic industry partnerships, government incentives, and cost-sharing schemes may provide a key to increasing access to the technology.

Opportunity

Expansion into Wearables, IoT, and Medical Applications

The 3D electronics / additive electronics market has enormous potential and is emerging in various application areas, including wearable electronics, the Internet of Things, combined technologies, and modern healthcare electronics. With IoT devices, where space efficiency and customization are paramount, 3D-printed electronics enable the fast prototyping and manufacture of highly specialized parts. The possibility of producing customized devices with embedded electronic capabilities (biosensors, diagnostic tools, smart implants) holds the transformative promise of patient-specific healthcare solutions in the medical sector. With highly developed industries abeing brought to miniaturization and customization levels, they require more innovative manufacturing methods, such as 3D-printed electronics.

Technology Insights

Why Did the Screen Printing Segment Dominate the Market in 2024?

The screen printing segment dominated the 3D electronics / additive electronics market with a 29% share in 2024. This is mainly due to its efficiency and flexibility, especially in producing smaller, power-intensive electronic products. Screen printing is suitable for a wide range of materials. Using a hybrid approach, screen printing deposits functional inks and pastes, like conductive, dielectric, and resistive materials, onto ceramics, metals, and polymers. This precise layering allows for the creation of advanced electronic components, including printed circuit boards (PCBs), capacitive sensors, and RFID tags. Screen printing is a key technology in the 3D electronics industry because it helps manufacturers efficiently and flexibly produce smaller, more powerful electronic products.

The aerosol jet printing segment is expected to grow at a significant CAGR over the forecast period. The aerosol jet printing technology is used in next-generation applications like wearable electronic devices, implants, and IoT devices. The thermal impact is low in this printing, and it is compatible with many conductive and insulating materials, so printing may be done without changing material properties on a heat-sensitive substrate. With the increasing need for miniaturized, flexible, and high-performance electronics, aerosol jet printing will become the preferred choice of manufacturers.

Material Insights

What Made Conductive Inks the Dominant Segment in the Market in 2024?

The conductive inks segment dominated the 3D electronics / additive electronics market while capturing a 36% share in 2024. Conductive inks are essential in additive electronics, enabling the deposition of electrically conductive patterns on various substrates through different printing methods. These particle-free inks, which can metalize in place to form ultra-smooth, thin conductive films, are gaining importance. They're ideal for high-frequency applications like electromagnetic interference shielding and printed antennas, where minimizing signal loss and high precision are critical. These links are also suited for temperature-sensitive materials, with growing applications in wearable electronics, medical devices, and flexible displays.

The conductive filaments segment is expected to grow at the highest CAGR during the projection period. This is mainly due to their essential role in making prototypes and producing small custom electronics, such as sensors, touch-sensitive surfaces, and embedded circuitry within enclosures. Furthermore, advancements in material science are enhancing the conductivity, flexibility, and durability of conductive filaments, broadening their use in consumer electronics, automotive, and smart devices. With the rising demand for multifunctional features and smaller components, conductive filaments are set to play a crucial role in the future of additive electronics.

Component Insights

Why Did the Printed Circuits Segment Dominate the 3D Electronics / Additive Electronics Market in 2024?

The printed circuits segment dominated the market with a 33% share in 2024. This is mainly due to the increased demand for printed circuit boards (PCBs), enabling the formation of multilayer and customized circuit patterns. In addition, the incorporation of different types of electronic components, including resistors, capacitors, and transistors, into the circuit structure in a direct manner helps speed up the performance while reducing the assembly needs. As the demand for smaller, lighter, and more powerful electronics increases, 3D-printed circuits are likely to be miniaturized, becoming a key element in the next generation of electrical systems.

The sensors segment is expected to grow at the fastest rate in the coming years. Additive manufacturing allows for the design of intricate sensor geometries that are challenging to create with other methods. Sensors made through additive manufacturing can be tailored to fit structures or flexible surfaces, simplifying assembly and enhancing usability. Furthermore, the ability to rapidly prototype and produce sensors on a small scale provides a competitive edge in industries where customization and quick time-to-market are essential.

Application Insights

How Does the Consumer Electronics Segment Dominate the Market in 2024?

The consumer electronics segment captured a 31% share in the 3D electronics / additive electronics market in 2024. 3D printing is reshaping design and manufacturing, enabling greater miniaturization, design flexibility, and cost reduction in production. These benefits are crucial for creating smaller, high-performance products like smartphones, smartwatches, wearable technology, and IoT devices. 3D printing allows for the customization of electronics to meet specific user needs, aligning with the growing interest in personalized, multitasking devices. Moreover, the rapid prototyping and design modifications have accelerated innovation cycles, allowing companies to launch new products sooner. With the increasing consumer demand for connected and adaptable products, 3D printing has become a key advantage in electronics manufacturing, poised for wider adoption in the market.

The healthcare & medical devices segment is expected to grow at a significant CAGR over the forecast period. Additive manufacturing enables high customization of patient-specific devices such as implants, prosthetics, surgical tools, and anatomical models for pre-surgical planning and training. In addition to mechanical components, integrating electronic capabilities into medical devices (biosensors, smart implants, and diagnostic tools) is creating new opportunities for real-time monitoring, personalized treatment, and minimally invasive surgery. With the growing demand for personalized healthcare, an aging population, and continuous advancements in medical technologies, the adoption of 3D-printed electronics in healthcare is expected to accelerate rapidly.

End-User Insights

Why Did the OEMs Segment Dominate the Market in 2024?

The OEMs segment dominated the 3D electronics / additive electronics market, holding 42% in 2024. OEMs are integrating 3D printing into their production lines to increase output, reduce time-to-market, and offer product customization. Rapid prototyping using additive manufacturing is particularly beneficial for OEMs in testing product designs, especially in the consumer electronics, automotive, and aerospace sectors. OEMs also benefit from the ability to create complex designs and weight-efficient structures that are difficult to achieve with traditional manufacturing methods. As 3D electronics become increasingly vital for device functionality and miniaturization, their role is set to expand.

The medical device companies segment is expected to grow at a significant CAGR over the forecast period. Manufacturers of medical devices are using 3D printing and additive electronics in designing and printing patient-specific implants, customized surgical equipment, and combined implants and diagnostic equipment. The accuracy and conformance provided by 3D electronics allow the creation of small electronics that can be made lightweight and biocompatible to be used in wearable health monitors, smart implants, and high-tech imaging equipment.

Medtronic, Abbott, and GE Healthcare are actively integrating additive technologies to enhance treatment outcomes and expand device capabilities. Furthermore, healthcare facilities and medical OEMs are increasing their collaborative efforts in developing highly specialized medical electronic components, driven by innovations from 3D electronics leaders such as Molex, Stratasys, and Nano Dimension.

3D Electronics / Additive Electronics Market Companies

- Nano Dimension Ltd. (Israel)

- Optomec Inc. (USA)

- nScrypt Inc. (USA)

- BotFactory Inc. (USA)

- Voltera Inc. (Canada)

- XJet Ltd. (Israel)

- Stratasys Ltd. (USA/Israel)

- 3D Systems, Inc. (USA)

- DuPont de Nemours, Inc. (USA)

- General Electric (GE) (USA)

- HP Inc. (USA)

- Henkel AG & Co. KGaA (Germany)

- Agfa-Gevaert Group (Belgium)

- BASF SE (Germany)

- NovaCentrix (USA)

- Nissha Co., Ltd. (Japan)

- Palo Alto Research Center Incorporated (PARC) (USA)

- NextFlex (USA

Recent Developments

- In May 2024, Make3d.in, an Indian manufacturer of 3D printers, revealed EKA XLE, a resin 3D printing machine, capable of engineering use. This is innovative and is a milestone because there is no resin 3D printer that is manufactured in India to be used in the engineering industry.

(Source: https://manufactur3dmag.com)

- In July 2024, Azul 3D announced a POND additive manufacturing system to develop materials and applications. The small-scale 3D printing system uses its High Area Rapid Printing (HARP) technology, which would yield quicker development of materials and applications. It is launched only weeks after Azul 3D introduced the OCEAN 3D printing system, the largest and most productive machine that the company has ever created.

(Source: https://www.tctmagazine.com)

- In July 2024, Taiwanese electronics brand Acer announced its launch of the Aspire 3D 15 Spatial Labs Edition laptop in India. Acer stated that the laptop features Spatial Labs' glass-free 3D technology and enables users to create content in 3D. It allows users to switch from 2D to stereoscopic 3D cases, giving versatility and more immersive experiences while not requiring any 3D glasses.

(Source: https://www.business-standard.com)

Market segment Covered in the Report

By Technology

- Inkjet Printing

- Aerosol Jet Printing

- Screen Printing

- Direct Write Technology

- Laser Direct Structuring (LDS)

- FDM with Conductive Filaments

By Material Type

- Conductive Inks

- Substrates (Polymers, Ceramics, Glass)

- Dielectrics

- Conductive Filaments

- Photoresists & Adhesives

- Encapsulation Materials

By Component Type

- Printed Circuits

- Sensors

- Antennas

- Interconnects

- Batteries & Power Sources

- Displays & Touch Interfaces

By Application

- Consumer Electronics

- Smartwatches

- Fitness Bands

- Smart Glasses

- Smartphones

- Earbuds

- AR/VR Devices

- Automotive & Transportation

- Embedded Sensors

- Touch Panels

- Antennas

- Interior Lighting

- Smart Dashboards

- Aerospace & Defence

- UAV Electronics

- Avionics

- RF Modules

- Lightweight Circuits

- Satellite Systems

- Healthcare & Medical Devices

- Biosensors

- Wearable Patches

- Implantable

- Diagnostic Devices

- Industrial Equipment

- IoT Tags

- RFID & NFC

- Smart Packaging

- Machine Interfaces

- Energy Sector

- Flexible PV Cells

- Printed Batteries

- Energy Harvesters

By End-User

- OEMs (Electronics & Devices)

- Automotive Manufacturers

- Medical Device Companies

- Aerospace & Défense Contractors

- Packaging & Logistics Firms

- Smart Appliance Manufacturers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting