AC-Coupled Energy Storage Inverter Market Size and Forecast 2025 to 2034

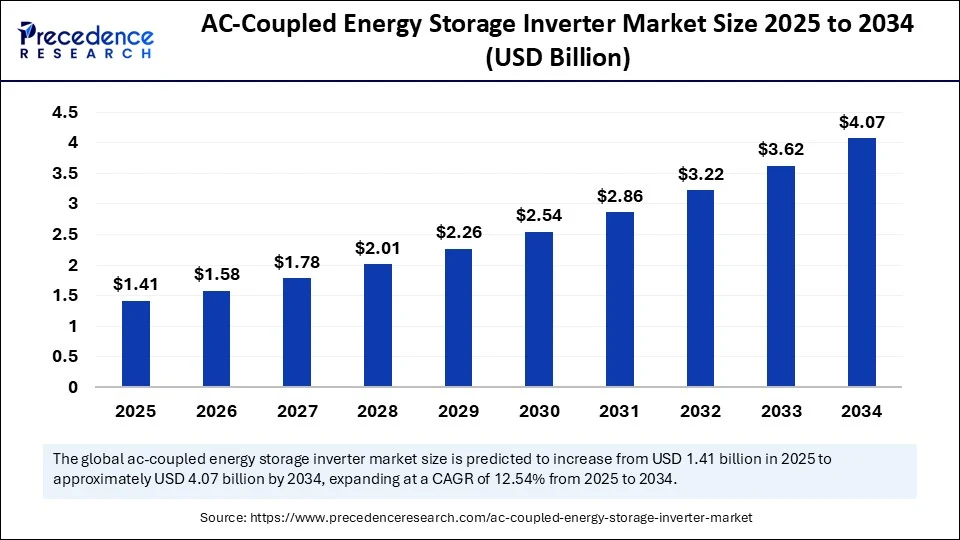

The global AC-coupled energy storage inverter market size accounted for USD 1.25 billion in 2024 and is predicted to increase from USD 1.41 billion in 2025 to approximately USD 4.07 billion by 2034, expanding at a CAGR of 12.54% from 2025 to 2034.The market is growing due to increasing adoption of renewable energy storage systems, government support for reducing carbon footprints, and innovative launches of inverters.

AC-Coupled Energy Storage Inverter MarketKey Takeaways

- In terms of revenue, the global AC-coupled energy storage inverter market was valued at USD 1.25 billion in 2024.

- It is projected to reach USD 4.07 billion by 2034.

- The market is expected to grow at a CAGR of 12.54% from 2025 to 2034.

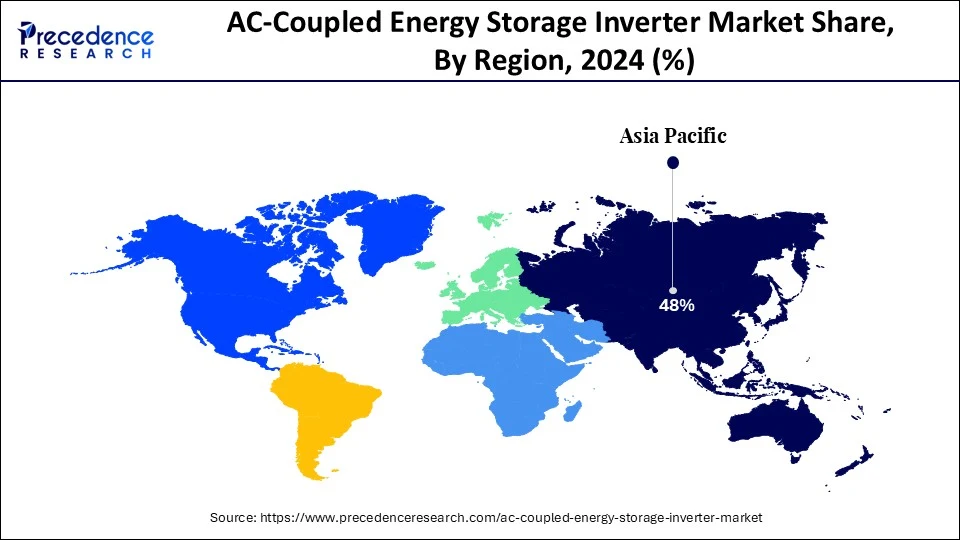

- Asia Pacific dominated the AC-coupled energy storage inverter market with the largest market share of 48% in 2024.

- North America is expected to witness the fastest CAGR during the foreseeable period.

- By type, the residential AC-coupled inverter segment held the biggest market share of 42% in 2024.

- By type, the utility-scale AC coupled inverter segment is expected to witness the fastest CAGR during the foreseeable period.

- By application, the residential segment captured the highest market share of 40% in 2024.

- By application, the commercial & industrial segment is expected to grow at the fastest CAGR during the foreseeable period.

- By storage technology, the lithium-ion battery system generated the major market share of 55% in 2024.

- By storage technology, the flow batteries segment is expected to witness the fastest CAGR during the foreseeable period.

- By grid type, the on-grid AC coupled segment accounted for the significant market share of 65% in 2024.

- By grid type, the hybrid/grid-tied with backup segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034.

- By power rating, the <10kW segment held the largest market share of 38% in 2024.

- By power rating, the 50-500 kW segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034.

How is AI transforming the AC-coupled energy storage market?

Artificial intelligence can be integrated with the AC-coupled energy storage inverter for smart energy management, which would be a revolutionary step for the expansion of AC AC-coupled energy storage inverter market globally. Smart energy management encompasses predictive analytics, arbitrage, and cost reduction, along with optimal energy dispatch, which further enhances battery management with efficiency. By recognizing past price fluctuation, AI can forecast prices for the upcoming period, allowing systems to buy energy at lower prices and sell it to customers when prices rise, which minimizes energy costs.

AI can further analyze real-time data, historical data, demand for energy, and patterns about it, and electricity prices to understand energy needs to optimize charging and discharging cycles of AC-coupled battery systems. This minimizes overconsumption and energy losses. AI can further support the integration of AC-coupled systems with existing AC-powered electrical systems.

Asia Pacific AC-Coupled Energy Storage Inverter Market Size and Growth 2025 to 2034

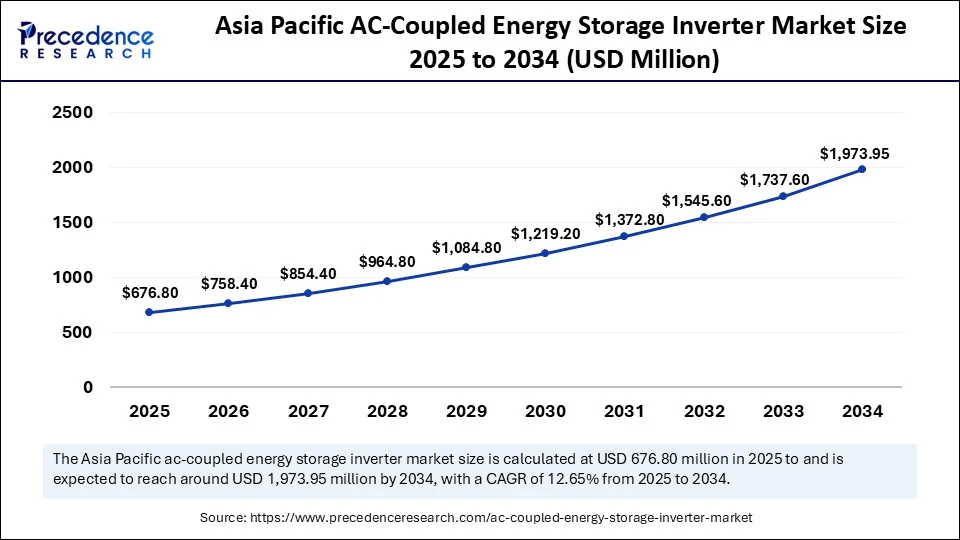

The Asia Pacific AC-coupled energy storage inverter market size was exhibited at USD 600.00 million in 2024 and is projected to be worth around USD 1,973.95 million by 2034, growing at a CAGR of 12.65% from 2025 to 2034.

Asia Pacific

Why is Asia Pacific dominating the AC-coupled energy storage inverter market?

Asia Pacific held the largest market share of 48% in 2024. The region's growth can be coupled with several factors, like growing renewable energy storage systems and their adoption, increasing government support to reduce carbon footprints, energy security needs, and the adoption of EVs in a leading country of the Asia Pacific. Many countries have accepted energy policies to promote renewable energy and its storage system with eco-friendly methods. Chia, for example, has set a target for solar capacity and its applications to offer financial backup for solar projects.

Increasing energy security concerns are further driving the Asia Pacific AC-coupled energy storage inverter market. Increasing adoption of EVs across several countries to reduce carbon emissions further accelerates the demand for AC-coupled energy storage inverters. Countries like China, India are major forces that support the market's growth and are expected to assert their dominance during the upcoming years.

North America

What are the factors driving the North America AC-coupled energy storage inverter market?

North America is expected to witness the fastest CAGR during the foreseeable period. A significant factor driving the growth of North America includes strong government support in terms of policies like investment tax credit and the self-generation incentive program, specifically in California. These policies have been seen as instrumental in supporting residential energy systems in North America. Also, the federal ITC offers a 30% tax credit for energy storage installation with solar systems to support economies. Moreover, growing adoption of solar and wind power at the utility and residential level to manage grid stability and power outage further excels market growth. Moreover, strong support for research and development of the ecosystem is further facilitating innovation and adoption of energy storage inverters.

Market Overview

AC-coupled energy storage inverters are power conversion devices that integrate energy storage systems, such as batteries, with AC power grids or renewable energy sources like solar PV systems. Unlike DC-coupled systems, AC-coupled inverters allow direct connection of energy storage to the AC bus, enabling independent operation of both solar generation and storage units. They are highly suitable for retrofitting existing PV installations, grid stabilization, peak shaving, and demand-side management. AC-coupled systems provide flexible scalability, improved efficiency in energy dispatch, and enhanced grid resilience, making them increasingly important in residential, commercial, and utility-scale renewable energy setups.

What are the key trends in the AC-coupled energy storage inverter market?

- Adoption of smart home technology: The growing adoption of smart homes with cutting-edge technology supports the growth of the AC-coupled energy storage inverter market, as they are increasingly used with smart home technology while providing energy management and automation, which offers better efficiency for the use of stored energy to analyze and control energy consumption and patterns.

- High-capacity batteries:The increasing trend of high-capacity batteries with longer life spans has become critical for enhancing energy storage efficiency and minimizing overall costs with improved sustainability. Eco-friendly materials and toxin-free manufacturing processes are increasingly being adopted in the market due to the push towards sustainability in the energy sector, aligning with the global focus of reducing greenhouse gases and their over emission to support responsible practices.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.07 Billion |

| Market Size in 2025 | USD 1.41 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.54% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Storage Technology, Grid Type, Application, Power Rating, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Inverter technology with a high stability grid

A significant driving factor for the AC-coupled energy storage inverter market is, continuously evolving inverter technology with advancements in high-stability grids, hybrid systems with digitally control capabilities. Such advancement has positively influenced the performance, flexibility, and efficiency of AC-coupled energy storage systems. Energy storage systems like AC-coupled inverters are essential for grid stability and play a vital role by minimizing the fluctuations due to renewable energy sources. These systems provide voltage and frequency regulation to avoid further damage by ensuring a continuous power supply. This is majorly helpful for areas with frequent natural disasters or problems with power supply, driving the innovation and adoption of technically sound energy storage systems.

Restraint

Grid integration and technical complexities

Despite having several benefits, AC AC-coupled energy storage inverter market is witnessing some hindering factors like regulatory uncertainties about complex interconnection methods of grids and their codes as per various regions and rules related to it, and installation barriers due to technical complexities. Utilities may need extensive research and studies with modifications before approving the installation of an energy storage system, which caused delayed processes as per data analysis of the Federal Energy Regulatory Commission (FERC).

Opportunity

Community energy systems and microgrids

A prominent opportunity that the AC-coupled energy storage inverter market is witnessing includes enhancement in localized energy management with improved grid stability and reliability by using microgrids. Microgrids can integrate local energy sources such as solar, wind, with smart control energy storage systems to offer an uninterrupted energy supply for communities, campuses, and various sites of industries that are heavily depends on energy sources. Such a decentralized approach minimizes the chances of a power outage by reducing dependency on the main grid. Microgrids further significantly minimize power loss through transmission lines by generating power nearer to the point of consumption.

- In October 2024, NTPC Limited collaborated with the Indian army to develop a solar hydrogen-based microgrid at Chushul, Ladakh, which is a popular remote area, while offering consistent renewable power for off-grid locations where the army resides. (Source:https://powerline.net.in)

Type Insights

Why does residential AC-coupled dominate the AC-coupled energy storage inverter market?

The residential AC-coupled segment held the largest segment of 42% in 2024. The segment is dominating due to factors like increasing focus on energy independence by homeowners, the requirement of backup power solutions in case of grid outages, along with attractive options like solar loans and power purchase agreements, which offer easy access to residential energy storage systems. AC-coupled systems provide a backup power option with high reliability and efficiency is a key driving factor for the segment.

The utility-scale AC-coupled segment is expected to witness the fastest CAGR during the foreseeable period. The utility scale offers high compatibility with the existing infrastructure and its ability to increase grid stability. They are attractive for retrofitting existing solar farms as they can be added to the solar installation side to reduce disruption to the present DC wiring and other crucial components.

Application Insights

Why do residential applications need AC AC-coupled energy storage inverter system?

The residential segment held the largest market share of 40% in 2024. Segment is dominating due to growing demand for rooftop solar adoption, creating a huge demand for energy storage solutions with high reliability and continuity. Thus, many homeowners are continuously adopting solar panels to minimize their electricity use, increase energy independence, and lower their carbon footprints to align with eco-friendly regulations in the energy sector. AC-coupled systems can be easily integrated with existing electricity supplier systems, which offer less effort and save time as well.

The commercial & industrial segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. Many commercial and industrial facilities are highly crucial as they cannot afford frequent power outages, grid instability, which increases overall downtime. It includes commercials and industries like data centers, multispecialty hospitals, and various manufacturing plants. Ac-coupled systems can offer critical services like frequency regulation and support constant voltage, fueling the segment growth.

Storage Technology Insights

Why are lithium-ion batteries used on a large scale?

The lithium-ion battery system held the largest segment of 55% in 2024. Lithium-ion battery systems are becoming highly demanding due to their characteristics like fast charging/discharging cycles without time delay, reducing costs, versatility, and easy integration, along with high energy density. This battery system can store maximum energy at once, unlike other batteries, in smaller and lighter packages, making them an ideal candidate for energy storage applications. Lithium-ion batteries can be easily integrated with other chemistries of batteries, which is highly beneficial for solar energy storage, where batteries need to charge quickly when the sun is present.

The flow batteries segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. Flow batteries are being adopted by utility-scale applications like grid-scale energy storage, power plants, along with transmission and distribution systems, due to their unique offerings like high scalability, longer lifecycle, long-duration storage capability with renewable energy integration. These batteries play a crucial role in grid stability and offer a constant energy supply.

Grid Type Insights

What are the benefits of the on-grid AC-coupled grid type, which supports AC-coupled energy storage inverter market growth?

The on-grid AC-coupled segment held the largest market share of 65% in 2024. On-grid AC-coupled systems can easily integrate with existing solar installations without significant modification, which is beneficial to save time and costs. These systems are highly compatible with diverse types of batteries because the battery is connected to the grid via an inverter, allowing easy upgrades and replacements without disturbing the current solar panel array. On-grid AC-coupled systems are highly compatible with smart grid technologies, fueling the segment growth.

The hybrid/grid-tied with backup segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. Segment is growing due to its ability to offer backup even during grid outages and potential cost savings. Hybrid inverters can easily switch to battery power when it's required to do so, especially when the grid is not working. This is highly anticipated for areas where power outages are often due to some crucial reasons.

Power Rating Insights

How is a <10kW power rating useful in different sectors?

The <10kW segment held the largest market share of 38% in 2024. Inverters with this range are highly affordable as compared to their higher-power counterparts, which is beneficial for commercial applications and residential energy storage needs as well. It allows homeowners to store extra solar energy created during the day to use it in the time when power is not available. This range is useful for economies of scale in manufacturing, offering competitive per-unit costs due to less initial investment for setup.

The 50-500 kW segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. This power range is well-suited for commercial and industrial applications like businesses, data centers, and manufacturing, where, continues power supply is needed with cost-effectiveness. Also, supportive government policies and tax benefits further support the segment growth in the AC-coupled energy storage inverter market.

Value Chain Analysis

- Resource Extraction

The foundation of AC AC-coupled energy storage inverter market lies in the basic components like power semiconductors, transformers, control circuitry, and others, and resource extraction like copper and aluminium with rare earth elements like lanthanum, neodymium, and cerium, which are needed for optoelectrical materials.

Key players- Albemarle, Arcadium i, Tinaqi Lithium, BHP group, Shenghe Resources Holding Co., Ltd.

- Energy Storage Systems

Installation of the AC-coupled system at the consumer's site to offer continuous maintenance and repairs with efficient and safe installation practices.

Key players- Tesla, SMA, Sungrow, Exide Industries, Tata Power Solar, and others

- Grid Maintenance and Monitoring

Grid maintenance and monitoring are possible by leveraging advanced monitoring technologies like AI/ML for AC-coupled energy storage systems to deal with their complex nature.

Key players- ABB, General Electric, Schneider Electric, OMICRON, and Qualitrol.

AC-Coupled Energy Storage Inverter Market companies

- SMA Solar Technology

- Huawei Technologies

- Sungrow Power Supply

- ABB / FIMER

- Enphase Energy

- Delta Electronics

- Schneider Electric

- KACO New Energy

- TMEIC

- Growatt New Energy

- Solis Inverters

- GoodWe

- Fronius International

- Sungjin Energy

- Ginlong Technologies

- Omron Corporation

- Victron Energy

- Tesla Energy

- BYD Company

- Schneider Electric (duplicate removed, include Sungrow or Ginlong if needed)

Recent Developments

- In April 2025, Sungrow introduced its innovative modular inverter, 1+X 2.0, for utility-scale applications at the Global Renewable Energy Summit 2025. It is engineered to work even in harsh conditions like extreme heat. (Source:https://www.solarpowerworldonline.com)

- In November 2024, Deye BK, a leading supplier of PV inverters and ESS, introduced a new series of energy storage microinverters that support on-grid, off-grid, and AC-coupled setups and feature battery ports, ideal for a balcony setup.(Source:https://solarquarter.com)

Segments Covered in the Report

By Type

- Residential AC-Coupled Inverter

- Single-phase AC-Coupled Inverter

- Multi-phase AC-Coupled Inverter

- Others

- Commercial AC-Coupled Inverter

- Three-phase AC-Coupled Inverter

- Modular AC-Coupled Inverter

- Others

- Utility-Scale AC-Coupled Inverter

- Centralized Inverter

- String Inverter

- Others

By Application

- Residential

- Rooftop Solar + Storage Integration

- Grid Backup/Off-grid Operation

- Peak Shaving / Load Management

- Commercial & Industrial

- Microgrid Integration

- Demand Response

- Energy Arbitrage

- Utility-Scale

- Grid Stabilization / Frequency Regulation

- Renewable Energy Integration

- Ancillary Services

By Storage Technology

- Lithium-Ion Battery Systems

- LFP (Lithium Iron Phosphate)

- NMC (Nickel Manganese Cobalt)

- Others

- Lead-Acid Battery Systems

- VRLA (Valve-Regulated Lead Acid)

- Flooded Lead Acid

- Others

- Flow Batteries

- Other Emerging Storage Technologies

By Grid Type

- On-Grid AC-Coupled Inverter

- Off-Grid AC-Coupled Inverter

- Hybrid/Grid-Tied with Backup

By Power Rating

- <10 kW

- 10–50 kW

- 50–500 kW

- >500 kW

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting