Advanced Antenna Systems Market Size and Forecast 2025 to 2034

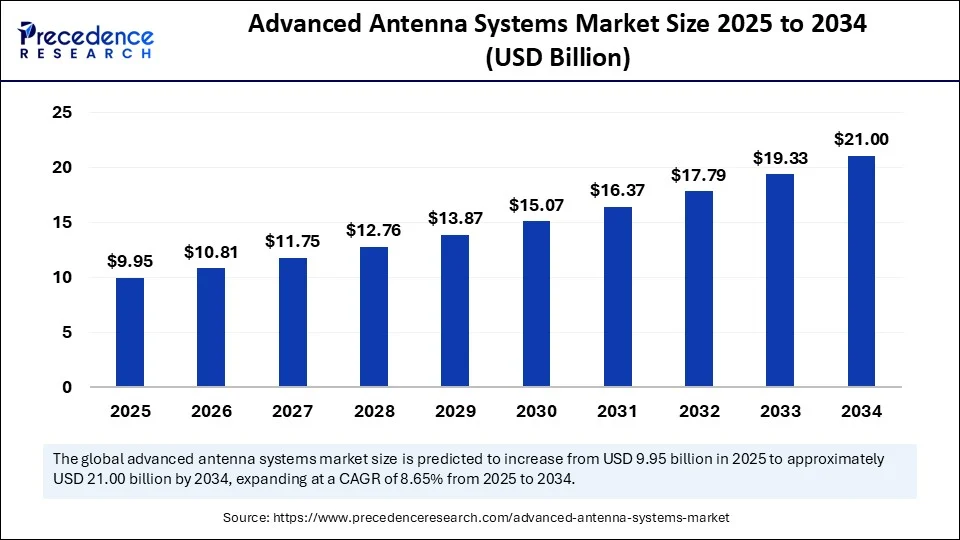

The global advanced antenna systems market size accounted for USD 9.16 billion in 2024 and is predicted to increase from USD 9.95 billion in 2025 to approximately USD 21.00 billion by 2034, expanding at a CAGR of 8.65% from 2025 to 2034. The rising demand for high-speed data connectivity, increasing adoption of 5G, surging investment in smart cities, and rapid expansion of the Internet of Things (IoT) technology are expected to boost the growth of the global advanced antenna systems market over the forecast period. Several key players in the market are widely adopting effective strategies to expand their market share and gain a competitive edge. Additionally, the market is expanding in emerging regions, particularly North America, driven by the widespread deployment of 5G networks and the rapid adoption of Internet of Things (IoT) devices across various industries.

Advanced Antenna Systems Market Key Takeaways

- In terms of revenue, the global advanced antenna systems market was valued at USD 9.16 billion in 2024.

- It is projected to reach USD 21.00 billion by 2034.

- The market is expected to grow at a CAGR of 8.65% from 2025 to 2034.

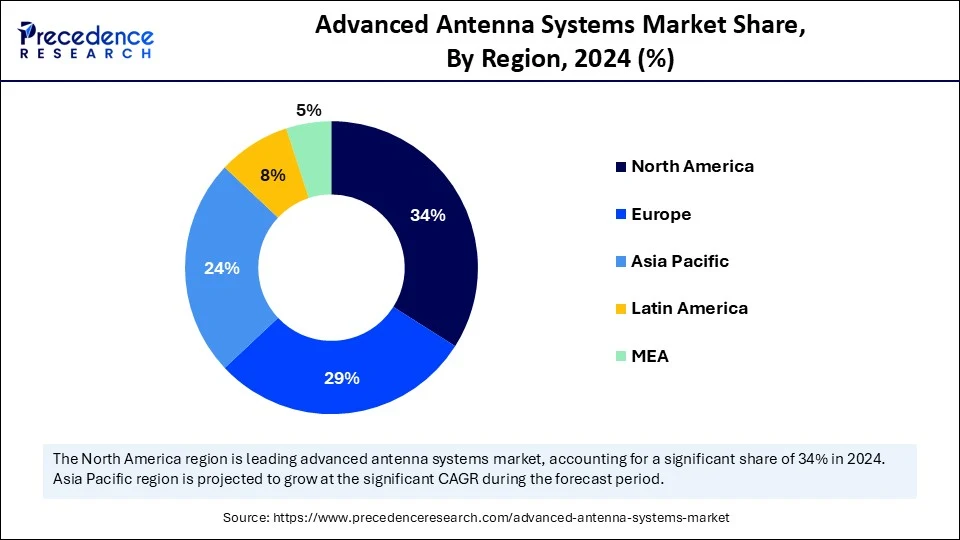

- North America dominated the global advanced antenna systems market with the largest share of 34% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By technology, the massive MIMO 64T64R segment captured the biggest market share of 32% in 2024.

- By technology, the massive MIMO beyond 128T segment is also experiencing the fastest growth during the forecast period.

- By frequency band, the sub-6 GHz (low & mid-band) segment contributed the largest market share of 45% in 2024.

- By frequency band, the mmWave (24–100 GHz) segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By component, the antenna array elements segment held the biggest market share of 36% in 2024.

- By component, the software & control algorithms segment is expanding at a significant CAGR from 2025 to 2034.

- By deployment type, the outdoor antenna systems segment generated the major market share of 38% in 2024.

- By deployment type, the indoor antenna systems segment is experiencing rapid growth in the market during the forecast period.

- By end-user industry, the telecom operators segment accounted for the significant market share of 42% in 2024.

- By end-user industry, the automotive & transportation segment is expected to witness remarkable growth during the forecast period.

How Can Artificial Intelligence Improve the Advanced Antenna Systems Market?

In the evolving technological landscape, artificial intelligence emerges as a transformative force, holding potential for growth and innovation in the advanced antenna systems market by significantly transforming antenna design and enhancing real-time performance to create smarter wireless networks. Artificial intelligence (AI) integration helps improve antenna performance, enhance network management, and optimize resource allocation. Machine learning (ML) algorithms enable smarter network management and adaptive beamforming, and can also replace computationally expensive electromagnetic simulations. The adoption of AI automates the design of complex antennas by efficiently generating and optimizing layouts based on specific performance goals.

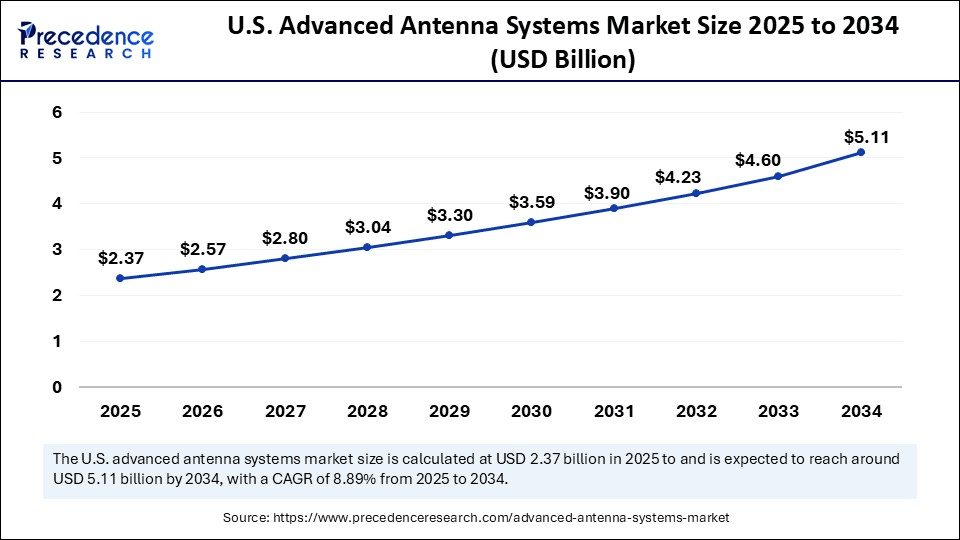

U.S. Advanced Antenna Systems Market Size and Growth 2025 to 2034

The U.S. advanced antenna systems market size was evaluated at USD 2.18 billion in 2024 and is projected to be worth around USD 5.11 billion by 2034, growing at a CAGR of 8.89% from 2025 to 2034.

How Did North America Lead the Advanced Antenna Systems Market in 2024?

North America held the dominant share of the advanced antenna systems market in 2024. The region benefits from a well-developed technology-driven infrastructure, surging investment in smart infrastructure, a supportive government framework, growing consumer demand for electric & autonomous vehicles, rising demand for high-speed wireless connectivity, and rising technological innovation in antenna design. The market is experiencing growth from the rapid expansion of Industry 4.0. and the integration of advanced technology such as AI and IoT devices. AI-driven optimization in smart antennas assists in better managing network resources. The rising rollout of 5G networks in the region increases the need for advanced antenna solutions to support higher data rates, ultra-reliability, and low-latency communications. The United States is a major contributor to the expansion of the advanced antenna systems market. The country's leading telecom operators are aggressively investing in 5G technology. Several telecom operators are heavily focusing on minimizing energy consumption and efficiently maintaining high data speeds to meet rising traffic demands. Advanced technologies, such as Massive MIMO and beamforming, enable operators to reduce power consumption, adapt channel capacity, and enhance signal quality and coverage in 5G networks. Such a combination of factors is expected to propel the growth of the advanced antenna systems market in the North American region.

What Made Asia Pacific the Fastest-Growing Region in the Advanced Antenna Systems Market in 2024?

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. The region's fastest growth is attributed to the increasing presence of key market players, the rapid expansion of smart infrastructure, rising consumer demand for reliable networks, the rapid pace of urbanization, the growing use of industrial automation, and the increasing deployment of 5G networks. Additionally, the increasing penetration of smartphones and growing demand for high-speed wireless connectivity are expected to drive the market's revenue in the region. Favorable government initiatives, such as tax incentives and funding for digitalization policies, are likely to drive the growth of the advanced antenna system market. The ongoing digital transformation across various industries is expected to drive demand for enhanced wireless connectivity and advanced solutions. Moreover, the surge in connected and IoT device adoption, along with the increasing demand for high-speed and low-latency communication for applications such as smart cities and connected homes, significantly drives innovation and expansion in the Asia-Pacific region.

- According to the article published by the Ministry of Housing & Urban Affairs in December 2024, as of 15.11.2024, under the Smart Cities Mission (SCM), work orders have been issued in 8,066 projects amounting to ₹1,64,669 crore, of which 7,352 projects (i91% of total projects) amounting to ₹1,47,366 crore have been completed, as per the data provided by 100 Smart Cities.(Source: https://www.pib.gov.in)

- According to the data from the Ministry of Industry and Information Technology (MIIT) in December 2024, China's 5G mobile phone subscriptions reached 1.002 billion by the end of November, a milestone in the world's leading telecom market. This figure represents 56 percent of all mobile phone subscriptions in the country, marking a 9.4 percentage point increase compared to the end of the previous year. The rapid growth in 5G subscriptions has been supported by massive infrastructure development. MIIT figures show China had deployed about 4.2 million 5G base stations by the end of last month.

(Source: https://english.www.gov.cn)

In June 2025, Ericsson marked a significant step forward in its India-based operations with the release of its first antenna model manufactured in India for global export, reinforcing the company's commitment to India as a strategic base for innovation and delivery. Ericsson is expanding its passive antenna manufacturing and engineering ecosystem in India to build an end-to-end capability that includes local sourcing, production, and engineering, with solutions specifically designed to meet global and Indian network requirements. With more than 50% of antenna content now produced locally, Ericsson is entering the next phase, evolving its India-based engineering capabilities to support regional adaptation, accelerate innovation, and scale with global demand.(Source: https://www.ericsson.com)

Market Overview

Advanced antenna systems (AAS) are complex systems comprising antennas that utilize new technologies to improve the performance and spectral efficiency of radiocommunication transceivers. Advanced antenna systems utilize multi-antenna technologies, such as beamforming and multiple-input multiple-output (MIMO), to significantly enhance network performance. Advanced antenna systems require sophisticated software and hardware to process radio signals and execute advanced features, including MIMO, adaptive beamforming, and other space division multiple access (SDMA) techniques.

What Are the Key Trends in the Advanced Antenna Systems Market?

- The rising demand for high-speed and reliable wireless connectivity is expected to contribute to the overall growth of the advanced antenna systems market.

- The rapid digitization and urbanization are estimated to promote the growth of the market during the forecast period.

- The rapid technological innovation in antenna design and the development of innovative solutions by key players are expected to fuel the expansion of the market for advanced antenna systems during the forecast period.

- The supportive government framework and surging investment in smart infrastructure are anticipated to accelerate the market's growth during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 21.00 Billion |

| Market Size in 2025 | USD 9.95 Billion |

| Market Size in 2024 | USD 9.16 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.65% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Frequency Band, Component, Deployment Type, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rapid Deployment of 5G Networks

The rising deployment of 5G networks is expected to boost the growth of the advanced antenna systems market during the forecast period. The market is also experiencing innovations in antenna design, signal processing, and beamforming technologies, which play a vital role in improving 5G network performance. 5G operates on higher frequencies, which increases the need for advanced antenna technologies such as massive beamforming and multiple-input multiple-output (MIMO) to deliver high speeds and low latency. Several telecom providers are increasingly investing in upgrading their networks to align with the evolving needs of consumers and enterprises, driving the expansion of the advanced antenna systems market in the coming years.

- In August 2025, Vodacom announced its investment of over R400 million to expand its 4G/5G network and promote digital inclusion in the Free State and Northern Cape. This investment is directed towards expanding network infrastructure, enhancing capacity and resilience, and empowering communities, with a particular focus on connecting underserved areas across the Free State and Northern Cape. The region spent R500 million during the 2024/25 financial year and R340 million in 2022/23 on expanding broadband coverage across the region.(Source: https://www.thefastmode.com)

Restraint

High Initial Investment

The high initial investment is anticipated to hamper the market's growth. The high investment required for procurement, workforce training, system integration, and infrastructure modifications can often be a barrier for small and mid-sized enterprises with limited budgets. Additionally, a shortage of skilled personnel may hinder the global advanced antenna systems market's growth during the forecast period.

Opportunity

How Is the Expanding Application of IoT Technology Across Various Industries Leaving an Impact?

The rapidly expanding application of Internet of Things (IoT) technology across various industries, including healthcare, automotive, electronics, aerospace, defense, and construction, is projected to offer lucrative growth opportunities for the advanced antenna systems market during the forecast period. IoT devices rely heavily on efficient antennas for wireless connectivity, resulting in a growing demand for specialized solutions, such as MIMO and beamforming antennas. The rise in the adoption of connected devices globally necessitates more advanced antenna technology to ensure high-speed, low-latency, and efficient wireless communication. Several governments around the world are heavily investing in smart city projects that mainly rely on interconnected cameras, sensors, and other devices. Advanced antennas play a crucial role in enabling real-time and efficient communication within urban ecosystems.

Technology Insights

What Made the Massive MIMO (64T64R) Segment Lead the Advanced Antenna Systems Market in 2024?

The massive MIMO (64T64R) segment was dominant, with the biggest share of the global advanced antenna systems market in 2024, owing to the increasing deployment of 5G networks for their high capacity and data rates. Massive MIMO (64T64R) antennas hold the potential to support high-capacity mobile networks, delivering speeds of nearly 3 to 6 Gbps per sector. For instance, in August 2024, Fujitsu unveiled a 64TR Massive MIMO Radio Unit, designed for 5G Open RAN networks. Developed using the Qualcomm QRU100 5G RAN Platform, this unit is tailored for modern Open RAN networks with Massive MIMO. It's designed to enhance scalability and power efficiency, while reducing the costs of deployment and operation, thereby supporting operators in the swift rollout of high-speed 5G networks. (Source: https://www.qualcomm.com)

On the other hand, the massive MIMO beyond 128T segment is also experiencing the fastest growth. Ultra Massive MIMO (UM-MIMO) systems use hundreds or thousands of antenna elements to meet the evolving demands of the future wireless ecosystem. Ultra Massive MIMO finds application in Industry 4.0, holographic communication, and 6G services owing to its ability to serve a large number of users with low latency and high data rates through its large arrays of antennas. Ultra Massive MIMO (UM-MIMO) offers higher data rates and improved reliability, aiming for terabits per second data rates for 6G applications.

Frequency Band Insights

What Causes the Sub-6 GHz (Low & Mid-band) Segment to Dominate the Advanced Antenna Systems Market?

The Sub-6 GHz (Low & Mid-Band) segment held a dominant market presence in 2024. Advanced antenna systems for 5G networks leverage MIMO technology to support the low- and mid-band sub-6 GHz spectrum, providing improved coverage and enhanced capacity. The sub-6 GHz spectrum is ideal for deployment using existing 4G-LTE infrastructure, which further makes it an economical and easy-to-implement option for 5G networks.

On the other hand, the mmWave (24–100 GHz) segment is expected to grow at a notable rate. Advanced antenna systems (AAS) for mmWave (24–100 GHz) are crucial for 5G services and beyond, offering ultra-high bandwidth, ultra-low latency, and multi-gigabit speeds, for numerous applications such as industrial automation, AR/VR, cloud gaming, and autonomous vehicles. The mmWave (24–100 GHz) band provides significantly more bandwidth than lower frequencies, allowing for multi-gigabit-per-second data transfer rates. Moreover, mmWave technology offers support for a high density of connected devices, which is crucial for smart cities, large-scale IoT deployments, and connected factories.

Component Insights

How Did the Antenna Array Elements Segment Dominate the Advanced Antenna Systems Market in 2024?

The antenna array elements segment dominated the market in 2024. Antenna array elements, individual antenna elements arranged in a certain pattern to control and shape electromagnetic beams. Individual element properties are designed to achieve complex radiation characteristics that are not possible with a single antenna. The most common types of antenna elements used in arrays include patch antennas: dipole and monopole antennas, dielectric resonator antennas, and others. On the other hand, the software & control algorithms segment is expected to register the fastest growth. Software & control algorithms are sophisticated software and signal processing algorithms specifically designed to control the antenna array and manage multiple signal paths. Software and control algorithms play a crucial role in managing these antenna arrays and optimizing signal delivery for an enhanced user experience in modern wireless communication systems.

Deployment Type Insights

How will Outdoor Antenna Systems Segment Dominate the Advanced Antenna Systems Market in 2024?

The outdoor antenna systems segment dominated the market in 2024. The outdoor antenna systems segment includes distributed antenna systems (DAS) that extend wide coverage over outdoor areas. The growth of this segment is primarily driven by the increasing demand for high-speed and reliable mobile coverage, particularly in large areas such as public venues, stadiums, and transportation hubs. Thus, bolstering the segment's expansion. On the other hand, the indoor antenna systems segment is witnessing the fastest growth. The growth of the segment is attributed to the increasing use of laptops, smartphones, tablets, and various wireless gadgets, which has significantly increased the demand for reliable and secure wireless connections. Indoor Distributed Antenna Systems (DAS) play a crucial role in ensuring seamless and high-capacity wireless coverage within large buildings, where cellular signals are often unavailable or weak.

End-User Industry Insights

How Did the Telecom Operators' Segment Dominate the Advanced Antenna Systems Market in 2024?

The telecom operators segment held the largest share in the advanced antenna systems market in 2024. The increasing deployment of 5G infrastructure by telecom operators has led to a growing demand for advanced antenna systems. Telecom operators are major customers for advanced antenna systems. They are widely leveraging these systems owing to the improved network performance, expanded coverage, achieving operational efficiency, and providing the infrastructure for advanced mobile services. On the other hand, the automotive & transportation segment is expected to grow significantly in the coming years. The rapid growth of the segment is driven by the rising demand for electric and autonomous vehicles, particularly in emerging economies. Electric vehicles (EVs) and autonomous vehicles require efficient antenna systems to obtain support for complex connectivity and sensor data. The integration of 5G technology offers improved data transfer and enables V2X communication, which is crucial for the future development of the transportation sector.

Advanced Antenna Systems Market Companies

- Ericsson

- Huawei Technologies

- Nokia

- Samsung Electronics

- ZTE Corporation

- CommScope

- Kathrein (now part of Ericsson)

- Airspan Networks

- Mavenir

- NEC Corporation

- Qualcomm

- Intel Corporation

- Recent Developments

Industry Leader Announcements

- In June 2025, Optus and Ericsson announced a strengthened partnership to deploy high-performance antennas designed to enhance the coverage, capacity, and energy efficiency of Optus' 5G network. Under the agreement, Ericsson will deliver Ericsson Antenna System (EAS) solutions tailored to Optus' operational needs, building on the companies' long-standing collaboration – helping to boost coverage and capacity for customers while supporting Optus' sustainability goals.(Source: https://www.5gamericas.org)

Recent Developments

- In March 2025, Inertial Labs, a VIAVI Solutions company, launched its M-AJ-QUATRO anti-jamming antenna system. Equipped with advanced Controlled Reception Pattern Antenna (CRPA) and digital processing technologies, M-AJ-QUATRO establishes Assured Positioning, Navigation, and Timing (A-PNT) in GPS/GNSS-challenged environments ranging from military operations to commercial aviation.(Source: https://www.iotinsider.com)

- In August 2025, Assured Space Access Technologies Inc. introduced the CapLink Array, a new phased array antenna system engineered to enhance missile defense radar missions and space-based communications. The system features a proprietary capacitive dipole design that enables a broad frequency bandwidth, high gain, and a wide field of view. These capabilities allow missile defense systems to track and respond to multiple threats simultaneously with improved speed and accuracy.(Source: https://www.spacewar.com)

Segments Covered in the Report

By Technology

- Massive MIMO (Multiple Input Multiple Output)

- 64T64R

- 128T128R

- Beyond 128T (Ultra Massive MIMO)

- Beamforming Antennas

- Analog Beamforming

- Digital Beamforming

- Hybrid Beamforming

- Active Antenna Systems (AAS)

- Integrated AAS

- Distributed AAS

- Smart Antennas

- Adaptive Arrays

- Switched Beam Antennas

By Frequency Band

- Sub-6 GHz (Low & Mid-Band)

- mmWave (24–100 GHz)

- 24–30 GHz

- 30–60 GHz

- 60–100 GHz

- Multi-band Antennas

By Component

- Antenna Array Elements

- Transceivers

- Phase Shifters

- Power Amplifiers

- Digital Signal Processors (DSPs)

- Software & Control Algorithms

By Deployment Type

- Indoor Antenna Systems

- Enterprise Buildings

- Stadiums & Airports

- Shopping Malls & Commercial Hubs

- Outdoor Antenna Systems

- Macro Cells

- Micro Cells

- Pico Cells

By End-User Industry

- Telecom Operators

- Government & Public Safety

- Military & Defense

- Automotive & Transportation

- Industrial & Manufacturing

- Healthcare

- Consumer Electronics

- Aerospace & Aviation

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content