What is the Automotive Drivetrain Market Size?

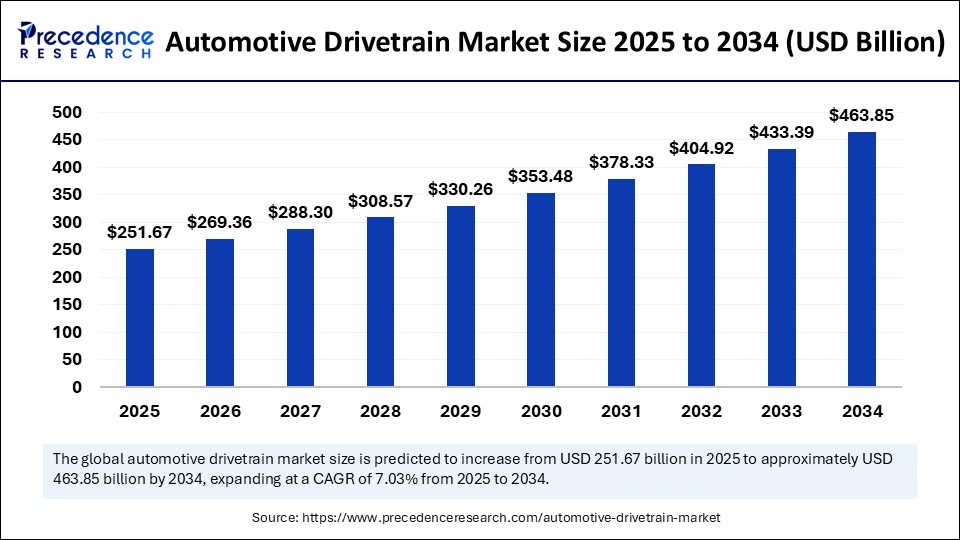

The global automotive drivetrain market size is accounted at USD 251.67 billion in 2025 and predicted to increase from USD 269.36 billion in 2026 to approximately USD 463.85 billion by 2034, expanding at a CAGR of 7.03% from 2025 to 2034. The demand for highly comfortable and safe vehicles is driving the growth of the market. The rising need for consumer preference for fuel-efficient and high-performance vehicles is fostering market growth.

Automotive Drivetrain Market Key Takeaways

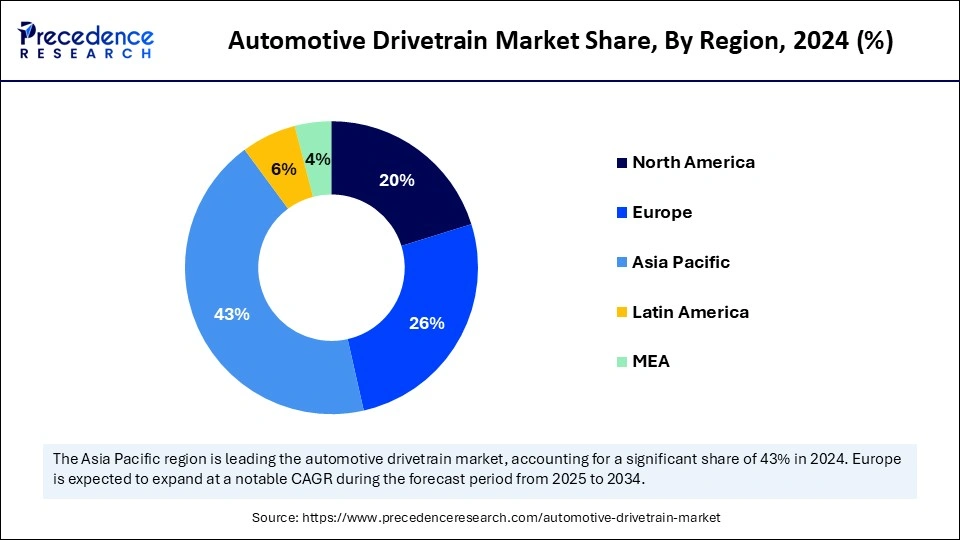

- Asia Pacific generated the largest revenue share of 43% in 2024.

- Europe automotive drivetrain market is expected to grow at a CAGR of 6.94% from 2025 to 2034.

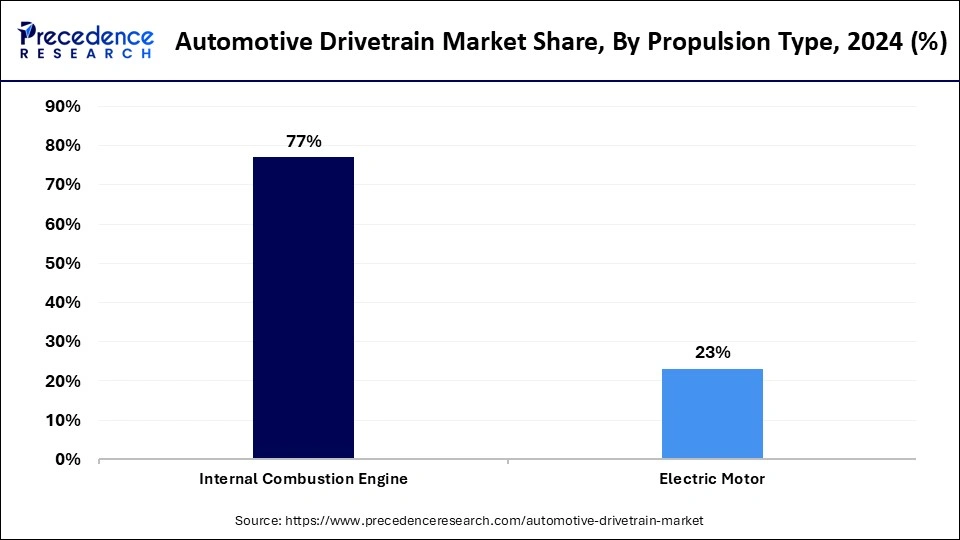

- By propulsion type, the internal combustion engine (ICE) segment held the major market revenue share of 77% in 2024.

- By propulsion type, the electric motor segment is projected to grow at a double digit CAGR of 18.54% during the forecast period.

- By drive type, the FWD segment accounted for the major revenue share of 52% in 2024.

- By drive type, the AWD segment is expected to grow at the highest CAGR in the coming years.

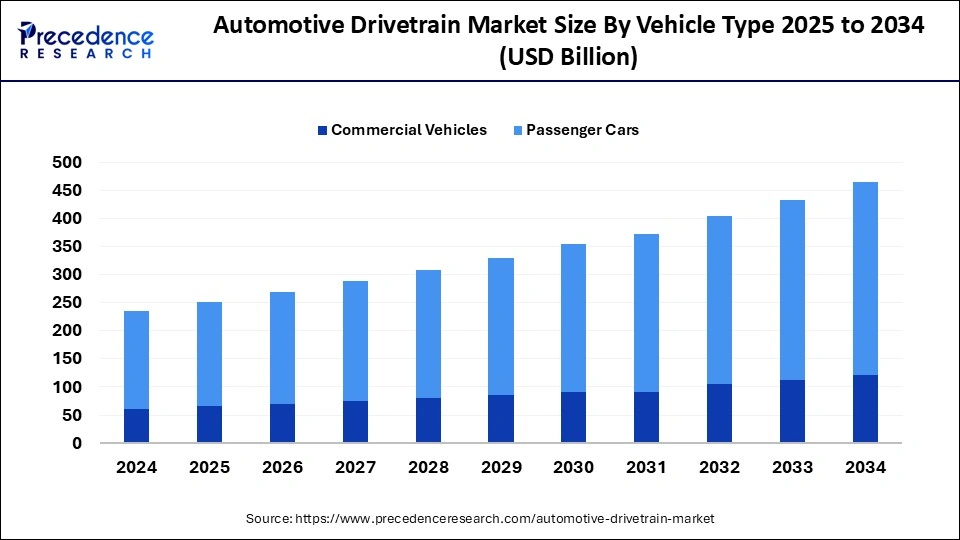

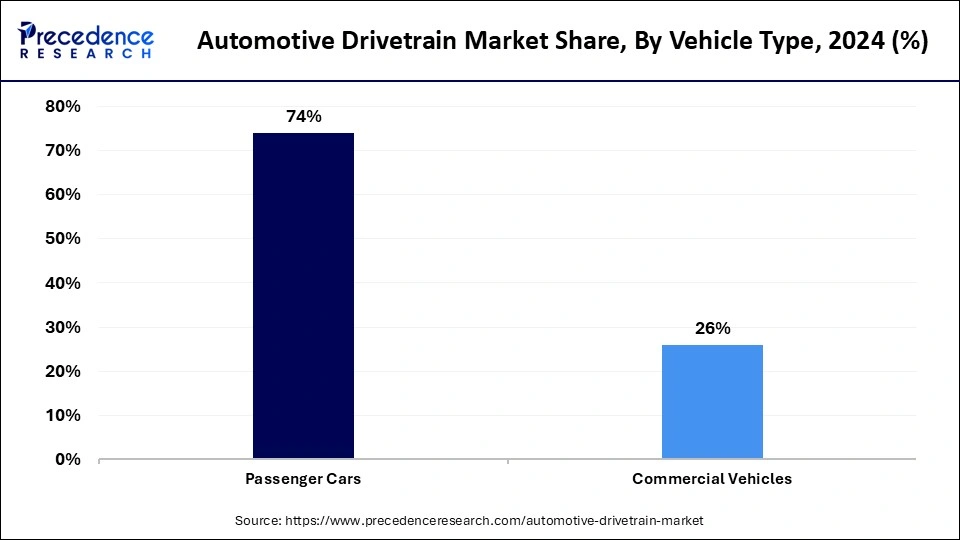

- By vehicle type, the passenger cars segment contributed the biggest revenue share of 74% in 2024.

- By vehicle type, the commercial vehicles segment is expected to expand at the fastest CAGR in the upcoming period.

Artificial Intelligence: The Next Growth Catalyst in Automotive Drivetrain

Artificial intelligence AI is playing a significant role in enhancing performance, efficiency, safety, and driving experiences. AI integration optimizes powertrain control by analyzing data from various sensors, enabling higher safety and better drivetrain performance. Predictive maintenance and optimization of drivetrain performance play a crucial role in improving fuel efficiency and drivetrain performance, reducing emissions, and preventing potential issues. Integration of AI in automobiles is becoming the next transformative approach. Improving drivetrain performance is spectacular to enhance overall vehicle performance. Tesla's Autopilot, BMW's Intelligent Personal Assistant, and Toyota's "Yui" AI are the key examples of next-generation drivetrains providing safe, convenient, and better personalized driving experiences.

Strategic Overview of the Global Automotive Drivetrain Industry

The global automotive drivetrain market is experiencing significant growth, driven by increased consumer demand for high-performance vehicles, including better acceleration, traction, and towing capabilities. Consumers are seeking highly comfortable and safe driving, significantly requiring sophisticated drivetrain systems. The rising trend toward sustainable transportation, driven by stringent emission regulations, government initiatives, and environmental awareness, is fostering the adoption of electric motors to boost demand for high-performance drivetrains. Additionally, government incentives, environmental concerns, and technological advancements lead to the growth of the EV industry, boosting the demand for drivetrains. The rising demand for better premium sports cars and trucks is trending in the market.

What are the Major Factors Boosting the Growth of the Automotive Drivetrain Market?

- Increased Automobile Production: The increased production of automobiles, like electric vehicles and passenger cars is transforming the adoption of drivetrain systems.

- Growing Demand for Better Performance: Rising consumer preference for highly efficient and high-performance vehicles is increasing demand for high-performance drivetrains.

- Adoption of Electric vehicles (EVs): The adoption of electric vehicles has increased, driven by government funding, stringent emission regulations, and consumer demands for sustainable alternatives, shifting the automotive drivetrain market.Technological Advancements: The advancements in technologies, such as batteries, innovative designs, and lightweight materials, are enhancing the performance and efficiency of drivetrains, contributing to market growth.

- Government Initiatives: The government has implemented various Strict emission regulations. Additionally, initiatives for electric vehicle promotion foster the adoption of electric and hybrid vehicles, driving demand for high-performance and highly efficient drivetrain systems.

Market Outlook

- Market Growth Overview: The automotive drivetrain market is expected to grow significantly between 2025 and 2034, driven by the rapid electrification of the automotive industry. As electric and hybrid vehicles gain traction, the market is shifting toward new technologies, such as e-axles, single-speed transmissions for BEVs, and sophisticated power electronics.

- Sustainability Trends: Sustainability trends involve an urgent need to reduce the transport sector's carbon footprint, stringent government regulations.

- Major Investors: Major investors in the market include BlackRock, Inc., Vanguard Group Inc., JPMorgan Chase & Co., and State Street Corp.

- Startup Economy: The startup economy is focused on electrification-innovation, advanced material and manufacturing, and ancillary services and IP licensing.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 463.85 Billion |

| Market Size in 2025 | USD 251.67 Billion |

| Market Size in 2026 | USD 269.36 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.03% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Propulsion Type, Drive Type, Vehicle Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Technological Innovations

Innovations in automotive technologies, including electric vehicles, hybrid vehicles, and autonomous vehicles, drive the growth of the automotive drivetrain market. Advancements such as lightweight materials, 48V mild hybrid systems, dual-clutch transmissions, variable transmissions, and AI integrations are fostering the development of highly efficient and better-performing vehicles. Ongoing trends toward integrating cutting-edge technologies, like ADAS and predictive maintenance, are improving the overall efficiency of vehicles. Additionally, the development of lightweight driveshafts and all-wheel drive (AWD) systems also contributes to market growth. Technological innovations are leading to the adoption of more efficient and environmentally friendly drivetrain systems.

Restraint

Geopolitical Tension

The major restraints for the automotive drivetrain market is the geopolitical tensions and supply chain distribution. Changes in policies, import & export regulations, and international conflicts between countries are hampering the automotive industry. Stringent emission regulations and changes in government incentives for electric and hybrid vehicles, causing impacts on the adoption of drivetrain systems in various countries. The geopolitical tension led to supply chain distribution, causing price volatility and supply shortages of raw materials. This, in turn, impacts production and restrains the growth of the market.

For instance, in April 2025, U.S. President Donald Trump imposed a 25% tariff on imported cars and automotive components, including engines, transmissions, powertrain parts, and electrical components. This can have a major impact on availability as well as the cost of drivetrain components.

Opportunity

Developments of In-Wheel Hub Drives

The increasing adoption of electric vehicles and the need to improve vehicle performance are driving the development of in-wheel hub drives. The in-wheel hub drives offer high efficiency, performance, and reduced emissions. These drives offer precise control, making them ideal for autonomous vehicles. Passenger and commercial cars are being developed with an in-wheel hub drive system for better stability, control, and traction. The ongoing focus on the development of integrated in-wheel hub drive systems with electric motors, brakes, cooling systems, and power electronics is expected to revolutionize the automotive industry.

Propulsion Type Insights

Which Propulsion Type Segment Dominated the Automotive Drivetrain Market in 2024?

The internal combustion engine (ICE) segment dominated the market with the largest revenue share of 77% in 2024 due to the well-established infrastructure and cost-effectiveness of the ICEs. Despite the rising adoption of electric vehicles worldwide, ICE-powered vehicles are increasingly preferred for the long haul due to their high performance. Well-established infrastructure for ICE-powered vehicles, like fueling stations and repair services, ensures the long-term growth of the segment. Additionally, fluctuations in energy prices and limited charging stations for EVs in some areas boost the adoption of ICE-powered vehicles, bolstering segmental growth.

The electric motor segment is expected to grow at the fastest CAGR of 18.54% during the forecast period. The growth of the segment is attributed to the increasing adoption of electric vehicles. Electric motors are becoming more compact, powerful, and efficient, increasing their adoption for various automotive applications. Emerging demands for DC/DC converters, battery management systems, power electronic controllers, and onboard chargers, depending heavily on electric motors, contribute to segment growth.

Drive Type Insights

How does the FWD Segment Dominate the Automotive Drivetrain Market?

The FWD (Front Wheel Drive) segment dominated the market by holding a major revenue share of 52% in 2024. This is mainly due to a heightened adoption of FWD drives in passenger cars and compact vehicles. The FWD is more affordable than other drive types and offers compact design, high fuel efficiency, and better traction. The FWD type is simple to design and cost-effective, making it ideal for automakers. The simpler drivetrain layouts and better traction make the segment ideal for urban and suburban areas. The growing consumer demand for less complex and lightweight drive types is fostering segment growth.

The AWD (All-Wheel Drive) segment is expected to grow at the fastest CAGR in the coming years. The growth of the segment can be attributed to the increasing adoption of AWD to improve vehicle stability and performance, especially in challenging conditions. The AWD drive offers better traction and control than FWD configurations. The rising adoption of SUVs and crossover vehicles is fostering demand for AWD drives. Additionally, ongoing advancements in AWD systems for adjusting power distribution for performance optimization and energy utilization are expected to boost the adoption rate in the upcoming sustainable era.

Vehicle Type Insights

Why did the Passenger Vehicles Segment Dominate the Automotive Drivetrain Market in 2024?

The passenger cars segment dominated the market by generating a maximum revenue share of 74% in 2024. This is mainly due to increased consumer preference for high-volumepassenger vehicles. The production and sale of passenger cars have increased in urban areas. The consumer demand for fuel-efficient and advanced vehicles is filling with passenger cars. The integration of electric control units, smart transmission systems, and cutting-edge drive-assistance systems with passenger cars, with transformative drivetrain functionality, fostering segment growth.

The commercial vehicles segment is expected to expand at the fastest CAGR in the upcoming period, driven by increased demand for specialized drivetrain technologies, such as All-Wheel Drive (AWD) systems, in medium and heavy commercial vehicles. The production and sale of commercial vehicles are growing, driven by government policies for cleaner alternatives, like electric and hybrid vehicles. The ongoing focus on the development of specialized vehicles for specific use is fostering the need for specialized drivetrain technologies.

Regional Insights

Asia Pacific Automotive Drivetrain Market Size and Growth 2025 to 2034

Asia Pacific automotive drivetrain market size is exhibited at USD 108.22 billion in 2025 and is projected to be worth around USD 201.77 billion by 2034, growing at a CAGR of 7.15% from 2025 to 2034.

How Asia Pacific Dominate the Global Automotive Drivetrain Market?

Asia Pacific dominated the market for automotive drivetrain with the largest share of 43% in 2024 due to the presence of a well-established automotive industry and increased electrification of vehicles. The adoption of cutting-edge drivetrain technologies has increased significantly in the last few years. Strong government support for EV production and adoption and a robust supply chain further bolstered the growth of the market. The rising demand for high-performance vehicles is creating the need for advanced drivetrains, sustaining the long-term growth of the market.

China Automotive Drivetrain Market Trends

China is a major player in the market. The country is the world's largest producer of vehicles. With the rising production of vehicles, the demand for drivetrain is increasing in China. Supportive government policies, a well-established automotive sector, a large population, and rising sales of AWD vehicles are bolstering the growth of the market. Meanwhile, India is emerging as a major marketplace due to the rapid shift toward electric vehicles and the rising adoption of hybrid vehicles. Government policies for the adoption of electric vehicles, rising consumer preference for sustainable alternatives, and ongoing technological innovations are boosting the growth of the market. The Government of India has launched several projects to boost domestic manufacturing of automobiles and components. The government's focus on promoting a Vehicle Scrapping Policy for the phase-out of older, polluting vehicles and establishing Registered Vehicle Scrapping Facilities (RVSFs) further contributes to market growth.

The Union Budget 2025-2026, introduced in February 2025, has increased funding for the automotive sector, especially for EV development and infrastructure. The funding includes initiatives of the Indian government, such as the "PM E-DRIVE Scheme" and the "PLI Auto Scheme." Indian industry leaders, such as Zypp Electric, ParkMate, and Bry-Air, are witnessing extreme support for EV electrification, local battery manufacturing, and road safety measures through the Union Budget 2025.

(Source: https://timesofindia.indiatimes.com)

Europe Automotive Drivetrain Market & Trends

Europe is the second-largest market and is expected to grow at the fastest CAGR in the upcoming period due to factors like a large surge in electric vehicle adoption, a strong automotive industry, stringent emission regulations, and a strong focus on technological advancements. Countries like Germany, France, and the UK have major adoption rates of electric vehicles and high investments in technology and infrastructure, contributing to market growth. In March 2025, the European Commission established an Action Plan to boost the European automotive sector's transition toward zero-emission mobility. According to the policy, automakers need to achieve a 15% reduction in CO? emissions by 2025. Such policies boosts the demand for electric drivetrains.

(Source: https://www.mondaq.com)

Germany Automotive Drivetrain Market Trends

Germany is a major player in the European automotive drivetrain market. The growth of the market in the country is driven by the presence of some well-known auto manufacturers. Germany is a major adopter of new technologies. There is a high demand for luxury and high-performance vehicles, fostering the wide availability of cutting-edge drivetrains in Germany. Germany has developed cutting-edge technologies, including all-wheel-drive (AWD) and electric powertrains, influencing the market growth.

North American Automotive Drivetrain Market Trends

North America is a notable region in the automotive drivetrain market. The growth of the market in the region is driven by the shift toward electrification and government policies to promote electric and hybrid vehicles. Region's ongoing focus on reducing emissions is boosting the adoption of electric vehicles. Governments around the region have imposed stringent regulations to reduce emissions from the automotive industry. Additionally, the rising demand for self-driving and high-performance cars is expected to boost market growth.

U.S. Automotive Drivetrain Market Trends

The U.S. is a major player in the market. This is mainly due to factors like changing consumer demands, government emission control regulations, battery technology advancements, and growing electric vehicle adoption. The adoption of all-wheel drive (AWD) and four-wheel drive (4WD) systems has increased in the U.S. market. A strong focus of U.S. car manufacturers on the development of EVs and autonomous technologies is drawing customers from ICE businesses. Additionally, a shift toward integrated drive e-powertrain systems to enhance vehicle efficiency and range, shaping the market.

Value Chain Analysis of the Automotive Drivetrain Market

- Inbound Logistics

This stage involves the procurement, receiving, and storage of raw materials and components necessary for manufacturing drivetrain systems, such as steel, aluminum, rare earth metals, and electronic components.

Key Players: DHL, Kuehne + Nagel, and Tier 2/Tier 3 parts manufacturers - Operations

This stage encompasses the manufacturing and assembly of drivetrain components and complete systems, including transmissions, axles, driveshafts, and differentials. Key Players: BorgWarner Inc., ZF Friedrichshafen AG, Magna International Inc., and Dana Limited - Outbound Logistics

Outbound logistics covers the storage and distribution of finished drivetrain systems to vehicle assembly plants (OEMs) and aftermarket distributors.

Key Players: CEVA Logistics, DB Schenker, and Ryder System, Inc. - Marketing and Sales

This stage involves promoting drivetrain technologies and solutions to potential customers, which can include both B2B sales to OEMs and B2C marketing for replacement parts.

Key Players: General Motors, Volkswagen AG, Toyota Motor Corporation, Ford - Service

The service stage encompasses after-sales support, maintenance, repair, and the supply of replacement parts for the lifespan of the vehicle.

Top Companies in the Automotive Drivetrain Market & Their Offerings

- BorgWarner Inc.: BorgWarner is a major global Tier 1 supplier that contributes significantly to the automotive drivetrain market by designing and manufacturing innovative powertrain solutions for both internal combustion and electric vehicles.

- Magna International: As one of the world's largest automotive suppliers, Magna contributes by providing a wide range of drivetrain systems and components, including complete all-wheel-drive (AWD) and four-wheel-drive (4WD) systems. They focus on modular and scalable solutions to meet diverse OEM needs across various vehicle types.

- General Motors: As a prominent OEM, General Motors is a major consumer of drivetrain components and a significant innovator in electric vehicle (EV) drivetrain systems, such as its Ultium platform.

- TOYOTA MOTOR CORPORATION: Toyota contributes to the market both as a major OEM that develops its own sophisticated drivetrain technology, especially for hybrid vehicles, and as a key driver of fuel efficiency and electrification trends.

- Schaeffler AG: This company is a key supplier of high-precision components and systems for engines, transmissions, and electrified mobility applications. Their focus is on developing innovative solutions that improve fuel efficiency and support the transition to electric mobility.

- Volkswagen Group: As one of the world's largest automakers, the Volkswagen Group contributes by driving large-scale production and demand for advanced drivetrain systems for its many brands.

- Stellantis NV: Formed from the merger of FCA and PSA, Stellantis contributes to the market through its extensive portfolio of global brands and a focus on developing both internal combustion and electric drivetrains.

- American Axle & Manufacturing, Inc.: This company specializes in the design, engineering, and manufacturing of driveline and metal forming technologies primarily for the automotive industry.

- Aisin Seki Co., Ltd.: A major Tier 1 supplier within the Toyota Group, Aisin contributes by developing and manufacturing advanced transmission systems and hybrid components for vehicles worldwide.

- ZF Friedrichshafen AG: ZF is a leading global technology company and major supplier of highly advanced driveline and chassis technology for the automotive industry.

- Hyundai Motor Company: As a major OEM, Hyundai contributes to the market by developing and implementing competitive drivetrain technologies in its vehicles, including innovative electric and hydrogen fuel cell systems.

Automotive Drivetrain Market Companies

- BorgWarner Inc.

- Magna International

- General Motors

- TOYOTA MOTOR CORPORATION

- Schaeffler AG

- Volkswagen Group

- Stellantis NV

- American Axle & Manufacturing, Inc.

- Aisin Seki Co., Ltd.

- ZF Friedrichshafen AG

- Hyundai Motor Company

Recent Developments

- In May 2025, the 2025 Kia Carens Clavis was revealed as the carmaker's new premium MPV, which is set to launch in June 2025. The Kia Carens Clavis is available in seven variants, including HTE, HTE(O), HTK, HTK Plus, HTK Plus (O), HTX, and HTX Plus (O). Kia Carens Clavis is designed with three engine options and variant-wise powertrain.

(Source: https://www.cardekho.com) - In April 2025, the Hyundai Motor Group's next-generation hybrid powertrain system was launched to enhance performance and efficiency, offering two petrol engines, such as a 2.5-litre and a 1.6-litre turbo-petrol. The 2.5-litre engine has debuted on the Palisade SUV. (Source: https://www.autocarindia.com)

Segment Covered in the Report

By Propulsion Type

- ICE

- Electric Motor

By Drive Type

- FWD

- RWD

- AWD

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content