What is the Automotive Ethernet Market Size?

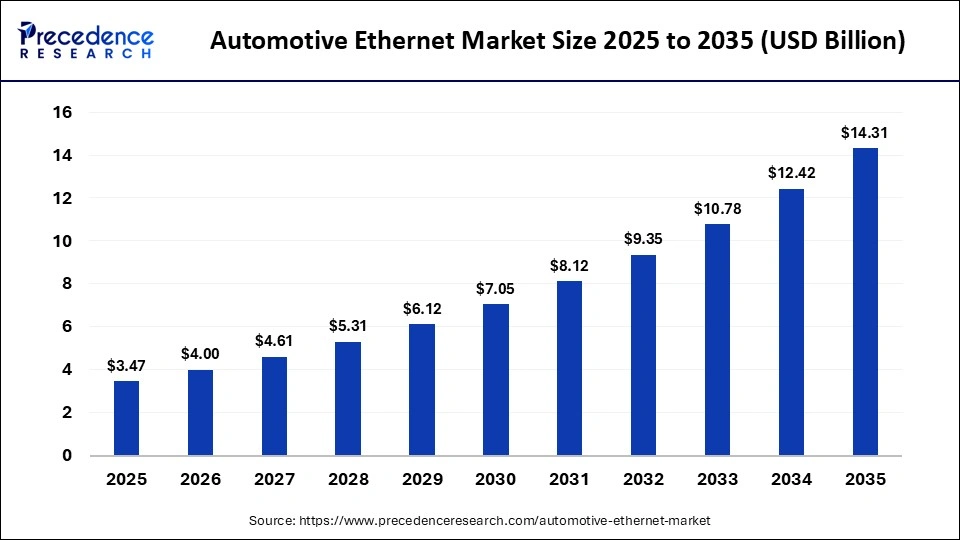

The global automotive ethernet market size was calculated at USD 3.47 billion in 2025 and is predicted to increase from USD 4.00 billion in 2026 to approximately USD 14.31 billion by 2035, expanding at a CAGR of 15.22% from 2026 to 2035. The market is majorly driven by the rising demand for high-bandwidth, low-latency data transmission within vehicles, which is essential for ADAS and infotainment platforms.

Market Highlights

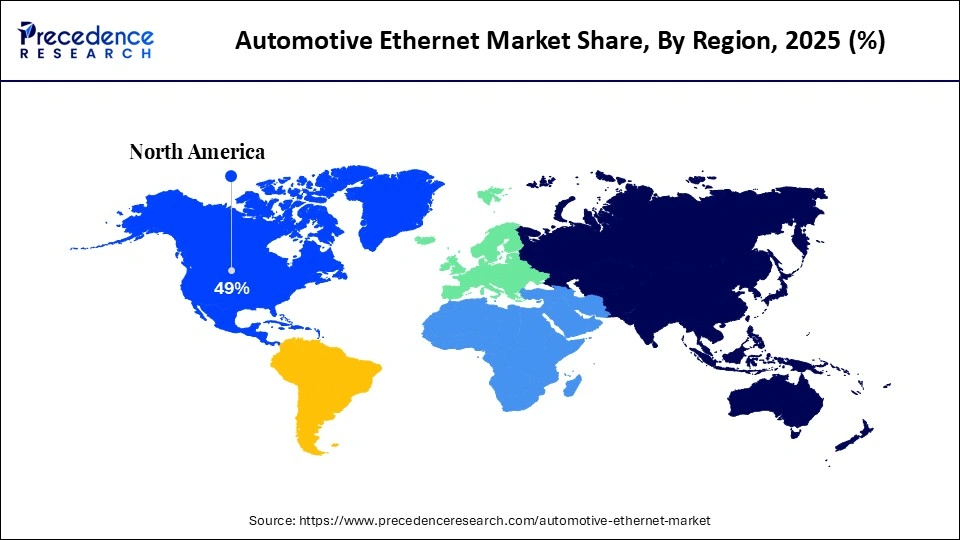

- Asia Pacific dominated the market with the largest share of 49% in 2025.

- The Europe is expected to grow at the fastest CAGR during the foreseeable period.

- By component, the hardware segment held the largest market share in 2025.

- By component, the services segment is expected to grow at the fastest CAGR during the foreseeable period.

- By bandwidth, the 100 Mbps segment dominated the market with the largest share in 2025.

- By bandwidth, the 1 Gbps segment is expected to grow at the fastest CAGR during the foreseeable period.

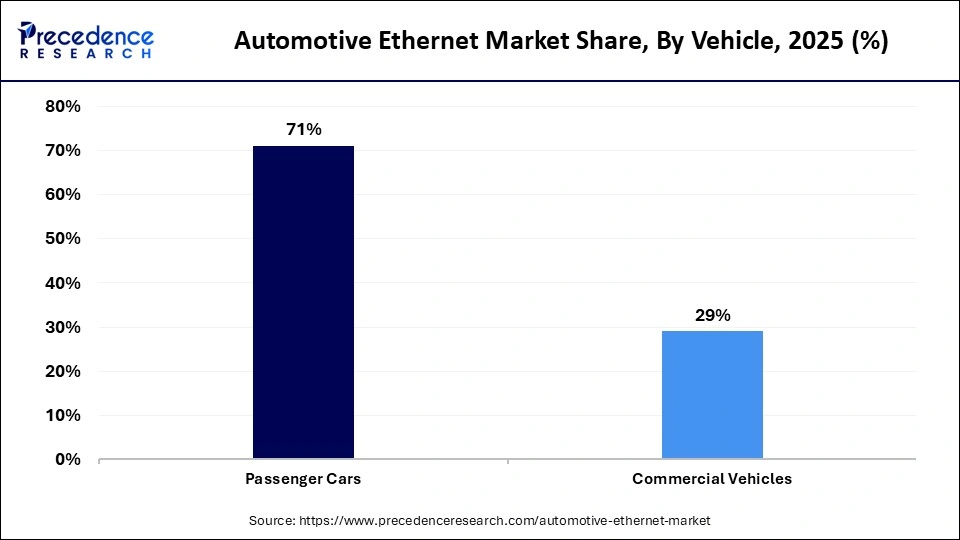

- By vehicle, the passenger cars segment contributed the biggest market share of 71% in 2025.

- By vehicle, the commercial vehicles segment is expected to grow at the fastest CAGR during the foreseeable period.

- By application, the ADAS segment held the largest market share in 2025.

- By application, the infotainment segment is expected to grow at the fastest CAGR during the foreseeable period.

Market Overview

The automotive Ethernet market encompasses the industry focused on the development and deployment of high-speed, reliable, and secure in-vehicle networking technologies specifically designed for automotive applications. Automotive Ethernet enables high-bandwidth data transmission to support advanced vehicle functionalities such as infotainment systems, advanced driver-assistance systems (ADAS), and other connected car features. By utilizing lightweight single-pair twisted-pair cables, automotive Ethernet helps reduce overall vehicle weight and system complexity while lowering costs and maintaining robust performance and enhanced security.

Automotive Ethernet acts as a foundational networking framework for modern vehicle architecture, enabling secure, high-speed, and real-time data exchange across in-vehicle systems. It plays a critical role in supporting autonomous driving functions, advanced driver-assistance systems, and next-generation infotainment through centralized and zone-based vehicle architectures. The market is driven by the rapid adoption of EVs and software defined vehicles.

Automotive Ethernet Market Trends

- Manufacturers are increasingly adopting zonal vehicle architectures and software-defined vehicle (SDV) platforms, which require high-bandwidth, robust automotive Ethernet networks to support centralized computing and seamless over-the-air (OTA) software updates.

- Autonomous and electric vehicle manufacturers are focusing on reducing vehicle weight and wiring complexity, driving the adoption of single-pair Ethernet (SPE) solutions that deliver higher efficiency while contributing to extended EV driving range.

- Secure Ethernet-based gateways are gaining traction as a critical component for protecting in-vehicle data, safeguarding communication between ADAS modules and infotainment systems, and mitigating cybersecurity threats.

- Next-generation autonomous vehicles increasingly require multi-gigabit Ethernet speeds, including up to 10 Gbps, to manage the massive data volumes generated by sensors, cameras, radar, and autonomous driving applications.

How is AI Influencing the Automotive Ethernet Market?

The integration of artificial intelligence with automotive Ethernet has significant benefits in terms of network optimization and security while supporting autonomous driving and ADAS. AI holds potential to automate network configuration, minimize manual troubleshooting, and enhance cybersecurity by detecting anomalies in data flow. AI also enables seamless over-the-air updates and advanced infotainment that solely depends on secure and fast Ethernet connectivity. By recognizing the immense potential of AI integration into automotive Ethernet, some of the leading companies are collaborating to offer AI-powered automotive Ethernet.

- For instance, in January 2025, Keysight Technologies collaborated with KD Inc. and developed a comprehensive test platform for the physical layer of Ethernet by using the capabilities of AI and ML, which is essential for OEMs and Tier-1 companies that are looking to validate next-gen technologies in the automotive sector.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.47 Billion |

| Market Size in 2026 | USD 4.00 Billion |

| Market Size by 2035 | USD 14.31 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 15.22% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Bandwidth, Vehicle, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

Why Does the Hardware Segment Dominate the Automotive Ethernet Market?

The hardware segment dominated the market while holding the largest share in 2025. This is mainly due to the large requirement of physical components such as switches, controllers, connectors, and cables that are a foundational part of high-speed data transmission. The rapid surge in ADAS and V2X connectivity requires high bandwidth, creating a substantial demand for hardware solutions. The segment's dominance is further reinforced by the increasing demand for EVs, which requires highly complex and reliable networking, significantly driving the demand for hardware solutions.

The services segment is expected to grow at the fastest CAGR during the foreseeable period, owing to the complexity in Ethernet integration. This significantly drives the demand for specialized services with expert consultation for testing and maintenance of the system, and to comply with strict regulations of data safety with seamless interoperability. Also, automakers are increasingly outsourcing tasks like time-sensitive networking tuning with deep inspection, further expanding the segment's growth.

Bandwidth Insights

Why Did the 100 Mbps Segment Lead the Automotive Ethernet Market?

The 100 Mbps segment led the market with the largest share in 2025, as it provides sufficient bandwidth for applications requiring data rates beyond 10 Mbps, including advanced infotainment systems, parking assistance cameras, and sensor data aggregation. This bandwidth level offers a highly cost-efficient solution, delivering cost savings of up to 80% compared to conventional shielded cabling. Additionally, 100 Mbps automotive Ethernet supports full-duplex communication, enabling simultaneous bidirectional data transmission over a single twisted-pair cable, which significantly enhances network efficiency and reliability.

The 1 Gbps segment is expected to grow at the fastest CAGR during the projection period, as it serves as a backbone for ADAS, infotainment systems, and zonal architectures. This bandwidth provides high-speed, low-latency data transmission, making it ideal for software-defined vehicles (SDVs) and modern in-car entertainment systems. Additionally, the automotive industry is shifting from traditional point-to-point wiring toward centralized zonal architectures, where 1 Gbps Ethernet functions as the main high-speed highway connecting multiple zonal controllers, thereby reducing overall wiring weight, complexity, and cost.

Vehicle Insights

What Made Passenger Cars the Leading Segment in the Automotive Ethernet Market?

The passenger cars segment led the market with a major revenue share in 2025, driven by the growing demand for high-bandwidth, low-latency in-vehicle networks. Modern passenger vehicles are increasingly equipped with LiDAR, radar sensors, cameras, and other ADAS components, which traditional networking systems cannot efficiently support, necessitating specialized Ethernet-based solutions. Additionally, rising consumer demand for high-definition streaming, advanced multimedia interfaces, and connected navigation systems, which ensure both safety and entertainment during long journeys, further fuels the growth of this segment.

The commercial vehicles segment is expected to grow at the fastest CAGR over the forecast period, as commercial vehicles need highly organized, precise, and high-speed data transmission for cameras, LiDAR, and Radar to secure in-car systems. Automotive Ethernet offers lightweight, low-cost, and scalable solutions that are highly beneficial for large vehicles, further optimizing fuel efficiency. Moreover, the increasing shift toward autonomous driving with intelligent support systems in commercial vehicles fuels the demand for reliable and high-speed networks that are achievable by Ethernet.

Application Insights

How Did the ADAS Segment Dominate the Automotive Ethernet Market?

The ADAS segment dominated the market by holding the largest share in 2025, as the rapid adoption of ADAS systems drives demand for high-bandwidth networks and zonal vehicle architectures worldwide. ADAS requires deterministic, low-latency communication to enable real-time safety decision-making. Automotive Ethernet serves as the digital nervous system of ADAS, leveraging Time-Sensitive Networking (TSN) to ensure that critical data reaches its intended destination without delay. Additionally, because ADAS is highly software-dependent, Ethernet facilitates over-the-air (OTA) updates, allowing manufacturers to continuously enhance safety features even after the vehicle has been delivered.

The infotainment segment is expected to grow at the fastest CAGR during the foreseeable period. This is mainly due to the increasing demand for high-speed, high-bandwidth in-car entertainment systems such as HD displays, streaming, and multi-zone audio. Automotive Ethernet enables high-speed, high-bandwidth data transmission, simplifying overall vehicle electronic architecture and supporting the complex connectivity requirements of modern infotainment platforms. Additionally, rising consumer expectations for seamless connectivity and personalized entertainment experiences are prompting OEMs to adopt Ethernet-based solutions for modern vehicles.

Regional Insights

What is the Asia Pacific Automotive Ethernet Market Size?

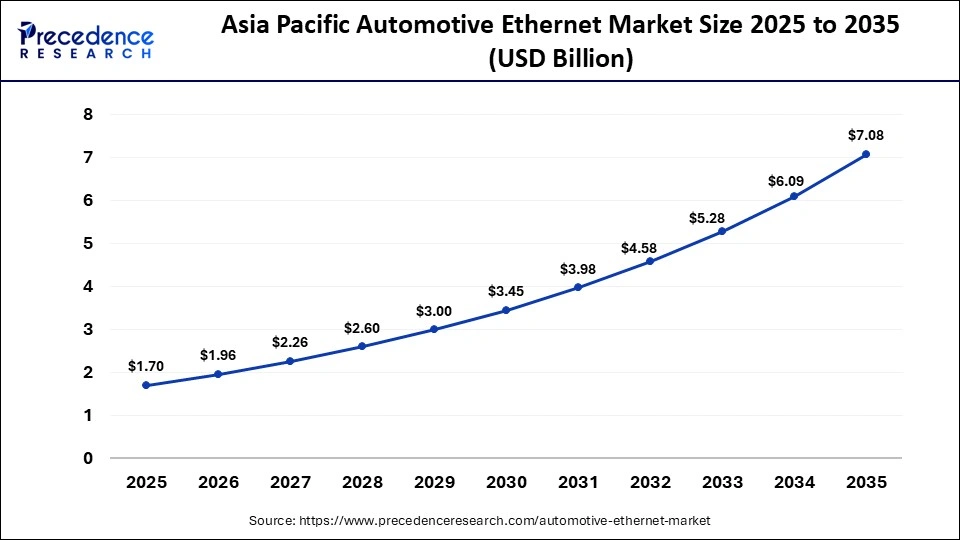

The Asia Pacific automotive ethernet market size is expected to be worth USD 7.08 billion by 2035, increasing from USD 1.70 billion by 2025, growing at a CAGR of 15.33% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Automotive Ethernet Market?

Asia Pacific dominated the market by capturing the largest share in 2025. This is mainly due to the massive production of automobiles that led to the higher demand for ADAS systems and increased adoption of EVs across the region to combat excessive carbon emissions as a national strategy. Automotive companies in the region have been heavily investing in ADAS infotainment systems for a better in-vehicle experience with AI-powered telematics, which requires higher bandwidth like 1Gbps to 10Gbps, and it is provided by Ethernet.

Additionally, the region serves as a central hub for automotive manufacturing, with companies like Toyota leveraging massive production capabilities. The rapid expansion of electric vehicle (EV) production, combined with strong consumer demand for smart, connected vehicles, is driving the adoption of high-speed automotive Ethernet networks in the region.

Japan Automotive Ethernet Market Trends

The market in Japan is majorly driven by the shift toward software-defined vehicles (SDVs), widespread ADAS adoption, and the growth of electric mobility. The rapid deployment of multi-gigabit Ethernet supports high-resolution sensor data and provides cost-effective, high-speed connectivity. To reduce wiring weight and overall system complexity, Japanese OEMs are increasingly adopting single-pair Ethernet (SPE), which can lower vehicle wiring weight by up to 40% and reduce costs by approximately 20%. Additionally, Japan is actively enhancing the safety standards for connected vehicles, with the Ministry of Land, Infrastructure, Transport, and Tourism updating protocols to include cybersecurity measures and Ethernet testing for autonomous and connected vehicle applications.

Why is Europe Rapidly Expanding in the Automotive Ethernet Market?

Europe is expected to grow at the fastest CAGR during the forecast period due to the rapid shift toward software-defined vehicles, regulations like ISO 26262, and the need for highly secure communication in modern EVs and advanced driver-assistance systems amid an aggressively changing automotive industry from traditional network to zonal architecture. OEMs in Europe are largely preferring zonal electronic architectures, needing a highly efficient and scalable Ethernet backbone. Also, the increasing demand for high-definition, real-time multimedia and advanced infotainment systems is boosting the need for high-bandwidth data transmission.

Germany Automotive Ethernet Market Analysis

Germany is a key contributor to the market within Europe, driven by the adoption of zonal architectures with Ethernet switches, the growing demand for software-defined vehicles (SDVs), and stringent cybersecurity requirements for automotive manufacturers. To ensure high-level security, manufacturers are increasingly deploying secure Ethernet-based gateways to protect connected vehicles from cyber threats. Furthermore, the rapid implementation of Time-Sensitive Networking (TSN) standards enables deterministic, low-latency communication, which is critical for safety-critical applications in autonomous and advanced driver-assistance systems.

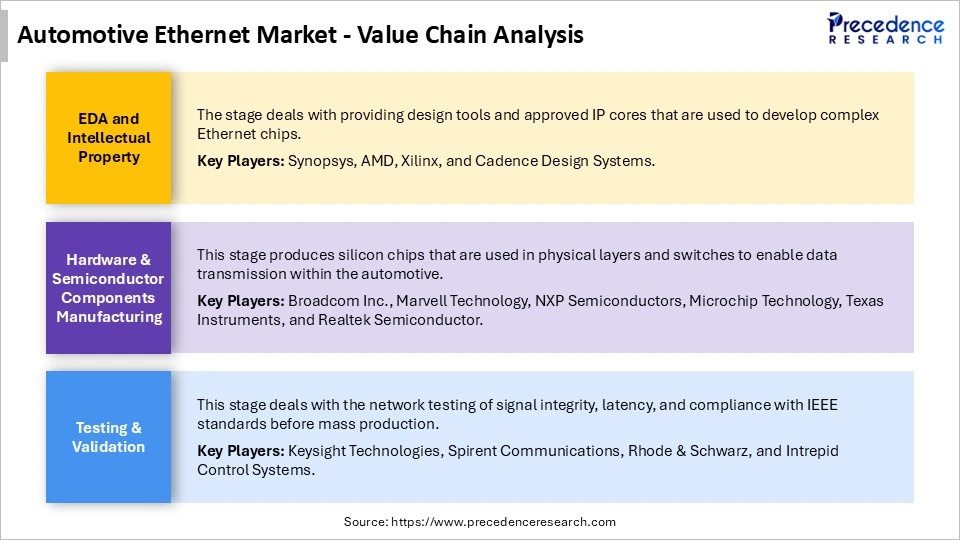

Automotive Ethernet Market Value Chain Analysis

Who are the Major Players in the Global Automotive Ethernet Market?

The major players in the automotive ethernet market include Broadcom Inc., Marvell Technology, NXP Semiconductors, Microchip Technology, Texas Instruments, Realtek Semiconductor, TE Connectivity, Molex, Vector Informatik, Keysight Technologies, Elektrobit, TTTech Auto, Aptiv, Continental AG, and Robert Bosch.

Recent Developments

- In January 2026, Anritsu launched an automotive Ethernet test solution for validating safety compliance by using a vector network analyzer and a Tektronix 6 series MSO oscilloscope.

(Source: https://www.automotivetestingtechnologyinternational.com) - In August 2025, Infineon Technologies completed the acquisition of Marvell Technology, Inc., and its automotive Ethernet business, which will boost Infineon's position in software-defined vehicles and global leadership in automotive semiconductors.(Source: https://www.infineon.com)

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Bandwidth

- 10 Mbps

- 100 Mbps

- 1 Gbps

- 2.5/5/10 Gbps

By Vehicle

- Passenger Cars

- Commercial Vehicles

By Application

- ADAS

- Infotainment

- Powertrain

- Chassis

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting