What is the Black Masterbatches Market Size?

The global black masterbatches market size accounted for USD 2.96 billion in 2025 and is predicted to increase from USD 3.11 billion in 2026 to approximately USD 4.84 billion by 2035, expanding at a CAGR of 5.04% from 2026 to 2035. Market growth is driven by increasing demand for high-performance, durable, and color-consistent plastics across the automotive, packaging, and consumer goods industries.

Market Highlights

- Asia Pacific held the dominant market share in 2025 and is expected to grow at the fastest CAGR of 5% from 2026 to 2035.

- Europe saw notable growth in the black masterbatches market.

- By type, the standard black masterbatch segment accounted for a considerable share of 41% in 2025.

- By type, the conductive black masterbatch segment is growing at a CAGR of 6% from 2026 to 2035.

- By carrier resin, the polypropylene (PP) segment led the market in 2025.

- By carrier resin, the PET-based segment is set to experience the fastest market growth from 2026 to 2035, with a 5.1% CAGR.

- By end-use industry, the automotive segment contributed the biggest market share in 2025.

- By end-use industry, the packaging segment is expected to grow at the highest CAGR of 5% from 2026 to 2035.

Black Masterbatches Market Overview

The growing global demand for lightweight, durable, and cost-efficient plastics continues to accelerate the plastics industry expansion, directly strengthening the black masterbatches market. Black masterbatch is essential in automotive components, cable sheathing, agricultural films, industrial containers, and a wide range of rigid and flexible packaging applications because it provides UV resistance, opacity, thermal stability, and deep coloration at a low additive cost.

Global plastic production reached approximately 435 million tonnes in 2020, and the OECD projects that worldwide plastic consumption and production could increase by nearly 70% by 2040 if current consumption patterns remain unchanged. This projection reflects the extensive use of plastics in packaging, construction, consumer goods, and logistics, which creates sustained demand for high-performance additives. The packaging sector alone continues to expand due to the growth of e-commerce, food distribution networks, and pharmaceutical supply chains, all of which rely heavily on black masterbatch for quality control, printability, product protection, and surface uniformity, leading to the growth trajectory of the black masterbatches market.

Impact of Artificial Intelligence on the Black Masterbatches Market

AI is transforming the black masterbatches market by improving production efficiency, strengthening formulation precision, and supporting more reliable supply chain management. Manufacturers increasingly deploy machine learning models to optimize carbon black dispersion inside polymer matrices, allowing consistent color performance and mechanical stability across products. AI tools also help select the most suitable resin and additive combinations by analysing historical process data, laboratory test outputs, and material behaviours under varying temperatures and pressures.

In addition, AI-enabled monitoring systems are being used to reduce batch variability, detect production faults in real time, and cut material waste in high-volume manufacturing environments. Supply chain teams use predictive analytics to forecast demand for carbon black, identify procurement risks, and schedule production runs more accurately to prevent downtime. These technological advancements help companies improve innovation cycles, maintain consistent quality standards, and strengthen competitiveness within the global black masterbatches market.

Black Masterbatches Market Growth Factors

- Rising Demand from Automotive Lightweighting: Growing regulations on vehicle emissions are fuelling the adoption of lightweight, durable black masterbatches in automotive components.

- Boosting Packaging Industry Efficiency: Increasing production of flexible and sustainable packaging is driving higher usage of black masterbatches for films and containers.

- Propelling Cable and Wire Insulation Standards: Rising electrical safety and durability standards are boosting the integration of high-performance black masterbatches in cable and wire coatings.

- Growing Consumer Electronics Applications: Expansion of consumer electronics and smart home appliances is propelling demand for thermally stable and color-consistent black masterbatches.

- Driving Sustainability and Recycling Initiatives: Increasing regulatory focus on circular economy practices is fuelling the development of masterbatches compatible with recycled polymers.

Exploring the Black Masterbatches Market: Statistics and Insights

- China is the worlds largest exporter of polymer color concentrates, including black masterbatches, accounting for an estimated 32-35% of global shipments under HS 320649 in 2023, supported by strong shipments from Guangdong, Zhejiang, and Shandong, according to China Customs and UN Comtrade.

- According to International Carbon Black Association (ICBA) and PlasticsEurope reports, carbon black prices increased by approximately 5-8% globally in 2025, impacting masterbatch pricing in Asia, Europe, and North America.

- In 2025, according to Eurostat and Dutch Customs data, the Netherlands receives substantial inbound shipments of black masterbatches, color concentrates, and polymer additives from China, Germany, and Italy.

- In 2023, global plastics exports reached 323 million metric tons (MT), with Asia-Pacific accounting for 59% (-190 MT). This dominance reflects the regions strong downstream polymer processing and compounding clusters, which are major consumers of black masterbatches for film extrusion, injection molding, and automotive components.

- India imported approximately 12 million MT of specialty plastics and polymer compounds in FY24, with flexible film and injection molding resins forming the bulk. This directly correlates with rising demand for black masterbatches in domestic packaging, automotive, and consumer electronics segments.

- In 2025, high-thermal-stability black masterbatches for EV battery enclosures and automotive parts were increasingly adopted in South Korea, Japan, and China, following stricter safety and material performance regulations reported by KPIA and KITECH.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.96 Billion |

| Market Size in 2026 | USD 3.11 Billion |

| Market Size by 2035 | USD 4.84 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.04% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Carrier Resin, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Black Masterbatches Market Segment Insights

Type Insights

Standard Black Masterbatch: The standard black masterbatch segment dominated the black masterbatches market in 2025, accounting for an estimated 41% market share, driven by its cost-efficiency, broad compatibility, and entrenched use in high-volume applications. Standard grades were popular among processors because they were reliable for producing jetness and dispersion at scale.

They minimize scrap and processing variability, which are vital to the extrusion of films, injection moulding, and pipe production. Furthermore, the marginal cost-benefit of standard black masterbatch is expected to fuel growth in the segment.

Conductive Black Masterbatch: The conductive black masterbatch segment is expected to grow at the fastest rate in the coming years, accounting for 6% of market share. Owing to the increase in the demand for electrostatic discharge (ESD), electromagnetic interference (EMI), and conductive pathways in electronics and intelligent packaging.

Consumer electronics and medical device OEMs should move forward with using conductive concentrates to produce lightweight, molded components in place of metal. Additionally, the rising focus on electronic reliability and anti-static safety is expected to drive converters to adopt certified conductive solutions across various markets.

Carrier Resin Insights

Polypropylene (PP): The polypropylene (PP) segment held the largest revenue share in the black masterbatches market in 2025, due to its low melt temperature, high processability, and wide compatibility with film extrusion and injection molding lines. The availability of resin in the region, especially in petrochemical hubs in the Gulf, China, and India, provided a constant supply of PP and competitive prices, further entrenching its use. Moreover, the high jetness retention and minimal effect on final part mechanicals promote further growth of the segment in the coming years.

Polyethylene Terephthalate (PET): The PET-based carrier resin segment is expected to grow at the fastest CAGR over the coming years, accounting for 5.1% market share, owing to its improved barrier properties and ease of integration into polyester recycling streams.

The owners of brands in the beverage, thermoformed package, and textile filament industries are using PET-compatible concentrates to preserve color during high-temperature processing and to meet recycled-content compliance requirements. The industry-wide PET carrier acceptance rate is projected to increase rapidly in areas with well-developed PET recycling systems and high demand for beverage packaging.

End-Use Industry Insights

Automotive: The segment dominated the black masterbatches market in 2025, as manufacturers have focused on lightweight plastics for interior trims, exterior body parts, wiring fittings, and under-the-hood applications. Tier-1 suppliers used high-dispersion black masterbatches to achieve uniform aesthetics across textured components and to meet rigorous durability and emissions standards.

OEM growth in EV systems required enhanced polymer housing, battery brackets, and cable insulation, all of which needed deep-black coloration to improve thermal conductivity and part durability. Furthermore, the development of lightweight design measures and polymer-metal replacement is expected to drive growing demand for black masterbatch solutions.

Packaging: The segment is expected to grow at the fastest rate in the coming years, which held a market share of about 5%. Owing to the increased demand for high-opacity films, decorative consumer packaging, and packaging with UV protection in food and beverage products.

Personal care, household goods, and FMCG brand owners are projected to increase reliance on streamlined black concentrates in multi-layer films and caps, with brand look and label-free labelling. Additionally, the rapid expansion of flexible packaging hubs across India, China, T�rkiye, and Southeast Asia is anticipated to accelerate market growth in the coming years.

Black Masterbatches Market Regional Insights

Asia Pacific led the black masterbatches market in 2025, capturing the largest revenue share, and is expected to maintain this position due to the presence of giant manufacturing ecosystems of China, India, South Korea, Japan, and ASEAN. They further provide immense opportunities in the packaging, automotive, consumer goods, and infrastructure applications.

The growth of EV supply chains in China, South Korea, and Japan also contributed to increased demand for heat-stable, conductive black masterbatches, thereby strengthening the regions dominance. In 2025, 7,000,000 BEVs were sold in the Asia-Pacific region, according to the IEA report. Moreover, the growing industrialization, urbanization, and modernization of packaging are expanding polymer consumption in developing economies in this region, thus boosting the market in the coming years.

China Black Masterbatches Market Trends

China is a major player in the black masterbatches market, and the Asia Pacific region has become the worlds largest integrated hub for high-performance black masterbatch production. Provinces such as Guangdong, Zhejiang, and Jiangsu have expanded their extrusion and injection-moulding capacities throughout 2025, supported by large industrial clusters and strong availability of polymer feedstock. This expansion has directly increased the consumption of high-dispersion black formulations in applications such as multilayer packaging films, automotive interior parts, appliance housings, and cable insulation compounds.

Chinas position as a leading exporter of plastics, combined with its strong domestic demand for engineering polymers, continues to accelerate market growth and encourages manufacturers to upgrade their compounding technologies for better dispersion quality and higher thermal stability.

The Europe region is expected to hold a notable revenue share of the market, owing to the developed regulatory frameworks and robust sustainability requirements. That compelled converters to implement engineered black masterbatch solutions according to the goals of a circular economy. The 2025 EU packaging and plastics policy roadmap, with strict recyclability and traceability requirements, increased demand for NIR-readable, low-contaminant pigment systems.

In Germany, France, Italy, and the Czech Republic, automotive suppliers used high-performance black formulations to address durability and heat stability. Furthermore, the high automation rates in EU extrusion and moulding lines are expected to support the consistent growth in the region.

Germany Black Masterbatches Market Trends

Germany is leading the charge in the European black masterbatches market because of the strength of its automotive, engineering plastics, and advanced packaging industries, all of which rely heavily on consistent, high-performance black formulations. The countrys manufacturers operate under some of the strictest regulatory and environmental standards in Europe, which increases demand for premium, high-purity, low-VOC masterbatches that meet EU compliance criteria.

Germany also benefits from one of the most automated extrusion and injection-moulding infrastructures in the region, and this pushes converters to use high-dispersion black concentrates that maintain mechanical strength and colour stability across complex components. Continuous investments in lightweight automotive materials, electrical cable insulation, and multilayer packaging films reinforce the need for technically optimized black masterbatches, supporting Germanys strong market position.

North America in particular, is experiencing strong growth in the black masterbatches market due to its mature manufacturing landscape, which includes one of the worlds largest networks of plastics converters, moulders, and extrusion facilities. The United States and Canada continue to upgrade production lines with automated compounding, real-time quality monitoring, and AI-assisted dispersion controls that improve consistency in carbon black distribution.

Growth is further supported by large-scale investment in electric vehicles, solar infrastructure, and high-performance packaging films that rely heavily on conductive, UV-protected, or high-opacity black masterbatch grades. The regions regulatory focus on material traceability and environmental compliance has encouraged the development of cleaner formulations suitable for food-contact packaging and recycled-content streams. As a result, North America remains an influential hub for innovation and adoption of premium black masterbatch solutions.

U.S. Black Masterbatches Market

The U.S. experienced strong and sustained growth in the black masterbatches market, driven by its advanced plastics-processing ecosystem and the rapid expansion of end-use industries such as automotive, electrical wiring, consumer goods, agriculture, and flexible packaging. Manufacturers in the United States and Canada increasingly rely on high-dispersion black masterbatch formulations to meet stringent performance requirements for UV stability, thermal resistance, and mechanical durability.

Growth has also been supported by the regions accelerated shift toward high-efficiency extrusion, blown-film production, and injection-molding technologies, which require consistent color masterbatch performance and improved processability. Moreover, rising investments in smart manufacturing, automated quality control, and AI-driven compounding systems have strengthened production capacities across the region. The push for recyclable plastics and compliance with environmental standards is further encouraging converters to adopt premium black masterbatch solutions that improve material recovery and overall product longevity.

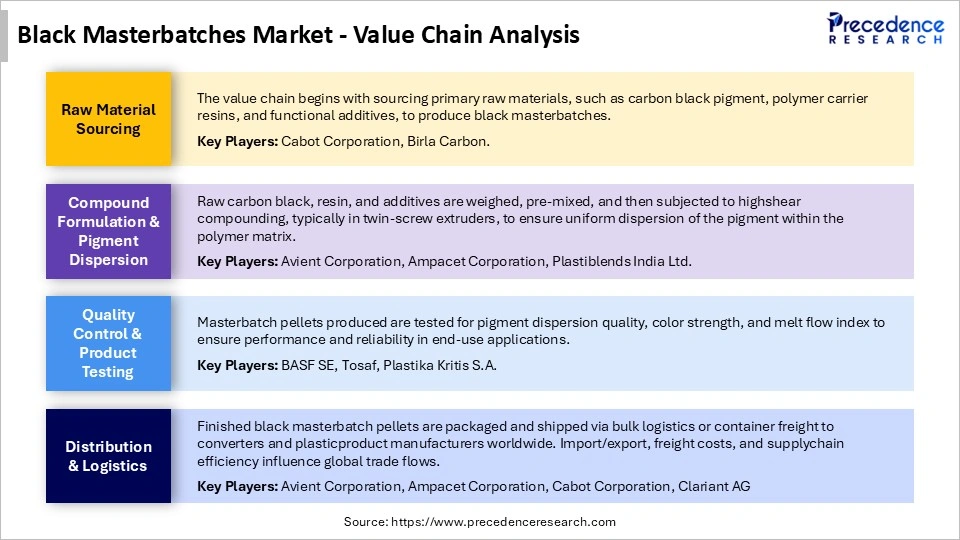

Black Masterbatches Market Value Chain

Top Vendors in the Black Masterbatches Market & Their Offerings

- Cabot Corporation

- LyondellBasell

- Avient Corporation

- Plastika Kritis S.A.

- Plastiblends India Ltd.

- Dow

- Polyplast Muller GmbH

- RTP Company

- Ampacet Corporation

- Tosaf

- Capital Colours

- Universal Masterbatch LLP

- JJ Plastalloy

- BASF SE

- Repin Masterbatch, Ltd.

Recent Developments

- In June 2025, Cabot expanded its Replasblak portfolio with two new black masterbatch grades, reUN5285 with 45% recycled content and reUN5290 with 20% recycled content. Both grades are ISCC PLUS-certified, enabling converters to achieve sustainable production goals while maintaining performance and consistency at an industrial scale.

- In May 2025, Cabot Corporation introduced its Replasblak universal circular black masterbatches featuring ISCC PLUS-certified sustainable content. Powered by EVOLVE Sustainable Solutions, these products deliver high-performance, reliable, and scalable circular solutions for the plastics industry. The launch reinforces Cabots commitment to combining sustainability with industrial-grade quality.

- In May 2025, Cabot unveiled two pioneering REPLASBLAK universal circular black masterbatches incorporating ISCC PLUS-certified sustainable materials. These products represent the industrys first universal circular black masterbatches, delivering scalable, high-performance solutions while supporting circular economy and sustainability initiatives.

(Source: https://www.indianchemicalnews.com)

(Source: https://www.plasticsnews.com)

(Source: https://www.businesswire.com)

(Source: https://www.chemanalyst.com)

Black Masterbatches MarketSegments covered in the report

By Type

- Standard Black Masterbatch

- High-Jetness Black Masterbatch

- UV-Resistant Black Masterbatch

- Conductive Black Masterbatch

- Recycled-Polymer Compatible Black Masterbatch

By Carrier Resin

- Polypropylene (PP)

- Linear Low-Density Polyethylene (LLDPE)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Polyamide & Other Resins

By End-Use Industry

- Automotive

- Exterior & Interior plastic parts

- Packaging

- Rigid containers, films, bottles

- Infrastructure / Construction

- Pipes, cables, fittings

- Electrical & Electronics

- Housings, components, cables

- Consumer Goods

- Appliances, furniture, and footwear

- Agriculture & Fibers

- Films, trays, fibers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting