What is the Board-to-Board Connector Market Size?

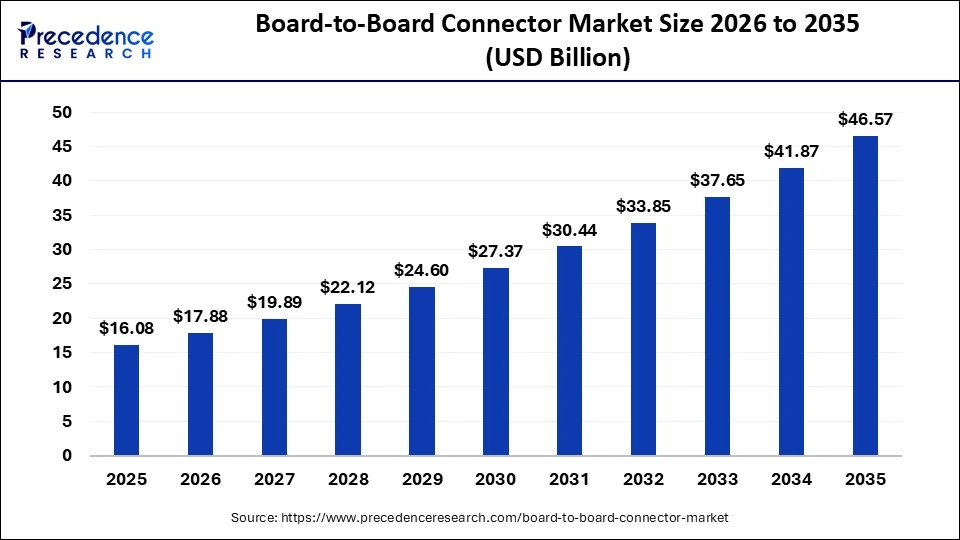

The global board-to-board connector market size is calculated at USD 16.08 billion in 2025 and is predicted to increase from USD 17.88 billion in 2026 to approximately USD 46.57 billion by 2035, expanding at a CAGR of 11.22% from 2026 to 2035. The board-to-board connector market is a technology-driven expansion, supported by rising electronics miniaturization, higher signal-density needs, and growing adoption of advanced consumer, automotive, and industrial devices.

Market Highlights

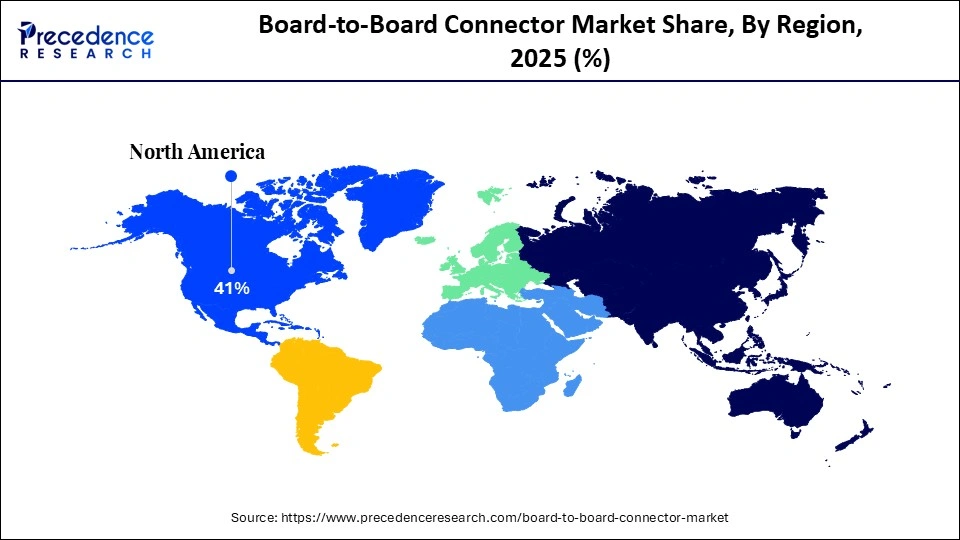

- North America led the board-to-board connector market with the largest share of 41% 2025.

- The Asia Pacific is expected to expand at the highest CAGR between 2026 and 2035.

- By type, the socket connectors segment captured the highest market share in 2025.

- By type, the male connectors segment is expected to grow at a notable CAGR market between 2026 and 2035.

- By connector style, the mezzanine connectors segment dominated the market in 2025.

- By connector style, the backplane connectors segment is expanding at the fastest CAGR market between 2026 and 2035.

- By end user industry, the consumer electronics segment contributed the largest market share in 2025.

- By end user industry, the automotive electronics segment is growing at the highest CAGR market between 2026 and 2035.

- By distribution channel, the direct OEM sales segment led the market in 2025.

- By distribution channel, the online platforms segment is growing at the highest CAGR market between 2026 and 2035.

What Factors Influence The Increase In Demand For Board To Board Connectors?

The growth of board-to-board connector systems stems from their compact design as electrical and mechanical devices utilising Printed Circuit Boards (PCB). A board-to-board connector system enables signal, power, or data transfer between two PCBs.

The board-to-board connector market comprises electrical connectors that interconnect two printed circuit boards (PCBs) for signal, data, and power transmission. These connectors enable compact system design, high-speed data communication, and modular PCB architecture across consumer electronics, automotive electronics, industrial automation, telecom, medical devices, aerospace, and computing hardware.

High-speed data transmission, large numbers of PCB layouts per square inch, and growing demand for robotically controlled and IoT-connected devices drive the need for board-to-board connectors. There are many more manufacturers of automated factories today, so more automotive manufacturers are now utilising advanced driver-assistance and hybrid infotainment systems, leading to greater demand for components that can withstand higher temperatures and vibration. New technological upgrades identify board-to-board connector systems as a critical component in the architecture of future electronic devices.

Innovation With AI Impacts the Future of the Board-to-Board Connector Market

The introduction of artificial intelligence to the design, optimization, and integration of the board-to-board connector market into the development of advanced electronic devices is changing the way these materials are designed. A significant milestone occurred in November 2025, when HARTING launched its AI-enabled connector configurator, which can transform an engineers plain-language input into an instantaneous three-dimensional prototype of the product. The result is a reduced design cycle from weeks to less than one minute, with the added ability to customize and create more accurately chosen connectors.

At the OCP Global Summit 2025 (October 13-16, 2025), Amphenol also demonstrated how high-speed/high-density board-to-board connectors can be engineered specifically for AI Servers and Cloud Data Centers. These products will be able to accommodate higher bandwidths and lower latency, as well as have improved power-handling abilities, all of which are key requirements of the training and inference workloads associated with AI.

These examples of innovation in the field of connectors clearly demonstrate that AI is leading to the development of connector technologies that will enable more intelligent, faster, and more efficient means of connecting electronic devices.

Trends to Watch in the Future of the Board-to-Board Connector Industry

- Increased Demand for Miniaturized Products: Compact electronic devices have led to an increase in demand for miniaturized, high-density connectors. Fine-pitch, lightweight, and space-saving connector designs will be necessary for wearable devices, IoT devices, portable medical devices, and the next-generation consumer electronics.

- Use of High-Speed / High-Signal Integrity Connector Designs: High-speed data communications are driving the creation of connectors with improved signal integrity. Examples of high-speed data communications include 5G infrastructure, ADAS in automotive applications, and industrial automation. Improvements in materials and shielding are necessary to maintain performance at high frequencies.

- Automotive and EV-driven Application: The increased use of electrification in combination with advances in vehicle electronics is driving growth in demand for connectors that offer the ability to withstand vibration, extreme heat, and harsh operating conditions. New designs and product innovations in connector systems are being developed based upon automotive-grade durability and reliability standards.

- Modularity and Flexibility in Connector Systems : As industrial /automated manufacturing and robotics continue to grow , modular connector systems are being developed that allow connectors to be easily customized , stacked and offered as scalable layout options . All of these connector systems allow for easier assembly, shorter maintenance times and quicker cycles of redesigning products.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 16.08 Billion |

| Market Size in 2026 | USD 17.88 Billion |

| Market Size by 2035 | USD 46.57 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.22% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Connector Style, End-Use Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Board-to-Board Connector Market Segmental Insights

Type Insights

Socket Connectors: Socket connectors have won this area, leading the way for the integration of compact devices needing reliable, interference-free connections. Additionally, the features of the socket connector (their ability to provide high levels of reliability, provide a large number of pins per connector, and the ease with which they can be used with multiple types of board layout) continue to keep them on top in consumer electronics, automotive modules, and industrial controls. Additionally, their durability and compatibility with changes in PCB designs provide them with an even stronger market position over time.

Male Connectors: As manufacturers move towards a modular PCB architecture and it becomes more widely accepted for use in embedded systems and electronics related to electric vehicles, the demand for male connectors will increase significantly. Additionally, many new applications of electrical products are now including IoT-enabled connectivity, thus driving the growth of the male connector. Additionally, many manufacturers have developed low-profile male connectors that provide ease of alignment with the board, enabling them to easily integrate automated assembly processes into their production lines.

Connector Style Insights

Mezzanine Connectors: The dominance of the mezzanine style of connector is due to its ability to facilitate high-density/high-speed interconnections necessary for the latest generation of compact electronics. With their ability to have flexible stacking heights, strong mechanical stability, and high levels of signal integrity, they have become a key component of computing systems, telecom equipment, and industrial automation systems. Their ability to adapt to the trend toward miniaturization will enable them to continue to be the most common style of connector for the foreseeable future.

Backplane Connectors: This segment is quickly increasing in popularity due to the need for high-bandwidth data transfer that exists in server farms, 5G infrastructure, and large-scale data centers. Their ability to handle the substantial amount of data being transferred, provide modular hardware configurations, and provide long-term reliability in harsh environments is driving their increased usage in various advanced communications systems.

Connector Style Insights

Mezzanine Connectors: Mezzanine connectors lead the board-to-board connector market because they offer superior density, signal integrity, and mechanical stability compared with other connector types. These connectors allow two parallel circuit boards to be stacked in compact configurations, which is essential for designing smaller, lighter, and higher-performance electronic systems. Their ability to support high-speed data transmission makes them the preferred choice in advanced applications such as 5G equipment, industrial automation systems, medical devices, and defense electronics. Manufacturers also prefer mezzanine connectors because they provide flexible stack heights and modularity, enabling engineers to optimize board spacing without compromising reliability.

End-Use Industry Insights

Consumer Electronics: Consumer electronic devices account for the highest total volume of board-to-board connector market sales, due to the explosive growth of mobile phones, wearables, DTV (digital television), gaming systems, and other consumer electronic devices necessitate compact, reliable, and high-performance board-to-board connectors. Additionally, this segment continues to benefit from shorter product lifecycles, increasing sophistication of consumer electronic devices, and ongoing miniaturization of printed circuit boards. The demand for high-performance connectors for camera modules, battery control units (BCU), sensor modules, and other display systems is expected to remain steady over the next several years.

Automotive Electronics: Automotive electronics continue to show strong growth as electric vehicles, Advanced Driver Assistance Systems (ADAS), In-Vehicle Infotainment Displays (IVD), and electronic control units (ECUs) all contribute to the expansion of the market. In particular, the increased movement towards electrifying vehicles will increase the need for durable, rugged, vibration-resistant, and waterproofed connectors that are capable of supporting high-speed data communication between automotive sensors and controllers. In addition, the continued advancement towards a fully autonomous and connected world will also create significant growth for automotive electronics over the next several years.

Distribution Channel Insights

Direct OEM Sales: Large electronic manufacturers have shifted towards long-term supply contracts rather than individual purchase orders from the connector manufacturer for their use. The longer-term supply agreements provide the large electronics manufacturers with greater flexibility, increased levels of customization, and improved quality assurance. Collaborating directly with connector manufacturers also allows engineers to work together on designing specialized connectors. The Direct OEM engagement model is critical for the delivery of connectors produced at high volume to support mission-critical applications.

Online Platforms: The online marketplace for connectors is seeing rapid growth due to the continued acceleration of digital procurement among both mid-tier manufacturers and component integrators. With easy access to extensive catalogs of connector products, transparent pricing, enhanced comparison capabilities, and the ability to place streamlined orders for smaller quantities of connectors, the online marketplace is becoming an increasingly attractive option for those seeking to procure connector products. The increasing adoption of e-commerce platforms for Industrial Components is a significant contributor to the strong growth of this segment.

Board-to-Board Connector Market Regional Insights

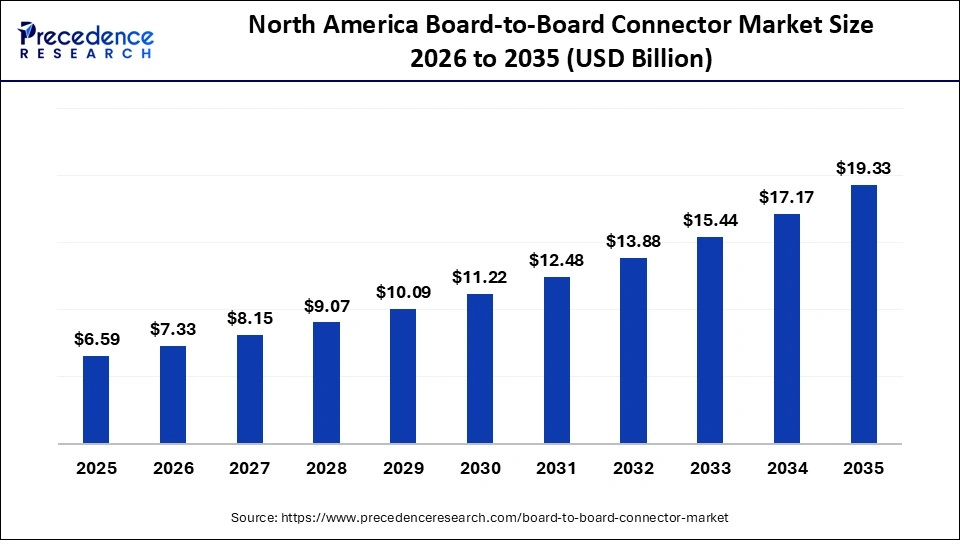

The North America board-to-board connector market size is estimated at USD 6.59 billion in 2025 and is projected to reach approximately USD 19.33 billion by 2035, with a 11.36% CAGR from 2026 to 2035.

Why is North America Dominating the Board-to-Board Connector Market?

North America has emerged as the worlds leading (or largest) market for board-to-board connectors due to several factors including its robust and sophisticated electronics engineering environment, large numbers of medical devices, aerospace, defence, industrial automation OEMS and continued strong demand for ruggedized, miniaturized, high-reliability connectors. Strict requirements placed on connector performance and safety have forced suppliers to provide very tightly engineered and built connectors that are designed specifically for the application.

Close integration between manufacturers of components and end-users or system designers has allowed for the rapid prototyping and qualification of connectors. Investment in advanced manufacturing, robotic manufacturing, and edge computing solutions continues to support the movement toward fine pitch/high density board-to-board connectors in highly critical applications and has enabled North America to keep its technological leadership position.

The U.S. board-to-board connector market size is calculated at USD 4.94 billion in 2025 and is expected to reach nearly USD 14.59 billion in 2035, accelerating at a strong CAGR of 11.44% between 2026 and 2035.

U.S. Board-to-Board Connector Market Trends

The US leads the way in this area, having more aerospace, defense, medical electronics, and industrial automation manufacturing markets per capita. Each of these markets requires highly reliable and application-specific board-to-board connectors with the expectation of extensive testing and compliance to meet (or exceed) industry standards. The continuous innovation and development of new connectors in the US will continue to drive the adoption of advanced connectors and create significant demand opportunities.

The Asia Pacific region is leading the way as the fastest-growing region for board-to-board connector sales due to its all-encompassing electronic manufacturing base (the largest globally), PCB fabricators, semiconductor fabricators, and rapid growth of Consumer Electronics, Battery-powered vehicles (EVs), Telecommunications, etc.

As such, this industry has accelerated the acceptance of new connector types designed specifically for compact size, low cost, and high-volume assembly by the regions Contract Manufacturing/EMS Companies. Additionally, as a result of increased automation, robotics, and batteries, there will be additional demand for high-density board-to-board connectors that have the ability to balance performance, reliability, and scalable production.

China Board-to-Board Connector Market Trends

With the largest ecosystem for electronics manufacturing in the Asia Pacific region, Chinas strength lies in all aspects of electronics manufacturing, including PCB fabrication, Connector manufacturing, module assembly, and device integration. Additionally,domestic demand for smartphones, electric vehicles (EVs), telecommunications networks, and industrial machinery has all contributed to the increased adoption of diverse Board-To-Board Formats. The expansion of the electronics manufacturing supply chain (Localization), the acceleration of PCB and Module manufacturing, and the fast design to manufacturing cycles enable China to be the central growth driver.

Europe is seeing rapid growth as a result of its strong automotive electronics ecosystem, advanced industrial automation, and the increasing trend of adopting renewable-energy systems and power electronics. There is a strong demand for highly engineered board-to-board connectors due to the regions emphasis on connector reliability, thermal stability, and EMI performance, as well as the need for connectors that provide a long product life cycle. European OEMs emphasise compliance, quality certification, and sustainable material use, leading to an emphasis on innovation in the development of rugged, miniaturised, and environmentally friendly designs.

Collaborative engineering between connector manufacturers and specialised equipment manufacturers will accelerate connector integration into robotics, factory automation, and next-generation vehicle platforms, which will support continued growth across the region.

Germany Board-to-Board Connector Market Trends

Germany is the leader in the region, with a highly competitive automotive industry and a strong industrial machinery and automation sector, which all have a need for high-precision, vibration-resistant, thermally robust board-to-board connectors. German OEMs require extensive testing, very high levels of long-term reliability, and engineering customisation, leading to the need for application-specific interconnect solutions that meet high-performance system requirements.

The Middle East and Africa region is becoming a growing player in the increasing board-to-board connector market. There is an uptick in demand for board-to-board connectors driven by telecom infrastructure, industrial equipment, smart city deployments, and electronic equipment used for defence purposes. The adoption of digital transformation, automation, and advanced communication technology by large economies, coupled with the demand for durable board-to-board connectors, is driving growth for the latter within the region.

Many applications require ruggedized, temperature-resistant resistant and custom-engineered interconnects to operate under harsh conditions. There are not many currently manufacturing locally, however; assembler operations are being built, and partnerships are forming with global connector suppliers. The introduction of project-based procurement processes within the Energy, Utility, and Mobility systems sectors is creating additional opportunities for smaller specialised connector production.

UAE Board-to-Board Connector Market Trends

The United Arab Emirates is at the forefront of the Middle East and Africa region as it expands its telecommunications networks and modernises its defence capabilities through the growth of its telecommunications infrastructure. In addition, the UAE has become a distribution hub for products and services into and out of the Gulf and Africa. With its high-technical standards and its adoption of high-end electronics, there has been an increased customer demand for durable board-to-board Connectors in various engineered systems.

Latin America is currently witnessing steady growth in the board-to-board connector marketplace due to the increasing levels of investment in industrial automation, automotive electronics, telecommunications upgrades, and consumer electronics assembly throughout Latin America. The modernisation of the Region manufacturing capabilities, in particular the manufacture of automotive components, as well as the construction of new telecommunications infrastructure and the refurbishment of current industrial control systems, is creating a consistent requirement for dependable board-to-board connectors. Although the Latin American Region remains sensitive to costs, by forming partnerships with global component suppliers and through the gradual strengthening of local assembly ecosystem development, the pace of the transition to higher-level connector technologies is being accelerated in the Region.

Brazil Board-to-Board Connector Market Trends

Brazil has the most developed automotive manufacturing base in the Region, as well as a rapidly expanding Electronics Assembly sector and significant-scale Telecom and Industrial Automation Projects, and therefore is the largest Country in Latin America when it comes to the demand for Connectors. OEMs in Brazil are increasingly utilising high-density and durable board-to-board connectors in their Control Module, Infotainment System, and Industrial Equipment applications. Growth in local production capabilities will ultimately position Brazil to be the largest driver of connector demand throughout the Region.

Board-to-Board Connector Market Value Chain

Manufacturers suppliers furnish all of the raw materials that comprise the electrical connector to include metal, plastics, plating chemicals, along with circuit and high-performance laminate materials. These raw materials are critical factors in ensuring the electrical connector can sustain mechanical wear, be electrically conductive, and operate safely at the maximum temperature limits before component assembly is permitted.

Key Players: Rogers Corporation, DuPont, 3M, Shin-Etsu Chemical, Henkel

Engineering teams perform electrical and mechanical designs for connectors, create precision tooling to assemble electrical connectors, and prototype electrical connector designs to meet the signal integrity, connector space, and connector mating cycle requirements of various end-applications.

Key Players: TE Connectivity, Amphenol, Molex, Hirose Electric, JAE

Automation of stamping, injection moulding, coating, surface mount technology (SMT) assembly, and shipping allows for increased production capacity while maintaining the tight tolerance and throughput required by OEMs for high-volume and custom connector manufacturing lines.

Key Players: Samtec, Panasonic Industrial, Foxconn (contract manufacturing), Flex, Jabil

The practice of comprehensive electrical and mechanical testing of electrical connectors, as well as the certification of electrical connectors by third-party laboratories (UL, IEC), guarantees the reliability of electrical connectors when used in extreme conditions, as well as compliance with industry standards.

Key Players: Intertek, UL Solutions, SGS, TUV Rheinland, Bureau Veritas

The distributors and EMS partners who distribute electrical connectors to OEMs provide support and services for integrating, supporting, and managing the lifecycle of a connector after the connector has been sold to an OEM.

Key Players: Arrow Electronics, Avnet, Digi-Key, Mouser, Celestica

Board-to-Board Connector Market Companies

Offers STRADA Whisper board-to-board connector platform for high-speed, low-latency data applications.

Provides BergStak board-to-board connectors supporting high-density, high-speed mezzanine designs.

Offers FX Series board-to-board connectors with compact pitch and robust mating.

Delivers SlimStack Board-to-Board connectors enabling compact, high-precision stacking for electronics.

Provides WP/WB Series board-to-board connectors optimized for compact and portable devices.

Offers FPC/board-to-board interconnects solutions for automotive electronics and high-reliability systems.

Features DF Series micro board-to-board connectors for miniaturized consumer and industrial devices.

Supplies JMD/JA Series board-to-board connectors designed for high-current and tight-pitch applications.

Provides har-flex board-to-board connectors supporting flexible pin counts for industrial and automation systems.

Recent Developments

- In February 2025, Keystone Electronics announced new SMT low-profile PCB edge connectors with horizontal orientation, ideal for parallel board-to-board or board-to-component signal/power transfer.

- In August 2025, Forlinx Embedded released the ultra-small 40 x 29 mm FET3506J-C SoM built on Rockchip RK3506J, featuring two 80-pin board-to-board connectors, up to 512 MB RAM, and 8 GB eMMC flash.

- In July 2025, Advantech introduced the new SBC AFE-E420 for EV chargers and energy-storage systems, integrating an NXP i.MX 93 processor with multiple interfaces (CAN-FD, RS-232/422/485, RTD, control-pilot) to simplify EVSE design.

- In February 2025, Kyocera Corporation launched its 5814 Series board-to-board connector featuring a 0.3 mm pitch, only 0.6 mm stacking height, and 1.5 mm width, aimed at enabling more compact, high-density electronic devices.

Exclusive Insights

According to analysts, the market for board-to-board connectors is expected to see steady growth due to increased PCB density, miniaturization, and the increased demand for uses in telecommunications, automotive electrification, and industrial automation. Suppliers success will depend on their ability to provide low-profile and high-reliability designs while contending with the volatility of supply chains and the effect of global commodity prices on raw materials.

Opportunities include developing custom high-speed connectors for 5G infrastructures, electrified automotive and modular consumer electronics as well as related testing and integration services. The major issues facing the industry are the fragmentation of standards, difficulty designing for automotive operated at very high production levels, and pressure on margins due to intense competition. Companies that invest in flexible manufacturing capabilities, create strategic Partnerships, and engage in IP-driven product differentiation will gain most of the share in this expanding market segment.

Board-to-Board Connector MarketSegments Covered in the Report

By Type

- Male Connectors

- Socket Connectors

By Connector Style

- Mezzanine Connectors

- Backplane Connectors

By End-Use Industry

- Consumer Electronics

- Automotive Electronics

- Industrial Automation

- Telecommunications & Networking

- Medical Devices

- Aerospace & Defense

By Distribution Channel

- Direct OEM Sales

- Distributors / Value-Added Resellers

- Online Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content