What is the Carbon Fiber Prepreg Market Size?

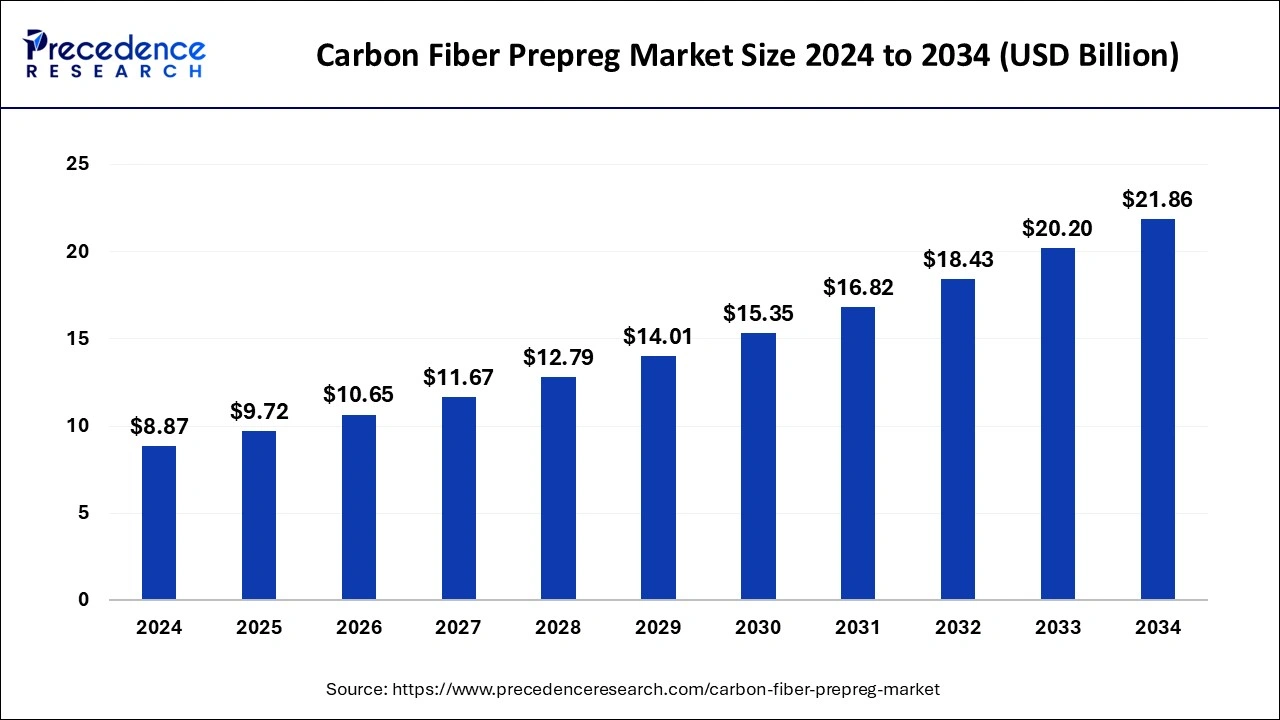

The global carbon fiber prepregmarket size is calculated at USD 9.72 billion in 2025 and is predicted to increase from USD 10.65 billion in 2026 to approximately USD 21.86 billion by 2034, expanding at a CAGR of 9.44% from 2025 to 2034. The carbon fiber prepreg market is driven by increasing demand from the wind power sector.

Carbon Fiber Prepreg Market Key Takeaways

- The global carbon fiber prepreg market was valued at USD 8.87 billion in 2024.

- It is projected to reach USD 21.86 billion by 2034.

- The carbon fiber prepreg market is expected to grow at a CAGR of 9.44% from 2025 to 2034.

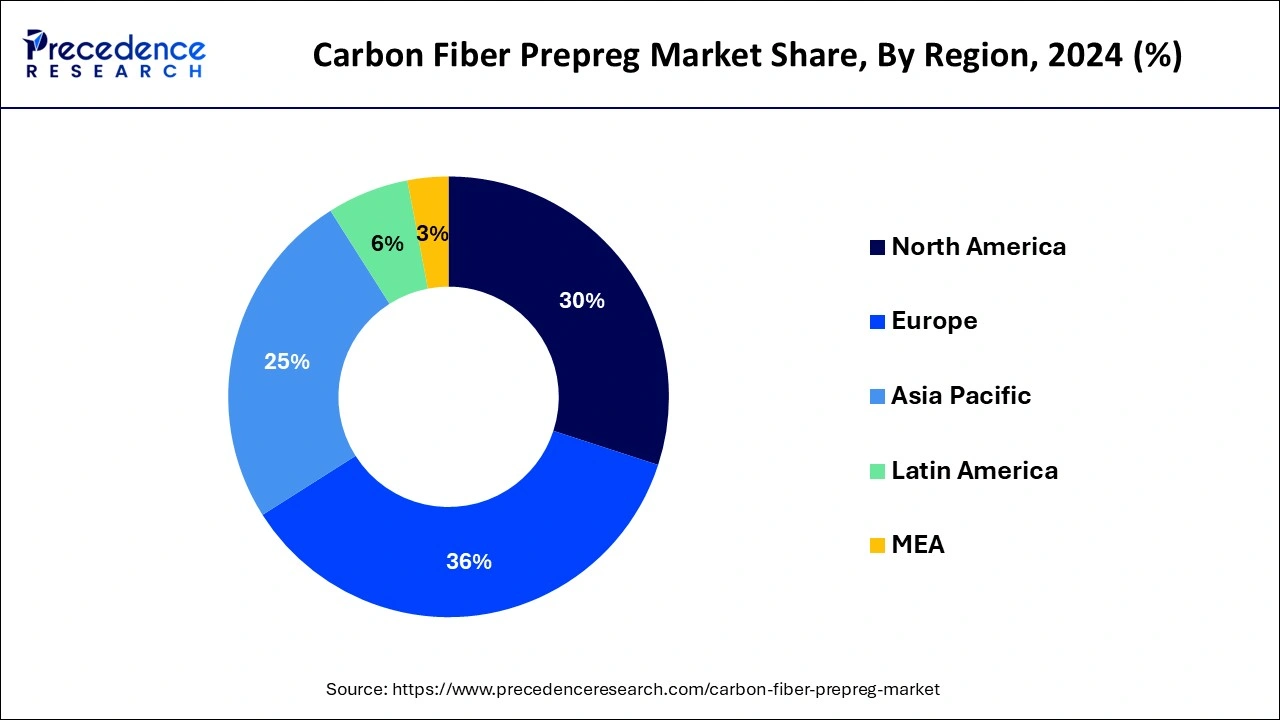

- Europe dominated the market with the largest market share of 36% in 2024.

- By resin type, the epoxy resin prepregs segment has contributed more than 48% of the market share in 2024.

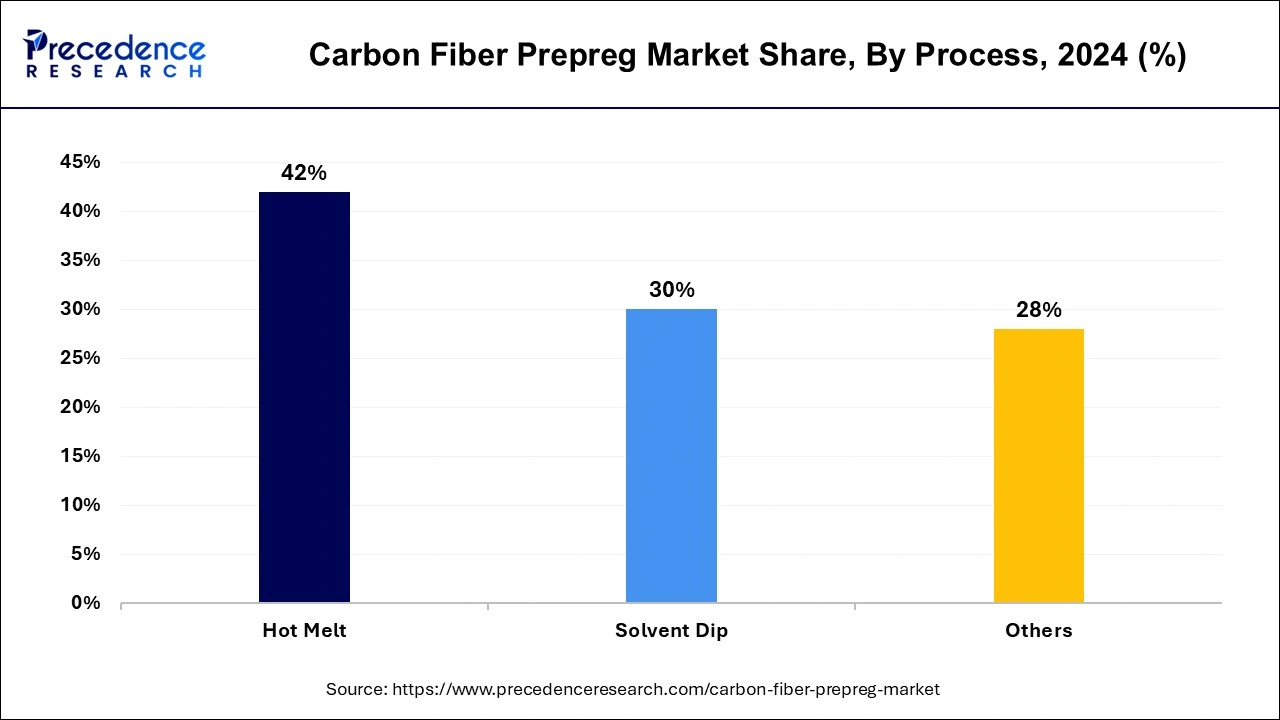

- By process, the hot melt segment has held the major market share of 42% in 2024.

- By application, the aerospace and defense segment is expected to grow at a notable CAGR of 7.75% between 2025 and 2034.

Market Overview

An intermediary material known as carbon fiber prepreg is a sheet of carbon fiber soaked with matrix resin. Prepreg comes in various forms, including cloth prepreg, which is made of carbon fibers woven into a fabric and impregnated with matrix resin, and UD prepreg (unidirectional prepreg), which aligns carbon fibers in a single direction. The strength, rigidity, and resistance to chemicals and high temperatures of carbon fiber prepregs are well-known. These characteristics and the fact that carbon fiber is incredibly light make it advantageous for use in both military and commercial applications, such as aerospace components and aircraft interiors.

The French company Toray Carbon Fibers Europe S.A., a subsidiary of Toray Industries Inc., declared that its production facilities in Lacq and Abidos, in Southwest France, have received ISCC Plus certification. With this certification, Toray Carbon Fibers Europe can provide and manufacture carbon fiber by utilizing the mass balancing approach to allocate and use biomass or recycled materials.

Carbon Fiber Prepreg Market Data and Statistics

- Jilin Chemical has independently created a patented extensive tow carbonization line for 35K prepreg, a first for China. A single line can produce over 3,000 tons of product annually, and its mechanical strength index is now the highest in the industry, ranking T700.

Carbon Fiber Prepreg Market Growth Factors

- Defense and aerospace: lighter aircraft for better fuel economy.

- Automotive: reducing weight in cars to improve efficiency and fuel economy.

- Carbon fiber prepreg contributes to the development of lighter, fuel-efficient automobiles.

- Greater strength, rigidity, and resistance to temperature than conventional materials.

- Wind energy: more effective energy production with stronger, lighter turbine blades.

Carbon Fiber Prepreg Market Outlook

Industry Growth Overview:

Between 2024 and 2034, the carbon fiber prepreg market is expected to grow rapidly, driven by demand in aerospace, automotive, and renewable energy sectors. The need for high-strength, lightweight composite materials is rising with the increased production of commercial airplanes and military platforms. Additionally, the growing expansion of wind energy, particularly in Europe and the Asia-Pacific region, is boosting the use of prepreg in turbine blades and industrial components.

Sustainability Trends:

Sustainability is increasingly influencing the carbon fiber prepreg market, as manufacturers and OEMs aim to reduce environmental impact throughout the composite lifecycle. Additionally, regulatory requirements and customer preferences are driving interest in composites that are reusable or recyclable at the end of their life, especially in the automotive and wind energy sectors. These sustainability initiatives become key differentiators for vendors in the global markets.

Global Expansion:

Leading carbon fiber prepreg manufacturers are expanding geographically to capitalize on growing demand and proximity to key OEM programs. Toray and Teijin have strengthened their presence in the U.S. and Japan, focusing on aerospace, defense, and EV markets. The companies Hexcel and Gurit are increasing their production facilities in Europe and Southeast Asia to serve the wind energy and industrial composite sectors.

Major Investors:

The market is drawing considerable interest from private equity and strategic investors due to high margins, technological barriers, and growth driven by aerospace and EV initiatives. These investors accelerate technology commercialization and support capacity expansion and overall financial stability of high-performance composite vendors. Their involvement is expected to continue because of the increasing demand for lightweight, high-strength materials across various sectors worldwide.

Startup Ecosystem:

The startup ecosystem is expanding in the market, with companies focusing on innovation in cost reduction, bio-based resins, automation, and next-generation fiber architectures. Axiom Materials (US) and other startups in Europe are also developing prepreg for use in aerospace, defense, and EV structural applications. These startups are attracting venture capital for expandable technologies that aim to reduce production time, energy consumption, and material waste. Their innovation pipelines can complement existing manufacturers and broaden the range of specialized, eco-friendly, and affordable prepreg solutions in the global market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.44% |

| Market Size in 2025 | USD 9.72 Billion |

| Market Size in 2026 | USD 10.65 Billion |

| Market Size by 2034 | USD 21.86 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Resin Type, By Process, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand in aerospace and defense

Carbon fiber prepregs provide high customizability and design freedom, enabling engineers to modify material properties to application needs. Because different components in aerospace and military have substantially varying performance requirements, adaptability is very beneficial in these fields. To fulfill the exacting performance requirements of aerospace and defense applications, engineers can modify parameters like fiber orientation, resin formulation, and curing methods to produce the best strength, stiffness, and other mechanical features.

Restraint

Limited production capacity

Manufacturers with limited production capacity may have to pay more for prepreg materials. A lack of supply may result in higher prices and production costs for businesses that use prepreg in their manufacturing processes. Ultimately, consumers might pay more for these increased expenses, reducing the appeal of carbon fiber items. Thereby, limited production capacity acts as a major restraint for the carbon fiber prepreg market.

Opportunity

Reinforcement of concrete structures

Carbon fiber prepregs have less environmental impact than typical construction materials, so they can reinforce concrete while adhering to sustainability guidelines. When compared to the production of steel, CFRP composites are made with less energy and emissions due to sophisticated manufacturing techniques. Furthermore, the extended service life of CFRP-reinforced structures minimizes the carbon footprint of infrastructure projects by reducing the need for periodic repair and replacement.

Resin Type Insights

The epoxy resin prepregs segment dominated the carbon fiber prepreg market in 2024.Prepregs based on epoxy resins provide excellent mechanical qualities, such as stiffness, fatigue resistance, and a high strength-to-weight ratio. These characteristics make them perfect for structural integrity and longevity applications, like wind turbine blades, automobile parts, sporting goods, and aerospace components. Compared to other resin types, many epoxy resin systems cure at comparatively low temperatures, which is beneficial for maintaining the integrity of the carbon fibers during manufacture. Epoxy resin prepregs are more economical for large-scale manufacturing when curing temperatures are lowered since they require less energy and money for processing.

- In October 2023, SolvaLite 716 FR is a fast-curing epoxy prepreg system introduced by global specialty materials supplier Solvay. It is intended for use in premium battery electric cars (BEVs) for various structural parts and reinforcements.

The phenolic resin prepregs segment is anticipated to grow in the carbon fiber prepreg market during the forecast period. Superior mechanical qualities, such as a high strength-to-weight ratio, stiffness, and dimensional stability, are displayed by phenolic resin prepregs. These characteristics make them appropriate for high-pressure applications where structural integrity and performance are critical, like body panels for automobiles and aircraft and athletic goods like golf clubs and tennis rackets. Phenolic resin prepregs have certain environmental advantages as sustainability becomes more important when choosing materials. Recycled or bio-based resources can be used to create phenolic resins, which lessens the final product's carbon impact and need on fossil fuels.

Process Insights

The hot melt segment dominated the carbon fiber prepreg market with revenue share of 42% in 2024. Unidirectional prepregs and fabric can both be produced using the hot melt technique. This technique consists of two steps. The hot resin is first applied in a thin layer to a paper substrate. The prepreg machine allows for the interaction of the resin and reinforcing material. The resin is injected into the fiber upon applying pressure and heat, producing the final prepreg that is twisted around a core.

The solvent dip segment is the fastest growing in the carbon fiber prepreg market during the forecast period. The solvent dip method, which entails dissolving the resin in a solvent bath and then immersing the reinforcing fabric in the resin solution, can only create fabric prepregs. Subsequently, the solvent is removed from the prepreg using a drying oven.

Application Insights

The aerospace and defense segment dominated the carbon fiber prepreg market in 2024. Materials with outstanding strength-to-weight ratios, high stiffness, and resistance to corrosion and fatigue are needed for aerospace and defense applications. Carbon fiber prepreg satisfies these criteria to an extraordinarily high degree. Due to its exceptional mechanical qualities, it is perfect for structural elements in missiles, defense systems, spacecraft, and airplanes. Customized solutions are frequently needed for aerospace and defense applications to satisfy certain design specifications and performance goals.

Carbon fiber prepreg is highly versatile concerning resin compositions, fiber orientations, and curing procedures, enabling producers to customize materials to match the requirements of individual applications precisely.

- In June 2023, two new aerospace material products from Hexcel have been released; they offer quicker cure cycles, allowing higher production build speeds.

The automotive segment is the fastest growing in the carbon fiber prepreg market during the forecast period. When compared to conventional materials like steel or aluminum, carbon fiber prepreg materials have better mechanical qualities. High-performance automobile parts can be designed and produced because of their improved stiffness, strength, and fatigue resistance. These characteristics help enhance the car's handling, dynamics, and general performance.

- In June 2023, The Formula 1 (F1) technology is the source of DNA for the advanced engineering company Dash-CAE, which unveiled the TR01, a new carbon fiber monocoque chassis. The chassis offers a cost-effective and adaptable solution for hypercar, supercar, and motorsport projects in the expanding performance automotive and motorsport sectors, significantly improving the price-to-performance ratio.

The wind energy segment shows a significant growth in the carbon fiber prepreg market during the forecast period. Renewable energy sources are growing more and more significant on a global scale, with wind power emerging as a significant contender. Governments and organizations worldwide make substantial investments in wind energy projects to cut carbon emissions and achieve sustainability goals. The demand for materials that can survive the rigors of wind turbine construction and operation is growing due to the spike in wind turbine installations.

- In April 2024, The MySE292 ultra-large offshore wind blades developed by MingYang Group are made entirely of carbon fiber, which Hengshen Co. Ltd exclusively provides. This company conducts research, development, and production of carbon fiber, woven, and NCF fabrics, resin, prepreg, and other composite materials.

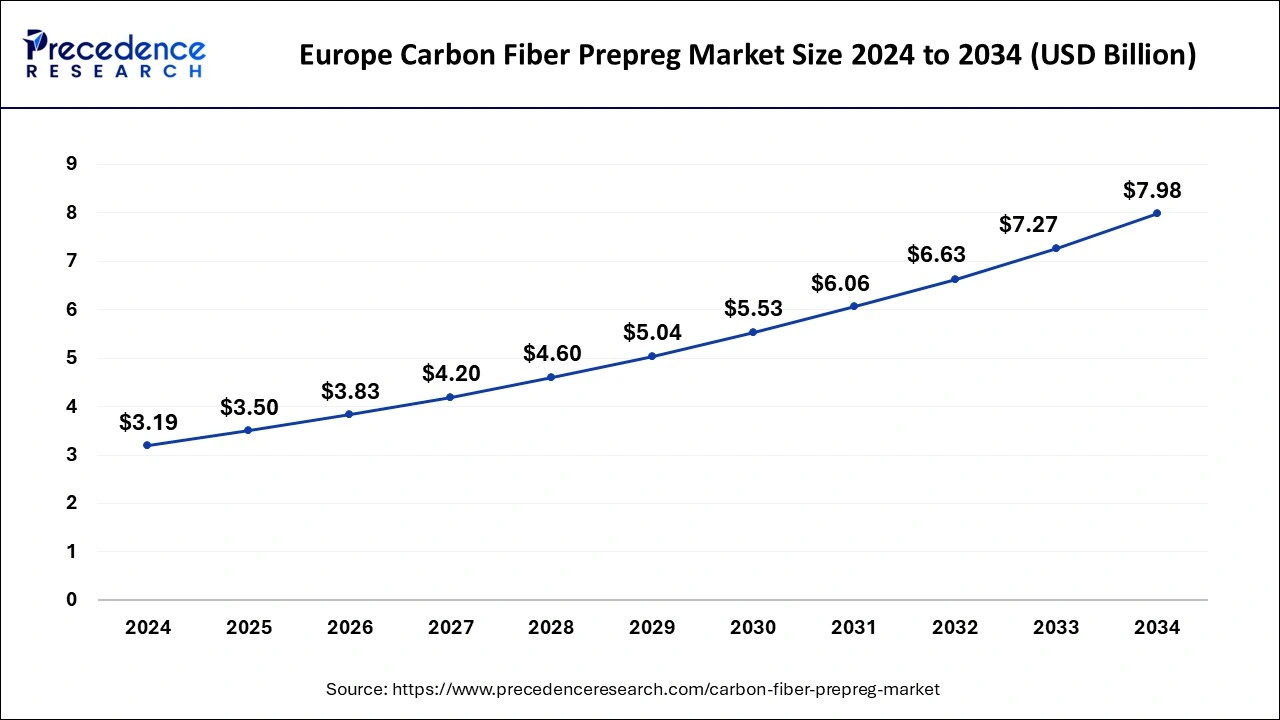

EuropeCarbon Fiber Prepreg Market Size and Growth 2025 to 2034

The Europe carbon fiber prepreg market size surpassed USD 3.50 billion in 2025 and is expected to be worth around USD 7.98 billion by 2034 at a CAGR of 9.60% from 2025 to 2034.

Europe held the largest share of 36% in 2024 in the carbon fiber prepreg market. The rising number of construction activities in the region creates a sum of potential in the area for the market to expand. Because of its resistance to corrosion, exceptional strength, and longevity, carbon fiber prepreg is used in infrastructure projects and provides benefits, including longer lifespans and lower maintenance costs. The demand for carbon fiber prepreg as a building material is expected to increase if public and private entities spend on updating and upgrading infrastructure, propelling revenue growth in the area.

Europe is home to a thriving aerospace and defense sector, which represents a significant market for carbon fiber prepreg materials. Carbon fiber composites offer exceptional strength-to-weight ratio, durability, and corrosion resistance, making them ideal for aircraft components, missile structures, and defense applications. The region's continued investment in aerospace innovation and defense modernization drives the demand for high-performance carbon fiber prepreg materials.

Germany Carbon Fiber Prepreg Market Analysis

Germany is a major contributor to the European carbon fiber prepreg market, driven by strong automotive and renewable energy initiatives. Manufacturers of luxury and electric vehicles such as BMW, Audi, and Porsche are expected to widely use prepregs in chassis, body panels, and battery enclosures to reduce weight and enhance performance. The growth of wind energy is also expected to boost the use of prepreg in turbine blade manufacturing, especially in offshore projects.

What Makes Asia Pacific the Fastest-Growing Market for Carbon Fiber Prepreg?

Asia-Pacific is observed to be the fastest-growing carbon fiber prepreg market during the forecast period. Carbon fiber prepreg is becoming increasingly popular among a variety of end-use sectors because of its excellent mechanical qualities, low weight, and high strength-to-weight ratio. Lightweight materials are in high demand in the aircraft sector to improve fuel efficiency and lower pollution. They are also broadly used in the automobile industry to meet weight reduction goals and enhance vehicle efficiency.

China Carbon Fiber Prepreg Market Analysis

China is a leading player in the Asia Pacific carbon fiber prepreg market, driven by rapid industrialization and the growth of aerospace, electric vehicles, and wind energy sectors. Investments by Toray, Teijin, and Hexcel in domestic prepreg manufacturing plants are expected to reduce reliance on imports and decrease long lead times. Government programs promoting renewable energy and electric vehicle adoption are likely to quickly boost demand.

Why is North America Considered a Notably Growing Area?

North America is expected to see notable growth in the market in the coming years, mainly driven by the region's strong aerospace and defense industry. Increasing spending on lightweight electric and hybrid vehicles is likely to boost demand, as automakers focus on reducing weight to improve energy efficiency. Additionally, the region's extensive R&D infrastructure is expected to accelerate the production of high-temperature and recyclable resin systems, further promoting market adoption.

U.S. Carbon Fiber Prepreg Market Analysis

The U.S. is expected to lead the North American carbon fiber prepreg market because of its established aerospace and defense industries. The consistent demand is fueled by Boeing, Lockheed Martin, and Northrop Grumman, who use high-performance prepregs in fuselage panels, wing structures, and satellite parts. Electric and hybrid vehicle projects are also likely to increase their use as manufacturers focus on lightweighting to boost energy efficiency.

What Potentiates the Growth of the Carbon Fiber Prepreg Market in Latin America?

The market in Latin America is expected to grow steadily over the forecast period, led by Brazil and Mexico. The trend of lightweighting in the automotive sector, especially in Mexico, is driving the use of prepreg in electric and hybrid vehicles. Other potential opportunities for prepreg-based composites include infrastructure development, such as wind energy and transportation projects.

Brazil leads the market, with the aerospace and automotive sectors contributing to growing prepreg demand. Growth opportunities are likely to come from wind energy, buildings, and infrastructure projects. Local investment in research and production helps localize the adoption of high-performance composites. Further market growth will also be supported by increasing awareness of sustainable and advanced materials.

What Opportunities Exist in the Middle East and Africa (MEA)?

The Middle East and Africa (MEA) region presents substantial opportunities for the carbon fiber prepreg market. The UAE, Saudi Arabia, and South Africa are expected to drive demand through the modernization of defense, aerospace component manufacturing, and industrial machinery applications. Regional diversification of industrial output and expansion of technological capabilities are likely to boost prepreg consumption.

The UAE is a leading contributor to prepreg consumption in the MEA, driven by defense modernization and industrial applications. Market adoption is likely to occur through regional efforts to diversify industrial output and develop advanced materials capabilities. The growing demand for automotive composites and sporting goods is expected to boost overall growth in demand.

Carbon Fiber Prepreg Market – Value Chain Analysis

Raw Material Sourcing

The foundation of carbon fiber prepreg production begins with the extraction and supply of precursor materials, including PAN (polyacrylonitrile), pitch-based fibers, epoxy resins, and other high-performance polymers. These raw materials determine the mechanical properties, thermal stability, and performance of the final prepreg.

Key Players: Toray Industries, Hexcel Corporation, SGL Carbon SE, Teijin Limited

Fiber & Resin Processing

Raw fibers are processed into high-strength carbon fibers, and resins are formulated into matrix systems suitable for prepreg. This stage involves fiber oxidation, carbonization, and resin modification to achieve the desired composite properties.

Key Players: Toray Industries, Teijin Limited, Victrex plc, Gurit Holding AG

Prepreg Manufacturing

Carbon fibers are impregnated with resins under controlled conditions to produce prepregs in rolls or sheets. Manufacturers ensure uniform resin distribution, fiber alignment, and precise thickness for aerospace, automotive, and industrial applications.

Key Players: Hexcel Corporation, Toray Industries, Gurit Holding AG, Park Aerospace Corp

Component Fabrication & Layup

Prepreg sheets are cut, layered, and shaped into specific components for aerospace structures, automotive parts, sporting goods, or industrial equipment. This stage may include automated fiber placement (AFP) or hand layup techniques.

Key Players: Boeing, Airbus, Bombardier, automotive OEM composites divisions

Curing & Final Product Consolidation

Prepreg components undergo heat-and-pressure curing in autoclaves or ovens to consolidate the composite, optimize fiber-matrix bonding, and achieve the required mechanical properties. Post-curing processes enhance thermal resistance and dimensional stability.

Key Players: Hexcel Corporation, Toray Industries, SGL Carbon SE, Park Aerospace Corp

Distribution & Integration

Finished prepreg components or raw prepreg rolls are distributed to OEMs and tier-one manufacturers for integration into aircraft, automotive, wind energy, marine, and industrial systems. Supply chain efficiency ensures timely delivery for high-performance applications.

Key Players: Airbus, Boeing, Bombardier, Tesla, BMW, General Motors

Carbon Fiber Prepreg Market Companies

- Hexcel Corporation (U.S.)

A leading advanced composites manufacturer supplying aerospace-grade carbon fiber prepregs for commercial aircraft, space systems, defense platforms, and high-performance industrial applications. - Teijin Limited (Japan)

A global composites innovator offering high-strength carbon fiber prepregs used in automotive lightweighting, aircraft structures, sporting goods, and industrial reinforcement systems. - Victrex plc (UK)

A specialty polymers leader producing PAEK-based prepreg solutions designed for extreme-temperature aerospace components, energy sector applications, and next-generation lightweight structural parts. - AOC Aliancys AG (Switzerland/Netherlands)

A major supplier of composite resins and prepreg systems formulated for marine, infrastructure, transportation, and industrial composite manufacturing. - Barrday Corporation (Canada/U.S.)

A producer of advanced fiber-reinforced prepregs engineered for defense armor, aerospace components, and high-temperature industrial composites. - Park Aerospace Corp (U.S.)

A developer of aerospace-grade composite materials, including carbon fiber prepregs used in aircraft primary structures, radomes, and advanced space applications. - Gurit Holding AG (Switzerland)

A global composites company offering prepreg systems tailored for wind turbine blades, marine performance structures, and automotive lightweighting programs. - Toray Industries, Inc. (Japan)

The world's largest carbon fiber manufacturer provides high-performance prepregs widely used in commercial aerospace, sporting goods, automotive structures, and industrial components. - SGL Carbon SE (Germany)

A major advanced materials company delivering carbon fiber prepregs for automotive structural parts, wind energy systems, and industrial high-temperature applications. - Axiom Materials Inc. (U.S.)

A specialist producer of oxide-oxide ceramic matrix composite (CMC) prepregs and advanced polymer prepregs for aerospace engines, defense systems, and hypersonic thermal-protection components.

Recent Developments

- In October 2023, The Mitsubishi Chemical Group (MCG Group) declared that it had acquired complete control of CPC SRL (CPC). This well-known Italian business specializes in producing and distributing carbon fiber reinforced plastic (CFRP) car parts.

- In July 2023, with great pleasure, Toray Composite Materials America, Inc. announced a significant expansion of its carbon fiber facility located in Spartanburg, South Carolina. This capacity-building capital investment will be needed to meet the rising demand for renewable energy solutions. Beginning in 2025, the 30,000-square-foot facility expansion will boost Toray's capacity to produce carbon fiber by 3,000 metric tons annually.

Segments Covered in the Report

By Resin Type

- Epoxy Resin Prepregs

- Phenolic Resin Prepregs

- Other Resin Types

By Process

- Hot Melt

- Solvent Dip

- Others

By Application

- Aerospace and Defense

- Automotive

- Sports and Leisure

- Wind Energy

- Marine

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting