What is the Cell Biology Market Size?

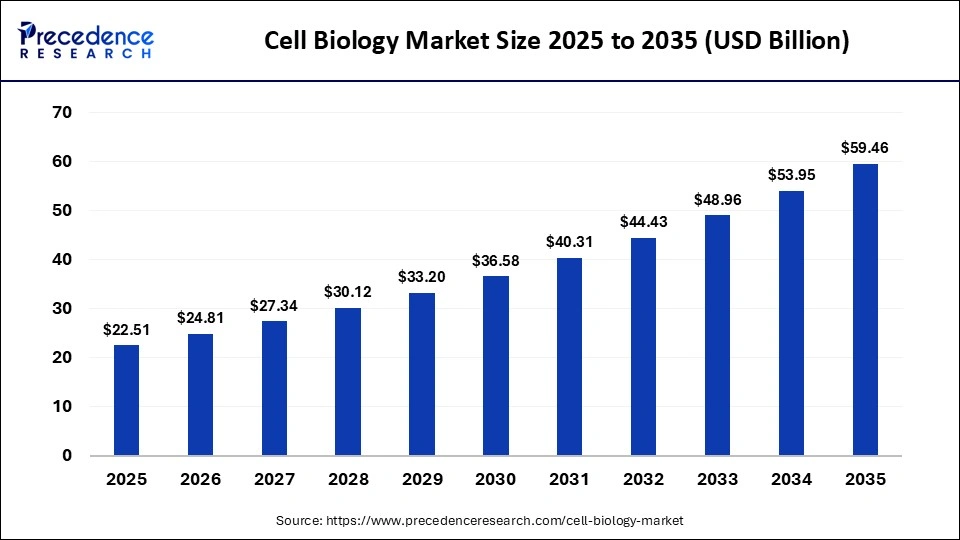

The global cell biology market size was calculated at USD 22.51 billion in 2025 and is predicted to increase from USD 24.81 billion in 2026 to approximately USD 59.46 billion by 2035, expanding at a CAGR of 10.20% from 2026 to 2035.This rapid expansion is triggered by a surge in demand for cutting-edge therapies, such as CAR T-cell therapy, and the rise in incidence of chronic disease requiring novel and groundbreaking treatment solutions.

Market Highlights

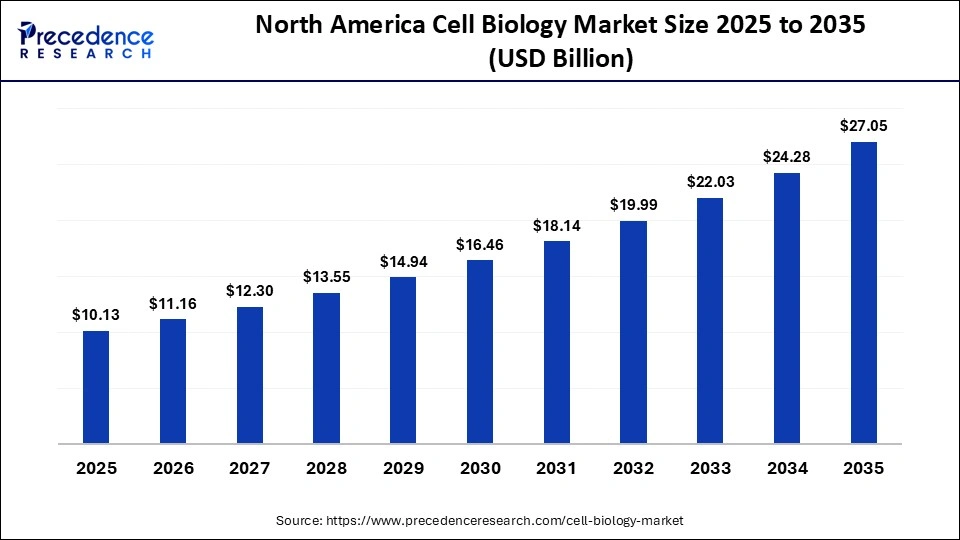

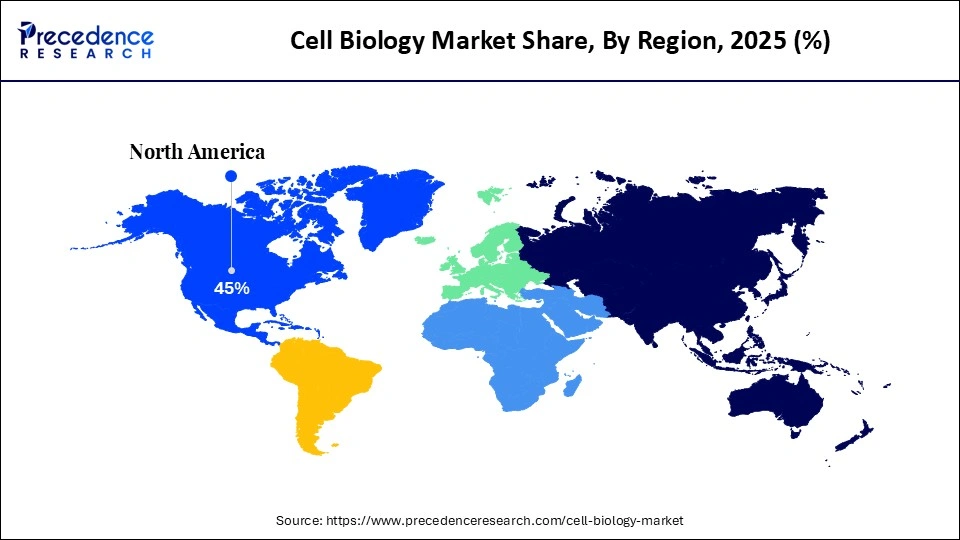

- North America dominated the cell biology market, holding a share of approximately 45% in 2025.

- Asia-Pacific is expected to expand with the highest CAGR of 10.5% during the forecast period.

- By product & service, the reagents & consumables segment held the largest market share of approximately 50% in 2025.

- By product & service, the software segment is expected to grow at a remarkable CAGR of 8.7% between 2026 and 2035.

- By technique/process, the flow cytometry & microscopy segment dominated the market with a share of approximately 35% in 2025.

- By technique/process type, the high-content screening segment is expected to rise at the highest CAGR of 8.8% during the forecast period.

- By application, the drug discovery & development segment held the largest market share of approximately 40% in 2025.

- By application, the toxicology & safety assessment segment is expected to grow at a significant CAGR between 2026 and 2035.

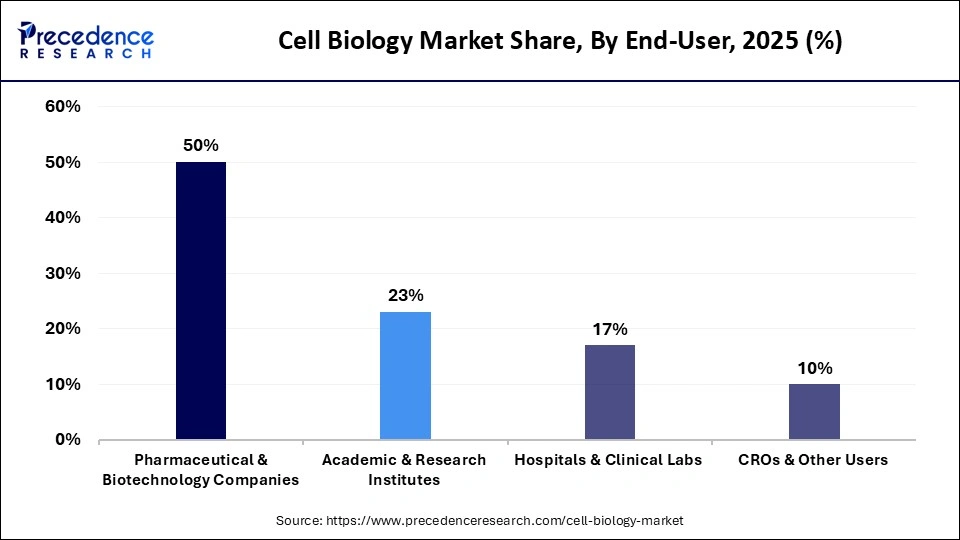

- By end-user, the pharmaceutical & biotechnology companies segment held the largest revenue share of approximately 50% in the industry.

- By end-user, the hospitals & clinical labs segment is expected to grow with the highest CAGR of 9.2% between 2026 and 2035.

What is the Strategic Landscape of the Cell Biology Industry?

The cell biology market comprises products, technologies, and services used to study cellular structures, functions, behavior, and interactions, enabling fundamental research and clinical applications. It includes instruments, reagents, assays, software, and services for cell culture, cell analysis, single-cell studies, and related workflows that support drug discovery, disease research, biotechnology development, and diagnostics.

The market is experiencing radical evolution propelled by advances in single-cell technology, genomic tools, and cell-based therapies. The growing demand for cell therapies, advancements in 3D cell culture, and massive investments in biotechnology propel market growth. The rise in regenerative medicine, advanced biopharmaceutical production, and rapid AI-powered systems has further boosted this market. This market trend is heavily dominated by demand for enhanced cell analysis tools fueled by the growth of personalized medicine.

What is the Role of AI in the Cell Biology Market?

Artificial intelligence is revolutionizing the market by advancing drug discovery, improving image analysis, and refining cell therapies. It can analyze complex, multivariable data, automating lab processes and generating predictive insights. The integration of AI with cell biology is crucial for managing massive datasets produced by modern technologies like high-content imaging and single-cell sequencing. The recent advancement is more seen in the direction of developing personalized medicine and rapid, cost-effective biotechnological innovation. Despite huge potential in AI, it faces various challenges like the need for highly standardized data, a lack of transparency, and ethical dilemmas regarding data privacy.

Cell Biology Market Trends

- Rapid Growth in Single-Cell Analysis: This market is experiencing immense growth due to advancements in personalized medicine, oncology, and immunology, and it is further fueled by microfluidics and high-throughput sequencing, which are driving a deeper understanding of cells and facilitating cancer research.

- Advancements in 3D Cell Culture: It is rapidly expanding in the market due to the immediate need for physiologically relevant in vitro models in cancer research, novel drugs, and regenerative medicine.

- Growing Utilization of Cellular Assays: It is experiencing rapid growth propelled by a surge in demand for advanced drug discovery, massive R&D investments, and a rise in precision medicine. These kits of reagents and assays are replacing traditional animal testing with faster and more efficient methods, hence improving their standing in the market.

- Automation and Digitalization: This market is heavily investing in AI data analysis, automated bioreactors, and advanced microscopy to improve the efficiency, replicability, and expandability of novel drugs and cell therapy, shifting away from labour-intensive manual processes.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 22.51Billion |

| Market Size in 2026 | USD 24.81 Billion |

| Market Size by 2035 | USD 59.46Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product & Service, Technique/Process, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product & Service Insights

Which Product & Service Segment Dominated the Cell Biology Market?

The reagents & consumables segment dominated the market with a share of approximately 50% in 2025, as they are crucial, required in large volumes, and used routinely in laboratory workflows. Their dominance is propelled by high, consistent demand for sterile plastics, assay kits, and culture media, which are necessary for research, diagnostics, and pharmaceutical drug development. All these factors together make them more significant revenue drivers than one-time equipment purchases.

The software segment is expected to rise at a remarkable CAGR of 8.7% between 2026 and 2035. It is experiencing rapid growth as advanced technology produces massive, complex data that requires software capable of processing it. Software can be widely used for various purposes from experiment planning to data analysis, simplifying researchers' tasks. The surge in demand for automation through the integration of AI into precision medicine and the development of novel drugs further fuels the segment's growth.

Technique/Process Insights

What Made the Flow Cytometry & Microscopy Segment Dominant in the Cell Biology Market?

The flow cytometry & microscopy segment held the largest revenue share of approximately 35% in the market in 2025. The surge in chronic disease, advancement in cancer immunology, and rise in demand for personalized medicine led to the dominance of this segment. Flow cytometry is preferred for its speed and statistical power; microscopy is essential for understanding the structural and spatial context of cells. Together, they are dominant tools in cellular research and diagnosis.

The high-content screening segment is expected to rise at the fastest CAGR of 8.8% between 2026 and 2035 due to its ability to provide high-yielding, automated microscopy, enabling multiplexed analysis of live cells. The primary catalyst for their expansion is rapid drug discovery, transitioning 3D models, and AI-driven data analysis.

Application Insights

Which Application Segment Led the Cell Biology Market?

The drug discovery & development segment led the market with a share of approximately 40% in 2025 due to the rise in complexity of disease, the high incidence of failure during phase III trials, the need for cost-effective therapeutics, and massive investments by pharmaceutical companies. The market is driven by the necessity of cell-based assays for validating therapeutic targets, ensuring drug safety, and understanding disease mechanisms in realistic human models.

The toxicology & safety assessment segment is expected to grow at the highest CAGR during the forecast period. This growth is propelled by the demand for more ethical, cost-effective, and human-like alternatives to traditional animal testing. Recent advancements in 3D cell culture models, high-content screening, and toxicogenomics augment the segment's growth. Numerous government and regulatory bodies make stringent regulations on animal testing, necessitating researchers to switch to in vitro testing.

End-User Insights

Which End-User Segment Dominated the Cell Biology Market?

The pharmaceutical & biotechnology companies segment held a major revenue share of approximately 50% in 2025, as they are the largest consumer of cell culture products for high-volume, industrialized applications like novel drug and vaccine production and the manufacturing of biopharmaceuticals. Their dominance is propelled by immediate, repetitive demand for advanced cell culture systems to develop complex therapies requiring rapid screening, along with rigorous, standardized, and reliable compliant production methods.

The hospitals & clinical labs segment is expected to rise with the highest CAGR of 9.2% between 2026 and 2035. The rapid expansion is propelled by a shift toward precision medicine, a rise in demand for early disease screening, and the amalgamation of advanced automated technology. Hospitals are integrating with clinical laboratories to handle complex procedures in oncology, immunology, and infectious diseases, further fostering the segment's growth.

Regional Insight

How Big is the North America Cell Biology Market Size?

The North America cell biology market size is estimated at USD 10.13 billion in 2025 and is projected to reach approximately USD 27.05 billion by 2035, with a 10.32 % CAGR from 2026 to 2035.

Why Did North America Dominate the Cell Biology Market?

North America dominated the market with a share of approximately 45% in 2025, driven by its well-established biotechnology sector, huge R&D investments, and a mature healthcare infrastructure. The market is driven by funding for stem cell research, the high incidence of chronic diseases, and the presence of major pharmaceutical companies. North America has 1230 developers in cell and gene therapy with nearly 1000 clinical trials as of 2024. Various government initiatives, like the Synthetic Biology Advancement Act of 2025 and the Somatic Cell Genome Editing Program, are further boosting this market in this region.

What is the Size of the U.S. Cell Biology Market?

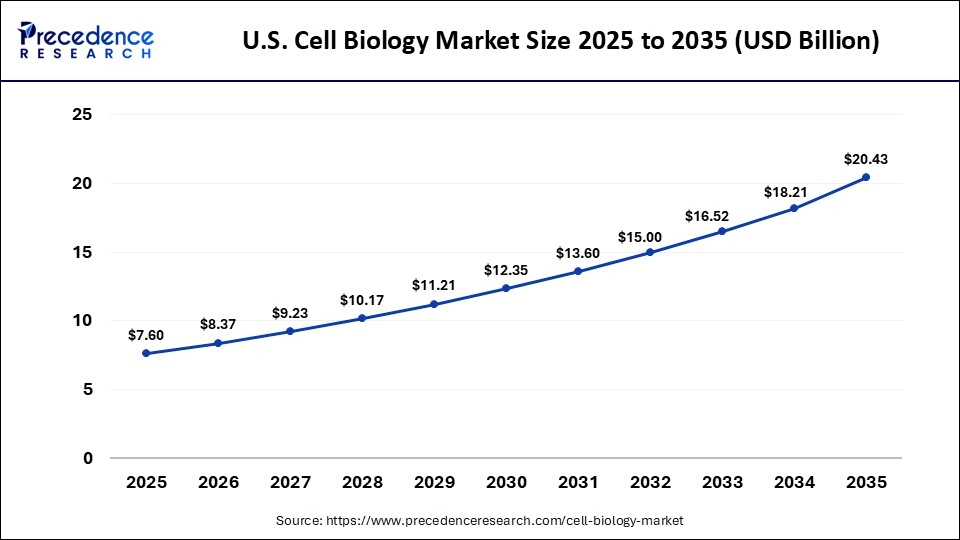

The U.S. cell biology market size is calculated at USD 7.60 billion in 2025 and is expected to reach nearly USD 20.43 billion in 2035, accelerating at a strong CAGR of 10.39 % between 2026 and 2035.

U.S. Market Trends

The integration of massive R&D, strong biopharmaceutical industries, and a well-established research ecosystem has driven the market expansion in this region. This market growth is further propelled by the presence of major pharmaceutical industries, huge funding from public and private sectors, enhanced FDA approval for cell-based therapies, and leading biotech hubs in cities like Boston, San Francisco, and San Diego. The market is further boosted by a highly skilled workforce and a strong CRO/CMO that backs the entire drug development.

How Will Asia Pacific Grow in the Cell Biology Market?

Asia Pacific is expected to grow with the highest CAGR of 10.5% during the forecast period. This market is expanding tremendously due to a massive increase in the pharmaceutical industry's R&D ecosystem, robust government support for biotechnology, and a surge in demand for advanced therapies. The development of cost-effective, localized cell counting analysis devices has further boosted this market. Government programs, like the BioPIPS initiative and cross-border collaboration, further drive the market in Asia-Pacific.

China Market Trends

China is leading in this market, as it is a primary revenue generator in this region. It is driven by significant investments in the biotechnology sector, a high volume of biopharmaceutical manufacturing capacity, and a mature CRO ecosystem. This expansion market is supported by various government policies like the 14th Five-Year Plan for Bio-economy and the 15th Five-Year Plan Preparation. The R&D initiatives, like the "Upstairs-Downstairs" Innovation Model, have further expanded the market.

Which Region is Expected to Show Remarkable Growth in the Cell Biology Market?

Europe is expected to show remarkable growth in the market during the predicted timeframe due to massive investments in R&D and a rise in demand for precision medicine and advanced biomanufacturing. Its growth is further propelled by stringent regulations that encourage non-animal research methods, the amalgamation of automation/AI in laboratories, and a strong collaborative biotech ecosystem. Various R&D initiatives like the European Synthetic Cell Initiative, Cell and Gene Therapy, and CorEuStem are further boosting this market.

Germany Market Trends

Germany holds the major regional share due to a strong pharmaceutical sector, a well-established R&D ecosystem, and massive government investments. Germany leads in medical biotechnology, as it has over 700 biotech companies with a highly skilled workforce that focuses on innovative therapies. The government heavily supports this market through initiatives like the Central Innovation Program for SMEs (ZIM), which further expands market growth.

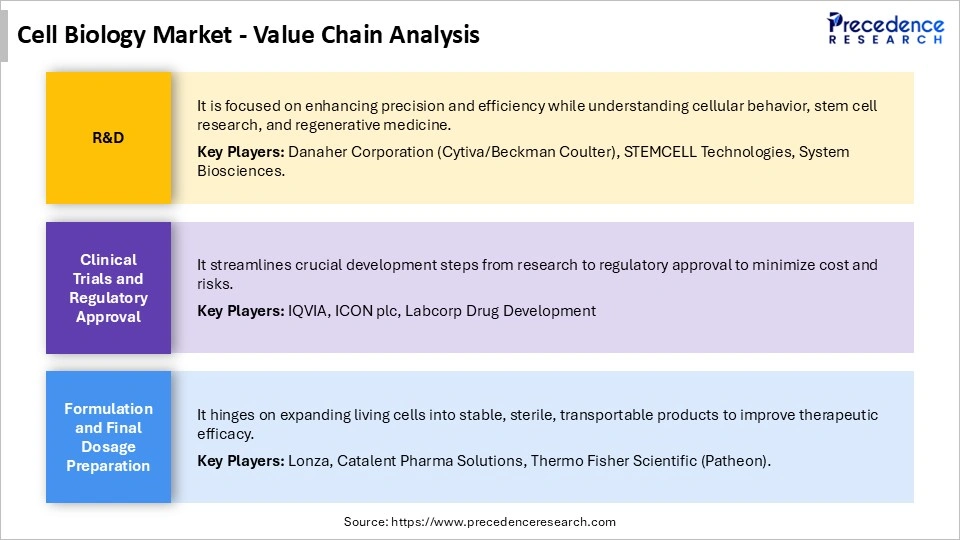

Cell Biology Market Value Chain Analysis

What is the cell biology market growth?

The major players in the cell biology market include Thermo Fisher Scientific, Danaher Corporation, Becton, Dickinson and Company (BD), Merck KGaA, Agilent Technologies, Bio-Rad Laboratories, Sartorius AG Miltenyi Biotec PerkinElmer (Revvity), 10x Genomics, QIAGEN, GE Healthcare/Cytiva, Illumina, Promega Corporation, Olympus Corporation

Recent Developments

- In December 2025, BD company launched BD FACSDiscover™ A8, a cell analyzer that allows analysis of up to 50 or more characteristics of a single cell with optimal resolution and sensitivity, enabling real-time analysis. The analyzer was designed for numerous labs to advance discoveries in immunology, cancer immunotherapy, and cell biology. (Source: https://investingnews.com)

- In August 2025, Umami Bioworks, a Singapore-based company, launched Marine Radiance, an AI-led cell cultivation platform, to produce sustainable marine bioactives for use in personal care and nutraceutical industries. The platform can address supply chain instability, ethical concerns, and quality variability. (Source: https://www.greenqueen.com)

- In April 2025, Bruker Corporation launched the Beacon Discovery™ Optofluidic System to offer an accessible entry point into live single-cell functional analysis. This system can transform TCR discovery for cancer immunotherapy. It can precisely isolate, control, and analyze single cells using ML-driven automation. (Source: https://www.news-medical.net)

Segments Covered in the Report

By Product & Service

- Reagents & Consumables

- Instruments

- Software

- Services & Accessories

By Technique/Process

- Flow Cytometry & Microscopy

- High-Content Screening

- PCR / Sequencing / Other Cell-Based Techniques

- Single-Cell Analysis

- Other Techniques

By Application

- Drug Discovery & Development

- Disease Research (Oncology, Immunology, etc.)

- Toxicology & Safety Assessment

- Basic & Academic Research

- Other Applications

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Hospitals & Clinical Labs

- CROs & Other Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting