What is the Chemical Injection Skid Market Size?

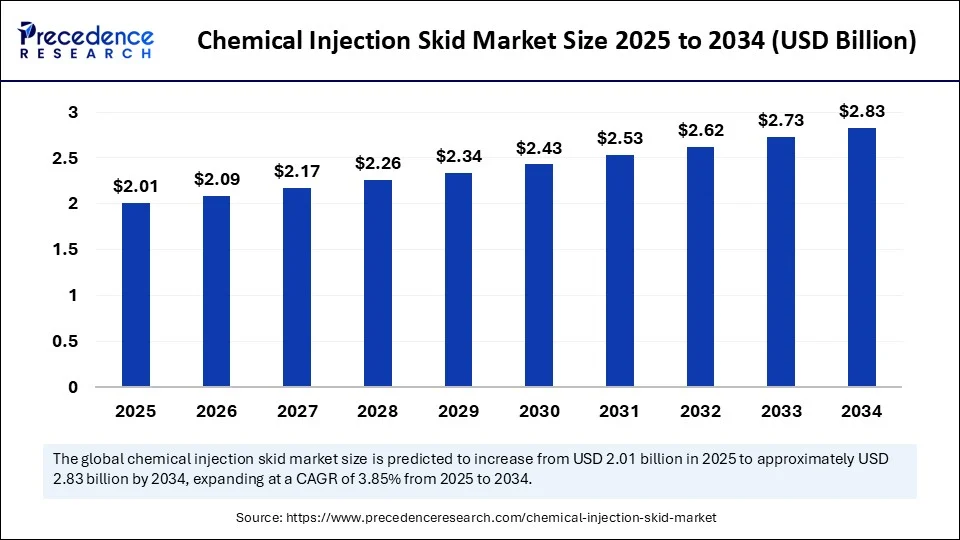

The global chemical injection skid market size is calculated at USD 2.01 billion in 2025 and is predicted to increase from USD 2.09 billion in 2026 to approximately USD 2.83 billion by 2034, expanding at a CAGR of 3.85% from 2025 to 2034. The chemical injection skid sector is experiencing significant growth due to increasing demand across various industries. Its expansion is expected to continue steadily over the next decade, driven by technological advancements and rising infrastructure development.

Chemical Injection Skid Market Key Takeaways

- In terms of revenue, the global chemical injection skid market was valued at USD 1.94 billion in 2024.

- It is projected to reach USD 2.83 billion by 2034.

- The market is expected to grow at a CAGR of 3.85% from 2025 to 2034.

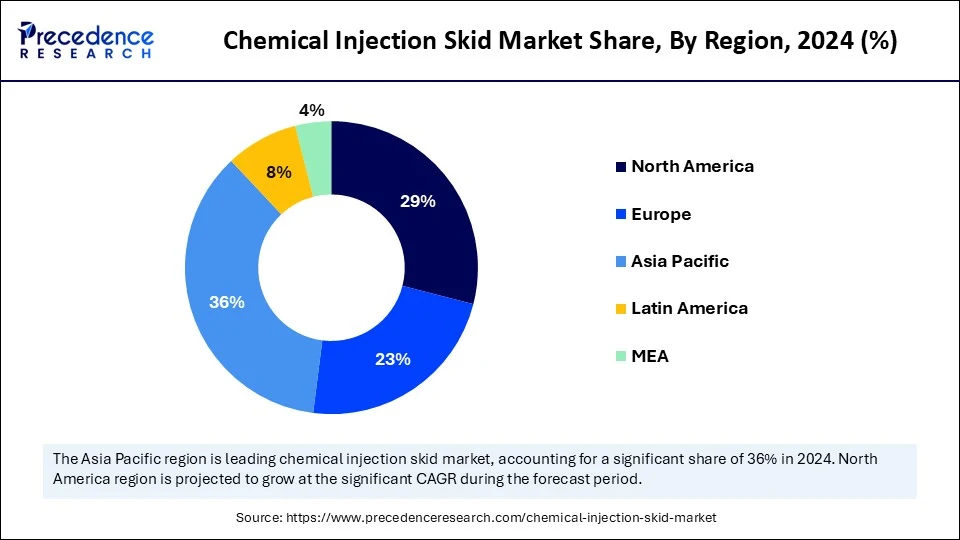

- Asia Pacific dominated chemical injection skid market with the largest revenue share of 36% in 2024 is expected to be the fastest-growing region in the upcoming years.

- By function type, the corrosion Inhibition segment held the maximum revenue share in 2024.

- By function type, the antifoaming segment is expected to witness the fastest growth over the forecast period.

- By product/type, conventional skids segments contributed the biggest market share in 2024.

- By product/type, the custom skids segment is expected to witness the fastest growth over the forecast period.

- By end-user type, the oil & gas segment led the market in 2024.

- By end-user type, the water supply & water treatment segment is expected to witness the fastest growth over the forecast period.

Why the Chemical Injection Skid Market is Expanding Rapidly Across Industries

The chemical injection skid market refers to the segment of the industrial equipment industry focused on prefabricated, skid-mounted systems designed to accurately and automatically inject various chemicals e.g., corrosion inhibitors, antifoaming agents, demulsifies, scale inhibitors, biocides, disinfectants into industrial processes primarily in sectors such as oil & gas, water treatment, petrochemical, energy, fertilizers, and others.

The chemical injection industry is growing due to the expanding oil and gas sector, rising water treatment requirements, and advancements in chemical dosing technologies. Industries rely heavily on chemical injection systems to maintain the integrity of equipment and ensure process continuity. Increasing exploration in offshore and deepwater oil fluids further boosts demand for sophisticated injection systems capable of handling extreme conditions. At the same time, water treatment applications are gaining momentum due to stricter regulations and environmental concerns. The market is also seeing a shift toward automated and IoT-enabled systems, offering real-time monitoring and optimization. With growing investments across industrial and municipal applications, the global chemical injection skid market is expected to witness significant expansion in the coming years.

How AI Is Transforming the Chemical Injection Skid Market?

Artificial intelligence is reshaping the chemical injection logistics by enabling predictive analytics, smart dosing, and enhanced process automation. AI-driven monitoring systems can analyze real-time data to adjust chemical dosing with precision, reducing waste and operational costs. Machine learning models are being employed to predict corrosion or scaling risks, ensuring proactive treatment and extending equipment lifespan. In offshore oil fields and remote facilities, AI allows for autonomous control and optimization, minimizing human intervention and improving safety. Integration with IoT sensors further enhances visibility across the supply chain, enabling smarter decisions. As AI adoption grows, chemical injection systems are evolving from reactive tools to intelligent, adaptive solutions that optimize performance and sustainability.

Market Key Trends

- Increasing adoption of automated and IoT-enabled injection systems.

- Rising demand for offshore and deepwater oil and gas operations.

- Stricter regulations on water treatment and industrial waste management.

- Growing focus on eco-friendly and sustainable chemical formulations.

- Expanding use of AI and predictive maintenance in injection systems.

- Rising investments in digital twins for optimizing chemical injection processes.

Market Outlook

- Industry Growth Offerings- The market is growing due to increasing demand from oil & gas exploration, rising water treatment needs, and the adoption of automated, IoT-enabled systems for corrosion and scale control.

- Global expansion- The global market is expanding as industries worldwide ramp up automation, IoT-enabled dosing systems, and precision chemical control to meet stricter environmental standards. High demand across oil & gas, water treatment, and petrochemical sectors, especially in Asia Pacific and Europe, fuels this growth.

- Startup Ecosystem- The chemical injection skid startup ecosystem focuses on IoT-enabled, automated dosing systems, collaborating with EPC contractors and industrial clients to scale innovative skid solutions. Key players include Proserv Group, SEKO S.p.A., and Intech Process Automation.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.83 Billion |

| Market Size in 2025 | USD 2.01 Billion |

| Market Size in 2026 | USD 2.09 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.85% |

| Dominating Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Function, Product/Type, End-User / Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Fueling Reliability in Critical Operations

The chemical injection skid space is primarily influenced growing need for reliability and safety in critical industrial operations. Oil and gas pipelines, power plants, and water treatment facilities cannot afford disruptions caused by corrosion, scaling, or microbial growth. Chemical Injection systems play a pivotal role in preventing these issues, thereby ensuring smooth and safe operations. Increasing exploration of unconventional resources and offshore oil fields further amplifies the demand for these systems. Additionally, stricter regulations on water quality and environmental safety are compelling industries to invest in advanced injection solutions. With rising energy demand and industrial expansion, the

Opportunity

Smart Systems for a Sustainable Future

Lucrative prospects in the injection skid market encompass the integration of smart technologies such as AI, IoT, and cloud platforms into chemical injection systems. These advancements enable remote monitoring, predictive maintenance, and real-time optimization, significantly improving efficiency. Furthermore, the demand for sustainable and environmentally friendly chemicals opens opportunities for suppliers to innovate eco-compatible injection solutions. Emerging economies in Asia, Africa, and Latin America also present untapped markets due to rapid industrialization and infrastructure development. The growing focus on renewable energy and desalination projects provides new avenues for injectable chemicals and applications. Companies that embrace digitalization and sustainability will be best positioned to capture these opportunities.

Restraint

Balancing Cost with Complexity

One of the major restraints in the chemical injection sector is the high cost associated with advanced systems and their maintenance. Sophisticated injection equipment, particularly those used in offshore operations, requires significant capital investment. Additionally, handling hazardous chemicals involves regulatory compliance and safety costs, which can further strain the workforce and technical expertise, also limiting adoption. Moreover, fluctuating oil and gas prices often impact investment cycles, affecting demand for injection systems. Balancing technological complexity with cost-effectiveness remains a persistent challenge for both manufacturers and end-users.

Function Insights

Why Corrosion Inhibition Leads the Market in the Year 2024?

The corrosion inhibition segment held a dominant presence in the chemical injection skid market in 2024 due to the rising critical need to protect infrastructure and equipment from degradation. Corrosion poses a significant financial burden in industries like oil and gas, power generation, and water treatment, with costs often running into billions annually. By extending equipment life and reducing maintenance expenses, corrosion inhibitors present a highly attractive solution. The growth of offshore exploration, pipelines, and industrial water systems is fueling greater adoption of these chemicals. Their ability to provide long-term asset protection aligns with industry cost-efficiency and safety goals. Increasing awareness of the hidden costs of corrosion is accelerating this market expansion.

The shift toward advanced infrastructure and high-pressure systems has heightened the need for robust corrosion management strategies. Emerging markets are the Asia Pacific and the Middle East, with significant oil, gas, and industrial activities, which are witnessing surging demand for corrosion inhibitors. Additionally, regulations pushing for safer and more reliable operations are compelling industries to integrate corrosion inhibitors into standard practices. Technological innovations, such as tailored inhibitor blends for specific environments, further enhance growth prospects. As industries strive for resilience and operational excellence, corrosion inhibition stands out as a vital and rapidly expanding segment in the chemical injection skid market.

The antifoaming functions are the fastest-growing in the chemical injection sector, arising from their critical role in preventing foam formation in industrial processes. Foam can lead to inefficiencies, equipment damage, and production downtime, making antifoaming chemicals an essential safeguard. Industries such as oil and gas, petrochemicals, and water treatment heavily rely on these solutions to maintain end-use sectors, ensure steady demand for antifoaming chemicals. Moreover, their relatively low cost compared to the operational losses from foam build-ups makes them a practical investment. The dominance of this segment is further reinforced by continuous product innovations, improving efficiency and environmental compatibility.

The growing emphasis on process optimization and cost savings continues to fuel the demand for antifoaming chemicals. Companies are increasingly investing in advanced formulations that deliver longer-lasting effects and reduced dosage requirements. Environmental compliance and sustainability are also driving a shift toward bio-based or eco-friendly antifoam products. Industries with large-scale fluid operations, such as refineries, remain primary consumers, ensuring sustained market leadership for this function. As processes become more complex and volumes expand, antifoaming functions will continue to occupy a central role in chemical injection systems.

Product/Type Insights

How Conventional Skids are Dominating the Market?

The conventional skids segment accounted for a considerable share of the chemical injection skid industry in 2024 by virtue of their reliability, cost-effectiveness, and ease of integration. These pre-engineered systems are widely used across industries, particularly in oil and gas, where proven solutions are often preferred. Their modular design allows for quick installation, reducing downtime and ensuring consistent performance. Many operators favour conventional skids because of their long-established track record and straightforward maintenance requirements. Their affordability makes them accessible to both large-scale and mid-tier companies. This widespread adoption ensures that conventional skids continue to lead the product type segment.

The scalability and customization options available within conventional skid systems also add to their appeal. Manufacturers have optimized these solutions to deliver durability under harsh operating conditions, enhancing trust among end users. Ongoing improvements in pump technology, materials, and automation are extending the lifecycle and efficiency of conventional skids. Despite competition from custom-designed alternatives, their standardization designs remain attractive for projects with tighter budgets and timelines. The balance between affordability, dependability, and functionality cements conventional skids as the dominant product category in the chemical injection skid market.

The custom skids are the fastest growing in the chemical injection skid space, fueled by the rising demand for tailored solutions to meet complex operational requirements. Unlike conventional systems, custom skids are engineered to address specific environmental, pressure, and flow conditions. Industries with unique or challenging processes, such as deepwater drilling or specialized chemical treatment plants, are driving this demand. Customization ensures greater efficiency, reduced chemical wastage, and enhanced performance. As industries pursue precision and efficiency, custom skid adoption is accelerating rapidly. These solutions cater to the growing need for specialized, project-specific equipment.

Advancements in digital design and modular engineering are making custom skids more accessible and cost-effective than before. The rise of automation, IoT integration, and data-driven operations further enhances their appeal. Custom skids are increasingly viewed as strategic investments that deliver long-term savings and improved process reliability. Their flexibility also allows them to accommodate evolving environmental and regulatory standards. While the upfront costs may be higher, the operational benefits and adaptability position custom skids as the most dynamic growth area in the chemical injection skid market.

End-User / Industry Insights

How Is Oil and Gas Dominating the Market?

The conventional skids have become a dominant force in the chemical injection skid industry, because it is enhancing production efficiency, preventing corrosion, controlling scale, and mitigating risks associated with hydrocarbon extraction. Offshore and drilling operations alike rely heavily on these systems to maintain operational continuity. The sheer scale of oil and gas infrastructure, including pipelines and refineries, ensures sustained usage of chemical injection solutions. The sector's global significance and continuous activity underpin its dominant position.

Investment in enhanced oil recovery and deepwater exploration further strengthens the reliance on chemical injection systems. The industry's constant pursuit of efficiency and safety ensures ongoing demand for advanced injection technologies. Many oil and gas companies are integrating automated chemical dosing to reduce manual intervention and improve accuracy. Despite volatility in oil prices, the critical nature of chemical injection for maintaining production levels safeguards its dominance. The oil and gas sector will continue to anchor the chemical injection skid market as energy demand persists worldwide.

The water supply and water treatment are the fastest growing in the chemical injection skid market, due to increasing global concerns over water quality, scarcity, and contamination, industries and municipalities are adopting advanced chemical treatment methods. Chemical injection ensures effective disinfection, scaling control, and corrosion prevention in water systems. Rising urbanization and industrialization are driving significant investments in water infrastructure, boosting demand for these technologies. Governments worldwide are prioritizing clean water initiatives, further accelerating adoption. This positions water treatment as a high-potential growth area.

Technological advancements in dosing accuracy and monitoring systems are enhancing the efficiency of chemical injection in water treatment projects to meet growing population needs. Environmental regulations are also pushing industries to invest in safe and reliable chemical injection systems. The versatility of these solutions makes them applicable to both municipal water supply and industrial wastewater treatment. The sustainability and water treatment sector is set to expand rapidly, making it the fastest-growing end-user segment.

Regional Insights

Asia Pacific Chemical Injection Skid Market Size and Growth 2025 to 2034

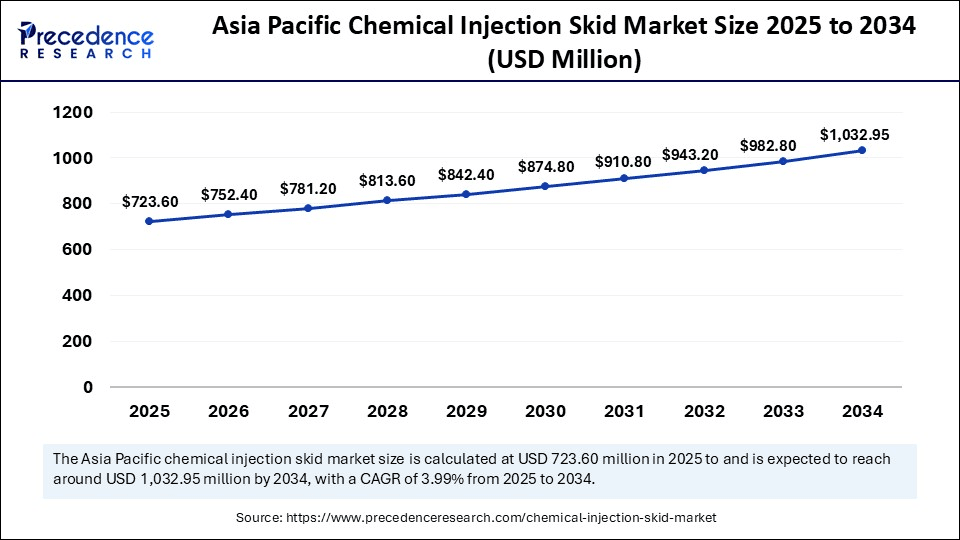

The Asia Pacific chemical injection skid market size is exhibited at USD 723.60 million in 2025 and is projected to be worth around USD 1,032.95 million by 2034, growing at a CAGR of 3.99% from 2025 to 2034.

Why is Asia Pacific a Rising Star in the Chemical Injection Skid Market?

By region, Asia Pacific dominated the global market in 2024 and is anticipated to grow at the fastest rate in the market during the forecast period, thanks to rapid industrialization, infrastructure expansion, and rising energy demand. Countries like China, India, and Southeast Asian nations are witnessing massive investments in oil and gas, power generation, and water treatment sectors. The region is also expanding its offshore exploration activities, particularly in deepwater fields, creating strong demand for advanced chemical injection systems. Growing urbanization is increasing the pressure on water treatment facilities, further fueling the need for efficient dosing technologies. Additionally, cost competitiveness in manufacturing supports market expansion.

The second reason for rapid growth lies in the Asia Pacific adoption of digital transformation and sustainability initiatives. Industries in the region are increasingly integrating IoT and AI-enabled systems to improve process efficiency and reduce chemical waste. Governments are implementing stricter regulations on water and environmental management, compelling industries to adopt advanced injection solutions. The growth of renewable energy and desalination projects across Asia also presents significant opportunities. With a large industrial base, rising technology adoption, and growing regulatory push, the Asia Pacific is set to outpace other regions in chemical injection skid market growth.

What Factors Are Powering China's Chemical Injection Skid Market Growth?

The China market is expanding due to rapid growth in oil & gas exploration, particularly in offshore and deepwater projects, increasing demand for corrosion and scale control. Rising industrialization and stricter environmental regulations drive water treatment applications. Adoption of automated and IoT-enabled systems for real-time monitoring, along with government support for energy infrastructure and process optimization, further boosts the market's growth across China.

What is driving Growth in North America's Chemical Injection Skid Industry?

The North American market is expanding due to increased oil and gas exploration, especially in shale and deepwater fields, which drives demand for corrosion, scale, and biocide control. Rising investments in water treatment and petrochemical sectors, coupled with the adoption of automated, IoT-enabled skid systems for real-time monitoring and process optimization, further boost growth. Regulatory focus on safety, efficiency, and environmental compliance also supports market expansion.

Why the U.S. Chemical Injection Skid Market is on the Rise?

The U.S. chemical injection skid market is growing due to expanding oil and gas operations, particularly in shale and offshore fields, driving demand for corrosion, scale, and biocide control systems. Increased adoption of automated and IoT-enabled skids enhances process efficiency and real-time monitoring. Additionally, stricter environmental and safety regulations, alongside rising investments in water treatment and petrochemical industries, are further accelerating market growth across the country.

How Automation and Regulation Are Boosting Europe's Skid Market?

The Europe market is increasing due to growing investments in oil and gas, petrochemical, and water treatment sectors, which drive demand for corrosion, scale, and biocide control systems. Adoption of automated and IoT-enabled skids enhances operational efficiency and real-time monitoring. Stricter environmental regulations, emphasis on safety, and the need for process optimization in industrial and municipal applications further support the region's market growth.

Why Offshore Exploration and Industrial Investments Propel the UK Market?

The UK market is growing due to rising oil and gas exploration, particularly in offshore and deepwater fields, which increases demand for corrosion, scale, and biocide control systems. Adoption of automated and IoT-enabled skid solutions enhances operational efficiency and real-time monitoring. Additionally, stringent environmental and safety regulations, coupled with investments in water treatment and petrochemical sectors, are further driving market growth in the UK.

Value Chain Analysis

Raw Material Sourcing

- Raw material sourcing focuses on corrosion-resistant metals like stainless steel and high-nickel alloys for skid frames, piping, and tanks.

- Ensures durability and reliability in harsh industrial and offshore environments.

Key Players:Butting Group, ThyssenKrupp, Sabre Alloys, Nickel Steel & Alloys (Shalco)

Testing and Certification

- Testing and certification for chemical injection skids include pressure testing, functional verification, and calibration to ensure leak-free operation and accurate chemical dosing.

- Compliance is ensured with project specifications and industry standards, such as EN12079 for offshore applications.

Key players: ABS Group, DNV, Bureau Veritas, TÜV SÜD, and Lloyd's Register.

Distribution and Sales

- Distribution involves chemical skids being sold through engineering, procurement, and construction (EPC) contractors, OEM system integrators, and service providers.

- Sales also rely on global chemical and industrial distributors that can provide modular skid solutions to end users in oil & gas, water, and petrochemical sectors.

Key Players: Univar Solutions, Stewart & Stevenson, SPX FLOW, LEWA GmbH, Milton Roy, IDEX Corporation.

Top Vendors and their Offerings

- Petronas: Delivers turnkey chemical injection skid solutions tailored for corrosion, scale, hydrate, and flow assurance management in onshore and offshore oil & gas operations.

- SEKO S.p.A.: Manufactures precise metering, solenoid, and peristaltic dosing pumps and packaged injection systems for industrial and oil & gas chemical applications.

- Controval: Provides integrated chemical injection skid systems with pumps, tanks, meters, and control panels designed for flow-accuracy in petrochemical, water, and mining sectors.

- AFP: Supplies high-precision fluid control components, including valves, manifolds, and injection accessories, optimized for analytical and chemical dosing systems.

- Doedijns: Offers pneumatic and plunger-driven pumps, high-pressure valves, and skid-mounted chemical injection units designed for oil, gas, and industrial dosing applications.

Chemical Injection Skid Market Companies

- Lewa GmbH

- IDEX Corporation

- Ingersoll Rand

- SPX FLOW, Inc.

- Petronash

- AES Arabia Ltd.

- INTECH Process Automation

- Milton Roy

- SEKO S.p.A.

- Carotek, Inc.

- Petrak Industries

- Proserv Group

- Integrated Flow Solutions LLC

- Petroserve International

- Casainox Flow Solutions

- Controval

- Doedijns

- AFP

- Spherical Insights

- Cameron

- India Mart

Recent Development

- In June 2025, Amarinth secured an order worth over £1.5 million to supply four custom API 675 chemical injection skid packages for deployment in Nigeria's Soku and Gbaran LNG fields, which serve as major feed gas sources for the Nigeria LNG (NLNG) plant at Finima, Bonny Island. Each skid is purpose-built for highly accurate chemical injection tasks that are vital for protecting pipeline integrity and ensuring equipment efficiency. The order covers two sets of packages: one comprising a biocide injection skid and an oxygen scavenger skid, and another consisting of a biocide injection skid paired with a scale inhibitor skid. Designed in full compliance with API 675 standards, the skids are equipped with integrated instrumentation, including pressure and level transmitters, actuated valves, and other essential components for advanced automation and monitoring.(Source: https://www.worldpumps.com)

Segments Covered in the Report

By Function

- Antifoaming

- Silicone-Based Antifoam Agents

- Non-Silicone-Based Antifoam Agents

- Corrosion Inhibition

- Organic Corrosion Inhibitors

- Inorganic Corrosion Inhibitors

- Multi-Functional Inhibitors

- Demulsifying

- Oil Demulsifiers

- Water Demulsifiers

- Scale Inhibition

- Phosphate-Based Scale Inhibitors

- Polymer-Based Scale Inhibitors

- Sulfonate-Based Scale Inhibitors

- Other Functions

- Biocides

- Flocculants

- Surfactants

By Product/Type

- Conventional (Standard) Skids

- Custom Skids

- Modular Skids

By End-User / Industry

- oil & gas

- Energy & Power

- Fertilizer

- Chemical & Petrochemical

- water supply & water treatment

- Pharmaceuticals

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting