What is Digital MRO Market Size?

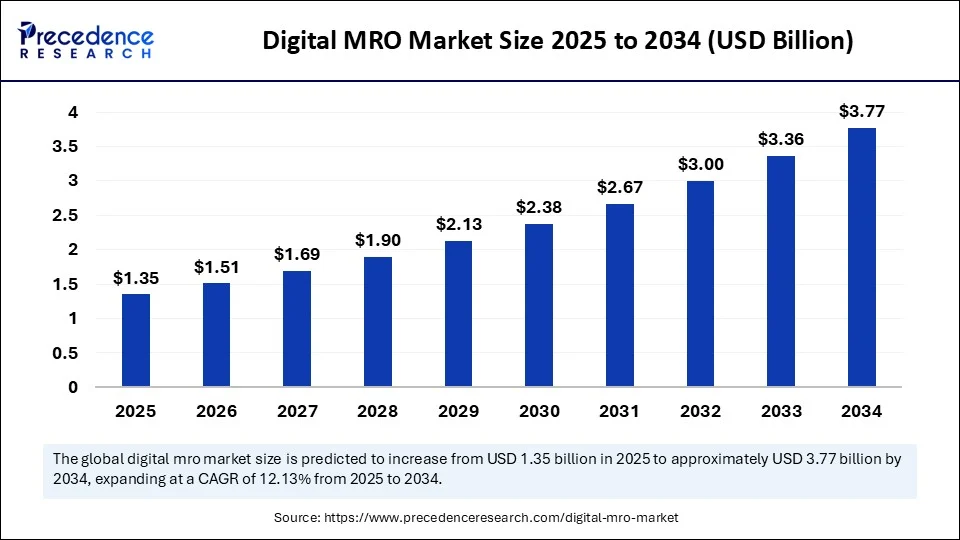

The global digital MRO market size is calculated at USD 1.35 billion in 2025 and is predicted to increase from USD 1.51 billion in 2026 to approximately USD 4.14 billion by 2035, expanding at a CAGR of 11.86% from 2026 to 2035. The growth of the market is driven by advancements in digital technologies and increasing demand for efficient maintenance, repair, and operations solutions.

Market Highlights

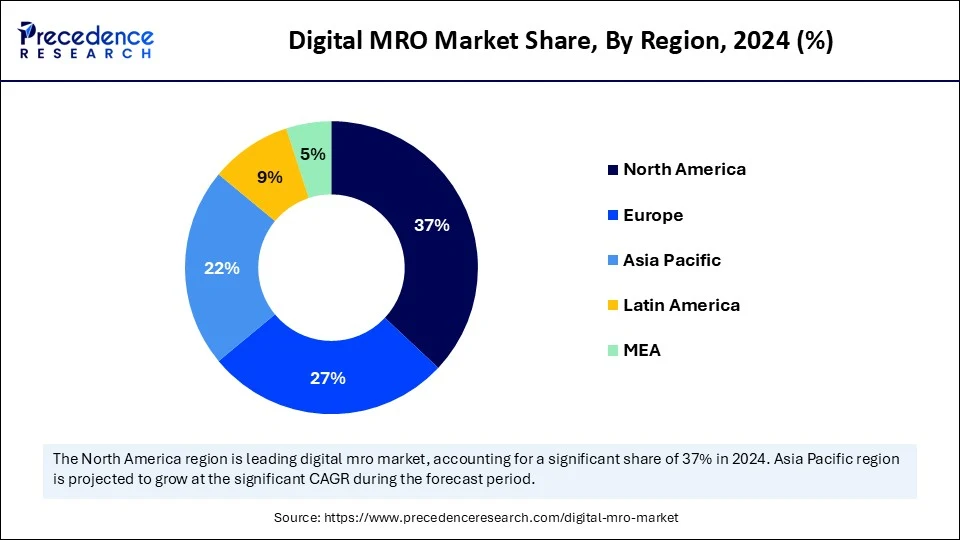

- North America dominated the digital MRO market with the largest share of 37% in 2025.

- By region, Asia Pacific is expected to expand at the fastest CAGR between 2026 to 2035

- By technology, the predictive maintenance segment held the biggest market share of 22.5% in 2025.

- By technology, the digital twin segment is expected to grow at the fastest CAGR between 2026 to 2035

- By end-user, the airlines segment captured the major market share of 31% in 2025.

- By end user, the MRO service providers segment is expected to grow at the highest CAGR between 2026 to 2035

- By application, the predictive maintenance and planning segment generated the largest market share of 28% in 2025.

- By application, the training & simulation segment is expected to grow at a remarkable CAGR between 2026 to 2035

- By deployment mode, the cloud-based segment captured the largest market share of 45% in 2025.

- By deployment mode, the hybrid segment is expected to grow at the fastest CAGR between 2026 to 2035

- By component, the solutions/software segment generated the major market share of 52% in 2025.

- By component, the services segment is expected to grow at a remarkable CAGR between 2026 to 2035

Market Overview

The digital MRO (maintenance, repair, and overhaul) market refers to the integration of advanced digital technologies such as artificial intelligence (AI), Internet of Things (IoT), digital twin, big data analytics, blockchain, and augmented reality (AR)/virtual reality (VR) into MRO operations across the aviation and aerospace industry. Digital MRO aims to enhance efficiency, minimize aircraft downtime, optimize supply chain management, ensure regulatory compliance, and reduce maintenance costs by transforming traditional MRO processes into connected, predictive, and data-driven operations.

The digital MRO market is steadily expanding, driven by aviation's demand for efficiency, sustainability, and safety. Airlines and MRO providers are investing in digital platforms for real-time monitoring, cloud-based documentation, and digital twins. The integration of IoT, AI, AR/VR, and blockchain is turning legacy maintenance systems into connected, intelligent networks. These innovations are enhancing turnaround times, improving regulatory compliance, and reducing operational costs. As more aircraft become digitally enabled, digital MRO is becoming the new standard rather than the exception. Increased aircraft deliveries and the need for next-gen fleet maintenance solutions further support the market's growth trajectory.

Major Market Trends

- Increased Adoption of Predictive Maintenance: Companies are increasingly shifting from reactive maintenance to predictive maintenance strategies, using advanced analytics and AI to foresee potential failures and schedule maintenance activities proactively. This trend is driven by the desire to minimize downtime and extend the life of aircraft components.

- Integration of Advanced Technologies: The incorporation of technologies such as IoT, AI, and digital twin models is transforming traditional MRO processes into more efficient, data-driven operations. These technologies provide real-time monitoring and actionable insights, leading to improved operational performance.

- Expansion of Remote Monitoring and Diagnostics: Remote monitoring capabilities are becoming crucial as airlines and MRO providers look to maintain operational efficiency. The ability to monitor aircraft systems in real time allows for faster diagnostics and repairs, reducing the need for physical checks and visits.

- Cloud-Based Solutions: The transition to cloud-based platforms is facilitating better data management, collaboration, and accessibility in MRO operations. Cloud solutions enhance documentation processes and provide greater flexibility in accessing information from anywhere, thus improving decision-making processes.

- Focus on Sustainability: As the aviation industry increasingly prioritizes sustainability, MRO operations are evolving to incorporate eco-friendly practices. This includes reducing waste, optimizing resource usage, and leveraging digital technologies to lower carbon footprints associated with maintenance activities.

- Training and Simulation Innovations: The use of augmented and virtual reality for training and simulation in MRO environments is on the rise. This trend allows personnel to gain hands-on experience in a controlled environment, thereby enhancing skills and reducing the likelihood of errors during actual maintenance procedures.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.35 Billion |

| Market Size in 2026 | USD 1.51 Billion |

| Market Size by 2035 | USD 4.14 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.86% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, End User, Application, Deployment Mode, Component, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Need for Increased Operational Efficiency

The aviation industry's push toward enhanced efficiency and reduced downtime is a major factor driving the growth of the digital MRO market. Airlines are increasingly under pressure to maximize aircraft availability while cutting operational costs. Digital tools allow real-time condition monitoring, helping technicians address issues proactively. The surge in commercial aircraft deliveries also fuels demand for scalable, efficient MRO solutions. Moreover, the growing need for predictive maintenance to minimize downtime and optimize resource allocation drives market growth.

Restraint

High Costs and Data Security Concerns

Despite its potential, the digital MRO market faces several barriers. High initial investment required for the procurement of digital MRO solutions creates challenges for smaller MRO providers. There is also resistance from traditional technicians due to a lack of training in digital tools. Data security and privacy remain major concerns, especially with cloud-based platforms. Integration with legacy systems can be complex and time-consuming. Regulatory ambiguity around digital documentation and maintenance can slow implementation.

Market Opportunity

Need for Fleet modernization

The growing need for fleet modernization and aircraft longevity opens vast opportunities in the digital MRO market. Startups and tech innovators have room to introduce AI-driven inspection tools, digital maintenance logs, and customized dashboards. Emerging economies with expanding aviation sectors are ripe markets for digital MRO adoption. Integration with cloud computing and 5G connectivity can unlock new frontiers in remote diagnostics and real-time support. OEMs and MRO providers can collaborate to create smart maintenance contracts powered by data analysis.

Segment Insights

Technology Insights

How Does the Predictive Maintenance Segment Dominate the Market in 2025?

The predictive maintenance segment dominated the digital MRO market in 2025. The dominance of the segment stems from its ability to minimize downtime and optimize asset utilization. Airlines and MRO providers are heavily leveraging sensor-based data and machine learning to forecast component failures well in advance. This reduces the risk of unexpected disruptions, ensuring higher safety and cost efficiency. Predictive maintenance aligns with the industry's shift from reactive to proactive approaches in maintenance strategies. It also supports data-driven decision making, enabling better inventory planning and labor allocation. As aviation fleets grow more complex, the need for reliable, real-time diagnostics has made predictive maintenance the dominant force in the market.

The integration of AI algorithms further enhances the accuracy of predictive models, allowing for customized maintenance schedules per aircraft or fleet. As airlines recover post-pandemic, the focus is on maximizing operational hours with minimal interventions, making predictive maintenance invaluable. Fleet managers are seeing improved ROI by avoiding unnecessary part replacements and unplanned aircraft groundings. In regions with harsh weather conditions, this technology is especially critical is assessing component fatigue. Overall, predictive maintenance is not just a feature it's the foundation of modern digital MRO ecosystems.

The digital twin segment is expected to grow at the fastest rate during the forecast period, driven by its potential in visualizing aircraft health in real-time. These virtual replicas allow engineers and technicians to monitor, stimulate, and diagnose problems before they occur. Airlines are increasingly deploying digital twins to enhance the accuracy of maintenance forecasting and scenario planning. By integrating operational data from sensors and logs, digital twins create a holistic view of system performance. This leads to more efficient maintenance cycles, improved safety, and reduced lifecycle costs. The immersive and interactive nature of digital twin tools is revolutionizing the way maintenance teams collaborate.

As the aviation sector shifts toward hyper-personalized asset management, digital twin solutions are being adopted at fleet, system, and component levels. OEMs and software providers are partnering to offer pre-integrated twin platforms tailored for specific aircraft models. These tools also support AR/VR training, allowing technicians to learn from simulated fault environments. As sustainability pressures mount, digital twins contribute by reducing resource wastage and optimizing part longevity. Regulatory bodies are also recognizing the value of this technology for ensuring traceability and compliance. The rising adoption of smart hangars and connected systems is further accelerating digital twin deployment across the global aviation landscape.

The artificial intelligence (AI) & machine learning segment is likely to grow at a notable rate in the coming years. Artificial intelligence is redefining MRO by making maintenance more predictive than reactive. AI algorithms analyze sensor data from aircraft components to forecast potential failures before they occur. This reduces unplanned downtime, extends component life, and improves flight safety. Machine learning further optimizes inventory management by predicting spare part demands with remarkable accuracy. AI-driven visual inspection tools are speeding up fault detection and reducing human error. Ultimately, AI is transforming traditional MRO processes into intelligent, agile ecosystems.

End User Insights

Why Did the Airlines Segment Dominate the Digital MRO Market in 2025?

The airlines segment dominated the market in 2025 due to their extensive fleets and more complex operational requirements. Airlines are investing heavily in aircraft utilization rates remain uninterrupted. Predictive tools, cloud-based tracking systems, and digital twins are commonly integrated across maintenance schedules. Due to international operations, full-service carriers also face stringent compliance requirements, making digitization vital. Their larger maintenance budgets and access to OEM-backed solutions further facilitate advanced MRO digitization.

In addition, full-service carriers are embracing AI to create integrated maintenance platforms across geographies. Real-time data sharing between departments enhances communication and reduces decision-making delays. These airlines are also using digital platforms to create automated work orders and streamline inventory management. As consumer expectations grow, minimizing delays due to maintenance becomes a critical performance metric. This focus on punctuality and reliability is driving demand for smarter, more responsive MRO technologies. Full-service carriers, thus, remain at the helm of innovation in the digital aviation maintenance ecosystem.

The MRO service providers segment is expected to expand at the fastest CAGR during the forecast period. Maintenance, repair, and overhaul (MRO) services play a crucial role in the aviation and aerospace industries, ensuring that aircraft remain safe and operational. These services encompass a range of activities, including routine maintenance checks, repairs of aircraft components, and complete overhauls to restore aircraft to optimal performance. The incorporation of advanced technologies, such as predictive maintenance and digital twins, has transformed traditional MRO practices into more efficient and proactive operations. By leveraging data analytics, MRO service providers can anticipate potential failures before they occur, reducing unplanned downtime and increasing aircraft availability. Moreover, MRO services contribute significantly to safety, as they ensure compliance with stringent regulatory standards. Overall, the evolution of MRO services is driving enhanced efficiency, reduced costs, and improvd safety measures in aviation.

In recent years, the MRO sector has seen significant technological advancements, with the integration of artificial intelligence and the Internet of Things revolutionizing operations. AI-powered tools facilitate real-time diagnostics and predictive analysis, allowing MRO providers to optimize maintenance schedules and inventory management. The shift towards cloud-based platforms has also improved data accessibility and collaboration among stakeholders, making operational processes more efficient. Remote monitoring systems enable MRO providers to track aircraft conditions from afar, potentially reducing the number of on-site visits needed for inspections. As the demand for efficient and sustainable operations grows, MRO services are becoming an essential component of the aviation industry's recovery and future performance. This focus on innovation and adaptability in MRO services not only enhances operational reliability but also promotes a culture of safety and efficiency across the industry.

Application Insights

What Made Predictive Maintenance & Planning the Dominant Segment in the Market in 2025?

The predictive maintenance & planning segment dominated the digital MRO market in 2025. This is mainly due to the key role of predictive maintenance in allowing operators to stay ahead of potential failures by continuously analyzing aircraft data. This foresight ensures improved flight safety, lower maintenance costs, and optimized labor management. Maintenance planning modules also assist in organizing schedules, parts procurement, and technician allocations. The ability to prevent last-minute disruptions is particularly valuable for airlines with tight operational margins. As a result, predictive maintenance tools are embedded in most digital MRO platforms and dashboards.

Airlines are moving from traditional, fixed-time inspection models to condition-based monitoring. Predictive planning applications also integrate seamlessly with logistics systems, enabling timely spare part availability. By analyzing past maintenance patterns, these tools help optimize future checks and reduce repeat repairs. The use of cloud-based systems for maintenance planning allows better visibility across fleets and locations. Combine with real data across fleets and locations. Combined with real-time updates from Artcraft sensors, predictive tools are reshaping how maintenance calendars are structured. These applications are now seen as critical not only for cost reduction but also for safety assurance.

The training & simulation segment is expected to expand at the fastest rate in the market during the forecast period, due to labor shortages and technological evolution. AR/VR-based simulators are enabling maintenance technicians to gain hands-on experience without needing access to real aircraft. These immersive platforms reduce training time, improve knowledge retention, and boost confidence. Airlines and MRO companies are investing in digital training labs to scale technician readiness quickly. Simulation modules also allow exposure to rare or emergency scenarios that may not be feasible in real-life training. As aviation becomes more complex, training tools are evolving into strategic assets.

The demand for upskilling in areas such as AI diagnostics, sensor management, and digital compliance is driving segmental growth. Training and simulation tools now include virtual maintenance manuals, interactive system diagrams, and real-time fault replication. These solutions are also being used for recurrent training and certifications, ensuring compliance with aviation authorities. Their cloud-based deployment ensures accessibility across locations, particularly useful for global airline operations. By minimizing the risk of human error and maximizing learning speed, training solutions are becoming integral to MRO workforce development. The scalability and flexibility of these tools make them a high-growth area in digital aviation.

Deployment Mode Insights

How Does the Cloud-Based Segment Dominate the Digital MRO Market in 2025?

The cloud-based segment dominated the market in 2025 due to its flexibility, scalability, and low upfront investment. Companies are increasingly adopting SaaS platforms to streamline operations without heavy IT infrstructure. With real-time data access, remote monitoring, and multi-location integration, cloud software ensures agility in today's fast-moving food industry. AI, IoT, and machine learning further enhance operational intelligence. Cloud systems are also crucial for enabling predictive maintenance and demand forecasting, helping manufacturers stay ahead of market shifts. As cybersecurity features improve, even highly regulated segments are growing confident in cloud-based compliance solutions.

Many enterprises are choosing cloud models to reduce downtime and improve efficiency across production lines. Cloud software also supports automatic updates, reducing the need for manual intervention and keeping systems up to date. Cost-effective subscription models appeal to both large and small enterprises, promoting widespread adoption. Cloud platforms enable easy integration with third-party logistics, e-commerce, and raw material vendors, creating a seamless digital economy. As remote work and decentralized operations continue, cloud-based food manufacturing software ensures continuity and adaptability. With increasing global internet penetration, even manufacturers in emerging economies are embracing the cloud shift.

The hybrid segment is expected to grow at the highest CAGR during the projection period. This model is increasingly favored by organizations aiming to balance legacy systems with modern digital needs. It enables sensitive data to be maintained on-premises while leveraging the scalability of the cloud for analytics and collaboration. Airlines and MRO firms using hybrid models can gradually transition to digital without disrupting existing operations. This flexibility is particularly beneficial for large-scale, global operations with varied IT infrastructure across locations. Hybrid systems also enhance cybersecurity by segmenting access based on operational needs.

As data volume grows from sensors and maintenance logs, hybrid solutions provide robust support without compromising performance. These systems allow customization, letting companies prioritize which modules run on cloud versus local servers. It also offers better disaster recovery options by distributing data backups across environments. Hybrid setups support progressive adoption of digital tools, minimizing resistance from traditional teams. Compliance and data residency regulations are also easier to manage under a hybrid model. This adaptability makes hybrid deployment the favored choice for digital MRO transformation.

Component Insights

Why Did the Solutions/Software Segment Dominate the Market in 2025?

The solutions/software segment dominated the digital MRO market in 2025, as these platforms serve as the foundation, integrating various data sources into actionable insights. Software tools help streamline inspections, automate workflows, and maintain regulatory compliance. AI-powered modules within these solutions enhance predictive analytics and part tracking. Maintenance logs, technician performance, and fleet-wide health monitoring are all handled via centralized dashboards. Their modular architecture allows for easy updates and customization, making them essential for any digital transition.

The services segment is expected to grow at the fastest rate throughout the forecast period. Consulting, integration, training, and maintenance services are in high demand as digital systems grow more complex. MRO providers are outsourcing digital transformation management to specialists to ensure smooth execution. Service providers also support compliance with aviation authorities, especially when integrating new tech into existing frameworks. Managed services are becoming popular, offering continual upgrades, cybersecurity, and performance optimization. These services ensure long-term ROI on digital investments.

Regional Insights

U.S. Digital MRO Market Size and Growth 2026 to 2035

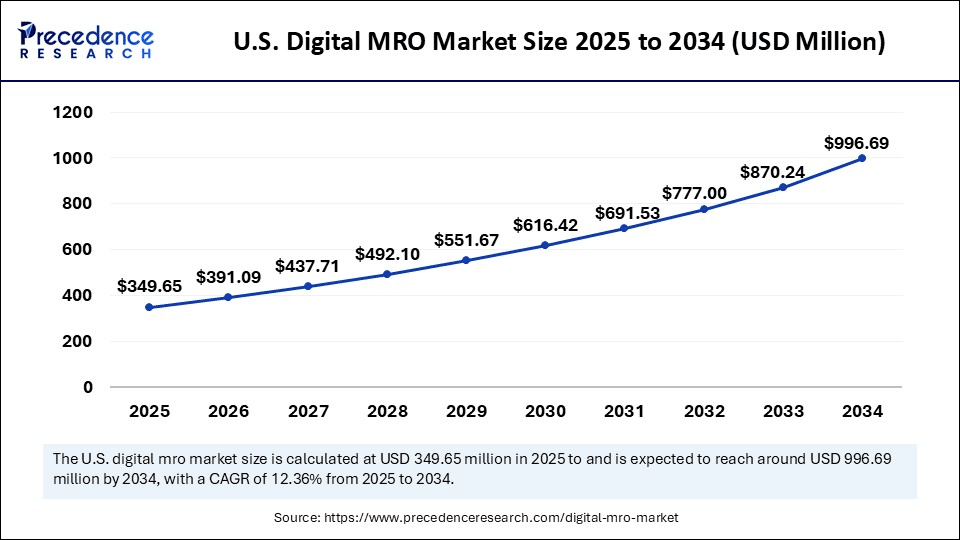

The U.S. digital MRO market size is evaluated at USD 349.65 million in 2025 and is projected to be worth around USD 1101 million by 2035, growing at a CAGR of 12.15% from 2026 to 2035.

What Made North America the Dominant Region in the Digital MRO Market?

North America continues to dominate the digital MRO market, driven by its technologically advanced aviation ecosystem. Major airlines and MRO providers in the region are heavily investing in artificial intelligence (AI), internet of things (IoT), anddigital twin technologies to streamline operations. The region's strong infrastructure, high digital literacy, and robust regulatory environment enable faster adoption of cutting-edge solutions. Strategic collaborations between OEMs, software firms, and aviation maintenance companies are further strengthening the digital MRO frameworks. Additionally, North America benefits from the presence of major aerospace manufacturers and tech innovators who are setting global benchmarks. These factors collectively make it a dominant force in shaping the digital future of aircraft maintenance.

The U.S. is a major player in the North American digital MRO market. The U.S.-based carriers are prioritizing predictive maintenance to enhance safety and meet stringent FAA standards. Training programs powered by AR/VR are being actively introduced to upskill technicians, thereby reducing labor-related inefficiency. Cloud-based MRO platforms are also seeing higher uptake, especially for managing aircraft maintenance documentation and compliance records. The growing adoption of sustainable aviation practices is pushing companies toward digitized maintenance tracking to optimize performance. Altogether, North America serves as both a testbed and a launchpad for next-gen MRO technologies.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is expected to be the fastest-growing market for digital MRO, driven by its booming aviation sector and expanding airline fleets. Countries like China, India, Japan, and Singapore are making significant investments in modernizing their aviation infrastructure. As new aircraft deliveries continue to rise, the demand for efficient, tech-enabled maintenance operations is becoming increasingly urgent. Additionally, the presence of competitive, low-cost carriers is accelerating the adoption of cost-effective and data-driven maintenance solutions. This growth trajectory is also supported by favorable government initiatives focused on aviation digitization. The region is also exploring blockchain integration for improved traceability and compliance in parts and service records.

India is a significant player in the digital MRO market in Asia Pacific. This is mainly due to the increasing collaboration between airlines, local MRO providers, and global tech firms. Predictive analytics and IoT-enabled asset tracking are gaining traction, helping reduce downtimes. Countries like Singapore and South Korea are emerging as MRO technology hubs, fostering innovations through smart hangars and connected maintenance bays. Furthermore, skill development programs are being introduced to build a digitally equipped aviation workforce.

How is the Opportunistic Rise of Europe in the Digital MRO Market?

Europe is expected to grow at a significant rate in the market throughout the forecast period due to increasing airline fleet expansions, stringent safety and regulatory compliance requirements, and rising adoption of predictive maintenance technologies. Integration of IoT, AI, and digital twin solutions enhances operational efficiency and reduces aircraft downtime. Additionally, government initiatives promoting aviation digitization and sustainability are driving investments in advanced MRO technologies across the region.

UK Market Analysis

The UK digital MRO market is expanding as airlines and maintenance providers invest in automated inspection systems, advanced analytics, and real-time monitoring tools to optimize maintenance schedules. Growing demand for cost-effective, data-driven solutions, coupled with the development of smart hangars and connected maintenance facilities, is accelerating adoption. Collaboration with tech firms is also fostering innovation in the sector.

Top Companies Operating in the Market & Their Offerings

- Lufthansa Technik

A leading aviation maintenance provider offering digital MRO solutions, predictive analytics, and connected maintenance platforms that enhance aircraft reliability, reduce downtime, and streamline maintenance planning for global airline fleets. - General Electric (GE Digital)

Provides industrial IoT and analytics platforms that support predictive maintenance, asset performance management, and digital twin technologies for aviation and MRO operations, improving efficiency and operational insights. - IBM Corporation

Delivers AI-driven asset management, IoT integration, and blockchain-enabled maintenance tracking solutions that help airlines and MRO providers optimize turnaround times and ensure regulatory compliance. - Microsoft Corporation

Offers cloud-based digital MRO solutions with Azure IoT, AI, and mixed reality tools to support predictive maintenance, real-time monitoring, and collaborative aircraft maintenance workflows. - IFS AB

Provides enterprise software for aviation MRO, including maintenance planning, repair scheduling, and field service management, facilitating streamlined operations and improved resource utilization. - SAP SE

Delivers integrated digital MRO and supply chain solutions on its enterprise platform, enabling real-time data analytics, predictive maintenance, and enhanced regulatory compliance for aviation operators. - Ramco Systems

Offers cloud native MRO software powered by AI and mobile technologies, covering maintenance execution, inventory management, and compliance reporting for aviation and defense sectors. - Collins Aerospace

Produces advanced avionics and digital maintenance technologies, including predictive diagnostics and real-time health monitoring systems that optimize fleet performance and maintenance efficiencies. - Capgemini SE

Provides consulting and digital transformation services, implementing IoT, AI, and analytics solutions that modernize aviation MRO operations and support data-driven decision making across maintenance lifecycles.

Other Digital MRO Market Companies

- HCLTech

- Swiss Aviation Software Ltd. (AMOS)

- Atos SE

- ST Engineering Aerospace

- Accenture

- SITA

- Oracle Corporation

- TCS (Tata Consultancy Services)

Recent Developments

- In July 2025, as part of a strategic move to strengthen aviation infrastructure, the Odisha government finalized all procedures to establish the state's first digital maintenance, repair, and overhaul (MRO) facility in Bhubaneswar. This represents a major step forward in developing aviation-related economic ecosystems, an official stated. Managed by the Commerce and Transport department, the new policy seeks to boost regional and international air connectivity through targeted incentives, route support, and airline facilitation. In a short period, the policy has greatly expanded Odisha's aviation presence both globally and domestically.(Source: https://www.thehansindia.com)

- In September 2024, Ramco Systems released version 6.0 of its Aviation Software, a revolutionary product release designed to transform M&E and MRO operations with AI-driven insights, advanced automation, and seamless integration. An integrated solution with modules for Contracts, Engineering, Planning, Maintenance, Supply Chain Management, Finance, ePUBS and advanced mobility capabilities, Ramco Aviation Software 6.0 is built to handle the challenges of tomorrow.(Source: https://www.ramco.com)

Segments Covered in the Report

By Technology

- Predictive Maintenance

- Big Data Analytics

- Internet of Things (IoT)

- Digital Twin

- Blockchain

- Artificial Intelligence (AI) & Machine Learning

- Augmented Reality (AR) / Virtual Reality (VR)

- Robotics and Automation

- Others

By End User

- Airlines

- Full-Service Carriers

- Low-Cost Carriers

- Charter Operators

- Others

- MRO Service Providers

- OEMs (Original Equipment Manufacturers)

By Application

- Inspection

- Predictive Maintenance & Planning

- Performance Monitoring

- Part Replacement & Inventory Management

- Training & Simulation

- Workforce Management

- Compliance & Safety Reporting

- Others

By Deployment Mode

- On-Premises

- Cloud-Based

- hybrid

By Component

- Solutions/Software

- MRO Suite Platforms

- Digital Twin Platforms

- Predictive Maintenance Systems

- AR/VR Modules

- Others

- Services

- Consulting & Advisory

- Implementation & Integration

- Support & Maintenance

- Training Services

- Hardware

- Sensors

- Wearables (AR Glasses, Smart Helmets)

- Drones & Inspection Tools

- Edge Devices

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting