What is the Dual Chamber Syringe Filling Machine Market Size?

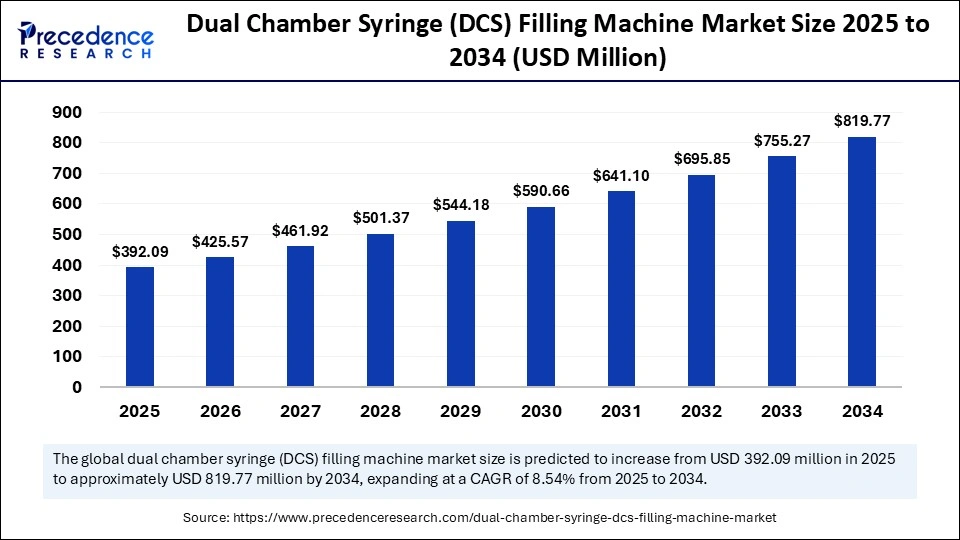

The global dual chamber syringe filling machine market size accounted for USD 392.09 million in 2025 and is predicted to increase from USD 425.57 million in 2026 to approximately USD 819.77 million by 2034, expanding at a CAGR of 8.54% from 2025 to 2034. The market for dual chamber syringe filling machines is driven by the growing demand for prefilled and lyophilized injectable drug formats in the biopharmaceutical industry.

Market Highlights

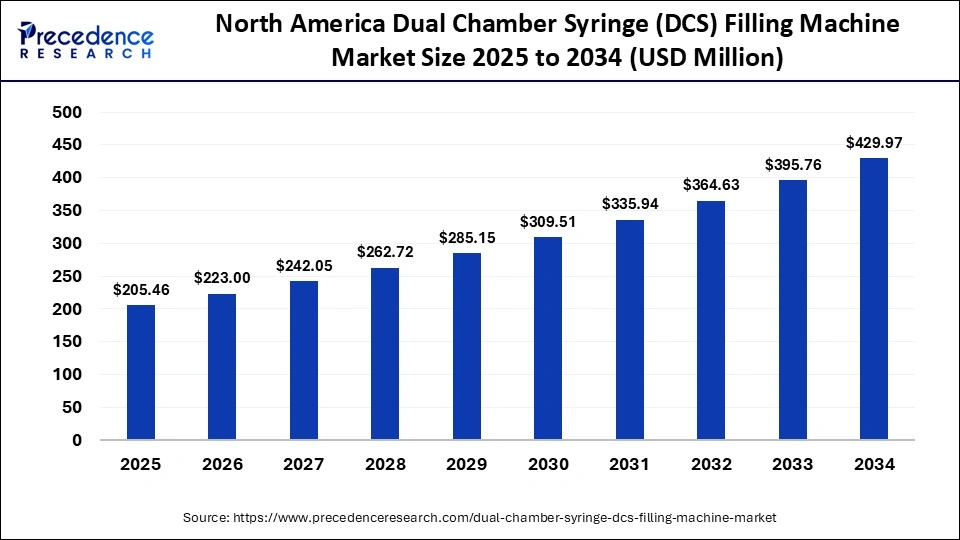

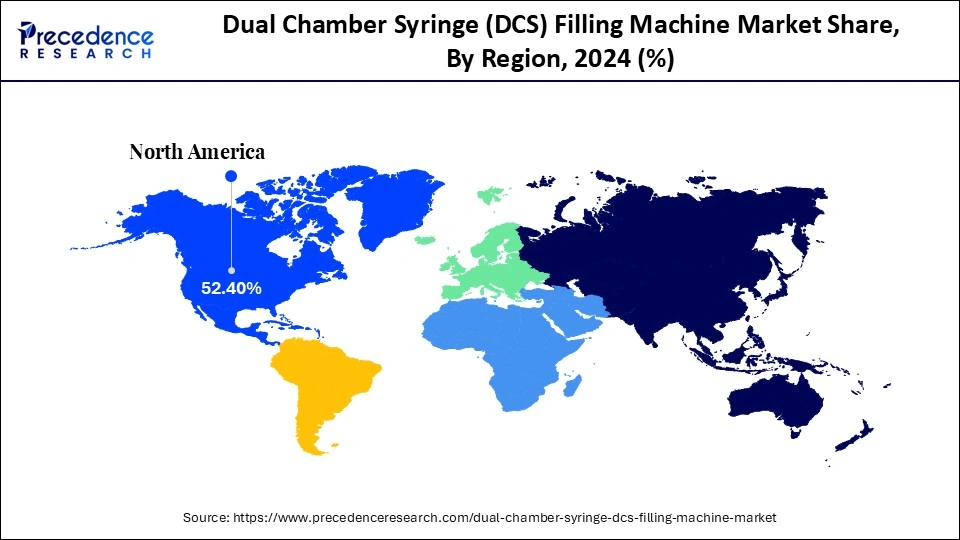

- North America dominated the market, holding the largest market share of 52.4% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 8.5% between 2025 and 2034.

- By machine type, the fully automatic inline filling & stoppering systems segment held the largest market share of 62.4% in 2024.

- By machine type, the semi-automatic/bench/laboratory systems segment is expected to expand at a remarkable CAGR of 7.5% between 2025 and 2034.

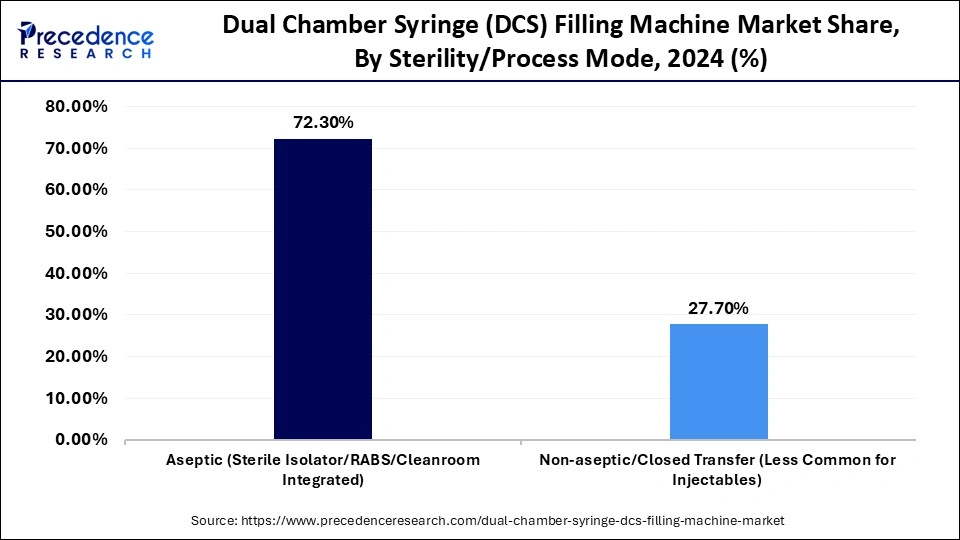

- By sterility/process mode, the aseptic (sterile isolator/RABS/cleanroom integrated) segment contributed the highest market share of 72.3% in 2024.

- By sterility/process mode, the non-aseptic/closed transfer (less common for injectables) segment is growing at a highest CAGR of 7.8% between 2025 and 2034.

- By chamber/product type filled, the liquid/lyophilized powder segment captured the biggest market share of 56.4% in 2024.

- By chamber/product type filled, the liquid/diluent + drug compartments segment is expected to expand at a solid CAGR of 7.7% CAGR from 2025 to 2034.

- By end-user/buyer, the pharmaceutical & biotech manufacturers segment accounted for the highest market share of 58.4% in 2024.

- By end-user/buyer, the contract development & manufacturing organizations segment is growing at a remarkable CAGR 7.5% between 2025 and 2034.

- By application/drug class, the biologics & monoclonal antibodies segment contributed the major market share of 52.3% in 2024.

- By application/drug class, the vaccines & immunotherapies segment is expected to expand at a remarkable CAGR of 7.8% between 2025 and 2034.

Injectables Revolutionization: The Dual-Chamber Syringe Filling Machines are Revolutionizing Pharmaceutical Production

The dual-chamber syringe filling machines are advanced pharmaceutical filling machines that can fill and assemble prefilled syringes containing two independent constituents, typically liquid-liquid or liquid-powder drugs. Precision volumetric filling, stoppering, sealing, and sterile transfer processes are automated or semi-automated, integrated into a single technology. Dual-chamber syringe systems are typically used in biologics, vaccines, and combination products to increase dosage precision, eliminate manual reconstitution for drug administration, and reduce contamination risks.

The rapid growth of biologic and biosimilar therapeutic agents is expanding the dual chamber syringe filling machine market, as these agents typically require careful mixing of unstable substances before inoculation. There has been a surge in regulatory emphasis on sterility and contamination control, leading to more pharmaceutical organizations investing in aseptic filling. In addition, the outsourcing trend toward contract development and manufacturing organizations for small-volume, high-value biologics favors the adoption of modular, flexible filling solutions.

Key AI shift in the Dual Chamber Syringe Filling Machine Market

Artificial intelligence is fostering a remarkable market revolution by offering greater accuracy, optimization, and quality. AI-based vision inspection systems can detect real-time micro-defects, particulate contamination, and volumetric anomalies, ensuring high-grade product sterility and compliance with GMF requirements. Predictive maintenance algorithms reduce downtime and machine failures by analyzing machine performance data, and adaptive control systems autonomously adjust the settings of the filling parameters for different viscosities and formulations. Additionally, integrating AI can support the creation of data-driven validation and digital twins, and make documentation and regulatory audits more efficient. The use of AI is transforming syringe filling processes through enhanced throughput, consistency, and by facilitating the move to intelligent, self-sufficient pharmaceutical production conditions.

Dual Chamber Syringe Filling Machine Market Outlook

The syringe filling machine market is enjoying growth in the dual chamber syringe, with increasing demand in the biologics, combination drugs, and sterile injectables. Automation, high dosing accuracy, and GMP-compliant aseptic technologies are driving the adoption of pharmaceutical and biotechnology manufacturing plants.

The application throughout the globe is increasing rapidly in North America, Europe, and the Asia-Pacific due to the advancements in the aseptic processing, the production of vaccinations, and biologic preparations. Emerging markets are adopting high-speed, modular systems to expand sterile drug production capacity and improve exportability.

Pharmaceutical giants, Pfizer, Roche, and AstraZeneca, equipment manufacturers, Syntegon, Bausch+Strobel, and OPTIMA are the largest investors. Precision filling and automated assembly technologies are advancing through ongoing investments in R&D and strategic alliances.

Startup firms are also gravitating towards small and flexible two-chamber syringe systems, which are coupled with robotics and AI-based inspection. Examples of companies that are dominating the efficiency pack include Groninger and Steriline because they have embraced smart automation, computerized validation, and lower-cost and customized solutions to CDMOs and small batches of biologic manufacturing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 392.09 Million |

| Market Size in 2026 | USD 425.57 Million |

| Market Size by 2034 | USD 819.77 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Machine Type, Sterility/Process Mode, Chamber/Product Type Filled, End-User/Buyer, Application/Drug Class, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Dual Chamber Syringe Filling Machine Market Segment Insights

Machine Type Insights

The fully automatic inline filling & stoppering systems segment held a 62.4% share of the dual chamber syringe filling machine market in 2024, due to their high efficiency, accuracy, and adherence to aseptic manufacturing standards. These systems offer high-speed, contamination-free filling and sealing, ideal for large-scale production of biologics, vaccines, and combination drugs. These systems are favored by pharmaceutical manufacturers because they can manage various formulations, comply with regulatory requirements, and be cost-effective. Their ability to scale up and fit across various syringe types is an advantage that can continue to cement their market dominance.

The semi-automatic/bench/laboratory systems segment captured a 7.5% market share in 2024 and is expected to grow significantly. Such systems have been widely used in research institutes, pilot-scale manufacturing facilities, and CDMOs that handle clinical trial materials. They are simple to use, inexpensive to scale, and easy to validate, making them suitable for initial formulation development and early-stage precision dosing. Although they have lower throughput than fully automated systems, their flexibility and precision enable innovation in biologics, biosimilars, and lyophilized drug formulations, and thus are a key component in R&D and pre-commercial-level manufacturing processes.

Modular filling modules are gaining popularity due to their modular design and ease of attachment to existing production lines. These systems enable pharmaceutical organizations to refurbish older systems with state-of-the-art filling, stoppering, and inspection capabilities without a complete system upgrade. They are both flexible for large- and small-scale applications and support scalability as product pipelines change. Individual modules are particularly welcome in multi-product plants, where rapid format changes and proper product cleaning are the primary factors for minimising downtime. The fact that the usage has been increasing in CDMOs and small biotech companies indicates their economic nature in enhancing production agility.

Sterility / Process Mode Insights

Aseptic (Sterile Isolator / RABS / Cleanroom Integrated): The aseptic (sterile isolator / RABS / cleanroom integrated) segment held a 72.3% share in the dual chamber syringe filling machine market in 2024, driven by increasing demand for biologics, vaccines, and injectables, and by the need for contamination-free manufacturing. These are systems that guarantee a completely closed, sterile environment through restrained access barrier systems (RABS) and isolators, which reduce human contact and ensure compliance with regulatory requirements, including FDA aseptic and EMA aseptic requirements. Complex biologic formulations and lyophilized drugs have also increased the need to use aseptic technologies to maintain drug integrity and to protect patient safety.

The non-aseptic/closed transfer (less common for injectables) segment accounted for a 7.8% share of the dual chamber syringe filling machine market in 2024. The systems are also applied to products that do not need high-level aseptic conditions and provide easier configurations and a lower cost of operation. Though non-aseptic filling lines cannot achieve the same high containment level as aseptic systems, they are suitable for some diagnostic or veterinary uses where sterility need not be as high. The segment is expected to grow in the future as advances in closed transfer systems and partial containment systems continue, driven by the need for cost-effective remedies for identified, low-contaminated pharmaceutical operations.

Chamber/Product Type Filled Insights

The liquid/lyophilized powder (liquid + powder) segment led the market, accounting for 56.4% share in 2024, as it is widely used in biologics, vaccines, and protein-based formulations that require only liquid reconstitution before injection. To ensure optimal diluent potency and a long shelf life, the liquid diluent and the lyophilized drug are separated in dual-chamber systems until required, which makes the product stable. The increasing need for patient-ready, self-administered injectables, as used in home care or for the treatment of chronic diseases, further accelerates the shift to liquid-powder formulations.

The liquid/diluent + drug compartments segment is expected to grow at a significant CAGR over the forecast period, with a 7.7% market share, as it is an easy-to-use, co-existing treatment, alongside combination and multi-dosage options. These two-chamber formats make drug reconstitution more convenient and allow patients or medical practitioners to integrate and deliver drug administration effectively during care. Increased use of bespoke biologics and emergency injectables, and rapidly prepared vaccines, all promote expansion of the market in the future. With a focus on convenience and reduced medical errors in the pharmaceutical industry, liquid/diluent forms are becoming the solution of choice for advanced injectable drug delivery systems.

The liquid/liquid dual chamber segment is gaining momentum as it finds application in therapies that require the precise combination of two liquids, such as vaccines and regenerative medicine. They can blend reactive or unstable liquids in a controlled environment and maintain the integrity of the product during storage. Regulatory compliance and consistency are guaranteed through automated filling, high-accuracy dosing, and sterile transfer technologies.

End-User/Buyer Insights

The pharmaceutical and biotech manufacturers (in-house) segment accounted for 58.4%, driven by the rise in in-sourcing of biologics, vaccines, and high-end injectables. Even the major pharmaceutical companies are investing in state-of-the-art aseptic filling lines to ensure they do not lose control over product quality, sterility, and regulatory standards. They also have integrated automation, robotic handling, and AI-based quality checks, which are useful to these manufacturers to increase throughput and minimize contamination risk.

Contract Development & Manufacturing Organizations: The segment of contract development and manufacturing organizations is projected to experience significant growth, with a 7.5% share in 2024. The CDMOs are flexible, require less capital, and can offer sophisticated aseptic equipment to manufacture batches even as small as 100 units and clinical scale. Their growing worldwide presence, combined with the use of artificial intelligence to automate and provide modular filling platforms, allows them to scale effectively and manufacture in GMP-compliant environments. With emerging biotech companies and mid-sized pharma players seeking faster market entry and lower costs, the partnership with CDMOs also becomes a primary driver of expansion in the dual-chamber syringe filling machine ecosystem.

The dual chamber syringe filling machine market supports innovations and formulations at early stages, serving small biotech firms, clinical trial sponsors, and laboratories engaged in research and development. These organizations primarily rely on semi-automatic or bench-scale systems to conduct pilot studies, batches of prototype and proof-of-concept testing of drugs. Their concerns are individualized medicine, biosimilars, and novel combinations that they need to fill with high precision, in small volumes, and with flexibility.

Application / Drug Class Insights

Biologics & Monoclonal Antibodies: The biologics & monoclonal antibodies segment led the market, accounting for 52.3% in 2024, as demand for highly complex, non-degraded, accurate injectable delivery systems increased. Biologics and mAbs are extremely sensitive to temperature and contamination, and thus two-chamber systems in which components are not mixed until administration are needed. These machines can aseptically fill, dose accurately, and seal up tightly- which is essential in preserving the structural integrity of large-molecule drugs. The trend toward self-administered biologic therapies and home care injectables supports market growth.

The vaccines and immunotherapies segment is set to experience an impressive CAGR during the forecast period, with a 7.8% share in 2024. Vaccines that require adjuvants and active ingredients to be stored separately to maintain potency and increase shelf life are also using dual-chamber syringes. Moreover, oncology and infectious disease immunotherapies are also dominating with dual-chamber designs to provide proper reconstitution and on-demand delivery.

The small-molecule combination injectables segment is growing, with pharmaceutical firms developing fixed-dose and multi-component formulations for the management of pain, heart disease, and diabetes. These formulations are stabilized using dual-chamber syringe filling machines that do not contact reactive compounds until use, thereby preserving their efficacy and safety. High-volumetric control and aseptic barrier systems ensure high-quality products and regulatory compliance.

Dual Chamber Syringe Filling Machine Market Region Insights

The North America dual chamber syringe filling machine market size is estimated at USD 205.46 million in 2025 and is projected to reach approximately USD 429.97 million by 2034, with a 8.55% CAGR from 2025 to 2034.

Why Did North America Lead the Global Dual Chamber Syringe Filling Machine Market in 2024?

North America led the global market with the highest market share of 52.4% in 2024, driven by a strong pharmaceutical manufacturing base, rapid adoption of automation, and increased biologic manufacturing. The region established regulatory framework, including the rigorous FDA standards for GMOs, encourages the adoption of aseptic filling technologies that ensure sterility and accuracy. Market expansion is driven by increased demand for prefilled dual-chamber syringes for biologics, vaccines, and combination therapies. Market expansion is enhanced by the growth of key pharmaceutical and biotech companies and the development of AI-integrated and robotic filling technologies.

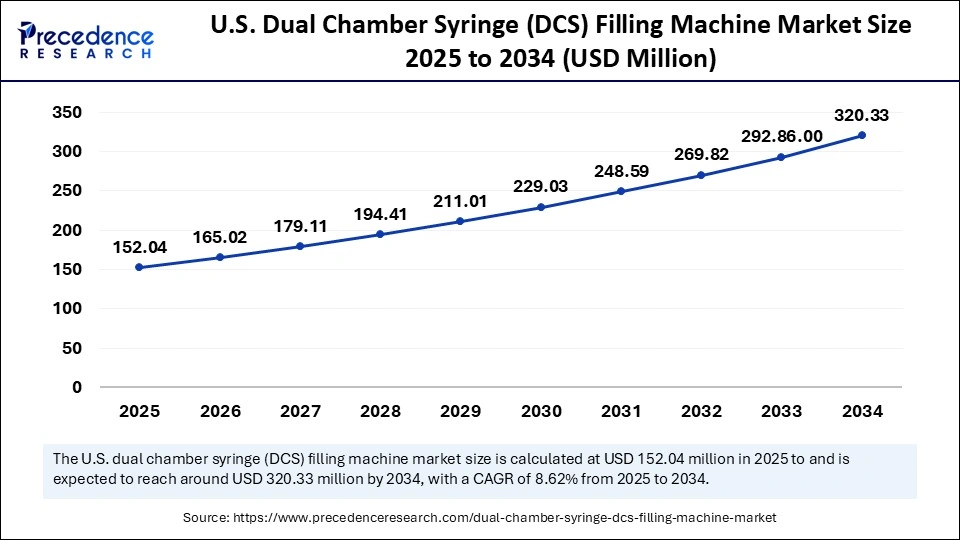

The U.S. dual chamber syringe filling machine market size is calculated at USD 152.04 million in 2025 and is expected to reach nearly USD 320.33 million in 2034, accelerating at a strong CAGR of 8.62% between 2025 and 2034.

U.S Dual Chamber Syringe Filling Machine Market Analysis

The U.S. accounted for the largest share of the North American dual-chamber syringe filling machine market in 2024, driven by a well-established biopharmaceutical industry and the growing adoption of precision aseptic manufacturing. The increased production of monoclonal antibodies, vaccines, and injectable biologics has increased the need to develop new high-end dual-chamber filling solutions that are both sterile and have reduced human intervention. The presence of major manufacturers such as Pfizer, Amgen, and Eli Lilly, as well as significant investments in automated and AI-based inspection systems, is boosting the growth of the domestic market.

Asia Pacific is estimated to achieve the highest CAGR throughout the forecast period, with 8.5% market share, driven by rapid growth in pharmaceutical production, rising production of biologics and biosimilars, and strong government support for healthcare facilities. China, India, South Korea, and Japan are making significant investments in automated, GMP-compliant aseptic filling technologies to meet global export requirements. The emergence of local CDMOs, combined with cost-effective manufacturing and a skilled workforce, is attracting international pharmaceutical collaborations. Also, the increasing incidence of chronic diseases and the transition to self-injection syringes are enhancing the demand for the dual-chamber syringe system.

China Dual Chamber Syringe Filling Machine Market Trends

The global growth of the dual chamber syringe filling machine has been spearheaded by China in the Asia Pacific, driven by rapid expansion in biologics, vaccines, and contract manufacturing. Regulatory changes in the nation that promote the implementation of GMP and quality improvement are influencing local companies to deploy high-precision, high-aseptic fillers. Demand for biosimilar drugs has increased, and the massive production of vaccines by big companies has also placed China on the global stage of sterile manufacturing. With China increasingly dominating global biopharmaceutical supply chains, its market will experience consistent double-digit growth and higher exports of underdeveloped injectable products.

The European dual chamber syringe filling machine market is witnessing sustainable growth driven by a strong manufacturing base, advanced automation, and heightened regulatory emphasis on aseptic processing in the region. The rising prevalence of chronic conditions and an aging population are driving demand for self-injections as a form of therapy, thereby aiding market growth. In addition, production efficiency and traceability are increasing due to ongoing investment in Industry 4.0 and AI-integrated filling technologies. Favourable government policies and a sustainability-oriented manufacturing cycle also reinforce Europes role as a major centre for high-precision, automated pharmaceutical filling solutions.

UK Dual Chamber Syringe Filling Machine Market Trends

The UK is becoming a major player in the European dual chamber syringe-filling machine market, owing to the fast-growing biologics, biosimilars, and highly developed therapeutic medicinal products (ATMPs). The robust network of pharmaceutical R&D centers and CDMOs in the country is investing in the development of modular, fully automated filling systems to sustain the increasing demand for sterile injectables worldwide. Moreover, the UK growing interest in personalized medicine, combined with increased manufacturing of dual-chamber prefilled syringes for clinical and commercial applications, positions the UK as an emerging leader in advanced injectable production in the European market.

Top Dual Chamber Syringe Filling Machine Market Companies

Provides advanced aseptic processing, filling, and packaging systems for pharmaceuticals and biotech products, emphasizing high automation, precision dosing, and compliance with stringent regulatory standards.

Supplies highly automated pharmaceutical filling, sealing, and packaging equipment for injectables, vials, syringes, and diagnostics, with strong expertise in sterile and high-speed systems.

Delivers comprehensive pharmaceutical packaging solutions including filling, sealing, sterilization, and assembly systems, supporting injectable, oral, and specialty drug production.

The former Bosch Packaging division (now Syntegon) develops high-performance sterile filling machines, isolators, and inspection technologies tailored for biologics and small-volume injectables.

Manufactures precision filling and sealing equipment for small-dose pharmaceutical and cosmetic applications, focusing on servo-driven accuracy and flexible production.

Provides aseptic filling, closing, and washing systems for vials, syringes, cartridges, and IV bags, widely used in biotech and sterile drug manufacturing.

Offers specialized liquid filling, closing, and assembly systems for pharma applications, known for modularity, innovation, and ability to handle complex container formats.

The U.S. arm of OPTIMA, providing pharmaceutical filling, assembly, and packaging technologies with strong service and integration capabilities for regulated markets.

Develops robotic, closed-system aseptic filling solutions for vials and syringes, widely adopted for biological drugs and small-batch production (now part of Cytiva).

Supplies pharmaceutical machinery, including filling, capping, labeling, and packaging systems designed for reliability and compliance in sterile production environments.

Recent Developments

- In September 2025, ApiJect Systems declared a milestone when they launched an innovative product in the form of a prefilled plastic syringe that is subject to the FDA regulatory approval. The creation is a transition towards cost-effective, scalable, and easily distributable syringe formats within the healthcare sector.

(Source: https://www.google.com) - In April 2025, Syntegon unveiled the MLD Advanced filling machine for ready-to-use (RTU) nested syringes, which is set to fill at high speed with full process control. The innovation expands Syntegon potential in the production of dual-chamber and prefilled syringes.

- In March 2024, Groniger and SKAN announced a strategic partnership to provide Civica with new advanced sterile filling lines for its new plant. The alliance highlights the increased attention towards automation and aseptic perfection in the production of dual-chamber syringes.

Dual Chamber Syringe Filling Machine MarketSegments Covered in the Report

By Machine Type

- Fully automatic inline filling & stoppering systems

- Semi-automatic/bench/laboratory systems

- Standalone filling modules

By Sterility/Process Mode

- Aseptic

- Non-aseptic/closed transfer

By Chamber/Product Type Filled

- Liquid/liquid dual chambers

- Liquid/lyophilized powder

- Liquid/diluent + drug compartments

By End-User/Buyer

- Pharmaceutical & biotech manufacturers

- Contract Development & Manufacturing Organizations

- Small biotech/clinical trial sponsors / R&D labs

By Application/Drug Class

- Biologics & monoclonal antibodies

- Vaccines & immunotherapies

- Small-molecule combination injectables

- Specialty & ophthalmic biologics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting