Electrolyte Tablet Market Size and Forecast 2025 to 2034

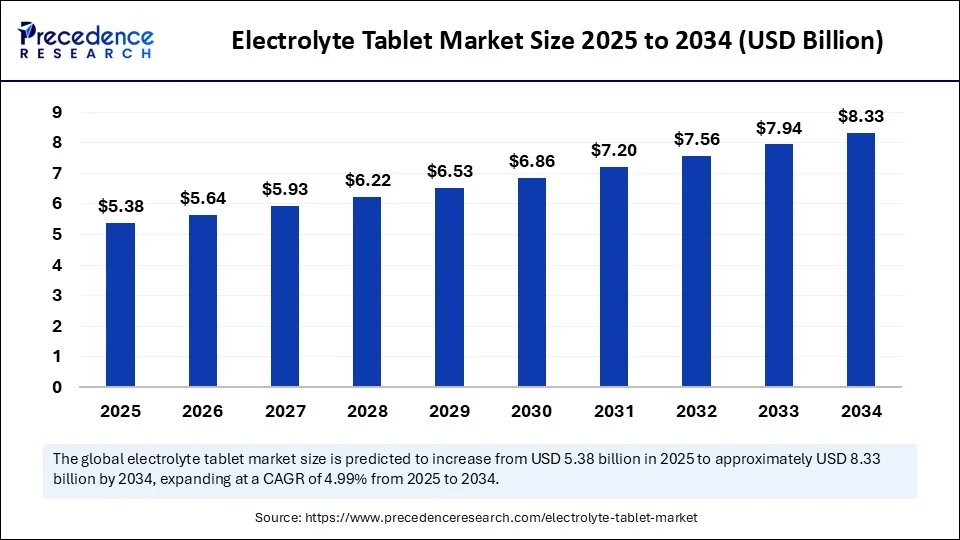

The global electrolyte tablet market size accounted for USD 5.12 billion in 2024 and is predicted to increase from USD 5.38 billion in 2025 to approximately USD 8.33 billion by 2034, expanding at a CAGR of 4.99% from 2025 to 2034. The electrolyte tablet market is experiencing significant growth, with its size expected to increase substantially in the coming years. Driven by rising health consciousness and hydration needs, it is projected to expand rapidly.

Electrolyte Tablet Market Key Takeaways

- In terms of revenue, the global electrolyte tablet market was valued at USD 5.12 billion in 2024.

- It is projected to reach USD 8.33 billion by 2034.

- The market is expected to grow at a CAGR of 4.99% from 2025 to 2034.

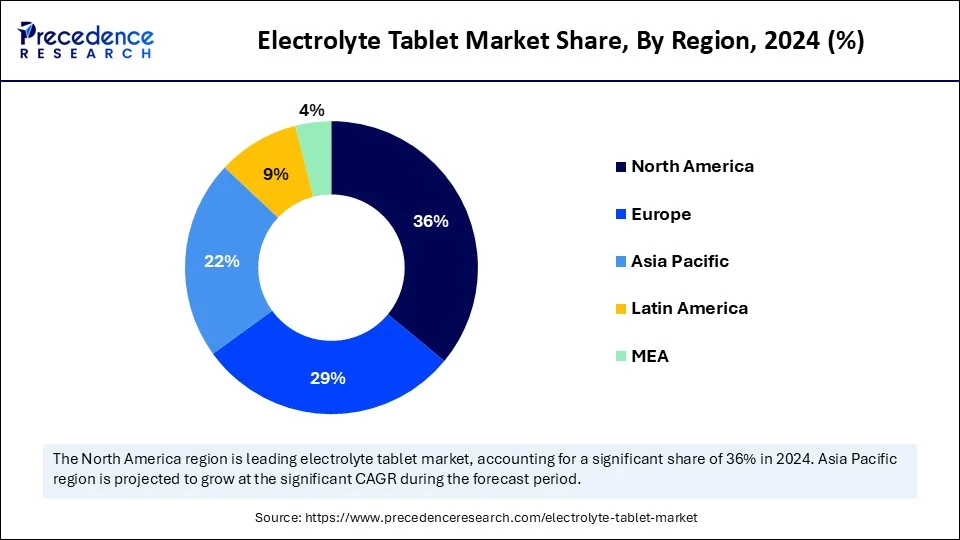

- North America held a major revenue share of approximately 36% of the electrolyte tablet market in 2024.

- Asia Pacific is expected to be the fastest-growing region in the upcoming years.

- By product type, the balanced blends segment held the maximum revenue share of 46% in the electrolyte tablet market size in 2024 and is expected to witness the fastest growth in the market over the forecast period.

- By flavor, the citrus segments captured the biggest market share of 34% in 2024.

- By flavor, the berry segment is expected to witness the fastest growth over the forecast period.

- By end user, the athletes & sports enthusiasts segment held the highest revenue share of 42% in 2024.

- By end user, the healthcare & recovery patients segment is expected to witness the fastest growth over the forecast period.

- By distribution channel, the pharmacies & drug stores segment held the maximum revenue share of 38% in 2024.

- By distribution channel, the online segment is expected to witness the fastest growth over the forecast period.

- By application, the sports & fitness hydration segment accounted for the significant market share of 50% in 2024.

- By application, the daily wellness & lifestyle segment is expected to witness the fastest growth over the forecast period.

- By packaging format, the tube packaging segment generated the major market share of 50% in 2024.

- By packaging format, the sachet/strip packaging segment is expected to witness the fastest growth over the forecast period.

How Smart Tech Meets Smart Hydration?

Artificial intelligence is reshaping the electrolyte tablet market by optimizing product development, personalization, and consumer engagement. AI-driven analysis of biometric data and hydration levels enables brands to create customized supplement formulations tailored to individual needs. Smart formulations tailored to individual needs. Smart wearables integrated with AI now provide real-time hydration monitoring, linking directly to electrolyte intake recommendations. Companies are leveraging predictive analytics to forecast demand, manage supply chains efficiently, and reduce waste. AI-also enhance customer education about hydration and electrolyte balance. This integration positions AI as a key enabler in driving innovation and customer loyalty in the sector.

Moreover, AI helps in analyzing consumer reviews and social media sentiment, offering insights for rapid product improvements. Personalized marketing campaigns powered by machine learning ensure that the right time. AI also aids in quality control by detecting inconsistencies in mineral blends and formulations during manufacturing. Startups are experimenting with AI-based apps that guide consumers on optimal electrolyte intake during workouts or illness recovery. This synergy of nutrition science and advanced technology is accelerating product adoption. Ultimately, AI is transforming electrolyte supplements into a more personalized, data-driven wellness experience.

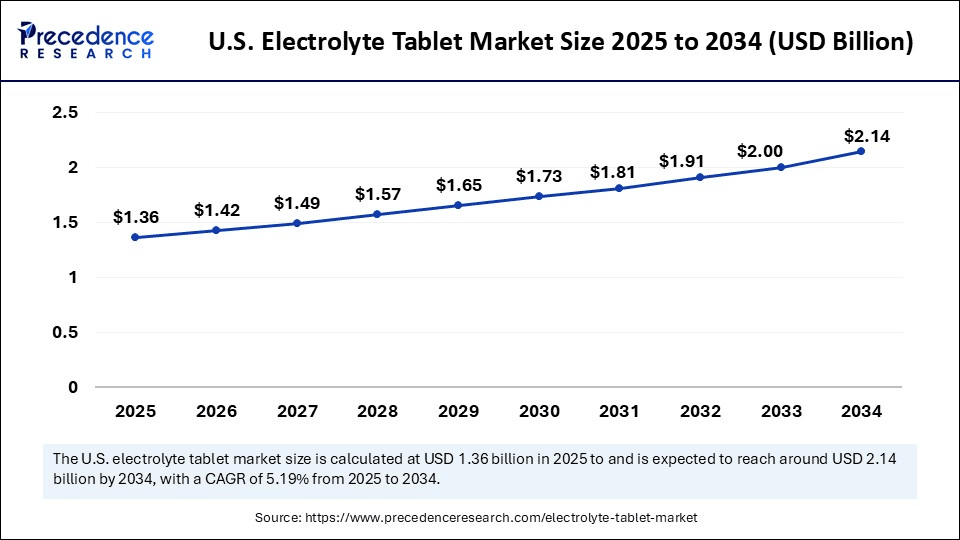

U.S. Electrolyte Tablet Market Size and Growth 2025 to 2034

The U.S. electrolyte tablet market size was evaluated at USD 1.29 billion in 2024 and is projected to be worth around USD 2.14 billion by 2034, growing at a CAGR of 5.19% from 2025 to 2034.

Why Does North America Lead the Electrolyte Tablet Market?

North America continues to dominate the electrolyte tablet market due to its strong culture of fitness, sports, and wellness. The region has a well-established consumer base ranging from professional athletes to everyday individuals focused on hydration and recovery. High awareness of dehydration-related health issues drives consistent product demand across all age groups. Consumers are highly receptive to innovation, making the region a prime testing ground for new formats like gummies, powders, and clean-label beverages. A strong retail network, including gyms, health stores, and e-commerce platforms, ensures wide availability. Additionally, marketing campaigns linking hydration to energy and productivity further strengthen consumer adoption.

The dominance is also supported by strong brand presence and heavy investment from major sports drink and nutrition companies. Clinical recommendations by healthcare professionals for hydration support during illness or physical exertion boost product credibility. The region's affluent population is willing to pay premium prices for personalized and functional supplements. Regulatory frameworks ensure product safety, which in turn fosters consumer trust and loyalty. Sustainability initiatives are also gaining traction, with eco-friendly packaging and low-sugar formulations aligning with health trends. Overall, North America remains the largest and most mature market for electrolyte supplements, setting global benchmarks for growth and innovation.

Why is Asia Pacific the Growing Market for Electrolyte Tablets?

Asia Pacific is the fastest-growing region in the electrolyte tablet market due to rapid urbanization and rising health awareness. Hot and humid climates across many countries increase the daily need for hydration solutions beyond sports usage. Expanding middle-class populations are showing greater interest in fitness, gyms, and wellness routines. Consumers are shifting from traditional hydration methods like coconut water to significantly balanced electrolyte supplements. Young demographics in countries like India, China, and Southeast Asia are driving demand for trendy, affordable products. E-commerce and social media influencers further accelerated adoption, making electrolyte supplements part of modern lifestyles.

Growth is further fueled by expanding distribution channels that make these products more accessible in both urban and semi-urban areas. Companies are localizing flavors and product formats to suit regional preferences, such as fruit-based powders and herbal blends. Price-sensitive markets are encouraging the rise of affordable sachets and single-serve packs. Governments and healthcare providers are also increasingly promoting hydration awareness in response to heat-related illnesses, with a large population base and untapped rural areas expected to emerge as the growth engine for the global electrolyte supplement industry in the coming years.

Fueling Hydration, Powering Performance

The electrolyte tablet market refers to the global industry focused on the manufacturing, marketing, and distribution of solid, dissolvable tablets containing essential electrolytes such as sodium, potassium, magnesium, calcium, and chloride. These tablets are designed to replenish lost electrolytes in the body, supporting hydration, muscle function, nerve signalling, and overall fluid balance. They are widely used by athletes, outdoor workers, travellers, and individuals recovering from illnesses or dehydration. The market encompasses a variety of formulations, flavors, packaging formats, and targeted functionalities, ranging from sports performance to medical recovery.

The electrolyte tablet market has emerged as a critical segment within the health and wellness industry, driven by rising awareness of hydration, sports performance, and recovery needs. These supplements, rich in essential minerals like sodium, potassium, calcium, and magnesium, help maintain fluid balance and prevent dehydration. Beyond athletes, consumers facing hot climates, physical labor, and even everyday wellness seekers are turning to electrolyte products. The market has expanded into multiple forms, including powders. Tablets, ready-to-drink beverages, and gummies cater to varied preferences. Growing concerns about lifestyle-induced fatigue and dehydration-related illness further add momentum. As wellness trends integrate into daily routines, the electrolyte supplements are shifting from niche sports products to mainstream health essentials.

The competitive landscape is shaped by sports nutrition brands, functional beverage companies, and emerging startups offering clean-label, sugar-free formulations. Innovation in flavors, convenient sachets, and natural sourcing has broadened consumer appeal. E-commerce platforms are playing a pivotal role by making electrolyte supplements easily accessible to global customers.

Market Key Trends

- Rising popularity of sugar-free and clean-label electrolyte products.

- Expansion of plant-based and natural mineral sources in formulations.

- Growth of on-the-go formats like stick packs, dissolvable tablets, and gummies.

- Increasing integration of electrolyte supplements into daily wellness regimens beyond sports.

- E-commerce and subscription models are driving accessibility and brand loyalty.

- Sustainability-focused packaging and eco-friendly innovations are gaining traction.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.33 Billion |

| Market Size in 2025 | USD 5.38 Billion |

| Market Size in 2024 | USD 5.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.99% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Flavor, End User, Distribution Channel, Application, Packaging Format, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Markets Dynamics

Drivers

Hydration at the Heart of Health

One of the strongest drivers of the electrolyte tablet market is the rising global awareness around hydration and its role in health and performance. Athletes, fitness enthusiasts, and everyday consumers are increasingly realizing that water alone may not be sufficient for optimal recovery and energy. The prevalence of heat-related illnesses and dehydration in hot climates has further boosted demand for electrolyte-rich solutions. Growth in endurance sports, marathons, and gym culture has also played a significant role in the market expansion. Additionally, medical professionals are recommending electrolyte supplements for faster recovery during illness, creating new consumer segments. These factors collectively ensure a strong, expanding customer base.

Demographic shifts also support the driver, with millennials and Gen Z showing a high inclination toward functional wellness products. Lifestyle changes such as long working hours, urban heat exposure, and increased travel amplify the need for quick hydration fixes. Moreover, the COVID-19 pandemic has heightened health consciousness, pushing consumers toward immunity-boosting and wellness-oriented products, including electrolyte supplements. The versatility of product formats allows easy incorporation into everyday routines. The wide relevance across different lifestyles underscores the importance of hydration as a non-negotiable aspect of modern health. As such, electrolyte supplements are riding a wave of health-first consumer demand.

Restraint

Barriers to widespread Hydration

Despite its growth, the electrolyte tablet market faces key restraints that may hinder expansion. One major challenge is the presence of sugar-laden formulations, which contradict the growing demand for healthier products. Consumers are becoming skeptical of “sports drinks” with excessive additives, which can slow adoption among health-conscious buyers. Another restraint is the high level of market fragmentation, leading to inconsistency in product quality and labeling. Regulatory scrutiny around claims and ingredients also creates barriers for newer entrants. Price sensitivity in developing regions further limits market penetration.

Moreover, educating consumers remains a hurdle, as many still associate electrolytes exclusively with professional athletes rather than everyday wellness. Some products also suffer from taste-related issues, reducing repeat purchases. The risk of overconsumption or improper use can lead to health concerns, creating hesitation among cautious consumers. Distribution challenges in rural or low-income areas add further difficulty. Intense competition among established beverage giants and small startups can squeeze margins and limit innovation. Unless addressed strategically, these restraints may slow down the market's true growth potential.

Opportunity

Tapping the Thirst of Tomorrow

The electrolyte tablet market presents vast opportunities through product innovation and consumer expansion. One key opportunity lies in targeting non-athletic demographics, such as office workers, travellers, and older adults needing better hydration. The growing demand for natural, organic, and plant-derived minerals creates room for differentiated product lines. Functional beverages fortified with electrolytes, combined with probiotics, vitamins, or adaptogens, also hold significant growth potential. Expanding distribution into developing markets with hot climates and rising fitness awareness is another major growth avenue. Subscription-based direct-to-consumer models present long-term engagement opportunities for brands.

Additionally, the convergence of technology and nutrition opens doors for smart supplements. Companies can collaborate with fitness apps, wearable devices, and digital health platforms to deliver personalized electrolyte solutions. There is also room for innovation in eco-friendly packaging, appealing to environmentally conscious consumers. Partnerships with healthcare providers for clinical hydration solutions could expand credibility and trust. Emerging markets in Asia, Africa, and Latin America represent untapped demand due to urbanization and rising disposable income. Overall, the market's opportunity is vast, with innovation, personalization, and accessibility driving the next phase of growth.

Product Type Insights

Why are Multi-Electrolyte Tablets Dominating the Electrolyte Tablet Market?

The multi-electrolyte tablets segment is dominating the electrolyte tablet market due to their balanced formulation covering sodium, potassium, magnesium, and calcium. Consumers prefer them for their convenience, as one tablet provides a comprehensive hydration solution. They are widely accepted by both athletes and everyday users because of their portability and ease of use. The demand is reinforced by healthcare professionals recommending multi-electrolyte tablets for quick rehydration. Additionally, their cost-effectiveness compared to buying multiple single-mineral products increases their appeal. This makes them the go-to choose for maintaining hydration across diverse consumer groups.

Their dominance is also driven by strong retail visibility in pharmacies, sports stores, and supermarkets. Brand leaders frequently market multi-electrolyte tablets as all-in-one solutions, reinforcing consumer trust. Innovation in flavors and sugar-free options has expanded their reach beyond sports enthusiasts to wellness-driven consumers. Long shelf life and compact packaging make them ideal for travel and outdoor use. Partnerships with sports events and fitness centers enhance consumer exposure. As a result, multi-electrolyte tablets continue to remain the most popular and widely consumed product type.

The same segment is also expected to be the fastest-growing segment in the electrolyte tablet market, driven by the growing popularity of marathon running, triathlons, and high-intensity sports. These products are designed with optimized ratios of electrolytes, often combined with carbohydrates, to meet long-duration energy needs. Professional athletes and serious fitness enthusiasts are the primary drivers of this demand. Companies are positioning endurance products as performance boosters rather than just hydration aids. This premium positioning allows brands to command higher pricing and stronger margins. As endurance sports culture expands globally, the demand curve continues to rise.

Growth is further fuelled by the personalization trend, with athletes seeking tailored formulas for their training and competitions. E-commerce has boosted accessibility, making endurance-focused supplements available worldwide. Collaborations with sports teams and sponsorships of endurance events have also enhanced brand visibility. Manufacturers are investing in research to create advanced blends that improve both hydration and stamina. Consumers see these products as essential performance enhancers rather than optional supplements. Overall, specialized endurance products are carving out the fastest-growing niche in the market.

Flavor Insights

Why Citrus is Dominating the Electrolyte Tablet Market?

The citrus segment was dominating the electrolyte tablet market in 2024, due to the appeal of flavors like lemon, lime, and orange to a wide audience, from children to adults. Their tangy taste masks the saltiness of electrolytes, making them highly palatable. Brands frequently highlight citrus flavors as natural and energizing, aligning with consumer expectations. The long-standing association of citrus with vitamin C also adds a perceived health benefit. This makes citrus the most trusted and widely purchased flavor in the market.

The popularity is reinforced by broad availability across tablets, powders, drinks, and gummies. Sports and fitness brands often launch citrus first, given its universal acceptance. Seasonal marketing campaigns also leverage citrus flavors as cooling options in hot weather. Repeat purchase rates are high because consumers rarely get flavor fatigue with citrus. It also aligns with low-sugar and natural ingredient trends, supporting clean-label claims. Consequently, citrus flavors remain the dominant and most enduring flavor profile in electrolyte supplements.

The berry segment has become the fastest-growing segment in the electrolyte tablet market. Flavors like strawberry, blueberry, and acai create a sense of premium and exotic appeal. They are increasingly used in wellness-focused supplements where taste differentiation is a key selling point. Berry flavors also carry a natural association with antioxidants, aligning with health-conscious consumer choices. This dual benefit of hydration plus perceived wellness is driving rapid adoption. As a result, berry-flavored supplements are quickly climbing in popularity.

The rise of berries is also supported by innovation in functional blends that combine berries with superfoods. Social media trends highlight berry flavors as fun, colorful, and Instagram-worthy. Limited-edition launches and berry-mix options further fuel curiosity and trial. Younger consumers particularly prefer berries over citrus, seeing it as more modern and lifestyle-oriented. The flexibility of berry flavors across powders, ready-to-drink, and gummies ensures wide application. This positions berry as the fastest-growing flavor segment in the market.

End User Insights

Why Are Athletes & Sports Enthusiasts Dominating the Electrolyte Tablet Market?

The athletes & sports enthusiasts segment made up the biggest share in the electrolyte tablet market. This group consumes supplements regularly during training, competitions, and recovery periods. Sports culture has ingrained the importance of hydration for stamina and muscle function. Brands focus heavily on this demographic, making athletes the primary target audience. Strong endorsement from sports figures boosts credibility and visibility. As a result, this segment consistently accounts for the largest market share.

The dominance is reinforced by partnerships between brands and fitness clubs, gyms, and sporting events. Athletes view electrolytes not just as supplements but as essentials for maintaining performance levels. Product availability in convenient formats like tablets and powders supports their active lifestyles. Professional sports leagues and college-level programs further drive structured usage. The heavy concentration of marketing resources toward this group ensures their continued dominance. Consequently, athletes and sports enthusiasts remain the most significant contributors to overall market growth.

The healthcare & recovery patients segment has become the fastest-growing segment in the electrolyte tablet market, due to rising medical use of electrolyte supplements. Doctors recommend them for patients recovering from dehydration, fever, or gastrointestinal illnesses. Hospitals and clinics are increasingly adopting them as part of recovery protocols. Older adults and individuals with chronic conditions also form a growing consumer base. The rising emphasis on preventive health is expanding demand beyond athletes to general wellness seekers. This makes healthcare and recovery the fastest-emerging end-user category.

The growth is also supported by retail pharmacies and healthcare distributors expanding product visibility. Electrolyte supplements are increasingly marketed as everyday recovery aids, not just sports-related solutions. Sugar-free and low-sodium variants are designed specifically for clinical and wellness applications. Public health campaigns highlighting hydration during heat waves and pandemics also drive adoption. This shift is creating a new wave of consumer acceptance in the healthcare segment. Ultimately, this end-user base is set to fuel the next phase of market expansion.

Distribution Channel Insights

Why Offline is Dominating the Electrolyte Tablet Market?

The offline segment has become a dominant force in the electrolyte tablet market, due to the ability to physically see and purchase supplements. Pharmacies, supermarkets, gyms, and specialty health stores provide easy accessibility. In-store promotions and sampling also encourage impulse buying. Healthcare professionals often recommend specific brands available in physical outlets. The trust associated with established retail networks makes offline the preferred choice. This ensures offline channels retain dominance despite online growth.

Brick-and-mortar stores also cater to immediate purchase needs, especially during sports events or illness. Retailers often provide bundle offers and discounts that drive higher sales volumes. Physical presence also allows brands to educate customers through brochures and displays. The ability to return or exchange products easily increases consumer confidence. Regional penetration through pharmacies enhances availability even in smaller towns. These factors collectively ensure offline channels remain the leading distribution network.

The online segment has become the fastest-growing segment in the electrolyte tablet market, as consumers can access global brands not always available in local stores. Subscription models and bulk discounts make online purchases cost-effective. Digital platforms also allow for better customization and comparison of products. Social media marketing drives direct traffic to e-commerce listings. This convenience-oriented lifestyle shift is fueling online growth.

Application Insights

Why is Sports & Fitness Hydration Dominating the Electrolyte Tablet Market?

The sports & fitness hydration segment registered its dominance over the electrolyte tablet market in 2024, because physical activity naturally increases electrolyte loss through sweat. Athletes and fitness-conscious consumers consistently turn to supplements to maintain performance. This application aligns directly with the origins of the electrolyte tablet market. Sports organizations heavily endorse hydration products, reinforcing their necessity. Specialized formulations cater to training, competition, and recovery phases. As a result, this segment commands the largest share of usage.

The daily wellness & lifestyle segment has become the fastest-growing segment in the electrolyte tablet market, as consumers adopt electrolyte supplements for everyday hydration. This shift is fueled by rising awareness of general dehydration and fatigue in daily routines. Busy professionals, students, and older adults are increasingly using them outside sports contexts. Lifestyle-driven marketing positions electrolytes as part of overall health and energy maintenance. Sugar-free, flavored, and convenient packaging options enhance appeal for non-athletes. This makes daily wellness the most dynamic growth segment.

Packaging Format Insights

Why is Tube Packaging Dominating the Electrolyte Tablet Market?

The tube packaging segment dominated the electrolyte tablet market in 2024 as consumers see the unique benefits of carrying tubes in gyms, travel bags, and workplaces. The resealable design preserves product freshness and prevents damage. Brands prefer tubes as they are durable and cost-effective for storage. Tubes also allow for attractive branding with colorful designs and logos. These advantages make tubes the leading packaging format in the segment.

The sachet/strip packaging segment has become the fastest-growing segment in the electrolyte tablet market because they are affordable, lightweight, and single-use friendly. They cater to emerging markets where consumers prefer small, low-cost purchase units. Sachets are highly portable, making them ideal for outdoor activities, sports, and travel. This format also enables brands to reach rural and semi-urban populations. The appeal lies in accessibility without the need for bulk purchases. This affordability makes sachets a game-changer in expanding market reach.

Electrolyte Tablet Market Value Chain Analysis

- Raw Material Sourcing: The foundation of electrolyte tablet production lies in identifying reliable suppliers for the key ingredients like sodium chloride, potassium chloride, magnesium, and calcium.

Key players: Weefshel Pharma, United Labs, and Lexicare.

- Component Fabrication: Raw materials are processed into electrolyte-grade components, including electrolytes, vitamins, and other additives, into a compressed tablet form that dissolves in water.

Key players: Justdail and Metoree

- Battery Cell Manufacturing: Careful selection of the processing of materials, precise tablet formation, and integration into the battery cell.

Key Players: Nuun, Science in Sport, GU Energy Labs, SaltStick, and KODA Nutrition

Electrolyte Tablet Market Companies

- Nuun Hydration

- GU Energy Labs

- Skratch Labs

- SOS Hydration

- Science in Sport (SiS)

- Gatorade (PepsiCo)

- Powerbar (Post Holdings)

- LyteShow

- Hydrant Inc.

- Hammer Nutrition

- SaltStick (Sports Research)

- High5 Sports Nutrition

- Precision Hydration

- Tailwind Nutrition

- Pedialyte (Abbott Laboratories)

- Vega (Danone)

- Revvies Energy Strips (with electrolyte versions)

- Liquid I.V. (Unilever)

- MyProtein (The Hut Group)

- ZipFizz

Segments Covered in the Report

By Product Type

- Single Electrolyte Tablets

- Sodium-based

- Potassium-based

- Magnesium-based

- Calcium-based

- Others

- Multi-Electrolyte Tablets

- Balanced Electrolyte Blends

- Specialized Endurance Formulations

- Recovery Formulations

- Others

By Flavor

- Citrus

- Berry

- Tropica

- Mint & Herbal

- Unflavored

- Others

By End User

- Athletes & Sports Enthusiast

- Outdoor & Adventure Participant

- Industrial & Occupational Users

- Healthcare & Recovery Patients

- Military Personnel

- Others

By Distribution Channel

- Offline

- Pharmacies & Drug Stores

- Supermarkets & Hypermarkets

- Specialty Nutrition Stores

- Others

- Online

- E-commerce Marketplaces

- Brand-owned Online Stores

- Others

By Application

- Sports & Fitness Hydration

- Medical & Clinical Use

- Travel & Adventure

- Daily Wellness & Lifestyle

- Others

By Packaging Format

- Tube Packaging

- Sachet/Strip Packaging

- Blister Packs

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting