What is the Energy Audit Services Market Size?

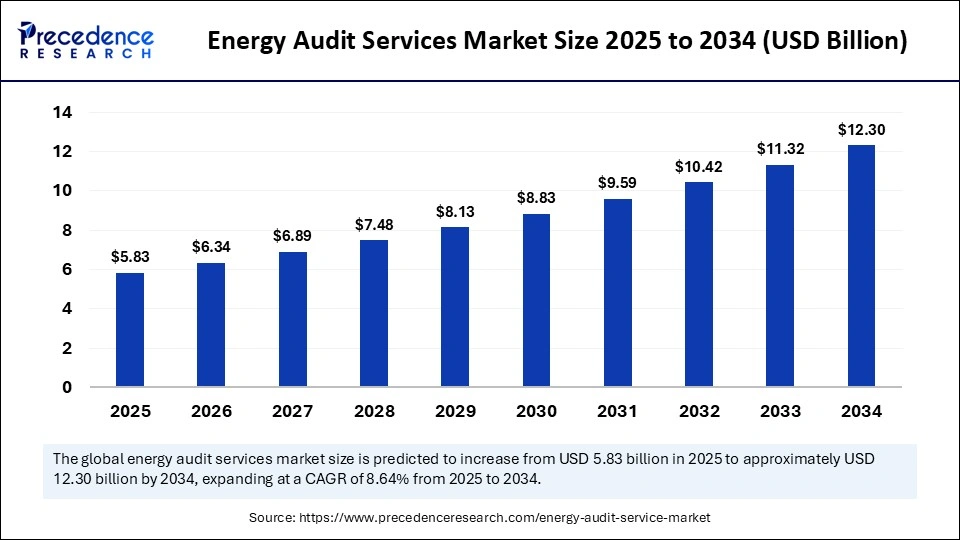

The global energy audit services market size is calculated at USD 5.83 billion in 2025 and is predicted to increase from USD 6.34 billion in 2026 to approximately USD 12.30 billion by 2034, expanding at a CAGR of 8.64% from 2025 to 2034. The market for energy audit services is driven by rising emphasis on energy efficiency, sustainability goals, and regulatory mandates encouraging businesses to reduce carbon emissions and optimize energy consumption.

Market Highlights

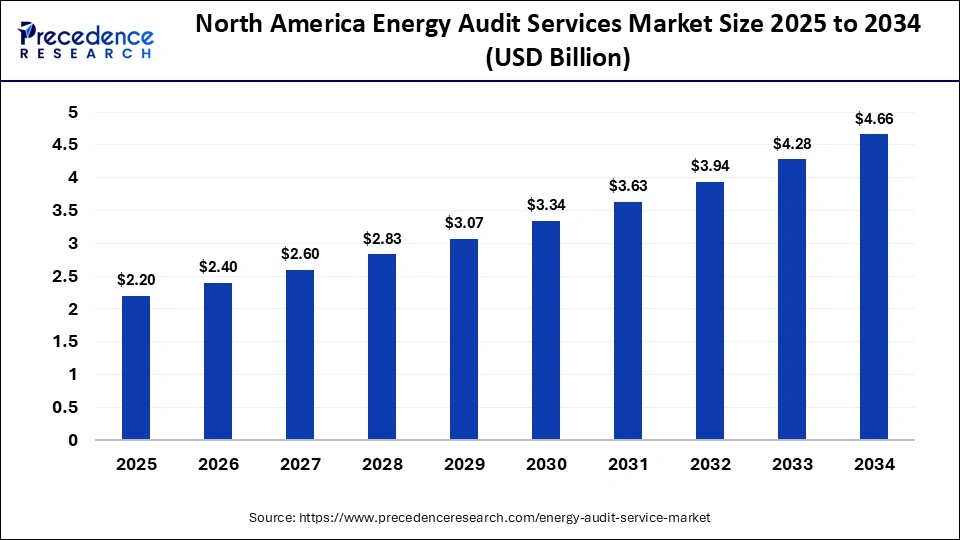

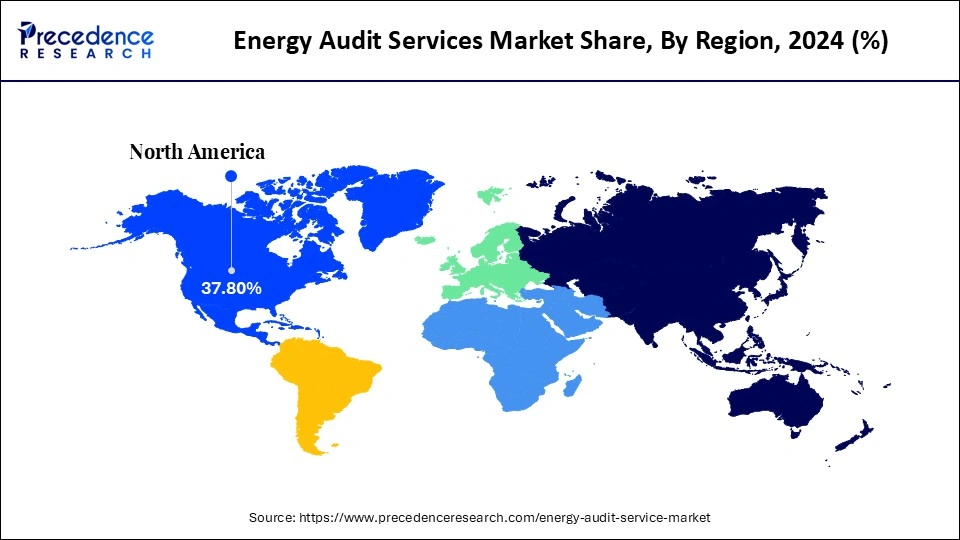

- North America dominated the market, holding a share of 37.8% in 2024.

- The Asia Pacific is expected to expand at the fastest CAGR of 11.9% between 2025 and 2034.

- By audit type, the detailed energy audits segment contributed the biggest market share of 39.4% in 2024.

- By audit type, the investment-grade audits segment is expected to expand at a notable CAGR of 11.6% between 2025 and 2034.

- By service type, the energy consumption analysis segment held the major market share of 31.2% in 2024.

- By service type, the monitoring & verification services segment is growing at a solid CAGR of 11.9% between 2025 and 2034.

- By end-use industry, the industrial sector segment held the highest market share of 45.6% in 2024.

- By end-use industry, the commercial segment is poised to grow at a solid CAGR of 9.8% between 2025 and 2034.

- By technology integration, the building energy management systems integration segment contributed the biggest market share of 33.5% in 2024.

- By technology integration, the AI-based pattern recognition segment is expected to expand at a remarkable CAGR of 13.1% between 2025 and 2034.

- By service provider, the energy service companies segment captured the highest market share of 42.8% in 2024.

- By service provider, the sustainability advisory firms segment is expanding at a remarkable CAGR of 10.9% between 2025 and 2034.

- By distribution channel, the direct institutional contracts segment held the biggest share of 63.2% in the market during 2024.

- By distribution channel, energy service partnerships segment is registering a notable CAGR of 10.8% between 2025 and 2034.

Maximizing Effectiveness: How AI Is Revolutionizing the Energy Audit Services Landscape

The global energy audit services market is an essential factor in advancing energy efficiency, green sustainability, and operational optimization across various sectors. Energy audit services include a methodical assessment of energy use patterns in buildings, industrial facilities, and infrastructure to detect inefficiencies, reduce costs, and reduce carbon footprints. These audits comprise extensive processes, ranging from initial walkthroughs to comprehensive investment-grade audits known as IGA, which involve gathering data, system diagnostics, benchmarking, and energy conservation measure suggestions.

The current market is driven mainly by rising energy costs, tighter government regulations that have increased energy efficiency, and the adoption of corporate sustainability and net-zero emission policies. Also, the world's shift to renewable energy sources and the intensification of smart city development are creating demand for integrated energy management solutions. North America and Europe are leading the market with powerful policy development and energy-saving operational incentives, whereas Asia-Pacific is becoming the world's fastest-growing region with rapid industrialization, urbanization, and government-led sustainability programs.

Key AI Integration in the Energy Audit Services Market

AI is transforming the energy audit services market by enabling real-time data analytics, predictive maintenance, and intelligent energy optimization. AI algorithms can analyze large volumes of data from IoT sensors, smart meters, and building management systems to detect inefficiencies and predict energy consumption trends with high accuracy. AI also automates energy benchmarking, anomaly detection, and performance reporting, saving a lot of time that manual analysis consumes. Besides, AI-based digital twins can be used to develop and further optimize buildings and industrial systems by creating virtual copies. The innovations improve the accuracy, transparency, and scalability of audit operations to enable the industry and governments to achieve decarbonization objectives and make data-driven decisions.

Energy Audit Services Market Outlook

The increasing energy price, international climate accords, and digital revolution of energy management drive industry growth. Modern analytics, smart-monitored control, and AI-based diagnostics are transforming conventional audits, delivering measurable cost reductions and enhancing sustainability across the industrial and infrastructure sectors.

The global expansion is being hastened by rapid industrialization and urbanization in the Asia-Pacific and firm policy backing in Europe and North America. Structured energy audits are emerging as the mode of operation in emerging economies aligned with the smart city programs, integration of renewable energy, and carbon-neutral development programs.

Schneider Electric, Siemens, ENGIE, and Johnson Controls are some of the leaders that invest in digital audit systems and AI-powered energy intelligence systems. Institutional investors are also supporting scalable energy service companies (ESCOs) that are efficiency and sustainability-oriented, as well as green funds.

There is an emerging culture of startups, and it offers AI-based audit tools, real-time analytics, and cloud-based tools for energy management. To help democratize access to energy audits and accelerate the planets decarbonization, startups are collaborating with utilities, industries, and governments.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.83 Billion |

| Market Size in 2026 | USD 6.34 Billion |

| Market Size by 2034 | USD 12.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered |

Audit Type, Service Type, End-Use Industry, Technology Integration, Service Provider, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Energy Audit Services Market Segment Insights

Audit Type Insights

Detailed Energy Audits: In 2024, the market share of the detailed energy audits segment was 39.4% as attention to accuracy-based energy assessment and cost-cutting initiatives increased. Such audits are characterized by significant amounts of data, analysis of equipment performance, and process optimization to identify high-impact efficiency opportunities. Commercial facilities and industries favor detailed audits because they are very thorough and address HVAC systems, lighting, process heating, and compressed air systems. The accuracy and predictive power of outcomes are improved through the integration of IoT-enabled monitoring and AI-driven analytics, which could help clients make valuable investment decisions.

Investment-Grade Audits: Investment-Grade Audits (IGA) segment in 2024 took 11.6% of the market, mainly because of its involvement in the provision of guidance to the capital-intensive energy efficiency projects. IGAs provide complete financial modelling, payback analysis, and risk evaluation for investment approval. The audits are essential for obtaining funding for retrofits and renewable additions by energy service companies (ESCOs) and industrial facilities, as well as for other major infrastructure projects. The increasing attention to performance-based contracting, carbon-reduction goals, and proven savings results is driving demand for IGAs. The combination of AI and digital twins enhances audit accuracy, project predictability, and financial transparency.

Preliminary/Walkthrough Energy Audits: The initial step in identifying energy-saving opportunities is a preliminary or walkthrough energy audit, and represented a good share of early market interactions in 2024. Such audits comprise simple inspections of equipment, electricity bills, and the facility operations to identify quick wins and low-cost efficiency solutions. The type of audit is often used by small and medium enterprises, public institutions, and commercial buildings to conduct first benchmarking and compliance reporting. The most common type of audit is the walkthrough audit, which is popular in large-scale energy management programs due to its cost-effectiveness, speed, and non-disruptive nature. With the simplification of the data collection process enabled by AI-based tools and electronic sensors, preliminary audits are becoming quicker and more in-depth.

Service Type Insights

Energy Consumption Analysis: The energy consumption analysis segment accounted for 31.2 percent of the market in 2024, as it lies at the epicenter of identifying inefficiencies and optimizing energy consumption in commercial buildings and industries. The accuracy of consumption information is being improved through high-tech analytics, IoT-driven observation systems, and AI-driven modeling systems. Such analyses are increasingly popular among organizations for formulating sustainability strategies, reducing business costs, and meeting regulatory requirements.

Monitoring & Verification (M&V) Services: The monitoring and verification services segment had an 11.9% market share in 2024 and is projected to grow considerably as organizations focus on tangible energy savings and clear performance monitoring. M&V services ensure that the effect of the implemented energy efficiency initiatives is justified through continuous data monitoring and comparison with the baseline performance. The real-time monitoring of the energy performance contracts (EPCs) and sustainability performance is ensured through the integration of smart meters, digital dashboards, and AI-driven anomaly detection. M&V protocols are becoming requirements for governments and ESCOs to ensure accountability and meet investment returns.

Equipment Performance Testing: Equipment performance testing is a crucial aspect of the market, ensuring mechanical, electrical, and HVAC systems remain at peak efficiency. This service will also be designed to measure the performance of the energy-consuming equipment in real time, such as boilers, chillers, compressors, and motors, with the view of detecting inefficiencies or faults. The growing interest in preventive maintenance, reliability optimization, and asset life-cycle management is driving the need for such testing. In response to the trend towards predictive maintenance and operational energy efficiency, equipment performance testing is becoming a significant tool for achieving operational excellence and sustainability.

End-Use Industry Insights

Industrial Sector: The industrial segment accounted for 45.6% of the market in 2024, driven by high energy consumption and the complexity of operations in manufacturing and process industries. Energy audits in this industry emphasize production efficiency, waste reduction, and upgrading outdated systems. Real-time energy monitoring is also used in manufacturing plants to reduce power and fuel costs. It is through such audits that chemical and petrochemical units can minimize emissions, enhance process heat recovery, and meet environmental compliance requirements.

Commercial Sector: In 2024, the commercial sector segment accounted for 9.8% of the market, driven by increased emphasis on building efficiency, carbon neutrality, and operational optimization. Audits are embraced in retail spaces to streamline refrigeration, air conditioning, and display lighting systems, thereby reducing utility costs. Audits have been incorporated into hospitality facilities to ensure a balance between high energy consumption, sustainability branding, and regulatory requirements. The commercial sector's increased investment in green building certifications, including LEED and BREEAM, also contributes to rising demand for professional energy auditing.

Residential Sector: The residential sector is a rapidly expanding market segment, and the adoption of intelligent technologies and consumerism defined by energy usage is driving faster growth in the niche. The audit of complex systems focuses on identifying waste in common utilities, heating, and cooling systems to reduce energy bills and minimise carbon emissions. The smart home benefit is that it includes a digital energy audit, powered by IoT sensors and AI analytics that monitor appliance performance, insulation, and power consumption trends. Governments that promote the construction of energy-efficient houses and the implementation of incentive-based retrofit projects are also accelerating adoption.

Technology Integration Insights

Building Energy Management Systems Integration: The segment dominated the market in 2024, with a 33.5% share, driven by growing demand for real-time energy monitoring, automation, and optimization in large buildings. BEMS integration enables central control of HVAC, lighting, and electrical systems and provides actionable data that enhances the effectiveness and sustainability of its operations. The rise in green building certifications and corporate ESG goals has accelerated the adoption of such systems. With such integrated platforms, organizations are using them to monitor energy performance, predict consumption, and automate corrective measures.

AI-Based Pattern Recognition: The AI-based pattern recognition segment already has a 13.1 percent market share of energy audit services in 2024 and is projected to grow rapidly over the coming several years. This is because of the added convenience of artificial intelligence, which identifies inefficiencies and anomalies in complex energy systems. These functions help minimize human error, enhance audit accuracy, and ensure consistent energy performance improvements. With more adaptive and transparent AI models, energy auditors are adopting them to develop dynamic, predictive insights that can help meet net-zero and decarbonization goals by transforming conventional static assessments into more dynamic, predictive ones.

IoT & Smart Meter Data Analytics: The data analytics market for IoT and smart meters is changing the landscape, enabling continuous, real-time monitoring of energy consumption across different assets and facilities. Intellectual energy information gathered from IoT sensors and smart meters is processed by auditors to identify opportunities for improvement, compare performance, and forecast future demand. With the implementation of cloud-based analytics systems, it is possible to remotely monitor energy processes and automatically report on them, saving time and costs associated with audits.

Service Provider Insights

Energy Service Companies: The energy service companies segment dominated the energy audit services market in 2024, accounting for 42.8% of the market share due to their integrated approach to energy efficiency, performance contracting, and guaranteed savings. ESCO services provide a one-stop solution, from initial audits and feasibility studies to the actual implementation and financing of energy-saving solutions. The reason they are the partners of choice for industrial, commercial, and institutional clients is their ability to deliver measurable cost reductions and the complex nature of the retrofit work. Increased government incentives, net-zero corporate objectives, and carbon-cutting requirements are among the reasons why ESCO-led audits are becoming increasingly necessary.

Sustainability Advisory Firms: The sustainability advisory firms segment has a 10.9% market share in 2024. These businesses are masters at integrating energy audits into broader sustainability strategies to help them determine their carbon footprint and develop emission-reduction strategies. Their knowledge of data analytics, life-cycle analysis, and regulatory provisions makes them strategic mining consultants to companies and cities. The trend toward digital sustainability consulting powered by AI and cloud-driven audit software is growing, with more providers offering comprehensive solutions.

Independent Engineering Consultants: Essential in the market, they provide objective, technology-neutral evaluations of energy systems. They have experience in mechanical, electrical, and industrial engineering, enabling them to perform accurate diagnostics and tailor efficiency recommendations for facilities of any size. This has increased the demand for specialized engineering consultancy services globally, as industries and other institutions of society strive for independent verification of investment-grade auditing and regulatory compliance.

Distribution Channel Insights

Direct Institutional Contracts: The division was the most dominant in 2024, with a solid 63.2% share of the energy audit services market. These organizations tend to award direct contracts to maintain control over the scope, methodology, and outcomes of the audits while also meeting internal sustainability and cost-efficiency goals. The direct model supports a long-term partnership with energy consultants and service firms, enabling the incorporation of continuous energy surveillance systems, facility retrofits, and performance benchmarking.

Energy Service Partnerships: The energy service partnerships segment accounted for 10.8% of 2024 and is projected to grow significantly as the need to join energy efficiency programs between service providers and enterprises increases. These alliances are characterized by shared savings deals, jointly financed initiatives, or turnkey energy management services by ESCOs and energy-specific consultants. The partnership model reduces clients' initial capital outlay while guaranteeing performance results. It is being rapidly adopted by small and medium-sized enterprises (SMEs) and public institutions that intend to achieve sustainability objectives without necessarily incurring significant infrastructure investments.

Government/Utility Programs: Government and utility programs play a major role in driving the energy audit services market by offering financial incentives, rebates, and compulsory audit programs to improve efficiency across sectors. These programs tend to be national energy and climate action plans intended to minimize carbon emissions and maximize grid output. The utilities collaborate with accredited audit companies to conduct standardized energy audits for residential, commercial, and industrial customers to identify and implement cost-effective conservation programs. These programs are especially available to small businesses and homeowners because of public funding and subsidies.

Energy Audit Services MarketRegion Insights

The North America energy audit services market size is estimated at USD 2.20 billion in 2025 and is projected to reach approximately USD 4.66 billion by 2034, with a 8.66% CAGR from 2025 to 2034.

Why Did North America Lead the Global Energy Audit Services Market in 2024?

In 2024, North America dominated the energy audit services market with a 47% share, driven by strict regulations, rising energy prices, and the prevalence of sustainability and net-zero programs. The area enjoys a well-developed industrial base, robust building infrastructure, and government programs that have been implemented to encourage energy efficiency across the government and private sectors. The United States is a master of regional development because federal and state-level requirements, such as the Energy Policy Act and LEED certification, that promote energy audits of commercial and institutional sites dominate. Corporations in the manufacturing, real estate, and utilities sectors are spending more on energy assessment programs to comply with ESG reporting requirements and reduce operating expenses.

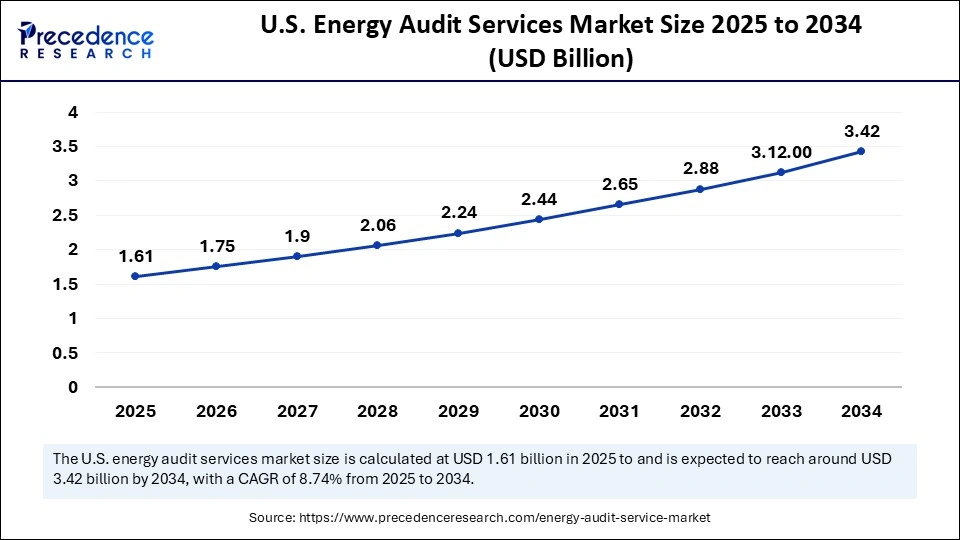

The U.S. energy audit services market size is calculated at USD 1.61 billion in 2025 and is expected to reach nearly USD 3.42 billion in 2034, accelerating at a strong CAGR of 8.74% between 2025 and 2034.

U.S Energy Audit Services Market Analysis

The US has been the most important player in shaping the North American market due to its comprehensive energy policies and aggressive carbon-cutting initiatives. The energy audit service has also established a flourishing ecosystem through assistance from the U.S. Department of Energy, including energy benchmarking, tax incentives, and performance-based funds for efficiency projects. Besides, the implementation of digital twins, real-time energy analytics, and smart grid integration is transforming the audit process, enabling continuous monitoring and optimization.

Asia Pacific is expected to lead the global energy audit services market growth over the forecast period, recording the highest CAGR, and will hold a 16% market share in 2024. Efforts by governments in countries such as China, India, Japan, and South Korea to promote energy conservation contribute to regional growth through rapid industrialization and urbanization. Increased energy costs, growing environmental concerns, and the adoption of renewable energy sources are compelling industries and the business world to undertake energy audits to increase efficiency and reduce reliance on fossil fuels. Due to the increased operations of multinational corporations in Asia, the need to audit energy in line with current global sustainability standards is gaining momentum, making the region the next center of energy efficiency innovation.

China Energy Audit Services Market Trends

The market for Energy Audit Services in China is transforming rapidly, and the focus on China becoming carbon neutral by 2060 and on optimizing industrial energy use is driving this evolution. The high production levels, energy consumption in industries, and the development of commercial infrastructure in the country are driving increased demand for professional energy audits. These developments are also facilitating better energy profiling, predictive maintenance, and real-time optimization, making China a global leader in industrial-scale energy audit innovation.

The European energy audit services market is witnessing sustainable growth, driven by strict EU regulations, including the Energy Efficiency Directive (EED), which requires large businesses and government buildings to undergo periodic audits. Countries like Germany, France, and Italy are on the path to implementing advanced auditing standards, including renewable integration, smart grids, and digital twin technologies. In addition, the continent's emphasis on circular economy and the decarbonization of the manufacturing industry is putting companies in a position where energy utilization is being evaluated and rationalized more strategically.

Developing sustainable infrastructure by investing more in this sector by the people and the government, as well as EU-funding initiatives, is enhancing the ecosystem of energy audit in the region. This established web of ESCOs, engineering consultants, and sustainability companies in Europe will continue to foster innovation and trans-boundary cooperation in energy management.

UK Energy Audit Services Market Trends

The energy audit services market in the United Kingdom is highly policy-supportive and is being driven by increasing corporate sustainability commitments. The fact that the UK is moving towards renewable energy much faster and is aiming to reach a net-zero emissions goal by 2050 has further increased demand for audit services, particularly in manufacturing, commercial real estate, and government sectors. The growth in the use of AI-powered audit solutions, online surveillance solutions, and IoT-based energy analytics is improving audit accuracy and transparency. With increased efforts by the UK to enhance its green finance system and sustainable construction policies, the energy audit industry is likely to have a significant role in ensuring that the national energy efficiency objectives are achieved in the long term.

Energy Audit Services Market Companies

Provides end-to-end energy audit and management solutions through its EcoStruxure platform, integrating IoT analytics, automation, and real-time monitoring to optimize energy use in industrial, commercial, and public-sector facilities.

Delivers digitalized energy audit offerings via its Smart Infrastructure division, leveraging AI-driven building analytics, automation systems, and predictive maintenance to enhance operational efficiency.

Offers customized facility audits that integrate HVAC optimization, building performance analytics, and sustainability consulting to improve long-term energy and operational performance.

Provides energy-efficiency audits, retrofitting services, and predictive maintenance powered by IoT and cloud-based energy management platforms tailored for industrial and commercial clients.

Specializes in investment-grade energy audits, energy performance contracting, and renewable energy integration for government, educational, commercial, and industrial customers.

Offers comprehensive energy auditing, decarbonization consulting, and integrated energy services focused on reducing emissions and improving building performance across global markets.

Provides technical energy audits, facility management services, and resource-efficiency solutions aimed at optimizing energy consumption and environmental performance.

A major provider of energy audits and performance contracting services, helping organizations reduce energy costs through efficiency upgrades and renewable energy projects.

Conducts detailed energy assessments focused on HVAC performance, thermal efficiency, and building system optimization using advanced data analytics.

Provides independent energy audits, verification, and advisory services focused on industrial efficiency, renewable integration, and compliance with global sustainability standards.

Recent Developments

- In May 2024, Veolia Environnement, through its consulting engineering subsidiary Seureca, purchased MRC Consultants & Transaction Advisers (Spain/UK) to support its energy-consulting and decarbonisation services.(Source: https://www.veolia.com)

- In July 2023, EMCOR Group announced its plans to acquire ECM Holding Group, a national organization specializing in energy-efficiency services and auditing in the U.S., to expand its portfolio of bundled energy-conservation and audit services.(Source: https://emcorgroup.com)

- In May 2025, audit-based efficiency came into greater investor attention as a private equity firm, CAPZA, purchased a minority stake in DI Environnement, a French environmental services business. CAPZA offers energy audit and efficiency services.(Source: https://www.reuters.com)

Energy Audit Services MarketSegments Covered in the Report

By Audit Type

- Preliminary/Walkthrough Energy Audits

- Detailed Energy Audits

- Investment-Grade Audits (IGA)

- Retro-Commissioning Audits

- Re-Audit/Post-Implementation Verification

By Service Type

- Energy Consumption Analysis

- Equipment Performance Testing

- Benchmarking & Compliance Reporting

- Implementation & Project Management Support

- Monitoring & Verification (M&V) Services

By End-Use Industry

- Industrial Sector

- Manufacturing Plants

- Chemical & Petrochemical Units

- Metals & Mining Facilities

- Commercial Sector

- Office Buildings

- Retail Spaces

- Hospitality Facilities

- Residential Sector

- Multi-Family Complexes

- Smart Homes

- Institutional Sector

- Hospitals, Universities, Government Buildings

- Utility & Energy Infrastructure

- Power Plants, Grids, Substations

By Technology Integration

- IoT & Smart Meter Data Analytics

- Building Energy Management Systems (BEMS) Integration

- AI-Based Pattern Recognition & Anomaly Detection

- Digital Twin Simulation for Energy Flow

- Blockchain for Data Integrity & Audit Validation

By Service Provider

- Energy Service Companies (ESCOs)

- Independent Engineering Consultants

- Utility-Backed Audit Service Providers

- Sustainability Advisory Firms

- Facility Management Companies

By Distribution Channel

- Direct Institutional Contracts

- Government / Utility Programs

- Energy Service Partnerships

- Online / Digital Platforms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting