What is the Exosome-based Cancer Therapy CDMO Market Size?

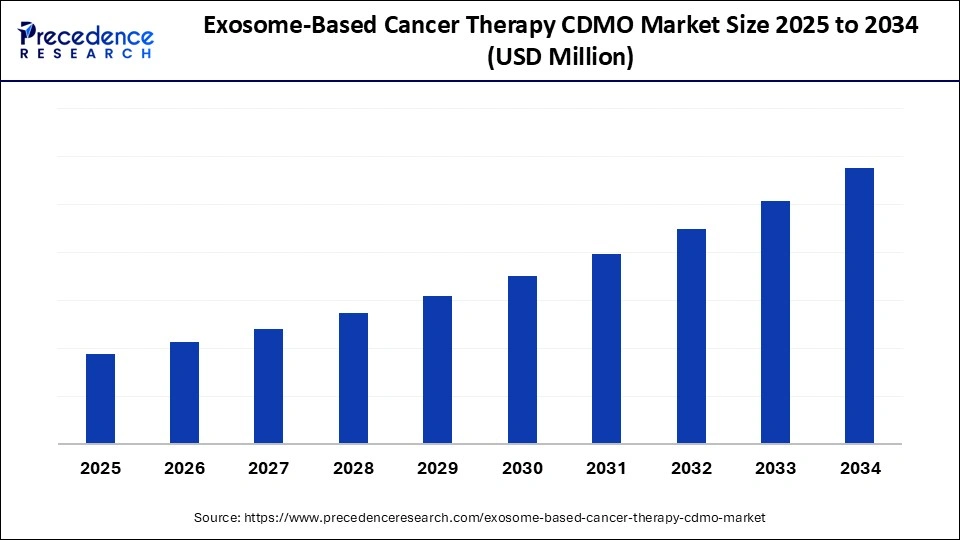

The global exosome-based cancer therapy CDMO market is witnessing rapid growth as biopharma firms partner with CDMOs to develop and manufacture novel exosome therapeutics.The global exosome-based cancer therapy CDMO market is witnessing robust growth driven by the growing demand for personalized treatment, increasing prevalence of cancer, rapid advancements in exosome isolation, and rising investments in healthcare infrastructure. This report covers market trends, production volumes, technological developments, and competitive dynamics across North America, Europe, and APAC between 2025 and 2030.

Exosome-based cancer therapy CDMO market Key Takeaways

- North America held the largest share, accounting for between 52% of the market in 2024.

- Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By exosome type/source, the engineered/modified exosomes segment accounted for the dominant share of 45% in the exosome-based cancer therapy CDMO industry during 2024.

- By exosome type/source, the autologous exosomes segment is expected to witness significant growth during the forecast period in the exosome-based cancer therapy CDMO market.

- By service type, the upstream processing segment held the majority share of 33.60% in 2024.

- By service type, the cargo loading & engineering segment is projected to grow at a high CAGR between 2025 and 2034.

- By therapeutic application, the solid tumors segment held a dominant presence in the market in 2024 with 60%.

- By therapeutic application, the hematologic cancers segment is set to see considerable growth in the global exosome-based cancer therapy CDMO market over the forecast period.

- By end user, the biopharmaceutical companies segment registered its dominance over the global exosome-based cancer therapy CDMO market in 2024, with 65%.

- By end user, the biotechnology startups segment is expected to grow significantly during the forecast period.

What Are Exosome Therapeutics?

The advances in exosome isolation & purification, an increase in clinical trials for cancer immunotherapy, and the growing demand from oncology are anticipated to drive the expansion of the exosome-based cancer therapy CDMO market during the forecast period. Exosomes are being engineered as natural drug delivery systems. Exosomes derived from various sources can deliver therapeutic agents, such as small-molecule drugs, nucleic acids, and proteins, to cancer cells through active or passive targeting. The exosome-based cancer therapy CDMO market encompasses contract development and manufacturing services for exosome-derived therapeutics targeting cancer. CDMOs offer comprehensive end-to-end solutions, encompassing exosome isolation, purification, engineering of therapeutic cargo, upstream and downstream processing, formulation, analytical testing, and fill-finish services.

Impact of AI in the Exosome-Based Cancer Therapy CDMO Market:

As technology in the industry evolves, artificial intelligence is transforming the field of exosome-based cancer therapy. CDMOs hold further potential for growth and innovation in exosome-based cancer therapy by enhancing diagnosis, optimizing targeted drug delivery, improving therapeutic delivery, and accelerating research and development activities. AI-driven enhancements in exosome-based cancer therapy can effectively analyze complex molecular data from exosomes, like lipids, proteins, and nucleic acids, to identify new biomarkers for cancer treatment. AI-powered solutions are significantly advancing exosome-based immunotherapy by efficiently identifying targets and optimizing immunomodulatory strategies. AI can study how exosomes influence immune responses, which assists in designing exosome-based therapies that activate the immune system. AI can utilize exosome-based cancer therapies tailored to individual patient profiles by analyzing their unique data, thereby enhancing the personalization of treatment strategies for improved outcomes.

Exosome-based cancer therapy CDMO market Outlook

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to experience accelerated growth, driven by an increasing number of exosome-based therapeutics in clinical pipelines, rising outsourcing by biopharmaceutical and biotechnology companies, increasing R&D in exosome technology, and the increasing technical complexity of scalable exosome production. Moreover, advances in exosome engineering for targeted delivery, improved isolation and characterization methods, and regulatory support for biologics manufacturing are further accelerating the global adoption of exosomes.

- Global Expansion: Leading players are expanding their geographical presence. For instance, in 2021, the Swiss CDMO Lonza expanded its position in exosome manufacturing capabilities by two new acquisitions, Codiak BioSciences' Lexington, MA facility, and Exosomics' service unit in Siena, Italy. Together, the two firms plan to establish a Center of Excellence for the development of exosome manufacturing technologies.(Source: https://www.pharmtech.com)

- Major Investors: Strategic investors are actively engaged in the market to strengthen their market presence. For instance, in April 2024, EXO Biologics, a pioneer in developing exosome-based therapies, announced the successful securing of a total of up to EUR 16 million in Series A funding. EXO Biologics will use the funds to support its ongoing and future clinical trials.(Source: https://www.exobio.be)

Major Trends in the Exosome-Based Cancer Therapy CDMO Market

- In June 2025, Samsung Biologics, a leading contract development and manufacturing organization (CDMO), announced the launch of Samsung Organoids, advanced drug screening services to support clients in drug discovery and development. Samsung Organoids to provide data-driven analysis of candidate molecules. Samsung Biologics expands service scope to include preclinical research. (Source: https://samsungbiologics.com)

- In April 2025, CD Bioparticles, a leading manufacturer and supplier of various drug delivery products and services, announced the launch of its new comprehensive line of kits for exosome labeling and purification. This expansion of the exosome product portfolio provides researchers with new and efficient tools for studying these important extracellular vesicles.(Source: https://exosome-rna.com)

- In September 2025, RION, a commercial and clinical-stage regenerative medicine company, announced a collaboration with Lonza, one of the world's largest contract development and manufacturing organizations (CDMOs), to provide cGMP manufacturing and technical support for commercial-scale production of its Purified Exosome Product (PEP) drug substance for late-phase clinical supply and beyond.(Source: https://www.lonza.com)

- In September 2025, ICIQ launched a project to develop exosome biosensors for disease diagnosis. Prof. Beatriz Prieto-Simón will lead EXOSENSE, a newly funded project aimed at developing a biosensor platform for detecting and analyzing exosomes, which are small extracellular vesicles found in biological fluids that carry biomarkers relevant to early disease diagnosis.(Source: https://iciq.org)

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Exosome Type / Source, Service Type, Therapeutic Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Exosome-Based Cancer Therapy CDMO Market: Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Food and Drug Administration (FDA) The Center for Biologics Evaluation and Research (CBER) oversees exosome products as biologics. | Federal Food, Drug, and Cosmetic (FD&C) Act., Good Manufacturing Practices (GMP) | Targeted Drug Delivery, Immunomodulation, Regenerative Medicine, Quality and Standardization | The FDA regulates exosome products as drugs or devices depending on their intended use. The FDA oversees preclinical and clinical trials to prove that an exosome therapy is both safe and effective for its intended use. |

| European Union | European Medicines Agency (EMA) | Regulation (EC) No 1394/2007 on Advanced Therapy Medicinal Products (ATMPs) | Product Classification, Quality and Manufacturing, Safety and Efficacy,Standardization, Clinical Trials: | The EU governs advanced therapy medicinal products (ATMPs) and the EU framework for all medicinal products for human use. This regulation harmonizes the assessment and supervision of clinical trials in the EU. |

| China | National Medical Products Administration (NMPA) | Products Administration (NMPA), Good Clinical Practice (GCP), and Good Manufacturing Practice (GMP). | Commercialization, Research and development, review, and evaluation. | The body governs the drug approval process and establishes stringent requirements for manufacturing quality control of biologics, addressing the challenge of consistency and purity in exosome production. |

Segmental Insights

Exosome Type / Source Insights

Which Segment Is Dominating by Exosome Type/Source in the Exosome-Based Cancer Therapy CDMO Market?

The engineered/modified exosomes segment dominated the global exosome-based cancer therapy CDMO market in 2024. The segment includes drug-loaded exosomes and surface-modified / targeted exosomes. Engineered or modified exosomes are the natural exosomes or their parent cells that have been systematically modified through engineering techniques. Engineered or modified exosomes are modified for targeted drug and gene delivery, offering enhanced specificity, efficacy, and safety for cancer treatment.

On the other hand, the autologous exosomes segment is expected to witness remarkable growth during the forecast period. The segment includes patient-derived tumor exosomes and patient-derived immune cell exosomes. Autologous exosomes are derived from a patient's own cells to facilitate intercellular communication and promote tissue repair, as well as reduce inflammation.

Service Type Insight

What Causes the Upstream Processing Segment to Dominate the Exosome-Based Cancer Therapy CDMO Market?

The upstream processing segment held the largest market share of 33.60% in 2024, as it encompasses 2D cell culture and 3D/bioreactor culture. Upstream processing for exosome-based cancer therapy involves the production of high-quality and clinical-grade exosomes from cell cultures. The upstream processing is designed to optimize cell culture conditions, thereby maximizing both the quality and quantity of exosomes.

On the other hand, the cargo loading & engineering segment is expected to grow at a notable rate. The segment includes nucleic acid loading (siRNA, mRNA, miRNA) and protein/peptide loading. Cargo loading and engineering are extensively utilized in cancer therapy to enhance drug delivery, often employing extracellular vesicles or nanoparticles to transport therapeutic agents, including proteins, drugs, and nucleic acids, to tumor cells.

Therapeutic Insights

How Did the Solid Tumors Segment Dominate the Exosome-Based Cancer Therapy CDMO Market in 2024?

The solid tumors segment held the largest market share in 2024 because the rising global burden of lung cancer, breast cancer, and colorectal cancer drives the growth of the segment. Exosomes serve as natural nanocarriers in cancer therapy, transporting drugs directly to cancer cells. There are several benefits of exosome-mediated drug delivery for cancer treatment over traditional systems, such as high biocompatibility and low immunogenicity of exosomes, which originate from the body's own cells.

On the other hand, the hematologic cancers segment is projected to grow at a CAGR between 2025 and 2034. The growth of the segment is driven by the increasing prevalence of leukemia, lymphoma, and multiple myeloma globally. Moreover, the surge in investment from biopharmaceutical companies, the increase in the number of clinical trials, and the expansion of academic-industry partnerships are accelerating the development and commercialization of exosome-based therapies for hematologic cancers.

End User Insights

How Do Biopharmaceutical Companies Dominate the Exosome-Based Cancer Therapy CDMO Market in 2024?

The biopharmaceutical companies segment held the largest share in the exosome-based cancer therapy CDMO market.  These companies are leveraging exosomes to deliver therapeutic payloads to cancer cells for personalized treatments with CDMOs. Several biopharmaceutical companies are at the forefront of exosome-based cancer therapy, with a rising focus on advanced technologies for loading and targeting exosomes. Additionally, the strategic partnerships between biopharmaceutical companies and CDMOs, as well as with academic institutions, are driving innovation and market expansion.

On the other hand, the biotechnology startups segment is anticipated to grow notably during the forecast period, owing to the rising venture capital investment and increasing collaboration between biotechnology startups and CDMOs to meet the needs of innovative therapies for cancer treatment.

Regional Insights

What Made North America Dominate the Exosome-Based Cancer Therapy CDMO Market in 2024?

In 2024, North America held a dominant presence in the market. This region holds a strong position in exosome therapeutics, with the presence of thriving biotechnology companies, an accelerating emphasis on healthcare spending, surging R&D investments by key players, and an increasing number of clinical trials for cancer immunotherapy, neurodegenerative diseases, and wound healing. The increasing prevalence of cancer, autoimmune diseases, infectious diseases, and neurodegenerative diseases like Alzheimer's Disease, Parkinson's Disease, and others, along with the rapid advancement in exosome collection technologies. Innovative methods, such as immunoaffinity capture, microfluidic devices, and continuous-flow systems, enable more efficient exosome isolation and purification from complex samples, which is expected to accelerate the market's revenue growth during the forecast period.

The United States is a major contributor to the growth of the exosome-based cancer therapy CDMO market. The country is home to modern research institutions and biotechnology companies, including Aegle Therapeutics, Capricor Therapeutics, StemXO Therapeutics, Codiak BioSciences, Coya Therapeutics, EV Therapeutics, and Direct Biologics. The country has a well-established healthcare infrastructure, a surge in clinical trials, increasing investment in advanced therapies, rising cases of chronic diseases, a growing demand for personalized medicine, high per capita healthcare expenditure, expanding applications of exosome therapeutics, and an increasing number of regulatory approvals.

On the other hand, the Asia Pacific region is expected to experience the fastest growth during the forecast period. The Asia Pacific market is expanding steadily, driven by the development of healthcare infrastructure, rising government funding for exosome-based therapies, advancements in biotechnology, favorable reimbursement policies, and a surge in regulatory approvals. Moreover, the increased R&D spending by major players and the growing number of clinical studies are likely to drive the expansion of the exosome-based cancer therapy CDMO market in the region.

The increasing burden of chronic diseases and growing focus on precision medicine in the region create significant medical needs, offering substantial market growth opportunities for innovative therapies. Several key players in the market are strategically adopting initiatives such as mergers & acquisitions to strengthen their market presence. The market is witnessing rapid advancements in exosome technologies are anticipated to propel the growth of the exosome-based cancer therapy CDMO market in the region by improving exosome isolation and purification, expanding their potential in regenerative medicine, and enhancing their use as targeted drug delivery vehicles. Such factors are paving the way for more effective and targeted treatments, as well as broadening the possibilities of exosome therapeutics in the region.

Country-Level Investments & Trends in Exosome-Based Cancer Therapy CDMO Market

- In June 2025, CMUH and Shine-On Biomedical lead Taiwan's push into global exosome-based precision medicine. The NextGen EV Therapeutics Forum, hosted by China Medical University and Healthcare System, brings together leading scientists, clinical experts, and biotech industry leaders from Taiwan and the United States to explore the forefront of extracellular vesicle (EV) research and translation. The forum showcased emerging EV-based applications in oncology, neurodegenerative disorders, immune modulation, and regenerative medicine, highlighting the rapid advances toward clinical implementation.

(Source: https://www.prnewswire.com) - In October 2024, Samsung Biologics, a global contract development and manufacturing organization (CDMO), announced a contract manufacturing deal with an Asia-based pharmaceutical company. The disclosed deal, worth USD 1.24 billion, is the largest contract signed by a single client. Production will take place at Samsung Biologics' biomanufacturing site in Songdo, South Korea, and the contract is set to run through December 2037.(Source: https://samsungbiologics.com)

- In March 2025, Exogenus Therapeutics, a biotech company based in Portugal, announced that it had contracted with the contract development and manufacturing organization (CDMO) Lonza to develop a good manufacturing practice (GMP)-compliant process for Exogenus' exosome-based lead candidate, Exo-101. Lonza will utilize its expertise in exosome development and analytical services at its Sienna, Italy site to define a process for producing Exo-101 for clinical supply.(Source: https://www.biopharminternational.com)

- In September 2025, FYR Bio, a biotechnology company utilizing extracellular vesicles (EVs) to develop an end-to-end solution for precision medicine tools, announced it had closed a new USD 8 million funding round. The Sontag Innovation Fund and the Yuvaan Tiwari Foundation join Two Bear Capital to support FYR's growing oncology portfolio and expanded focus in neuro-oncology and neurodegeneration.(Source: https://exosome-rna.com)

Recent Developments

- In September 2024, Samsung Biologics, a global contract development and manufacturing organization (CDMO), launched a series of proprietary development platforms as part of continued efforts to ensure high-quality development and provide client-tailored services.(Source: https://samsungbiologics.com)

- In January 2024, EXO Biologics SA announced the worldwide launch of ExoXpert, a contract development and manufacturing organization (CDMO) specializing in exosomes. ExoXpert offers an MSC-based exosome manufacturing platform used in European clinical trials. ExoXpert is a wholly owned subsidiary of EXO Biologics.(Source: https://www.exobio.be)

- In August 2024, NEC Bio Therapeutics and AGC Biologics announced a partnership to advance the production of NECVAX-NEO1, an orally delivered, bacteria-based DNA vaccine designed to target patient-specific tumor neoantigens. This important and promising collaboration aims to enhance the production of personalized cancer treatments by leveraging the biotechnology strengths of both companies.(Source: https://www.nec.com)

Top Key Players in the Exosome-Based Cancer Therapy CDMO Market & Their Offerings

- Lonza Group: A global leader in biologics manufacturing offering scalable, GMP-compliant exosome production, purification, and analytical support. Lonza's strong regulatory expertise and advanced bioprocessing facilities make it a preferred CDMO partner for exosome therapeutics.

- WuXi AppTec: Provides integrated end-to-end services for exosome-based biologics, from discovery and preclinical development to GMP manufacturing. Known for its “follow-the-molecule” model and rapid project turnaround.

- Catalent: Expanding into exosome-based modalities through its cell and gene therapy divisions, offering process development, formulation, and aseptic fill-finish capabilities. Catalent leverages its expertise in advanced biologics and drug delivery.

- Fujifilm Diosynth Biotechnologies: Offers biologics and cell therapy CDMO services with growing capabilities for exosome purification, analytics, and formulation development. Strong expertise in viral vectors and protein expression platforms.

- Samsung Biologics: One of the largest biologics CDMOs globally, investing in advanced modalities including exosomes. Its large-scale biomanufacturing infrastructure ensures reliability and compliance with global regulatory standards.

- Curia: Provides customized bioprocessing solutions for novel modalities, including exosome-based biologics. Known for flexible capacity, tailored development services, and strong analytical capabilities.

- Codiak BioSciences: A pioneer in exosome therapeutics with its proprietary engEx™ platform, developing exosome-based drug delivery systems and partnering with CDMOs for clinical-scale production.

- Evox Therapeutics: Focused on engineering exosomes for targeted drug delivery and therapeutic applications. Partners with major CDMOs to expand GMP manufacturing capacity for oncology and rare disease programs.

- Thermo Fisher Scientific / Patheon Biologics: Offers integrated bioprocessing systems, raw materials, and CDMO services supporting exosome research and production. Combines equipment supply with manufacturing expertise for biologics and exosomes.

- KBI Biopharma: Provides biopharmaceutical process development, analytical testing, and small- to mid-scale GMP manufacturing services applicable to exosome production.

- BioVectra (Canada): Specializes in biologics, small molecule, and mRNA manufacturing, supporting exosome-based drug production through its bioprocess development capabilities.

- Rentschler Biopharma: Offers expertise in cell culture manufacturing and downstream purification—key elements in scalable exosome therapy production. Recognized for quality and regulatory excellence.

- AGC Biologics: A global CDMO providing cell culture, protein, and viral vector manufacturing, expanding into exosome therapeutics as part of its advanced therapies portfolio.

- GenScript Biologics offers biologics development and manufacturing, along with gene vector and payload services, adaptable for exosome-based therapies.

- Evotec: Focuses on integrated discovery and early-stage development partnerships, supporting preclinical exosome therapeutic programs and translational oncology research.

- CMC Biologics: Specializes in biologics and cell therapy manufacturing, providing expertise in process development and analytical characterization for exosome products.

- Cytovance Biologics (USA):Offers custom biologics process development and GMP manufacturing, with growing applications in exosome-based biotherapeutic development.

- Jubilant Biosys: Provides early-stage discovery, process development, and analytical support, enabling foundational R&D for exosome therapeutic programs.

- Boehringer Ingelheim BioXcellence: BI's biologics manufacturing arm provides comprehensive CDMO services for complex biologics, including emerging platforms such as exosomes.

- Oxford Biomedica: A leader in viral vector manufacturing, expanding into exosome bioprocessing, leveraging its cell and gene therapy production expertise and GMP infrastructure.

Segments Covered in the Report

By Exosome Type / Source

- Autologous Exosomes

- Patient-Derived Tumor Exosomes

- Patient-Derived Immune Cell Exosomes

- Allogeneic Exosomes

- Donor-Derived MSC Exosomes

- Donor-Derived Immune Cell Exosomes

- Engineered / Modified Exosomes

- Drug-Loaded Exosomes

- Surface-Modified / Targeted Exosomes

- Others

By Service Type

- Exosome Isolation & Purification

- Ultracentrifugation

- Filtration & Size Exclusion

- Affinity-Based Purification

- Upstream Processing

- 2D Cell Culture

- 3D / Bioreactor Culture

- Cargo Loading & Engineering

- Nucleic Acid Loading (siRNA, mRNA, miRNA)

- Protein / Peptide Loading

- Downstream Purification

- Concentration & Diafiltration

- Chromatography-Based Purification

- Formulation Development

- Liquid Formulations

- Lyophilized Formulations

- Analytical & Characterization Services

- Particle Size & Concentration Analysis

- Surface Marker & Potency Assays

- Fill-Finish & Packaging

- Vials

- Prefilled Syringes / Auto-injectors

- Others

By Therapeutic Application

- Solid Tumors

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Others

- Hematologic Cancers

- Leukemia

- Lymphoma

- Multiple Myeloma

- Others

By End User

- Biopharmaceutical Companies

- Biotechnology Startups

- Research Institutes

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting