What is the Fermented Foods Market Size?

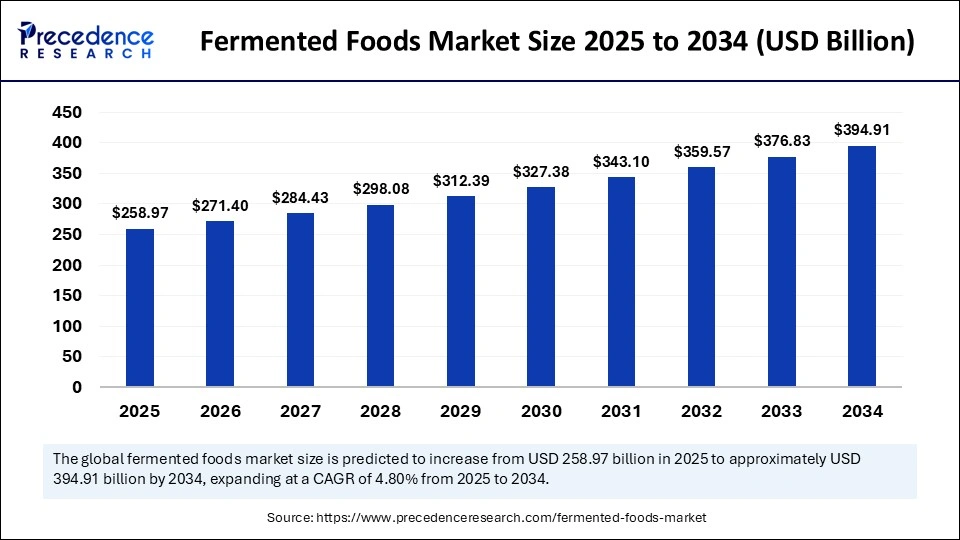

The global fermented foods market size is accounted at USD 258.97 billion in 2025 and predicted to increase from USD 271.40 billion in 2026 to approximately USD 394.91 billion by 2034, expanding at a CAGR of 4.80% from 2025 to 2034. The increased consumer awareness of gut health and the benefits of fermented foods are likely to contribute to the growth of the market.

Fermented Foods Market Key Takeaways

- In terms of revenue, the fermented foods market is valued at $ 258.97 billion in 2025.

- It is projected to reach $ 394.91 billion by 2034.

- The market is expected to grow at a CAGR of 4.80% from 2025 to 2034.

- North America dominated the fermented foods market with the largest share in 2024.

- Asia Pacific is expected to grow at the fastest rate in the upcoming years from 2025 to 2034.

- By food type, the fermented dairy products segment held a significant share of the market in 2024.

- By food type, the fermented confectionery & bakery products segment is expected to grow at the fastest rate during the forecast period from 2025 to 2034.

- By ingredient type, the organic acids segment dominated the market with the largest share in 2024.

- By ingredient type, the industrial enzymes segment is expected to grow at the fastest rate in the coming years from 2025 to 2034.

- By fermentation process, the anaerobic fermentation segment dominated the market in 2024.

- By fermentation process, the batch fermentation segment is projected to grow at the fastest CAGR between 2025 and 2034.

- By distribution channel, the supermarkets & hypermarkets segment led the fermented foods market with the largest share in 2024.

- By distribution channel, the online stores segment is expected to grow at the fastest rate in the coming years from 2025 to 2034.

How can AI help reduce costs and waste in fermented food manufacturing?

Artificial Intelligence technologies make it possible to precisely control and monitor fermentation parameters like temperature, pH, and microbial activity in real time, which maximizes yields and reduces batch failures. By using predictive analytics to predict fermentation results, manufacturers can proactively modify parameters and cut down on resource waste. AI-powered automation also optimizes production processes by reducing labor expenses and enhancing uniformity. Furthermore, AI-driven quality control systems enable early detection of defects in the production process, reducing production costs and preventing product spoilage. The production of fermented foods is made more profitable and sustainable through AI technology.

- On 10 March 2025, Zymergen announced the launch of an AI-powered platform to monitor and optimize fermentation processes in its bio-fermentation labs. This technology enables early detection of fermentation anomalies, reducing waste and improving product yield efficiency across multiple projects.

Market Overview

The fermented foods market has been witnessing steady growth, driven by the growing desire among consumers for food products that are naturally functional and health-promoting. Foods that contain probiotics like yogurt, kefir, kimchi, sauerkraut, kombucha, and tempeh are becoming more and more popular because they help with immunity boosting, digestion, and general health. The growing popularity of clean labels and minimally processed foods has altered eating habits, and growing awareness of gut health has greatly aided market growth. Furthermore, social media and wellness trends have increased consumer interest in both conventional and plant-based fermented foods.

The demand for fermented foods is primarily driven by the rising prevalence of lifestyle-related disorders and the growing consumer awareness about the health benefits of fermented foods. These foods improve gut health. Consumers are increasingly preferring natural, preservative-free products. Furthermore, a wider range of people now find fermented foods more palatable and accessible due to advancements in flavor and packaging as well as the emergence of health-conscious brands.

What are the Major Trends in the Fermented Foods Market?

- Rising Health Awareness: Increasing awareness about the health benefits of probiotics and gut-friendly bacteria is encouraging consumers to incorporate fermented foods into their daily diets.

- Surge in Digestive Health Issues: The growing incidence of digestive disorders and lifestyle-related health problems is pushing consumers toward natural remedies, such as fermented foods, for relief and prevention.

- Clean-label and Natural Product Demand: Consumers are seeking minimally processed, additive-free foods, making fermented items a preferred choice due to their natural fermentation process.

- Plant-Based and Vegan Trends: With the rise in vegan and vegetarian lifestyles, plant-based fermented foods like tempeh, kombucha, and kimchi are gaining popularity.

- Product Innovation and Variety: Brands are introducing new flavors, packaging formats, and fusion products, making fermented foods more attractive and accessible to younger and diverse consumer groups.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 394.91 Billion |

| Market Size in 2025 | USD 258.97 Billion |

| Market Size in 2026 | USD 271.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.80% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Food Type, Ingredient Type, Fermentation Process, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Health & Wellness Trends

Consumers are giving priority to foods that promote immunity, gut health, and general well-being. Fermented foods are known to improve digestive health and lower inflammation because they are high in probiotics and good bacteria. Fermented products are in high demand as a result of rapid shifts toward functional foods. Consumer confidence is also increased by scientific research that keeps confirming the benefits of fermented foods in preventing chronic illnesses. Fermented foods are now a mainstay of diets that emphasize health due to the rising awareness brought about by wellness influences and health campaigns.

- In 2025, fermented foods like kimchi, kombucha, miso, and natto became mainstream must-haves, celebrated for their gut health benefits.

(Source: https://www.voguebusiness.com)

Growth in Plant-Based Diets

The demand for fermented plant-based foods has increased due to the rise in vegetarian and vegan diets. In addition, products like tempeh, miso, and fermented plant-based dairy substitutes are gaining traction. In addition to improving the flavors and textures of plant-based foods, fermentation increases the bioavailability of plant proteins. A low emission high nutrient food source is provided by plant-based fermentation as sustainability gains importance.

Restraint

Complex Production Process and Short Shelf Life

The complex production process of fermented foods is a key factor restraining the growth of the fermented foods market. To guarantee product consistency and safety, the fermentation process necessitates careful handling. This complexity restricts the scalability of many conventional fermentation techniques and raises operating costs. Scaling up the production process is challenging and requires substantial investments. Stringent labeling requirements and lengthy product development cycles further create challenges in the market. Moreover, fermented foods have limited shelf life, requiring specific storage conditions. This significantly affects distribution and sales.

- On 15 January 2025, Standing Ovation highlighted the complexity of scaling precision fermentation in their recent announcement, citing the need for specialized bioreactors and quality control processes to maintain consistent product quality. These technical challenges are reflected in the timeline for their advanced casein launch in the U.S. market.

(Source:https://vegconomist.com)

Opportunities

Clean Label and Allergen-Free Product Development

Clean-label products are in high demand as consumers favor fermented foods free of artificial preservatives and allergens. This change pushes producers to develop plant-based fermented foods that are free of gluten and other allergens while satisfying consumer demands and legal requirements. With these qualities, product portfolio diversification can increase brand loyalty and open new opportunities in the market.

- On 25 March 2025, Meli introduced fermented, gluten-free quinoa beer targeting health-conscious consumers looking for allergen-free, clean-label alcoholic beverages, thereby tapping into emerging functional beverage trends.

(Source:https://www.foodandwine.com)

Advancements in Precision Fermentation Technology

Technological innovations create lucrative growth opportunities for the fermented foods market. High-quality dairy proteins without animal products and other fermented ingredients with a lower environmental impact can be produced through precision fermentation. Businesses now have the chance to produce inventive, sustainable goods that satisfy consumers' increasing desire for moral substitutes thanks to technological advancements. In a competitive market, it also helps brands stand out by facilitating quicker product development cycles and the customization of flavor and nutritional profiles.

- On 18 May 2025, Formo announced its partnerships with retailers and food service companies to scale the production of their precision-fermented animal-free cheeses. These collaborations facilitate wider distribution and adoption of sustainable cheese alternatives.

(Source: https://www.greenqueen.com.hk)

By Food Type Analysis

Why Did Fermented Dairy Products Dominate the Fermented Foods Market in 2024?

The fermented dairy products segment dominated the fermented foods market with a significant share in 2024 due to their recognized health benefits and broad acceptance. Products that are rich in probiotics and vital nutrients, such as cheese, kefir, and yogurt, are mainstays in many diets. Steady demand and market leadership are fueled by their well-established presence in both traditional and modern diets, as well as their enduring consumer trust.

- On 15 January 2025, Danone launched a new probiotic yogurt range targeting gut health-conscious consumers, reinforcing its leadership in the fermented dairy segment.

The fermented confectionery & bakery products segment is expected to grow at the fastest rate during the forecast period. Fermented bakery products are gaining traction as new functional snacks. Health-conscious consumers looking for novel flavors and gut-friendly substitutes are driving the popularity of artisanal sourdough pieces of bread, probiotic-enriched chocolates, and other fermented treats. Changing dietary preferences and rising health awareness are likely to drive segmental growth.

- On 10 March 2025, Cultured Treats announced the launch of probiotic-infused chocolate bars, combining indulgence with digestive health benefits.

By Ingredient Type Analysis

Why Did Organic Acids Dominate the Fermented Foods Market in 2024?

The organic acids segment dominated the fermented foods market in 2024 due to their critical role in fermentation processes. These acids support good gut bacteria, improve flavor, and preserve food while also offering health benefits. Both the conventional and industrial fermentation sectors use these acids as they inhibit the growth of harmful bacteria, fungi, and yeasts. This significantly extends the shelf life and makes the food safer.

- On 22 February 2025, LacticLabs expanded its production facility to meet the growing demand for lactic acid used in food preservation and flavor enhancement.

The industrial enzymes segment is expected to grow at the fastest rate in the coming years, driven by the need for more effective fermentation processes and technological advancements. Enzymes facilitate the creation of innovative fermented products with reliable quality to speed up fermentation and increase yield. This quick expansion, particularly in large-scale commercial production, is being driven by rising investments in enzyme research and development.

- On 28 April 2025, EnzyCore launched a specialized enzyme designed to enhance fermentation efficiency and flavor development in dairy products.

By Fermentation Process Analysis

Why Did Anaerobic Fermentation Lead the Fermented Foods Market in 2024?

The anaerobic fermentation segment dominated the fermented foods market in 2024. This is mainly due to the increased use of this fermentation process in the manufacturing of goods like cheese, yogurt, and alcoholic drinks. This process flourishes in oxygen-free conditions, encouraging the development of advantageous microorganisms that produce distinctive tastes and textures. It is a staple in the production of both commercial and artisanal fermented foods due to its demonstrated efficacy and scalability.

- On 05 March 2025, Yogurta Co. expanded its anaerobic fermentation facility to increase the production of probiotic yogurts and kefirs for international markets.

The batch fermentation segment is projected to grow at the fastest rate during the forecast period. The growth of the segment is attributed to its adaptability and suitability for creating a large range of fermented foods in regulated cycles. Producers can support creativity and customization by using this method to optimize conditions for various strains and recipes. The market is expanding faster due to the growing use of batch fermentation technology in both industrial and small-scale settings.

- On 18 April 2025, BatchFerment Inc. launched a new automated batch fermentation system designed to improve control and consistency for artisanal and industrial producers.

By Distribution Channel Analysis

Why Did Supermarkets and Hypermarkets Dominate the Fermented Foods Market in 2024?

The supermarkets & hypermarkets segment led the fermented foods market in 2024. This is mainly due to the increased preference for physical purchasing when it comes to dairy products. These retail formats are the main way that fermented dairy, bakery, and beverage products are bought because they provide large product assortments at affordable prices. These stores enable consumers to physically test the quality and freshness of products, enhancing shopping experiences. Their powerful supply chain networks and marketing prowess underpin their dominance.

- On 12 February 2025, Kroger expanded its fermented foods section across all stores in the U.S., focusing on increasing the availability of probiotic yogurts and kombuchas.

The online stores segment is expected to grow at the fastest rate in the coming years, driven by increasing digital penetration and changing consumer shopping behaviors. E-commerce platforms provide access to niche, artisanal, and international fermented products that may not be widely available in physical stores. Convenience, wider choices, and personalized shopping experiences are fueling the growth of the segment.

By Regional Analysis

Why Did North America Lead the Fermented Foods Market in 2024?

North America dominated the fermented foods market with the largest share in 2024. This is mainly due to the increased demand for probiotic-rich dairy products and beverages. With the growing health-conscious population, there is a high demand for plant-based fermented foods. Stringent clean-label regulations and growing health and wellness trends are sustaining the long-term growth of the market in the region. Its dominance is also reinforced by its widespread retail networks. Consumers favor functional foods that boost immunity and digestive health. The development of new products that cater to a variety of dietary requirements further bolsters the growth of the market in the region.

Asia Pacific is expected to grow at the fastest rate in the upcoming years. The growth of the market in the region is driven by growing health consciousness and a cultural affinity for fermented foods. The rapid urbanization and the increasing awareness among consumers about the nutritional benefits of fermented foods are fueling the market's growth. The rapid expansion of the e-commerce industry is improving the accessibility to fermented foods, enabling consumers to buy products from the convenience of their homes.

Europe is considered to be a significantly growing area. The growth of the fermented foods market in Europe is attributed to the rising demand for organic, plant-based, and sustainably produced food products. Strict regulations regarding food safety and innovations in fermentation methods are influencing the growth of the market. Consumers are highly conscious of ingredient quality, favoring artisanal and minimally processed products. Food manufacturers in the region are utilizing fermentation methods to enhance the shelf life of packaged foods, supporting regional market growth.

Fermented Foods MarketCompanies

- Ajinomoto Co., Inc.

- Angel Yeast Co., Ltd.

- Archer Daniels Midland Company

- Cargill Incorporated.

- Chr. Hansen Holding A/S

- Conagra Brands Inc

- Danone, Dohler GmbH

- General Mills Inc.

- Kerry Group plc

- KeVita Inc (PepsiCo Inc.)

- Koninklijke DSM N.V.

- Lallemand Inc.

- Mars Incorporated

- Meiji Holdings Co. Ltd.

- Mondelez International

- Nestlé S.A.

- Royal Friesl

- Campina N.V.

Latest Announcements

- On 16 May 2025, Nutri Ferment launched the Functional Fermented Beverage Line. The CEO of Nutri Ferment stated, "Our new beverage line blends tradition with innovation, offering consumers functional benefits through carefully crafted fermentation processes."

- On 19 April 2025, GreenFerment launched the Eco-Friendly Fermented Snack Range. The CEO of GreenFerment stated, "Our new snack range is designed to meet consumer demands for delicious, healthy, and eco-conscious fermented foods that support both wellness and the planet."

Recent Developments

- On 05 January 2025, BioNectar announced the launch of an advanced probiotic fermentation platform aimed at enhancing production efficiency and strain diversity of fermented health supplements.

- On 22 February 2025, Cultured Foods Inc. launched a new line of plant-based fermented cheeses targeting the growing vegan and lactose-intolerant consumer segments

- On 30 April 2025, ProBio Innovations launched a shelf-stable fermented beverage using novel preservation technology aimed at expanding distribution without cold chain requirements.

Segments Covered in the Report

By Food Type

- Fermented Dairy Products

- Fermented Beverages

- Fermented Confectionery & Bakery Products

- Fermented Vegetables

- Others

By Ingredient Type

- Amino Acids

- Organic Acids

- Vitamins

- Industrial Enzymes

- Others

By Fermentation Process

- Batch Fermentation

- Continuous Fermentation

- Aerobic Fermentation

- Anaerobic Fermentation

By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting