What is Gel Documentation Systems Market Size?

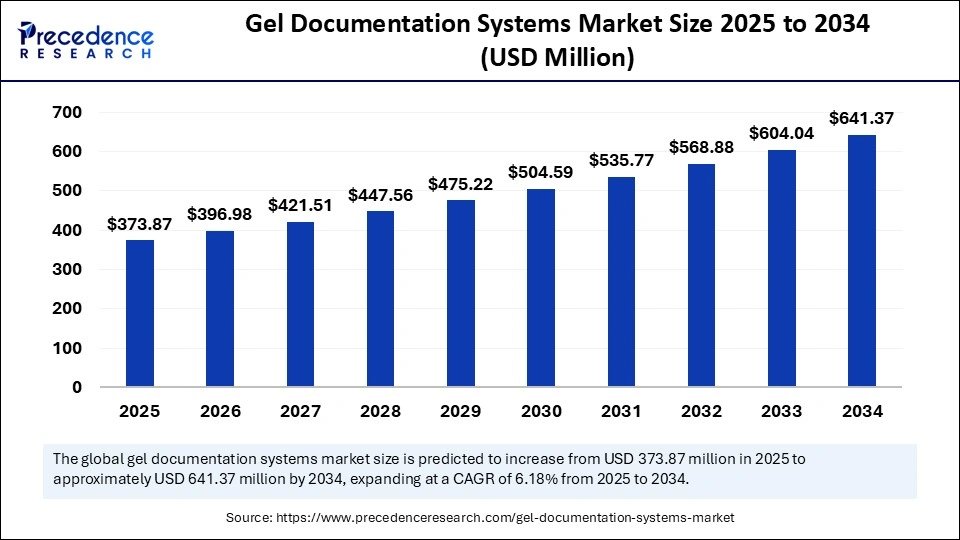

The global gel documentation systems market size is calculated at USD 373.87 million in 2025 and is predicted to increase from USD 396.98 million in 2026 to approximately USD 641.37 million by 2034, expanding at a CAGR of 6.18% from 2025 to 2034. The market growth is attributed to the expanding adoption of advanced imaging technologies in molecular biology and clinical diagnostics.

Market Highlights

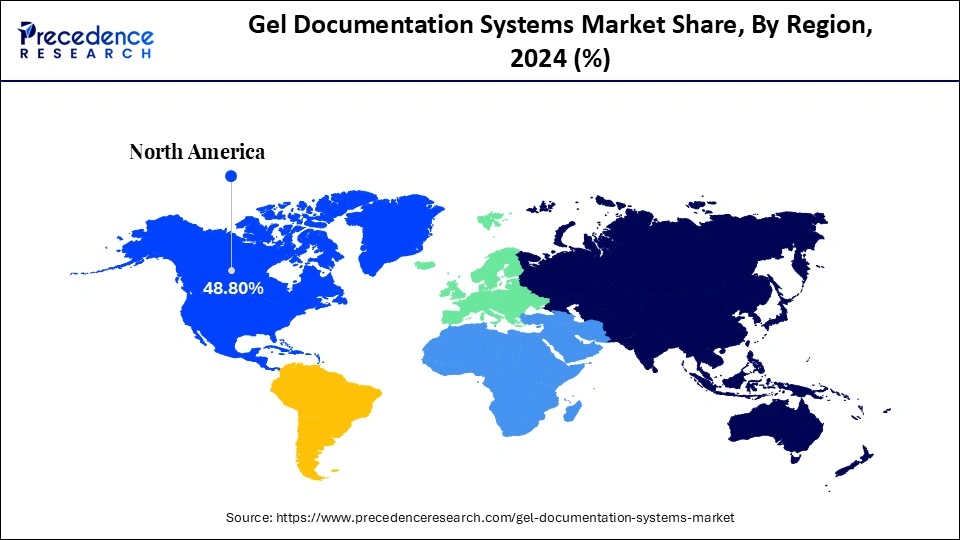

- North America held a dominant presence in the market in 2024, accounting for an estimated 48.8% market share.

- The Asia Pacific is expected to grow at the fastest CAGR of 5% from 2025 to 2034.

- By product type, the instrument segment accounted for a considerable share of 54.4% in 2024.

- By product type, the software segment is growing at a CAGR of 5.4% between 2025 and 2034.

- By light source, the UV light segment led the market, accounting for an estimated 50.4% market share.

- By light source, the biodegradable & compostable materials segment is expanding at a strong CAGR of 5.6% from 2025 to 2034.

- By detection technique, the UV detection segment has held the major market share of 52.4% in 2024.

- By detection technique, the fluorescence detection segment is growing at a CAGR of 5.5% % from 2025 to 2034.

- By application, the nucleic acid quantification segment dominated, accounting for an estimated 51.5% market share in 2024.

- By application, the protein quantification segment is poised to grow at a strong CAGR of 5.8% from 2025 to 2034.

- By end-user, the academic & research institutes segment contributed the highest market share of 50.2% in 2024.

- By end-user, the pharmaceutical & biotechnology companies segment is expected to grow at a solid CAGR of 6.9% from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 373.87 Million

- Market Size in 2026: USD 396.98 Million

- Forecasted Market Size by 2034: USD 641.37 Million

- CAGR (2025-2034): 6.18%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What Are Gel Documentation Systems?

The increased focus on molecular biology and genomics research is expected to drive the growth of the gel documentation systems market. Laboratories switch to more accurate imaging and reproducible data workflows. Contemporary gel imagers represent the combination of high-resolution cameras, UV/blue-light transilluminators, sensitive detectors, and multi-wavelength capture.

AI-based analysis software to identify and measure protein and nucleic acid bands and generate audit-friendly metadata to be used downstream. In 2025, EMBL-EBI announced more open-data services and bigger throughput at nationwide centers that facilitate massive sequencing and imaging processes. New digital image management and forensic-grade documentation protocols that the laboratories follow to enhance the image integrity and reproducibility among multi-site studies. Furthermore, the increased focus on molecular biology and genomics research is predicted to create immense opportunities for gel documentation technology.(Source: https://www.ebi.ac.uk)

Impact of Artificial Intelligence on the Gel Documentation Systems Market

Artificial intelligence (AI) is transforming the gel documentation systems industry with higher accuracy, speed, and reliability of gel imaging and analysis. The automated separation, quantification, and labeling of protein or nucleic acid bands have been made possible by AI-powered software. This minimizes manual errors and enhances experimental outcomes' reproducibility.

Smart algorithms also maximize image capture, regulate exposure, and filter background noise. They are allowing a document to be made of electrophoresis gels with better clarity and consistency. Furthermore, AI usage boosts innovation in gel imaging, which has a direct effect on the purchase decision and spurred the expansion of this specialized technology field.

Growth Factors

- Rising Demand for High-Throughput Screening: Growing requirements for large-scale protein and nucleic acid analysis are propelling the adoption of automated protocols in the gel documentation systems market.

- Boosting Efficiency in Biopharmaceutical R&D: Increasing focus on accelerated drug discovery and biologics development is driving investment in precise imaging platforms.

- Expanding Clinical Genomics Testing: Rising implementation of personalized medicine and genetic testing programs fuels demand for reproducible and high-resolution electrophoresis documentation.

- Growing Integration with Laboratory Information Systems: Propelling connectivity and data traceability, integration with ELNs and LIMS enhances workflow efficiency across research and diagnostic labs.

- Driving Standardization in Proteomics Research: Rising emphasis on reproducible quantitative protein analysis is fostering the adoption of digital imaging technologies with automated analysis capabilities.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 373.87 Million |

| Market Size in 2026 | USD 396.98 Million |

| Market Size by 2034 | USD 641.37 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.18% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Lightsource,Detection Technique, Aplication, End User, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Specialty Regulatory Global Landscape for Gel Documentation Systems Market

|

Country / Region |

Regulatory Body |

Key Regulations |

Focus Areas |

Notable Notes |

|

United States |

U.S. FDA (Food and Drug Administration), OSHA (Occupational Safety and Health Administration), EPA |

FDA 21 CFR Part 11 (electronic records), OSHA lab safety standards, and EPA hazardous waste rules |

Device safety, electronic data integrity, chemical handling, and lab personnel safety |

Equipment used in clinical diagnostics must comply with FDA validation requirements; labs must follow OSHA safety protocols. |

|

European Union |

European Commission, European Chemicals Agency (ECHA), EU MDR (Medical Device Regulation) |

EU MDR 2017/745, CLP (Classification, Labeling, Packaging), REACH |

Device safety, chemical classification, and environmental compliance |

Gel documentation systems intended for clinical use fall under Class I or Class IIa medical devices; REACH ensures safe handling of reagents. |

|

China |

National Medical Products Administration (NMPA), Ministry of Ecology and Environment (MEE) |

NMPA medical device registration, MEE lab safety standards, and GB standards for equipment |

Device certification, environmental safety, and lab chemical handling |

Importers must register gel documentation systems with NMPA; compliance with GB standards is mandatory for lab electronics. |

|

India |

Central Drugs Standard Control Organization (CDSCO), Bureau of Indian Standards (BIS), Ministry of Environment, Forest and Climate Change (MoEFCC) |

CDSCO medical device regulations, BIS equipment standards, Hazardous Waste Management Rules |

Clinical device approval, lab safety standards, and environmental compliance |

Labs must ensure gel documentation systems meet BIS electrical safety standards; CDSCO approval is needed if used for diagnostics. |

|

Japan |

Pharmaceuticals and Medical Devices Agency (PMDA), Ministry of Health, Labor and Welfare (MHLW) |

PMD Act, ISH (Industrial Safety and Health Act) |

Device safety, worker protection, and electronic record compliance |

Clinical use devices require PMDA approval; occupational safety standards apply to laboratory personnel handling chemicals. |

|

Canada |

Health Canada, Canadian Standards Association (CSA) |

Medical Device Regulations (SOR/98-282), CSA lab equipment standards |

Device safety, lab safety, and electronic records |

Equipment intended for diagnostics must be licensed under Health Canada MDR; CSA ensures the equipment's electrical and mechanical safety. |

|

Australia |

Therapeutic Goods Administration (TGA), Safe Work Australia |

TGA medical device regulations, AS/NZS standards for lab equipment |

Device safety, occupational safety, and electronic data compliance |

Gel documentation systems are classified under TGA Class I or II devices for diagnostic use; labs must follow AS/NZS safety standards. |

Global Expansion and Capacity Enhancement in Gel Documentation Systems Industry: Key Statistics and Developments (2024)

- In 2024, the National Tuberculosis Reference Laboratory (NMRL) expanded its diagnostic capabilities by acquiring 46 GeneXpert machines, enabling rapid molecular testing for tuberculosis. This expansion supports 113 testing and treatment centers across the country, significantly improving diagnostic turnaround times and treatment outcomes.

- EMBL invested in upgrading laboratory imaging facilities in 2024, funding new high-resolution gel documentation systems to enhance genomics and proteomics research across its five European sites. These investments support cross-lab collaboration and standardized data acquisition.

- In 2024, Genome Canada allocated CAD 12 million to expand laboratory infrastructure in molecular diagnostics centers, supporting equipment upgrades, including gel imaging platforms for precise DNA and protein analyses.

- The Japan Science and Technology Agency (JST) PRESTO program provided targeted grants in 2024 for early-career researchers to acquire advanced laboratory instrumentation, including gel documentation systems, focusing on high-throughput genetic studies.

- The Australian Research Council (ARC) funded Laboratory Infrastructure and Equipment (LIEF) grants in 2024, totaling AUD 9.3 million for universities to procure advanced imaging and gel documentation instruments to support life sciences research.

- DOE announced in 2024 funding of USD 32 million for national laboratory upgrades, including advanced gel imaging facilities to support proteomics and molecular biology research programs.

- UK research centers and hospital labs invested roughly USD 65 million in gel imaging systems in 2024, driven by molecular diagnostics and biomarker discovery, according to UK Research and Innovation (UKRI).

(Source: https://drugtodayonline.com)

(Source: https://apps.who.int)

(Source: https://pmc.ncbi.nlm.nih.gov)

(Source: https://www.embl.org)

(Source: https://genomecanada.ca)

(Source: https://www.arc.gov.au)

(Source: https://www.energy.gov)

(Source: https://www.mobihealthnews.com)

Segment Insights

Product Type Insights

Why Do Instruments Continue to Lead the Gel Documentation Systems Market?

The instruments segment dominated the gel documentation systems market in 2024, accounting for an estimated 54.4% market share, as laboratories were concerned with powerful, high-quality equipment to image small biomolecule separations. Integrated optics, high-resolution CCD/CMOS detectors, and cooled imaging units provided the sensitivity required to measure low-concentration samples' faint bands.

An analysis in 2024 by a number of core labs showed that failed runs went down almost 30% with the replacement of older instrumentation. This boosts effective throughput in proteomics and genomic facilities. Furthermore, the firmware updates, preventive maintenance, and strong service contracts that provided an on-site calibration practice strengthened institutional belief in long instrument reliability.(Source: https://www.corelab.com)

The software segment is expected to grow at the fastest rate in the coming years in the gel documentation systems market, with an estimated 5.4% CAGR, owing to its demand for automation, auditability, and AI-enabled quantification. Multi-user Image-analysis tools based on automated band-detection, background-correction, and normalization decrease variability among users and decrease the time taken to perform an analysis in multi-user labs.

The tools include software like GelBox (2024) that has been popular as they facilitate reproducibility of analysis and openness in gel image quantification. In 2024, AI-based systems such as GelGenie were also introduced and indicating that software was able to classify bands under a wide variety of experimental settings in seconds, outperforming older methods in consistency. Furthermore, the availability of cloud-enabled and LIMS-enabled platforms further propels the segment in the coming year. (Source: https://www.nature.com)

Light Source Insights

Why Does UV Light Dominate Gel Documentation Systems for Detection?

The UV light segment held the largest revenue share in the gel documentation systems market in 2024, accounting for 50.4% of the market share, due to the use of high-excitation efficiency of UV light by the laboratories in their classic nucleic-acid stains and pre-established electrophoresis-based workflows. Moreover, the UV suppliers cited the constant demand for replacement of UV lamps and calibration in 2024, which further affirms the instrument-centric ecosystem that spearheads UV dominance.

The LED-based system segment is expected to grow at the fastest CAGR in the coming years, with an estimated 5.6% growth rate in the gel documentation systems market because of the increasing demand for systems as safe excitation sources, multi-wavelength capability, and low operating costs. Moreover, the institutional safety officers pointed out in guidance that LEDs lower UV exposures to operators and make compliance with laboratory safety policies easier, leading to upgrades in hospitals and academic centers.

Detection Technique Insights

Why Is UV Detection the Preferred Technique in Gel Documentation Systems?

The UV detection segment dominated the gel documentation systems market in 2024, accounting for an estimated 52.4% market share, as it is widely used in nucleic acid visualization and can be used with conventional ethidium bromide (EtBr) staining procedures. Furthermore, the North American, European, and Asian-Pacific labs indicated that they were continuing to use UV systems. They were familiar with the regulations, and it was cost-effective in large-scale genomic and proteomic processes, further fuelling the segment.

The fluorescence detection segment is expected to grow at the fastest rate in the coming years, with an expected CAGR of 5.5% in the gel documentation systems market. Owing to the rising interest in non-toxic stains, high-dynamic range imaging, and multiplexed analysis. Additionally, the ongoing advancement of dye chemistry and imaging optics in 2024 enhanced the attractiveness of fluorescence detection as the solution of choice for high-accuracy and safety-oriented labs.

Application Insights

Why Is Nucleic Acid Quantification the Key Application Driving Gel Documentation Systems?

The nucleic acid quantification segment held the largest revenue share in the gel documentation systems market in 2024, accounting for an estimated 51.5% market share, due to its invaluable use in genetic studies, molecular diagnostics, and biotechnological studies. Automated gel documentation systems in laboratories across the world have become more popular in testing the purity and concentration of DNA and RNA before next-generation sequencing (NGS) and CRISPR-based gene editing operations.

In 2024, the National Center for Biotechnology Information (NCBI) found that, before the application of sequencing and cloning, electrophoresis was the most commonly used technique of quality assurance in molecular biology labs. Furthermore, the growing interest in data traceability, validated workflow, and regulatory compliance under Good Laboratory Practices (GLP) is expected to fuel the nucleic acid quantification systems.

The protein quantification segment is expected to grow at the fastest CAGR in the coming years that holding a market share of about 5.8%, owing to the increased proteomic research studies, precision therapeutics, and clinical biomarker discovery efforts.

It is expected that laboratories in Europe and North America focus on the hybrid imaging platforms that support the high-throughput Western blot analysis with quantification algorithms. Moreover, the Increasing investments in the manufacturing of recombinant proteins, cancer biomarkers, and personalized medicine are also likely to boost the growth trend of this segment.(Source: https://pmc.ncbi.nlm.nih.gov)

End User Insights

Why Do Academic and Research Institutes Drive Demand for Gel Documentation Systems?

The academic institutes & research institutes segment dominated the gel documentation systems market in 2024, accounting for an estimated 50.2% market share, due to the wide use of gel imaging systems in molecular biology, genomics, and proteomics research processes. The UKRI and NIH, through collaborative projects, insisted on standardized workflows of electrophoresis, further promoting the use of advanced gel documentation tools.

The pharmaceutical & biotechnology companies segment is expected to grow at the fastest rate in the coming years with an expected 5.6% CAGR, owing to the growth of drug discovery, biomarker studies, and therapeutic protein studies. In 2024, organizations began to use systems with fluorescence, chemiluminescence, and multiplexed imaging to enhance sensitivity and precision in the Western blotting, ELISA, and high-throughput screening workflow.

Connection with cloud-enabled systems and LIMS helped to comply with regulations, provide information in real time, and preserve the records safely. Furthermore, the growing interest in proteomics, antibody validation, and production of recombinant proteins should drive the use of improved gel documentation systems in pharmaceutical and biotech settings.

Regional Insights

U.S. Gel Documentation Systems Market Size and Growth 2025 to 2034

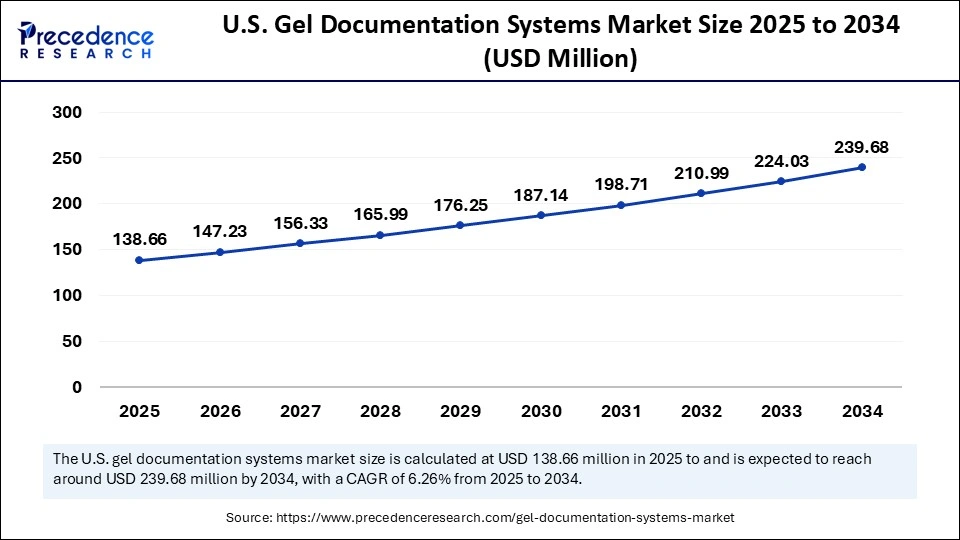

The U.S. gel documentation systems market size is exhibited at USD 138.66 million in 2025 and is projected to be worth around USD 239.68 million by 2034, growing at a CAGR of 6.26% from 2025 to 2034.

North America led the gel documentation systems market, capturing the largest revenue share in 2024, 48.8% market share in 2024, due to well-developed infrastructure in biotechnology, pharmaceuticals, and education. The U.S., in particular, has major research centers and drug development firms that are actively involved in the application of gel documentation in nucleic acid and protein diagnostic and genomic applications.

Positive governmental funding initiatives, including the NIH Research Project Grants (RPGs), also contributed to the uptake of more advanced gel imaging technology in 2024. Furthermore, the market leadership has also been consolidated by the sheer presence of the major manufacturers of gel documentation, including Thermo Fisher Scientific, Bio-Rad Laboratories, and Agilent Technologies.

United States Leads North America's Gel Documentation Systems Market in 2024

The United States is the main initiator of the gel documentation systems market in North America, which speaks to its highly developed biotechnological infrastructure and pharmaceutical market. In 2024, the U.S. research laboratories widely used high-resolution gel imaging platforms in their genomic and proteomic workflows, such as CRISPR validation. Additionally, the multi-site research studies were made with the aid of collaborative projects between academia and industry led to additional demand for advanced gel imaging instruments.

(Source: https://www.nih.gov)

(Source: https://pmc.ncbi.nlm.nih.gov)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period that holding a market share of about 5.0%. Owing to the augmented investments in biotechnology, life sciences, and pharmaceutical industries in different nations such as India and China, Japan, and South Korea.

The last policy of the government, including the growth and development of national biotechnology programs in India, has led to increased adoption of modern laboratory equipment, including gel documentation systems. Furthermore, the growth of the biotech ecosystem is likely to reinforce the market growth trend in the region.

China Drives Rapid Growth in the Asia Pacific Gel Documentation Systems Market

China became one of the significant players in the high-growth rate gel documentation systems industry in the Asia Pacific. The 14th Five-Year Plan (2021-2025) prioritized genomics, precision medicine, and biopharmaceutical innovation, which led to the upgrades of automated, high-sensitivity imaging systems. Additionally, the rise in investment in clinical proteomics and personalized medicine research work, backed by NSFC projects, strengthened the implementation of an AI-based gel documentation system.

The Europe and Africa region is expected to hold a notable revenue share of the market, due to the massive emphasis on genomics, proteomics, and molecular diagnostics. Furthermore, the rising partnerships between the pharmaceutical firms, biotech firms, and researchers in Europe are also likely to make further adoption of the state-of-the-art gel documentation technologies in the next few years.

Germany at the Forefront of Europe's Gel Documentation Systems Market Expansion

The main force behind the development of the gel documentation systems market in Europe is Germany. The use of high-resolution gel imaging platforms to analyze nucleic acids and proteins became common in German research institutions and biotech companies in 2024, especially in the context of molecular diagnostics and drug discovery settings. Moreover, the clinical research laboratories aim to accelerate the discovery of biomarkers and personalized medicine initiatives, thereby reinforcing the country's central position in the development of gel documentation systems in Europe.

Value Chain Analysis of Specialty Chemicals Gel Documentation Systems Market

- Raw Material Sourcing (Metals, Electronics, and Optical Components)

The production of gel documentation systems begins with sourcing essential raw materials such as aluminum, stainless steel, polymers, optical glass, and semiconductor components. These materials form the structural, imaging, and illumination units of the system.

Key Suppliers: Corning Inc., 3M, SCHOTT AG, Texas Instruments

- Component Fabrication and Machining

Precision fabrication converts sourced materials into functional components such as UV transilluminators, CCD/CMOS imaging sensors, filter assemblies, and enclosure panels. Advanced machining and micro-electronic fabrication ensure accuracy and high sensitivity for molecular imaging applications.

Key Players: Hamamatsu Photonics, Thorlabs Inc., Teledyne Technologies

- Testing and Certification

Each component undergoes rigorous optical calibration, safety checks, and image fidelity testing to comply with global standards such as ISO 13485 and CE certification for laboratory diagnostics equipment.

Regulatory Authorities: U.S. FDA, European Medicines Agency (EMA), Bureau of Indian Standards (BIS)

- Installation and Commissioning

After manufacturing, gel documentation systems are configured with image acquisition software and calibrated illumination. On-site commissioning ensures compatibility with laboratory workflows, including electrophoresis gel imaging and DNA/protein quantification setups.

Key Service Providers: Bio-Rad Laboratories, Analytik Jena, Azure Biosystems

- Distribution and Sales

Finished systems are distributed through a network of authorized dealers and laboratory equipment suppliers across regions. Online procurement platforms and institutional partnerships with research institutes and hospitals drive global sales.

Key Distributors: Fisher Scientific, VWR International, Thermo Fisher Scientific

- Maintenance and After-Sales Service

Post-installation support includes software updates, preventive maintenance, sensor recalibration, and replacement of UV lamps or LEDs. Service contracts and technical assistance are vital for ensuring consistent imaging quality.

Key Service Providers: Syngene International, Cleaver Scientific, Vilber Lourmat

- Product Lifecycle Management (PLM)

Manufacturers adopt continuous product lifecycle strategies that integrate AI-based imaging software, automation in data processing, and environmentally sustainable material reuse. Feedback from end-users in academic and clinical laboratories informs future R&D and design improvements.

Top Vendors in Gel Documentation Systems Market & Their Offerings:

- Thermo Fisher Scientific Inc.: Thermo Fisher offers a comprehensive range of gel documentation and imaging systems designed for protein and nucleic acid visualization. Its systems feature advanced CCD imaging, high dynamic range, and integrated software for quantitative analysis. The company's focus lies in improving reproducibility, sensitivity, and workflow automation in molecular biology research.

- Bio-Rad Laboratories, Inc.: Bio-Rad is a leading provider of gel documentation systems, including the ChemiDoc and GelDoc series, widely used in academic and clinical laboratories. These systems combine chemiluminescence, fluorescence, and colorimetric imaging in a single platform. The company emphasizes ease of use, digital data accuracy, and compatibility with a wide range of electrophoresis and blotting techniques.

- GE HealthCare Technologies Inc.: GE HealthCare delivers high-performance imaging and electrophoresis documentation platforms that support both research and diagnostic workflows. Its imaging systems integrate advanced optics and analysis software to deliver precise gel band quantification. The company focuses on developing scalable imaging solutions for proteomics and genomics applications.

- Agilent Technologies, Inc.: Agilent provides precision gel imaging systems and analytical software for DNA, RNA, and protein visualization. Its solutions are built for high reproducibility, quantitative accuracy, and efficient workflow integration. The company continues to innovate in digital imaging technologies and data processing tools for advanced life science research.

- Analytik Jena GmbH: Analytik Jena, through its Biometra product line, offers automated gel documentation systems featuring UV, blue, and white light illumination options. Its systems are known for robust performance, high image resolution, and modular design. The company's innovations focus on automation, safety, and cross-compatibility with electrophoresis systems.

Other Gel Documentation Systems Market Companies

- Syngene International Ltd.: Specializes in gel documentation and analysis platforms like G: BOX systems, offering high-sensitivity imaging for chemiluminescent and fluorescent gels.

- Cleaver Scientific Ltd.: Provides electrophoresis and gel documentation equipment optimized for education, clinical, and research laboratories.

- Vilber Lourmat SAS:Manufactures gel documentation systems featuring multi-wavelength illumination and advanced software for DNA, RNA, and protein imaging.

- Azure Biosystems, Inc.: Focuses on next-generation imaging systems with high dynamic range cameras and multiplex detection for precise protein quantification.

- PerkinElmer Inc.: Develops imaging platforms for life science analysis, integrating chemiluminescence and fluorescence imaging with automated data processing tools.

- Lonza Group AG: Offers electrophoresis and imaging solutions designed for high reproducibility and integration into molecular diagnostics workflows.

- Gel Company, Inc.: Provides compact and cost-effective gel documentation systems tailored for small labs and academic research environments.

- UVP LLC (Analytik Jena subsidiary): Produces UV and blue light gel documentation systems featuring intuitive control interfaces and advanced imaging software.

- Eppendorf SE:Delivers versatile gel documentation systems integrated with its electrophoresis products, emphasizing precision and ease of use in routine analysis.

- Major Science: Supplies affordable gel documentation and UV transilluminator systems designed for educational and research applications.

Recent Developments

- In July 2025, BIO.B, a global leader in life science research and clinical diagnostics products, introduced the ChemiDoc™ Go Imaging System, the newest addition to its ChemiDoc Imaging Systems portfolio. The system delivers rapid, reliable, and highly sensitive gel and Western blot imaging in a compact benchtop format, enabling streamlined workflows for laboratories.

- In September 2025,Mallinckrodt plc, a global specialty pharmaceutical company, announced the publication of results from a cross-sectional, physician-reported medical chart review and survey. The study assessed patient characteristics, medication utilization, and treatment effects on health status in patients with ankylosing spondylitis (AS) or psoriatic arthritis (PsA) treated with Acthar Gel (repository corticotropin injection). The manuscript is now available online in Open Access Rheumatology: Research and Reviews.

- In June 2025, Biotium launched the glo-plate white photoactivation device, a compact LED-powered light box designed for DNA gel analysis in educational and academic laboratories. The device offers bright, uniform white LED illumination for clear visualization of DNA bands stained with Biotium's DNAzure blue nucleic acid gel stain. This allows direct gel inspection without imaging systems or UV light, providing a safer and more cost-effective solution for students and educators.(Source: https://www.bio-rad.com)

(Source:https://www.prnewswire.com)

(Source: https://pharmafile.com)

Segments Covered in the Report

By Product Type

- Instruments

- Software

- Accessories & Consumables

By Light Source

- UV Light

- LED Light

- Laser-Based Systems

By Detection Technique

- UV Detection

- Fluorescence Detection

- Chemiluminescence Detection

By Application

- Nucleic Acid Quantification

- Protein Quantification

- Gel Imaging & Analysis

- Western Blot Analysis

By End-User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Diagnostic Laboratories

- Contract Research Organizations

By Region

- North America (US, Canada)

- Europe (EU, UK, Rest)

- Asia-Pacific (China, Japan, South Korea, Australia)

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting