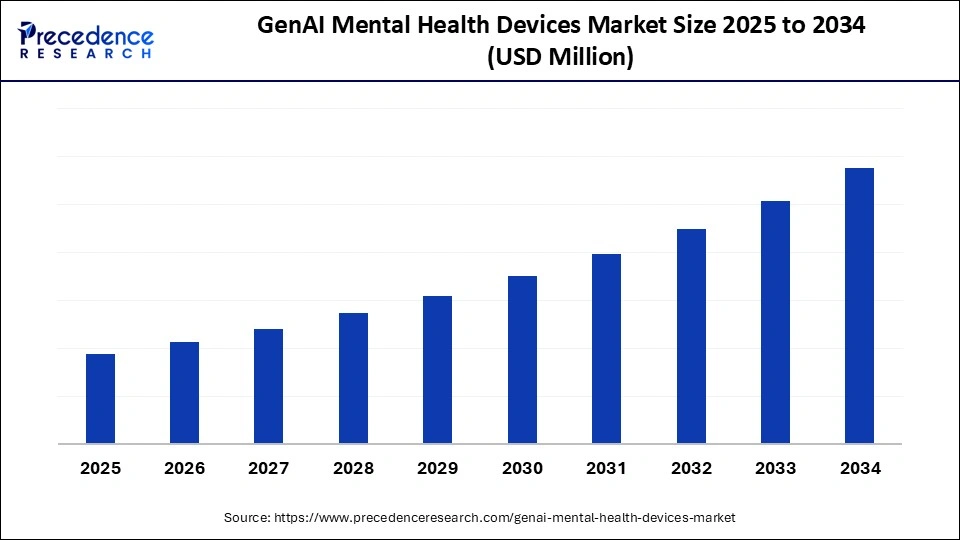

What is the GenAI Mental Health Devices Market Size?

The global genAI mental health devices market is evolving rapidly as AI-powered wearables, sensors, and diagnostic tools enhance emotional wellbeing, early detection, and personalized mental health support.The GenAI mental health devices market is driven by rising demand for personalized support, improved diagnostic capabilities, and broader integration of AI-powered therapeutic tools across diverse healthcare settings.

Market Highlights

- North America led the genAI mental health devices market with around 38% of the share in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By product type, the wearable devices segment held more than 35% of the market share in 2024.

- By product type, the mobile & app-integrated devices segment is growing at the fastest CAGR between 2025 and 2034.

- By deployment type, the home/personal use segment captured the highest market share of 50% in 2024.

- By deployment type, the corporate / workplace wellness programs segment is expected to expand at a significant CAGR from 2025 to 2034.

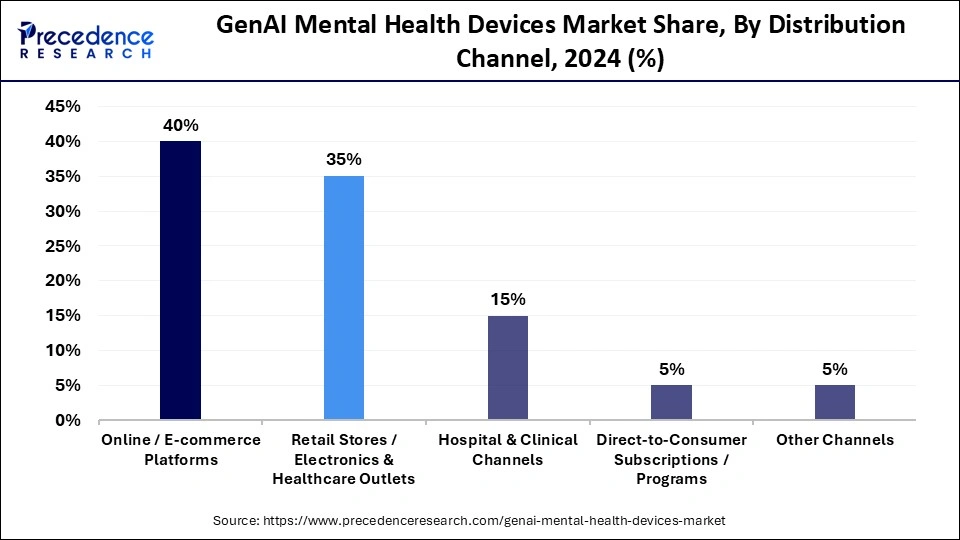

- By distribution channel, the retail stores / electronics & healthcare outlets segment held the major market share of 35% in 2024.

- By distribution channel, the online / e-commerce platforms segment is projecetd to grow at a notable CAGR between 2025 and 2034.

- By technology type, the AI-powered cognitive behavioral therapy (CBT) devices segment captured more than 40% of the market share in 2024.

- By technology type, the neurofeedback & brain stimulation devices segment is expanding at a solid CAGR from 2025 to 2034.

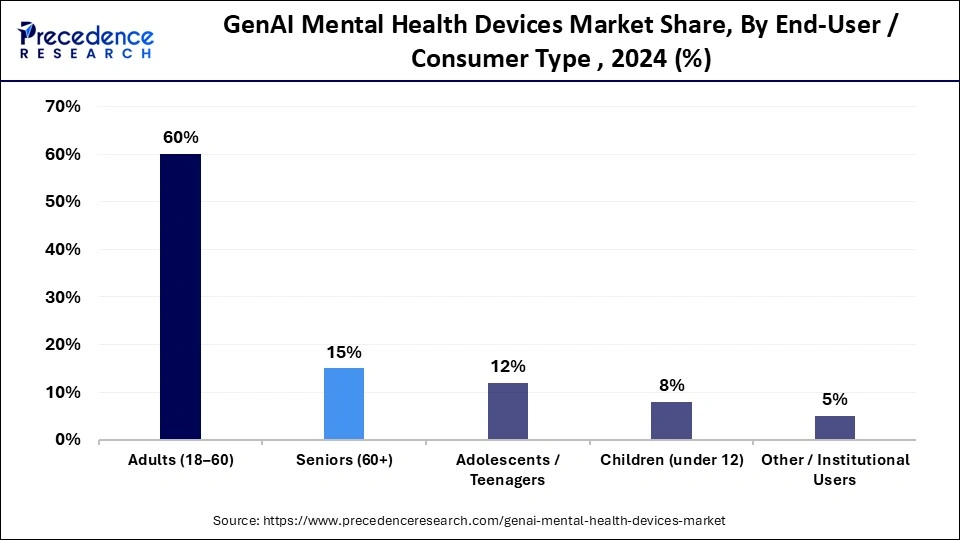

- By end-user / consumer type, the adults (18–60) segment contributed approximately 60% of the market share in 2024.

- By end-user / consumer type, the seniors (60+) segment is expected to expand at a notable CAGR between 2025 and 2034.

Advancement of GenAI-Driven Mental Wellness Tools

The worldwide expansion of genAI mental health devices is fast-tracking across the globe. The demand for immediate assistance with emotional health and the growing reliance on AI-enabled health monitoring support this growth. GenAI mental health devices facilitate continuous, individualized support while relieving demand for mental health systems that continue to be inundated with rising demands for emotional support.

The worldwide market for GenAI mental health devices includes wearables, sensors, and companion hardware that use generative AI to analyze mood fluctuations, interpret physiological signals, and promote personalized coping strategies. Bio signals are used as markers to assess mood and behavior, using metrics such as heart rate variability, sleep cycles, and stress biomarkers, integrated with the reasoning ability of large-language models designed to trigger proactive engagement. As these devices become increasingly integrated with smartphones and telehealth opportunities, use in consumer and clinical settings will continue to grow.

Market Trends

Emerging Trends Influencing the GenAI Mental Health Devices Sector

- Precision AI Diagnostics: GenAI devices are being increasingly utilized for real-time assessments by analyzing voice, expressions, and behaviours with audio and video devices. Their clinical acceptance is growing as providers seek faster, more objective diagnostic support.

- Emotion-Tracking Wearables: Wearables featuring mood-sensing algorithms and analytics of bio-signals are becoming mainstream. Such wearables enable passive monitoring and early-warning alerts, facilitating more proactive management of emotional changes.

- AI Therapy Companions: Conversational GenAI devices are being more frequently adopted to provide daily mental-health support. They provide guided interventions, stress management tools, and personalized behavioural feedback on evidence-based techniques and processes, adding value to what patients have learned in traditional in-office therapy.

- Cloud-Enabled Mental-Care Systems: Cloud-enabled GenAI devices are supporting therapy management, remote mental health monitoring, and their ability to receive instant updates. Cloud-enabled GenAI devices supportthe development of digital care network partnerships and improve continuity for patients across many platforms.

- Multilingual Support Platforms: Developers build multilingual and culturally adaptive models to broaden global reach. Such developments improve accessibility with diverse populations, which supports broader adoption in multilingual regions.

Empowering Minds: The Ascendance of Gen-AI Mental-Health Devices

The generative-AI mental health device market is undergoing rapid technological advancement. Large language models are now sophisticated enough to emulate empathetic conversations, detect emotional signals, and provide dynamic personalization in therapeutic conversations, provide early consultations, and deliver cognitive-behavioural therapy, thereby disrupting the boundary of human therapists versus AI assistants. These devices leverage advances in sensor data and behaviour analytics to identify early signs of mood changes, triggering immediate therapeutic prompts and supporting scalable cognitive-behavioural therapy modules.

Clinically validated digital therapeutic approaches are beginning to meld with generative frameworks, with the potential to expand access to evidence-based care in more affordable, convenient formats. Regulatory scrutiny and models of hybrid human-AI oversight, review, and monitoring continue to develop, and ecosystems to further develop, promote, and deploy. With the global increase of demand in mental health care, these generative-AI devices have the potential to expand access, even user engagement, while also promoting new pathways for care, all while maintaining ethical transparency and rigor in clinical care.

GenAI Mental Health Devices Market Outlook

National mental-health systems are under increased pressure, which is driving the uptake of AI-enabled devices, catalyzed by increased reporting of diagnoses and the availability of digital care. Public health data from the U.S. indicate that rates of clinically reported anxiety and depression are on the rise, supporting acceptance of adjunct remote and AI-enabled interventions within traditional regulated care pathways.

International regulators are actively updating the frameworks for digital mental-health tools, including the MHRA device qualification guidance, facilitating compliance expectations for companies scaling to major regions.

Academically and governmentally funded studies are demonstrating that rapid progress is being made in on-device LLM models that can detect mood, interact in real-time, and process user data privately, with the understanding that these tools will be adjuncts to professional care.

Federal drug authorities are seeking to establish structured evaluation pathways for generative-AI mental-health technologies; this is enabling significant regulatory predictability and technology distribution into both clinical and consumer environments.

Enhanced data protection rules like HIPAA and GDPR are driving developers toward secure building architectures, such as federated learning, more stringent encryption, and local processing which are influencing how next-generation devices are developed and applied.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Deployment Type, Distribution Channel, Technology Type, End-User/Consumer Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

GenAI Mental Health Devices Market Segment Insights

Product Type Insights

The wearable devices segment dominated the market with a 35% share, as remote monitoring and continuous mental-health tracking services utilizing AI technologies work well with wearables, cognitive behavioural therapy (CBT) devices, and app-based platforms. The category is further supported by the ongoing trend toward self-guided preventive care, subscription-based insights, and secure data dashboards that help users establish long-term emotional trends.

The mobile & app-integrated devices segment is set to be the fastest-growing in the genAI mental health devices market, as AI-guided digital therapy and virtual coaching are growing rapidly and gaining popularity for their ability to deliver real-time cognitive restructuring, behavioural nudges, and personalized mental-health-related exercises. The service category appeals strongly to individuals seeking an alternative to therapy, with a desire for flexibility and stigma-free therapeutic experience, through conversational generative AI technology.

Another significant segment is the portable diagnostic devices, which enables rapid assessments of a person mental state using generative AI-driven pattern identification. They can support the evaluation of an individual for potential early-onset mood disorders, burnout, cognitive decline, or stress dysregulation by analyzing metrics generated by devices, such as data patterns in brainwaves, sleep, or physiological responses. They are also increasingly incorporated into hybrid clinical workflows, such as in clinical practice, in wellness programs in schools, and in tablet- or smart-device-based tools prescribed in a digital-first healthcare model.

Deployment Type Insights

The GenAI mental health devices market is dominated by home and personal-use deployment, representing a 50% market share driven by an increasing preference for self-directed care, growing confidence in AI-based emotional monitoring, and the ease of use of the devices, such as smart bands, EEG headsets, and computerized cognitive behavioural therapy, at home. Users can enjoy features such as continuous monitoring, privacy, and prompt feedback, all of which make home-based deployment the preferred intervention for stress, sleep, and mood regulation.

Corporate and workplace wellness programs are the fastest-growing deployment type, with employers increasingly investing in GenAI-enabled well-being tools to address stress management, burnout, and productivity. Organizations are adopting AI-programmable wearables, neurofeedback technology, and mental health dashboards to evaluate employee satisfaction, address retention challenges, and better equip the workforce for resilience. Additionally, in light of hybrid work environments and a growing awareness of mental health within human resources teams, the workplace context will be an accelerating and growing frontier for connected mental health technologies.

The clinical/hospital/therapy centers deployment remains a significant segment and supports specified diagnostic pathways for treatment. In these contexts, GenAI-enabled devices are used to analyse mood, evaluate neurocognitive functioning, assess therapy outcomes, and assist clinicians in understanding patient behavior patterns at a deeper level. Furthermore, leveraging AI analytics can enrich clinical decision-making regarding mood, while neurofeedback devices can facilitate care support.

Distribution Channel Insights

Retailers and electronic healthcare retailers dominated the distribution landscape for the GenAI mental health devices market, with a 35% share, driven by consumer trust, in-person product experience, and an established physical infrastructure. Buyers prefer the in-store experience to understand and guide their use of AI-based mental health tools, particularly in assessing usability, comfort, and device accuracy. The credibility and accessibility of this channel help maintain the highest share of uptake across diverse use cases.

Online and e-commerce are emerging as the fastest-growing distribution channels due to shifting consumer purchasing behavior in digital spaces, the global availability of smart mental health devices, and product comparison features in digital contexts. This channel enables subscription and product model continuity, remote updates to devices, and direct-to-consumer engagement, making it ideal for AI-based devices.

Hospital and clinical distribution channels bring depth to the market by allowing supervised access to AI-based mental health devices for medically monitored conditions. This distribution channel permits formal requests for assessment, prescription, and supervised monitoring of technology, as well as clinical oversight of conditions requiring clinical support. The distribution of AI-based mental health devices in the hospital and clinical context adds credibility and ensures compliance with therapeutic protocols, prescribing a connected pathway of responsibility and accountability for conditions that range from self-care to the treatment stage.

Technology Type Insights

The AI-powered cognitive behavioural therapy devices segment held a 40% share and dominated the market, offering structured, evidence-based interventions for mental health through automated guidance, mood tracking, and tailored behavioural recommendations. Their robust therapeutic evidence base and the ability to effectively identify therapeutic elements without replacing traditional CBT contribute to their increased popularity. Whether new or advanced, products in this sector leverage integrations popularity to streamline consumer adoption and uptake among adults seeking easily accessible, digital mental-health support.

The neurofeedback and brain stimulation technologies represent the fastest-growing segment within this category, as demand rises for non-invasive, sensor-based mental health optimization support. These emerging systems use EEG readings, neural mapping signals, and real-time adaptive stimulation to promote focus, regulate emotions, and reduce anxiety. Their growth is additionally fueled by advances in portable neurotech hardware, increasing interest in the cognitive enhancement market, and acceptance of lenses to improve mental well-being based on our brain signals.

Virtual/augmented reality therapeutic devices designed to assist with sleep and stress may be further expanded to address baseline wellness factors that encourage mental health. These automated biosignal sensors, trained to detect circadian effects, and AI behaviours designed to help users understand their sleep, stress, and autonomic patterns, represent additional opportunities to support a preventive mental health care model. More generally, they may improve functioning in daily contexts, while also supporting well-being measures within a larger scope of GenAI-informed practices.

End-User/Consumer Type Insights

With 60% of the GenAI mental health devices market, adults are dominating as AI-based solutions designed to increase interest-based stress management, productivity, and emotional well-being. Adults are particularly receptive to wearables and cognitive-behavioural therapy (CBT)-based devices that seamlessly integrate into routines. Higher rates of digital literacy, work-related pressures on mental health and wellness, and spending habits contribute to adults leading position in the market.

Seniors are the fastest-growing end-user group in the genAI mental health devices market as GenAI-enabled devices increasingly address cognitive changes, mood swings, sleep issues, and social isolation associated with aging. Improvements in simple-to-use interfaces, voice-based commands, and remote monitoring appeal to seniors. The growing demand for increased support in monitoring cognitive decline, tracking fall risk in daily life, and ongoing support for health and wellness is influencing the adoption of GenAI devices among the growing senior demographic.

Adolescents round out the market because they adopt AI-powered devices that facilitate emotional regulation, school-related sources of stress, and early signs of anxiety or behavioural changes. Devices with gamified feedback, mood tracking, and discreet monitoring are favoured by youth with digital literacy. Rising academic pressure, stress related to social media, and the growing provision of early wellness education are making GenAI mental health solutions increasingly relevant to the adolescent demographic.

GenAI Mental Health Devices Market Regional Insights

North America is leading the genAI mental health devices market with a 38% share, has an advanced digital health ecosystem, strong investment flows into AI-enabled clinical technologies, and a well-defined regulatory landscape that sets safety and performance expectations for the use of AI-based tools in mental health. Large healthcare systems in North America are currently undertaking structured pilot programs to integrate generative AI (GenAI) triage, monitoring, and therapist-support modules into integrated virtual care pathways. Increased payer interest in evidence-based digital therapies, coupled with expanded reimbursement discussions, is incentivizing vendors to develop clinically validated, scalable devices. The strong regulations surrounding cybersecurity, access to rich clinical data, and innovative collaboration between industry and academia are major factors influencing innovation and market uptake in the region.

The U.S., specifically, is leading the way because federal regulators have recently increased oversight and guidance for technology associated with mental health, creating clearer pathways to clinical validation and market entry. Recent surveys indicate that approximately 1 in 6 U.S. adults use GenAI at least once a month to find health information or advice, and that approximately 40% of mental health care practitioners use ChatGPT to support clinical decision-making, documentation, and patient messaging. Health systems are increasingly implementing hybrid care models that use generative AI tools to support screening, patient engagement, and workflow improvement.

The abundance of venture capital funding, robust clinical research infrastructure, and large-scale digital health pilot testing programs in the U.S. allows organizations to rapidly test and refine GenAI mental health devices.

Asia Pacifics robust growth is driven by its sizable digital-first population, high smartphone penetration, and considerable unmet mental health needs, making scaling GenAI solutions particularly important. Governments in the Asia Pacific are working to strengthen digital health frameworks, expand tele-mental-health programs, and foster new national programs relevant to technology and start-ups to support AI innovation.

Private-sector activity in rapidly deploying AI-based chatbots, CBT-guided applications, and remote monitoring devices to stimulate early intervention and youth mental health support is also accelerating growth in the region. Increasing downloads of mental-health apps, growing use of subscription-based applications, and hospital-AI partnerships all signal accelerating adoption. Cost-effective delivery via mobile, culturally relevant content, and improved cloud infrastructure are also driving growth in the region.

India GenAI Mental Health Devices Market Trend

India leadership position, which stems from a large digital user base, is being further strengthened by rapidly expanding government tele-mental-health programs, such as its Tele-MANAS program, and the strong momentum of startups developing AI-enabled emotional-wellness applications. High levels of smartphone access and the increasing demand for low-cost, stigma-free support in both urban and rural communities are accelerating the uptake of generative AI mental health tools. Academic institutions and health ministries are also pushing to enact validation studies and guidelines, making India a key hub of innovation and growth in the Asia Pacific.

Across Europe, there is consistent growth as health care systems focus on safety, evidence, and transparency in the rollout of GenAI-enabled devices for mental health. This regional growth is driven by the EUs well-organized, country-specific regulatory environment, which pushes developers to deliver products that meet higher quality standards before entering clinical workflows. Hospitals and insurers are selectively adopting AI-enabled mental health solutions for clinical use, particularly products that enhance clinician productivity, support early screening, and enable remote support. Differences in adoption are increased by digital-therapy pilots, cross-border health data sharing, and demand for validated, privacy-preserving solutions. The region has strong data-protection laws, well-developed health care systems, and government-funded innovation plans, making it a strong candidate for a regulated, robust expansion region for thoroughly tested and evaluated GenAI-enabled devices for mental health.

Germany GenAI Mental Health Devices Market Trend

Germany leads in adoption because the structured pathway to digital health adoption focuses on key pathways, specifically the DiGA reimbursement system, which incentivizes clinically validated mental health applications. Developer incentives to produce strong evidence, while adhering to strict data security requirements, fully support transformation. Hospitals and insurers are increasingly interested in GenAI-supported mental health solutions that enable therapy, monitoring, and care coordination, making Germany the most active setting in the region for advancing regulated digital mental health solutions.

Latin America is becoming a growth-oriented region as governments, NGOs, and health providers are increasing their efforts to expand access to mental health through digital and AI-enabled tools. Countries in the region have many mental health-related workforce shortages; as a result, GenAI-supported screening, symptom-directed guidance, and self-help interfaces are valuable in underserved communities. Public-private partnerships are establishing regional telehealth programs that are gradually embedding digital mental health modules into primary care workflows. The rising rate of smartphone use, the demand for mental-wellness-related apps among youth, and the increasing amount of venture funding directed to health-tech companies are also accelerating the adoption of digital solutions.

Brazil GenAI Mental Health Devices Market Trends

Brazil is in the lead, due to the national telemedicine expansion, a strong urban digital adoption, and a rapidly growing ecosystem of behavioral health platforms. Organizations in Brazil, including public programs and private providers, are increasingly adopting AI-enabled triage and remote care tools to manage rising demand for mental health care. Brazil large population, active innovation hubs, and growing digital health infrastructure make it the leading environment in the region for testing and deploying GenAI mental health devices.

Governments Utilize Gen-AI to Scale Mental-Health Support Across Nations

Around the world, governments are increasing their participation in generative AI to support mental health care. For example, in the United States, the U.S. Food and Drug Administration is planning to hold an advisory committee meeting in November to investigate pathways for regulating AI-enabled digital mental health devices, leveraging its reach and scale while keeping safety risks in check. Similarly, in India, the government initiated a 24×7 remote-tele-mental-health program, Tele MANAS, as well as a plan to incorporate AI research guidelines from the Indian Council of Medical Research and NITI Aayog to promote the safe use of AI in mental health services.

In China, the national plans embrace AI technologies to support mental wellness and service delivery via public health policies, alongside care plans that include an AI-enabled assessment tool, an AI-enabled rehabilitative skills program, and AI-enabled creative therapy tools. These national plans also include reforms for public health insurance.

GenAI Mental Health Devices Market Companies

Woebot provides an AI-driven mental health companion that uses conversational GenAI and cognitive behavioral tools to deliver real-time emotional support, self-guided therapy pathways, and mood tracking.

Wysa offers an AI mental wellness coach that uses GenAI-powered chat, CBT exercises, mindfulness tools, and clinical escalation options to support stress, anxiety, and behavioral health management.

Koa Health delivers digital mental wellbeing tools enhanced by AI for stress reduction, resilience building, and behavioral health support, with personalized intervention paths for enterprise and clinical users.

Headspace integrates mindfulness exercises with AI-assisted personalization, offering meditation, sleep tools, and mental wellness programs enhanced by adaptive GenAI recommendations.

Ginger provides on-demand behavioral health support combining AI triage, chat-based coaching, and access to therapists and psychiatrists, offering scalable mental health care for employers.

Talkspace uses AI-enhanced matching and digital assessment tools to connect users with licensed therapists for text, audio, and video therapy, improving accessibility and treatment continuity.

BetterHelp leverages AI-based intake and therapeutic matching systems to pair individuals with online therapists, supporting virtual counseling through messaging and live sessions.

Pear develops FDA-cleared digital therapeutics supported by AI-guided engagement tools for treating mental health disorders such as substance use disorder, insomnia, and depression.

Mindstrong uses AI to analyze digital biomarkers from smartphone interactions, offering early detection of mood changes and personalized mental health interventions.

Limbic AI provides AI-powered clinical assessment tools that streamline intake processes, support triage decisions, and assist clinicians with precision diagnostics in mental health care.

Spring Health uses AI-based precision mental healthcare to match users with optimal therapies and providers, offering digital exercises, coaching, and clinical treatment pathways.

Top Key Players in GenAI Mental Health Devices Market and their Offerings

- Lyra Health: Lyra integrates AI-enabled assessments and personalized care recommendations to connect users with digital mental health tools, coaching, and evidence-based therapy.

- Quartet Health: Quartet uses AI to identify behavioral health needs through claims and clinical data, connecting patients to appropriate mental health resources and care pathways.

- Happify Health: Happify provides AI-driven mental wellness and digital therapeutics programs using gamified CBT, mindfulness, and personalized behavior change modules.

- Flow Neuroscience: Flow offers a wearable tDCS headset combined with an AI-guided behavioral therapy app for drug-free treatment of depression and mood disorders.

- BrainsWay: BrainsWay produces deep TMS devices for treating depression, OCD, and anxiety, using AI-driven data insights to refine treatment personalization.

- Empatica: Empatica develops AI-enabled wearable devices that track physiological signals for stress, mood, and emotional health monitoring, supporting mental health intervention and research.

- Muse (InteraXon): Muse provides neurofeedback headbands that use EEG signals and AI interpretation to support meditation training, stress reduction, and cognitive wellness.

- Neurable: Neurable develops brain-computer interface devices and EEG-based wearables that use AI to track focus, mental fatigue, and emotional state for mental wellbeing applications.

- BioBeats: BioBeats delivers AI-powered mental health and stress analytics through wearable biometrics, offering personalized behavior change programs for workplace wellness and individual health.

Recent Developments

- In May 2025, Israeli startup Mentaily raised US$3 million in seed funding to accelerate the development of its AI-powered mental health diagnostic and support tool called LIV in collaboration with Microsoft and KPMG.(Source: https://www.medicaldevice-network.com)

- In August 2025, Healthcare Triangle Inc. announced the launch of its new subsidiary QuantumNexis, which will lead a generative AI-powered platform via strategic acquisitions (including Niyama and Ezovion) to serve the future of healthcare data and integrated systems.(Source: https://finance.yahoo.com)

- In February 2025, Cedars Sinai introduced its immersive mental-health app named Xaia (eXtended-Reality Artificially Intelligent Ally), built for the Apple Vision Pro headset; the app uses generative AI and spatial computing to deliver avatar-led therapy and personalised coaching in virtual calm environments.

(Source: https://pharmaphorum.com)

GenAI Mental Health Devices MarketSegments Covered in the Report

By Product Type

- Wearable Devices (smartbands, headsets, neurofeedback devices): 35%

- Smartbands & wrist-wearables

- EEG headsets

- Neurofeedback devices

- Mobile & App-Integrated Devices: 25%

- Mental health monitoring apps with sensors

- AI-guided cognitive therapy devices

- Portable Diagnostic Devices: 15%

- Portable EEG/ECG units

- Stress and sleep monitoring devices

- VR/AR Therapeutic Devices: 10%

- Virtual reality therapy headsets

- Augmented reality cognitive training devices

- Stationary Clinical Devices: 8%

- In-clinic neurostimulation units

- Clinical-grade monitoring consoles

- Other Devices & Accessories: 7%

By Deployment Type

- Home/Personal Use: 50%

- Clinical / Hospital/Therapy Centers: 30%

- Corporate/Workplace Wellness Programs: 12%

- Other Deployments: 8%

By Distribution Channel

- Online / E-commerce Platforms: 40%

- Retail Stores / Electronics & Healthcare Outlets: 35%

- Hospital & Clinical Channels: 15%

- Direct-to-Consumer Subscriptions / Programs: 5%

- Other Channels: 5%

By Technology Type

- AI-Powered Cognitive Behavioral Therapy (CBT) Devices: 40%

- Neurofeedback & Brain Stimulation Devices: 25%

- Sleep & Stress Monitoring Devices: 15%

- Virtual / Augmented Reality Therapeutic Devices: 12%

- Other Technology Types: 8%

By End-User/Consumer Type

- Adults (18-60): 60%

- Seniors (60+): 15%

- Adolescents/Teenagers: 12%

- Children (under 12): 8%

- Other/Institutional Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting