Glass Prepreg Market Size and Forecast 2025 to 2034

The global glass prepreg market size was calculated at USD 6.00 billion in 2024 and is predicted to increase from USD 6.45 billion in 2025 to approximately USD 12.21 billion by 2034, expanding at a CAGR of 7.36% from 2025 to 2034. Advantages of the glass prepreg include consistent fiber alignment and resin content, strength, easy handling, lightweight, and structural stability that contribute to the growth of the market.

Glass Prepreg Market Key Takeaways

- The global glass prepreg market was valued at USD 6.00 billion in 2024.

- It is projected to reach USD 12.21 billion by 2034.

- The glass prepreg market is expected to grow at a CAGR of 7.36% from 2025 to 2034.

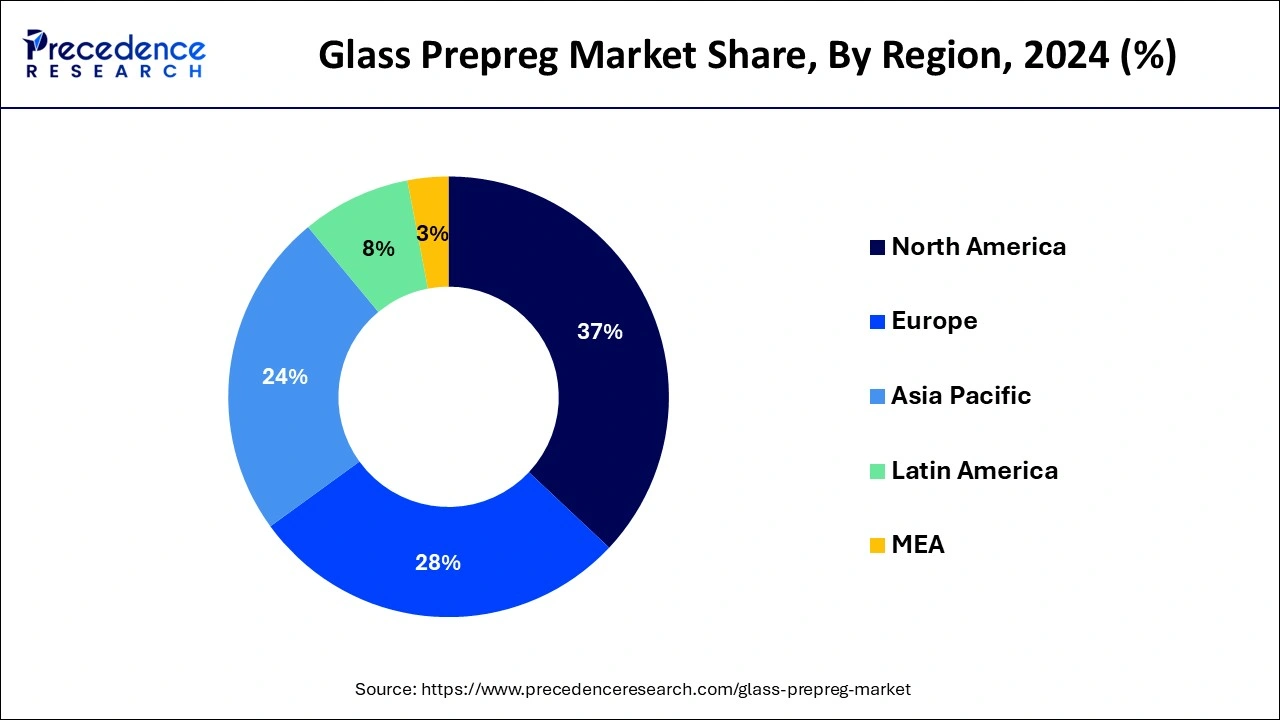

- North America dominated the market with the largest market share of 37% in 2024.

- Asia Pacific is estimated to be the fastest-growing during the forecast period of 2025-2034.

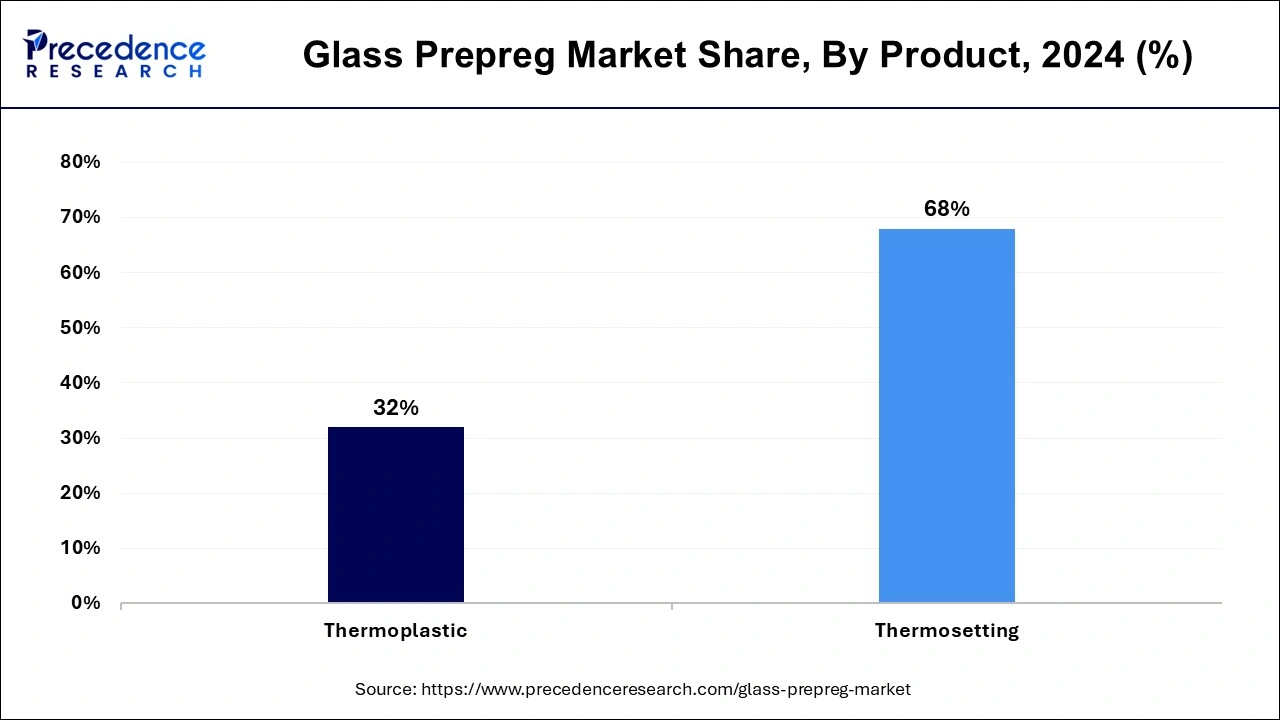

- By product type, the thermosetting segment has held a major market share of 68% in 2024.

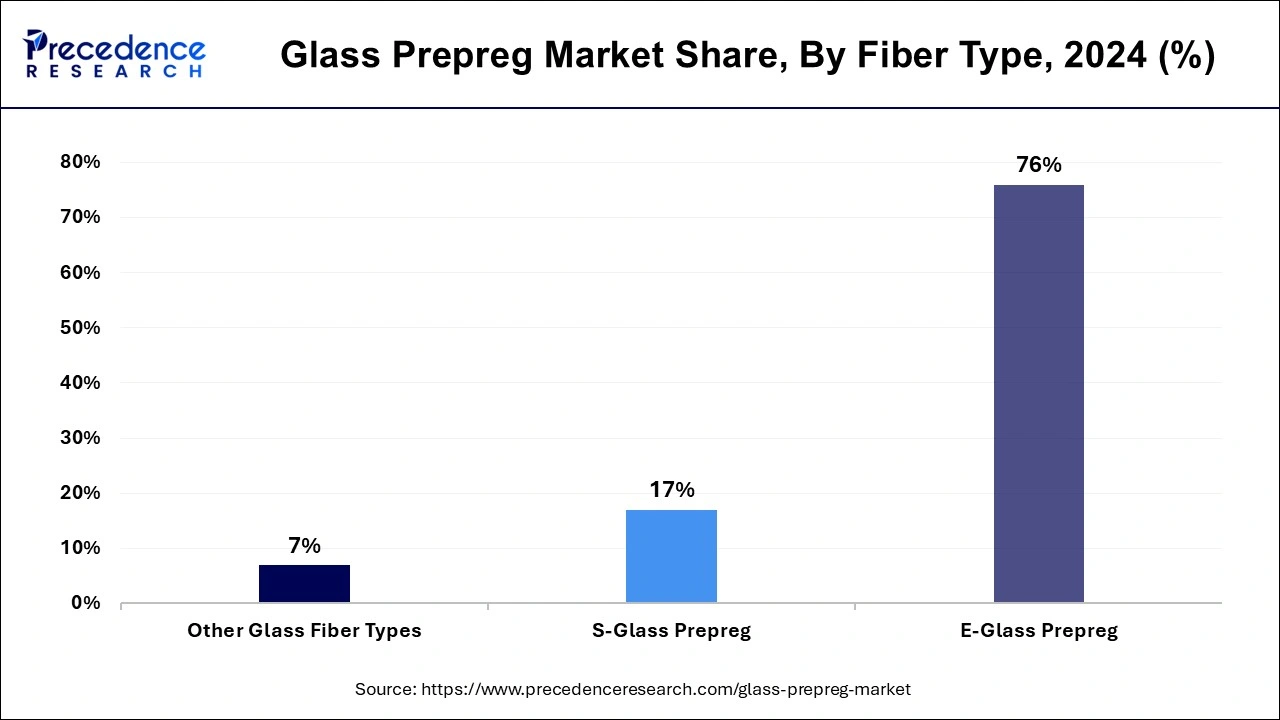

- By fiber type, the e-glass prepreg segment led the market with the biggest market share of 76% in 2024.

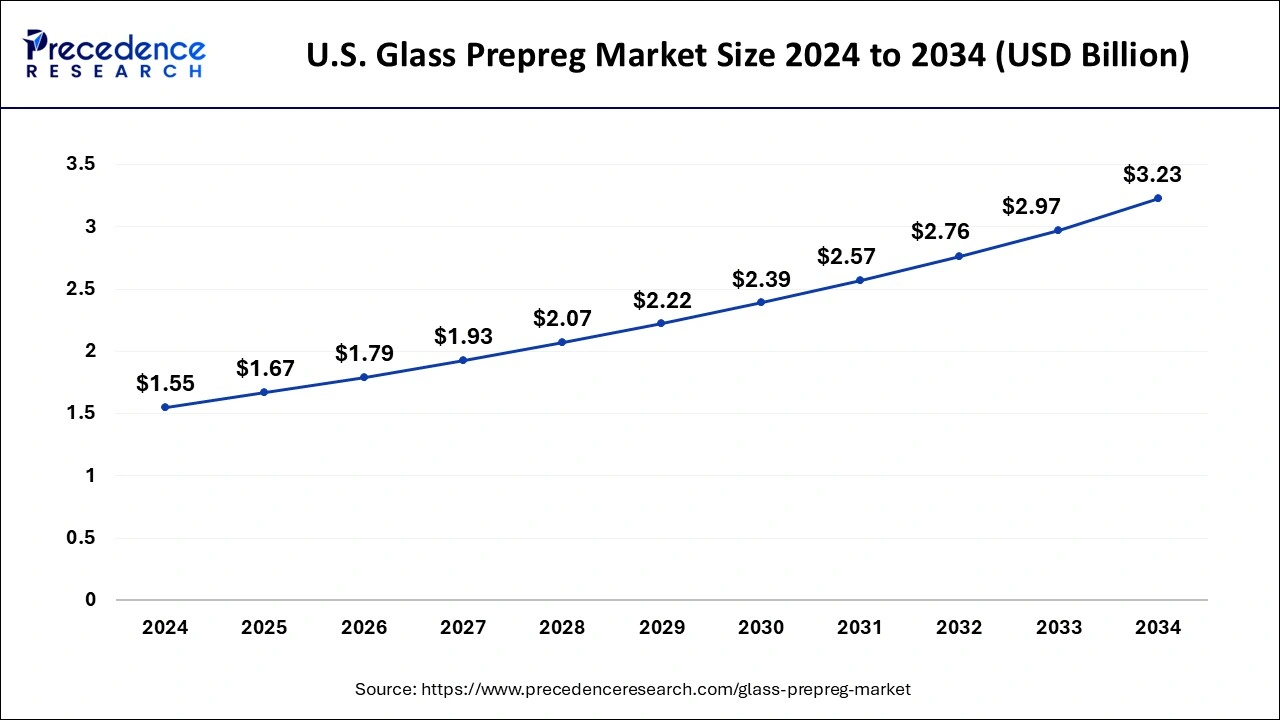

U.S. Glass Prepreg Market Size and Growth 2025 to 2034

The U.S. glass prepreg market size was exhibited at USD 1.55 billion in 2024 and is projected to be worth around USD 3.23 billion by 2034, growing at a CAGR of 7.62% from 2025 to 2034.

North America dominated the glass prepreg market in 2024. Rising automotive industries help to the growth of the market in this region. Other than the automotive industries, there are several sectors in which glass prepreg is useful. Toray Composite Materials America produces advanced prepreg systems for many industries like automotive, aerospace, and sports. United States manufacturing companies, including Zoltek Companies Inc., Isola Group, Renegade Materials Corporation, Hexcel, and TCR Composites Inc., are contributing to the growth of the market in the North American Region.

- In June 2023, two new aerospace materials ‘HiFlow HF610F-2 resin and HexPly M51 prepreg' for enabling higher production build rates and for faster-delivering cure cycles were launched by Hexcel, Stamford, Conn. US, due to OEM requirements and to increase efficiency of production.

Asia Pacific is estimated to be the fastest growing during the forecast period of 2025-2034. The Asia Pacific glass prepreg market is growing due to rising innovation and industrial demand, which focuses on high-performance and lightweight materials. The expansion of wind energy, automotive, and aerospace sectors helps the growth of the market in the Asia Pacific region. China is among the top countries in the world for supplying glass prepreg. The county also supplies prepreg in India. India and Vietnam are among the top importers of glass prepreg.

Market Overview

The glass prepreg market deals with large applications in numerous industries like construction, electronics, automotive, and aerospace. Glass prepreg is made of glass fiber mats or fabric infused with a resin system. Glass prepreg material is used in producing aerospace composites and printed circuit boards (PCBs). Fabricators mainly use it for removing the weight of the product part. Glass prepreg is also applied in commercial products, pressure vessels, sporting goods, and racing. Glass prepregs are used in industries and academia due to their properties like high specific strength and corrosion resistance, high tensile, fatigue resistance, high-temperature resistance, and lightweight. It also has reasonable costs compared to other prepregs and has easy techniques of manufacturing. These factors help to the growth of the market.

Glass Prepreg Market Growth Factors

- Glass prepreg has excellent properties like high specific strength, corrosion resistance, fatigue resistance, and lightweight, which lead to high demand in the industries and academia.

- Glass prepregs are more cost-saving than other prepregs and easy techniques of manufacturing.

- Other properties like high tensile and high-temperature resistance are useful in the glass prepreg market.

- E-glass prepregs are useful for making transparent compounds and light transparent unique opportunities. It is also used because it helps reduce waste and facilitate systematic manufacturing over time.

- It is also useful for better cosmetics, requires less time for curing, and has maximum strength.

- Glass prepregs are applicable in making structural parts of compounds.

- In aerospace, there is a high demand for lightweight materials to reduce emissions and improve fuel efficiency, which contributes to the growth of the glass prepreg market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.36% |

| Market Size in 2025 | USD 6.45 Billion |

| Market Size in 2024 | USD 6 Billion |

| Market Size by 2034 | USD 12.21 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and Fiber Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising demand in aerospace industries

Glass prepregs are applied in aerospace engineering due to their durable, strong, and lightweight properties, which make them suitable for aerospace applications. These are used in aerospace compounds to increase their durability. They are sticky on one side, which makes it easier for aerospace engineers to use them than other compound materials. Time is required for the manufacturing process of aerospace compound materials compared to other alternatives like plastics or metals. The properties of glass prepregs are highly resistant to chemical or solvent damage, and abrasive and corrosive are helpful in aircraft engineering. These factors contribute to the use of glass prepregs in the aerospace industries and contribute to the growth of the glass prepreg market.

Restraint

High cost, shelf-life, and lack of awareness

Glass prepregs are high in price. The cost of fabric, cure, and resin prepregs is added, and it becomes very costly. Regarding the shelf life of prepregs, some types of prepregs may be stored at room temperature 75°F for up to six months. Shelf life is reduced due to glass prepregs stored at warmer temperatures. There is a need for cooler storage and freezing for the glass prepregs, which also helps to extend their life. There is also a lack of awareness and worry that the carcinogenic effect can restrict the growth of the glass prepreg market. Limited awareness of the glass prepreg problems and solutions between policymakers, businesses, and consumers can slow down the growth of the market.

Opportunity

Rising demand in wind turbines

For green and eco-friendly environments, there is pressure to recycle the wind turbine blades, and there is difficulty due to their composite materials and blade structures. In wind turbine blades, glass fibers and thermosetting matrices can be used for manufacturing. Another point is that thermosetting or thermoplastic forms cannot be improved for making new products. There is an opportunity for the reuse of wind turbine blades by transforming compound material into a new source of the material. This can help to expand renewable energy, especially wind energy, and reduce dependence on fossil fuels. This may be done by the use of extra large wind turbine blades, which require stiff composite, damage-tolerant, fatigue-resistant, highly durable, lightweight, and advanced materials. These factors contribute to the growth of the glass prepreg market.

Product Insights

The thermosetting segment dominated the glass prepreg market in 2024. Thermosetting product type includes polyester resin, phenolic resin, and epoxy resin. Thermosetting properties include the interface with the reinforcement, curing of the matrix, etc. Thermosetting matrices are used in wind turbine blades for renewable energy, especially for wind energy. Polyester resins are used in the composite blades and extra large blades. The phenolic resins are used for prepreg; if they are made at a high temperature, the curing rate will be high.

For airplane components, phenolic resins are highly suitable because of their low density, low-smoke toxicity, low-smoke generation, chemical resistance, high-temperature performance, and high fire resistance properties. Phenolic resins are used in the overhead storage bins of an aircraft. The phenolic resin applications also include maritime, aerospace, and construction. Epoxy resin is also called e-glass fiber. In the manufacturing of composite materials, it acts as an intermediate. These factors help the growth of the segment and contribute to the growth of the market.

- In June 2022, Swancor launched new recyclable thermosetting epoxy resins, CleaVER and EzCiclo, for the reuse and recycling of wind turbine blades.

The thermoplastic segment held a considerable share of the market. Thermoplastic is a plastic polymer material. Thermoplastic product types include polyamide, polyetherimide, and polyphenylene sulfide. The traditional thermoplastic prepreg contains a complete polymerized matrix. Thermoplastic's advantages include that it may allow larger deflections than other metals without deformation and has better properties than other metals.

It has low cost, high precision, energy-efficient processing and manufacturing, and high volume production properties. In aerospace, for aircraft interiors, aerospace components, and satellites and spacecraft, it is useful. In the automotive industry, thermoplastics are used for tooling and automotive parts manufacturing. In renewable energies like solar panels and wind turbine blades making and in sports like sporting goods and racing car parts making, thermoplastics are useful. These various applications help the growth of the segment and contribute to the growth of the glass prepreg market.

Fiber Type Insights

The e-glass prepreg segment dominated the glass prepreg market in 2024, and it will be dominant during the forecast period of 2025-2034. E-glass prepregs have advanced in fabrication and processing technology. There are many advantages over traditional manufacturing processes, such as systematic manufacturing with time and waste reduction.

The e-glass prepreg has various applications in different fields like aerospace, marine, sports equipment, pressure vessels, and commercial products due to their beneficial properties. In the aerospace industry, e-glass prepregs are used because they provide durability, stiffness, and strength for making aircraft components like structural parts, fuselages, and wings. In the marine sector, e-glass prepegs are used in marine applications and boat building due to their resistance to UV exposure, corrosion, and water. It also benefits for structural components, decks, and boat hulls. For sports equipment, e-glasses are used for bicycles, golf clubs, rackets, and tennis frames. Its strength and lightweight nature contribute to the growth of the segment.

E-glass is used in pressure vessels like tanks and gas cylinders. In various commercial products, e-glass is used in architectural structures, wind turbine blades, and automotive parts due to its mechanical and versatility properties. These various applications contribute to the growth of the segment and are helpful for the growth of the market.

The s-glass segment also has a significant share in the glass prepreg market. S-glass, also called high glass, is used in defense and wind energy due to its improved mechanical properties. S-glass prepreg type contains a higher level of silica than the other standard glass fibers for improved physical properties. The main properties of s-glass prepreg include improved impact resistance, high-temperature resistance, compressive strength, and high tensile. S-glass has various applications in different fields where strong and lightweight components are required.

Recent Developments

- In September 2022, the Native Lab Managing Composites training division launched an online session masterclass on carbon fiber prepreg monocoque.

- In February 2023, the Toray industry of Tokyo, Japan, supplied the Japan Aerospace Exploration Agency's prepreg and Toryka carbon fiber H3 launch vehicle to the H-IIA rocket.

- In April 2023, CompPair expanded its HealTech Standard product family and launched a swift prepreg line, the CS02, for faster product manufacturing, industrial applications, leisure, and sports. It may also be applicable in autoclaves and out of autoclaves. CompPair also supplies fibers, including glass and carbon, and special textiles, including recycled and sustainable fibers.

- In December 2023, a new fast-curing epoxy prepreg system, SolvaLite 716 FR launched by Solvay and it is designed for reinforcement in premium battery electric vehicles (BEVs) and a range of structural parts. SolvaLite has a high demand for materials in the automotive sector due to their materials are helpful for the protection of electric batteries from the fire risk.

Glass Prepreg Market Companies

- Axiom Materials

- ACP Composites

- Cytec Solvay Group

- Gurit Holding

- Hexcel Corporation

- Isola

- Lingol

- Lewcott

- Mitsubishi Rayon

- Newport

- Owens Corning

- Royal Ten Cate

- Sunrez

- SGL Carbon

- Toray Industries, Inc.

- Teijin Limited

- Zyvex Technologies

- Zoltek Companies

Segments Covered in the Report

By Product

- Thermosetting

- Epoxy Resin

- Phenolic Resin

- Polyester Resin

- Thermoplastic

- Polyamide (PA)

- Polyetherimide (PEI)

- Polyphenylene sulfide (PPS)

By Fiber Type

- E-Glass Prepeg

- S-Glass Prepeg

- Other Glass Fiber Types

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting