Infectious Disease Vaccines Market Size and Forecast 2025 to 2034

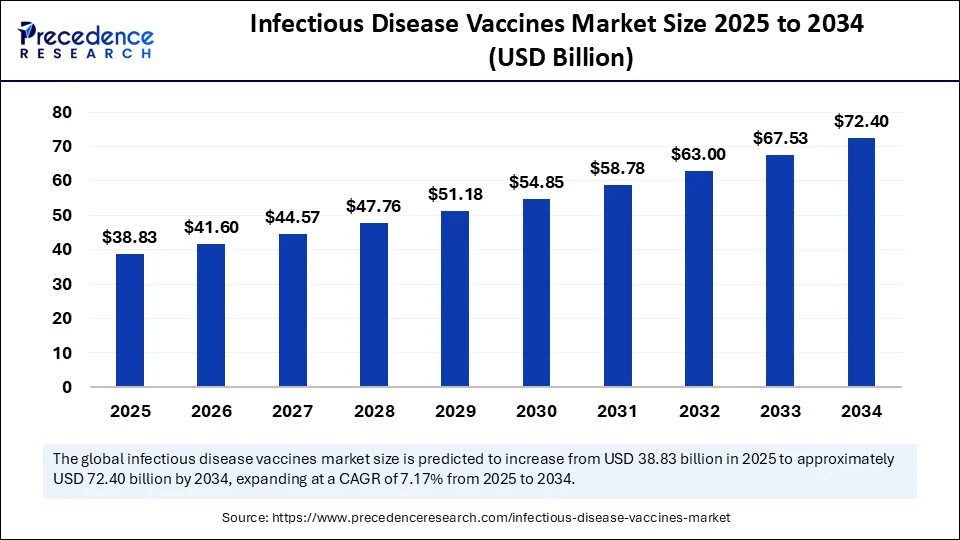

The global infectious disease vaccines market size accounted for USD 36.25 billion in 2024 and is predicted to increase from USD 38.83 billion in 2025 to approximately USD 72.40 billion by 2034, expanding at a CAGR of 7.17% from 2025 to 2034. The increased prevalence of infectious diseases and advancements in vaccine technology are driving the global market. The government initiatives and support are further contributing to the market growth.

Infectious Disease Vaccines MarketKey Takeaways

- In terms of revenue, the global infectious disease vaccines market was valued at USD 36.25 billion in 2024.

- It is projected to reach USD 72.40 billion by 2034.

- The market is expected to grow at a CAGR of 7.17% from 2025 to 2034.

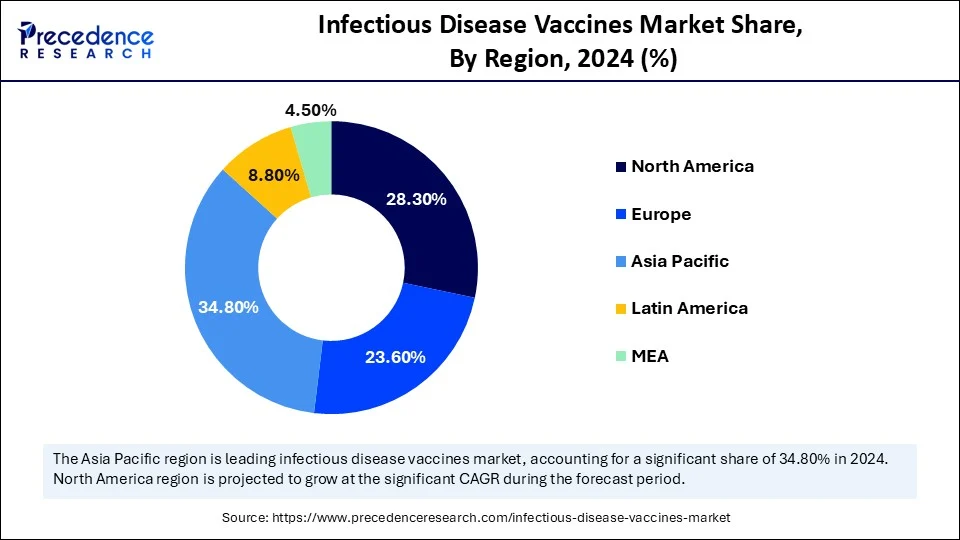

- Asia Pacific dominated the global infectious disease vaccines market with largest market share of 34.8% in 2024.

- North America is expected to grow at a significant CAGR from 20245 to 2034.

- By technology, the subunit, recombinant, polysaccharide & conjugate vaccines segment contributed the biggest market share of 28.6% share in 2024.

- By technology, the mRNA vaccines segment is expected to grow at a notable CAGR between 2025 and 2034.

- By disease indication, the COVID-19 segment captured the highest market share of 22.3% in 2024.

- By disease indication, the dengue segment will grow at a notable CAGR between 2025 and 2034.

- By age group, the pediatric segment held the largest market share of 45.1% in 2024.

- By age group, the adult segment will grow at a significant CAGR between 2025 and 2034.

- By end-use, the government immunization programs segment generated the major market share of 52.4% in 2024.

- By end-use, the hospitals & clinics segment will grow rapidly between 2025 and 2034.

- By distribution channel, the public (government & NGO-led programs) segment accounted for the significant market share of 61.7% in 2024.

- By distribution channel, the private (pharmacies, hospitals, clinics) segment will grow at a notable CAGR between 2025 and 2034.

AI in Infectious Disease Vaccine Research and Development

AI is playing a transformative role in the research and development of infectious disease vaccines. The ongoing focus on accelerating machine learning algorithms for creating vaccines for various disease to enhance their effectiveness and accessibility is contributing to the growth. AI acceleration in next-generation mRNA therapies for various infectious diseases is enabling the cutting-edge research and development of infectious disease vaccines. The ongoing focus on leveraging AI in infectious diseases for effective management and study of unknown patterns and sectors is supporting vaccine research & development.

- From December 4-5, 2025, the 2nd Artificial Intelligence in Infectious Disease Workshop 2025 will be held as a hybrid meeting. The workshop will bring collaborations between the artificial intelligence (AI) technology sector and healthcare professionals.(Source: https://academicmedicaleducation.com)

Asia Pacific Infectious Disease Vaccines Market Size and Growth 2025 to 2034

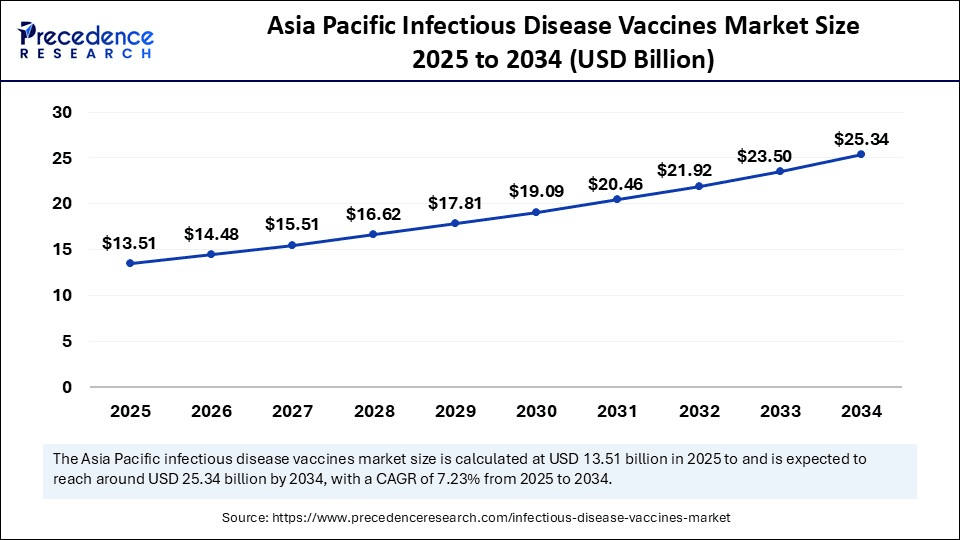

The Asia Pacific infectious disease vaccines market size was exhibited at USD 12.61 billion in 2024 and is projected to be worth around USD 25.34 billion by 2034, growing at a CAGR of 7.23% from 2025 to 2034.

Asia Pacific Infectious Disease Vaccines Market

Asia Pacific dominates the global market, driven by the increased prevalence of infectious diseases in the region, particularly measles. The incidence of measles in East Asia and the Pacific has increased, driving significant focus on the vaccination program. The expanding pharmaceutical firms, investments in research & development, and government initiatives and support are contributing to the market growth. Government investments in local manufacturing capabilities in China and India are fostering the development and manufacturing of novel vaccines and therapeutics. The growing focus on technological advancements is further contributing to the market growth.

Asia Pacific is the hub for vaccine developments with 46% of the global prophylactic trials and 31% of therapeutic trials of vaccines, due to growing innovations in advanced technologies, strong pipelines, and collaborations to prevent compact disease. (Source:https://www.biospectrumasia.com)

Strong Manufacturing Capabilities: To Lead the China Market

China is a major player in the regional market, growth driven by the country's well-established pharmaceutical sector, robust research & development infrastructure, and government support. China leads the Asian vaccine market with 41% of prophylactic vaccine trials and 28% of therapeutic trials conducted. China dominates both prophylactic and therapeutic vaccine trials with advanced mRNA and viral vector platforms. China is a country with a large-scale prevalence of infectious diseases, driving significant emphasis on the development of vaccines to cope with part of the country's efforts to boost the areas of the manufacturing sector.

India as a Major Vaccine Supplier

India is the second-largest player in the regional market, contributing to the growth due to the country's vast vaccine manufacturing and strong supply of cost-effective vaccines. The government investments in local pharmaceutical companies and manufacturing giants are fostering this growth. According to the WHO vaccine report 2024, the WHO South-East Asia is the 87% self-supplier for its vaccines due with India 84% of doses procured in Asia and processing 99% of its needs. (Source: https://www.biospectrumasia.com)

North America Infectious Disease Vaccines Market

North America is the fastest-growing region in the global market, growth driven by the region's large infectious disease prevalence and well-established healthcare infrastructure. North America is a large adopter of new vaccines and large-scale immunization programs for various diseases. The prevalence of infectious diseases such as seasonal influenza, COVID-19, and HPV is rapidly increasing in the region. The well-established healthcare system and government initiatives are supporting the market growth and vaccine distribution.

Large Infectious Disease Prevalence: To Boost the U.S. Vaccination Developments

The U.S. is a major player in the regional market, driven by robust regional healthcare infrastructure and the existence of robust pharmaceutical companies and regulatory support. The U.S. Food and Drug Administration (FDA) is accelerating approvals for novel and innovative vaccine developments and adoption for infectious diseases. The growing infectious disease cases in the U.S. is leading the focus on research, development, and manufacturing of novel and innovative vaccines.

The U.S. reported approximately 1,300 cases of measles in 2019, according to the Centers for Disease Control and Prevention (CDC). Between 2000 to 2024, 3 people died from measles in the U.S., where the number of cases led to 3 deaths by May 2025. (Source: https://www.chop.edu)

Market Overview

The infectious disease vaccines market refers to the industry focused on the research, development, production, and distribution of vaccines designed to prevent infectious diseases caused by viruses, bacteria, and other pathogens. This market includes traditional vaccine technologies as well as advanced platforms such as mRNA and vector-based vaccines, serving global immunization needs across age groups and geographies. Additionally, the advancements in new virus-like particle (VLP) platforms are further aiding in the creation of novel vaccine types and enhancing the effectiveness of existing ones.

The increased infectious disease prevalence has fueled the requirement for new trial designs and technology solutions to improve the speed and flexibility of infectious disease vaccine research and development. The government emphasizes preventing potential future risk of infectious diseases, and is contributing to rising investments in R&D and immunization programs.

CSL Seqirus UK Limited started manufacturing of over 5 million doses of the human H5 influenza vaccine in December 2024. The UK has bought these vaccines to protect against bird flu, in preparation to avoid risk in 2025. (Source: https://www.vax-before-travel.com)

What are the Key Trends of the Infectious Disease Vaccines Market?

- Prevalence of Infectious Disease: The increased infectious diseases prevalence such as HPV, influenza, COVID-19, malaria, and tuberculosis, has increased demand for efficient vaccines globally.

- Growing Public Awareness: The rising awareness among the public about the growing number of infectious diseases and the importance of vaccines to treat such diseases is driving the adoption of various infectious disease vaccines across the world.

- Advancements in Vaccine Technology: The growing emphasis on vaccine technology advances, such as mRNA, viral vector, and recombinant protein technologies, is enhancing the development, scalability, and flexibility of vaccines.

- Public-Private Collaborations: Growing partnerships between pharmaceutical companies, research institutes, international organizations, and governments are enabling accessible and rapid vaccine development and distribution.

- Focus on New Vaccine Development: The ongoing rapid surge in development of novel and therapeutic vaccines by using existing vaccines and for therapeutic uses is projected to expand the emerging market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 72.40 Billion |

| Market Size in 2025 | USD 38.83 Billion |

| Market Size in 2024 | USD 36.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.17% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Age Group,Disease Indication, Distribution Channel, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Technological Advancements in Vaccine Development and Administration

The technological advancements in vaccine development and administration, such as mRNA technology, self-amplifying RNA (saRNA) vaccines, vaccine delivery systems, digital health integration, and thermostable formulations, are driving the global market. The increased need for rapid development and scalability of infectious disease vaccines has led to the adoption of mRNA technologies. The ongoing demands for personalized vaccine administration have transformed focus toward advancements in genomics and biotechnology to enhance personalized vaccines and therapeutic vaccines for chronic infectious diseases, including hepatitis and HIV. The digital health integration includes electronic health records (EHRs), real-time adverse effect detection systems, and national immunization information registries and enhancing vaccine coverage and supply chain management.

Restraint

High Vaccine Development and Manufacturing Cost

The high cost associated with the development and manufacturing of vaccines is the major market restraint. The development and manufacturing of vaccines includes various stages such as advanced research, multiple phases of preclinical and post clinical trials, and setting up a large-scale manufacturing process, adding to the cost. The strict quality control and regulatory compliance with safety and quality standards further add to this cost. The small pharmaceutical or low-resource setting-based firms witness high challenges for vaccine development and manufacturing.

Opportunity

Investments in Research & Development

Pharmaceutical companies, private organizations, and governments are investing heavily in R&D of vaccines to enhance novel developments and innovations. The investments are enabling developments of new and highly efficacy vaccines as well as advancements in vaccine technologies. The organization has invested heavily in major target vaccine developments for infectious diseases such as malaria, tuberculosis (TB), influenza, and HIV. Other diseases, like Group A Streptococcus, further contribute to research and development investments for urgent vaccines. The vaccine research and development investment cases are major identified by private pharmaceutical companies, multilateral donors, and national governments.

- In July 2025, the Global Health Innovative Technology (GHIT) Fund invested around JPY 1 billion (USD 7.3 million) in four R&D projects for the development of vaccines, diagnostics, and drugs for tuberculosis (TB) and malaria. (Source: https://firstwordpharma.com)

Technology Insights

Which Technology Led the Infectious Disease Vaccines Market in 2024?

In 2024, the subunit, recombinant, polysaccharide & conjugate vaccines segment led the infectious disease vaccines market, due to their high specificity of pathogens like sugar antigens and proteins, hep to stimulate the immune system. The subunit and recombinant technology enable safe and targeted developments of vaccines to prevent the risk of disease-causing. The polysaccharide technology enables bacterial protection by targeting the sugar molecules. The conjugated vaccines technology helps to improve immune response, particularly in infants and young children.

The mRNA vaccines segment is expected to grow fastest over the forecast period, driven by its supportive role in the rapid development and scalability of effective vaccines. The regulatory approvals for novel mRNA vaccines are contributing to rising innovations and developments. The various preclinical and clinical trials for infectious disease vaccines have shown the effective role of mRNA vaccines. The growing technological advancements in mRNA vaccines for enhancing antiviral immunity against an infectious agent range, including varicella-zoster virus, rabies virus, CMV, RSV, HIV, influenza virus, Zika, and SARS-CoV-2, are supporting the segment growth.

Disease Indication Insights

What Made COVID-19 Disease Indication Dominate the Infectious Disease Vaccines Market in 2024?

The COVID-19 segment dominated the infectious disease vaccines market in 2024, due to rapid demand for effective vaccines for combating the pandemic 2024. The government funding for mass vaccination campaigns and growing awareness about the advantages of vaccination and prevention of healthcare measures contributed to the vaccine demand for the COVID-19 disease. The pandemic has shifted the government's focus on investing in vaccine development, manufacturing, and distribution. The rapid advancements in vaccine technologies, such as mRNA and viral vector vaccines, are bringing promising outcomes in offering immunity against COVID-19.

The dengue segment is the second-largest segment, leading the market, due to the increased prevalence of dengue in 2024. The government initiatives, such as the implementation of mass vaccination programs and collaborations with pharmaceutical companies for controlling dengue outbreaks, have boosted demand and adoption of the vaccines. The rising awareness about dengue and the importance of vaccination to prevent and control the disease are fostering the demand for vaccines. Additionally, the advancements in vaccine technologies like Sanofi's Dengvaxia and Takada's QDENGA are contributing to the segment's growth.

Age Group Insights

Which Age Group Segment Dominates the Infectious Disease Market?

The pediatric segment dominated the infectious disease vaccines market in 2024, due to the high prevalence of infectious diseases in infants and children. The increased government and international support in immunization programs for pediatric vaccinations is fostering the high administration of vaccines in this age group. The prevalence of infectious diseases and transmissibility of diseases like MMR in children have high chances. The growing innovations in the development of new vaccines for the pediatric age group are forging the segment. Additionally, the growing combination vaccination rates are contributing to preventing infectious diseases in the pediatric age group.

The adult segment is the second-largest segment, leading the market, driven by increased demand for vaccines among adult patients. The impact of COVID-19 on the adult age group has fueled the awareness of the importance of preventing infectious diseases. The increased demand for vaccines to protect from age-related infectious diseases like the flu is further aiding in this growth. The large accessibility of effective vaccination for adults in pharmacies and hospitals is further supporting this growth.

End-Use Insights

What Made Government Immunization Programs Dominate the Infectious Disease Vaccines Market in 2024?

The government immunization programs segment dominated the market in 2024, due to increased government focus on preventing disease prevalence. Organizations, including Gavi, the Vaccine Alliance, and the World Health Organization (WHO), are accelerating to enhance vaccine access across the world. The immunization programs are the most effective and affordable interventions for eradicating diseases and controlling them. Immunization helps to save millions of patient lives across the world annually. It encourages healthcare providers, communities, and governments globally to increase their focus on vaccines and extended immunization coverage. The growing emphasis of government and organizations for investing in vaccine research & development, manufacturing, distribution, as well as increasing public awareness, is revolutionizing the market.

On November 10, the annual World Immunization Day is celebrated to increase awareness of the vaccine's crucial role in the prevention of infectious diseases and public health protection. (Source: https://www.mohfw.gov.in)

The hospitals & clinics segment is expected to lead the market over the forecast period, driven by the rising adoption of vaccinations in hospitals & clinics. The hospitals & clinics are primary end-user providers of pediatric services, including vaccinations for children. The growing number of hospitalizations due to the increasing prevalence of infectious diseases is boosting the need for vaccinations in hospitals & clinics. Additionally, the participation of hospitals & clinics in immunization programs for offering essential vaccination services for patients is further contributing to the rising demand and adoption of infectious disease vaccines.

Distribution Channel Insights

Which Distribution Channel Dominated the Infectious Disease Vaccines Market in 2024?

In 2024, the public (government & NGO-led programs) segment dominated the market, due to high adoption of vaccines through government and NGO-led programs. These programs are essential for providing access to vaccines in low-income countries. The growing emphasis of government and NGO-led programs to foster immunization coverage in underserved areas is fueling vaccine adoption. The global government initiatives like CEPI, WHO, and Gavi are accelerating development, manufacturing, and access to vaccine facilities.

The private (pharmacies, hospitals, clinics) segment is the fastest-growing segment of the market, and contributes to growth due to growing hospitalization and demand for effective vaccination in pharmacies, hospitals, and clinics. The hospitals and clinics are primary distributors of the vaccines. The growing awareness about the importance of vaccines has boosted demand for infectious disease therapies in hospitals and clinics. The pharmacies, hospitals, and clinics provide sophisticated patient care, prompt reimbursement, and favorable insurance policies, making vaccination more accessible for patients.

Value Chain Analysis

R&D

The R&D of infectious diseases includes stages such as exploratory, pre-clinical, and clinical developments in three phases of phase 1, phase 2, and phase 3, regulatory review & approvals, manufacturing, and pharmacovigilance

Key Players: Moderna, GSK, Sanofi, and Pfizer

- Clinical Trials and Regulatory Approvals

Infectious disease vaccines go through pre-clinical trials, including phases 1, 2, 3, and 4. The regulatory frameworks, such as the U.S> Food and Drug Administration (FDA) and the European Medicines Agency (EMA), offer approvals for novel innovations and developments.

Key Players: Pfizer/BioNTech, GlaxoSmithKline (GSK), Moderna, and Merck & Co.

- Packaging and Serialization

The typical packaging system for infectious vaccines is cardboard, shrink wraps, and plain boxes. Vials, ampoules, and prefillable syringes made from tubular glass or cyclo olefin polymer (COP) are mainly used in the packaging & serialization of vaccines.

Nepro is the major provider of high-quality primary packaging solutions for infectious disease vaccines, including D2FTM Pre-Fillable Glass Syringes and D2FTM Glass Vials.

(Source:https://www.nipro-group.com)

Key Players: SCHOTT AG, Stevanato Group, Gerresheimer AG, and Thermo Fisher Scientific.

Infectious Disease Vaccines Market Companies

- Pfizer

- Moderna

- Johnson & Johnson (Janssen)

- GlaxoSmithKline (GSK)

- Sanofi Pasteur

- Merck & Co.

- AstraZeneca

- Novavax

- Bharat Biotech

- Serum Institute of India

- CSL Limited (Seqirus)

- Daiichi Sankyo

- Mitsubishi Tanabe Pharma

- Biological E Limited

- Sinovac Biotech

- CanSino Biologics

- Zydus Lifesciences

- CureVac

- Inovio Pharmaceuticals

- Valneva

Recent Developments

- In July 2025, the vaccine candidate for the deadly virus Nipah is ready for mid-stage human trials in Bangladesh. The vaccine (PHV02) developed by the U.S.-based biotech company Public Health Vaccines (PHV) will launch its trial in early 2026, which will be among the first Niphan vaccine candidates to reach the stage of testing in people.(Source:https://cepi.ne)

- In June 2025, the Centers for Disease Control and Prevention's (CDC) Advisory Committee on Immunization Practices (ACIP) held a meeting at CDC headquarters in Atlanta, Georgia, with joint stakeholders for ACIP comprises to lead medical and public health experts in advising the CDC on the safety, clinical requirements, and effectiveness of vaccines. (Source: https://www.cdc.gov)

Segment Covered in the Report

By Technology

- Live Attenuated Vaccines

- Inactivated Vaccines

- Subunit, Recombinant, Polysaccharide & Conjugate Vaccines

- Toxoid Vaccines

- mRNA Vaccines

- Viral Vector Vaccines

- DNA Vaccines

- Others

By Disease Indication

- Influenza

- Hepatitis (A, B, E)

- Human Papillomavirus (HPV)

- Tuberculosis

- Meningococcal Disease

- Pneumococcal Disease

- Rotavirus

- Measles, Mumps, Rubella (MMR)

- COVID-19

- Dengue

- Malaria

- HIV/AIDS

- Others

By Age Group

- Pediatric

- Adults

- Geriatric

By End Use

- Hospitals & Clinics

- Research Institutes

- Government Immunization Programs

- Others

By Distribution Channel

- Public (Government & NGO-led Programs)

- Private (Pharmacies, Hospitals, Clinics)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content