What is the Injection Molded Plastics Market Size?

The global injection molded plastics market size was calculated at USD 358.71 billion in 2025 and is predicted to increase from USD 371.70 billion in 2026 to approximately USD 511.9 billion by 2035, expanding at a CAGR of 3.62% from 2026 to 2035. The market growth is attributed to rising demand for lightweight, durable, and cost-effective plastic components across automotive, packaging, and electronics sectors. Additional growth is supported by increasing adoption of injection molding in medical devices and consumer goods manufacturing due to its high-volume production efficiency, design flexibility, and material utilization advantages.

Market Highlights

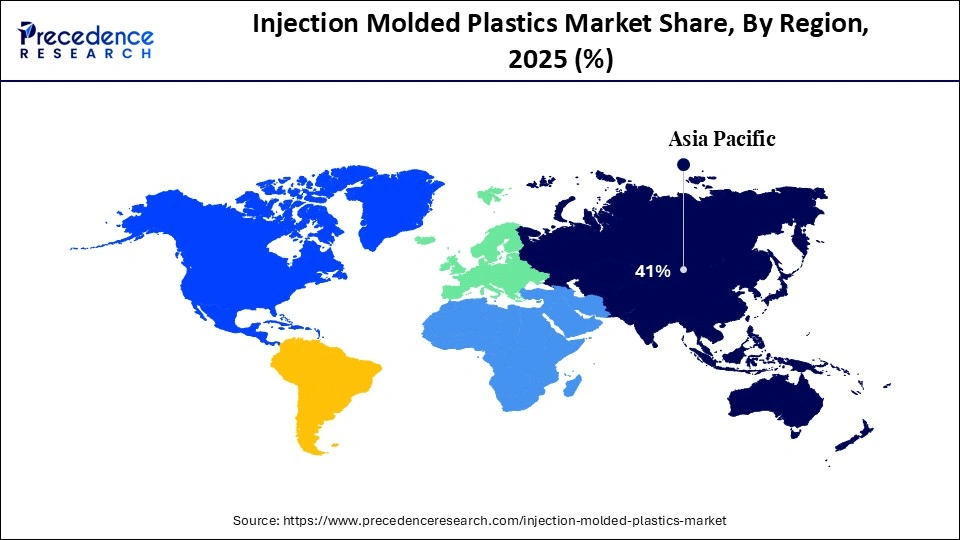

- Asia Pacific dominated the market with the largest market share of 41% in 2025.

- Europe is expected to grow at the fastest CAGR between 2026 and 2035.

- By raw material, the polypropylene (PP) segment contributed the highest share of 23% in 2025.

- By raw material, the acrylonitrile butadiene styrene (ABS) segment is growing at a strong CAGR between 2026 and 2035.

- By application, the packaging segment held a major market share of 34% in 2025.

- By application, the consumables & electronics segment is expected to expand at a notable CAGR from 2026 to 2035.

What Are Injection Molded Plastics?

The world injection molded plastics industry experienced an improvement in the coming years due to the high demand for engineered plastic components. Particularly in the automotive, packaging, and electronic industries, which rely on the low-cost yet high-precision injection-molded polymer components. Injection molding is being utilized as the world's plastics production continues to grow, with growing global plastic production.

Plastic injection molding is beneficial to manufacturers against the increase in unit costs through optimizing throughput and reducing scrap in computer-controlled, automated plants. Additionally, greater automotive electrification and general growth of smart consumer devices are expected to lead to further demand for precisely molded thermoplastics.

Injection Molded Plastics Market Growth Factors

- Rising Adoption of Electric Vehicles: Growing EV production is fuelling demand for lightweight and precision injection-molded components in battery packs and interior modules.

- Increasing Automation in Manufacturing Facilities: Advancements in robotic-assisted molding and Industry 4.0 technologies are driving higher efficiency and consistency in plastic part production.

- Expansion of E-Commerce and Logistics Packaging: The surge in online shopping is boosting demand for protective, lightweight, and recyclable molded packaging solutions.

- Growing Use of High-Performance Polymers: Rising need for flame-retardant, heat-resistant, and durable plastics is propelling adoption in electronics, automotive, and industrial equipment.

Expanding Production Scale Continues to Strengthen the Injection Molded Plastics Market

- Spain was the world's largest importer of injection-molding machines in 2024, with approximately EUR 75.5 Million of global machine consumption volume.

- China led global production of injection-molding machines in 2024, with an output of around 119,000 units, collectively with the Philippines (91,000) and Singapore (50,000) comprising 58 % of global machine manufacturing volume.

- In Europe in 2024, more than 2.5 million tons of polymer resins were processed into thin-walled injection-molded packaging products (cups, containers, trays, and closures), with polypropylene (PP) and polystyrene (PS) holding the largest share, followed by polyethylene terephthalate (PET) as a significant rigid packaging polymer.

- Electrical & electronics applications represent about 6.5% of plastics demand among European plastics converters, reflecting demand for high precision injection molding in consumer electronics.

- Automotive industry continues leading plastic substitution for metal parts, with OEM disclosures showing that plastics now account for 15-20% of vehicle structural and non-structural components by weight in 2024, up from 12-14% in 2022.

- China exported 195,572 injection molds, the highest count globally, showing its dominant tooling and mold manufacturing presence.

Vietnam exported 78,457 injection molds, the second largest exporter, indicating significant production capacity supporting OEM supply chains. - Plastic molding operations specifically added a total of 1,646 industrial robots globally in 2023, contributing to automation growth in injection molding facilities year over year.

Impact of Artificial Intelligence on the Injection Molded Plastics Market

Artificial intelligence allows for making smart, faster, and more uniform manufacturing processes throughout the world in injection molded plastics market production facilities. Process monitoring system based on AI continually accepts machine parameters and optimizes the performance of the cycle. This guarantees the formation of dimensional accuracy in the molded parts. Furthermore, in automotive, medical, and packaging systems of high volume, manufacturers use machine learning models to identify patterns of defects in real time, lower scrap rates, and enhance yield.

Injection Molded Plastics Market Trends

- Hybrid Additive Injection Molding Integration:Hybrid production combining 3D printing with traditional injection molding is gaining traction for prototyping and low-volume production. The process is used to expedite the design cycles and reduce design lead times of complex geometries. OEMs in aerospace and tailored medical equipment are also making huge investments in hybrid lines to have more agile production.

- Circular Economy Reinforcement with Chemical Recycling:Chemical recycling technologies are being integrated directly into molding supply chains to upcycle mixed plastic waste into a virgin equivalent feedstock. This helps in closing the loop of production, and the carbon intensity of molded parts is greatly reduced. It is anticipated that by 2026, onsite or near-site depolymerization feeds will be used by more converters.

- Distributed Manufacturing Nodes Close to Demand Centers:Companies are shifting toward geographically dispersed micro-factories equipped with advanced molding lines. These localized plants, which are smaller, decrease the logistics cost and lead times and enhance the responsiveness to seasonal and regional demand changes. Anticipate a good adoption in North America and Western Europe towards the end of 2026.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 358.71Billion |

| Market Size in 2026 | USD 371.70 Billion |

| Market Size by 2035 | USD 511.9Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 3.62% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Raw Material, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Raw Material Insights

Why was Polypropylene (PP) the Leader of the Injection Molded Plastics market?

Polypropylene (PP) segment dominated the injection molded plastics market in 2025, due to its versatile and cost-effective material. High-flow PP grades were preferred by manufacturers because of their high-flowing properties. This allows quick production of cycle time in automotive interiors, packaging closures, and consumer goods. It was also durable and had a high chemical resistance, which meant that it should be used in long-lasting applications. The lightweight properties allowed the OEMs to achieve the energy efficiency and emission minimization objectives. Moreover, the demand for PP would continue to be steady up to 2025-2026 for the application of electric vehicle parts such as interior modules and battery casings.

The acrylonitrile butadiene styrene (ABS) segment is expected to grow at the fastest rate in the injection molded plastics market during coming years, owing to the growing need to consume durable and high-precision components. ABS was used in smartphone, laptop, and appliance housings in consumer electronics. The material was of good surface finish, dimensional stability, and impact resistance. Furthermore, the expansion in emerging regions, combined with the technological adoption of AI-assisted injection molding, is expected to further increase ABS production.

Application Insights

Why Is Packaging Leading the Injection Molded Plastics Market?

The packaging segment held the largest revenue share in the injection molded plastics market in 2025, due to the dominance of PP in packaging applications, including closures and containers. The world's plastic output had been rising to an average of 430.9 million tonnes in 2024. The highest rates of packaging are still seen in areas with good consumer markets and plastic usage per capita, such as Europe and North America.

Structurally molded packaging products are used to package food, beverages, and personal care products. Such trends assisted the packaging in winning the best volumetric demand of the injection-molded application. Furthermore, the macro trends (American Chemistry Council) indicate that packaging continues to dominate the plastics production flows and strategies within the world.

Consumables & electronics segment is expected to grow at the fastest CAGR in the coming years in the injection molded plastics market. Owing to the rapid proliferation of devices and precision components requiring durable molded plastics. The conversion data of Plastics Europe indicates that electrical and electronics contributed significant amounts of the plastics demand, in addition to the dominating uses of packaging and construction.

Injection molding continues to be the process of preference in manufacturing smartphone, laptop, peripheral, IoT, and smart device housings, connectors, insulators, and internal components. Moreover, the growing consumption of electronic gadgets in new markets in Southeast Asia, India, and Latin America is expected to increase the need for injection-molded components.

Regional Insights

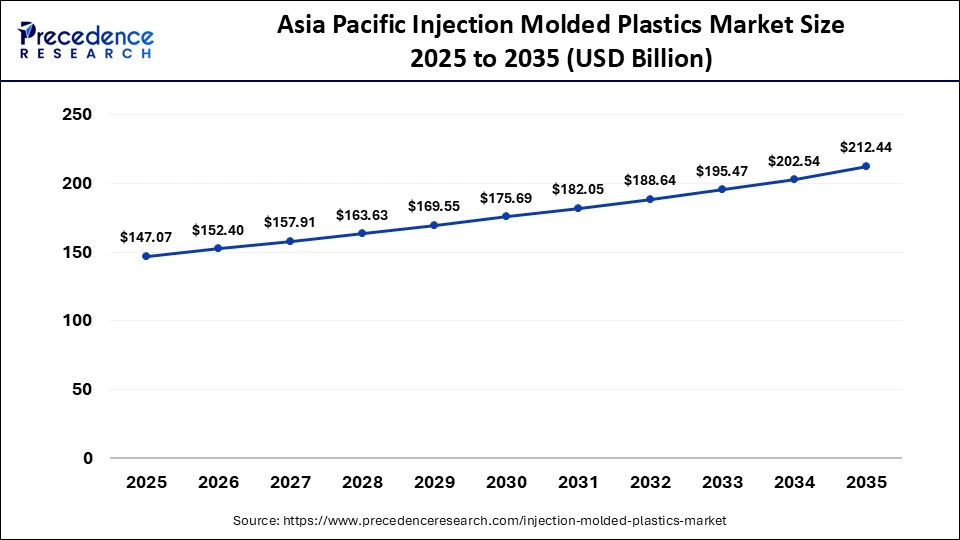

What is the Asia Pacific Injection Molded Plastics Market Size?

The Asia Pacific injection molded plastics market size is expected to be worth USD 212.44 billion by 2035, increasing from USD 147.07 billion by 2025, growing at a CAGR of 3.75% from 2026 to 2035.

Why Is Asia Pacific Dominating the Injection Molded Plastics Market?

Asia Pacific led the injection molded plastics market, capturing the largest revenue share in 2025. Due to the rapid industrialization trend and large production base in China, India, Japan, and Southeast Asia. Rapid growth in the use of plastic components is driven by high consumption in the packaging, automotive assemblies, electrical, electronics, and construction applications.

The area was a huge world assembly center for electronics with billions of units produced by the year, which demanded high-accuracy molded components. It is expected that the manufacturing ecosystems of the region will be able to draw additional investments in the sophisticated molding technologies. Furthermore, the integration of the supply chain between China, India, and the Southeast Asian region is expected to propel the region towards becoming the global injection molding output leader.

China Rising Economy in the Asia Pacific Injection Molded Plastics Market

China is leading the charge in the Asia Pacific injection molded plastics market, driven by the presence of the largest manufacturing hub in the region. In 2025, China manufactures approximately 131.5174 million tons of plastic globally. The automotive sector of China supplied more than 27 million cars in 2025, most of which used engineered plastics to lighten them and make them durable. Additionally, the development of electrification and the growth of EV production are expected to double the consumption of injection molded plastics in battery packs and interior modules.

Why Is Europe Growing in the Injection Molded Plastics Market?

Europe is anticipated to grow at the fastest rate in the market during the forecast period. Owing to the expanding production in automotive supply chains, industrial goods, and consumer products. The packaging industry continues to be a major user of plastics in weight terms.

According to the PlasticsEurope 2025 report, Europe was a major manufacturer of plastics in 2024, with 54.6 million tonnes, which strengthens the consistent volume of molded plastics. Additionally, the European plastic converters are expected to boost cross-border cooperation on design to recycle and improve the competitiveness of molded plastic solutions in the supply chains worldwide.

Germany Is a Leading Nation in European Injection Molding Plastic Market

Germany leads the injection molded plastics market in Europe with a significant portion of the local plastics conversion and manufacturing output. Germany contributes 21.4% of total plastic manufacture in Europe in 2024. High-cutting-edge polymer processing facilities and strong automotive OEM association supply chains stimulated positive demand for molded plastic products. Furthermore, the plastic injection molded products market of Germany is expected to increase due to the automotive electrification and precision engineering still influencing the use of plastics.

Injection Molded PlasticsMarket Value Chain Analysis

Who are the Major Players in the Global Injection Molded Plastics Market?

The major players in the injection molded plastics market include AptarGroup, Inc., BASF SE, Berry Global, Inc., Dow, Inc., DuPont de Nemours, Inc., Eastman Chemical Company, ExxonMobil Corporation, Heppner Molds, HTI Plastics Inc., Huntsman International LLC., IAC Group, INEOS Group, LACKS ENTERPRISES, INC., LyondellBasell Industries Holdings B.V., Magna International, Inc., Master Molded Products Corporation, Rutland Plastics, SABIC, The Rodon Group.

Recent Developments

- In January 2025, Molding Solutions will inaugurate a new production site in India on January 20 and 21, 2026. This greenfield plant allows the company to expand its footprint in one of the world's largest markets for plastics injection molding and strategically boost its capacities in hot runner systems. The new facility is part of Molding Solutions' long-term growth plan. The goal is to reduce delivery times, enhance order-processing flexibility, and strengthen customer proximity in the Asian market. Previously, the Indian market was mainly served from production sites in China. By establishing local manufacturing capabilities, the company is fully committing to a local-for-local strategy.

- In December 2025, Nicolet Plastics LLC, a Wisconsin-based custom plastic injection molder offering manufacturing and engineering support across multiple industries, announced the addition of a 360-ton two-shot injection molding press, expanding the company's production capabilities and enabling in-house manufacturing of complex, multi-material plastic components. The new press has been installed at the Jackson, Wisconsin, facility and marks a significant investment in advanced injection molding technology designed to meet evolving customer design and production needs.(Source:https://plasticker.de ,https://www.vvdailypress.com.)

Segments Covered in the Report

By Raw Material

- Acrylonitrile Butadiene Styrene (ABS)

- High-density Polyethylene (HDPE)

- Low-density Polyethylene (LDPE)

- Polyether Ether Ketone (PEEK)

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polystyrene (PS)

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Others

By Application

- Automotive & Transportation

- Building & Construction

- Consumables & Electronics

- Medical

- Packaging

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting