Intelligent Battery Sensor Market Size and Forecast 2025 to 2034

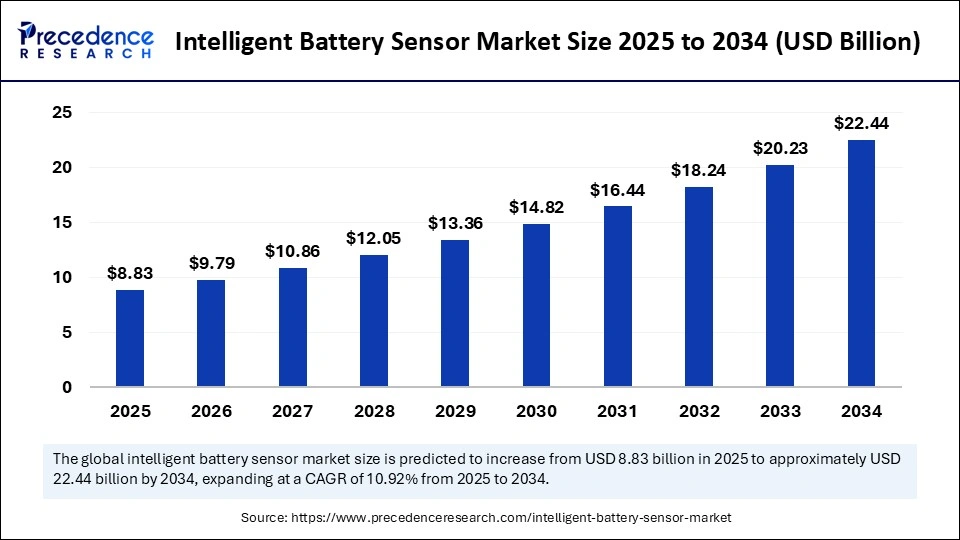

The global intelligent battery sensor market size accounted for USD 7.96 billion in 2024 and is predicted to increase from USD 8.83 billion in 2025 to approximately USD 22.44 billion by 2034, expanding at a CAGR of 10.92% from 2025 to 2034.The growth of the intelligent battery sensor market is driven by the rising demand for smart, data-driven energy management solutions in the automotive and energy sectors.

Intelligent Battery Sensor MarketKey Takeaways

- In terms of revenue, the intelligent battery sensor market is valued at $8.83 billion in 2025.

- It is projected to reach $22.44 billion by 2034.

- The market is expected to grow at a CAGR of 10.92% from 2025 to 2034.

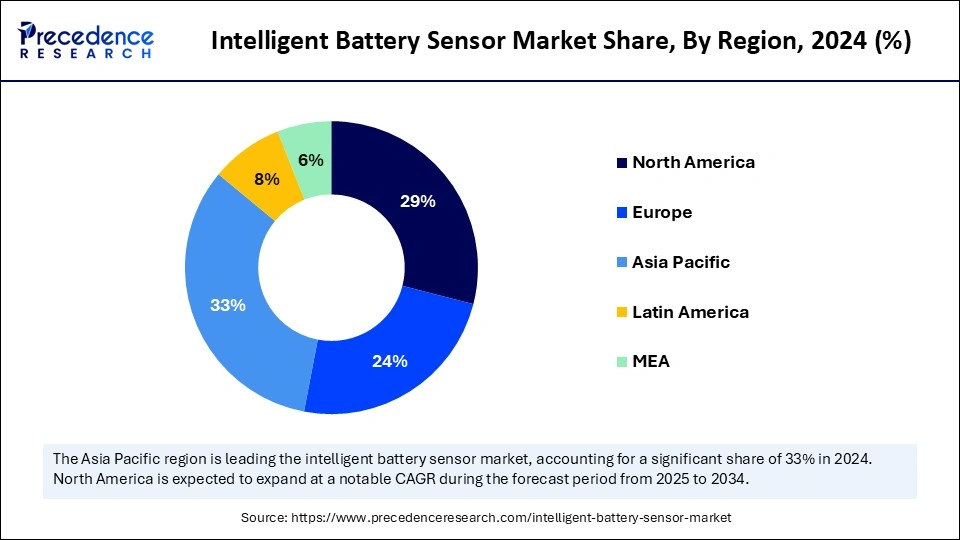

- Asia Pacific accounted for the major revenue share of 33% in 2024.

- North America is expected to expand at a CAGR of 10.1% from 2025 to 2034.

- By sensor type, the integrated sensors segment held the largest revenue share of 42% in 2024.

- By sensor type, the voltage sensors segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By sales channel, the OEM segment dominated the intelligent battery sensor market in 2024.

- By sales channel, the aftermarket segment is expected to grow at the fastest CAGR from 2025 to 2034.

- By application, the battery management systems segment held the largest market share in 2024.

- By application, the telematics segment is expected to grow at a rapid pace between 2025 and 2034.

- By end use, the automotive manufacturers segment dominated the market in 2024.

- By end use, the renewable energy providers segment is expected to grow at the highest CAGR from 2025 to 2034.

How is AI Revolutionizing the Intelligent Battery Sensor Market?

Artificial intelligence AI is revolutionizing the intelligent battery sensor market by enabling predictive analytics, real-time diagnostics, and adaptive energy management. With the integration of AI, intelligent battery sensors can predict battery failures, optimize charging cycles, and automatically adjust energy output based on usage patterns and environmental conditions. AI also facilitates vehicle-to-cloud communication, allowing manufacturers to monitor fleet health remotely, reduce downtime, and ensure safer, longer-lasting battery operations. This fusion of AI and sensor intelligence is setting new standards in electrified mobility and smart energy ecosystems.

Asia Pacific Intelligent Battery Sensor Market Size and Growth 2025 to 2034

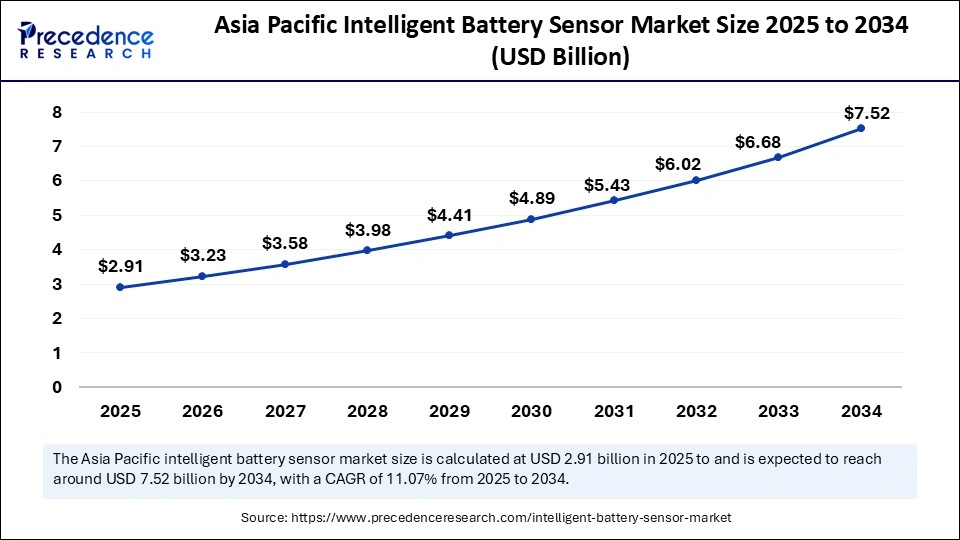

Asia Pacific intelligent battery sensor market size was exhibited at USD 2.63 billion in 2024 and is projected to be worth around USD 7.52 billion by 2034, growing at a CAGR of 11.07% from 2025 to 2034.

What Made Asia-Pacific the Dominant Region in the Intelligent Battery Sensor Market?

Asia-Pacific dominated the market with the largest revenue share of 33% in 2024. This is mainly due to its commitment to electric mobility, advanced manufacturing techniques, and innovative energy solutions. Key nations such as China, Japan, South Korea, and India are at the forefront of electric vehicle (EV) production and battery technology advancements. These countries are also heavily investing in industrial automation, which increasingly relies on intelligent sensing technologies for efficient energy management.

In China, robust government initiatives, including substantial subsidies and incentives for EV adoption, have accelerated the growth of the electric vehicle industry, while nationwide policies aimed at reducing emissions have created a conducive environment for battery development. Japan's focus on high-performance batteries and cutting-edge research, coupled with South Korea's strong battery manufacturing capabilities, positions these countries as global leaders in battery technology innovation. India is also rapidly expanding its EV infrastructure, driven by its ambitious goal to shift to electric mobility, supported by increasing urbanization and rising environmental consciousness among consumers.

The region's automotive sector is characterized by a diverse ecosystem of established original equipment manufacturers (OEMs), burgeoning EV startups, and specialized battery manufacturers. This blend not only fosters competitive pricing structures but also enhances consumer adoption rates, driven by a growing awareness of sustainability and technology benefits. Rapid urbanization is further intensifying the demand for smart energy solutions, thus reinforcing the strategic importance of IBS deployment. Government policies promoting emission controls, paired with a transition toward smarter urban infrastructures, are catalyzing advancements in power management systems, ultimately solidifying Asia-Pacific's position as the undisputed leader in the Intelligent Battery Sensor market.

What Factors Drive the Growth of the Intelligent Battery Sensor Market Within North America?

North America is projected to grow at a notable CAGR of 10.1% from 2025 to 2034, primarily due to substantial investments in electric vehicles (EVs), renewable energy infrastructure, and advanced AI-powered automotive technologies. The U.S. and Canada are experiencing a notable surge in demand for connected vehicles and the electrification of commercial fleets, which is creating an ideal environment for the widespread adoption of intelligent battery sensor solutions. Major technology firms and automotive industry leaders in the region are actively integrating cutting-edge predictive battery monitoring systems and AI-based energy diagnostics into their vehicles. This integration not only enhances the efficiency of battery management but also significantly improves the safety and longevity of battery systems, making IBS solutions more attractive to both manufacturers and consumers.

Furthermore, stringent regulatory standards aimed at enhancing fuel efficiency and promoting sustainability are playing a critical role in accelerating the transition towards smart energy management tools. These regulations motivate companies to innovate and adopt smarter technologies, positioning North America as a vibrant hotspot for the rapid expansion of the IBS market. As a result, the region is not only responding to current consumer demands for greener transportation options but is also paving the way for future advancements in energy management and mobility solutions.

Is Europe Quietly Building a Smarter Battery Ecosystem?

Europe is experiencing strong and steady growth in the intelligent battery sensor market, driven by its long-standing commitment to sustainable mobility, clean energy, and stringent environmental regulations. Countries like Germany, France, Norway, and the Netherlands are making substantial investments in electric vehicle (EV) infrastructure, which includes the establishment of widespread charging networks, the development of advanced smart grid systems, and initiatives promoting green public transportation options. The European Union's ambitious agenda aims for carbon neutrality by 2050 and has set specific e-mobility targets for 2030, significantly boosting the demand for intelligent sensors that enhance vehicle efficiency and battery longevity. These sensors provide real-time data on battery performance, optimizing energy usage and extending the operational range of electric vehicles.

Furthermore, collaborations between leading automotive brands and innovative technology companies are cultivating a dynamic ecosystem for the development of cutting-edge smart battery solutions. These partnerships are not only improving battery management systems but are also fostering advancements in power electronics and energy storage technologies. As a result, Europe is reinforcing its position as a vital contributor to the global IBS landscape, driving forward the transition to greener transportation options and sustainable energy practices.

Market Overview

The intelligent battery sensors market is witnessing robust growth, driven by the accelerating shift toward electrification, energy efficiency, and vehicle intelligence. Intelligent battery sensor (IBS) devices have become an integral part of modern automotive systems, especially in electric vehicles, plug-in hybrids, and start-stop vehicles, where precise battery monitoring is critical for performance, safety, and longevity. With the growing demand for real-time battery diagnostics, improved fuel economy, and lower emissions, manufacturers are increasingly integrating intelligent battery sensors into both conventional and electrified powertrains. These advanced sensors monitor voltage, current, and temperature in real time, optimizing battery performance, extending battery life, and enhancing vehicle performance. Additionally, regulatory pressures and sustainability goals are prompting OEMs to adopt next-generation battery technologies supported by intelligent sensing and AI-driven analytics.

What are the Major Trends in the Intelligent Battery Sensor Market?

- Electrification of vehicles: The surge in EV adoption is driving the demand for advanced IBS technology that ensures accurate battery state-of-charge and health monitoring critical for extending the range and reducing battery degradation.

- AI integration and predictive analytics: IBS devices are being enhanced with AI and machine learning algorithms to enable predictive maintenance, fault detection, and adaptive performance tuning, minimizing risks and extending battery life.

- Growing popularity of start-stop systems: Increasing demand for start-stop vehicle systems, especially in fuel-efficient models, is boosting IBS usage to monitor and maintain battery charge during frequent engine restarts.

- Miniature and sensor innovation: IBS devices are becoming more compact and energy-efficient, with multi-parameter sensing capabilities for improved systems diagnostics and integration flexibility.

- OEM partnerships and smart manufacturing: Automakers are collaborating with sensor manufacturers to develop customized IBS solutions that align with next-gen vehicle architectures and digital twin systems, improving overall vehicle health management.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 22.44 Billion |

| Market Size in 2025 | USD 8.83 Billion |

| Market Size in 2024 | USD 7.96 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Authentication, Component,Deployment, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Modern Vehicles Boost the Demanding for Intelligent Battery Sensor?

The global rise in the production of electric and hybrid vehicles, coupled with the need for enhanced fuel efficiency and reduced emissions, is significantly driving the growth of the intelligent battery sensor market. Today's vehicles rely heavily on electronic systems that demand real-time, accurate information on battery health, charge status, and power flow. IBS devices play a crucial role in optimizing energy consumption, enabling start-stop functionality, and preventing battery failures, especially in high-load environments. As consumers and manufacturers shift toward connected and electrified mobility, intelligent sensing solutions are no longer optional; they are essential.

The rising production of electric vehicles (EVs) significantly accelerates the adoption of intelligent battery management systems (IBS). Intelligent battery sensors play a crucial role in ensuring battery safety, enhancing efficiency, and optimizing driving range. As global sales of electric vehicles soar, the demand for sophisticated, real-time energy monitoring solutions has become more essential than ever, underscoring the importance of intelligent battery sensors.

Restraint

Is Cost Still a Roadblock to Widespread Adoption?

The high cost of advanced sensors is one of the key factors restraining the intelligent battery sensor market. Intelligent battery sensors are expensive, which creates barriers, especially for low and medium-range budget vehicle manufacturers. IBS units with multi-functionality and AI capabilities can significantly raise the total cost of vehicle electronics. Moreover, complex calibration requirements, potential system compatibility issues, and limited standardization across platforms pose adoption challenges, particularly in developing countries. Without economies of scale and cost-effective production models, the pace of IBS deployment could be hampered in certain segments.

Opportunity

Is the Shift to Smart Energy a Golden Opportunity?

The growing emphasis on sustainable energy solutions, smart grid integration, and battery-powered systems across industries opens a wide avenue for IBS applications. Beyond the automotive sector, opportunities are expanding in renewable energy storage systems, telecom towers, industrial UPS units, and data centers, where intelligent battery monitoring ensures uptime, safety, and cost-efficiency. Emerging markets, increasing urbanization, and digital transformation trends are fueling the demand for cost-effective, scalable, and AI-enabled battery sensing solutions. This creates a strong window of opportunity for manufacturers to diversify their product offerings and expand into new verticals with adaptable IBS technology.

Sensor Type Insights

Why did the Integrated Sensors Dominate the Intelligent Battery Sensor Market?

The integrated sensors segment dominated the market by holding more than 42% of revenue share in 2024. Integrated sensors have become the cornerstone of the IBS (Intelligent Battery System), thanks to their capacity for comprehensive multi-parameter monitoring. These sensors adeptly track crucial metrics such as voltage, current, and temperature, all within a streamlined, cost-effective module. This innovative design not only simplifies the installation process but also minimizes wiring complexity, leading to a more efficient systems architecture. Furthermore, they facilitate real-time battery diagnostics, which are essential for optimizing the performance of modern automotive systems. Their remarkable versatility across various vehicle platforms positions them as the preferred choice among original equipment manufacturers (OEMs) who prioritize both system efficiency and safety in their developments.

On the other hand, the voltage sensors segment is expected to grow at a remarkable CAGR, driven by the escalating precision demands for electric and hybrid powertrains. As battery architectures evolve into increasingly intricate systems, these sensors play a vital role in ensuring safe voltage levels while facilitating precise state-of-charge calculations. This is particularly crucial in high-voltage electric vehicle (EV) systems, where the accuracy and reliability of voltage monitoring are essential for performance, safety, and longevity.

Sales Channel Insights

How does the OEM Segment Dominate the Market?

The OEM segment dominated the intelligent battery sensor market with the largest share in 2024. Original Equipment Manufacturers (OEMs) are at the forefront of integrated battery systems (IBS) sales, strategically embedding advanced intelligent sensors within the design of new vehicles. This innovative approach not only enhances the vehicles' energy efficiency but also significantly boosts system reliability and ensures compliance with stringent emission standards. As a result, IBS has become a pivotal and standardized component in the evolution of next-generation automotive platforms, driving the industry toward a more sustainable and technologically advanced future.

On the other hand, the aftermarket segment is expected to grow at the fastest CAGR in the coming years. As vehicle owners and fleet operators increasingly pursue modern enhancements to their existing vehicles through advanced smart battery monitoring technologies, the need for intelligent battery sensors continues to rise. These sensors not only mitigate the risk of battery failures but also enhance overall vehicle performance. This is particularly relevant for commercial fleets and older vehicles, where the efficiency and reliability of battery performance are paramount for operational success.

Application Insights

What Made Battery Management System the Dominant Segment in 2024?

The battery management system segment dominated the intelligent battery sensor market in 2024. The Battery Management System (BMS) serves as the critical backbone for intelligent battery systems (IBS). This sophisticated system incorporates various sensors that meticulously monitor the condition of the battery, ensuring precise tracking of key metrics such as voltage, temperature, and charge state. By facilitating real-time control over charge and discharge cycles, the BMS plays a pivotal role in preventing overcharging, which can lead to diminished battery performance or even failure. Additionally, it actively works to maximize battery lifespan, a crucial factor in both internal combustion engine (ICE) vehicles and electric vehicles. This advanced monitoring and management not only enhances the efficiency of energy use but also contributes significantly to the overall reliability and sustainability of modern automotive technologies.

Meanwhile, the telematics segment is expected to grow at a rapid pace in the upcoming period, driven by the seamless integration of IBS (In-vehicle Broadcast Services) data with advanced vehicle health monitoring systems, GPS technology, and remote diagnostics. This powerful combination empowers fleet managers to monitor vehicle performance in real time, allowing for the optimization of energy consumption. As a result, organizations can enhance operational efficiency while implementing proactive maintenance strategies, ultimately leading to improved vehicle reliability and longevity.

End Use Insights

Why did the Automotive Manufacturers Segment Dominate the Intelligent Battery Sensor Market?

The automotive manufacturers segment dominated the market with the largest share in 2024. This is mainly due to the increased production volumes of passenger vehicles and consumer demand for fuel efficiency, enhanced safety features, and advanced smart diagnostics. Innovations such as start-stop systems, connected vehicle technologies, and improved vehicle electrification have transformed intelligent battery monitoring into an essential feature sought after in both luxury and mass-market cars. As automakers prioritize these advancements, the integration of sophisticated battery management becomes crucial for delivering a superior driving experience.

Automotive manufacturers are the largest adopters of intelligent battery sensors, as these advanced sensors play a critical role in optimizing vehicle design, enhancing safety, and improving energy efficiency. With the increasing trend toward electrification and the implementation of stringent regulatory standards, the adoption of IBS has evolved into a fundamental engineering requirement for many automakers. These sensors not only contribute to the overall performance of vehicles but also ensure compliance with emerging environmental regulations, positioning manufacturers at the forefront of innovation in the automotive industry.

On the other hand, the renewable energy providers segment is expected to grow at the highest CAGR in the upcoming period. Renewable energy providers are progressively embracing intelligent battery sensors to effectively monitor and manage battery storage systems integral to solar and wind installations. These advanced intelligent sensors play a pivotal role in ensuring the reliability of energy storage solutions, actively preventing power loss, and maximizing system uptime. By seamlessly integrating these technologies, they not only enhance the efficiency of operations but also support the development of smart grids and bolster the transition to clean energy. Their critical function in optimizing energy management highlights their importance in the evolving landscape of sustainable energy solutions.

Intelligent Battery Sensor Market Companies

- Robert Bosch GmbH

- Continental AG

- HELLA GmbH & Co. KGaA

- NXP Semiconductors N.V.

- Midtronics, Inc.

- Valence Technology, Inc.

- Texas Instruments Inc.

- DENSO Corporation

- Analog Devices, Inc.

- Infineon Technologies AG

- TE Connectivity Ltd.

- Eberspaecher Vecture Inc.

- Current Ways Inc.

- Murata Manufacturing Co., Ltd.

- Delphi Technologies

Recent Developments

- In December 2024, Butlr announced the launch of a wireless and anonymous AI sensor featuring a multi-year battery life, scalability, and real-time ultra precise insights into how people interact in their environments. Data from Butlr sensors is used to transform buildings into adaptive, data-driven spaces that enhance human experience while improving operational efficiency.

(Source: https://www.butlr.com) - In November 2023, the United Safety & Survivability Corporation announced the launch of its latest innovation, a Lithium-Ion Battery Failure Detection Sensor. This groundbreaking product sets a new standard for safety for electric vehicles across industries.

(Source: https://www.prnewswire.com)

Segment Covered in the Report

By Sensor Type

- Voltage Sensors

- Current Sensors

- Temperature Sensors

- Integrated Sensors

By Sales Channel

- OEM

- Aftermarket

By Application

- Battery Management Systems (BMS)

- Telematics

- Start-Stop Systems

By End Use

- Automotive Manufacturers

- Fleet Operators

- Telecommunications Companies

- Renewable Energy Providers

- Aerospace & Defense

- Consumer Electronics

- Others

By Region

- North America

- APAC

- Europe

- Latin America

- MEA

Get a Sample

Get a Sample

Table Of Content

Table Of Content